Markets are ignoring the risk of US government shutdown

Global market indices

US Stock Indices Price Performance

Nasdaq 100 +4.65% MTD and +16.62% YTD

Dow Jones Industrial Average +1.27% MTD and +8.41% YTD

NYSE +1.57% MTD and +12.50% YTD

S&P 500 +2.75% MTD and +12.86% YTD

The S&P 500 is +0.57% over the past seven days, with 6 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.42% over this past week and +7.55% YTD.

The S&P 500 Communication Services sector is the leading sector so far this month, +7.06% MTD and +25.48% YTD, while Materials is the weakest sector at -3.09% MTD and +6.87% YTD.

Over this past week, Utilities outperformed within the S&P 500 at +2.92%, followed by Information Technology and Industrials at +2.63% and +1.15%, respectively. Conversely, Materials underperformed at -1.78%, followed by Consumer Staples and Communication services at -1.67% and -1.46%, respectively.

The equal-weight version of the S&P 500 was -0.21% on Wednesday, outperforming its cap-weighted counterpart by 0.07 percentage points.

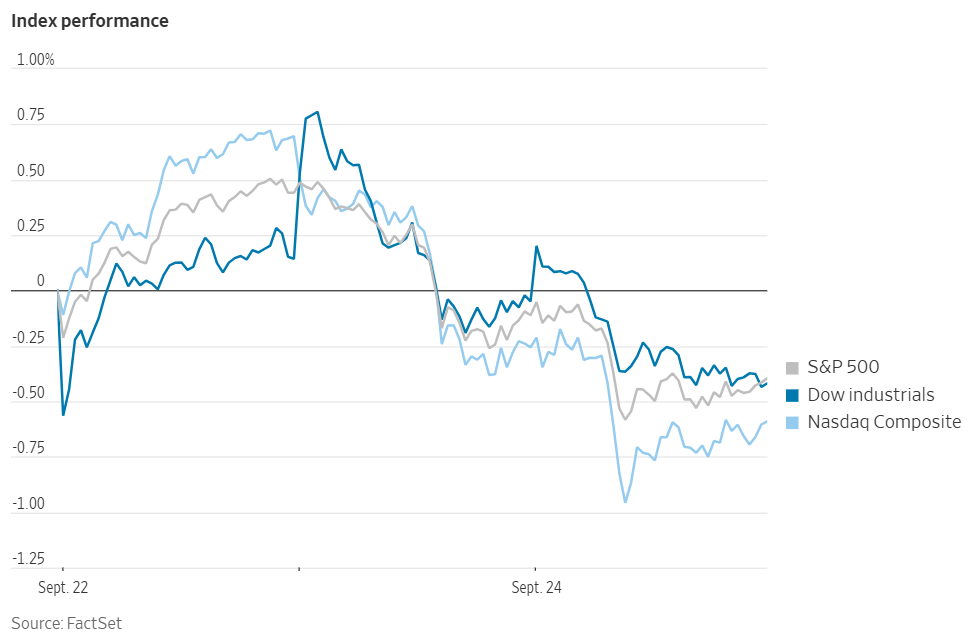

By the end of the trading session major US stock indices declined on Wednesday, weighed down by a second consecutive day of losses in the Information Technology sector. The Nasdaq Composite and the broader S&P 500 fell by -0.33% and -0.28%, respectively. The Dow Jones Industrial Average closed the session 172 points down or -0.37%.

In corporate news, Alibaba Group has announced its intention to increase expenditures on AI beyond its initial commitment exceeding $50 billion. This strategic decision aligns the company with other technology industry leaders dedicating progressively larger capital to the global pursuit of technological advancement.

Xcel Energy has reached a settlement to resolve claims that its power lines were a contributing factor in the ignition of the costliest wildfire in Colorado's history in 2021. The utility agreed to a payment of approximately $640 million, thereby preempting a jury trial where potential liabilities could have reached billions of dollars.

According to Bloomberg news, sources familiar with the matter indicate that Medline is contemplating a public filing for an IPO potentially as early as late October. This move could result in the largest US listing of the current year.

Oracle successfully issued $18 billion in new investment-grade bonds on Wednesday, an increase from the initial guidance of $15 billion, reflecting robust investor demand. This demand persisted despite concerns regarding Oracle's negative free cash flow and existing debt. Moody's Investors Service suggests that the proceeds from these bonds are allocated for general corporate purposes, which may encompass investment in AI infrastructure.

Iberdrola is reinforcing its multi-billion-dollar commitment to global power grids, anticipating that increased electricity demand from AI, electric vehicles, and heavy industry will serve as a primary catalyst for growth.

TotalEnergies has stated it will reduce its share buyback programme for the fourth quarter and into the next year. This adjustment is being made as the company addresses rising debt levels and navigates a challenging forecast for the oil market.

Mega caps: The Magnificent Seven had a mixed performance over the past week. Over the last seven days, Apple +5.57%, Tesla +3.98%, Nvidia +3.92%, and Microsoft +0.03%, while Alphabet -0.96%, Meta Platforms -1.94%, and Amazon -4.93%.

Energy stocks had a mostly positive performance this week, with the Energy sector itself +1.03%. WTI and Brent prices are +1.11% and +1.81%, respectively, over the past week. Over the last seven days, Energy Fuels +20.81%, Halliburton +9.84%, Baker Hughes +7.29%, BP +4.61%, Marathon Petroleum +4.56%, Phillips 66 +2.59%, Shell +2.57%, ConocoPhillips +1.93%, and APA +1.10%, while Chevron -0.57%, ExxonMobil -0.63%, and Occidental Petroleum -0.64%.

Materials and Mining stocks had a mixed performance this week, with the Materials sector -1.78%. Over the past seven days, Sibanye Stillwater +19.93%, CF Industries +8.86%, Newmont Corporation +6.07%, Mosaic +5.18%, Yara International +3.28%, and Albemarle +1.77%, while Nucor -4.48%, Celanese Corporation -6.05%, and Freeport-McMoRan -16.46%.

Freeport-McMoRan invokes force majeure at Grasberg, expecting lower copper and gold sales. Shares of Freeport-McMoRan declined substantially following the company's disclosure to investors regarding significant production delays linked to a fatal mudslide at its Garsberg mine in Indonesia.

The Phoenix-based miner's stock closed -16.95% lower. On Wednesday, Freeport confirmed that the bodies of two employees had been recovered, while five workers remain missing after an estimated 800,000 tons of wet material flowed into its Grasberg mine on 8th September.

In response to the tragedy, the company has invoked force majeure on contracted supplies from the mine. This declaration releases the company from its contractual obligations, a situation that has fuelled scarcity concerns and contributed to a global increase in copper prices.

Due to these disruptions, Freeport anticipates that consolidated sales for Q3 will be 4% lower for copper and 6% lower for gold compared to the estimates it provided in July.

European Stock Indices Price Performance

Stoxx 600 +0.68% MTD and +9.11% YTD

DAX -0.98% MTD and +18.87% YTD

CAC 40 +1.60% MTD and +6.05% YTD

IBEX 35 +1.35% MTD and +31.04% YTD

FTSE MIB +0.67% MTD and +24.25% YTD

FTSE 100 +0.69% MTD and +13.18% YTD

This week, the pan-European Stoxx Europe 600 index is +0.59%. It was -0.19% on Wednesday, closing at 553.88.

So far this month in the STOXX Europe 600, Basic Resources is the leading sector, +6.36% MTD and +4.49% YTD, while Food & Beverages is the weakest at -5.37% MTD and -6.09% YTD.

This week, Technology outperformed within the STOXX Europe 600, at +4.16%, followed by Basic Resources and Oil & Gas at +3.81% and +3.14%, respectively. Conversely, Personal & Household Goods underperformed at -1.82%, followed by Telecom and Construction Materials at -1.74% and -1.51%, respectively.

Germany's DAX index was +0.23% on Wednesday, closing at 23,666.81. It was +1.32% over the past seven days. France's CAC 40 index was -0.57% on Wednesday, closing at 7,827.45. It was +0.52% over the past week.

The UK's FTSE 100 index was +0.60% over the past seven days to 9,250.43. It was +0.29% on Wednesday.

In Wednesday's trading session, Aerospace & Defence was the outperformer, as the US President's remarks supporting Ukraine's full territorial reclamation provided a significant impetus. Within the sector, Fincantieri traded higher after Italy's Ministry of Defence presented a €1.6 billion naval investment programme.

In the broader Industrials Goods & Services sector, Bouygues' shares were higher following an upgrade by Morgan Stanley, citing potential margin upside at its subsidiary, Equans. Goodwin also advanced on a strong trading update and a new partnership announcement.

The Utilities also outperformed, with a spotlight on TotalEnergies and RWE, which jointly won a French government tender to build the country's largest offshore wind farm. The project is valued at €4.5 billion and is scheduled to begin at the start of the next decade.

Technology stocks ended the session higher, with a focus on positive developments related to AI. This was supported by encouraging earnings and guidance from Micron Technology and an increased investment ramp-up by Alibaba Group. Additionally, OpenAI, SoftBank, and Oracle announced a joint $400 billion investment to expand the Stargate initiative with new AI data centre sites.

Conversely, the Autos & Parts sector was the day's underperformer. Stellantis shares came under pressure amid reports of production pauses at its European plants due to weak demand. The Chemicals sector also declined, as Lanxess and Evonik Industries were both downgraded by Deutsche Bank, which cited structural pressures.

Financials also demonstrated a notable underperformance following comments from Fed Chair Jerome Powell that tempered optimism regarding near-term interest rate cuts.

As of 23rd September, according to LSEG I/B/E/S data, for the STOXX 600, Q2 2025 earnings are expected to increase 3.9% from Q2 2024. Excluding the Energy sector, earnings are expected to increase 7.6%. Q2 2025 revenue is expected to decrease 1.7% from Q2 2024. Excluding the Energy sector, revenues are expected to increase 0.5%. Of the 285 companies in the STOXX 600 that have reported earnings by 23rd September for Q2 2025, 50.5% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 353 companies in the STOXX 600 that have reported revenue for Q2 2025, 49.6% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

Financials is the sector with most companies reporting above estimates at 68%. Financials, with a surprise factor of 12.2%, is the sector that beat earnings expectations by the highest surprise factor. In the Basic Materials sector, 73% of companies have reported below estimates. Its earnings surprise factor was the lowest at -13.2%. The STOXX 600 surprise factor is 5.5%, which is above the long-term (since 2012) average surprise factor of 5.8%. The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.3x, slightly above the 10-year average of 14.2x.

During the week of 29th September, one company is scheduled to report Q2 earnings.

Other Global Stock Indices Price Performance

MSCI World Index +2.38% MTD and +15.36% YTD

Hang Seng +5.75% MTD and +32.20% YTD

The MSCI World Index is +0.29% over the past 7 days, while the Hang Seng Index is -1.45% over the past 7 days.

Currencies

EUR +0.46% MTD and +13.38% YTD to $1.1738

GBP -0.43% MTD and +7.47% YTD to $1.3445

The US dollar gained against major currencies on Wednesday, including the yen, Swiss franc, and euro, following Fed Chair Jerome Powell's cautious remarks on further monetary easing. The dollar index ended the day +0.66% higher at 97.85, ending a two-day losing streak. It has risen +0.86% over the past week. It is -0.01% MTD, and -9.80% year-to-date.

The US dollar strengthened by +0.54% against the Swiss franc to CHF 0.7950, reversing two consecutive sessions of losses. The euro also weakened against the US dollar, falling -0.64% to $1.1738 after two days of gains. Sterling declined by -0.53% to $1.3443, though it remained steady against the euro at 87.27 pence.

The dollar's most significant increase on Wednesday was against the Japanese yen, rising +0.88% to ¥148.85, its highest level in three weeks. The shift came as candidates for leadership of Japan's ruling Liberal Democratic Party answered questions. Frontrunner Sanae Takaichi stated that while monetary policy is the BoJ's domain, higher rates could impact mortgages and corporate investment.

The dollar has strengthened +1.30% against the yen over the past week, contributing to a +1.24% appreciation so far this month.

Fed Chair Jerome Powell's cautious tone on Tuesday, in which he emphasised the need to balance the risks of high inflation and a weakening job market, has put this week's US economic data under close scrutiny. Investors are focused on tomorrow's release of the Personal Consumption Expenditures (PCE) price index, a key measure that will influence expectations for the Fed's policy path.

Note: As of 5:00 pm EDT 24 September 2025

Cryptocurrencies

Bitcoin +4.76% MTD and +34.98% YTD to $113,629.13

Ethereum -4.44% MTD and +24.69% YTD to $4,172.39

Bitcoin is -2.10% and Ethereum -7.92% over the past 7 days. On Wednesday, Bitcoin was +1.25% to $113,629.13 and Ethereum was -0.33% to $4,712.39.

Spot Bitcoin and Ethereum ETFs have experienced significant outflows this week as investors reposition following the Fed’s 25 bps rate cut last week and in anticipation of PCE data later this week. They recorded a combined $244 million in outflows on 23 September and $439 million of outflows on 22 September.

Despite the drop in Bitcoin over the past week, crypto firm River said in a post on X that companies now hold more Bitcoin than ETFs, with both continuing to accumulate. This means that corporate and institutional ETF buying is helping offset any Bitcoin whale sell-offs and creating a structural floor for the cryptocurrencies. Whales is a term for entities that hold upwards of 1,000 Bitcoin. As noted by DLNews, over the past month, Bitcoin whales have sold over $16 billion worth of coins with the selling happening at the fastest monthly rate since Bitcoin’s last halving event in 2024.

In addition, following last week’s US Securities and Exchange Commission (SEC) decision to adopt new listing standards eliminating the need for individual regulatory review of each crypto ETF application, allowing products that meet predetermined standards to launch without a lengthy case-by-case approval process, there are growing expectations that at least a dozen new crypto ETFs, most likely tied to Solana and XRP, may emerge in October. There are currently about 21 US cryptocurrency ETFs that own either Bitcoin or Ethereum, or a combination of both.

Note: As of 5:00 pm EDT 24 September 2025

Fixed Income

US 10-year yield -8.4 bps MTD and -42.7 bps YTD to 4.149%

German 10-year yield +2.6 bps MTD and +38.4 bps YTD to 2.753%

UK 10-year yield +4.7 bps MTD and +10.8 bps YTD to 4.676%

US Treasury yields rose on Wednesday, influenced by an increase in corporate and government bond supply. This shift occurred a day after Fed Chair Jerome Powell expressed a cautious stance regarding the FOMC upcoming interest rate decision on 29th October.

The 10-year Treasury note yield climbed by +4.2 bps to 4.149%, its highest level since 5th September. Similarly, the 30-year bond yield increased by +3.4 bps from Tuesday's close, settling at 4.753%. In contrast, the two-year yield, often seen as reflecting interest rate expectations, fell -1.8 bps to 3.612%.

On the supply front, the Treasury Department auctioned $70 billion in five-year notes on Wednesday, following a $69 billion two-year auction on Tuesday. The five-year auction had a bid-to-cover ratio of 2.34x, while the two-year auction's ratio was 2.51x, indicating that dealer demand for new paper has been modest in recent auctions. The Treasury is scheduled to auction $44 billion in seven-year notes on Thursday.

At the close of trading, the spread between the two- and 10-year Treasury notes widened to a positive 53.7 bps, an expansion of 2.4 bps from the 51.3 bps recorded last week.

Over the past seven days, the yield on the 10-year Treasury note was +6.4 bps. The yield on the 30-year Treasury bond was +6.3 bps. On the shorter end, the two-year Treasury yield was +4.0 bps.

Traders are pricing in 68.5 bps of cuts by year-end, lower than last week’s 70.2 bps, according to CME Group's FedWatch Tool. Fed funds futures traders are now pricing in a 93.0% probability of a 25 bps rate cut at October’s FOMC meeting, up from 87.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was -0.7 bps to 4.676%. The UK 10-year yield was +4.7 bps over the past seven days. The 30-year gilt was -0.7 bps to 5.493% on Wednesday and is +6.1 bps over the past seven days.

Across the English channel, eurozone bond yields eased on Wednesday following the unexpected decline in German business sentiment for September.

The Ifo institute revealed that its business climate index slipped to 87.7 in September from a revised 88.9 in August. The report indicated that German companies were less satisfied with their current business conditions, reflecting increased pessimism.

The yield on Germany's 10-year bond was down -0.2 bps to 2.753%. The yield on Germany's 30-year bond fell slightly, by -0.3 bps, to 3.343%. On the short-end of the German curve, the 2-year Schatz was -0.7 bps to 2.027%.

Yields for other regional bonds, including those from France and Italy, also trended lower in alignment with German debt. The 10-year French yield rose 0.7 bps to 3.578% on Wednesday. The yield spread between French and German 10-year government bonds, a key indicator of the risk premium for French debt, was 0.9 bps higher from the previous week's 81.6.bps, settling at 82.5 bps.

Over the past seven days, the German 10-year yield was +7.9 bps. Germany's two-year bond yield was +1.9 bps, and, on the longer end of the spectrum, Germany's 30-year yield was +11.3 bps.

The spread between US 10-year Treasuries and German Bunds is now 139.6 bps, a contraction of 1.5 bps from last week’s 141.1 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 81.6 bps, a 2.0 bps expansion from 79.6 bps last week. The Italian 10-year yield was +9.9 bps over last week, after trading +1.4 bps on Wednesday to 3.569%.

Italy is scheduled to sell up to €8.75 billion in 5-year and 10-year bonds this week.

Commodities

Gold spot +8.39% MTD and +42.49% YTD to $3,735.92 per ounce

Silver spot +10.69% MTD and +52.02% YTD to $43.91 per ounce

West Texas Intermediate crude +1.25% MTD and -9.70% YTD to $64.81 a barrel

Brent crude +1.48% MTD and -7.56% YTD to $69.13 a barrel

Gold prices declined on Wednesday as the US dollar strengthened, causing the precious metal to retreat from the record high it reached in the previous session.

Spot gold fell by -0.74% to $3,735.92 per ounce, following its all-time high of $3,790.82 on Tuesday. The rise in the US dollar index, which gained +0.66%, made gold more expensive for investors using other currencies.

Gold is often seen as a safe-haven asset, appealing to investors during periods of geopolitical and economic uncertainty. Its value also tends to increase in a low-interest-rate environment, as it is a non-yielding asset that does not compete with interest-bearing investments.

Gold prices have increased +2.08% over the last seven days, and have gained +8.39% so far this month.

Oil prices rose Wednesday, with both Brent and US WTI futures reaching a seven-week high. The increase, exceeding 1.5 percentage points, was driven by multiple factors pointing to tightening supplies. A key catalyst was a surprise decline in US crude inventories, which, when combined with ongoing export challenges in Iraq and Russia, heightened concerns about supply constraints.

Brent futures saw a rise of $1.27, or +1.87%, to settle at $69.13 per barrel. WTI crude futures increased by $1.16, or +1.82%, to close at $64.81. This marked the highest closing price for Brent since 1st August and for WTI since 2nd September.

This week, WTI and Brent prices are +1.11% and +1.81%, respectively.

Ukrainian military strikes on two oil pumping stations in Russia's Volgograd region and a declared state of emergency in the major Black Sea port of Novorossiisk introduced further market volatility. These developments compounded existing fuel shortages in Russia, which traders and retailers attribute to recent Ukrainian drone attacks on energy infrastructure aimed at diminishing Moscow's export revenues.

Meanwhile, US oil and gas production in the key states of Texas, Louisiana, and New Mexico saw a slight decline in the third quarter of 2025, according to the Dallas Fed.

Despite rising prices, a few developments offered some counter-pressure. Eight international oil companies operating in Iraqi Kurdistan reached an agreement in principle with Iraqi federal and Kurdish governments to resume oil exports.

Furthermore, Iran's Oil Minister, Mohsen Paknejad, stated that no new restrictions would be placed on the country's oil sales, and exports to China would continue, even as Tehran and European powers work to prevent the re-imposition of international sanctions. Iran's President, Masoud Pezeshkian, also addressed the UN General Assembly, reiterating that Iran has no intention of building nuclear weapons, just days before the potential sanctions. Iran was the third-largest crude producer in OPEC in 2024, behind Saudi Arabia and Iraq.

EIA report. According to the Weekly Petroleum Status Report from the Energy Information Administration (EIA) on Wednesday, US crude oil and fuel inventories decreased last week amid a rise in demand.

For the week ending 19th September, crude inventories experienced a modest draw of 607,000 barrels, bringing the total to 414.8 million barrels. This occurred despite a 177,000-barrel build at the Cushing, Oklahoma, delivery hub. Trade flows contributed to the inventory change, as net US crude imports rose by 1.6 million barrels per day (bpd), while crude exports fell by 793,000 bpd to 4.48 million bpd.

Refinery crude runs increased slightly by 52,000 bpd, although the overall utilisation rate declined by 0.3 percentage points to 93.0%.

The data indicated strengthening consumption, with total product supplied—a key measure of demand—rising by 156,000 bpd to 20.79 million bpd. This figure is 190,000 bpd above the four-week average for the same period last year.

Reflecting this higher demand, inventories of refined products also fell. US gasoline inventories fell 1.1 million barrels to 216.6 million barrels. Distillate stockpiles, which include diesel and heating oil, saw a larger decrease of 1.7 million barrels, settling at 123 million barrels.

Note: As of 5:00 pm EDT 24 September 2025

Key data to move markets

EUROPE

Thursday: GfK Consumer Confidence Survey

Friday: Spanish GDP and speeches by ECB Executive Board member Piero Cipollone and Bank of Spain Governor José Luis Escrivá

Monday: Spanish Harmonised Index of Consumer Prices, Eurozone Business Climate, Consumer Confidence, and Economic Sentiment Indicators

Tuesday: German Retail Sales, Unemployment Change and Harmonised Index of Consumer Prices, and French, Italian and German CPI and Producer Price Indices (PPIs)

Wednesday: Eurozone, Spanish, French, German and Italian HCOB Manufacturing PMIs and Eurozone Harmonised Index of Consumer Prices and Core Harmonised Index of Consumer Prices

UK

Friday: BoE Quarterly Bulletin

Monday: Speech by BoE Deputy Governor Dave Ramsden

Tuesday: GDP and speeches by BoE Deputy Governors Clare Lombardelli, Catherine Mann, and Sarah Breeden

Wednesday: Speech by BoE Deputy Governor Catherine Mann

USA

Thursday: Initial and Continuing Jobless Claims, Q2 Personal Consumption Expenditures (PCE) and Core PCE, Durable Goods Orders, Nondefence Capital Goods Orders, GDP, Personal Consumption Expenditures Prices, Existing Home Sales, and speeches by Chicago Fed President Austan Goolsbee, Kansas City Fed President Jeff Schmid, New York Fed President John Williams, Dallas Fed President Lorie Logan, San Francisco Fed President Mary Daly, and Fed Governors Michelle Bowman and Michael Barr

Friday: PCE Price Index, Core PCE Price Index, Personal Income, Personal Spending, Michigan Consumer Expectations, Sentiment Index, UoM 1-year and 5-year Consumer Inflation Expectations, and speeches by Richmond Fed President Thomas Barkin and Fed Governor Michelle Bowman

Monday: Pending Home Sales and speeches by St Louis Fed President Alberto Musalem, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic

Tuesday: Housing Price Index, Chicago PMI, Consumer Confidence, JOLTS Job Openings, and a speech by Chicago Fed President Austan Goolsbee

Wednesday: ADP Employment, ISM Manufacturing PMI, Manufacturing Prices Paid, Employment Index, and New Orders Index

CHINA

Tuesday: NBS Manufacturing PMI and Non-Manufacturing PMI, RatingDog Manufacturing PMI and Services PMI

JAPAN

Thursday: Tokyo CPI and Core CPI

Monday: Large Retailer Sales and Retail Trade

Tuesday: Tankan Large All Industry Capex, Manufacturing Index, and Manufacturing Outlook

Global Macro Updates

Market complacency persists despite government shutdown risk. With the 30th September deadline approaching, an agreement to extend government-spending authority has not been reached, raising the possibility of a government shutdown beginning on 1st October.

Republicans have put forward a proposal for a ‘clean’ continuing resolution to maintain current funding levels through 21st November. However, the House measure was defeated in the Senate, where Republicans will ultimately require at least ten Democratic votes to avoid a filibuster. In response, Democratic leadership is demanding that any continuing resolution include key spending priorities, most notably an extension of certain Affordable Care Act subsidies that are set to sunset on 1st January. According to a report from Axios, Republicans may be willing to concede on this point, but not as part of a temporary stopgap bill.

Negotiations appear to have stalled. On Tuesday, the US President cancelled a planned Thursday meeting with Democratic leaders. Politico reports that House Republican leadership does not plan to reconvene the chamber until after the shutdown deadline has passed.

Financial markets appear to be ignoring the risk of at least a partial shutdown despite the prevailing uncertainty and the potential impact a government shutdown can have on growth. This reaction is likely based on the expectation that many critical government functions remain operational during a shutdown and that past economic damages have generally been reversed after an agreement is reached. Critically, the current negotiations do not involve discussions over the debt ceiling, thus avoiding any default risk.

US pledges $20 billion swap line to bolster Argentina. The US has signalled strong financial support for Argentina, with US Treasury Secretary Scott Bessent confirming that Washington is in negotiations to provide a $20 billion swap line to the nation and stands ready to purchase its dollar-denominated debt. Secretary Bessent vowed support for President Javier Milei in his effort to counter ‘speculators,’ emphasising that the White House would be ‘resolute in our support for allies of the US.’ This commitment is aimed at calming a significant market crisis currently challenging President Milei.

In a post on the social media platform X on Wednesday, Secretary Bessent specified the nature of the support. ‘The Treasury is currently in negotiations with Argentine officials for a $20 billion swap line with the Central Bank.’ Adding that ‘the U.S. Treasury stands ready to purchase Argentina's USD bonds and will do so as conditions warrant.’ The Secretary further noted the readiness to provide ‘significant standby credit via the Exchange Stabilization Fund,’ referencing the fund previously utilised during the 1995 Mexican bailout, and confirmed ‘active discussions with President Milei's team to do so.’

President Milei is currently navigating the most severe crisis of his presidency ahead of next month's midterm elections, where the public will evaluate his economic policies. While these policies averted hyperinflation, they have suppressed economic growth in recent months.

Investor concerns were heightened by a substantial defeat for Milei's party in a recent regional election and a concurrent corruption scandal. These events precipitated a run on the peso last week, which threatened to force a chaotic devaluation of the currency.

Following Secretary Bessent's latest intervention, the price of Argentina's dollar bonds registered modest gains, building upon a steep rally observed on Monday, when the Trump administration initially signalled its support for President Milei. The peso has strengthened 10% since Monday, rebounding to its valuation before a surprise election loss for Milei two weeks ago in the Buenos Aires province. Additionally, Argentina's Merval share index rose nearly 5% in dollar terms on Wednesday, although it remains down 12% over the past month.

Some investors had anticipated a direct purchase of Argentine pesos by the US - a possibility Bessent had suggested on Monday - to defend the currency's trading band against the dollar, which has been under pressure in recent weeks.

It is noteworthy that Argentina currently possesses an $18 billion swap line with the PBoC, though only $5 billion is presently active. Senior Trump administration officials have previously expressed criticism of the Chinese swap, and analysts speculate that the termination of this arrangement may be a prerequisite for securing the new US swap line.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.