Will US data uplift market sentiment?

What to look out for today

Companies reporting on Tuesday, 10th February: American International Group, Duke Energy, DuPont de Nemours, Ford Motor, Gilead Sciences, Hasbro, Marriott International, Robinhood Markets, S&P Global, and The Coca-Cola Co

Key data to move markets today

USA: ADP Employment Change 4-week Average, Employment Cost Index, Retail Sales, and a speech by Cleveland Fed President Beth Hammack

CHINA: CPI and PPI

US Stock Indices

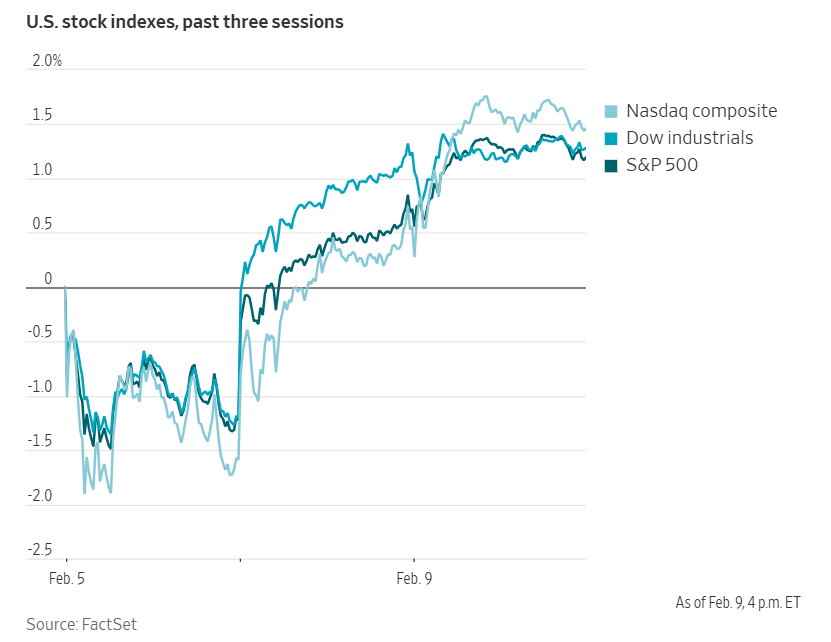

Dow Jones Industrial Average +0.04%

Nasdaq 100 +0.77%

S&P 500 +0.47%, with 7 of the 11 sectors of the S&P 500 up

The stock market’s resurgence continued apace on Monday, building on the momentum that took the Dow Jones Industrial Average to a record high of 50,000 Friday, following a selloff earlier in the week.

Technology shares were at the forefront of gains, with investors showing renewed confidence in both software companies and leaders in AI that had been adversely affected by the previous week’s sell-off. The Nasdaq Composite advanced by +0.90%, the S&P 500 increased by +0.47%, and the Dow Jones Industrial Average edged up +0.04% to close at a fresh all-time high of 50,135.87.

In corporate news, Eli Lilly & Co. announced an agreement to acquire privately held US biotechnology firm Orna Therapeutics for up to $2.4 billion in cash. This marks the company’s second major transaction in as many days, as it seeks to diversify its portfolio beyond its prominent obesity drug, Zepbound.

Novo Nordisk has initiated legal proceedings against Hims & Hers Health, alleging the production of imitation versions of its obesity medications. This action comes as Hims has abandoned plans to market a generic variant of the Wegovy pill.

Kroger is poised to appoint Greg Foran as its next CEO, according to sources familiar with the matter, as reported by Bloomberg news. This move follows the collapse of a major merger and the unexpected departure of the previous CEO, as the nation’s largest supermarket chain seeks to redefine its strategic direction.

Activist investor HoldCo Asset Management has reached an accord with two US regional banks and has declared its support for KeyCorp’s chief executive, having previously advocated for his removal.

Transocean, a deep-water oil rig operator, has agreed to acquire its competitor Valaris in an all-stock transaction valued at $5.8 billion, reflecting increased activity within the offshore drilling sector.

S&P 500 Best performing sector

Information Technology +1.59%, with Oracle +9.64%, Corning +7.56%, and Amphenol +5.85%

S&P 500 Worst performing sector

Health Care -0.86%, with Waters -13.94%, Biogen -3.66%, and Merck & Co -3.51%

Mega Caps

Alphabet +0.40%, Amazon -0.76%, Apple -1.17%, Meta Platforms +2.38%, Microsoft +3.11%, Nvidia +2.50%, and Tesla +1.51%

Information Technology

Best performer: Oracle +9.64%

Worst performer: Workday -5.13%

Materials and Mining

Best performer: Freeport-McMoRan +4.85%

Worst performer: Avery Dennison -1.07%

Corporate Earnings Reports

Posted on Monday, 9th February

ON Semiconductor quarterly revenue -11.1% to $1.530 bn vs $1.530 bn estimate

EPS at $0.64 vs $0.64 estimate

Hassane El-Khoury, President and CEO, said, “We remained disciplined in our execution and met expectations in the fourth quarter as we saw increasing signs of stabilization in our key markets. We continue to invest in intelligent power and sensing technologies that position us to win in the most critical technology transitions shaping our industry. Our strategy is clear: lead in automotive, industrial, and AI data center power with innovation that delivers higher-value solutions for our customers and long-term returns for our shareholders.” — see report.

European Stock Indices

CAC 40 +0.60%

DAX +1.19%

FTSE 100 +0.16%

Commodities

Gold spot +1.96% to $5,057.84 an ounce

Silver spot +6.91% to $83.36 an ounce

West Texas Intermediate +1.45% to $64.42 a barrel

Brent crude +1.78% to $69.13 a barrel

Gold prices advanced by nearly two percent on Monday, supported by the weakening of the US dollar.

Spot gold increased by +1.96% to $5,057.84 per ounce, building on a +3.88% rally recorded on Friday.

The US dollar index declined by -0.83% to reach its lowest level in over a week, thereby making bullion priced in dollars more affordable for international buyers.

Furthermore, data released by the PBoC on Saturday indicated that the country's central bank has continued its gold acquisition campaign for a fifteenth consecutive month as of January.

In addition, spot silver surged by +6.91% to $83.36 per ounce following a +10.08% increase in the previous session. The metal reached a record high of $121.64 on 29th January.

Oil prices closed more than one percent higher on Monday, following an advisory issued by the US Department of Transportation. The department recommended that US-flagged vessels maintain a significant distance from Iranian territory while transiting the Strait of Hormuz and the Gulf of Oman.

Brent crude oil futures settled at $69.13 per barrel, an increase of $1.21, or +1.78%. Similarly, US WTI crude rose by 92 cents, or +1.45%, closing at $64.42 per barrel.

According to the US Department of Transportation's Maritime Administration, vessels navigating the Strait of Hormuz and the Gulf of Oman have historically faced the risk of being boarded by Iranian forces, with the most recent incident occurring on 3rd February.

The agency further advised US-flagged ships to remain close to Oman when travelling eastbound through the Strait of Hormuz.

This guidance has reignited concerns that escalating tensions between the US and Iran could potentially disrupt oil supplies. Earlier in the day, oil prices had fallen, extending the losses from the previous week, after the US and Iran agreed to continue indirect negotiations, which both parties described as constructive.

Investors are closely monitoring Western measures aimed at restricting Russia's oil export revenues, which finance its ongoing military actions in Ukraine. The European Commission has put forward a comprehensive proposal to ban all services that facilitate Russia's seaborne crude oil exports.

In response, Indian refiners, previously significant purchasers of Russian crude, are reportedly refraining from securing deliveries for April, according to sources cited by Reuters.

Note: As of 4 pm EST 9 February 2026

Currencies

EUR +0.83% to $1.1914

GBP +0.62% to $1.3694

Bitcoin +0.05% to $70,367.03

Ethereum +3.35% to $2,121.70

The Japanese yen appreciated on Monday, following Prime Minister Sanae Takaichi’s electoral triumph, ending a six-day period of depreciation.

Initially, the yen experienced a modest decline after Takaichi’s victory on Sunday, reaching its lowest point in two weeks. However, as trading progressed, the currency regained strength. By the close of the session, the dollar was trading -0.85% lower against the yen, at ¥155.86.

Earlier in the day, Japan’s chief currency official, Atsushi Mimura, stated that the government is ‘closely watching currency movements with a high sense of urgency’ following the coalition’s landmark electoral victory under Takaichi’s leadership.

The US dollar index declined by -0.83% to 96.87. Conversely, the euro appreciated by +0.83% against the dollar to reach $1.1914, marking its highest value since 30th January. Sterling also strengthened, rising +0.62% against the dollar to $1.3694.

Fixed Income

US 10-year Treasury -0.5 basis points to 4.212%

German 10-year bund unchanged at 2.843%

UK 10-year gilt +2.2 basis points to 4.535%

On Monday, yields on short-dated and 10-year US Treasury securities declined, moderating from earlier increases. In contrast, long-term yields advanced, resulting in a further steepening of the US yield curve.

Data expected this week includes monthly retail sales for December, the Consumer Price Index (CPI) for January, and the nonfarm payrolls report for January, which was postponed due to a brief US government shutdown that concluded last week.

The yield on the US 10-year Treasury note eased by -0.5 bps, reaching 4.212%. The 30-year bond’s yield increased by +0.9 bps to 4.847%, and the two-year yield declined by -1.0 bps to stand at 3.500%.

Consequently, the spread between the yields on two- and 10-year Treasury notes widened by 0.5 bps, reaching 71.2 bps.

Additionally, the market anticipates increased supply this week, as the Treasury is scheduled to auction $58 billion in three-year notes on Tuesday, $42 billion in 10-year notes on Wednesday, and $25 billion in 30-year bonds on Thursday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 57.9 bps of cuts in 2026, higher than the 48.3 bps priced in the previous week. Fed funds futures traders are now pricing in a 17.7% probability of a 25 bps rate cut at the 18th March FOMC meeting, up from 10.4% a week ago.

Eurozone government bond yields were mixed on Monday, as investors remained cautious ahead of major US economic data and following Japan's recent election.

Germany’s 10-year government bond yield remained unchanged at 2.843%, having reached 2.813% on Friday, its lowest level since 19th January.

German two-year bond yields, sensitive to shifts in policy rate expectations, declined by -1.7 bps to 2.076%. On Friday, they reached 2.046%, marking their lowest point since 3rd December. In contrast, at the long end of the curve, the 30-year German yield increased by +1.9 bps to 3.531%.

Italy’s 10-year government bond yield declined by -1.2 bps to 3.456%. The yield spread against German Bunds stood at 61.3 bps, having narrowed to 53.5 bps in mid-January, its tightest level since August 2008.

Note: As of 5 pm EST 9 February 2026

Global Macro Updates

Lower inflation expectations and improved labour market outlook in NY Fed Consumer Survey. According to the January survey, respondents expect inflation over the next year to fall by 0.3% to 3.1%, while expectations for inflation over the three- and five-year horizons remain unchanged. The survey also highlights a reduction in median uncertainty around inflation for the one- and three-year periods, alongside a noted decline in expectations for petrol price growth.

On the employment front, expectations for year-ahead earnings growth increased to 2.7% from 2.5% the previous month. The perceived likelihood of losing one’s job in the coming 12 months edged down to 14.8% from 15.2%, though this remains slightly above the 12-month average. The average perceived chance of finding a new job within three months, should one lose their current role, rose by 2.5% to 45.6%.

Elsewhere, the survey found a modest dip in the median expected income growth over the next year and steady expectations for growth in spending. However, respondents expressed greater concerns about future credit availability, even as the average perceived probability of missing a minimum debt payment in the next three months declined.

Perceptions of current household financial situations worsened, with more people reporting they are worse off than a year ago. Looking ahead, year-ahead expectations also deteriorated, as a larger proportion anticipated being worse off in a year’s time.

China urges financial institutions to reduce US Treasury exposure. According to Bloomberg news, citing sources familiar with the matter, Chinese regulators have recently delivered so-called window guidance to several of the country’s largest banks, instructing them to scale back their holdings of US Treasuries. This directive, aimed at mitigating concentration risks and responding to market volatility, encourages banks to limit purchases of US government debt and requires those with significant exposure to reduce their positions. Importantly, the directive does not affect China’s state holdings of US Treasuries.

The move reflects a heightened regulatory focus on diversifying market risk, echoing similar concerns expressed by other governments and fund managers regarding the haven status of US debt and the attractiveness of the dollar. The guidance is viewed as a response to market risk rather than a shift in geopolitical stance or confidence in US creditworthiness. Sources indicated that these instructions were issued prior to the Trump-Xi phone call last Wednesday.

Data from the State Administration of Foreign Exchange showed that, as of September, Chinese banks held around $298 billion in dollar-denominated bonds, although the proportion represented by Treasuries remains unclear. Over the past decade, both state and private Chinese holdings of US Treasuries have steadily declined, with Japan and the UK now surpassing China as leading holders.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。