Will PCE data affect dovish expectations?

Key data to move markets today

EU: Eurozone GDP, Eurozone Employment Change, German Factory Orders, and a speech by ECB Chief Economist Philip Lane

USA: Personal Consumption Expenditures (PCE), Core PCE, Personal Income, Personal Spending, Factory Orders, Michigan Consumer Sentiment and Expectations Indices, UoM 1- and 5-year Consumer Inflation Expectations

US Stock Indices

Dow Jones Industrial Average -0.07%

Nasdaq 100 -0.10%

S&P 500 +0.11%, with 5 of the 11 sectors of the S&P 500 up

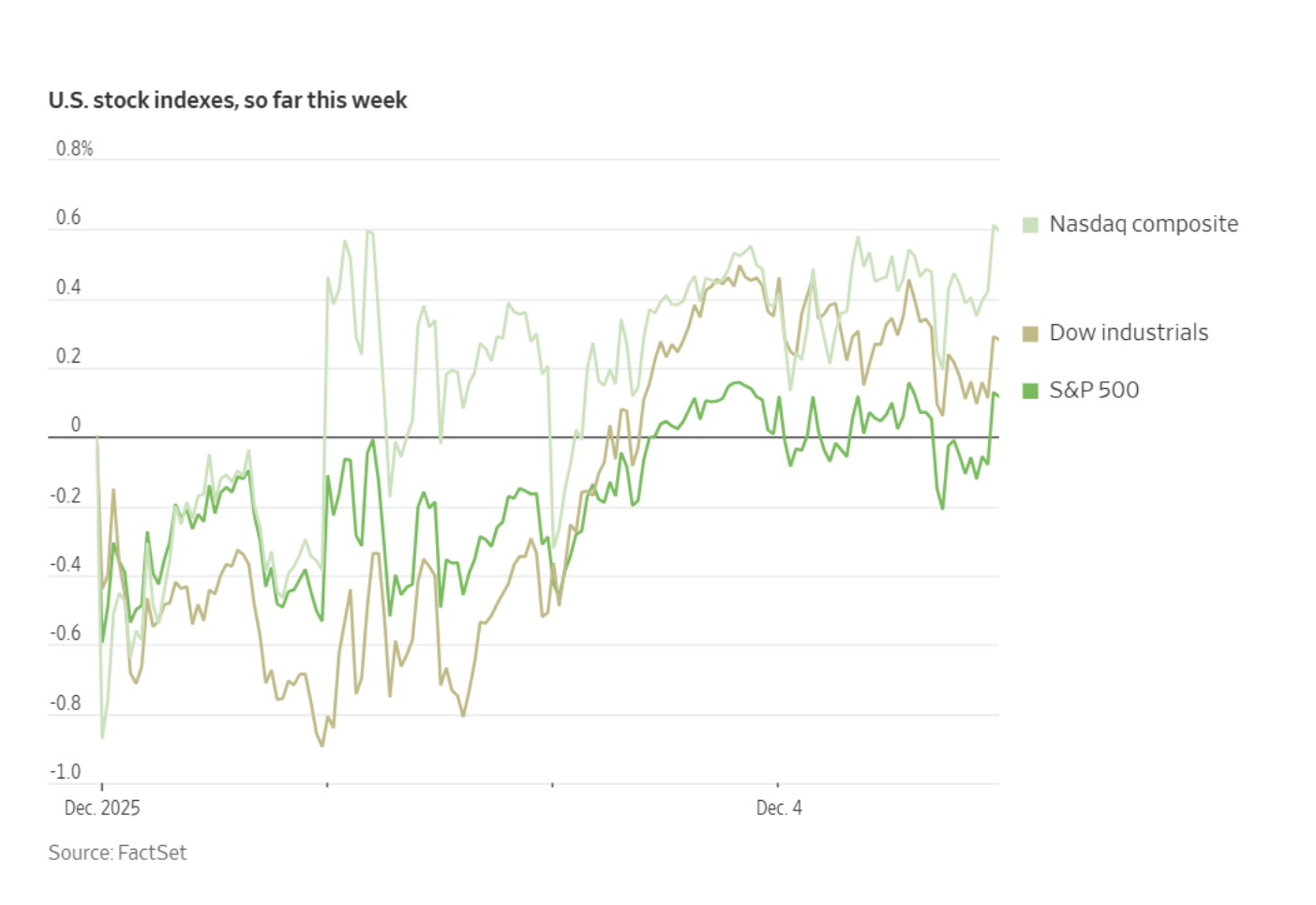

On Thursday, stock markets contended with mixed signals regarding labour market conditions and consumer spending, ultimately ending the session with varied results.

The S&P 500 closed marginally higher, up +0.11%, while the Dow Jones Industrial Average declined by -0.07%. The Nasdaq Composite advanced +0.22%. The Russell 2000 rose by +0.76% to a record close of 2,531.25.

Investor sentiment showed significant improvement, as evidenced by the AAII Bull-Bear spread, which surged over 24 percentage points to +13.5% for the week ending 3rd December. This marked the largest gain and highest reading since the week ending 23rd January, breaking a three-week streak of negative sentiment.

The recent uptick in sentiment followed a strong recovery in late November. During this period, the S&P 500 managed to close November with a gain, despite having been down more than 4.5% earlier in the month.

In corporate news, Meta Platforms faces the possibility of a temporary ban by the EU on the implementation of new policies related to its AI features in WhatsApp, following the latest investigation into Big Tech’s influence in the region.

Dollar General has raised its full-year outlook, exemplifying how retailers focused on value are successfully attracting consumers seeking bargains.

Kroger has revised the upper range of its full-year sales forecast downward, signaling growing competition among food retailers vying for increasingly discerning shoppers.

Ulta Beauty increased its full-year guidance after posting stronger-than-expected Q3 results, indicating that consumers are overcoming spending hesitancy and are willing to purchase cosmetics and hair care products.

The Wall Street Journal reported Thursday that PepsiCo is close to reaching a settlement with activist investor Elliott Investment Management, although specific details of the agreement were not disclosed.

Chevron has begun transporting employees from Caracas to its oil production facilities in Venezuela, despite a safety warning from the US government concerning air travel in the area due to potential military satellite interference.

Paramount Skydance has accused Warner Bros. Discovery of not conducting a fair auction, asserting that the company is failing to act in the best interests of its shareholders.

S&P 500 Best performing sector

Industrials +0.51%, with GE Vernova +4.51%, Generac Holdings +2.56%, and Huntington Ingalls Industries +2.15%

S&P 500 Worst performing sector

Consumer Staples -0.73%, with Kroger -4.62%, Costco Wholesale -2.86%, and Philip Morris International -2.06%

Mega Caps

Alphabet -0.70%, Amazon -1.41%, Apple -1.21%, Meta Platforms +3.43%, Microsoft +0.65%, Nvidia +2.11%, and Tesla +1.74%

Information Technology

Best performer: Enphase Energy +4.66%

Worst performer: Intel -7.45%

Materials and Mining

Best performer: Corteva +1.52%

Worst performer: LyondellBasell Industries -6.24%

European Stock Indices

CAC 40 +0.43%

DAX +0.79%

FTSE 100 +0.19%

Commodities

Gold spot +0.09% to $4,206.89 an ounce

Silver spot -2.36% to $57.10 an ounce

West Texas Intermediate +1.12% to $59.68 a barrel

Brent crude +0.84% to $63.32 a barrel

Gold prices were relatively stable on Thursday.

Spot gold was up +0.09% at $4,206.89 per ounce.

Silver fell -2.36% to $57.10 after touching a record high of $58.98 on Wednesday. The metal is up +97.02% this year, supported by a structural supply deficit, and its inclusion in the US critical minerals list.

Oil prices advanced on Thursday, driven by stalled Ukraine peace negotiations that dampened expectations for a resolution capable of restoring Russian oil flows to the global market.

Brent crude settled 53 cents higher, or +0.84%, at $63.32 per barrel, while US WTI ended the session up 66 cents, or +1.12%, at $59.68.

Rising tensions between the US and Venezuela have been cited by analysts as a factor supporting higher prices, due to concerns that crude oil shipments from Venezuela might decrease. Additionally, perceptions that progress toward a Ukraine peace deal has stalled further pushed prices up; this followed reports indicating that US officials wrapped up negotiations with the Kremlin without making any breakthroughs to resolve the conflict. Earlier, hopes for a resolution to the war had weighed on prices, since many in the market believed an agreement would bring Russian oil supplies back into a global arena already experiencing excess supply.

On Thursday, Fitch Ratings revised its oil price assumptions for 2025 through 2027 downward, reflecting expectations of market oversupply and production growth that is likely to exceed demand.

In response to these market dynamics, Saudi Arabia reduced its January official selling price (OSP) for Arab Light crude to Asia to $0.60 per barrel above the Oman/Dubai average—its lowest premium in five years, as indicated by a pricing document reviewed by Bloomberg News. This adjustment marks the second consecutive monthly decline and represents the lowest level since January 2021; the December OSP premium stood at $1 per barrel.

These price cuts align with a broader downward trend in the cash Dubai premium to swaps, which has averaged 70 cents thus far in December, compared with an average of 90 cents in November. The adjustments occur amid rising global supply, as OPEC+ increases output.

Eight OPEC+ members have paused additional output hikes for Q1 2026 after collectively raising their output targets by approximately 2.9 million barrels per day (bpd) since April 2025. Other major producers, including the US and Brazil, are also increasing supply, thereby intensifying concerns about a potential market surplus.

The reduction in official selling prices could stimulate further purchases by Chinese independent refiners, who recently received their first batch of 2026 import quotas. Saudi crude OSPs often set the benchmark for Iranian, Kuwaiti, and Iraqi prices, collectively impacting about 9 million bpd of crude destined for Asian markets.

Note: As of 4 pm EST 4 December 2025

Currencies

EUR -0.22% to $1.1644

GBP -0.21% to $1.3332

Bitcoin -1.67% to $92,170.26

Ethereum -1.35% to $3,123.37

The US dollar inched higher on Thursday, yet remained close to the five-week low observed earlier in the session, as investors anticipated a potential Fed rate cut next week. The dollar index advanced by +0.20% to 99.07, thereby ending a nine-day losing streak, but still hovered near its recent low of 98.765.

The euro declined -0.22% to $1.1649. Nonetheless, the European currency continued to find support from data released on Wednesday, which indicated that business activity in the eurozone expanded at its fastest pace in thirty months during November.

Recently, the dollar has faced additional downward pressure as market participants have considered the possibility of White House economic adviser Kevin Hassett succeeding Jerome Powell as Fed Chair upon the latter's term conclusion in May. Hassett is expected to advocate for further rate reductions.

The British pound fell -0.21% to $1.3323, after briefly reaching its highest level in more than five weeks at $1.3358. It remained close to its strongest point since 24th October, bolstered by an upward revision to business activity data that improved perceptions of the UK economy. Against the euro, sterling was little changed at 87.44 pence.

Market pricing currently reflects a 90% probability of a rate cut at the upcoming BoE meeting later this month.

The Japanese yen rose +0.08% against the US dollar to ¥155.11, nearing its highest level since 17th November. This movement was fueled by expectations that the BoJ will raise interest rates when it convenes later this month. According to three government officials cited by Reuters, the BoJ is likely to implement a December rate hike; however, future policy direction remains uncertain, with markets fully pricing in only one additional rate increase next year and assigning roughly a 50% probability to another.

Despite these developments, a cautious stance from the BoJ, the continued attractiveness of carry trades involving the dollar and yen, and ongoing upward pressure on Japanese government bond yields amid potential fiscal expansion are all factors likely to contribute to sustained yen weakness.

Fixed Income

US 10-year Treasury +3.5 basis points to 4.102%

German 10-year bund +2.6 basis points to 2.776%

UK 10-year gilt -1.0 basis points to 4.441%

US Treasuries declined on Thursday, ending a three-day rally, as data indicated that the labour market remains relatively robust. This resilience supported the view that the economy is not experiencing a sharp downturn, thereby marginally lowering the likelihood of an interest rate cut at next week's FOMC meeting. Additionally, market participants cited investor consolidation ahead of the Fed's policy decision, scheduled for 9th - 10th December, as a contributing factor to the selloff.

In afternoon trading, the yield on the 10-year Treasury note increased by +3.5 bps to 4.102%, while the 30-year yield rose by +2.2 bps to 4.755%. At the shorter end of the maturity spectrum, the two-year yield—sensitive to changes in Fed policy—advanced by +3.3 bps to 3.531%.

The yield curve remained relatively stable on Thursday. The spread between the US two-year and 10-year Treasury yields was 57.1 bps, compared to 56.9 bps on Wednesday. This represented a modest reversal from the steepening trend observed in the last few days.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 87.0% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 83.4% and the 68.6% probability assigned a month ago. Traders are currently expecting 21.8 bps of cuts by year-end.

Eurozone government bond yields advanced modestly on Thursday, mirroring movements in US Treasuries. Germany’s 10-year yield climbed by +2.6 bps to reach 2.776%, while the 2-year yield—sensitive to expectations for the ECB’s policy outlook—rose +1.9 bps to 2.078%. At the longer end of the curve, the 30-year yield increased by +1.8 bps to 3.405%.

Italy’s 10-year yield also advanced, rising by +3.4 bps to 3.477%. Consequently, the yield spread between Italian 10-year government bonds and German Bunds stood at 70.1 bps. The narrower spreads result from economic strength and fiscal discipline in peripheral EU countries, as well as slower growth and higher bond issuance in Germany.

Note: As of 5 pm EST 4 December 2025

Global Macro Updates

Initial claims lowest since 2022, though Challenger job cuts YTD highest since 2020. Recent labour market data presented a mixed picture. Initial jobless claims declined to 191,000, notably below both the consensus estimate of 221,000 and the prior week’s upwardly revised figure of 218,000 (previously 216,000). Continuing claims stood at 1,939,000, also below expectations of 1,954,000 and the previous week’s revised total of 1,943,000 (previously 1,960,000). Initial claims are now at their lowest level since September 2022, with the four-week moving average falling by 9,500 to reach 214,750.

Despite the decline in claims, US employers announced 71,321 job cuts in November, representing a 24% increase y/o/y but a 53% decrease compared to October. Year-to-date job cuts have reached 1.1 million, marking the highest total since 2020. Layoffs were primarily concentrated in the telecommunications and technology sectors, with Verizon’s planned reductions accounting for the majority in telecom.

Restructuring was the leading cause of layoffs in November, while federal Department of Government Employment (DOGE) layoffs have been the predominant factor for 2025 overall. Layoffs attributed to AI remain modest for the year-to-date, whereas approximately 21% of 2025 layoffs have been associated with market and economic conditions.

Additionally, US employers announced 497,151 planned hires through November, reflecting a 35% decrease y/o/y and marking the lowest year-to-date total since 2010.

BoE launches stress tests of private equity and credit. The BoE has announced the initiation of a comprehensive system-wide exploratory exercise focused on private markets. This marks the BoE's second system-wide assessment, following its prior examination of Gilt markets and sterling corporate bond markets. The primary objective of this exercise is to identify and address potential risks associated with private market finance. The BoE has noted that total assets under management in private markets have reached $16 trillion globally, with private equity (PE) and private credit (PC) sectors expanding significantly from approximately $3 trillion to nearly $11 trillion over the past decade.

Within the UK, businesses sponsored by PE account for 15% of total corporate debt and represent 10% of private sector employment—equating to just over two million jobs. The BoE will consider the potential impact of a global economic downturn on private market assets, as well as the broader implications for UK corporate investment and employment. The assessment will also determine whether corporations might encounter difficulties in accessing financing through banks or alternative markets during periods of stress. Furthermore, the exercise will explore whether these financing channels serve as buffers or conduits for risk transmission.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。