Government shutdown on Saturday?

What to look out for today

Companies reporting on Tuesday, 27th January: General Motors, HCA Healthcare, Northrop Grumman, Sysco, UnitedHealth Group, Synchrony Financial, UPS, RTX, Invesco, Boeing, NextEra Energy, Union Pacific, PACCAR, PPG Industries, Texas Instruments, F5, Logitech

Key data to move markets today

EU: Speeches by German Bundesbank President Joachim Nagel and ECB President Christine Lagarde

USA: ADP Employment Change 4-week Average, Housing Price Index, and Consumer Confidence

US Stock Indices

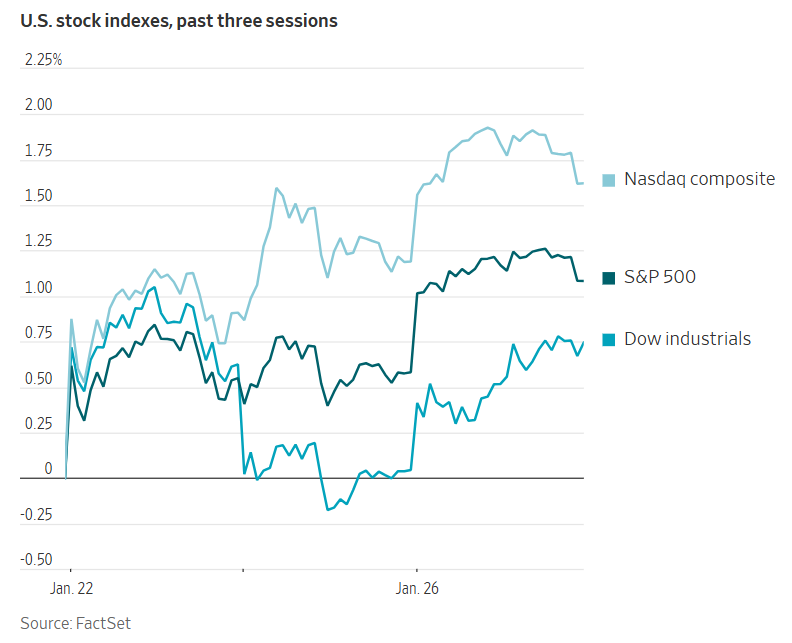

Dow Jones Industrial Average +0.64%

Nasdaq 100 +0.42%

S&P 500 +0.50%, with 8 of the 11 sectors of the S&P 500 up

US equities advanced on Monday, overcoming ongoing geopolitical uncertainties. The Dow Jones Industrial Average increased by approximately 314 points, or +0.64%, while the S&P 500 and Nasdaq Composite rose +0.50% and +0.43%, respectively.

In corporate news, Nvidia committed an additional $2 billion investment to CoreWeave, supporting an initiative to expand AI computing capacity by more than five gigawatts by 2030. Furthermore, Nvidia introduced new open-source software and models aimed at facilitating the adoption of AI and advanced data analytics by governments and enterprises, specifically to enhance in-house weather forecasting capabilities.

Goldman Sachs issued a $2.5 billion US investment-grade bond on Monday, following a record-setting $16 billion sale less than two weeks prior.

According to the Wall Street Journal, Merck & Co has ended acquisition discussions with biotechnology company Revolution Medicines after the parties were unable to agree on valuation terms.

Chevron has mobilised its largest fleet of vessels in nearly a year to transport Venezuelan crude oil. This action follows the US government’s efforts to exert greater control over Venezuela’s oil sector after the capture of dictator Nicolás Maduro.

Baker Hughes announced plans to double its target for data centre equipment orders to $3 billion over the next three years, reflecting robust demand for power to support AI operations.

Apollo Global Management incurred an estimated $170 million loss after an asset-backed financing arrangement for Amazon brand aggregator Perch was written off.

Wizz Air Holdings’ UK subsidiary has applied for authorisation to operate flights to the US, following the collapse of its expansion plans in the Middle East earlier this year.

Abu Dhabi National Oil Company is increasing its ownership stake in the Rio Grande LNG project in Texas. This move aligns with the United Arab Emirates’ broader strategy to expand its international gas portfolio and strengthen commercial relations with the US.

S&P 500 Best performing sector

Communication Services +1.32%, with Match Group +3.22%, Meta Platforms +2.06%, and Alphabet +1.57%

S&P 500 Worst performing sector

Consumer Discretionary -0.71%, with Darden Restaurants -4.72%, Caesars Entertainment -4.20%, and Ulta Beauty -3.61%

Mega Caps

Alphabet +1.57%, Amazon -0.31%, Apple +2.97%, Meta Platforms +2.06%, Microsoft +0.93%, Nvidia -0.64%, and Tesla -3.09%

Information Technology

Best performer: Arista Networks +5.41%

Worst performer: Intel -5.72%

Materials and Mining

Best performer: Corteva +1.30%

Worst performer: Steel Dynamics -4.41%

Corporate Earnings Reports

Posted on Monday, 26th January

Steel Dynamics quarterly revenue +14.0% to $4.414 bn vs $4.551 bn estimate

EPS at $1.82 vs $1.70 estimate

Mark D. Millett, Chairman and CEO, said, “The teams delivered solid operational and financial performance across our operating platforms in 2025, generating annual net sales of $18.2 billion, operating income of $1.5 billion, and adjusted EBITDA of $2.2 billion. This performance demonstrates the strength and consistency of our cash generation, as we generated $1.4 billion in cash flow from operations during the year, after investing $450 million in growth working capital associated with our new aluminum products platform. Our three-year after-tax return-on-invested-capital of 14 percent is a testament to our ongoing high-return capital allocation strategy. We are growing, returning capital to shareholders, and maintaining strong returns as compared to best-in-class domestic manufacturers.” — see report.

Nucor quarterly revenue +8.6% to $7.687 bn vs $7.906 bn estimate

EPS at $1.73 vs $1.86 estimate

Leon Topalian, Chair and CEO, said, "I want to thank our teammates for their tremendous work throughout 2025 - delivering for our customers, advancing key growth projects, and making this Nucor's safest year. During the year, we brought several major projects online, including our new rebar micro‑mill in Lexington, North Carolina, the Kingman, Arizona melt shop, our Alabama Towers and Structures facility, and our coating complex in Crawfordsville, Indiana. As these and other recently completed projects ramp up, they are beginning to deliver meaningful earnings contributions and we believe they will play an important role in strengthening our earnings power over time. Looking ahead to 2026, we are encouraged by robust demand in several key end markets, historically strong backlogs, and federal policies that support a vibrant domestic steel industry. Our focus remains on execution and generating strong, through‑cycle returns for our shareholders." — see report.

Ryanair Holdings quarterly revenue +14.4% to $6.315 bn vs $6.286 bn estimate

EPS at $1.85 vs $1.76 estimate

Michael O’Leary, CEO, said, “Q3 revenue rose 9% to €3.21bn. Scheduled revenue increased 10% to €2.10bn as traffic grew 6% with 4% higher fares, thanks to strong Oct. school mid-term and close-in Christmas/New Year bookings. Ancillary revenue was solid, rising 7% to €1.11bn. Operating costs (pre-except. charge) rose 6% to €3.11bn (flat per pax). With almost all of our B-8200 “Gamechangers” delivered, other income in Q3 dipped due to the absence of delivery delay compensation in the quarter (which was incl. in PY Q3 comp). Q4 FY26 fuel is 84% hedged at $77bbl and we’ve now locked-in FY27 savings with 80% of our jet-fuel requirements hedged at c.$67bbl.” — see report.

European Stock Indices

CAC 40 -0.15%

DAX +0.13%

FTSE 100 +0.05%

Commodities

Gold spot +0.55% to $5,009.94 an ounce

Silver spot +0.93% to $103.90 an ounce

West Texas Intermediate -1.06% to $60.63 a barrel

Brent crude -1.92% to $64.92 a barrel

Gold prices surged to unprecedented levels on Monday as investors sought safe-haven assets in response to rising international political tensions. Silver also reached new historical highs during the session.

Spot gold ended the trading day +0.55% to $5,009.94 per ounce after reaching a record high of $5,110.50 earlier in the session.

Spot silver marked a new all-time high at $117.69 per ounce and was +0.93% on the day at $103.90. Prices surpassed the $100 threshold on Friday, driven by increased retail investor participation, momentum-based buying, and persistent tightness in the physical markets.

Oil prices declined by more than one percent on Monday as investors assessed the effects of recent winter storms on crude output in the US.

Brent crude futures fell $1.27 or -1.92% to settle at $64.92 per barrel. WTI crude ended the day down 65 cents, or -1.06%, at $60.63.

Analysts and traders estimated that US oil producers lost up to 2 million barrels per day — approximately 15% of national output — over the weekend, as the severe winter weather strained energy infrastructure and power supply systems across the country.

Production outages reached their peak on Saturday, with the Permian Basin accounting for the largest share of the decline at around 1.5 million barrels per day. By Monday, production losses in the Permian had eased to about 700,000 barrels per day, and full restoration of output was anticipated by 30th January.

According to regulatory filings over the weekend, there were approximately two dozen reports of operational upsets at natural gas processing plants and compressor stations in Texas. This figure is notably lower than the more than 200 incidents reported during the first five days of a major winter storm in 2021.

In Kazakhstan, the energy ministry announced Monday plans to resume production at the country’s largest oilfield. However, industry sources indicated that output remained limited and a force majeure on CPC Blend exports was still in effect.

The Caspian Pipeline Consortium, which operates Kazakhstan’s principal oil export pipeline, reported on Sunday that its Black Sea terminal had returned to full loading capacity following the completion of maintenance at one of its three mooring points.

Note: As of 4 pm EST 26 January 2026

Currencies

EUR +0.44% to $1.1878

GBP +0.27% to $1.3678

Bitcoin -1.44% to $87,971.71

Ethereum -0.49% to $2,927.59

On Monday, the US dollar declined broadly while the Japanese yen surged to its highest level in over two months, amid increasing speculation regarding potential joint Tokyo - Washington intervention. This followed statements from Japan’s prime minister and the nation's chief currency official that fuelled market expectations.

Additionally, investors reduced their holdings of the dollar in anticipation of Wednesday’s FOMC meeting and a possible announcement by the US President nominating a new Fed Chair. Lingering concerns about another potential US government shutdown also pressured the dollar.

This broad-based dollar selling was supportive to the euro and the British pound, driving both to four-month highs. The euro rose +0.44% to $1.1878, while the pound rose by +0.27% to $1.3678, attaining its highest value since 17th September. The pound declined -0.10%, to 86.79 pence.

The BoE is scheduled to meet next week; however, it is widely anticipated that interest rates will remain unchanged. According to money market pricing, traders expect 36 bps of monetary easing by year-end, implying one quarter-point rate cut and roughly a 45% probability of a second cut.

The dollar weakened -1.00% against the yen, reaching ¥154.16. This marked a -2.68% decline over the past two trading sessions, its steepest drop since Liberation Day last April.

Prime Minister Sanae Takaichi of Japan stated on Sunday that her government would undertake ‘necessary steps’ to counter speculative movements in the market.

Japanese Finance Minister Satsuki Katayama refrained from commenting on foreign exchange rate checks. Currency diplomat Atsushi Mimura affirmed that the government would maintain close cooperation with the US on foreign exchange matters and would act appropriately.

The US has not participated in coordinated efforts to intervene in the Japanese currency since March 2011, when it sold yen following the Fukushima earthquake.

Data from the BoJ’s money markets on Monday suggested that the sharp appreciation of the yen against the dollar on Friday was unlikely the result of official Japanese intervention.

Fixed Income

US 10-year Treasury -1.3 basis points to 4.217%

German 10-year bund -3.5 basis points to 2.873%

UK 10-year gilt -3.1 basis points to 4.498%

US Treasury securities advanced on Monday, as robust demand in a two-year note auction signalled sustained investor interest in dollar-denominated assets, despite ongoing fiscal challenges and mounting global tensions related to trade and national security.

Treasury yields declined before the auction, mirroring movements in European bond markets, notably those of France and Germany.

The yield on the US 10-year Treasury note declined -1.3 bps to 4.217%, while the two-year Treasury yield slipped -1.1 basis points to 3.594%. On the long end, the 30-year yield fell -2.6 bps to 4.804%.

The two-year note auction was priced at 3.580%, which was lower than the anticipated rate at the bidding deadline. The bid-to-cover ratio reached 2.75x, above the 2.61x average.

The spread between the two-year and 10-year Treasury yields was 62.3 bps.

Attention now turns to an upcoming auction of $70 billion in five-year notes scheduled for today.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 45.1 bps of cuts in 2026, lower than the 46.4 bps priced in the previous week. Fed funds futures traders are now pricing in a 2.8% probability of a 25 bps rate cut at the FOMC meeting Wednesday, down from 5.5% a week ago.

French government bonds outperformed their eurozone counterparts on Monday, as the premium for holding French debt over German narrowed to its lowest level since June 2024. This improvement was largely attributed to positive investor sentiment regarding the government's moves to push the 2026 budget through the legislature.

The yield on France's 10-year OAT declined -5.5 bps to 3.444%, marking its lowest point since late November.

Germany's 10-year yield fell -3.5 bps to 2.873%. As a result, the spread between the two yields contracted to 57.1 bps, its narrowest since the French legislative elections in June 2024.

Prime Minister Sebastien Lecornu's government withstood two votes of no-confidence in parliament on Friday, following its decision to implement the income portion of the 2026 budget without granting the National Assembly final approval.

Consequently, a significant portion of the idiosyncratic risk premium in OATs has been unwound.

French yields have also dipped back below those of Italy, albeit by just 2.1 bps. The Italian 10-year yield was -4.5 bps to 3.465%. On Monday, France successfully sold nearly 8 billion euros in Treasury bills.

Germany's 2-year yield fell -2.8 bps to 2.111%, while the 30-year yield dropped -3.9 bps to 3.473%.

Note: As of 5 pm EST 26 January 2026

Global Macro Updates

Government shutdown risk returns as Democrats voice DHS concerns. Expectations for a partial US government shutdown have increased significantly, particularly as funding authorisation for agencies representing approximately 75% of federal discretionary spending is set to expire after Friday. Previously, the market consensus was that there would be little appetite for another shutdown following the record 43-day lapse last year.

However, Democratic lawmakers have raised concerns regarding immigration enforcement activities in Minnesota, especially after the fatal shooting of a US citizen over the weekend. In response, Senate Minority Leader Schumer indicated that Democrats would not support advancing planned spending bills as long as they include funding for the Department of Homeland Security (DHS). Although Republicans currently hold a Senate majority, securing support from at least seven Democrats remains necessary to overcome a filibuster.

Senator Schumer has proposed separating DHS funding from the broader spending package. Thus far, Republicans have not expressed intentions to pursue this approach. It is also important to note that any substantial modifications to House-passed legislation would require the House to reconvene and re-approve the bills, but the chamber is currently in recess until 2nd February.

Prediction markets experienced a surge in bets on a government shutdown over the weekend. Kalshi’s probability rose to approximately 78% (up from around 10%), while Polymarket increased to nearly 90% (compared to 16% on Friday evening).

Durable good orders demonstrate economy’s continuing strength. Preliminary headline data for November durable goods orders showed a 5.3% m/o/m increase, surpassing expectations of 0.8% and improving from the revised October figure of -2.1% (previously -6.2%). Durable goods orders are now at their highest point since May 2025.

Durable goods orders excluding transportation rose by 0.5% m/o/m in November, exceeding the anticipated 0.3% and up from an unrevised October reading of 0.1%. This represents the highest level since September 2025.

Core capital goods orders (excluding defence and aircraft) increased by 0.7% m/o/m in November, outperforming estimates of 0.3% and higher than the 0.3% reported in October.

In January, the Dallas Fed Manufacturing Index increased by 10 points m/o/m to -1.2, marking its highest level since July 2025. Nevertheless, the index remained in negative territory for the sixth consecutive month.

The production index improved to +11.2 from -3.0, while the new orders index climbed to +11.8 from -6.2. The employment index also rose, reaching +8.2 compared to -1.8 previously. Additionally, the finished goods price index saw a significant increase to 18.5 from 8.5, whereas the raw material price index was relatively stable at +37.1.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。