Uncertainty keeps the Fed guessing

What to look out for today

Companies reporting on Friday, 21st November: Alibaba Group

Key data to move markets today

EU: German, French, and Eurozone HCOB Manufacturing, Services and Composite PMIs, Eurozone Negotiated Wage Rates, speeches by ECB President Christine Lagarde, Vice President Luis de Guindos, Bundesbank President Joachim Nagel, and Bank of Spain Governor José Luis Escrivá

UK: Public Sector Net Borrowing, Retail Sales, S&P Global Composite, Manufacturing and Services PMIs, and a speech by BoE Chief Economist Huw Pill

US: S&P Global Composite, Manufacturing, and Services PMIs, UoM 1- and 5-year Consumer Inflation Expectations, Michigan Consumer Sentiment and Expectations Indices, and speeches by New York Fed President John Williams, Fed Governor Michael Barr, Fed Vice Chair Philip Jefferson, and Dallas Fed President Lorie Logan

US Stock Indices

Dow Jones Industrial Average -0.84%

Nasdaq 100 -2.38%

S&P 500 -1.56%, with 10 of the 11 sectors of the S&P 500 down

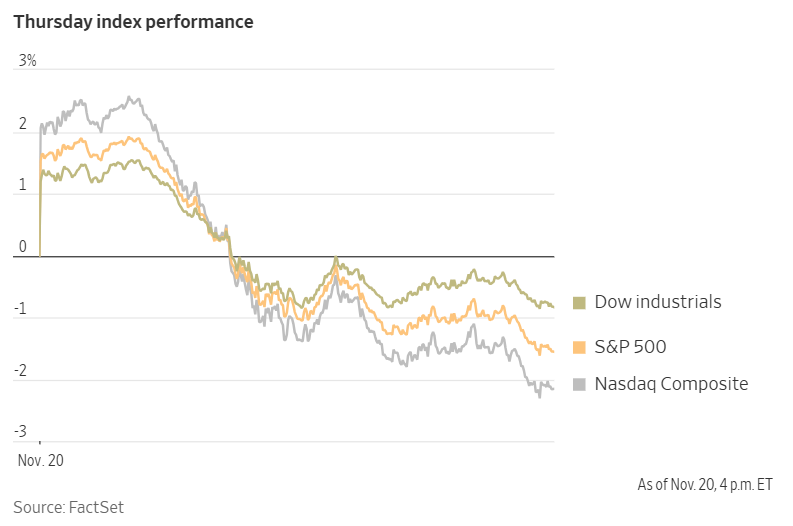

After a volatile session sparked by Nvidia's robust earnings report, stocks relinquished early gains and closed significantly lower. The Nasdaq Composite, which had climbed more than 2% earlier in the day, ultimately ended down -2.2%. Nvidia itself erased a substantial advance, finishing the session with a -3.2% decline.

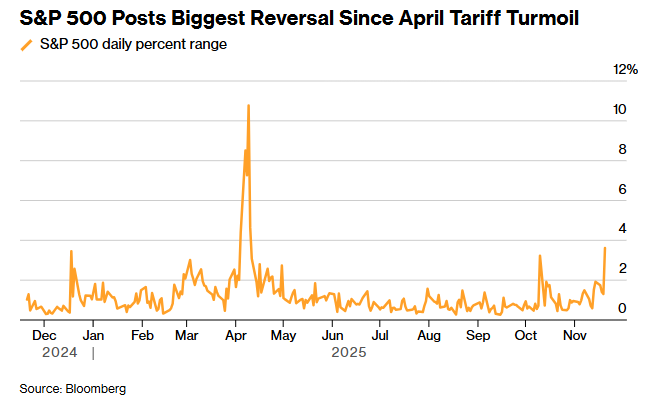

Losses were widespread across the market, with ten out of eleven S&P 500 sectors posting declines. The S&P 500 Index, which had risen as much as 1.4% during morning trading, closed -1.6% lower. The Dow Jones Industrial Average also retreated, dropping 387 points, equivalent to a -0.8% decrease. Notably, the S&P 500 registered its largest intraday reversal since the tariff-related volatility of April, swinging 3.6% from its session high. The index has now declined 5% from its latest peak.

In corporate news, Alphabet announced that it has created a method enabling its latest Pixel smartphones to transfer images and other files with iPhones by utilising Apple’s AirDrop protocol. This initiative represents a notable effort to challenge the exclusivity of Apple’s tightly controlled ecosystem.

Palo Alto Networks revealed on Wednesday its plans to acquire Chronosphere for $3.35 billion, aiming to enhance its portfolio of AI-driven cybersecurity solutions.

Verizon Communications disclosed on Thursday morning an extensive round of layoffs, potentially reducing up to 20% of its non-union workforce. This significant measure is part of a broader restructuring strategy spearheaded by the company’s new CEO, Dan Schulman.

Netflix has informed Warner Bros. Discovery’s management that it intends to continue releasing the studio’s films theatrically, should Netflix succeed in acquiring the company, according to individuals familiar with the matter.

Paramount Skydance has secured the broadcasting rights for the Champions League in both the UK and Germany, marking the company’s first major foray into international sports media, as reported by sources with knowledge of the agreement.

Abbott Laboratories has reached an agreement to acquire Exact Sciences, a cancer-screening firm, in a transaction valued at approximately $21 billion in total equity.

Exxon Mobil has lifted a force majeure on its Rovuma liquefied natural gas project in Mozambique, following improved security conditions—an important milestone toward advancing the project and committing capital for its construction.

Siemens Energy announced its largest share buyback programme since going public five years ago, reflecting increased optimism driven by rising investments in data centres.

S&P 500 Best performing sector

Energy +1.11%, with Texas Pacific Land +3.41%, Valero Energy +3.40%, and Diamondback Energy +3.34%

S&P 500 Worst performing sector

Materials -2.66%, with Eastman Chemical -3.94%, Celanese -2.58%, and International Flavors & Fragrance -2.30%

Mega Caps

Alphabet -1.03%, Amazon -2.49%, Apple -0.86%, Meta Platforms -0.20%, Microsoft -1.60%, Nvidia -3.15%, and Tesla -2.17%

Information Technology

Best performer: Micron Technology +4.17%

Worst performer: Lam Research -3.30%

Materials and Mining

Best performer: Mosaic +1.96%

Worst performer: Eastman Chemical -3.94%

European Stock Indices

CAC 40 +0.34%

DAX +0.50%

FTSE 100 +0.21%

Corporate Earnings Reports

Posted on Thursday, 20th November

Walmart quarterly revenue +5.8% to $179.496 bn vs $177.444 bn estimate

EPS at $0.62 vs $0.60 estimate

Doug McMillon, President and CEO, said, “The team delivered another strong quarter across the business. eCommerce was a bright spot again this quarter. We’re gaining market share, improving delivery speed, and managing inventory well. We’re well positioned for a strong finish to the year and beyond that, thanks to our associates. It’s been an honor to serve them as CEO, and I’m as excited about the future of this company as I’ve ever been. John Furner is a fantastic leader with a proven track record. I couldn’t be happier for him and for Walmart.” — see report.

Commodities

Gold spot -0.00% to $4,076.81 an ounce

Silver spot -1.33% to $50.64 an ounce

West Texas Intermediate -1.38% to $58.76 a barrel

Brent crude -0.86% to $63.12 a barrel

Gold prices remained stable on Thursday, with spot gold declining slightly by 17 cents to $4,076.81 per ounce.

The strengthening of the US dollar against most major currencies contributed to making gold, which is denominated in the greenback, more expensive for international buyers.

As a traditional safe haven asset, gold is up +55.38% this year, reaching a record high of $4,381.22 per ounce on 20th October.

Oil prices declined on Thursday following reports that the US administration is encouraging Ukraine to consider a peace agreement with Russia as a means to resolve the ongoing conflict.

Brent crude futures closed at $63.12 per barrel, a decrease of 55 cents or -0.86%. US WTI crude futures settled at $58.76 per barrel, down 82 cents or -1.38%. Earlier in the session, both benchmarks had experienced gains.

The proposed US-Russia peace initiative reportedly entails concessions of Ukrainian territory to Russia and reductions in Ukraine's military forces—conditions that President Volodymyr Zelenskiy has previously declined. On Thursday, President Zelenskiy indicated he would review the proposal and consult with the US regarding the plan.

Additionally, US sanctions targeting oil trade with Russian companies Rosneft and Lukoil take effect today. Lukoil has been granted until 13th December to divest its extensive international holdings.

Note: As of 5 pm EST 20 November 2025

Currencies

EUR -0.08% to $1.1527

GBP -0.55% to $1.3070

Bitcoin -3.66% to $87,220.49

Ethereum -3.70% to $2,878.34

The US dollar strengthened against most major currencies on Thursday, rebounding after an earlier decline prompted by indications of accelerated US job growth in September.

The euro, Swiss franc, Australian dollar, and British pound all depreciated relative to the dollar following the release of minutes from the FOMC October meeting, which revealed that ‘many’ participants had dismissed the likelihood of a December rate cut, while ‘several’ others considered it likely.

The euro fell -0.08% to $1.1527, reaching a two-week low, while sterling dropped -0.55% to $1.3070, its lowest since early November. Consequently, the dollar index rose by +0.10% to 100.22, approaching the six-month high recorded in early November.

The Japanese yen continued to weaken, declining -0.20% against the dollar to ¥157.46. The dollar climbed as high as ¥157.78, marking its strongest level since January and positioning the yen for a fourth consecutive daily loss. Since Prime Minister Sanae Takaichi’s election as leader of Japan’s LDP ruling party on 4th October, the yen has depreciated by -6.24%, despite rising Japanese bond yields. Market participants remain cautious about the extent of borrowing required to finance Takaichi’s stimulus measures.

Japan’s newly formed government is preparing a comprehensive economic stimulus package valued at more than ¥20 trillion—the largest since the onset of the COVID-19 pandemic—which Prime Minister Takaichi is expected to announce today. Japanese Finance Minister Satsuki Katayama stated on Tuesday that the government is closely monitoring currency markets ‘with a high sense of urgency.’

The yen’s continued weakness is closely linked to concerns over Japan’s fiscal outlook and the potential for further expansion. Although official intervention may temporarily influence the currency, it does not fundamentally alter the prevailing context.

Fixed Income

US 10-year Treasury -5.4 basis points to 4.088%

German 10-year bund +0.8 basis points to 2.725%

UK 10-year gilt -1.0 basis points to 4.589%

On Thursday, yields on US Treasury securities declined across the curve following the release of data indicating that, despite employers adding more jobs than anticipated in September, the unemployment rate increased. This development prompted a rally in Treasuries as traders adjusted their expectations, bringing the probability of a Fed rate cut in December closer to 40%.

In recent days, traders had reduced the likelihood of a December rate cut after numerous FOMC members voiced concerns regarding additional monetary easing amid persistently elevated inflation. The yield on the two-year Treasury note—particularly sensitive to changes in Fed policy expectations—fell by -5.7 bps to 3.545% for the day. The yield on the 10-year Treasury note decreased by -5.4 bps, settling at 4.088%. On the long end, the 30-year yield declined by -3.1 bps to 4.727%.

The spread between the two- and ten-year Treasury yields widened to 54.3 bps from 49.9 bps the previous week, marking a slight increase of 0.3 bps since late Wednesday.

Additionally, the US Treasury conducted an auction of $19 billion in 9-year, 8-month Treasury Inflation-Protected Securities (TIPS) on Thursday. The securities were sold at a high yield of 1.843%, with a median yield of 1.765%, and the auction attracted a bid-to-cover ratio of 2.41x.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 39.1% probability of a 25 bps rate cut at December FOMC meeting, lower than the prior week’s 50.1%. Traders are currently expecting 9.8 bps of cuts by year-end, lower than the 12.5 bps anticipated the prior week.

Long-dated eurozone government bond yields inched higher on Thursday. The yield on the German 10-year Bund rose by +0.8 bps to 2.725%, marking its highest level since early October.

Yields on longer-term German government bonds rose further, with the 30-year yield advancing +2.4 bps to 3.354%, marking its highest level since early September. In contrast, the two-year Schatz yield slipped by -0.3 bps to 2.025%, illustrating a curve steepening dynamic.

Market expectations, as reflected in the swaps market, indicate that the ECB is unlikely to adjust interest rates in the coming year.

Italy’s 10-year BTP yield advanced by +1.5 bps to 3.471%, widening the spread over German Bunds to 74.6 bps.

Note: As of 5 pm EST 20 November 2025

Global Macro Updates

Labour market surprises: nonfarm payrolls up, unemployment up. September nonfarm payrolls, which were delayed due to the government shutdown, significantly exceeded expectations, increasing by 119,000 compared to the consensus estimate of 50,000. This represents the strongest monthly gain since April. However, previous months saw downward revisions, with August's figures adjusted from a gain of 22,000 to a loss of 4,000, and July's total revised from 79,000 to 72,000. Analysts attributed the notable September outperformance to seasonal factors, suggesting that October's results may be softer as a result.

The unemployment rate unexpectedly rose to 4.4%, its highest level in four years, up from 4.3%. This increase was partly attributed to higher labour-force participation. Average hourly earnings advanced by 0.2% m/o/m, falling short of the 0.3% consensus and decelerating from August's 0.4% gain. On a y/o/y basis, average hourly earnings remained steady at 3.8%.

Job growth was concentrated in the leisure and hospitality, health care, and construction sectors, while declines were observed in transportation and warehousing, professional and business services, manufacturing, and the federal government.

About the implications for a potential December rate cut, analysts noted the surprise rise in unemployment, negative August revision, and seasonal distortions behind headline strength may give a divided FOMC more cover to cut, while others contend that the robust headline number mitigates concerns about labour market softening.

Initial jobless claims totaled 220,000 for the week ending 15th November, representing a decrease of 8,000 from the prior week and falling below the consensus estimate of 225,000. Continuing claims reached 1,974,000 for the week ending 8th November, an increase of 28,000 w/o/w and surpassing the forecast of 1,939,000; this marks the highest level since November 2021. The release indicated that there will be no retroactive publication of missed releases, although the data remains accessible through the Department of Labor's website.

The Philadelphia Fed's manufacturing index for November registered at -1.7, below the consensus expectation of +1.5 but an improvement over October's reading of -12.8. The report noted that the prices-paid component stayed elevated, with 59% of respondents indicating an increase in prices. A special survey question revealed that 40% of firms observed heightened price sensitivity among customers. While the employment component edged up slightly, most firms reported no changes in staffing levels.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.