AI keeps markets racing

Corporate Earnings Calendar

20th November - 26th November 2025

Thursday: Walmart, Intuitive Surgical

Friday: Alibaba Group

Monday: Zoom Communications

Wednesday: Deere & Co.

Global market indices

US Stock Indices Price Performance

Nasdaq 100 -4.71% MTD and +17.27% YTD

Dow Jones Industrial Average -2.99% MTD and +8.45% YTD

NYSE -1.36% MTD and +10.85% YTD

S&P 500 -2.90% MTD and +12.93% YTD

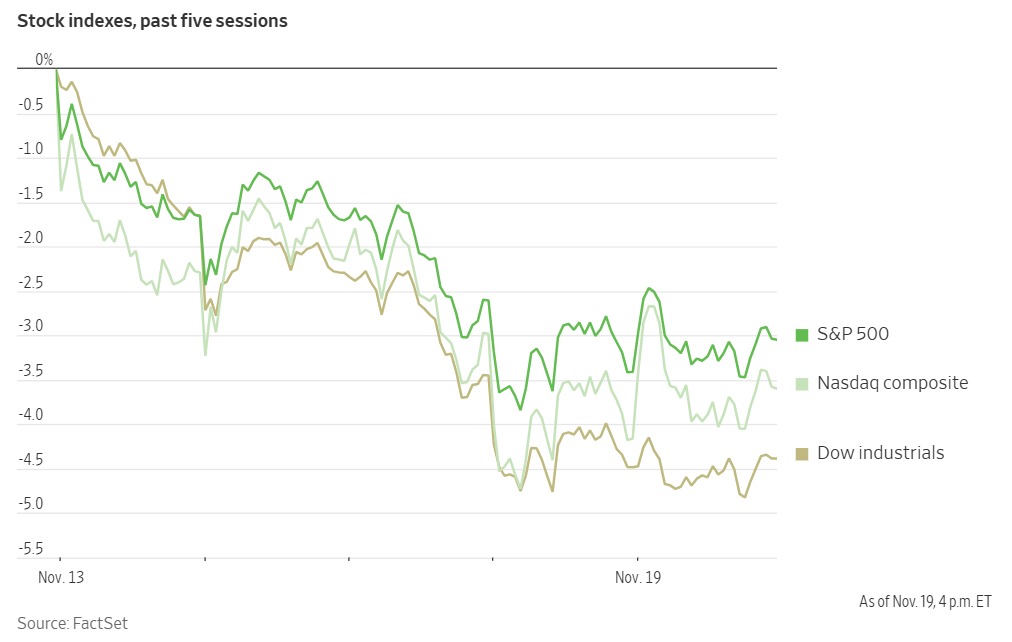

The S&P 500 is -3.05% over the past seven days, with 4 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is -3.12% over this past week and +5.07% YTD.

The S&P 500 Health Care sector is the leading sector so far this month, +5.57% MTD and +10.52% YTD, while Consumer Discretionary is the weakest sector at -7.34% MTD and -0.66% YTD.

Over this past week, Health Care outperformed within the S&P 500 at -0.31%, followed by Communication Services and Energy at -0.61% and -0.91%, respectively. Conversely, Consumer Discretionary underperformed at -6.45%, followed by Financials and Information Technology at -3.93% and -3.80%, respectively.

The equal-weight version of the S&P 500 was -0.30% on Wednesday, underperforming its cap-weighted counterpart by 0.68 percentage points.

All three major stock indices finished Wednesday’s session higher, with the Nasdaq Composite advancing +0.59%. Both the S&P 500 and Dow Jones Industrial Average snapped four-day losing streaks. A rally in Nvidia shares contributed to a +0.10% increase in the Dow. The S&P 500 rose +0.38%, with the S&P 500 Information Technology sector adding +0.93%.

However, the indices remained lower for the week: the S&P 500 has declined -3.05%, the Dow Jones has lost -4.39%, and the Nasdaq Composite is down -2.93%.

In corporate news, Adobe entered into an agreement to acquire the marketing software firm Semrush Holdings for $1.9 billion, representing its first announced takeover since the unsuccessful $20 billion bid for Figma in 2022.

Tesla has received authorisation to provide ride-hailing services in Arizona, one of the states targeted for the company’s anticipated robotaxi initiative.

Brookfield Asset Management is seeking to secure $10 billion in fund commitments for a global AI infrastructure programme, which it is undertaking in collaboration with Nvidia and the Kuwait Investment Authority.

According to sources cited by Bloomberg news, Abbott Laboratories is approaching a potential acquisition of cancer screening specialist Exact Sciences, a transaction that could become the largest deal in the global health care sector this year.

Constellation Energy’s initiative to restart the decommissioned Three Mile Island nuclear facility is receiving $1 billion in support from the US government, aligning with the administration’s efforts to expand atomic power capacity on the nation’s electric grid.

Kraken has confidentially filed for a US IPO, setting the stage for the cryptocurrency exchange operator to potentially go public as early as next year.

Deutsche Lufthansa and International Airlines Group are expected to submit expressions of interest for a stake in Portugal’s state-owned carrier, TAP, in the coming days, joining Air France-KLM in the competitive bidding process.

Mega caps: The Magnificent Seven had a mostly negative performance over the past week. Over the last seven days, Alphabet +2.13%, while Apple -1.80%, Meta Platforms -3.07%, Nvidia -3.76%, Microsoft -4.70%, Tesla -6.18%, and Amazon -8.81%.

Nvidia Q3 earnings. Nvidia reported record-breaking sales and delivered robust guidance on Wednesday, alleviating concerns (for now) about a potential AI bubble that had unsettled investors over the past week.

For Q3, revenue reached $57.0 billion, reflecting a 62.5% increase from the same period last year, driven by surging demand for the company’s advanced AI data centre chips. This result surpassed consensus estimates compiled by FactSet of $55.0 billion. Looking ahead, Nvidia raised its guidance for Q4, projecting sales between $63.7 billion and $66.3 billion, compared to the analyst consensus midpoint of $63.0 billion.

Segment results were as follows: Data centre revenue reached $51.22 billion, exceeding FactSet’s expectation of $49.05 billion; Gaming generated $4.27 billion, slightly below the $4.39 billion consensus; Professional Visualization (ProViz) posted $760 million versus the $607.0 million forecast; Automotive and Robotics recorded $592 million, falling short of the $617.4 million estimate; and OEM & Other contributed $174 million, surpassing the projected $159.7 million.

Nvidia’s gross margin was 73.6%, in line with FactSet’s estimate of 73.4%, but below the 75% margin from a year earlier. The operating margin was 66.2%, slightly ahead of FactSet’s 65.7%. Net income totalled $31.77 billion, beating the consensus estimate of $30.80 billion and marking a 64.5% increase from Q3 2024. EPS for Q3 was $1.30, versus FactSet’s forecast of $1.26.

On the earnings call, CFO Colette Kress emphasised that half of Nvidia’s long-term growth opportunity lies in customers’ transition to accelerated computing and generative AI. During the Q&A session, key themes included the industry-wide shift from CPU to GPU-accelerated computing as Moore’s Law slows, the adoption of generative and agentic AI across hyperscale, enterprise, and emerging applications, and persistently strong demand for AI infrastructure that continues to exceed supply among cloud and enterprise customers.

However, management identified risks to growth, including supply chain and geopolitical challenges such as constraints in power, memory, and foundry capacity, and export restrictions — particularly those affecting China.

Energy stocks had a mostly negative performance this week, with the Energy sector itself -0.91%. WTI and Brent prices are -0.10% and +0.20%, respectively, over the past week. Over the last seven days, Baker Hughes +2.00%, and APA +0.67%, while ExxonMobil -0.65%, Marathon Petroleum -0.70%, Chevron -1.06%, Occidental Petroleum -1.14%, ConocoPhillips -1.22%, Energy Fuels -1.67%, Halliburton -1.75%, Phillips 66 -2.56%, BP -2.62%, and Shell -3.95%.

Materials and Mining stocks had a mixed performance this week, with the Materials sector -2.97%. Over the past seven days, Albemarle +13.92%, Sibanye Stillwater +2.13%, and Nucor +0.13%, while Freeport-McMoRan -1.34%, Yara International -3.61%, Mosaic -3.77%, Newmont Corporation -5.97%, CF Industries -7.12%, and Celanese Corporation -7.59%.

European Stock Indices Price Performance

Stoxx 600 -1.78% MTD and +10.66% YTD

DAX -3.32% MTD and +16.34% YTD

CAC 40 -2.06% MTD and +7.76% YTD

IBEX 35 -0.89% MTD and +37.04% YTD

FTSE MIB -1.21% MTD and +24.76% YTD

FTSE 100 -2.16% MTD and +16.33% YTD

This week, the pan-European Stoxx Europe 600 index is -3.85%. It was -0.03% Wednesday, closing at 561.71.

So far this month in the STOXX Europe 600, Health Care is the leading sector, +2.97% MTD and +1.49% YTD, while Technology is the weakest at -6.31% MTD and +0.46% YTD.

This week, Health Care outperformed within the STOXX Europe 600, at -1.61%, followed by Utilities and Oil & Gas at -1.97% and -2.05%, respectively. Conversely, Banks underperformed at -5.97%, followed by Autos & Parts and Industrial Goods at -5.65% and -5.39%, respectively.

Germany's DAX index was -0.08% Wednesday, closing at 23,162.92. It was -5.00% over the past seven days. France's CAC 40 index was -0.18% Wednesday, closing at 7,953.77. It was -3.49% over the past week.

The UK's FTSE 100 index was -4.08% over the past seven days to 9,507.41. It was -0.47% on Wednesday.

In Wednesday's trading session, Basic Resources advanced, supported by higher base metal prices and sustained industrial demand. The Construction & Materials sector traded higher, highlighted by Sto SE & Co. KGaA’s increase on nine-month revenue of €1.22 billion and full-year EBIT guidance between €51 and €71 million. In contrast, Nordisk Bergteknik shares declined as it announced the launch of a new Mining unit, while Friedrich Vorwerk Group outperformed following Cantor Fitzgerald’s overweight rating, benefiting from copper and steel infrastructure tailwinds.

Travel & Leisure also traded higher, with Jet2 reporting H1 EPS of 292.2 pence, revenue of £5.34 billion, pre-tax income of £780 million, and a 2.3% interim dividend increase to 4.5 pence. The company anticipates a 7.7% rise in seat capacity for Winter 2025/26. Retail exhibited mixed performance, with luxury sector weakness, exemplified by Kering’s Gucci store closures, offsetting strength in food retail.

As the market shifted towards a pro-cyclical recovery, sectors such as utilities, telecommunications, real estate, and other defensive sectors underperformed. However, Technology declined prior to Nvidia’s earnings report after the US market close, as ongoing concerns over AI valuations persisted.

Other Global Stock Indices Price Performance

MSCI World Index -2.88% MTD and +16.15% YTD

Hang Seng -0.10% MTD and +29.01% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -3.42% and -3.90%, respectively.

Currencies

EUR +0.06% MTD and +11.47% YTD to $1.1536

GBP -0.07% MTD and +4.36% YTD to $1.3142

Following the release of the FOMC's October meeting minutes, the US dollar advanced against most major currencies. The dollar index climbed +0.51% to 100.11 on Wednesday, and has advanced +0.63% over the past seven days. The dollar index is +0.40% MTD and -7.72% YTD.

The euro declined -0.37% to $1.1536, contributing to a weekly drop of -0.46%. Nonetheless, it’s up +0.06% MTD.

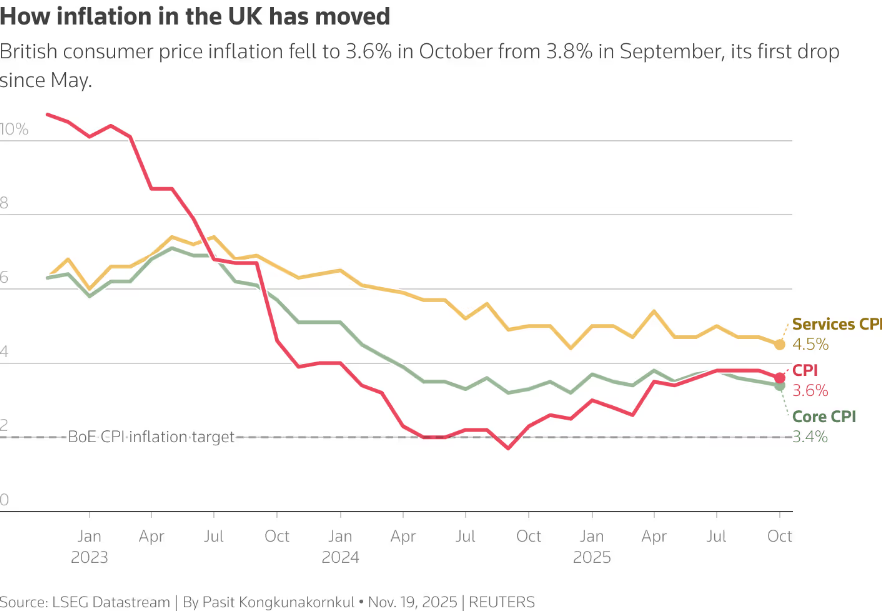

In the UK, official data revealed that consumer price inflation eased to 3.6% in October, down from September’s joint 18-month high of 3.8%, in line with BoE expectations. This moderation in inflation reinforced market expectations of a BoE rate cut in December.

Sterling weakened -0.66% against the dollar to $1.3142 due to ongoing speculation surrounding the 26th November budget. Over the week, sterling advanced +0.09%.

The dollar also appreciated against the Japanese yen Wednesday, pushing the yen to a 10-month low. The yen fell -1.06% to ¥157.15. Over the past seven days, the yen has declined -1.52%, contributing to a -2.05% drop this month. Year-to-date, the US dollar is +0.12% against the Japanese yen.

Japanese Finance Minister Satsuki Katayama said the new government is monitoring market developments with heightened urgency. Minister Katayama and other top officials met BoJ Governor Kazuo Ueda on Wednesday, after which the yen declined further.

Market sentiment is swayed by expectations that Prime Minister Sanae Takaichi’s new administration will introduce a substantial fiscal stimulus package supported by continued low interest rates. According to the Kyodo news agency, Japan’s forthcoming stimulus package may exceed ¥20 trillion, financed by an additional budget estimated at approximately ¥17 trillion.

Note: As of 5:00 pm EST 19 November 2025

Fixed Income

US 10-year yield +6.3 bps MTD and -43.4 bps YTD to 4.142%

German 10-year yield +8.3 bps MTD and +34.8 bps YTD to 2.717%

UK 10-year yield +19.1 bps MTD and +3.1 bps YTD to 4.599%

On Wednesday, Treasury yields advanced as traders moderated their expectations for a potential Fed interest rate cut next month.

The US Bureau of Labor Statistics stated that a consolidated employment report covering October and November will be published on 16th December, following the Fed's policy meeting scheduled for 9th – 10th December.

The minutes from the Fed's October meeting, published on Wednesday, showed that the FOMC was divided: it moved forward with a rate cut even as some policymakers expressed concerns that reducing borrowing costs might undermine attempts to control inflation.

The absence of up-to-date labour market data has added to the Fed's path uncertainty and played a role in restricting Treasury yields to a fairly tight range.

The yield on the two-year note, closely tied to expectations for Fed policy, advanced +1.7 bps Wednesday to 3.602%. The yield on ten-year Treasury notes rose +2.9 bps to 4.142%. On the long end, the 30-year yield was +2.3 bps to 4.758%.

Over the past seven days, the yield on the 10-year Treasury note was +6.7 bps. The yield on the 30-year Treasury bond rose +10.1 bps. On the shorter end, the two-year Treasury yield advanced +2.6 bps.

The spread between two- and ten-year yields widened by 4.1 bps over the past week, reaching 54.0 bps.

The Treasury auctioned $16 billion in 20-year bonds on Wednesday, which attracted only moderate interest. The bonds were sold at a high yield of 4.706%, marginally above their pre-auction trading level, with a bid-to-cover ratio of 2.41x — the lowest seen since February 2024.

The US Treasury is also scheduled to sell $19 billion in ten-year Treasury Inflation-Protected Securities today.

Traders are pricing in 8.2 bps of cuts by year-end, significantly lower than last week’s 15.7 bps, according to CME Group's FedWatch Tool. Fed funds futures traders are now pricing in a 29.6% probability of a 25 bps rate cut at December’s FOMC meeting, down from 50.1% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was +4.3 bps to 4.599%. Over the past seven days, it is +19.6 bps. Investors remain concerned about tax rises in next week’s budget being inflationary.

Eurozone 10-year yields held near multi-week highs Wednesday. Germany's 10-year government bond yield increased +1.0 bp to 2.717%, having reached a peak of 2.718% earlier this week —the highest level observed since 7th October. In contrast, Germany's 2-year yield, more responsive to shifts in the ECB policy rate outlook, declined -1.0 bps to 2.028%. Earlier this week, it climbed as high as 2.051%, marking its highest point since 28th March. At the longer end, the 30-year Bund yield was +0.5 bps higher to 3.330%.

Eurostat released euro area inflation data that aligned with analysts' expectations, prompting traders to assign approximately a 30% probability of a 25-bps rate cut by the ECB by September of next year.

Over the past seven days, the German 10-year yield was +7.0 bps. Germany's two-year bond yield was +2.0 bps, and, on the longer end, Germany's 30-year yield was +10.1 bps.

The yield spread between German Bunds and 10-year UK gilts reached 188.2 bps on Wednesday and was 12.6 bps wider over the past week.

The 10-year French yield was -0.8 bps lower to 3.458% on Wednesday. The yield spread between French and German 10-year government bonds was 0.3 bps higher from the previous week's 73.8 bps, settling at 74.1 bps.

The spread between US 10-year Treasuries and German Bunds is now 142.5 bps, 0.3 bps lower from last week’s 142.8 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 73.9 bps, a 0.9 bps increase from 73.0 bps last week. The Italian 10-year yield was +7.9 bps over the last week, after trading -0.6 bps on Wednesday to 3.456%, their highest level since 13th October.

Commodities

Gold spot +1.88% MTD and +55.38% YTD to $4,076.98 per ounce

Silver spot +5.48% MTD and +78.28% YTD to $51.32 per ounce

West Texas Intermediate crude -2.14% MTD and -17.09% YTD to $59.58 a barrel

Brent crude -2.15% MTD and -14.71% YTD to $63.67 a barrel

Gold prices moderated their earlier gains on Wednesday following the release of the FOMC’s October meeting minutes.

Spot gold rose +0.26% to $4,076.98 per ounce, having advanced by more than one percent earlier in the trading session. However, spot gold was -2.82% over the last seven days. It is still +1.88% MTD.

Year-to-date, spot gold is +55.38% due to a combination of factors such as escalating geopolitical tensions, expectations of monetary easing, increased central bank purchases, efforts toward de-dollarisation, and robust ETF inflows.

Oil prices declined on Wednesday following reports that the US is renewing efforts to end Russia's war in Ukraine.

Brent crude futures decreased by $1.13, or -1.74%, settling at $63.67 per barrel. US WTI crude futures closed down $1.09, or -1.80%, at $59.58 per barrel. This week, WTI and Brent prices are -0.10% and +0.20%, respectively.

Washington has communicated to Ukrainian President Volodymyr Zelenskiy that Ukraine is expected to accept a US-drafted plan for ending the conflict, which calls for the cession of territory and certain weapons. President Zelenskiy emphasised the necessity for continued effective US leadership to resolve the war. He also noted that Turkish President Tayyip Erdogan has suggested alternative negotiation formats.

The potential conclusion of the war in Ukraine could facilitate increased Russian oil exports, exacerbating existing concerns about oversupply in the market. A reduction in the geopolitical risk premium would likely shift investor focus more toward the sector’s underlying fundamentals.

EIA report. US crude oil inventories declined last week due to increased refining activity and higher export demand, while gasoline and distillate inventories posted gains, according to the EIA. For the week ending 14th November, crude stockpiles decreased by 3.4 million barrels, reaching a total of 424.2 million barrels. Inventories at the Cushing, Oklahoma delivery hub fell by 698,000 barrels over the same period.

US crude oil exports saw a notable increase, rising 1.34 million barrels per day (bpd) to 4.16 million bpd. Concurrently, net crude imports dropped by 614,000 bpd. The combined effect of stronger refinery throughput and robust crude exports contributed to the drawdown in overall crude inventories. Specifically, refinery crude runs expanded by 259,000 bpd, and refinery utilisation rates improved by 0.6 percentage points, reaching 90%.

Total product supplied — which serves as a proxy for overall demand — declined by 613,000 bpd to 20.16 million barrels per day. Gasoline demand fell 500,000 bpd to 8.53 million bpd, while distillate demand fell by 136,000 bpd to 3.88 million bpd.

In terms of inventories, US gasoline stocks rose 2.3 million barrels, totalling 207.4 million barrels for the week. Distillate inventories, including diesel and heating oil, rose 200,000 barrels to 111.1 million barrels.

Note: As of 5:00 pm EST 19 November 2025

Key data to move markets

EUROPE

Thursday: German PPI, German Bundesbank Monthly Report and Eurozone Consumer Confidence

Friday: German, French, and Eurozone HCOB Manufacturing, Services and Composite PMIs, Eurozone Negotiated Wage Rates, speeches by ECB President Christine Lagarde, Vice President Luis de Guindos, Bundesbank President Joachim Nagel, and Bank of Spain Governor José Luis Escrivá

Saturday: A speech by ECB President Christine Lagarde

Monday: German IFO Business Climate, Current Assessment, and Expectations

Tuesday: German GDP

UK

Thursday: GfK Consumer Confidence, and a speech by BoE MPC External Member Swati Dhingra

Friday: Public Sector Net Borrowing, Retail Sales, S&P Global Composite, Manufacturing and Services PMIs, and a speech by BoE Chief Economist Huw Pill

Wednesday: Budget Report

USA

Thursday: Nonfarm Payrolls, Average Hourly Earnings, Average Weekly Hours, Initial and Continuing Jobless Claims, Unemployment Rate, U6 Underemployment Rate, Labour Force Participation, Philadelphia Manufacturing Survey, Existing Home Sales, and speeches by Fed Governor Lisa Cook, Chicago Fed President Austan Golsbee, and Fed Governor Stephen Miran

Friday: S&P Global Composite, Manufacturing, and Services PMIs, UoM 1- and 5-year Consumer Inflation Expectations, Michigan Consumer Sentiment and Expectations Indices, and speeches by New York Fed President John Williams, Fed Governor Michael Barr, Fed Vice Chair Philip Jefferson, and Dallas Fed President Lorie Logan

Tuesday: ADP Employment Change 4-week average, PPI, Core PPI, Retail Sales, Housing Price Index, Consumer Confidence, Pending Home Sales, and Richmond Fed Manufacturing Index

Wednesday: Personal Consumption Expenditures (PCE) and Core PCE Indices, Durable Goods, GDP, Initial and Continuing Jobless Claims, Nondefense Capital Goods Orders ex Aircraft, Personal Income and Personal Spending, Chicago PMI, New Home Sales, and Fed’s Beige Book

JAPAN

Thursday: National CPI, Exports, Imports, and Adjusted Merchandise Trade Balance

Global Macro Updates

Trump’s proposed tariffs-dividend bonanza. Throughout the week, President Trump has consistently advocated for the distribution of $2,000 ‘tariff dividends’ to low- and middle-income Americans, asserting that revenues generated from heightened import tariffs would sufficiently fund these payments while also contributing to debt reduction. Treasury Secretary Scott Bessent clarified last weekend that such dividends would require legislative approval.

Implementing a tariff dividend in mid-2026 would mean substantial payments to a majority of voters immediately preceding the midterm elections. Furthermore, the scale and breadth of this initiative could potentially trigger renewed inflationary pressures, similar to those observed following previous fiscal stimulus programmes.

This is a move straight out of the Emerging Markets playbook, where leaders facing electoral challenges often restructure social programmes into direct cash handouts to bolster their popularity or maintain power.

Preview: September nonfarm payrolls. The Bureau of Labor Statistics (BLS) is scheduled to release the shutdown-delayed September nonfarm payrolls report at 8:30 am Eastern Time today.

Market consensus anticipates an increase of 50,000 jobs, following a gain of only 22,000 in August. The unemployment rate is expected to remain steady at 4.3%, while average hourly earnings are projected to rise by 0.3% m/o/m. Additionally, the average workweek is forecast to edge up to 34.3 hours from the previous 34.2 hours.

Analyst forecasts suggest there may be an upward revision to August’s employment figures, supported by seasonal adjustments and the initially low response rate for that month.

September’s job growth is expected to be solid, with stable jobless claims during the reference period and ongoing strength in the leisure and hospitality sectors, reflecting travel and consumer spending trends. However, federal government employment is anticipated to weigh on overall job gains.

While analyst previews also addressed the potential release of an October nonfarm payrolls report, the BLS confirmed Wednesday that it will not publish the October data. Instead, the agency noted that establishment survey results for October will be included with the November nonfarm payrolls report, which has been postponed from the original 5th December release date to 16th December.

FOMC: diverging views on year-end rate move. The minutes from the FOMC October meeting highlighted persistent divisions regarding the potential for a rate cut in December. The release contained no significant surprises, reaffirming the lack of consensus among committee members.

The October meeting resulted in a 25-bps reduction. However, the decision was marked by both hawkish dissent from Kansas Fed President Jeffrey Schmid and dovish dissent from Fed Governor Stephen Miran. The minutes indicated that ‘many’ participants believed maintaining current rates through year-end would be appropriate, while several members supported the possibility of a December rate cut and ‘many’ others viewed such a move as unsuitable.

Committee staff projected moderately stronger real GDP growth through 2028 compared to the September outlook, with personal consumption expenditures (PCE) inflation estimated at 2.8% for September. The labour market was assessed as continuing to cool, evidenced by slower job gains.

While every effort has been made to verify the accuracy of this information, LHCM Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。