Is US manufacturing broken?

Key data to move markets today

EU: Eurozone Harmonised Index of Consumer Prices and Eurozone Unemployment Rate

UK: Financial Stability Report

USA: Speeches by Fed Chair Jerome Powell and Fed Vice Chair for Supervision Michelle Bowman

US Stock Indices

Dow Jones Industrial Average -0.90%

Nasdaq 100 -0.36%

S&P 500 -0.53%, with 8 of the 11 sectors of the S&P 500 down

US equity indices began December, a historically strong month for equities, on a downbeat note, with stocks retreating as investors rotated out of riskier assets amidst a broader selloff in cryptocurrencies.

The Dow Jones Industrial Average led the decline, falling -0.90%, or 427 points and the Nasdaq 100 fell -0.38%. The S&P 500 was -0.53%. This drop follows a rally that propelled the S&P 500 to its longest streak of monthly gains since 2021. Although the benchmark index briefly dipped below the 6,800 level, it managed to close slightly above that threshold.

In corporate news, as noted by Bloomberg news, Eli Lilly & Co. is cutting the price for introductory doses of its weight-loss drug Zepbound again, as competition heats up with rival Novo Nordisk.

In a statement issued on Monday, Nvidia said it invested $2 billion in Synopsys Inc. at $414.79 each. The stake represents 2.6% of Synopsys’ outstanding stock. This was part of a broader engineering and design tie-up with the new partnership involving integrating Nvidia’s tools into Synopsys’ chip-design applications. The companies also will deploy AI agents and work on joint marketing.

Chinese startup DeepSeek unveiled two updated versions of the experimental artificial intelligence model it released weeks ago. The company stated that these new iterations feature fresh capabilities designed to integrate reasoning with the autonomous execution of specific actions.

Strategy announced the creation of a $1.4 billion reserve to fund future dividend and interest payments. This measure aims to temper market concerns that the Bitcoin accumulator might be forced to liquidate a portion of its approximately $56 billion cryptocurrency portfolio should token prices continue to decline.

Moderna shares came under pressure after the Food and Drug Administration issued a memo late last week indicating it would implement new restrictions on vaccine market entry.

Walt Disney’s Zootopia 2 generated $272 million in China, securing the second-largest opening ever for a foreign film in the region.

Barrick Mining is reportedly exploring an initial public offering for its North American gold assets. Potentially valued at over $60 billion, the move comes as the company navigates operational setbacks and a management reshuffle.

BHP Group, according to Bloomberg news, offered approximately £40 billion ($53 billion) during its now-terminated attempt to acquire Anglo American.

S&P 500 Best performing sector

Energy +0.91%, with Diamondback Energy +2.34%, Devon Energy +2.16%, and Valero Energy +2.14%

S&P 500 Worst performing sector

Utilities -2.35%, with Sempra -3.40%, Ameren -3.15%, and Dominion Energy -3.14%

Mega Caps

Alphabet -1.56%, Amazon +0.28%, Apple +1.52%, Meta Platforms -1.09%, Microsoft -1.05%, Nvidia +1.66%, and Tesla -0.01%

Information Technology

Best performer: Synopsys +4.85%

Worst performer: Broadcom -4.19%

Materials and Mining

Best performer: Mosaic +1.92%

Worst performer: FMC -3.15%

European Stock Indices

CAC 40 -0.32%

DAX -1.04%

FTSE 100 -0.18%

Commodities

Gold spot +0.34% to $4,230.04 an ounce

Silver spot +2.80% to $57.96 an ounce

West Texas Intermediate +1.78% to $59.52 a barrel

Brent crude +1.62% to $63.33 a barrel

Gold prices climbed to a six-week peak on Monday, while silver achieved a new record high.

Spot gold advanced +0.34% to $4,230.04 per ounce, marking its highest level since 21st October. Silver rose +2.80% to $57.96 per ounce after reaching an all-time high of $58.83 earlier in the session.

The decline of the US dollar to a two-week low enhanced gold’s appeal by making it more affordable for investors holding other currencies.

Oil prices increased by more than one percent on Monday, driven by several key developments: Ukrainian drone attacks, the closure of Venezuelan airspace by the US, and OPEC's decision to maintain current output levels for Q1 2026.

Brent crude futures gained $1.01 or +1.62% to $63.33 per barrel. US WTI crude settled at $59.52 per barrel, up $1.04 or +1.78%.

Concerns regarding a potential conflict between the US and Venezuela remain on the backburner, as market attention is primarily centred on the ongoing war in Ukraine. Ukraine’s drone strikes on Russia’s shadow fleet, alongside OPEC’s commitment to uphold existing production levels, contributed to the price gains observed during New York’s morning trading session.

In addition, the Caspian Pipeline Consortium — which transports approximately 1% of global oil supply — reported on Saturday that one of its three mooring points at the Novorossiysk terminal was damaged, resulting in a temporary halt in operations. However, Chevron, a stakeholder in the CPC, clarified late Sunday that loadings at Novorossiysk were continuing, noting that typically two moorings are utilised for loading while the third serves as a backup. These incidents occurred as Ukraine intensified its military operations in the Black Sea, targeting two oil tankers bound for Novorossiysk.

Note: As of 4 pm EST 1 December 2025

Currencies

EUR +0.08% to $1.1607

GBP -0.18% to $1.3209

Bitcoin -4.92% to $86,461.39

Ethereum -7.93% to $2,792.65

Across broader currency markets, the dollar maintained a softer profile as investors prepared for a consequential December, which could see the FOMC implement its final rate cut of the year and the appointment of a dovish successor to Fed Chair Jerome Powell. The euro appreciated by as much as 0.50% to reach a two-week high of $1.1652, before moderating its gains to end +0.08% on the day at $1.1607.

The British pound was down -0.18% at $1.3209, following its best weekly performance in over three months.

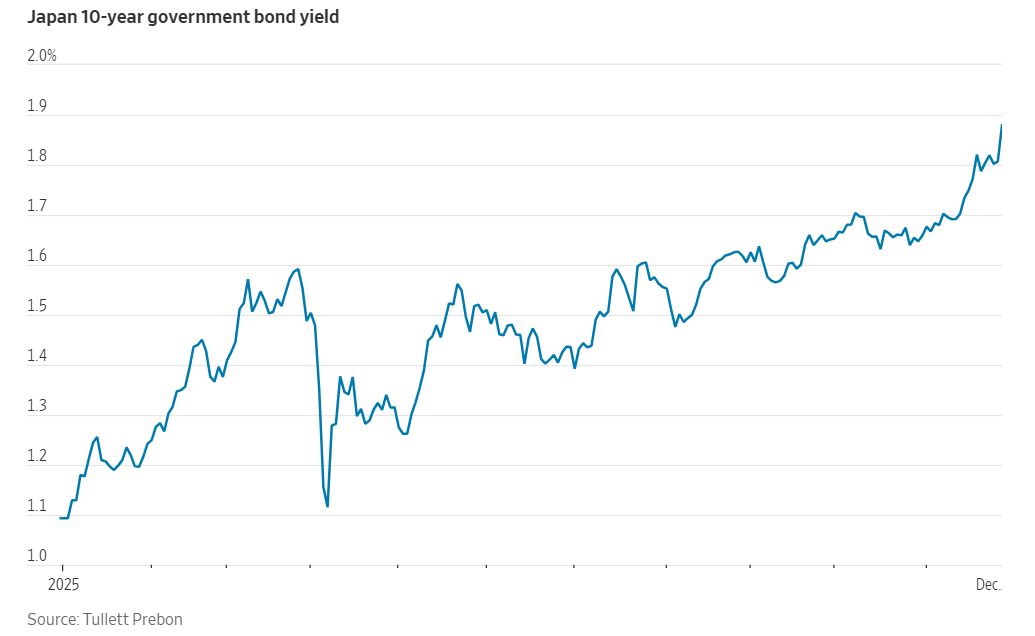

The US dollar fell against the Japanese yen on Monday after BoJ Governor Kazuo Ueda stated that the BoJ would weigh the advantages and disadvantages of a rate hike during its next meeting. During a subsequent press conference, Ueda noted that he would further outline the central bank’s future path for rate increases once rates reach 0.75%. He emphasised that the December policy decision would incorporate wage data and other relevant information.

The dollar fell by nearly one percent to ¥154.66 yen before recovering to end the day -0.45% at ¥155.47. Market participants have increasingly priced in the likelihood of a December rate hike from the BoJ, particularly following the yen’s descent to ten-month lows last month, which has strengthened the case for monetary tightening.

The dollar’s weakness reflects the prevailing expectation among investors that a December rate cut is nearly assured, further exacerbated by reports suggesting that White House economic adviser Kevin Hassett is a leading candidate to become the next Fed chair.

As the December FOMC approaches a fully priced 25 bps cut, attention will shift to future meetings. FOMC division limits dovish expectations, but with significant labour data due before January, Q1 pricing may be too conservative.

Fixed Income

US 10-year Treasury +7.4 basis points to 4.092%

German 10-year bund +6.4 basis points to 2.756%

UK 10-year gilt +3.9 basis points to 4.486%

US Treasuries declined on Monday, influenced by concurrent weakness in both Japanese and European government bond markets.

The rise in Japanese government bond yields — prompted by the increasing likelihood of a rate hike — diminishes Japanese investors’ incentive to purchase foreign bonds and encourages the repatriation of capital. Japan remains the largest foreign holder of US Treasuries, with approximately $1.2 trillion in US government debt.

During afternoon trading, the 10-year Treasury yield climbed +7.4 bps to 4.092%, marking its largest single-day gain since mid-July. Similarly, the yield on the 30-year Treasury advanced +7.4 bps to 4.741%, the most pronounced daily increase since 11th July. On the front end of the curve, the two-year yield — sensitive to shifts in interest rate expectations — rose +4.7 bps to 3.549%, achieving its strongest daily advance since late October.

The yield curve steepened on Monday, as the spread between the US two-year and 10-year yields widened to 54.3 bps from 51.6 bps on Friday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 87.2% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 85.2% and the 63.0% probability assigned a month ago. Traders are currently expecting 21.8 bps of cuts by year-end.

On Monday, German borrowing costs reached multi-month highs, with the ultra-long end of the German yield curve remaining at its steepest level since May 2019. This movement in the curve reflects growing investor uncertainty regarding Germany's long-term bond supply. However, despite a significant increase in fiscal spending, German Bunds are still widely considered the euro area's safest asset for the foreseeable future.

Last Friday, Germany’s parliament approved the 2026 budget, authorising over €180 billion in new debt to support efforts aimed at revitalising the country’s sluggish economy. In response, the yield on Germany’s 10-year bonds rose by +6.4 bps to 2.756%, marking the highest level since 26th September. On the long end, the German 30-year yield advanced +6.8 bps to 3.389%. The yield of Germany's two-year bond — often more responsive to policy rate expectations — climbed +3.2 bps to 2.069%, the highest since 27th March.

Money markets now assign a roughly 25% probability to a ECB rate cut by September, with expectations for the key rate to stand at 1.95% in December 2026. The ECB deposit rate is currently 2%.

Investors will watch out for euro area inflation data due later today, although preliminary figures from individual member states released last week have reinforced economists’ views that the ECB is unlikely to implement further rate cuts in the near term.

The yield spread between Italian and German bonds, a key measure of the additional premium investors require to hold Italian debt over safe-haven Bunds, fell to a 16-year low of 68.8 bps earlier in the session before settling at 71.4 bps. This narrowing of spreads to multi-year lows reflects both the economic resilience and fiscal discipline seen in so-called peripheral countries, as well as Germany’s modest growth outlook and increased bond issuance.

Note: As of 5 pm EST 1 December 2025

Global Macro Updates

US manufacturing still feeling negative trade effects. The Institute for Supply Management’s November manufacturing index slipped to 48.2 from 48.7 in October. The measure has been below 50, which indicates contraction, for nine straight months. The New Orders Index came in at 47.4 percent, a decrease of 2 percentage points compared to October. The Prices Index reading was 58.5 percent (up 0.5 percentage point) with core products steel and aluminum remaining drivers of inflation. The Employment Index was 44 percent, down 2 percentage points, a three-month low. Susan Spence, MBA, Chair of the Institute for Supply Management Manufacturing Business Survey Committee, noted that 10 months of data is clear: Current trade policy has not boosted the manufacturing sector. In many ways, it has had the opposite effect. The US Supreme Court is still deciding on the legality of the tariffs imposed by the Trump administration.

The ISM numbers stood in contrast to the S&P Global Manufacturing PMI, which came in at 52.2 in November, slightly down from October’s 52.5 reading. The index has now posted above the critical 50.0 no-change mark for four successive months. The growth in the reading was underpinned by the best rise in output since August, but the survey showed the steepest rise in warehouse stocks in the survey’s 18-and-a-half-year history. Tariffs continued to drive higher input price inflation, which remained elevated and little changed since October. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, stated that although the headline PMI signalled a further expansion, manufacturers are making more goods but often not finding buyers for these products and profit margins are coming under pressure from a combination of disappointing sales, stiff competition and rising input costs, the latter widely linked to tariffs.

Nevertheless, there was an improvement in confidence with the outlook jumping since October to reach its highest level since June. Employment growth rose to a three-month high as employers took on staff in expectation of higher sales in coming months.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。