Will the BoE cut rates this week?

What to look out for today

Companies reporting on Monday, 3rd November: Berkshire Hathaway, Coterra Energy, Diamondback Energy, Eastman Chemical, Loews, ON Semiconductor, Palantir Technologies, Pinnacle West Capital, SBA Communications, The Clorox, Vertex Pharmaceuticals

Key data to move markets today

EU: Spanish, Italian, French, German and Eurozone PMIs, and a speech by ECB Board Member and Chief Economist Philip Lane

UK: S&P Global Manufacturing PMI

USA: S&P Global Manufacturing PMI, ISM Manufacturing Employment and New Orders Indices, PMI and Prices Paid and speeches by San Francisco Fed Governor Mary Daly, and Fed Governor Lisa Cook

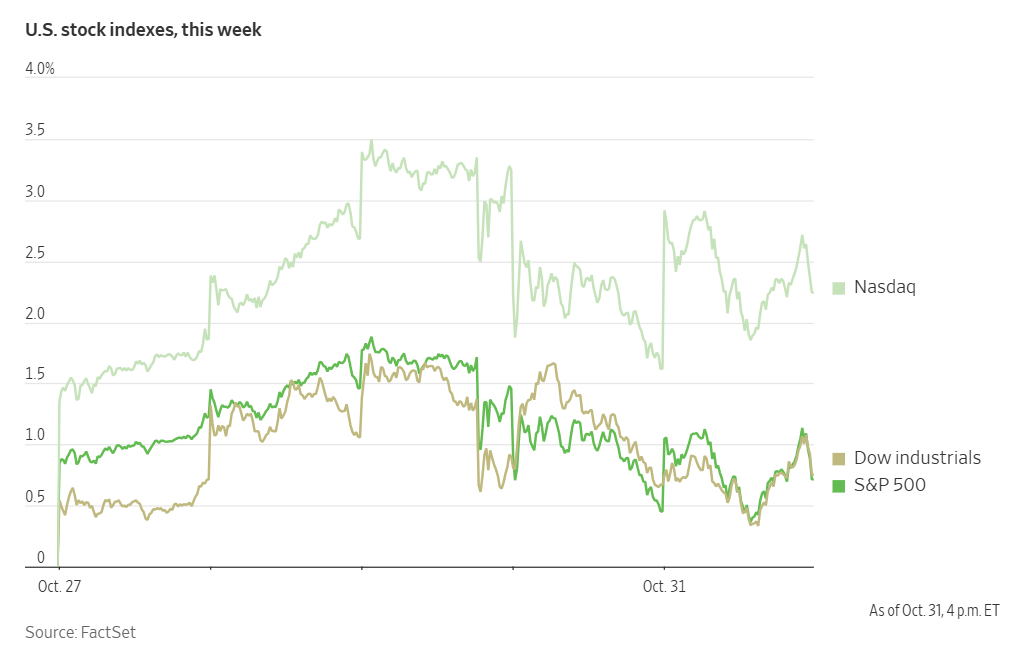

US Stock Indices

Dow Jones Industrial Average +0.09%

Nasdaq 100 +0.48%

S&P 500 +0.26%, with 5 of the 11 sectors of the S&P 500 up

On Friday, the Nasdaq Composite advanced following robust earnings reports from Amazon and Apple, which provided reassurance to investors regarding the outlook for major technology companies.

Amazon shares rose by +9.58%, driven by the fastest growth in its cloud-computing segment since 2022 and ambitious plans to expand data centre capacity. Apple shares fluctuated between modest gains and losses, ultimately closing -0.38% lower. The company reported record sales and projected a strong Q4, anticipating a wave of upgrades to the new iPhone 17.

These positive results alleviated some investor concerns about the potential returns from significant CapEx investments in AI. Earlier in the week, Meta Platforms and Microsoft shares declined after the companies announced substantial planned spending on AI, exerting pressure on the broader market.

By the end of the week and month, major indexes closed higher. The Dow Jones Industrial Average and Nasdaq Composite posted their sixth and seventh consecutive monthly gains, respectively—marking the longest winning streaks for both benchmarks since January 2018.

The S&P 500 also registered its sixth straight monthly gain, achieving its longest such streak since August 2021.

As of Friday’s close, all three major US stock indexes had risen by at least two percent for the month. The Nasdaq Composite led with a +4.70% increase, followed by the Dow’s +2.51% rise and the S&P 500’s +2.27% gain.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +13.8%. This number jumps to 14.7% when excluding the Energy sector. Of the 315 companies in the S&P 500 that have reported earnings to date for Q3 2025, 83.2% have reported earnings above analyst estimates, with 80.1% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 7.5% in Q3, increasing to 8.2% when excluding the Energy sector.

The Health Care sector, at 91.7%, is the sector with most companies reporting above estimates. Communication Services with a surprise factor of 15.7%, is the sector that’s beaten earnings expectations by the highest surprise factor. Within Communication Services, 27.3% of companies have reported below estimates and Industrials is the sector with the lowest surprise factor at 1.2%. The S&P 500 surprise factor is 8.3%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 23.1x.

In corporate news, Nvidia CEO Jensen Huang expressed continued interest in selling chips from the company’s Blackwell series to clients in China, although he noted that there are presently no plans in place to pursue such sales, as stated to reporters on Friday.

Cloudflare delivered sales results that surpassed both quarterly and annual expectations, following a strategic reorganisation and the acquisition of additional large enterprise customers.

Coinbase Global, the largest US cryptocurrency exchange, reported revenue for Q3 that exceeded Wall Street estimates, driven by an increase in trading activity and record-high token prices.

Carlyle Group experienced a decline in earnings within its private equity division during Q3. The firm relied on its credit and secondaries businesses to sustain performance as it navigated a challenging environment for dealmaking recovery.

S&P 500 Best performing sector

Consumer Discretionary +4.08%, with Amazon +9.58%, Caesars Entertainment +7.83%, and MGM Resorts International +4.26%

S&P 500 Worst performing sector

Materials -0.86%, with Linde -2.70%, FMC -2.32%, and Newmont -1.63%

Mega Caps

Alphabet -0.03%, Amazon +9.58%, Apple -0.38%, Meta Platforms -2,72%, Microsoft -1.52%, Nvidia -0.16%, and Tesla +3.74%

Information Technology

Best performer: First Solar +14.28%

Worst performer: Monolithic Power Systems -7.59%

Materials and Mining

Best performer: LyondellBasell Industries +2.70%

Worst performer: Linde -2.70%

European Stock Indices

CAC 40 -0.44%

DAX -0.67%

FTSE 100 -0.44%

Corporate Earnings Reports

Posted on Friday, 31st October

Abbvie quarterly revenue +9.1% to $15.776 bn vs $15.586 bn estimate.

EPS at $1.86 vs $1.77 estimate.

Robert A. Michael, Chairman and CEO, said, “AbbVie continues to deliver outstanding results, with significant momentum across key areas of our portfolio. We are also making great progress advancing our pipeline and investing in innovation to support AbbVie's long-term growth. Based upon the strength of our business and its promising outlook, we are once again raising our quarterly cash dividend.” — see report.

Chevron quarterly revenue -1.9% to $49.726 bn vs $47.229 bn estimate.

EPS at $1.85 vs $1.69 estimate.

Mike Wirth, Chevron’s Chairman and CEO, said, “Third quarter results reflect record production, strong cash generation and sustained superior cash returns to shareholders. US and worldwide production hit new company records, up 27 percent and 21 percent, respectively, from last year. Strong cash flow from operations was sustained while the company's adjusted free cash flow increased more than 50 percent from a year ago. The company returned $6 billion of cash to shareholders in the quarter, and over $78 billion in the last 3 years. The integration of Hess is progressing well, unlocking synergies across our operations and positioning Chevron as a premier global energy company.” — see report.

Colgate-Palmolive quarterly revenue +1.9% to $5.131 bn vs $5.127 bn estimate.

EPS at $0.91 vs $0.89 estimate.

Noel Wallace, Chairman, President and CEO, said, “We are pleased to have delivered another quarter of net sales and organic sales growth, even in the face of slowing category growth in many markets and the negative impact from lower private label pet sales as we have exited that non-strategic business. As we transition to our new 2030 strategy and deploy our previously announced Strategic Growth and Productivity Program, we are well positioned to reaccelerate growth despite uncertainty in global markets and lower worldwide category growth. The 2030 strategy is our blueprint for adapting to the challenges and capturing the opportunities of this more complex operating environment. Our organization is aligned and motivated, with particular focus around accelerating our science-based innovation and omni-channel demand generation capabilities to drive category growth and market shares. The Strategic Growth and Productivity Program will help ensure we have the organizational structure and support we need to achieve our goals in the near term and deliver consistent compounded earnings per share growth over the long term.” — see report.

Commodities

Gold spot -0.53% to $4,001.78 an ounce

Silver spot -0.52% to $48.65 an ounce

West Texas Intermediate +0.98% to $60.88 a barrel

Brent crude +0.53% to $65.07 a barrel

Gold prices declined by -0.53% on Friday, closing at $4,001.78 per ounce. Over the past week, the metal registered a loss of -2.67%, though it achieved a notable gain of +3.67% in October.

The dollar index remained near a three-month high on Friday, which increased the cost of greenback-denominated bullion for holders of other currencies.

Gold prices have increased by +52.52% so far this year, reaching a record high of $4,381.21 on 20th October.

Oil prices concluded Friday’s volatile trading session marginally higher, initially rising on media speculation that US air strikes on Venezuela were imminent, then retreating after the US President publicly denied such reports via social media.

Brent crude futures closed at $65.07 per barrel, marking an increase of 34 cents or +0.53%, while US WTI crude futures settled at $60.88 per barrel, up 59 cents or +0.98%. Over the past week, US WTI recorded a -0.91% decline, and Brent fell by -1.18%. In October, Brent and WTI dropped by -2.97% and -2.56%, respectively, as OPEC and major non-OPEC producers expanded output.

This additional supply is expected to help mitigate the effects of Western sanctions that have disrupted Russian oil exports to key buyers such as China and India.

According to the Baker Hughes report released on Friday, US energy firms reduced the number of operating oil and natural gas rigs for the first time in three weeks. The total rig count decreased by four to 546 for the week ending 31st October, representing the lowest level since September and placing the count 39 rigs, or 7%, below figures from the same period last year. Specifically, the number of oil rigs dropped by six to 414, the lowest since September, while gas rigs increased by four to reach 125, the highest since August 2023.

In Texas, the nation’s leading oil and gas producing state, the rig count declined by one to 235, the lowest since September 2021. Conversely, Louisiana’s rig count rose by one to 41, the highest observed since September 2024.

OPEC+ meeting sets December oil strategy, pauses for Q1 2026. On Sunday, OPEC+ agreed to implement a modest increase in oil production for December, followed by a suspension of further increases during the first quarter of next year. This decision reflects the producers’ group’s cautious approach in response to heightened concerns over a potential supply surplus.

Since April, OPEC+ has raised output targets by approximately 2.9 million barrels per day (bpd), representing about 2.7% of global supply. However, the pace of these increases was moderated from October onward due to forecasts indicating the possibility of oversupply in the market.

Additional challenges have emerged from newly imposed Western sanctions on Russia, a key OPEC+ member. With the US and Britain implementing new measures against major Russian producers Rosneft and Lukoil, Moscow may face limitations in further increasing output.

During the monthly meeting, the eight participating OPEC+ members—Saudi Arabia, Russia, United Arab Emirates, Iraq, Kuwait, Oman, Kazakhstan, and Algeria—agreed to raise December output targets by 137,000 bpd, maintaining the same increment as in October and November. The group further announced that, due to seasonal factors, production increases would be paused for January, February, and March 2026.

OPEC+ had previously instituted significant production cuts, which peaked in March at a total of 5.85 million bpd. These reductions comprised voluntary cuts of 2.2 million bpd, 1.65 million bpd by eight members, and an additional 2 million bpd by the entire group.

The group is currently in the process of reversing voluntary cuts, while the collective reduction of 2 million bpd is intended to remain in effect through the end of 2026. The eight OPEC+ members are scheduled to reconvene on 30th November, coinciding with the full OPEC+ meeting.

Note: As of 5 pm EDT 31 October 2025

Currencies

EUR -0.35% to $1.1529

GBP -0.01% to $1.3151

Bitcoin +1.50% to $109,513.73

Ethereum +2.25% to $3,860.43

The Japanese yen experienced a monthly decline against the US dollar on Friday, following BoJ's decision to maintain a dovish stance on future rate hikes, contrary to traders’ expectations for a more hawkish approach. Similarly, the Fed tempered hopes for a rate cut in December.

The yen managed to recover some losses after Japanese Finance Minister Satsuki Katayama emphasised that the government is closely monitoring foreign exchange fluctuations, expressing heightened concern as the yen continues to weaken. Data released on Friday indicated that core inflation in Tokyo accelerated in October, remaining above the central bank’s 2% target.

Despite this, investor disappointment persisted after BoJ Governor Kazuo Ueda adopted a less aggressive position on potential rate increases than anticipated, maintaining the policy rate at 0.5%. Japan’s newly elected leader, Sanae Takaichi, is expected to pursue more expansionary fiscal policies aimed at stimulating economic growth.

By the end of Friday, the yen was -0.05% lower to ¥154.00 and poised for its weakest monthly performance since July. Over the past week, the US dollar strengthened by +0.17% against the yen and increased +4.17% in October.

The dollar index rose +0.20% to 99.72, marking a +1.97% monthly gain in October—its strongest since July—and advanced +0.79% last week. The US dollar has been supported by optimism regarding the economic outlook, even as labour market indicators soften and Fed officials remain vigilant about inflationary pressures.

Fed Chair Jerome Powell noted on Wednesday that divergent views within the FOMC and a lack of comprehensive federal government data could prevent another interest rate cut this year. The Fed reduced rates as anticipated, though dissent was evident among policymakers: Fed Governor Stephen Miran advocated for a deeper reduction in borrowing costs, while Kansas City Fed President Jeffrey Schmid preferred no cut.

The euro fell -0.35% on Friday to $1.1529 after the ECB left interest rates unchanged at 2% for the third consecutive meeting and reiterated that monetary policy remains in a ‘good place’. The single currency declined -0.83% last week and posted a -1.76% decrease for October.

The British pound slipped -0.01% to $1.3151, its lowest level since 14th April, amid growing political pressures on Finance Minister Rachel Reeves. Against the euro, sterling reached its weakest point since May 2023. The pound recorded a -2.17% loss for October, following a -1.19% decline last week, as gilt yields fell due to concerns over the implications of Reeves’ upcoming November budget on businesses, households, and overall economic activity.

Market participants are increasingly pricing in the possibility of a BoE rate cut, though the central bank is expected to maintain current rates at its meeting this week.

Fixed Income

US 10-year Treasury -2.0 basis point to 4.079%

German 10-year bund -1.4 basis point to 2.634%

UK 10-year gilt -2.4 basis point to 4.408%

US Treasury yields declined on Friday; however, they experienced significant increases over the week, amid heightened uncertainty regarding additional rate cuts and the ongoing federal government shutdown, which continues to cloud the market outlook. Despite these weekly gains, yields across the curve ended October lower.

Following the FOMC announcement on Wednesday, Fed Chair Jerome Powell’s remarks tempered market expectations for an additional 25 bps reduction in December. This week, investors will closely monitor Wednesday’s ADP employment report for October and Thursday’s job creation estimates from Revelio Labs for further insight into labour market conditions. Additionally, the ISM Manufacturing and Services surveys are anticipated to provide insights into overall economic activity.

On Friday, the yield on the US 10-year Treasury note fell by -2.0 bps to 4.079%, yet it posted its largest weekly increase since April, climbing +5.6 bps over the week. At the longer end, the 30-year Treasury yield edged down by -0.4 bps to 4.655% but finished the week +5.1 bps higher. The two-year Treasury yield, which closely tracks interest rate expectations, decreased by -3.4 bps to 3.582% on Friday, still recording its largest weekly advance since April with an +8.1 bps rise.

The spread between the two- and 10-year Treasury yields narrowed to 49.7 bps, contracting by 2.5 bps over the week and by 3.8 bps throughout October, down from 53.5 bps at the end of September.

For the month, the 10-year yield declined by -7.3 bps, the two-year yield by -3.5 bps, and the 30-year yield by -7.5 bps.

Looking ahead, markets will pay close attention to the Treasury Department’s release of its quarterly financing estimates today and the forthcoming refunding plan scheduled for Wednesday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 69.2% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 91.7%. Traders are currently expecting 17.3 bps of cuts by year-end, lower than the 25.3 bps anticipated last week.

Eurozone government bond yields registered their second consecutive weekly increase after a largely uneventful ECB meeting. The ECB maintained its policy rate at 2%, emphasising that monetary policy remains appropriately positioned as economic risks subside and the euro area continues to demonstrate resilience amid prevailing uncertainties.

Germany’s 10-year Bund yield declined by -1.4 bps on Friday to 2.634%, yet posted a modest weekly gain of +0.6 bps. Similarly, the two-year German yield, more responsive to shifts in the ECB’s policy outlook, fell by -2.1 bps to 1.972% on Friday but finished the week +0.5 bps higher. The 30-year German yield increased +1.1 bps to 3.212% on Friday, contributing to a weekly rise of +0.4 bps.

On a monthly basis, the 10-year Bund yield decreased by -8.2 bps in October, while the two-year and 30-year yields declined by -6.1 and -7.2 bps, respectively.

In Italy, the 10-year yield fell by -0.9 bps on Friday to 3.363%, resulting in a -2.8 bps decrease over the week and an -18.2 bps decline for October. The spread between 10-year Italian BTPs and German Bunds narrowed by -10.0 bps over the month, standing at 72.9 bps, down from 82.9 bps at the end of September.

French 10-year OAT yields edged up by +0.1 bps on Friday to 3.422%, though they fell -1.6 bps over the week. For October, French 10-year yields fell by -11.9 bps, with the spread over German Bunds narrowing to 78.8 bps, a 3.7 bps decrease from the 82.5 bps recorded at September’s close. The spread reached 87.96 bps in early October, its widest since January, amid heightened concerns regarding France’s fiscal outlook.

In the wake of the ECB and FOMC meetings, traders reduced their expectations for future ECB rate reductions, with market sentiment remaining steady following the ECB’s policy announcement and remarks from President Christine Lagarde. As of Friday, money markets were pricing a roughly 50% probability of a 25 bps ECB rate cut by September, down from approximately 70% prior to the release of European PMI data. The ECB’s key rate is projected to be at 1.90% by December 2026, compared to the current 2.00%.

Note: As of 5 pm EDT 31 October 2025

Global Macro Updates

BoE rate cut risk: markets may be underestimating easing potential. While the prevailing consensus anticipates the BoE will maintain current interest rates at its upcoming meeting, some economists caution that markets may be underestimating the potential for a rate cut. Barclays, for example, has indicated that money markets are mispricing the likelihood of a 25 bps reduction and expects a closely contested vote in favour of easing rates, as reported by the Bloomberg news. Similarly, both Goldman Sachs and Nomura believe that policymakers may lean toward further monetary easing, according to the London Times.

Arguments supporting a dovish stance include the recent inflation figures, which remained unexpectedly at 3.8% y/o/y rather than accelerating, alongside moderating food prices, a softening wage environment, and a labour market that is easing more rapidly than anticipated. Conversely, policymakers with a more hawkish perspective have cautioned that structural changes in the labour market could contribute to persistently higher inflation and trigger second-round effects.

Another factor is the forthcoming Budget, scheduled for three weeks after the BoE’s decision, which could significantly influence the economic outlook should the government pursue a tighter-than-expected fiscal policy. While the BoE may opt to defer action until December, dovish policymakers may emphasise strong signals from the government regarding substantial tax increases. Given these dynamics, this week’s policy decision is likely to be finely balanced.

Fedspeak urges caution on easing as inflation remains high. In an official statement, Kansas City Fed President Jeff Schmid elaborated on his dissent regarding Wednesday’s 25 bps rate cut, emphasising his assessment that the labour market remains balanced, the economy retains significant momentum, and inflation continues to run at an elevated level. He asserted that the current policy stance is only modestly restrictive and argued that the Federal Reserve should prioritise curbing inflation over addressing labour market vulnerabilities.

Similarly, in Dallas, at 'The Evolving Landscape of Bank Funding' conference, Dallas Fed Governor Lorie Logan delivered hawkish remarks in a speech on Friday, expressing her preference for maintaining rates at the latest FOMC meeting. She observed that the labour market is balanced and cooling gradually, while inflation persists at high levels. She indicated that another rate cut in December would only be warranted if there is clear evidence of inflation declining more rapidly than anticipated or if the labour market cools more swiftly.

Atlanta Fed Governor Raphael Bostic noted on a panel at the same conference that, while the Fed is not operating without guidance, it is prudent to proceed with caution during periods of uncertainty. Additionally, Cleveland Fed President Beth Hammack stated that she would also have preferred to maintain rates at the recent meeting, highlighting the need to preserve some degree of policy restriction to bring down inflation. Hammack further remarked that market participants tend to overemphasise the median Summary of Economic Projections (SEP) dot.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。