Will US inflation surprise to the upside?

Key data to move markets today

EU: German IFO Business Climate, Current Assessment, and Expectations surveys and Eurozone Harmonised Index of Consumer Prices

UK: CPI, PPI, and RPI

USA: Speeches by Atlanta Fed President Raphael Bostic, New York Fed President John Williams, and Fed Governor Christopher Waller

US Stock Indices

Dow Jones Industrial Average -0.62%

Nasdaq 100 +0.26%

S&P 500 -0.24%, with 8 of the 11 sectors of the S&P 500 down

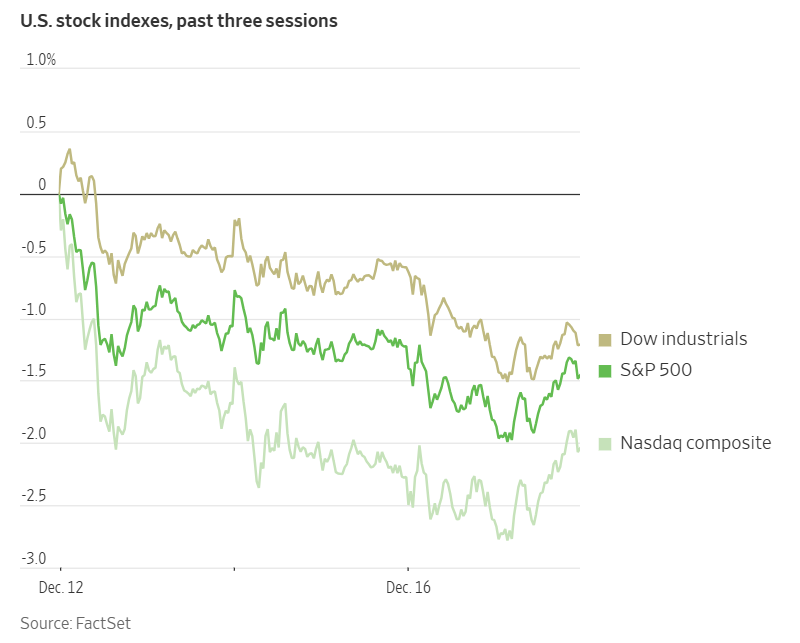

On Tuesday, two of the three major US stock indexes closed lower following the release of delayed employment data that highlighted ongoing concerns in the US labour market.

The Dow Jones Industrial Average was down 302.30 points or -0.62% to 48,114.26. The S&P 500 slipped -0.24%, while the Nasdaq Composite managed a modest gain of +0.23%.

In corporate news, Pfizer issued guidance indicating minimal to no sales growth for the upcoming year as the company seeks to revitalise its portfolio through a series of significant acquisitions.

Kraft Heinz announced a leadership change, appointing Steve Cahillane, former CEO of Kellanova, to succeed Carlos Abrams-Rivera as Chief Executive effective 1st January.

Truist Financial unveiled a new stock repurchase programme authorising buybacks of up to $10 billion.

Visa announced the expansion of its US network to support Stablecoin settlements, broadening its suite of crypto-related offerings.

Mortgage lender Freddie Mac revealed that Kenny M. Smith will assume the role of CEO as of 17th December. Smith, formerly Vice Chairman of Deloitte Consulting, steps into this position ahead of a highly anticipated public share sale planned by the Trump administration.

Apollo Global Management is considering a divestiture of Atlas Air, aiming for a potential valuation exceeding $12 billion including debt, according to sources familiar with the matter. An investor consortium led by Apollo previously acquired Atlas Air for approximately $5.2 billion, inclusive of debt, in 2022.

S&P 500 Best performing sector

Information Technology +0.32%, with Dell Technologies +2.48%, Palantir Technologies +2.46%, and Intuit +2.25%

S&P 500 Worst performing sector

Energy -2.98%, with Phillips 66 -6.88%, APA -5.18%, and Marathon Petroleum -4.70%

Mega Caps

Alphabet -0.51%, Amazon +0.01%, Apple +0.18%, Meta Platforms +1.49%, Microsoft +0.33%, Nvidia +0.81%, and Tesla +3.07%

Information Technology

Best performer: Dell Technologies +2.48%

Worst performer: Jabil -3.91%

Materials and Mining

Best performer: Linde +1.56%

Worst performer: Mosaic -5.63%

European Stock Indices

CAC 40 -0.23%

DAX -0.63%

FTSE 100 -0.68%

Commodities

Gold spot -0.03% to $4,302.11 an ounce

Silver spot -0.37% to $63.74 an ounce

West Texas Intermediate -2.54% to $55.17 a barrel

Brent crude -2.44% to $58.87 a barrel

Gold experienced a modest decline on Tuesday, with spot prices slipping by -0.03% to $4,302.11 per ounce.

This downturn occurred despite the US dollar reaching a two-month low earlier in the session—a development that typically enhances the appeal of dollar-denominated bullion for international buyers by making it more affordable.

Spot silver also retreated, falling -0.37% to $63.74 an ounce after reaching a record high of $64.65 on Friday.

On Tuesday, oil futures settled at their lowest levels since February 2021, pressured by persistent concerns over excess supply and growing optimism regarding a possible peace agreement between Russia and Ukraine.

Brent crude futures closed down $1.47 or -2.44%, at $58.87 per barrel. US WTI crude finished at $55.17, down $1.44, or -2.54%.

The US offered to extend NATO-style security assurances to Ukraine and European negotiators reported progress in talks on Monday, increasing hopes that the conflict could soon be resolved. However, Russia maintained its stance against territorial concessions.

Concerns about oversupply were somewhat tempered by the US' seizure of an oil tanker off Venezuela last week. Nevertheless, market participants have indicated that an abundance of floating storage and increased Chinese purchases from Venezuela, driven by the anticipation of eased sanctions, continued to limit the overall impact on prices.

Notably, the six-month Brent futures spread entered a contango for the first time since October, signalling expectations of higher prices in the future.

Note: As of 4 pm EST 16 December 2025

Currencies

EUR -0.03% to $1.1746

GBP +0.35% to $1.3420

Bitcoin +2.04% to $87,787.72

Ethereum +0.34% to $2,951.52

On Tuesday, the US dollar weakened against major currencies, with the dollar index -0.07% to 98.22, marking its second consecutive session of losses.

Traders are focussed on this week’s central bank decisions. The ECB is broadly expected to maintain its current interest rates at Thursday's meeting despite some mixed economic signals; German investor sentiment improved more than expected in December, while overall euro zone business activity growth has slowed.

The euro traded down -0.03% to $1.1746 against the US dollar, though it reached its strongest level since September earlier in the session after advancing for four consecutive sessions.

In the UK, unemployment data has reached its highest level since early 2021. Nevertheless, the composite S&P Purchasing Managers’ Index climbed to 52.1 in December, surpassing forecasts, but remaining below its long-term average. The British pound was +0.33% to $1.3420 and gained +0.35% against the euro to 87.59 pence, having earlier touched 87.89 pence — its weakest since 3rd December.

Financial markets are currently pricing in approximately 60 bps of BoE rate cuts by the end of next year. The Bank’s vote on interest rates is expected to be closely contested, with Governor Andrew Bailey expected to be the swing vote in favour of a reduction. However, the determining piece of the puzzle will likely be the release of the November CPI inflation figures today.

The US dollar declined by -0.33% to ¥154.72 against the Japanese yen as markets await the BoJ’s policy decision scheduled for Friday.

While markets have mostly priced in a rate hike from the BoJ this Friday, any signals from policymakers about possible additional tightening — especially before spring wage talks — would be seen as adopting a more hawkish approach.

Additionally, business sentiment among major Japanese manufacturers reached a four-year high in the three months through December, reinforcing expectations for additional monetary tightening.

Fixed Income

US 10-year Treasury -3.9 basis points to 4.145%

German 10-year bund -1.0 basis points to 2.846%

UK 10-year gilt +1.5 basis points to 4.523%

US Treasury yields declined on Tuesday following the release of data indicating an unexpected rise in the unemployment rate for the previous month. However, analysts cautioned that this report may be less reliable than usual due to distortions resulting from the US government shutdown.

Nonfarm payrolls rose 64,000 in the latest month, surpassing economists’ expectations of a 50,000 gain. The unemployment rate edged higher to 4.6%, while forecasts had projected the rate would remain unchanged at 4.4%.

The yield on the two-year Treasury note, sensitive to changes in the Fed Funds rate outlook, fell -1.6 bps to 3.500%. The 10-year yield was -3.9 bps to 4.145%. On the long-end, the 30-year yield was -3.2 bps to 4.815%.

The spread between two- and ten-year Treasury yields narrowed by 3.2 bps to stand at 64.5 bps.

Additional economic data released Tuesday showed that US retail sales were unexpectedly unchanged in October. Nevertheless, consumer spending appears to have remained resilient at the outset of Q4, despite the ongoing rise in the cost of living. This suggests that the economy is increasingly relying upon the higher income quintiles for a disproportionate share of consumer spending and increasing the economy’s vulnerability.

Looking ahead, the next key US economic indicator will be the consumer price inflation (CPI) data for November, which is scheduled for release on Thursday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 59.3 bps of cuts in 2026, higher than the 48.0 bps priced in last week. Fed funds futures traders are now pricing in a 25.5% probability of a 25 bps rate cut at January’s FOMC meeting, up from 21.6% a week ago.

Eurozone government bond yields remained largely stable Tuesday, within their recent trading ranges. Germany's 10-year government bond yield edged down -1.0 bps to 2.846%, after reaching 2.894% last week — its highest level since mid-March.

The yield on Germany’s two-year Schatz also fell, -1.7 bps to 2.142%. On the long-end, the 30-year yield was -0.7 bps to 3.467%.

Italy’s 10-year yield was -1.1 bps to 3.516%, maintaining the spread against the 10-year Bund at 67.0 bps. The yield on France’s 10-year OAT slipped -0.9 bps to 3.557%, with the spread versus Bunds unchanged at 71.1 bps.

In related developments, French senators approved the 2026 budget bill on Monday, paving the way for lawmakers to negotiate a final compromise text ahead of a key vote scheduled for 23rd December.

Note: As of 5 pm EST 16 December 2025

Global Macro Updates

November NFP report. November Nonfarm Payrolls (NFP) beat expectations, rising 64,000 versus the consensus estimate of a 50,000 gain. October payrolls declined by 105,000, reflecting Federal buyout-related job exits. Additionally, September figures were revised downward to a gain of 108,000 from 119,000. August was revised lower to a decline of 26,000 from the previously reported decrease of 4,000, highlighting ongoing volatility in recent job growth.

The unemployment rate rose to 4.6%, above the consensus estimate of 4.4% and the prior reading of 4.4%, marking the highest level since September 2021. The labour force participation rate remained relatively stable at 62.5%.

Average hourly earnings (AHE) increased by 0.1% m/o/m, falling short of the anticipated 0.3% rise and decelerating from the previous month's 0.2% gain. On an annual basis, wage growth slowed to 3.5%, approaching levels seen before the pandemic.

Job gains were primarily concentrated in healthcare, construction, and social assistance. In contrast, employment declined in transportation and warehousing, leisure and hospitality, manufacturing — which posted its lowest reading since March 2022 — and the Federal government. Private sector job growth remains largely concentrated within education and health services.

Sell-side analysts interpreted the modest increase in the unemployment rate as having slightly dovish implications, though they cautioned that the mixed nature of the report is unlikely to significantly influence Fed policy. Economists still expect unemployment to drift to around 4.7% by year-end.

PMI pulse: misses in US and eurozone, UK shows resilience. In December, both the S&P Global US Flash Manufacturing and Services PMIs undershot expectations. The Manufacturing PMI dipped to 51.8, missing the consensus of 52 and falling from November’s 52.2, marking a five-month low. The Services PMI reached a six-month low, coming in at 52.9, below consensus expectations of 54 and down from November’s 54.1. Manufacturing output dropped by 1.4 points to 53.0, its lowest in three months, while manufacturing new orders fell for the first time in a year. The services sector saw new business decline to a 20-month low. Employment trends were mixed: manufacturing hiring improved to a four-month high, but services employment was flat, with the smallest net increase since April. Input costs rose at their fastest pace since November 2022, with services sector inflation reaching its highest in three years, largely due to tariffs and rising labour costs. Selling prices increased at the quickest rate since July, though manufacturing price inflation was the slowest since January, while services price inflation hit its fastest pace since August 2022.

By contrast, December’s UK PMI data exceeded market expectations. The Flash Composite PMI rose to a two-month high of 52.1, beating consensus expectations of 50.3 and the prior 50.2. The Services PMI matched this two-month high, outperforming both the forecast of 51.6 and last month’s 51.3. Manufacturing PMI reached a 15-month high of 51.2, ahead of the consensus of 50.3 and the previous reading of 50.2. Stronger new order intakes fuelled output growth, with new business rising at its fastest pace in 14 months. Respondents cited increased confidence, a recovering sales pipeline, and more new work from abroad. The backlog of work rose marginally for the first time since February 2023, but hiring remained subdued, with employment declining for the fifteenth straight month. Inflation persisted, as input costs climbed at the quickest rate since May, and prices charged reached their highest since August. S&P Global indicated the PMI results support GDP growth accelerating by 0.2%, though only a 0.1% expansion is expected for Q4 overall.

In the eurozone, the S&P Flash Composite PMI fell to a three-month low of 51.9 in December, missing the consensus of 52.7 and previous 52.8. Manufacturing PMI dropped to an eight-month low of 49.2, below the forecast of 49.9 and prior 49.6, while the Services PMI hit a three-month low of 52.6, missing consensus of 53.3 and prior 53.6. Despite the weaker momentum, the eurozone achieved a full year of growth for the first time since the Covid pandemic began. The slowdown was attributed to softer new order growth and a sharper decline in new business from abroad. Services sector sentiment weakened, but the manufacturing outlook improved. Growth in Germany slowed, and output in France stagnated, with its services sector near contraction; however, other euro area countries continued solid growth, lifting employment for the third consecutive month. Price pressures increased, as input costs reached a nine-month high and output prices edged up.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.