Will the UK budget be “Gilt-y” as charged?

What to look out for today

Companies reporting on Monday, 17th November: Xpeng

Key data to move markets today

EU: Italian CPI, German Bundesbank Monthly Report, and speeches by ECB Vice President Luis de Guindos, Dutch Central Bank President Olaf Sleijpen, ECB Chief Economist Philip Lane, and ECB Executive Board member Piero Cipollone

UK: A speech by BoE’s MPC External Member Catherine Mann

US: New York Empire State Manufacturing Index, Monthly Budget Statement, and speeches by New York Fed President John Williams, Fed Vice Chair Philip Jefferson, Minneapolis Fed President Neel Kashkari, and Fed Governor Christopher Waller

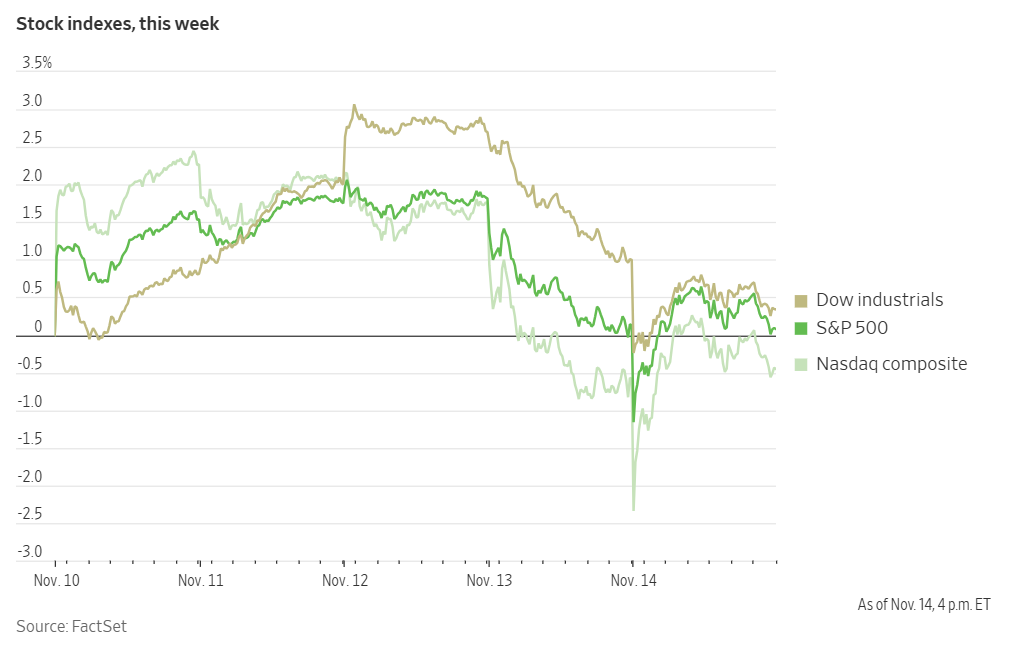

US Stock Indices

Dow Jones Industrial Average -0.65%

Nasdaq 100 +0.06%

S&P 500 -0.05%, with 7 of the 11 sectors of the S&P 500 down

Last week’s trading activity indicated that some investors began reallocating capital from this year’s primary growth driver — AI — toward more defensive sectors. Companies within Healthcare, Materials, and Energy stocks emerged as leaders within the S&P 500. Simultaneously, certain companies linked to the circular deals emanating from OpenAI faced significant declines. Oracle shares dropped -6.86% over the week, and data centre cloud-services provider CoreWeave fell -25.82%. However, a rebound late on Friday helped Nvidia recover, allowing its shares to close the week up +1.07%.

The S&P 500 finished last week with a modest gain of +0.08% and the Dow Jones Industrial Average advanced +0.34%, while the Nasdaq Composite slipped -0.45%.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +16.9%. This jumps to 17.9% when excluding the Energy sector. Of the 456 companies in the S&P 500 that have reported earnings to date for Q3 2025, 82.7% have reported earnings above analyst estimates, with 77.6% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 8.1% in Q3, increasing to 8.7% when excluding the Energy sector.

The Health Care sector, at 93.0%, is the sector with most companies reporting above estimates. Industrials with a surprise factor of 15.5%, are the sectors that have beaten earnings expectations by the highest surprise factors. Within Communication Services, 40.0% of companies have reported below estimates and Real Estate is the sector with the lowest surprise factor at 4.0%. The S&P 500 surprise factor is 10.1%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.8x.

In corporate news, late on Friday Warren Buffett’s Berkshire Hathaway revealed it had added Alphabet to its investment portfolio during Q3. Alphabet shares subsequently rose in after-hours trading.

Walmart announced the retirement of CEO Doug McMillon after over fifteen years at the helm of the nation’s largest retailer.

According to The Wall StreetJournal, Topgolf Callaway Brands is reportedly negotiating to sell its Topgolf unit to private equity firm Leonard Green.

Under Armour has expanded its restructuring initiative and will discontinue its association with basketball star Stephen Curry’s brand.

Shares of Warner Bros. Discovery rallied following reports that Comcast, Netflix, and Paramount Skydance are preparing bids for the company. However, shares of Comcast and Netflix, which are primarily interested in the studio and streaming assets, declined.

Applied Materials exceeded expectations in its quarterly results and outlook, driven by continued strength in the artificial intelligence sector.

Amazon and Microsoft, two of Nvidia’s largest clients, expressed support for legislation that would further restrict the company’s ability to export to China. Despite these developments, Nvidia’s stock rose, as did Microsoft’s.

Merck announced a $9.2 billion acquisition of Cidara Therapeutics.

Bristol Myers Squibb and Johnson & Johnson discontinued a late-stage trial of a heart-disease medication after analysis suggested the treatment was unlikely to succeed.

S&P 500 Best performing sector

Energy +1.37%, with Texas Pacific Land +3.41%, Valero Energy +3.40%, and Diamondback Energy +3.34%

S&P 500 Worst performing sector

Materials -1.18%, with Eastman Chemical -3.94%, Celanese -2.58%, and International Flavors & Fragrance -2.30%

Mega Caps

Alphabet -0.77%, Amazon -1.22%, Apple -0.20%, Meta Platforms -0.07%, Microsoft +1.37%, Nvidia +1.77%, and Tesla +0.59%

Information Technology

Best performer: Micron Technology +4.17%

Worst performer: Lam Research -3.30%

Materials and Mining

Best performer: Mosaic +1.96%

Worst performer: Eastman Chemical -3.94%

European Stock Indices

CAC 40 -0.76%

DAX -0.69%

FTSE 100 -1.11%

Commodities

Gold spot -2.18% to $4,079.58 an ounce

Silver spot -3.28% to $50.55 an ounce

West Texas Intermediate +2.42% to $60.02 a barrel

Brent crude +2.31% to $64.34 a barrel

Gold prices fell more than 2 percent on Friday amid a broader market sell-off.

Spot gold ended the day -2.18% to $4,079.58 per ounce, following an earlier drop of over 3% during the session. Despite this, gold was +2.02% last week following the ending of the government shutdown and the expected release of weak economic data over the coming weeks.

Oil prices advanced more than 2 percent on Friday, driven by heightened supply concerns following the suspension of exports from Russia’s Novorossiisk port after a Ukrainian drone attack targeted an oil depot in the region.

Brent crude futures closed up $1.45, or +2.31%, to $64.34 per barrel. US WTI crude finished $1.42 higher, or +2.42%, to $60.02 per barrel. Over the last week, Brent was +1.02%, and WTI rose +0.30%.

The attack at the Novorossissk port on Friday inflicted damage on a vessel at the port, nearby apartment buildings, and the oil depot in Novorossiisk, resulting in injuries to three crew members, according to Russian officials. Subsequently, the port suspended oil exports amounting to 2.2 million barrels per day (bpd), representing approximately 2% of global supply. Furthermore, according to two industry sources cited by Reuters, Transneft, Russia’s oil pipeline operator, has suspended crude shipments to the port.

Ukraine said it separately struck an oil refinery in Russia’s Saratov region and a fuel storage facility in Engels overnight. Market participants are evaluating the implications of these recent attacks and their potential long-term effects on Russian oil supply. Attention is also focused on the influence of Western sanctions on Russian oil trade and export flows.

On Friday, the UK authorised a special licence permitting businesses to maintain operations with two Bulgarian subsidiaries of the sanctioned Russian oil company Lukoil, following the Bulgarian government’s seizure of the assets. The US has imposed sanctions prohibiting transactions with Russian oil firms Lukoil and Rosneft after 21st November, aiming to encourage the Kremlin to enter peace negotiations regarding Ukraine.

Currently, approximately 1.4 million bpd of Russian oil — nearly a third of the country’s seaborne export capacity — has been redirected to storage on tankers, as offloading has slowed in response to the US sanctions against Rosneft and Lukoil. The process of unloading these cargoes is expected to face increased difficulty following the 21st November deadline for accepting oil supplied by these companies.

Note: As of 5 pm EST 14 November 2025

Currencies

EUR -0.09% to $1.1620

GBP -0.17% to $1.3166

Bitcoin -4.14% to $94,717.71

Ethereum -0.64% to $3,159.75

The US dollar strengthened against both the euro and the British pound on Friday, while it was roughly unchanged versus the Japanese yen.

The anticipated return of US economic data releases is expected to heighten market volatility. On Friday, the Commerce Department’s Bureau of Economic Analysis announced ongoing efforts to update its schedule for economic data releases that were delayed by the US government shutdown.

Volatility in rate differentials is likely to increase as the release of US economic data resumes, amid uncertainty regarding the future policy paths of the BoE and the BoJ.

The dollar index edged up +0.11% to 99.27 on Friday, although it posted a -0.29% decline for the week.

The euro fell -0.09% to $1.1620, yet finished the week +0.48% higher. On Friday, the pound was -0.17% at $1.3166, but it still ended the week +0.07% higher.

The pound sterling weakened against both the US dollar and the euro following media reports that British Prime Minister Keir Starmer and Chancellor of the Exchequer Rachel Reeves reversed course on proposed income tax hikes. This represents a significant policy shift ahead of the 26th November budget announcement.

The dollar slipped -0.01% to ¥154.54 on Friday, but gained +0.74% over the course of the week.

Fixed Income

US 10-year Treasury +2.7 basis points to 4.153%

German 10-year bund +3.1 basis points to 2.723%

UK 10-year gilt +14.2 basis points to 4.583%

US Treasury yields increased across all maturities on Friday, ending the week higher. Rather than instilling market confidence, the government's reopening this week has raised investors' concerns. Missing economic data — when eventually published — could delay further monetary easing by the Fed.

There is still uncertainty about when October's inflation numbers will be released, and the employment report will reportedly not include the jobless rate since the necessary household survey was not carried out, according to White House economic adviser Kevin Hassett.

The yield on the US 10-year Treasury note increased +2.7 bps to 4.153%, marking a weekly gain of +5.2 bps. The two-year US Treasury yield, which generally reflects expectations for Fed policy, rose +2.2 bps to 3.625%, and recorded a +5.7 bps increase for the week. In addition, the yield on the 30-year Treasury bond rose +3.8 bps to 4.747%, which contributed to a weekly rise of +4.1 bps.

The spread between the yields on two-year and 10-year Treasury notes stood at a positive 52.8 bps, 0.5 bps lower than the previous week’s 53.3 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 44.4% probability of a 25 bps rate cut at December FOMC meeting, lower than the prior week’s 66.9%. Traders are currently expecting 11.1 bps of cuts by year-end, lower than the 16.7 bps anticipated the prior week.

Bund yields recorded a fourth consecutive weekly increase on Friday, approaching levels last seen in early October. Market volatility remained subdued throughout the euro area. Uncertainty lingered regarding the effects of Germany’s fiscal package. The German budget committee approved the draft 2026 budget, which encompasses substantial investment plans aimed at supporting the country's economic recovery.

Germany’s 10-year government bond yield rose +3.1 bps to 2.723%, marking its highest level since 7th October, and a weekly increase of +5.1 bps.

The 2-year German yield — considered more responsive to expectations surrounding ECB policy — edged up +0.4 bps to 2.045%, its highest since 26th September, contributing to a +4.0 bps gain for the week. At the longer end of the curve, the 30-year yield climbed +3.7 bps to 3.319%, resulting in a weekly rise of +5.2 bps.

Italy’s 10-year government bond yield advanced +4.7 bps to 3.469%, with the spread over German Bunds standing at 74.6 bps, after reaching a new 15-year low of 70.68 bps earlier in the week. This spread narrowed by 2.0 bps from last week’s 76.6 bps, as Italy’s BTP 10-year yield registered a +3.1 bps increase for the week.

In this environment, traders have scaled back their expectations for ECB rate cuts, now assigning roughly a 30% probability to a 25 bps reduction by September and anticipating the key rate will stand at 1.99% in March 2027, down slightly from the current 2.00%.

Note: As of 5 pm EST 14 November 2025

Global Macro Updates

Labour drops income tax rise to defend PM Starmer, UK assets fall. The Labour government made an unexpected reversal on its previously announced plan to increase income tax rates ahead of the 26th November budget, as reported by the Financial Times. Chancellor Reeves had spent several weeks preparing the markets for tax hikes that would break the party’s manifesto pledges, aiming to address an estimated £30 billion fiscal gap. However, updated projections from the Office for Budget Responsibility (OBR), cited by Bloomberg news, now suggest the shortfall is closer to £20 billion. This policy shift comes amid mounting pressure from dissatisfied voters and dissenting Labour MPs, culminating in a turbulent week marked by internal party disputes involving Prime Minister Starmer.

Despite the more favourable OBR estimates, concerns persist that significant unfunded spending initiatives may prove unsettling for bond traders. An increase in the basic income tax rate from 20% to 22% could have generated between £15 billion and £20 billion in revenue. In lieu of rate increases, the government’s U-turn now necessitates a reliance on threshold adjustments and a series of smaller, less effective tax increases. Nonetheless, analysts have cautioned that relying on a patchwork of smaller, anti-growth tax measures may be inadequate, introducing further policy uncertainty and exacerbating the government’s credibility challenges. This political maneuver heightens fiscal policy uncertainty, complicating BoE’s outlook. According to Bloomberg news, Reeves’ primary goal remains to cut inflation to allow the BoE to lower its interest rate next month. This would trim the £110 billion ($144.5 billion) annual debt interest bill, and free up some fiscal space for a hard-pressed government.

UK financial markets came under pressure following Chancellor Reeves’ u-turn, raising serious concerns about fiscal credibility and political competence. The yield on the 10-year gilt surged +14.2 bps on Friday — the steepest increase since July — contributing to a weekly rise of +11.3 bps and settling at 4.583%. Money markets now reflect only a 75% probability of a BoE rate cut in December, down from 85%. The 30-year gilt surged 10 bps on Friday before easing somewhat. Analysts have expressed concern that the budget may be based on overly optimistic growth projections, while ongoing political instability increases the risk of a leadership transition toward policies that are more left-leaning and potentially fiscally unsustainable.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。