More rotation than retreat?

Key data to move markets today

EU: Eurogroup meeting, Eurozone Industrial Production, and a speech by German Bundesbank President Joachim Nagel

USA: A speech by Fed Vice Chair for Supervision Michelle Bowman. Bond and Stock markets closed for President’s Day

US Stock Indices

Dow Jones Industrial Average +0.10%

Nasdaq 100 +0.18%

S&P 500 +0.05%, with 7 of the 11 sectors of the S&P 500 up

On Friday, stocks initially climbed after the Bureau of Labor Statistics announced that CPI growth slowed to an annual rate of 2.4% in January. This easing in price pressures, combined with robust labour market data earlier in the week, offered some reassurance to investors that the Fed might be able to cut interest rates.

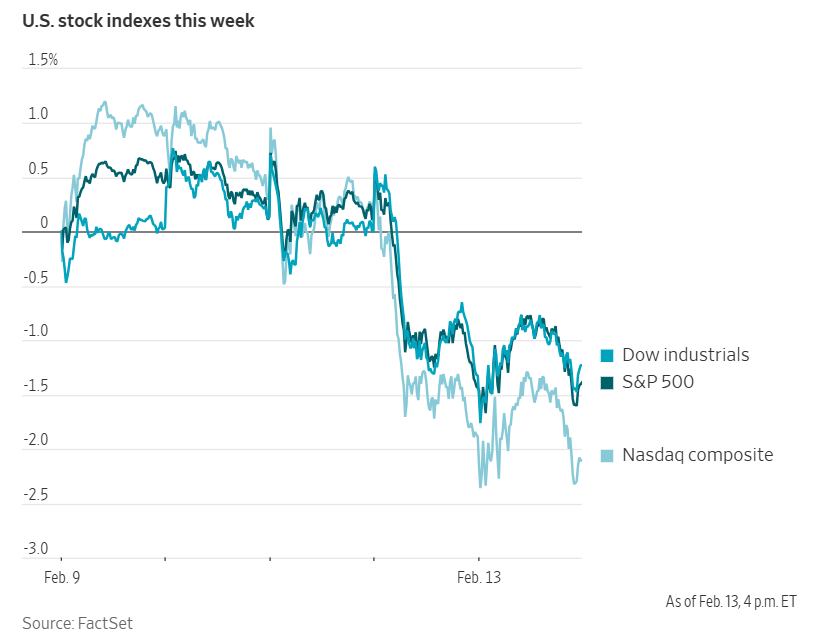

However, these early gains proved short-lived. By mid-afternoon, sentiment had soured as concerns over AI’s long-term disruptive potential resurfaced. The Nasdaq Composite slipped -0.22%, extending its losing streak to five sessions — a cumulative decline of -2.98% and marking its longest run of weekly losses since May 2022.

The S&P 500 edged up +0.05%, but still finished the week -1.85%, its steepest weekly fall since late November, when concerns over high technology valuations and ambitious AI investment plans prompted a similar pullback. The Dow Jones Industrial Average rose +0.10%, or 49 points, but ended the week -1.27%.

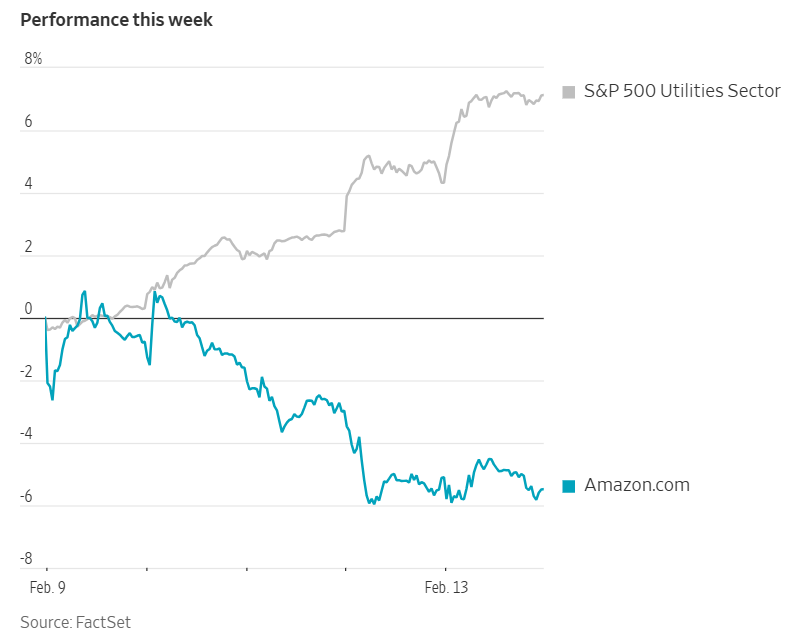

Amid this turbulence, investors sought refuge in traditional safe havens. The S&P 500’s Utilities sector surged +7.13% over the week to close at a record high, outperforming all other sectors within the index’s eleven groups.

In corporate news, SpaceX is reportedly considering a dual-class share structure for its anticipated IPO this year, mirroring a strategy previously floated by its founder, Elon Musk, for Tesla, according to Bloomberg news.

The US Federal Trade Commission is intensifying its examination of Microsoft’s potential anti-competitive practices. The probe focuses on whether Microsoft is unlawfully consolidating its position across substantial portions of the enterprise computing sector through its cloud software and artificial intelligence offerings, including Copilot.

Anthropic PBC appointed Chris Liddell to its board of directors; he is known for his pivotal role in guiding General Motors through its public offering.

According to sources familiar with the arrangements and reported by Bloomberg news, OpenAI has established partnerships with two defence technology firms chosen by the Pentagon to compete in the development of voice-activated drone swarming software for the US military.

S&P 500 Best performing sector

Utilities +2.69%, with NRG Energy +6.52%, Vistra +5.14%, and Constellation Energy +4.46%

S&P 500 Worst performing sector

Communication Services -0.76%, with Meta Platforms -1.55%, Alphabet -1.08%, and Verizon Communications -0.91%

Mega Caps

Alphabet -1.08%, Amazon -0.41%, Apple -2.27%, Meta Platforms -1.55%, Microsoft -0.13%, Nvidia -2.24%, and Tesla +0.09%

Information Technology

Best performer: Applied Materials +8.08%

Worst performer: Zebra Technologies -3.48%

Materials and Mining

Best performer: Newmont +6.50%

Worst performer: Air Products and Chemicals -4.03%

Corporate Earnings Reports

Posted on Friday, 13th February

Moderna quarterly revenue -29.8% to $678 mn vs $625 mn estimate

Loss Per Share at -$2.11 vs -$2.64 estimate

Stéphane Bancel, CEO, said, “In 2025, we sharpened our commercial execution, launched our third product and brought online three international manufacturing sites, while advancing our mRNA pipeline. At the same time, we lowered our annual operating expenses by approximately $2.2 billion, significantly surpassing our cost-reduction targets. We entered the new year with strong momentum despite the continued challenging environment in the U.S., poised to deliver up to 10 percent revenue growth through mNEXSPIKE expansion and our international strategic partnerships. We look forward to delivering multiple potential product approvals and late-stage clinical readouts, while driving continued innovation across our mRNA platform.” — see report.

European Stock Indices

CAC 40 -0.35%

DAX +0.25%

FTSE 100 +0.42%

Commodities

Gold spot +2.45% to $5,042.11 an ounce

Silver spot +2.98% to $77.40 an ounce

West Texas Intermediate -0.16% to $62.81 a barrel

Brent crude +0.06% to $67.63 a barrel

Gold prices advanced on Friday as cooling inflation raised hopes of Fed easing. Robust demand for gold persisted in China ahead of the Lunar New Year, whereas the Indian market shifted to a discount.

Spot gold increased by +2.45% to reach $5,042.11 per ounce. It was +1.65% over the course of the week.

Spot silver also rebounded on Friday, climbing +2.98% to $77.40 per ounce after experiencing a -10.83% decline in the previous session. Despite this recovery, silver registered a weekly loss of -0.74%.

Oil prices remained relatively steady on Friday, despite indications from OPEC+ of a potential resumption in production increases.

Brent crude futures closed 4 cents, or +0.06%, higher at $67.63 per barrel. US WTI crude settled 10 cents, or -0.16%, lower at $62.81 per barrel.

Both crude benchmarks recorded weekly losses, with Brent declining by -0.43% and WTI falling by -1.09%.

Earlier in the session, prices declined following a Reuters report suggesting that OPEC is considering resuming oil output increases from April. This comes ahead of the anticipated peak summer fuel demand and in the context of firmer crude prices, partly attributed to ongoing tensions between the US and Iran.

Oil prices had seen upward momentum earlier in the week due to concerns that the US might undertake military action against Iran over its nuclear programme. However, comments on Thursday from the US President, indicating the possibility of a diplomatic agreement with Iran in the coming month, exerted downward pressure on prices.

Nonetheless, the Pentagon announced on Friday that it would deploy an additional aircraft carrier from the Caribbean to the Middle East. This means two carriers will be present in the region amid escalating tensions between Washington and Tehran.

Russia confirmed on Friday that the next round of peace negotiations concerning Ukraine is scheduled for this week.

Additionally, the US eased sanctions on Venezuela's energy sector on Friday, issuing two general licences. These measures permit international energy companies to operate oil and gas projects in Venezuela and allow further negotiations for new investments.

According to US Secretary of Energy Chris Wright, oil sales from Venezuela under US control have already exceeded $1 billion and are expected to generate an additional $5 billion over the coming months.

Note: As of 4 pm EST 13 February 2026

Currencies

EUR -0.02% to $1.1867

GBP +0.19% to $1.3648

Bitcoin +4.67% to $68,869.17

Ethereum +6.78% to $2,053.00

The US dollar remained largely unchanged against major currencies on Friday. The dollar index slipped by -0.01% to 96.88 and fell by -0.82% over the week.

The euro declined -0.02% to $1.1867 against the US dollar, yet posted a gain of +0.43% over the course of the week.

On Friday, the pound strengthened +0.19% against the US dollar, culminating in a +0.29% gain over the week.

Earlier in the week, sterling, as well as UK bonds and equities, came under pressure due to a political crisis ignited by the Epstein affair, which appeared to jeopardise Prime Minister Keir Starmer's leadership. Nevertheless, market sentiment improved and selling pressures eased after the cabinet publicly affirmed its support for Starmer, pledging that he would not quit his position.

The yen dominated currency market activity last week, following Japanese Prime Minister Sanae Takaichi's historic election victory. For the week, the yen advanced +2.88%, representing its most significant rise since November 2024. It edged +0.03% higher Friday to reach ¥152.68.

Fixed Income

US 10-year Treasury -5.2 basis points to 4.052%

German 10-year -2.3 basis points to 2.759%

UK 10-year gilt -3.5 basis points to 4.420%

US Treasury yields declined on Friday, with two-year note yields reaching their lowest levels in four months. This movement was driven by January's CPI figures, which proved cooler than anticipated and reinforced market expectations for at least two Fed rate cuts this year. Yields on both the US 10-year and 30-year Treasury notes fell to ten-week lows.

On Friday, the US 10-year Treasury yield declined -5.2 bps to 4.052%. Over the week, it dropped -16.5 bps, marking its most pronounced weekly decrease since mid-November.

The 30-year Treasury yield fell -4.3 bps to 4.696% and registered a weekly decrease of -15.7 bps, its largest since late March 2025.

The yield on two-year Treasury notes, which are particularly sensitive to interest rate expectations, dropped -4.4 bps to 3.418%. For the week, it declined -9.2 bps, the most significant weekly reduction in three months.

Last week, the spread between two-year and 10-year yields narrowed by 7.3 bps to 63.4 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 62.8 bps of cuts in 2026, higher than the 55.2 bps priced in the previous week. Fed funds futures traders are now pricing in a 9.8% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 18.4% a week ago.

Euro area benchmark Bund yields declined on Friday, reflecting broader downward momentum in European government bonds.

Market expectations for ECB rate cuts have shifted, with the likelihood of a move now seen as less than 50% for December, compared to earlier bets on September. This change follows President Christine Lagarde’s comments last week, where she downplayed the influence of dollar movements on the ECB’s future policy decisions.

Nevertheless, money market pricing for a rate cut by December increased after the release of US CPI data, with the probability rising to 40% from around 30% earlier in the day.

Germany’s 10-year government bond yield slipped -2.3 bps to 2.759%, after reaching 2.738% — its lowest level since 3rd December. Over the week, it fell by -8.4 bps, marking the largest weekly drop since the end of March.

The yield on Germany’s two-year bond declined -2.1 bps to 2.045%. It was -4.8 bps for the week. At the long end of the curve, the 30-year yield fell -1.3 bps to 3.433%, contributing to a -7.9 bps weekly decline.

Italy’s 10-year government bond yield dropped -2.3 bps on Friday to 3.368%, recording a weekly fall of -10.0 bps. The spread over Bunds narrowed to 60.9 bps, down 1.6 bps from last week’s 62.5 bps.

Similarly, France’s 10-year yield slipped -2.2 bps to 3.349%, ending the week -10.4 bps lower. The spread against Bunds stood at 59.0 bps, 2.0 bps less than the previous week’s 61.0 bps.

Analysts noted that ongoing progress in European financial integration remains a key factor contributing to further narrowing of euro area yield spreads.

Note: As of 5 pm EST 13 February 2026

Global Macro Updates

January CPI. The January Consumer Price Index (CPI) report was broadly in line with market expectations. Core CPI rose by 0.3% m/o/m, up from December’s 0.2%, but matching consensus estimates. Headline CPI advanced by 0.2% m/o/m, falling slightly short of the consensus forecast of 0.3% and December's 0.3% rise. On an annualised basis, core inflation stood at 2.5%, in line with expectations and down from 2.6% in the previous month. Annualised headline inflation was recorded at 2.4%, its lowest level since April 2025. It was down from December’s 2.7% and lower than consensus estimates of 2.5%.

This result, which was either in line with or marginally cooler than expectations, provided some relief to market participants, especially as analysts had previously raised concerns over potential upside risks stemming from residual seasonality.

Core goods prices remained unchanged m/o/m, while core services saw a 0.4% increase following a 0.3% gain in December. The shelter index rose by 0.2%, down from 0.4% in December, yet continued to be the main contributor to the monthly headline CPI increase.

Outside of shelter, price pressures eased in energy, used vehicles, food, and medical care. However, inflation was observed in areas such as airline fares, appliances, furniture, and new vehicles.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.