The doves win, for now

Corporate Earnings News

Global market indices

Currencies

Cryptocurrencies

Fixed Income

Commodity sector news

Key data to move markets this week

Global macro updates

Corporate Earnings News

According to Refinitiv I/B/E/S data, the earnings for Q3 of the top 7 mega caps are forecasted at $72.3 billion (+35.9% y/y, +5.2% q/q) while revenue is forecasted at $364.5 billion (+11.3% y/y, +4.4% q/q). This compares to S&P 500 aggregate earnings (combining actuals and estimates) of $468.8 billion (+2.2% y/y, +3.7% q/q) and revenue of $3,767.0 billion (+1.0% y/y, +1.6% q/q).

Corporate earning calendar 2 November - 9 November 2023

Thursday: Apple, Ball Corporation, Barrick Gold, Moderna, Block, Coinbase Global, Novo Nordisk, Starbucks, Palantir Technologies, Virgin Galactic, Shopify, Shell, S&P Global, Stryker, The Cigna Group

Friday: Enbridge, Duke Energy, Dominion Energy, Cardinal Health, Church & Dwight Co., Magna International

Monday: Vertex Pharmaceuticals, Celanese Corporation

Tuesday: Viatris, Gilead Sciences, Lucid Group, Occidental Petroleum, Uber Technologies, Rivian Automotive, Airbnb, Advanced Micro Devices, Eli Lilly & Co., Microstrategy Inc., Newmont

Wednesday: W K Kellogg Company, Walt Disney Company, Roblox, Jackson Financial, The Trade Desk, Twilio, Unity Software, Take Two Interactive Software, AMC Entertainment

Thursday: Fiverr International, Illumina

US Stock Indices

Nasdaq 100 +1.77% MTD and +34.05% YTD

Dow Jones Industrial Average +0.67% MTD and -0.28% YTD

NYSE +0.56% MTD and +1.20% YTD

S&P 500 +1.05% MTD and +9.23% YTD

The S&P 500 dropped 2.2% in October and experienced its first three-month slump since early 2020 as investors became much more risk-off as tensions escalated across the Middle East and growing concerns around the amount of new issuance required along with questions about the sustainability of the debt resulted in surging Treasury yields.

Mega caps: A generally good week for the mega caps as. Apple, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia are all up, while Tesla is slightly down this week after it missed Q3 estimates for gross margin, profit and revenue. It also undershot its Q3 forecasts for its global deliveries.

Energy stocks had a mixed week this week as concerns around oil and gas supplies waned with US crude oil production rising and some companies reporting poor results for Q3. Occidental Petroleum, Apa Corp (US), ConocoPhillips, Shell, Chevron, Halliburton, and ExxonMobil are all down. Baker Hughes, Marathon Petroleum, Phillips 66, and Energy Fuels are all up this week.

Materials and Mining stocks were mixed this week as a strong USD continued to weigh on metal stocks although Zinc did rise after Netherlands-based Nyrstar said it plans to temporarily close two U.S. zinc mines. Yara International, Sibanye Stillwater, Nucor Corporation are up, Freeport-McMoRan and Newmont Mining are relatively flat, while Albemarle Corporation, CF Industries Holdings, and Mosaic are down.

European Stock Indices

Stoxx 600 +0.67% MTD and +2.75% YTD

DAX +0.76% MTD and +7.01% YTD

CAC 40 +0.68% MTD and +7.09% YTD

IBEX 35 +0.64% MTD and +10.28% YTD

FTSE MIB +0.82% MTD and +17.98% YTD

FTSE 100 +0.28% MTD and -1.47% YTD

According to LSEG I/B/E/S data, the 23Q3 Y/Y blended earnings growth estimate is 5.0%. If the energy sector is excluded, the growth rate for the index is 10.5%. Of the 310 companies in the S&P 500 that have reported earnings to date for 23Q3, 79.7% reported above analyst expectations. This compares to a long-term average of 66%. The 23Q3 Y/Y blended revenue growth estimate is 1.4%. If the energy sector is excluded, the growth rate for the index is 3.7%.

Other Global Stock Indices

MSCI World Index +0.94% MTD and +6.16% YTD

Hang Seng -0.06% MTD and -13.55% YTD

Currencies

The US dollar fell after the Federal Reserve held interest rates, but didn't rule out another rate increase. The Fed acknowledged the economy's unexpected resilience despite a high rate environment. The GBP is -0.08% MTD and +0.37% YTD against the USD. The BoE kept rates on hold at its meeting today, which may put further downward pressure on Sterling. The EUR is -0.10% MTD and -1.28% YTD against the USD as the ECB chose not to raise rates last week amid signs that Eurozone growth is continuing to cool in its larger economies. According to worldgovernmentbonds.com, the yield spread between the US and the Eurozone’s largest economy, Germany, is +200.7 bps, a rise of 23.9 bps in a month. However the spread between European bonds appears to be falling, with the spread between Italy and Germany falling to 187.6 bps from 206.5 bps last month.

Cryptocurrencies

Bitcoin +2.26% MTD and +113.70% YTD

Ethereum +1.98% MTD and +54.38% YTD

Bitcoin hit a more than 17-month high after the Fed once again paused rates and raised hopes that no further rate rises may be on the cards. It is also continuing to rise on expectations that a Bitcoin ETF will soon be approved and that this will be a fresh source of demand for the cryptocurrency.

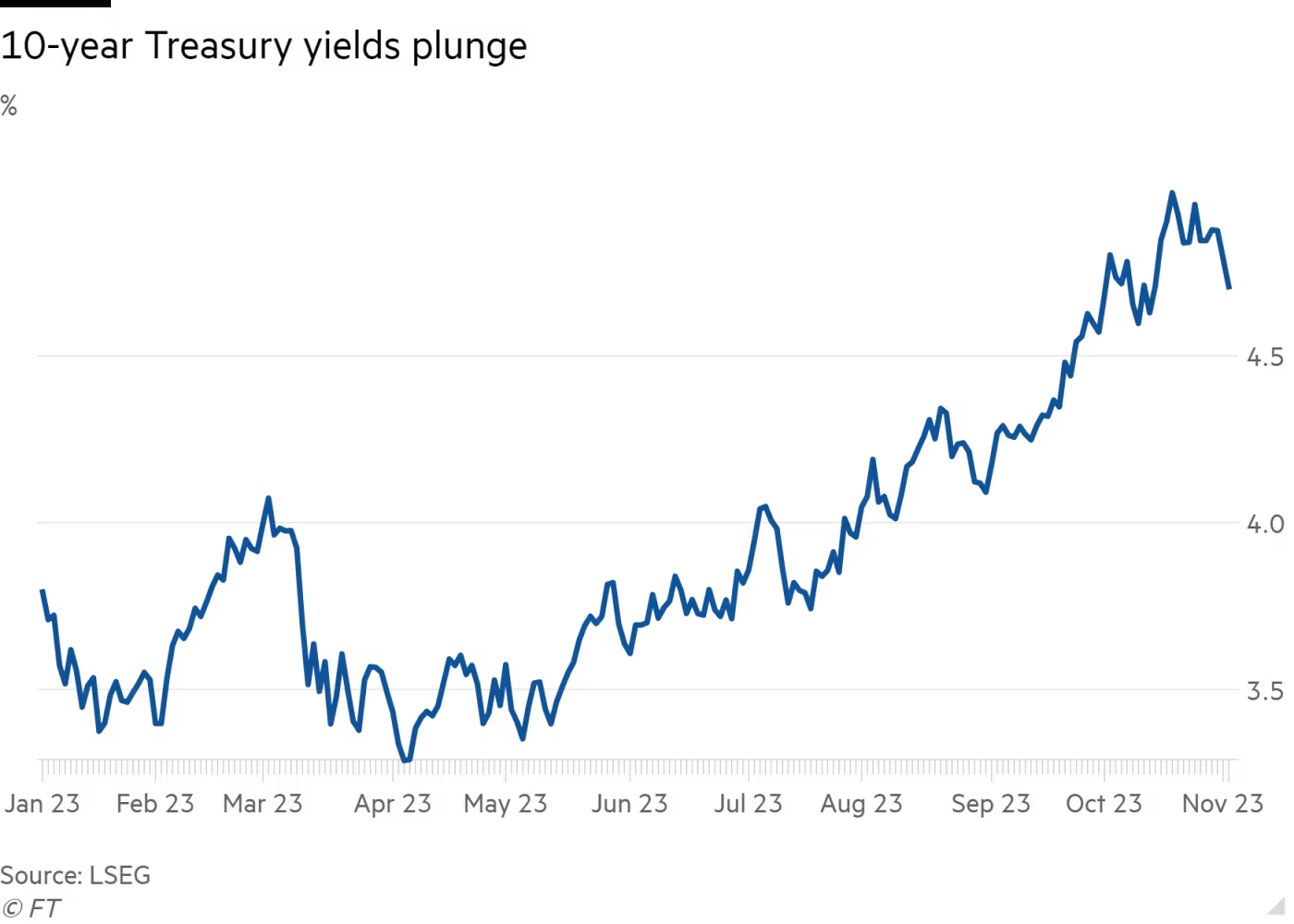

Fixed Income

US 10-year yield to 4.73%.

German 10-year yield to 2.76%.

UK 10-year yield to 4.49%.

US benchmark 10-year yields dropped by about 20 basis points after Fed Chair Jerome Powell’s comments at the FOMC press conference as traders raised their bets the Fed is done raising its policy rate. After the press conference futures markets were pricing in a less than 20% chance of a rate rise at the December policy meeting, down from almost 30% on Tuesday. This optimism came despite Fed chair Powell’s insistence that another increase is still an option. Yields also fell as the US Treasury Department on Wednesday said it will slow the pace of increases in its longer-dated debt auctions in the November 2023 to January 2024 period and expects it will need one more additional quarter of increases after this to meet its financing needs. On Monday the government had cut its borrowing estimate for the October-December quarter to $776 billion which is $76 billion less than its forecast in July.

Commodities

Gold futures to $1,987.50an ounce.

Silver futures to $22.79 per ounce.

West Texas Intermediate crude to $80.44 a barrel.

Brent crude to $84.63 a barrel.

Oil prices fell over this past week to a three-week low on a rising US dollar and after the Fed kept interest rates steady. The US Energy Information Administration said oil and gas production has continued to rise to record levels. It appears that companies are squeezing more from each well despite a fall in the number of rigs employed, with the industry boosting efficiency to offset the impact of lower prices.

Gold prices rose as the US dollar weakened slightly and yields fell after the Fed announced its rate pause. Investors seem to think that the Fed may have concluded its rate hiking cycle with CME Group’s FedWatch tool indicating that traders are now pricing in an 80% chance of another Fed pause in December.

Note: As of 5 pm EDT 1 November 2023

Key data to move markets this week

EUROPE

Thursday: Eurozone HCOB Manufacturing PMI, German HCOB Manufacturing PMI, German Unemployment Change, German Unemployment Rate, and a speech by ECB Chief Economist Philip Lane.

Friday: Eurozone Unemployment Rate.

Monday: German Factory Orders, German HCOB Composite and Services PMIs, Eurozone HCOB Composite and Services PMIs, Eurozone Sentix Investor Confidence

Tuesday: German Industrial Production and Eurozone Producer Prices.

Wednesday: Eurogroup Meeting, German Harmonised Index of Consumer Prices, and Eurozone Retail Sales.

Thursday: Ecofin Meeting and ECB Economic Bulletin.

UK

Thursday: Bank of England Monetary Policy Decision and a speech by BoE Governor Andrew Bailey.

Friday: S&P Global/CIPS Composite and Services PMIs and a speech by BoE MPC member Jonathan Haskel.

Tuesday: BRC Like-for-Like Retail Sales.

Wednesday: A speech by BoE Governor Andrew Bailey.

US

Thursday: Initial Jobless Claims, Challenger Job cuts, Nonfarm Productivity, Unit Labour Costs, and Factory Orders.

Friday: Nonfarm Payrolls, Average Hourly Earnings, Unemployment Rate, Labour Force Participation Rate, S&P Global Composite and Services PMIs, ISM Services New Orders Index, ISM Services Employment Index, ISM Services PMI, and ISM Services Prices Paid.

Sunday: Daylight Saving Time Ends

Monday: Loan Officer Survey.

Thursday: Initial Jobless Claims.

CHINA

Friday: Caixin Services PMI.

Tuesday: Imports, Exports, and Trade Balance.

Thursday: CPI and PPI.

Global Macro Updates

A hedged hold. The Fed maintained rates at 5.25% on Wednesday. Fed Chair Jerome Powell said it remained unclear whether overall financial conditions were restrictive enough to tame inflation. During the press conference following the decision Powell said, "We're not confident that we haven't, we're not confident that we have" reached that sufficiently restrictive plateau. Inflation has been coming down, but it's still running well above our 2% target. A few months of good data are only the beginning of what it will take to build confidence." Powell referred to the strength of the US economy, noting that the labour market, although cooling slightly, was still very tight. This was supported by JOLTS data yesterday showing that job openings increased 56,000 to 9.553 million in September and layoffs dropped to a nine-month low. There were 1.5 job openings for every unemployed person in September, still well above the pre-pandemic ratio of 1.2. Fed Chair Powell did note that the strong performance in Q3 was constructive, but that “it is still likely we will need to see some slower growth and some softening in the labour market to fully restore price stability.”

A realistic BoE? In a 6-3 vote the Bank of England’s Monetary Policy Committee kept interest rates on hold today at the 15-year high of 5.25%. The BoE statement said that “the MPC's latest projections indicate that monetary policy is likely to need to be restrictive for an extended period of time. Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressure." The decision to keep rates on hold was despite the UK having an inflation rate more than double that of the eurozone and almost twice the US rate. However, the BoE released new forecasts which showed that UK GDP is expected to have been flat in 2023 Q3, weaker than projected in the August Report. GDP is expected to grow by 0.1% in Q4,with zero growth forecast for 2024 and an expansion of just 0.25% in 2025. The BoE forecast the unemployment rate would rise to 5% in two years' time from around 4.2% now. The BoE noted that CPI inflation remains well above the 2% target, but it expects it to continue to fall sharply, to 4.75% in Q4 2023, 4.5% in Q1 2024 and 3.75% in Q2 2024. Risks are skewed to the upside with second-round effects in domestic prices and wages expected to take longer to unwind and risks to inflation from energy prices given events in the Middle East. BoE Governor Andrew Bailey has stressed that although inflation was falling, there was a greater risk that it would stay higher rather than fall further. He again stressed that cuts wouldn’t be happening any time soon. Traders are pricing in the first cut for September 2024, after the US and the ECB. Deputy governor Dave Ramsden said that service sector inflation was a focus of the bank’s concerns.

Can the ECB maintain cruising altitude? With German unemployment rising more than expected in October with the number of people out of work increasing by 30,000 in seasonally adjusted terms to 2.678 million, and the eurozone economy shrinking by 0.1% in the three months to September, the ECB will be hard pressed to maintain its policy stance. However, ECB chief economist Philip Lane said today there was still a "good case" for the economy to avoid a recession despite a tightening credit market as companies were not bracing for a recession. According to Bloomberg news, he told an event in Ireland that, "We remain fairly optimistic that this is not that type of episode. And so the soft landing scenario, we think (there is) still a good case for it." Klaas Knot, President of the Netherland’s Central Bank, had previously described the current level of rates as "a good 'cruising altitude' where they can remain for some time"

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.