Is AI debt reshaping credit markets?

What to look out for today

Companies reporting on Monday, 24th November: Zoom Communications

Key data to move markets today

EU: German IFO Business Climate, Current Assessment, and Expectations

US Stock Indices

Dow Jones Industrial Average +1.08%

Nasdaq 100 +0.77%

S&P 500 +0.98%, with 11 of the 11 sectors of the S&P 500 up

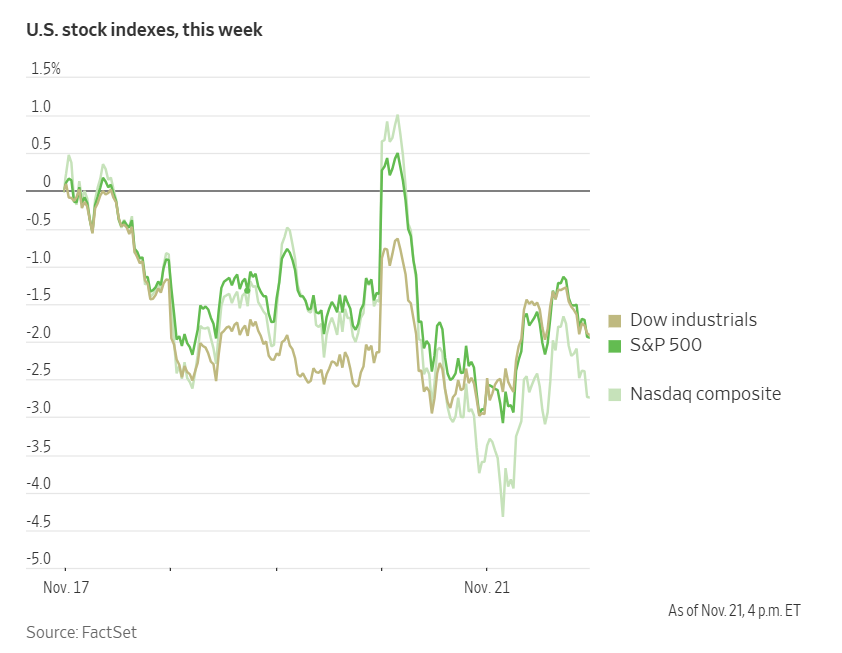

Equities concluded Friday’s session on a positive note, with the Dow Jones Industrial Average recovering losses from the prior day. This advance capped a week marked by notable market turbulence, as investors weighed concerns over high technology sector valuations and ambitious AI CapEx strategies.

All three major US stock indices closed higher on Friday, led by the Dow’s gain of 493 points, or +1.08%. Nevertheless, the week’s rally was insufficient to offset earlier declines, with the Dow, S&P 500, and Nasdaq Composite each finishing the week down by -0.74%, -1.04% and -1.92%, respectively.

Volatility resurfaced during the week, particularly in assets favoured by retail momentum traders, such as cryptocurrencies and leading AI stocks, which experienced pronounced price fluctuations. Persistent uncertainty regarding the FOMC ability to implement rate cuts contributed to market instability. Although the Cboe Volatility Index declined slightly, it remained elevated at 23.4.

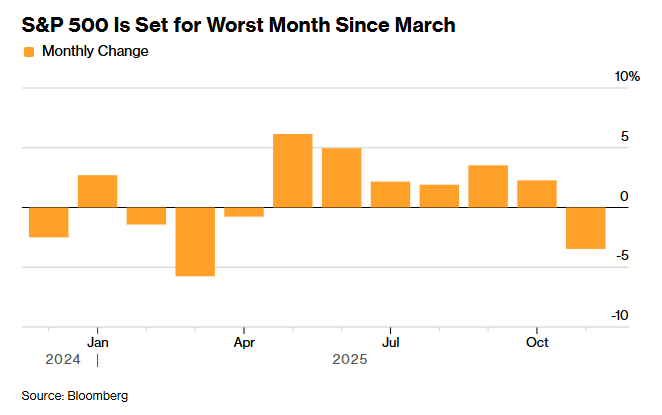

Despite Friday’s recovery, the S&P 500 remained on track for its weakest monthly performance since March. Market dynamics were further amplified by the estimated expiration of more than $3.1 trillion in notional options contracts, resulting in heightened risk transfer and elements of capitulation during last week.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +14.7%. This jumps to 15.5% when excluding the Energy sector. Of the 472 companies in the S&P 500 that have reported earnings to date for Q3 2025, 82.6% have reported earnings above analyst estimates, with 77.2% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 8.2% in Q3, increasing to 8.8% when excluding the Energy sector.

The Health Care sector, at 91.4%, is the sector with most companies reporting above estimates. Industrials with a surprise factor of 15.3%, are the sectors that have beaten earnings expectations by the highest surprise factors. Within Communication Services, 38.1% of companies have reported below estimates and Real Estate is the sector with the lowest surprise factor at 4.0%. The S&P 500 surprise factor is 9.6%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.1x.

In corporate news, Eli Lilly achieved a milestone on Friday by becoming the 10th US company—and the first pharmaceutical firm—to reach a $1 trillion market capitalisation, joining a group predominantly composed of technology companies. The Indianapolis-based drugmaker’s advance was propelled by surging demand in the weight-loss drug market. Eli Lilly’s stock has appreciated by +69.38% in just over three months since hitting a recent low on 8th August.

Ford Motor announced that the recent fire at a major aluminum supplier’s facility in New York is not expected to impact its profitability for the year. The company indicated that the blaze was ‘swiftly contained,’ and the plant has since resumed operations.

Additionally, Eli Lilly and Novo Nordisk disclosed plans to introduce their widely-used obesity medications to employers through a novel distribution strategy designed to circumvent traditional pharmaceutical sales channels and broaden access to these high-cost treatments.

The three bidders for Warner Bros. Discovery are facing considerable regulatory scrutiny, which, according to sources cited by Bloomberg news, may delay the approval of any potential merger by a year or more.

Airbnb announced in a regulatory filing on Friday that Chief Technology Officer Ari Balogh will step down from his position in December.

The Wall Street Journal reported that JPMorgan Chase, Bank of America, and Citigroup have withdrawn plans for a $20 billion bailout package for Argentina. Instead, the banks are now evaluating a shorter-term, $5 billion repurchase facility aimed at supporting Argentina in meeting a $4 billion debt obligation due in January.

S&P 500 Best performing sector

Communication Services +2.15%, with Interpublic Group of Companies +4.77%, Omnicom Group +4.70%, and Charter Communications +4.26%

S&P 500 Worst performing sector

Utilities +0.01%, with Vistra -2.99%, Constellation Energy -2.22%, and PG&E -1.07%

Mega Caps

Alphabet +3.33%, Amazon +1.63%, Apple +1.97%, Meta Platforms +0.85%, Microsoft -1.32%, Nvidia -0.97%, and Tesla -1.00%

Information Technology

Best performer: HP +5.97%

Worst performer: Oracle -5.66%

Materials and Mining

Best performer: Celanese +6.75%

Worst performer: Albemarle +0.34%

European Stock Indices

CAC 40 +0.02%

DAX -0.80%

FTSE 100 +0.13%

Commodities

Gold spot -0.28% to $4,065.39 an ounce

Silver spot -1.26% to $50.00 an ounce

West Texas Intermediate -1.33% to $57.98 a barrel

Brent crude -1.01% to $62.48 a barrel

Gold prices remained relatively stable on Friday, declining by -0.28%, following an earlier drop of more than one percent during the session.

Spot gold held firm at $4,065.39 per ounce, ultimately ending the week with a modest decline of -0.35%.

Oil prices declined by over one percent on Friday, reaching their lowest levels in a month, as diplomatic efforts by the US to broker a peace agreement between Russia and Ukraine raised the prospect of increased global oil supplies.

Brent crude futures fell by 64 cents, or -1.01%, settling at $62.48 per barrel, while US WTI crude dropped 78 cents, or -1.33%, to close at $57.98 per barrel. For the week, Brent recorded a -2.89% decline, and WTI fell -3.40%, marking their weakest settlements since 21st October.

The market's bearish sentiment was fuelled by Washington's push for a resolution to the three-year conflict between Ukraine and Russia, alongside the implementation of sanctions on Russian oil producers Rosneft and Lukoil, which took effect on Friday.

Ukrainian President Volodymyr Zelenskiy cautioned that Ukraine risked losing its dignity, freedom, or even US support if it were to accept the peace plan proposed by President Donald Trump, which Washington urged Kyiv to consider within a week.

Russian President Vladimir Putin indicated that the US peace proposals could serve as a foundation for resolving the conflict but warned that Russian forces would advance further if Kyiv rejected the plan.

A successful agreement could enable Russia to increase its fuel exports. In 2024, Russia was the world's second-largest crude oil producer after the US, according to US federal energy data. Nonetheless, a final peace deal may still be some time away.

Additionally, a stronger US dollar exerted downward pressure on oil prices, as the US dollar index reached a six-month high, thereby making dollar-denominated oil more costly for many international buyers.

Note: As of 5 pm EST 21 November 2025

Currencies

EUR -0.14% to $1.1511

GBP +0.18% to $1.3094

Bitcoin -2.77% to $84,803.50

Ethereum -3.90% to $2,766.04

On Friday, the US dollar weakened against the yen following increased verbal intervention by Japanese officials seeking to curb the currency’s decline. Despite this movement, the greenback was poised for its largest weekly gain in six weeks.

Against other major currencies, the US dollar remained well-bid, with the US dollar index reaching its highest level since late May. The index approached a five-and-a-half-month peak and last stood at 100.19, showing a marginal decrease of -0.02% for the day, but ultimately closed the week up +0.93%.

The euro depreciated by -0.14% to $1.1511 and experienced a -0.94% decline over the week. It remained stable after preliminary PMI data indicated growth in euro zone business activity this month, though manufacturing activity slipped into contractionary territory.

Sterling rose +0.18% to $1.3094, as investors anticipated Britain’s upcoming budget this week. Economic data revealed ongoing struggles for the UK economy ahead of this week’s critical events for both the currency and bond markets. The pound lost -0.55% over the course of the week.

The yen strengthened in afternoon trading, advancing +0.68% to ¥156.39 per dollar. This followed remarks from Japanese Finance Minister Satsuki Katayama, who stated that intervention might be considered to address excessive volatility and speculative activity, heightening trader vigilance for potential yen purchases by Tokyo. The Japanese currency had reached a near ten-month low of ¥157.90 on Thursday and declined -1.20% for the week.

Concerns about Japan’s deteriorating fiscal outlook have pressured the yen, resulting in a -5.88% decline since Prime Minister Sanae Takaichi assumed party leadership on 4th October. On Friday, Takaichi’s cabinet approved a ¥21.3 trillion yen economic stimulus package. Against the euro, the yen remained near its lowest levels since the single currency’s introduction, although the euro fell -0.83% on Friday to ¥180.01.

Fixed Income

US 10-year Treasury -2.0 basis points to 4.068%

German 10-year bund -1.8 basis points to 2.707%

UK 10-year gilt -3.8 basis points to 4.551%

US Treasury yields reached a three-week low on Friday as investors increasingly anticipated a potential interest rate cut by the Fed next month, prompted by signs of a softening labour market.

Data released on Thursday indicated that, although employers added more jobs in September than economists had forecast, the unemployment rate rose during the month. Additionally, August’s payroll figures were revised to reflect job losses for the second time this year.

Among the employment data, the rise in the unemployment rate and the downward revision to negative job growth in August appeared to exert a greater influence on market sentiment than the stronger-than-expected increase in September payrolls.

The yield on the two-year Treasury note—sensitive to expectations regarding Fed policy—fell by -2.7 bps to 3.518% and posted a weekly decline of -10.7 bps. The yield on the 10-year note decreased by -2.0 bps to 4.068%, down -8.5 bps over the week. Long-term yields also moved lower, with the 30-year yield declining by -1.3 bps on Friday, contributing to a weekly drop of -3.3 bps.

The spread between two-year and 10-year Treasury yields stood at 55.0 bps, marking an increase of 2.2 bps from the previous week.

Data released on Friday showed that US factory activity slowed to a four-month low in November. Heightened import tariffs drove up prices, dampening demand and resulting in an accumulation of unsold goods, which could potentially impede broader economic growth.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 71.0% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 44.4%. Traders are currently expecting 17.4 bps of cuts by year-end, higher than the 11.1 bps anticipated the prior week.

Eurozone bond yields receded from six-week highs on Friday, as market sentiment shifted and investors divested from risk assets in favour of purchasing bonds. Germany's 10-year bond yield declined by -1.8 bps to 2.707%, after reaching its highest level in six weeks at 2.741% on Thursday. Over the course of the week, the German 10-year yield fell by -1.6 bps.

Italy’s 10-year government bond yield also decreased, falling by -0.7 bps to 3.464% after touching its own six-week peak on Thursday. For the week, Italy’s 10-year yield was down by -0.5 bps. Consequently, the spread between Italy’s 10-year BTP yield and Germany’s 10-year bund widened by 1.1 bps to 75.7 bps compared to the previous week.

On the economic data front, eurozone business activity continued to grow steadily this month, driven by the fastest expansion in the services sector in one and a half years. Additionally, subdued demand caused manufacturing activity to contract, according to a private survey.

The 20-member bloc has demonstrated economic resilience despite ongoing global uncertainty since the beginning of the year, reinforcing expectations that the ECB will likely maintain interest rates throughout the next year.

Yields on shorter-term bonds, particularly sensitive to changes in interest rate policy, also declined on Friday. Germany’s two-year yield dropped by -1.2 bps to 2.013%, after briefly reaching a two-week low; for the week, it was down by -3.2 bps. At the longer end of the maturity spectrum, Germany’s 30-year yield fell by -1.3 bps on Friday to 3.341%, although it ended the week +2.2 bps higher.

Note: As of 5 pm EST 21 November 2025

Global Macro Updates

Dovish Fedspeak colours market expectations. During the 100th Anniversary of the Central Bank of Chile, New York Fed President John Williams, who holds a voting position, in prepared remarks, indicated that there remains scope for an additional interest rate adjustment in the near term to guide monetary policy toward a more neutral stance. He emphasised the necessity of returning inflation to the Fed’s 2% target, but stressed the importance of achieving this objective without compromising labour market stability. Williams acknowledged that progress on inflation has recently paused, yet he does not anticipate that tariffs will exert a lasting effect on price levels.

Williams’ remarks are particularly notable given his reputation as one of the more hawkish members of the FOMC. As recently as 9th November, he described monetary policy as a ‘balancing act’ amid persistent inflation, an economy demonstrating resilience, and a labour market that is cooling gradually, according to the Financial Times. Following his statements, market expectations shifted, with the probability of a Fed rate cut in December rising to 71.0%, up from 40% on Thursday.

In related commentary, Boston Fed President Susan Collins, speaking on CNBC, expressed some reservations regarding a potential rate cut in December. She argued that maintaining a moderately restrictive policy remains appropriate, given ongoing concerns about the adverse effects of inflation on consumers. Dallas Fed President Lorie Logan maintained her hawkish position, advocating for steady rates in light of current uncertainties. Furthermore, as reported by Bloomberg news, Philadelphia Fed Anna Paulson advised a cautious approach leading into December’s FOMC meeting, noting that she is now somewhat more concerned about labour market conditions than inflation.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。