What’s driving global trade?

About this report

This report explores the changes taking place in the global trading system. We also review the rise of trade barriers and reformations due to geo fragmentation and evolving geopolitical associations. We consider the potential impact of ESG and climate change as well as the development of new digital technologies on global trade. We review how all of these factors may combine and what impact all of these factors are having on global trade including national, transnational, and social and economic blocs’ responses. Finally, we consider what the impact may be for investors in currencies, bonds, and stocks due to the changes in domestic trade priorities, geopolitical shifts and fragmentation, the development of digital technologies, and climate change.

Executive Summary

During the peak of the Covid pandemic, it was increasingly claimed that the 20+year growth in globalisation was permanently over and that countries were starting to focus on their own internal supply chains, with trade concentrating among “friendly” nations.

Although it is clear that globalisation itself isn’t ending, it is changing in nature through countries’ emphasis on stronger regional links, changing domestic priorities (often tied to industrial policies) and the formation of economic blocs for sensitive and strategically important sectors.

How trade itself is conducted is changing. There are three core drivers that are emerging:

- Introduction of trade disrupting measures in response to changing geopolitical alignments.

- Climate change and the impact it has on how rising ESG risks impact companies’ operations, current and future profitability.

- Increasing digitisation, e.g, the use of smart contracts and blockchain technologies in payments.

The impact of changing trade patterns can also be felt as countries alter trade policies to benefit from the twin transitions to green and digital economies.

For investors it must be remembered that trade disruption and change resulting from greater geopolitical risks will create more volatile economies with higher currency risks. Another consideration is the impact these changing trade practices of nearshoring and friendshoring may have on the future growth of supply chains and the impact this may have on companies profit margins and share price in addition to how these practices may affect a country’s balance of payments, currency valuation and bond prices and yields.

In short, there is both caution and hope in the knowledge that although global trade has changed post Pandemic, the world is not, in fact, deglobalising. What it does mean is that global relationships are changing due to changing geopolitical concerns and realignments, new technologies, and, increasingly, due to the effects of climate change. With all of these challenges investors and businesses need to remain alert to these changing dynamics as they consider their portfolio holdings.

Setting the scene: Changing global patterns

In the aftermath of the global Covid pandemic and the rise in discussions by companies of re-shoring and friendshoring, global trade is no longer the structural tailwind for the global economy that it has been through the 1990s and through to 2019. The globalisation era of more open borders which led to improvements in efficiency and stronger financial markets as well as rising economic activity and lower prices, could be ending.

As noted by ECB President Christine Lagarde, “there are a number of plausible scenarios where we could see a fundamental change in the nature of global economic interactions. In other words, we may be entering an age of shifts in economic relationships and breaks in established regularities.” The IMF refers to this as the rise of geoeconomic fragmentation, or GEF. The pandemic and Russia’s war in Ukraine have raised legitimate concerns about supply chain security and broader national security. However, it must be acknowledged that increased resilience comes with a cost. We are seeing an increase in policy actions around the world that, if continued, pose a threat to global prosperity. Geopolitical tensions top the list of challenges, with a rise in protectionist measures from governments.

Global supply chains are likely to be rearranged in the years to come, with reshoring, near-shoring and friend-shoring all likely to become much more widespread as firms react to the vulnerabilities in their supply chains that the pandemic has unearthed.

What is shifting?

Back in April 2023, the World Trade Organisation (WTO) forecast that the world merchandise trade volume would grow 1.7% in 2023 before picking up to 3.2% in 2024. There were a number of downside risks including geopolitical tensions, food insecurity, potential financial instability stemming from monetary policy tightening, and increasing levels of debt. The WTO also identified a number of factors affecting global trade including a deepening geopolitical divide that is increasing a realignment of the global economy into competing blocs and rising levels of protectionism, often related to industrial policy, as countries and trading blocs reconfigure their supply chains to align with new strategic goals.

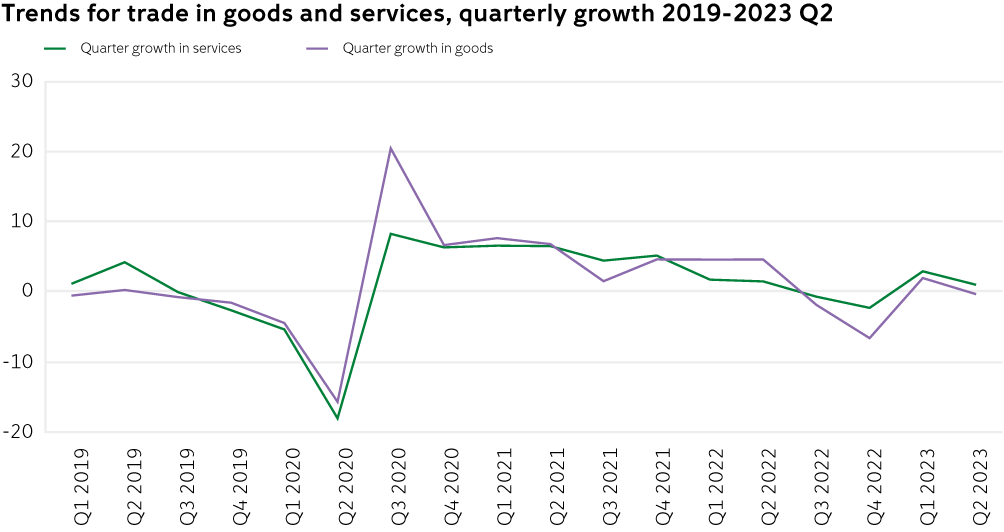

Source: UNCTADstat. UNCTAD calculations based on national statistics. Note: Quarterly growth is the quarter-over-quarter growth rate of seasonally adjusted values. Q1 2023 is estimated and Q2 2023 is a nowcast.

The question of whether those dire warnings have rung true as we move into the 4th quarter of 2023 is an important one for countries in terms of their export performance and the associated inflows into their balance of payments. It is also important for companies, as global market investors consider their profitability and sustainability prospects moving forward. What we have seen is that weaker import demand from the US and softer global goods demand are likely to weigh on trade data. According to the United Nations Conference on Trade and Development (UNCTAD), it’s likely that global trade growth in 2023, (measured in constant United States dollars at market exchange rates) is expected to drop to 2.1% compared to 3.1% in 2022.

However, UNCTAD suggested that the total value of goods traded in 2022 will exceed $32tn, 12.2% higher than 2021 and 40.3% more than the pandemic peak of 2020. Furthermore, world container shipping hit an all-time high in August of 2022.

The risks are strongly on the downside with global macroeconomic conditions this year still shaky as monetary tightening slows and fiscal policies adjust to slowing global growth. However, as recession threatens the world’s major economies and the WTO trimmed its forecast for 2023 trade growth to just 1%, it’s clear that global trade may no longer be resilient enough to withstand any further major geopolitical shocks.

The role of Geopolitics

As noted by PIMCO, we are moving from a unipolar world centred on US influence toward a more multipolar world, with the US still maintaining its global dominance but with other multiple centres of power growing in economic, demographic, financial and geopolitical strategic importance. This is not only impacting the trade in goods and services, but also financial markets performance, stock prices, currencies, and bond yields. However, the forces that have driven the wave of globalisation since the 1990s appear to have changed, perhaps irrevocably so.

Geopolitical impacts

There have been a number of geopolitical events that are going to continue to impact international trade and corporations. According to research by the UK strategic think tank Chatham House, the deepening tensions between the US and China related to China’s activities in Taiwan and the South China Sea as well as an escalation of the Russia–Ukraine war, pose downside risks to the global economy and trade.

The war in Ukraine, the decoupling of the United States-China trade interdependence, and the consequences of Brexit have played a significant role in shaping key bilateral trade trends during this period. We are also seeing Western nations’ decreasing their reliance on China trade and the rise of political and economic blocs such as the Association of Southeast Asian Nations (ASEAN) and the BRICS. One of the ways countries have been reacting to these power shifts is through the introduction of trade restrictions.

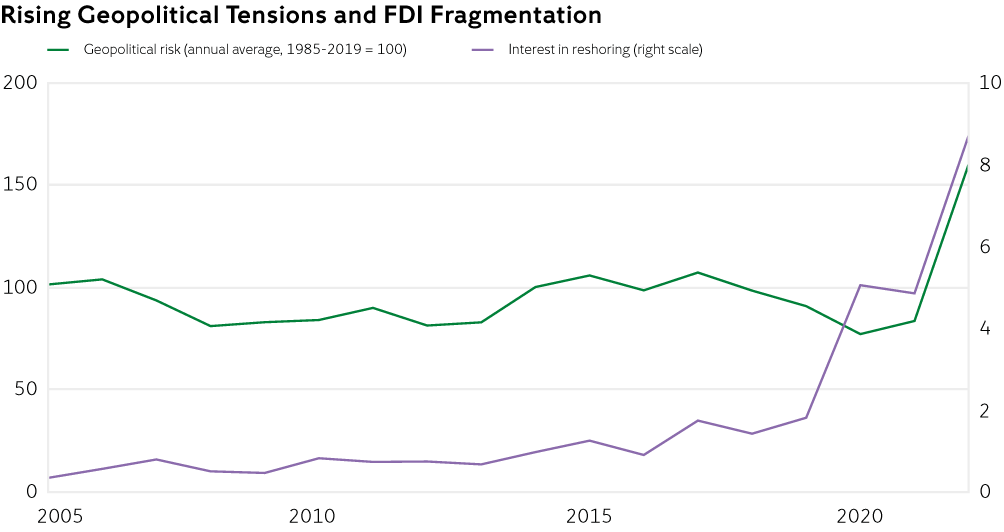

Sources: Bailey, Strezhnev, and Voeten (2017); Hassan and others (2019); NL

Analytics; and IMF staff calculations. Note: The interest in reshoring measures the frequency of mentions of reshoring, friend-shoring, or near-shoring in firms’ earnings calls.

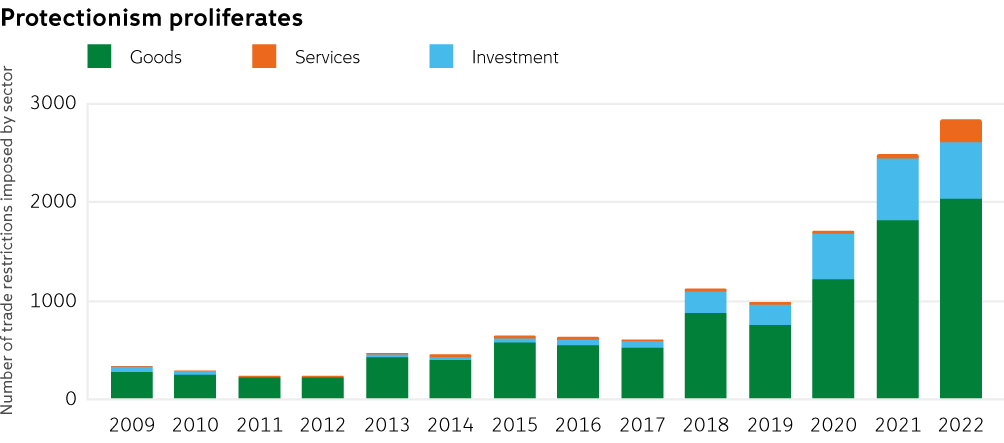

Over the past decade, the number of trade restrictions in place has increased tenfold. As noted by the IMF, new trade barriers introduced annually have nearly tripled since 2019 to almost 3,000 last year. Specifically, trade restrictions across goods, investment, and services while industrial policies aimed at re-shoring and friend-shoring strategic industries are now multiplying. And while this has not yet led to de-globalisation, evidence of changing trade patterns is mounting.

Sources: Global Trade Alerts and IMF staff calculations.

There is also the issue of intensifying US controls on technology exports to China and investment screening. This has now spread to Europe, although Charles Michel, the president of the European Council, has said that the EU is focusing on a “rebalancing” to avoid excessive reliance on one country.

And it is not just decoupling between the US and China that is of concern. Once solid transatlantic ties have come under increasing pressure. Changing views on how to continue to respond to the events in Ukraine and how to deal with China are becoming more fractious and politically charged both domestically and inter-regionally. There is also the issue of the US’ green energy and industrial policy. The US’ Inflation Reduction Act will fund an unprecedented $369 billion investment in American climate and clean energy efforts. It has sparked concerns in Europe about industrial competitiveness due to the provision of state support.

De-globalisation: myth vs reality

There has been a misconception that globalisation is ending. Although trade in goods clearly outweighs trade in services in terms of value, the ratio of trade in services to world output has continued to rise.

However, there is evidence that globalisation is giving way to regionalisation. This may come through the different guises of “reshoring” as supply chains have been diverted or otherwise changed in response to rising nationalism, protectionism and concerns around supply access that emerged during the Covid pandemic. There has also been discussion of increasing ”nearshoring” and “friend-shoring”, but de-globalisation itself has not actually taken place. While companies do need to adjust for heightened geopolitical tensions, they are not necessarily abandoning global strategies. Corporate deglobalisation, in fact, could be a riskier path than making focused adjustments to mitigate geo-political or climate related risk.

The WTO has found “friend-shoring” has been on the rise since late 2022, characterised by a reorientation of bilateral trade flows to prioritise countries that share similar political values. In its Global Trade Update (June 2023), UNCTAD found that during 2022 and Q1 2023, the geographical proximity of international trade remained relatively stable, suggesting a lack of significant nearshoring or far-shoring trends, at least on average. However, it noted an increase in the political proximity of trade since the latter part of 2022.

This indicates a reorientation of bilateral trade flows to countries that share similar political values, i.e., “friend-shoring.” The organisation also noted that there has been a decline in diversification of trade partners, implying that global trade has become more concentrated.

Source: UNCTAD secretariat calculations based on national data, UN voting data, and CEPII geographical data. Note: Geographic proximity based on average geodesic distance of global trade. Geopolitical closeness is measured by the similarity of foreign policy positions based on voting patterns at the UN General Assembly. Trading Partners’ diversification is based on the Herfindal concentration index. All variables are normalised to 100 in Q1 2022.

While firms may be talking more openly about the need to “nearshore’ or “reshore’, the data suggest this process is yet to begin in earnest beyond some small moves to create a more focused push to improve supply chain resilience. Companies may increase their focus on nearshoring to produce goods closer to their customers. However, major supply-chain reconfigurations can take years. This may mean that companies, rather than nearshoring, are utilising other strategies to boost resilience, such as digitisation and dual sourcing.

Reshoring can benefit firms and consumers if it provides better control of production processes. It can also reduce the negative effects that disruption in one country can have in others. But it is also associated with the fragmentation the IMF has warned of as it makes economies more vulnerable to internal and external shocks because they have fewer trading partners. As noted by the ECB, reshoring and friend-shoring also imply new supply constraints, especially if trade fragmentation accelerates before the domestic supply

base has been rebuilt. And, as the IMF has pointed out, the risk is that policy interventions adopted in the name of economic or national security could have unintended consequences, or they could be used deliberately for economic gains at the expense of others.

Corporate deglobalisation, in fact, could be a riskier path than making focused adjustments to mitigate geopolitical risks. Reshoring, although often politically popular, does have drawbacks. It can also reduce profit margins and make equities less attractive as a source of returns. As noted by EY, geopolitical developments are likely to continue to influence supply chain strategies, shift investment destinations and push up costs for companies and consumers.

The influence of climate change and ESG

As noted by the LSE’s Grantham Institute, the rising frequency and intensity and widening geographical spread of extreme and sudden weather events due to climate change, along with “slow-onset” impacts including sea level rise, pose serious risks to the transport infrastructure necessary for the smooth and reliable operation of international trade routes.

According to a report on Systemic risks from climate-related disruptions at ports, more than $122 billion of economic activity systemic impacts — those risks faced due to knock-on effects within global shipping, trade and supply chains network - will hit ports and economies around the world, even if the local ports are not directly affected by extreme events. In fact, according to the study, some $81billion per year maritime trade is at-risk, around 60% of which is because of cross-border knock-on effects; those outside a country’s own jurisdiction.

It is clear that extreme weather events like hurricanes, droughts, floods, and fires are becoming more frequent and more costly. These changes are requiring countries to build resilience by improving climate adaptation rates and adopting climate risk mitigation measures. The International Energy Agency estimates that mitigation-related investment needs in emerging markets and developing economies will reach about $2 trillion annually by 2030—or 40% of global needs. It is not clear where this funding will come from or how the lack of investment in such infrastructure may impact global and even domestic trade. It is also not clear exactly what it means for balance sheets although these material risks are now part of their required reporting and do influence their share price. This is because of the growing use of ESG ratings by institutional and retail investors.

Simultaneously many countries, particularly within Europe, the UK, and parts of North America, are undergoing an energy transition, which in tandem with accelerating climate change is triggering profound transformations in global energy markets. The EU is now aiming for more than 40% of energy generation to come from renewables by 2030, while it is anticipated that the US will have the majority of its electricity from solar and wind-generated sources by 2050.

The climate crisis is increasingly impacting global supply chains and trade routes. It is also affecting the relationships between countries that may historically had close political and economic ties. For example, the enactment of the Inflation Reduction Act in the US has led the EU to respond with the Green Deal Industrial Plan, while the UK is seeking to develop its own industrial strategy to develop clean energy sources and compete with Europe and the US on global climate related projects.

The comparative advantages that many countries have had for centuries in terms of which countries are best positioned to trade and produce goods and services, are shifting as the energy transition from fossil fuels to renewables is set to radically transform trade. New developments in energy technology such as energy storage and transmission, will greatly affect a country’s energy security standing and its ability to produce and trade. This is because countries with abundant renewable energy resources may be less dependent upon external suppliers. They may also, as a result, be better able to therefore regulate input prices into their traded goods and services. However, as noted by the ECB, the shift in the global energy mix is also likely to increase the size and frequency of energy supply shocks, with oil and gas becoming less elastic, while renewables still face intermittency and storage challenges.

Yet the question of how or even if these geopolitical and climate risks are really impacting companies, at least at present, remains somewhat uncertain. Allianz, in its 2023 survey found that even though Covid-19 and the energy crisis quite significantly disrupted their activities, and despite their acknowledgement of growing ESG and political risks, companies have not majorly overhauled their supply chains. Only 25% did so post-Covid and most do not plan to do so because of the energy crisis. Only about 20% are considering changing location or suppliers to mitigate ESG and political risks.

The impact of digital technologies

According to the World Economic Forum (WEF), emerging and new technologies are changing global trade. In fact, the WEF says “TradeTech” is expected to have the biggest impact in four areas — supply chain management, trade compliance, information exchange and digitalisation, and trade finance and liquidity. It notes that the next generation of digital technologies — advanced manufacturing and 3D printing, autonomous shipping and trucking, blockchain-enabled customs documentation, and quantum computing — will have significant global trade and development impacts. However, one of the most significant impacts of digital technologies is the extent to which they will reduce trade costs. In addition, digital technologies will affect the composition of trade by increasing the services component, encouraging trade in certain goods, changing patterns of comparative advantage and affecting the complexity and length of global value chains.

A positive impact of increased digital technology, such as smart contracts and the use of blockchain technologies, is that they may improve open account trading parties’ confidence. This is because by their very design they promote trade transaction transparency, ensure data veracity, lower the risk of errors or fraud, and simplify the exchange of payments. Companies and individuals can acquire financial services at a cheaper cost and higher efficiency, based on a reduced cost of information flow. Advancements in digital technologies also make it easier to obtain trade finance as well as trade services across borders, making relocating business processes internationally (offshoring or even nearshoring) even simpler. The shift away from documentary trade to open account, the growth of e-commerce and the need to reduce friction is also advancing trade finance with the data coming from digitised sources making the process of obtaining credit more transparent and easier. In addition, the greater integration of procurement, treasury and finance allows for greater visibility into how and where companies invest. It also allows for greater analysis of ESG ratings and overall risk management.

However, the benefits of technology may be negated by governments as they think about their own and collective national security concerns and competitive advantages. The rise of trade barriers will inhibit free-flowing global trade in digital technologies that are key to not only increasing operational transparency and reducing costs for businesses and consumers, but also in reducing global emissions. Such trade barriers may also hinder the ability of companies to track their ESG footprint and therefore may also impact the company’s stock valuation.

Implications for the global economy and financial markets

The complex and interconnected nature of global value chains that shape international trade means that disruptions in key locations can have an outsized effect on the global economy. Geoeconomic fragmentation and a shift to more inward-looking trade policies would curtail the gains from global trade and hit living standards in many countries. As noted by the ECB, if concerns about climate change and geopolitical shifts are true, we face both higher investment needs and greater supply constraints. We are therefore likely to see stronger price pressures in markets like commodities — especially for the metals and minerals that are crucial for green technologies.

One of the big questions is whether globalisation has now evolved into one with less global trade, or trade that now involves a different set of parties. Supply chains may end up being more resilient as a result, but this may come at the cost of higher input prices for firms and additional trade frictions. And while interest rates in the US, the UK, and in the Eurozone are expected to remain higher for longer, it is also clear that central banks are unlikely to cut borrowing costs until there is sustained evidence that core price pressures have been contained. This means that a still tight credit cycle will likely continue to weigh down on exports and global economic growth.

As noted by economist Dani Rodrik, when national jurisdictions are linked up through international trade and finance, additional questions arise: Which countries’ rules and regulations should take precedence when businesses compete in global markets? Should the rules be designed anew through international treaties and regional or global organisations? The decisions on these questions will likely impact the growth of global stock markets and the valuation of national and bloc currencies for the foreseeable future.

Implications for bonds and currencies

The potential shifts in economic relationships and breaks in established trading patterns and partnerships will likely make it much harder for central banks to control inflation, particularly as it may be imported due to supply constraints as well as their currency. The BRICS summit in August, which resulted in the largest expansion of the bloc since its formation, stressed the expanded use of local currencies for trade and lending, rather than the US dollar. Although the USD is highly unlikely to fall as the benchmark currency for global trade, with the bloc expanding to include large countries such as Saudi Arabia and with the potentially expanded bloc’s share of global GDP hovering around 40%, the increased use of other currencies will now carry greater consequences for global trade.

And relative prices will also need to adjust to ensure that resources are reallocated towards growing sectors and away from shrinking ones. In other words, we may, as noted by ECB President Lagarde, be entering an age of shifts in economic relationships and breaks in established regularities, which means that traditional monetary responses may not be sufficient.

If central banks are forced, due to changing trade patterns affecting their countries balance of payments, then it could either encourage or discourage rebalancing to that country’s currency denominated assets. This is because the balance of payments affects exchange rates by indicating whether a country is a net importer or exporter. If a country has a current account surplus (exports exceed imports), its currency may appreciate in value and vice versa. If the country has rising interest rates differentials to other countries, it will also impact the rebalancing of government debt portfolios.

Heightened geopolitical risks may play a role in the investment decisions of official reserve managers as well as in the credit markets. The credit markets are critical to the growth of the economy as this is where corporations, municipalities, banks, and others borrow money to expand their businesses. If yields are rising, making the cost of investment that much higher, there will likely be a slowdown in investment, employment, and growth. It appears that the slowdown in globalisation and the threat of are also leading to a preference for less risky assets.

Conclusion

During and shortly after the Covid pandemic, global discourse was dominated by fears of “deglobalisation”, “decoupling” and “economic fragmentation”, but it appears that, although there is a slowdown in global trade, globalisation is far from finished. Multiple measures of globalisation — from global trade in goods and services to the flow of investment, people and data across borders — indicate that globalisation is not in its death knell. However, the forces that have driven the wave of globalisation since the 1990s appear to have changed, perhaps irrevocably so.

Most importantly, if, as noted by ECB President Christine Lagarde, global supply does become less elastic, global competition is reduced, we should expect prices to take on a greater role in adjustment. And as we are likely to face more energy and geopolitical shocks, we could see firms passing on cost increases more consistently. This could lead to more frequent episodes of rising inflation, with the potential to make monetary policy more erratic and associated yields and currency valuations far more volatile.

Therefore for investors, global trade policies remaining open are important. The potential impact trade restrictions and trade reorientation due to geopolitical shocks and geo fragmentation will have on some countries’ balance sheets and thereby the value of their currencies and bonds could impact their portfolios.

Investors should also consider the impact of climate change and other ESG risks, particularly those associated with social disruptions that may emerge if governments have to deal with an extreme weather and/or geopolitical event as these will likely affect commodity prices and company margins within that sector.

Equally important is the influence digital technologies have on easing trade and the positive implications that would have for business and economic growth.

The dynamism of these challenges means that investors and businesses need to be vigilant about the influence they may have on their risk mitigation strategies and their portfolio holdings.

References

- Allianz Research: Testing Resilience: Allianz Global Trade Survey 2023

- Brookings Papers on Economic Activity, Spring 2023, Pinelopi K. Goldberg and Tristan Reed.: Is the Global Economy Deglobalizing? And if so, why? And what is next?

- Chatham House: Global trade in 2023 What’s driving reglobalization?

- Economist Impact: Trade in Transition 2023

- ECB: Deglobalisation: risk or reality?

- ECB: Policymaking in an age of shifts and breaks

- EY: EY Geostrategic Analysis - September 2023

- Steven A. Altman and Caroline R. Bastian, Harvard Business Review: The State of Globalization in 2023

- Laura Alfaro and Davin Chor,Global Supply Chains: The Looming "Great Reallocation", Harvard Business School,

- LSE, Grantham Institute: How does climate change impact on international trade?

- IMF:Charting a Course Through Rough Seas: How Emerging Markets Can Navigate Tougher External Conditions

- IMF: The Costs Of Geoeconomic Fragmentation

- IMF: World Economic Outlook April 2023, A Rocky Recovery

- International Renewable Energy Agency (IRENA): Geopolitics of the Energy Transition: Critical Materials

- Nature.com: Jasper Verschuur, Elco E. Koks & Jim W. Hall, Nature Climate Change volume 13, pages 804–806 (2023) Systemic risks from climate-related disruptions at ports

- PIMCO: Shifting Macro Trends in the Aftershock Economy

- UNCTAD: Global Trade Update (June 2023)

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。