Is this the end of the bubble or a bump in the road?

What to look out for today

Companies reporting on Friday, 30th January: American Express, Aon, Chevron, Exxon Mobil, Verizon Communications

Key data to move markets today

EU: French, Spanish, German, Italian, and Eurozone GDP, German and Spanish Harmonised Index of Consumer Prices, and Eurozone Unemployment Rate

USA: US PPI, Chicago PMI, and speeches by St Louis Fed President Alberto Musalem and Fed Vice Chair for Supervision Michelle Bowman

US Stock Indices

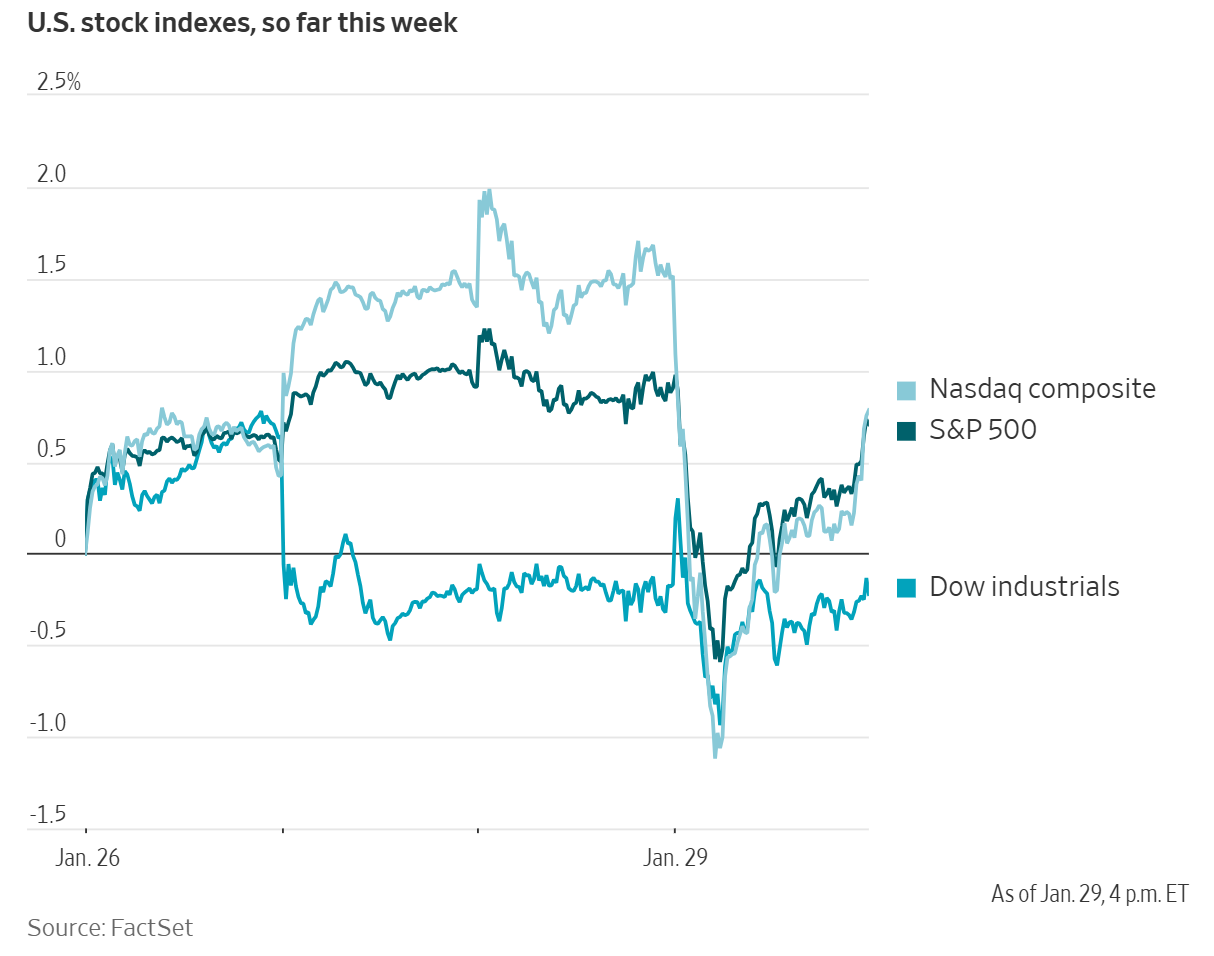

Dow Jones Industrial Average +0.04 %

Nasdaq 100 -0.53%

S&P 500 -0.15%, with 7 of the 11 sectors of the S&P 500 up

Tech stocks brought US indices down on Thursday with the technology heavy Nasdaq leading declines as investors were worried by the latest earnings reports and AI spending. The S&P 500 was hit by Microsoft slumping almost 10%, losing $360 bn in market value after it reported a surge in data centre spending on Wednesday and investors grew concerned that its alliance with OpenAI was not reaping returns fast enough. The S&P 500 was also dragged down by other software stocks such as SAP, whose shares fell after its cautious cloud outlook, ServiceNow, Salesforce, Oracle, Adobe, and cloud security firm Datadog.

The S&P 500 lost 10.41 points, or -0.15%, to end at 6,967.62 points. The Nasdaq Composite lost 179.39 points, or -0.75%, to end the session at 23,678.05. In contrast, the Dow Jones Industrial Average rose 21.05 points, or +0.04%, to 49,036.65.

In corporate news, Dow said it would slash about 4,500 jobs, or 13% of its total workforce, in a restructuring aimed at boosting profitability by at least $2 billion. CEO Jim Fitterling said the company expects to deliver by the end of the year the remaining more than $500 million in cost savings from its previously announced $1 billion programme.

Lockheed Martin said it reached a deal with the Pentagon to increase THAAD interceptor production, as the company issued an upbeat guidance for 2026 amid record deliveries of its F-35 fighter and growing missile sales.

International Paper said it plans to break up and spin off its European packaging business as it seeks to strengthen operations.

As noted by the Financial Times, Apple bought the four-year old Israeli start-up Q.AI, whose technology can analyse facial expressions to understand “silent speech” at close to $2 bn, according to people familiar with the terms. The deal is designed to help Apple narrow its gap with Meta, Google and OpenAI in the growing race to create new kinds of wearable devices to speak to AI.

S&P 500 Best performing sector

Communication Services +4.53%, with Meta Platforms +10.40%, Charter Communications +4.76%, and AT&T +4.40%

S&P 500 Worst performing sector

Information Technology -1.86%, with Microsoft -9.99%%, ServiceNow -9.94%, and Tyler Technologies -9.33%

Mega Caps

Alphabet +0.67%, Amazon -0.53%, Apple +0.72 %, Meta Platforms +10.40%, Microsoft -9.99%, Nvidia +0.52%, and Tesla -3.45%

On Thursday Apple forecast higher-than-expected revenue growth of 13-16% for the March quarter, far ahead of its guidance of 10-12%. This was due to a strong launch for the iPhone 17 pushing smartphone revenue up 23% y/o/y in Q4, a sharp rebound in China, and increasing demand in India. It said sales in China jumped 38% y/o/y, while it reported $42 bn in net income for the quarter, well ahead of expectations. The company also forecast operating expenses of $18.4 bn to $18.7 bn, slightly above spending in the first quarter.

Information Technology

Best performer: IBM +5.13%

Worst performer: Microsoft -9.99%

Materials and Mining

Best performer: Steel Dynamics +4.35%

Worst performer: International Paper -6.00%

Corporate Earnings Reports

Posted on Thursday, 29th January

Apple quarterly revenue +16 % to $143.76 bn vs $138.48 bn estimate

EPS at $2.84 vs $ 2.67 estimate

Tim Cook, CEO, said, “Today, Apple is proud to report a remarkable, record-breaking quarter, with revenue of $143.8 billion, up 16 percent from a year ago and well above our expectations. iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment, and Services also achieved an all-time revenue record, up 14 percent from a year ago. We are also excited to announce that our installed base now has more than 2.5 billion active devices, which is a testament to incredible customer satisfaction for the very best products and services in the world.”

Mastercard quarterly net revenue +18% to $4.3 bn vs $3.83 bn estimate

Diluted EPS at $4.76 vs $4.25 estimate

Michael Miebach, CEO, said, “2025 was another strong year for Mastercard, with net revenue up 16% year-over-year or 15% on a currency neutral basis. We're executing and winning with programs like the Apple Card and robust growth in value-added services and solutions at 23%, or 21% currency-neutral. The overall macroeconomic environment is supportive and we continue to see healthy consumer and business spending. That, together with trusted technology, constant innovation, and deep partnerships, powers our performance. Focused, agile, and diversified, we’re well positioned for the opportunities ahead in 2026.” — see report.

European Stock Indices

CAC 40 +0.06%

DAX -2.07%

FTSE 100 +0.17%

Commodities

Gold spot -0.3% to $5,399.23 an ounce

Silver spot +2.80% to $116.70 an ounce

West Texas Intermediate +3.4% to $65.42 a barrel

Brent crude +3.5% to $70.71 a barrel

Gold fell -0.3% on Thursday to settle at $5,399.23 an ounce as investors took profits after reaching a record high of $5,594.82 earlier in the session. Spot silver hit another record high, reaching $121.64 an ounce before falling back later in the trading day to $116.70.

Oil prices climbed over 3% to a five-month high on Thursday on rising concerns that President Trump could attack Iran and on a weaker US dollar. Market participants are worried that global supplies could be disrupted if a nuclear deal between the US and Iran is not agreed. On Thursday the EU adopted new sanctions on Iran targeting individuals and entities involved in a violent crackdown on protesters over the past few weeks. The EU also designated Iran's Revolutionary Guard as a terrorist organisation. According to the US Energy Information Administration (EIA), Iran was the third-biggest crude producer in OPEC+, behind Saudi Arabia and Iraq in 2025.

However, news from Kazakhstan may put some downward pressure on prices in the future. As noted by Reuters, Kazakhstan said US oil major Chevron would take measures to ensure the reliable and safe operation of facilities at Kazakhstan's giant Tengiz oilfield, with the aim of reaching full production in a week. Russian President Putin agreed with President Trump that Kyiv would not be bombed for a week. Putin reiterated his invitation to Ukraine’s President Volodymyr Zelenskiy to come to Moscow for peace talks. In addition, US crude production continued to recover after storms over the weekend negatively impacted production, with losses peaking at 2 million bpd.

Brent futures rose $2.31, or +3.4%, to settle at $70.71 a barrel, its highest since 31 July. US WTI gained $2.21, or +3.5%, to settle at $65.42, its highest since 26 September. This surge has pushed both crude benchmarks into technically overbought territory.

Note: As of 4 pm EST 29 January 2026

Currencies

EUR -0.03% to $1.1965

GBP -0.01% to $1.3802

Bitcoin -5.8% to $84,090.62

Ethereum -7.1% to $2,804.32

On Thursday, the US dollar fell, with the return of the so-called debasement trade outweighing Treasury Secretary Scott Bessent’s affirmation on Wednesday of a strong-dollar policy. Investors have been worried by US policy volatility, and tariff uncertainty. They also have expectations of continued Federal Reserve rate cuts this year despite the Fed’s somewhat hawkish tone following the FOMC meeting on Thursday. The dollar index was -0.24% to 96.20. The euro edged down -0.03% to $1.1965, while the British pound remained virtually unchanged, slipping just -0.01% to $1.3802.

The yen rose +0.17% against the US dollar to trade at ¥153.12.

Fixed Income

US 10-year Treasury -1.2 basis point to 4.235%

German 10-year bund -1.8 basis points to 2.839%

UK 10-year gilt -2.8 bps to 4.512%

US Treasury yields fell slightly on Thursday as investors focused on next week’s monthly employment report in the hopes that it may offer a clearer picture of labour dynamics and the pace of Fed rate cuts. However, that report could be delayed by another partial government shutdown if the US Senate does not agree to a deal to cut out funding for the Department of Homeland Security from a spending package that includes funding for the Department of Labor and the Bureau of Labor Statistics.

The US 10-year Treasury note slipped -1.2 bps to 4.235%, while the 30-year yield edged very slightly up +0.02 bps to 4.855%. The two-year Treasury yield, which is sensitive to shifts in interest rate expectations, fell -2 bps, settling at 3.561%.

The yield curve steepened earlier in the day with the gap between two- and ten-year Treasuries rising to 68.4 bps, but ended the session at 67 bps, the same level seen late on Wednesday.

The Treasury auctioned $44 billion in seven-year notes on Thursday with lackluster results. It was priced at 4.018%, slightly higher than the expected yield at the bid deadline, suggesting soft demand. The auction yield was above the six-auction average of 3.912%.

According to CME Group's FedWatch Tool, Fed funds futures traders are now pricing in a 14.4% probability of a 25 bps rate cut at March's FOMC meeting, down from 14.9% a week ago.

In the UK, the 10-year gilt declined -2.8 bps to 4.512%.

Eurozone bond yields edged lower in afternoon trading on Thursday as concerns resurfaced over the strength of the euro and whether it might prompt the ECB to ease monetary policy sooner than currently expected.

The yield on Germany’s 10-year Bund was -1.8 bps to 2.839%. Germany’s two-year yield, sensitive to policy rate expectations, was also down -1.8 bps to 2.057%. On the long end of the curve, the 30-year yield was -0.5 bp to 3.488%.

The yield spread between 10-year French government bonds and Bunds was 57.8 bps.

Italy’s 10-year government bond yield was -1.4 bps to 3.444%. The spread relative to Bunds stood at 60.1 bps.

Note: As of 4 pm EST 29 January 2026

Global Macro Updates

US labour market shows weak hiring. Weekly jobless claims fell 1,000 to 209,000 in the week ended 24 January. The prior week's level of claims was revised up by 10,000 to 210,000. This suggests layoffs remain low, but weak hiring is stoking anxiety about the labour market. Continuing claims, a proxy for hiring, decreased 38,000 to 1.827 million during the week ended 17 January. It was the third straight weekly decline. The continuing claims figures also have been impacted by seasonal adjustment challenges. The four-week moving average of new applications, a metric that helps smooth out volatility, rose slightly to 206,250 last week.

On Thursday during the FOMC press conference Fed chair Jerome Powell said that "labour market indicators suggest that conditions may be stabilising after a period of gradual softening." The unemployment rate slipped to 4.4% in December from 4.5% in November. The Chicago Fed is forecasting the unemployment rate for January to be 4.35%. The Bureau of Labor Statistics' closely watched employment report for January, scheduled for release next Friday, could be delayed if the government shuts down again on Saturday due to the disagreement over funding for the US Department of Homeland Security.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。