Will Nvidia deliver?

What to look out for today

Companies reporting on Wednesday, 19th November: Nvidia, Palo Alto Networks, Target, Lowe’s Companies

Key data to move markets today

EU: Eurozone Harmonised Index of Consumer Prices and Core Harmonised Index of Consumer Prices

UK: CPI, PPI, and RPI

US: Building Permits, Housing Starts, FOMC Minutes and speeches by Fed Governor Stephen Miran and New York Fed President John Williams

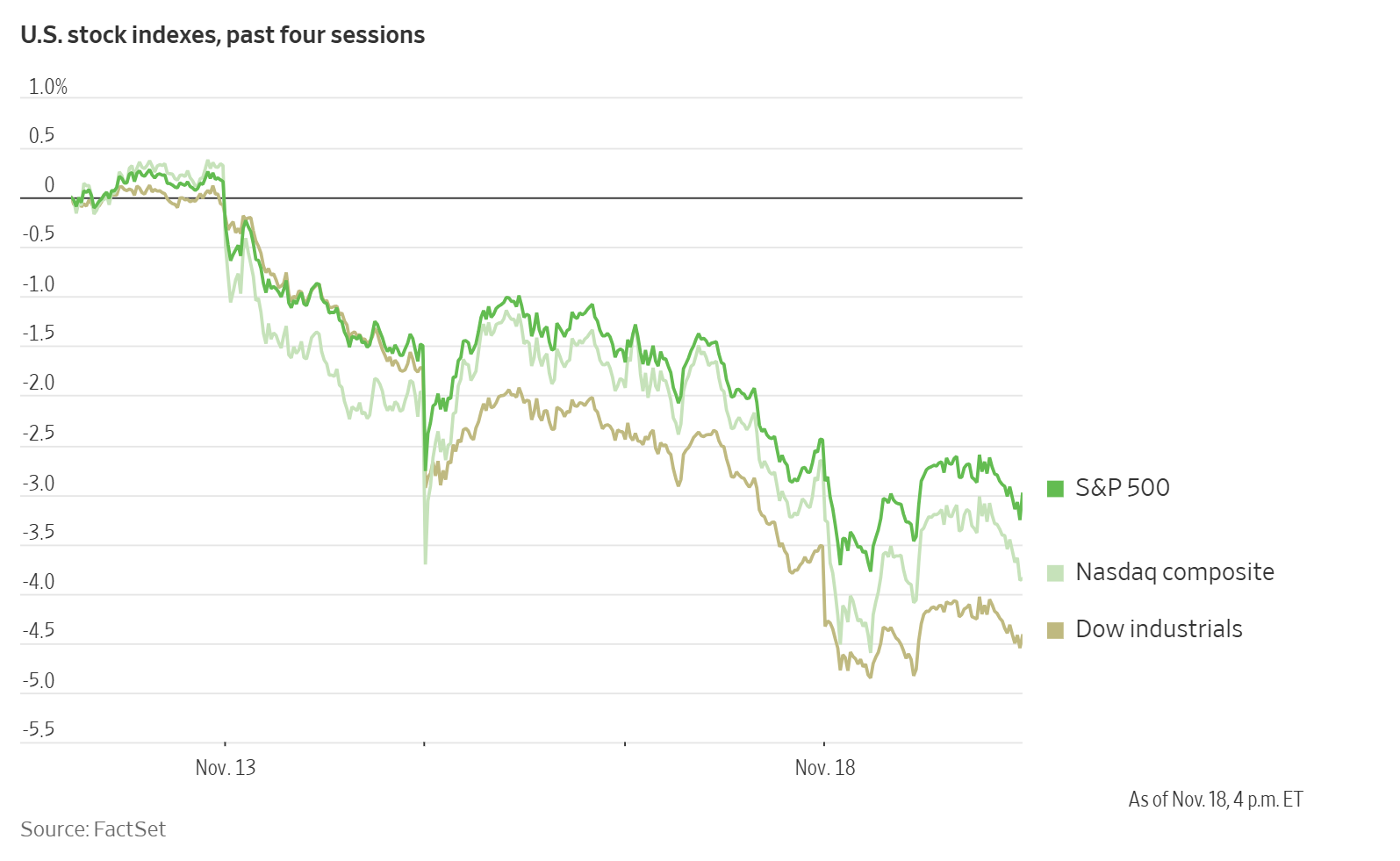

US Stock Indices

Dow Jones Industrial Average -1.07%

Nasdaq 100 -1.20%

S&P 500 -0.83%, with 6 of the 11 sectors of the S&P 500 up

US equity markets dropped for a fourth straight session on Tuesday as the VIX rose to a one-month high ahead of today’s corporate earnings release from Nvidia. Investors appear to be growing increasingly concerned that AI still isn’t generating enough revenue or profits to justify the massive spending on infrastructure by companies. Nvidia fell -2.81%, while Microsoft was -2.70% and Amazon -4.43%. The S&P 500 closed down 55.09 points or -0.83% to 6,617.32. The Nasdaq Composite was down 275.23 points or -1.21% to 22,432.85. The Dow Jones Industrial Average was down 498.50 points, or -1.07%, to 46,091.74.

In corporate news, a major outage on the network of cybersecurity firm Cloudflare disrupted websites from around the globe including X and ChatGPT for several hours on Tuesday before being resolved.

Pfizer plans to raise $6 billion through a US dollar corporate bond offering that will help fund its acquisition of Metsera Inc.

Home Depot cut its full-year earnings guidance after it missed earnings expectations for the third straight quarter due to weaker home improvement demand and consumers putting off large purchases. Its shares closed down 6% on Tuesday and are down about 13% so far this year, trailing the S&P 500’s 12.5% gain this year.

Meta Platforms won a lawsuit Tuesday after a federal judge ruled that the company’s acquisitions of the photo-sharing app Instagram and messaging service WhatsApp do not violate US antitrust law.

According to Bloomberg news, Freeport-McMoRan has set out a restart schedule for its Indonesian copper mine after a deadly mudslide in September.

S&P 500 Best performing sector

Energy +0.61%, with Valero Energy +3.94%, Devon Energy +2.28%, and APA Corp (US) +2.21%

S&P 500 Worst performing sector

Consumer Discretionary -2.50%, with Home Depot -6.02%, Amazon -4.43%, and Lowe’s Companies -2.41%

Mega Caps

Alphabet -0.26%, Amazon -4.43%, Apple -0.01%, Meta Platforms -0.72%, Microsoft -2.70%, Nvidia -2.81%, and Tesla -1.88%

Microsoft and Amazon saw their ratings cut to neutral from buy on Tuesday, as Rothschild & Co Redburn’s Alexander Haissl downgraded the stocks for the first time since initiating coverage in June 2022, according to data compiled by Bloomberg.

Information Technology

Best performer: Take-Two Interactive Software +2.36%

Worst performer: Western Digital -5.90%

Materials and Mining

Best performer: Albemarle +3.14%

Worst performer: Avery Dennison -1.89%

European Stock Indices

CAC 40 -1.86%

DAX -1.74%

FTSE 100 -1.27%

Corporate Earnings Reports

Posted on Tuesday, 18th November

Medtronic quarterly revenue +6.6% to $9 bn vs $8.87 bn estimated

Adjusted EPS $1.36 vs $1.31 estimated

Geoff Martha, Medtronic chairman and chief executive officer, said, “We delivered a strong second quarter, with both revenue and EPS beating expectations. Overall, procedure volumes and our end markets are robust, and we’re executing well across the business. Looking ahead, we are positioned for even greater acceleration of revenue growth in the back half of the year and beyond, driven by several enterprise growth drivers, including our PFA franchise for Afib, Symplicity procedure for hypertension, Hugo robotic-assisted surgery system, and Altaviva therapy for urge urinary incontinence.” — see report

Home Depot quarterly sales +2.8% to $41.35 bn vs $41.15 bn expected

Adjusted EPS $3.74 vs $3.84 estimated

Ted Decker, chair, president and CEO, said, “Our results missed our expectations primarily due to the lack of storms in the third quarter, which resulted in greater than expected pressure in certain categories. Additionally, while underlying demand in the business remained relatively stable sequentially, an expected increase in demand in the third quarter did not materialize. We believe that consumer uncertainty and continued pressure in housing are disproportionately impacting home improvement demand.” — see report

Commodities

Gold spot +0.6% to $4,072.40 an ounce

Silver spot +1.2% to $50.54 an ounce

West Texas Intermediate +1.39% to $60.74 a barrel

Brent crude +1.07% to $64.89 a barrel

Gold prices rose on Tuesday on soft US employment data from the US Department of Labor as investors considered the likelihood of a Fed cut in December. Spot gold was +0.6% to $4,072.40.

Oil prices were higher on Tuesday as traders weighed the impact of Western sanctions on Russian oil flows vs a global supply glut. Prices rose after President Donald Trump said his administration had begun interviewing the next Federal Reserve chair.

Brent crude was up 69 cents, or +1.07%, to $64.89 a barrel. US WTI was up 83 cents, or +1.39%, to $60.74.

Note: As of 4 pm EST 18 November 2025

Currencies

EUR -0.09% to $1.1582

GBP -0.05% to $1.3149

Bitcoin +1.1% to $92,799.46

Ethereum +3.9% to $3,121.86

The US dollar edged up very slightly on Tuesday as traders await Thursday’s nonfarm payroll data and the release of the FOMC minutes today for further indications of monetary policy. The dollar index was +0.02% to 99.60.

The euro was -0.09% to $1.1582 but was up again against the British pound, +0.05% to 88.12 pence. It traded as high as 88.64 pence on Friday, its highest since August 2023. As noted by Reuters, the euro has gained on the pound for the past four weeks in succession. The British pound edged down against the US dollar, -0.05% to $1.3149 as investors awaited British inflation data due today. This data may provide additional indications of the BoE’s policy path. Traders are increasingly expecting the BoE to cut rates, with an 80% chance of a rate cut next month. Market participants are also now expecting 59 bps of cuts by December 2026, compared with 54 bps late on Monday.

The dollar rose again against the Japanese yen on Wednesday, hitting a 9-1/2-month high. The dollar was +0.17% to ¥155.52. Despite BoJ Governor Kazuo signalling an increased likelihood of a rate rise in December, the Prime Minister Sanae Takaichi appears to be against the idea as she is looking to reflate the economy through stimulus measures. This means that there may be a growing risk of foreign-exchange intervention although there does not appear to be any imminent action. The suggested stimulus package has steepened the yield curve for Japanese government bonds, with 20-year yields reaching a 26-year high.

Fixed Income

US 10-year Treasury -1.9 basis points to 4.116%

German 10-year bund -1.1 basis points to 2.703%

UK 10-year gilt -0.4 basis points to 4.551%

US Treasury yields fell on Tuesday due to growing demand for safe-haven bonds as valuation worries continued to hit technology shares and as weakening labour market indicators raised expectations that the Fed will cut rates by 25 bps in December. The US federal government has started to release economic data that was delayed by the 43-day shutdown. The number of Americans on jobless benefits rose substantially between mid-September and mid-October. An ADP employer report showed that private employers shed an average of 2,500 jobs a week during the four weeks ending 1 November. Market participants will be watching out for today’s release of the FOMC’s 28-29 meeting and the nonfarm payroll report for September due on Thursday for further indications of the near term trajectory of Fed policy.

The 2-year note, which typically moves in step with Fed rate expectations,was -3.6 basis points to 3.571%. The yield on the benchmark 10-year notes fell -1.9 basis point to 4.116%. The yield on the 30-year Treasury bond was -0.1 basis point to 4.733%.

The spread between the yields on two-year and 10-year Treasury notes stood at a positive 54.5 bps, 2.3 bps higher than the previous week’s 52.2 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 48.9% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 66.9% probability.

Germany’s 10-year government bond yield was down -1.1 bps to 2.703% on Tuesday. The 2-year German yield, considered more responsive to ECB policy expectations, was -0.7 bps to 2.028%. The 30-year yield was +0.9 bps to 3.323%.

Italy’s 10-year government bond yield was +1.1 bps to 3.457%, with the spread over 10-year German Bunds standing at 75.4 bps.

In the UK, the 10-year yield was -0.4 bps to 4.551%.

Note: As of 5 pm EST 18 November 2025

Global Macro Updates

Signs of a cooling economy continue. According to the Labor Department website, the number of jobless claims for the week ending 18 October totalled 232,000. Continuing claims, a proxy for the number of people receiving benefits, came in at 1.957 million, up slightly from 1.947 million in the prior week. The department did not release its weekly jobless claims report during the government shutdown, which ended last week. ADP research showed that companies shed 2,500 jobs per week on average in the four weeks ended 1 November. In addition, Cleveland Fed data showed that 39,006 Americans in 21 states were given advance notice of layoffs last month. Traders will therefore be very focussed on Thursday’s scheduled release of the long-delayed September nonfarm payrolls report for an indication of whether the Fed may cut rates again at the December meeting.

In other economic news, US homebuilders’ confidence barely rose this month, ticking up 1 point in November to 38. A number below 50 indicates more builders see conditions as poor than good. The data showed that 41% of home builders reported cutting prices, a record in the post-Covid period. This was despite falling mortgage rates. Builder sentiment in the South and the West climbed to the highest since April. Sentiment in the Northeast fell the most since February.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora