Global bond markets under pressure: whose next on the bond vigilantes’ list?

Key data to move markets today

EU: Spanish, Italian, French, German and Eurozone’s HCOB Composite and Services PMIs, Eurozone PPI, and a speech by ECB President Christine Lagarde.

UK: Speeches by BoE’s Monetary Policy Committee external member Catherine Mann and BoE Deputy Governor Sarah Breeden, S&P Global Composite and Services PMIs.

US: JOLTS Job Openings, Factory Orders, Fed’s Beige Book, and speeches by St Louis Fed President Alberto Musalem and Minneapolis Fed President Neel Kashkari.

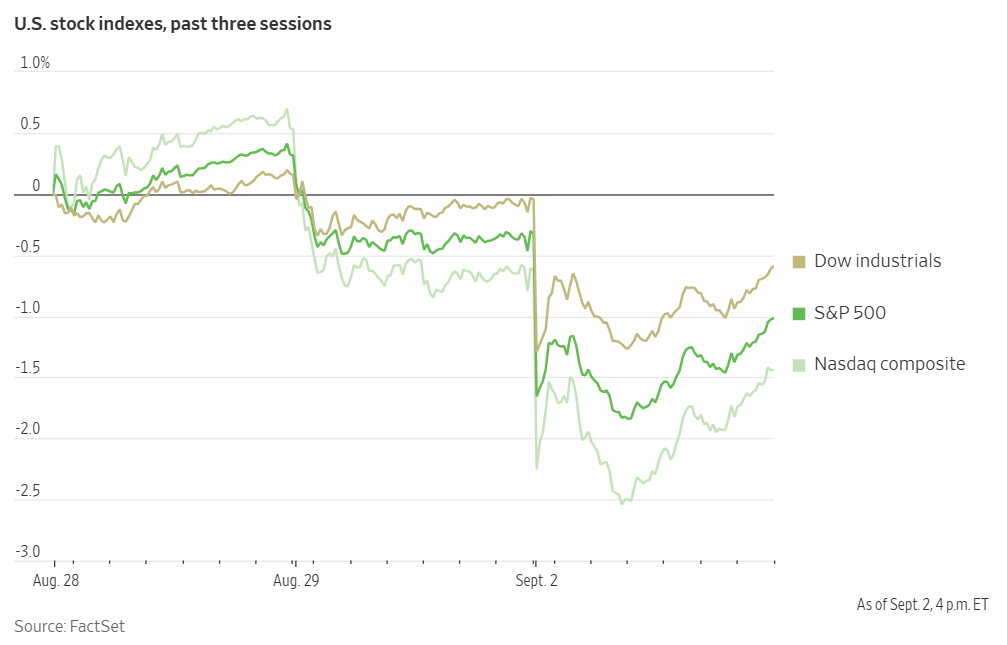

US Stock Indices

Dow Jones Industrial Average -0.55%.

Nasdaq 100 -0.79%.

S&P 500 -0.69%, with 8 of the 11 sectors of the S&P 500 down.

All three major indexes declined Tuesday. The market's downturn was led by the Nasdaq Composite, which fell -0.82%. The S&P 500 and the Dow Jones Industrial Average were -0.69% and -0.55%, respectively.

In corporate news, the US revoked TSMC's authorisation to freely ship essential equipment to its main Chinese chipmaking facility. This decision could potentially limit the production capabilities at the older-generation plant.

Apple's lead AI researcher for robotics has departed to join a competing initiative at Meta Platforms, as part of a broader trend of AI talent leaving the iPhone maker.

Kraft Heinz announced its plan to split into two separate companies. This action would undo a major merger from a decade ago that had established the company as one of the world's largest packaged food sellers.

Target shares declined following an endorsement from the American Federation of Teachers, the second-largest teachers' union in the US, for a boycott against the retailer. This was due to Target's decision to end certain diversity programs amidst pressure from conservative activists and the US government.

Klarna Group and some of its shareholders are seeking to raise up to $1.27 billion as the financial-technology company revives its planned New York initial public offering, which was previously delayed due to market volatility.

Activist investor Elliott Investment Management has acquired a stake of approximately $4 billion in PepsiCo and intends to push for changes at the beverage maker.

S&P 500 Best performing sector

Energy +0.23%, with APA +2.67%, Valero Energy +1.49%, and Expand Energy +1.48%.

S&P 500 Worst performing sector

Real Estate -1.74%, with Weyerhaeuser -3.79%, Essex Property Trust -3.56%, and AvalonBay Communities -3.49%.

Mega Caps

Alphabet -0.72%, Amazon -1.60%, Apple -1.04%, Meta Platforms -0.49%, Microsoft -0.31%, Nvidia -1.91%, and Tesla -1.35%.

In antitrust ruling, Google is spared Chrome divestiture but must share search information. A judge has ruled in the US antitrust case against Google, opting for more moderate penalties rather than the sweeping remedies sought by the Justice Department. While the ruling bars Google from entering into exclusive search engine agreements, it rejected a forced spinoff of its Chrome browser and other major structural changes.

In his Tuesday ruling, US District Judge Amit P. Mehta stated that Google cannot make payments to be the sole search engine on devices and browsers. However, he permitted the company to continue making payments for the distribution of its products, arguing that a complete prohibition on these agreements would be detrimental to recipients, such as Apple.

This decision follows Judge Mehta's earlier ruling that Google had illegally monopolised the search market for over a decade. That prior opinion concluded that Google leveraged illegal distribution agreements with companies like Apple to secure and maintain a 90% market share, thereby preventing rivals from developing competitive alternatives.

While the initial ruling was a significant setback for Google, Tuesday's decision largely aligned with the company's position on appropriate remedies. Judge Mehta emphasised that a judge should approach remedies with humility and noted that market dynamics are already evolving, particularly with the advent of AI technology. "There are strong reasons not to jolt the system and to allow market forces to do the work," he wrote.

According to analysts, this ruling may facilitate further collaboration between Google and Apple on AI-related services for Apple devices. Apple currently has a partnership with OpenAI to integrate ChatGPT into its iPhone services, and has also been in discussions with Google regarding a similar deal for its Gemini AI system.

The most significant restriction placed on Google is the prohibition of deals with browser companies and device manufacturers that mandate the exclusive use of its search engine, Chrome browser, or AI products. The ruling also prevents Google from linking the licensing of its app store on Android devices to the use of these products.

Furthermore, Google is now required to share certain search data to help competitors achieve the scale necessary to offer superior search results. Judge Mehta specified that this data-sharing is essential to diminish the advantages Google gains from its default search engine agreements. However, he did not require the company to share advertising data.

Information Technology

Best performer: NetApp +2.29%.

Worst performer: Zebra Technologies -3.16%.

Materials and Mining

Best performer: Newmont +1.96%.

Worst performer: Albemarle -6.34%.

European Stock Indices

CAC 40 -0.70%.

DAX -2.29%.

FTSE 100 -0.87%.

Commodities

Gold spot +1.69% to $3,534.49 an ounce.

Silver spot +0.53% to $40.90 an ounce.

West Texas Intermediate +0.95% to $65.62 a barrel.

Brent crude +1.38% to $69.10 a barrel.

On Tuesday, spot gold hit a record $3,534.49 per troy ounce. It has risen by 34.65% year-to-date. According to the World Gold Council (WGC), this trend is expected to continue due to sustained robust demand from central banks and from investors buying into physically backed gold ETFs.

This demand has been fuelled by shifts in global geopolitics, including the US President's reorientation of western security policy, ongoing trade disputes, and concerns regarding Fed independence.

According to the consultancy Metals Focus, central banks have purchased over 1,000 metric tons of gold annually since 2022, and they are projected to acquire 900 tons this year. This is double the annual average of 457 tons from 2016 - 2021. This has largely been driven by developing nations seeking to diversify their reserves away from the US dollar, following western sanctions that froze approximately half of Russia's official foreign currency reserves in 2022.

According to the WGC, official figures reported to the IMF account for only 34% of the total estimated central bank gold demand for 2024. From 2022 to 2025, central banks contributed 23% to total annual gold demand, double the average share recorded during the 2010s.

In contrast to investment demand, physical demand for gold for jewelry, which is a key market, saw a 14% decline to 341 tons in the second quarter of 2025. This marks the lowest level since the pandemic in the third quarter of 2020, as high prices deterred buyers. The decline was most pronounced in the largest markets, China and India. The WGC estimated their combined market share fell below 50% for only the third time in the past five years.

While the overall investment market remains strong, there has been a notable shift in product preferences. Gold bar purchases increased by 10% in 2024, while coin buying fell by 31%, a trend that has continued into the current year.

Gold ETFs have become an increasingly important source of demand, recording an inflow of 397 tons from January to June, their largest first-half inflow since 2020. Total holdings in these ETFs reached 3,615.9 tons by the end of June, the highest level since August 2022, though still below the record of 3,915 tons set five years ago.

Oil prices rose on Tuesday, influenced by new US sanctions against Iran and in anticipation of a meeting of OPEC+ members.

Brent crude settled 94 cents higher, or +1.38%, at $69.10 a barrel. WTI crude closed 62 cents, or +0.95%, higher at $65.62 a barrel.

The US Treasury Department announced new sanctions targeting a network of shipping companies and vessels led by an Iraqi-Kittitian businessman. This network was found to be smuggling Iranian oil disguised as Iraqi oil. These sanctions are part of Washington's continued pressure on Iran as nuclear talks remain stalled following the suspension of the sixth round of negotiations after the 12-day conflict in June.

Separately, in the aftermath of July EU sanctions on Russian-backed refiner Nayara Energy, both Saudi Aramco and Iraq's state oil company SOMO have ceased crude oil sales to the Indian firm.

India's trade minister, Piyush Goyal, noted on Tuesday that India is in talks with the US for a bilateral trade agreement, days after Washington doubled tariffs on Indian goods as a punitive measure for New Delhi's continued importation of Russian oil.

Investors are closely monitoring an upcoming meeting of eight OPEC+ members on Sunday, 7th September. Analysts expect the group will not unwind its remaining voluntary production cuts, which have been lending support to prices, keeping them within the $60 per barrel range.

On the supply side, Ukrainian drone attacks have reportedly shut down facilities accounting for at least 17% of Russia's oil-processing capacity, equivalent to 1.1 million barrels per day. Conversely, Kazakhstan's daily crude oil output (excluding gas condensate) increased to 1.88 million barrels per day in August, up from 1.84 million bpd in July.

Note: As of 5 pm EDT 2 September 2025

Currencies

EUR -0.57% to $1.1641.

GBP -1.09% to $1.3393.

Bitcoin +3.12% to $111,181.70.

Ethereum +1.66% to $4,332.98.

The Japanese yen and the British pound both fell on Tuesday due to growing investor concerns over their respective government finances. The slightly weaker-than-expected US ISM manufacturing PMI report released mid-morning did not elicit much response in the foreign exchange market, as the week's main focus remains Friday's August non-farm payrolls data. The US dollar index was +0.75% to 98.42.

There was renewed pressure on global bond markets, particularly in the UK where 30-year borrowing costs reached their highest level since 1998. The pound sterling fell to a 3.5-week low, trading -1.09% lower at $1.3393. This drop reflects growing unease about the UK's fiscal situation ahead of the autumn budget announcement.

The dollar strengthened +0.80% against the Japanese yen, reaching ¥148.35, its highest level since 1st August. The euro also weakened, falling -0.57% to $1.1641. For the Japanese yen, the absence of a hawkish policy signal from Deputy Governor Ryozo Himino is expected to encourage speculators to continue building short yen positions.

Fixed Income

US 10-year Treasury +3.0 basis points to 4.263%.

German 10-year bund +4.0 basis points to 2.791%.

UK 10-year gilt +5.5 basis points to 4.809%.

On Tuesday, US 30-year Treasury yields climbed to their highest levels since mid-July, reaching just under 5%. This was in line with sharp rises in European and UK bond yields, as investors are becoming increasingly concerned that major economies are losing control over their fiscal deficits while trying to boost growth without sparking inflation. The Treasury yield curve steepened, with the spread between two-year and 10-year yields widening as much as 63.60 bps during Tuesday’s session, the largest spread since April. It ended the day 61.8 bps wider, compared to 60.9 bps late Friday.

US 30-year bond yields finished the session +3.0 bps to 4.959% after earlier touching 4.999%, their highest point in approximately a month and a half. This was the largest single-day increase since 11th July.

The 10-year yield was +3.0 bps to 4.263%, reaching a one-week high and its biggest one-day gain since 15th July. The two-year yield was +2.0 bps to 3.645%.

This rise in yields is taking place while the US budget is still undergoing debate. The US Congress has less than a month to pass legislation to keep federal agencies funded and avoid a partial government shutdown. Lawmakers must agree on the roughly $1.8 trillion in discretionary spending within the $7 trillion federal budget.

Fed funds futures traders are now pricing in a 92.7% probability of a rate cut in September, up from 87.8% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 55.5 bps of cuts by year-end, higher than the 54.9 bps expected last week.

Across the Atlantic, France’s 30-year government bond yield surged to its highest level in over 16 years. This was driven by fears that the growing budget deficit will topple prime minister François Bayrou’s government. The National Rally party announced on Monday that it is preparing for snap elections, anticipating that opposition parties will succeed in a no-confidence vote scheduled for 8th September.

France’s 30-year government bond yield reached 4.523%, its highest point since June 2009. It was +5.3 bps to 4.500%. The German 10-year bond yield rose +4.0 bps to 2.791%. The yield spread between perceived ‘safe-haven’ German Bunds and 10-year French government bonds widened to 79.6 bps, after having reached 82.0 bps last week.

Ultra-long-dated government bonds have been under selling pressure due to market expectations that Germany’s investment plans and potential increases in defence spending across the eurozone will lead to higher debt levels. The 30-year German bond yield hit a new 14-year high of 3.402%, after rising +4.4 bps on Tuesday. The German two-year bond yield, more sensitive to ECB rate expectations, rose +3.6 bps to 1.988%.

Italy’s 10-year yield was +7.5 bps to 3.683%.

Markets are currently pricing in an approximate 70% chance of a 25 bps ECB rate cut in June 2026. They also anticipate a deposit facility rate of 1.91% in December 2026, down from the current 2.00%.

Across the British channel, the UK’s 30-year bond yield reached its highest point since 1998. This was due to mounting concerns over public finances as investors sold off UK debt a day after Prime Minister Keir Starmer reshuffled his top team of advisers, moving Chancellor of the Exchequer Rachel Reeves' deputy Darren Jones to Downing Street in an attempt to improve government coordination. The UK’s 30-year yield rose by +5.7 bps to 5.698%, and the 10-year UK gilt yield was +5.5 bps to 4.809%.

Note: As of 5 pm EDT 2 September 2025

Global Macro Updates

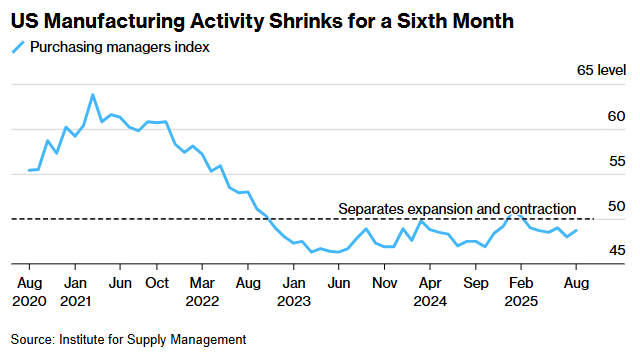

August's ISM Manufacturing index missed estimates, but new orders increased. The August ISM Manufacturing Index was reported at 48.7, falling below the consensus forecast of 49.2, although it marked a slight increase from July's 48.0. A closer look at the sub-indices reveals a mixed picture. The New Orders Index saw a rise to 51.4 from 47.1 in July, while the Production Index declined to 47.8 from 51.4. The Prices Index, though still in expansionary territory, fell to 63.7 from 64.8. The Employment Index experienced a marginal increase to 43.8 from 43.4 in July. According to the report, a recurring theme in respondent feedback was the negative impact of tariffs, with every sector citing them as the primary disruptor. Participants specifically highlighted supplier surcharges, increased costs of raw materials, and price escalations being passed along the supply chain.

In a separate report, the final S&P PMI Manufacturing for August came in at 53.0, slightly below the consensus and previous reading of 53.3. This report noted that operating conditions improved to the greatest extent in over three years, driven by a surge in production and solid growth in new orders. However, it also pointed out that input cost inflation accelerated at its second-sharpest pace in three years.

Additionally, July construction spending showed an unexpected month-over-month decline of 0.1%, contrary to the anticipated 0.4% increase.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.