Is the EU economy cleared for takeoff?

Key data to move markets today

EU: French Consumer Price Index (CPI), Spanish CPI and Harmonised Index of Consumer Prices, Eurozone GDP, Employment Change, European Commission’s Economic Growth Forecasts, and speeches by Bank of Spain Governor José Luis Escrivá, ECB Board Member Frank Elderson, and ECB Chief Economist Philip Lane

US: PPI, Core PPI, Retail Sales, and speeches by Kansas City Fed President Leff Schmid, Dallas Fed President Lorie Logan, and Atlanta Fed President Raphael Bostic

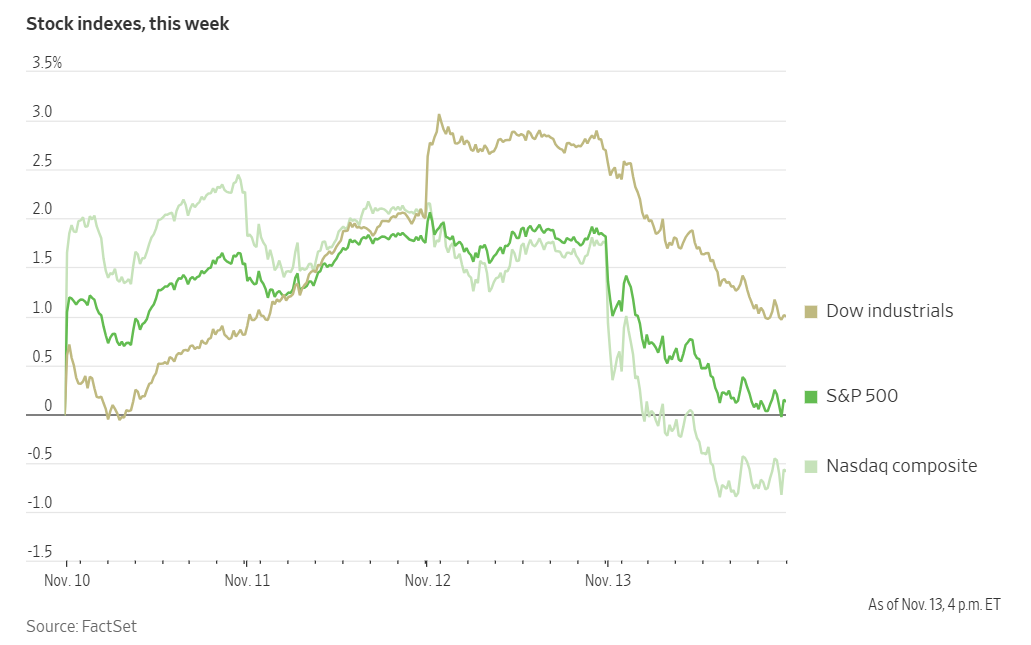

US Stock Indices

Dow Jones Industrial Average -1.65%

Nasdaq 100 -2.05%

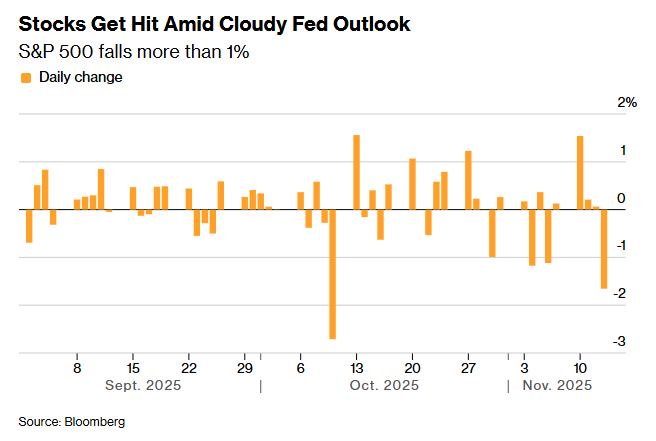

S&P 500 -1.66%, with 10 of the 11 sectors of the S&P 500 down

Following the initial relief on Wall Street from the conclusion of the US government shutdown, investor sentiment shifted on Thursday toward apprehension regarding an impending influx of delayed economic data, prospects of a shift monetary easing policy, and elevated valuations among leading technology companies.

US equities experienced their most significant decline in a month, unwinding a rally that began with news of a deal to end the federal government’s longest closure. Losses were widespread across sectors, with technology stocks retreating in tandem with the Dow Jones Industrial Average, which fell by nearly 800 points. Shares of smaller companies also suffered, as evidenced by a -2.77% decrease in the Russell 2000 index.

On Thursday, the S&P 500 declined by -1.66%, while the Dow Jones Industrial Average lost -1.65%, or 797.60 points. The Nasdaq Composite dropped by -2.29%, marking the largest single-day losses for all three major indices since 10th October. Despite these declines, both the S&P 500 and the Dow remained marginally higher for the week and continued to trade near record levels.

Information Technology faced challenges, with declines affecting nearly every part of the sector. CoreWeave shares declined -8.30%—bringing its weekly loss to -26.74%—after it disclosed a project delay by a data-centre developer earlier in the week. Nvidia and Oracle shares declined by -3.58% and -4.15%, respectively.

Earlier in the week, losses in technology had been offset by gains in other sectors, particularly healthcare, which propelled the Dow to a record close above 48,000 on Wednesday. Still, the blue-chip index couldn’t sustain that momentum Thursday, as it was weighed down in part by a -7.75% decline in Walt Disney shares following the company’s report of lower-than-anticipated revenue.

In corporate news, Apple announced a new initiative on Thursday that will allow it to generate revenue from mini apps and games embedded within larger ‘super apps,’ reflecting a strategic effort to capitalise on emerging trends among software developers.

Additionally, Apple and Tencent Holdings reached an agreement enabling Apple to process payments and collect a 15% commission on purchases made within WeChat mini games and apps, resolving a notable dispute in the world’s largest smartphone market.

Verizon Communications is reportedly preparing to announce company-wide job cuts next week, according to sources familiar with the plans, as part of a broader transformation under the leadership of new CEO Dan Schulman.

Unionised Starbucks baristas initiated a series of walkouts on Thursday, which they indicate could escalate into their most significant strike to date.

S&P 500 Best performing sector

Energy +0.31%, with APA +3.35%, Chevron +1.47%, and Phillips 66 +1.07%

S&P 500 Worst performing sector

Consumer Discretionary -2.73%, with Tesla -6.64%, eBay -3.83%, and Carnival -3.65%

Mega Caps

Alphabet -2.89%, Amazon -2.71%, Apple -0.19%, Meta Platforms +0.14%, Microsoft -1.54%, Nvidia -3.58%, and Tesla -6.64%

Information Technology

Best performer: Cisco Systems +4.62%

Worst performer: Corning -7.47%

Materials and Mining

Best performer: LyondellBasell Industries +5.10%

Worst performer: Vulcan Materials -3.73%

European Stock Indices

CAC 40 -0.11%

DAX -1.39%

FTSE 100 -1.05%

Corporate Earnings Reports

Posted on Thursday, 13th November

Applied Materials quarterly revenue -3.5% to $6.800 bn vs $6.676 bn estimate

EPS at $2.17 vs $2.11 estimate

Gary Dickerson, President and CEO, said, “As AI adoption drives substantial investment in advanced semiconductors and wafer fab equipment, Applied Materials delivered its sixth consecutive year of growth in fiscal 2025. We are well positioned at the highest value technology inflections in the fastest growing areas of the market, enabling us to extend our leadership in leading-edge logic, DRAM and advanced packaging as next-generation technologies ramp in volume production over the coming years.” — see report.

The Walt Disney Company quarterly revenue -0.5% to $22.464 bn vs $22.757 bn estimate

EPS at $1.11 vs $1.05 estimate

Robert A. Iger, CEO, said, “This was another year of great progress as we strengthened the company by leveraging the value of our creative and brand assets and continued to make meaningful progress in our direct-to-consumer businesses. Our strategy, coupled with our portfolio of complementary businesses and a strong balance sheet, enables us to continue investing in high-quality offerings for our consumers and increasing our returns to shareholders, and I’m pleased with our many achievements this fiscal year to position Disney for the future.” — see report.

Commodities

Gold spot -0.59% to $4,170.65 an ounce

Silver spot -1.89% to $52.26 an ounce

West Texas Intermediate +0.21% to $58.60 a barrel

Brent crude +0.27% to $62.89 a barrel

Gold prices declined by over 0.5 percent on Thursday, retreating from a three-week peak reached earlier in the session amid widespread market selling.

Spot gold fell -0.59% to $4,170.65 per ounce, after having touched a session high of $4,244.94—the highest level recorded since 21st October.

Oil prices remained largely unchanged on Thursday, following a decline of more than 3.5 percent in the previous session.

Brent crude futures edged up by 17 cents, or +0.27%, to $62.89 per barrel, while US WTI crude increased by 12 cents, or +0.21%, settling at $58.60 per barrel.

The US imposed sanctions on Lukoil as part of its strategy to encourage the Kremlin to engage in peace negotiations regarding Ukraine. These sanctions, which will prohibit transactions with the Russian oil company after 21st November, are expected to influence market dynamics.

The recent weakness in oil prices appears to be linked to OPEC’s revision of its supply-demand balance for 2026, as detailed in its latest monthly report. The organisation now acknowledges the potential for a supply surplus in 2026, marking a notable shift from its previously optimistic outlook.

In addition, the US Energy Information Administration (EIA) reported in its Short-Term Energy Outlook on Wednesday that US oil production is projected to reach a new record this year, surpassing earlier forecasts. The EIA further indicated that global oil inventories are set to increase through 2026, as production growth is expected to outpace demand for petroleum fuels, thereby exerting additional downward pressure on oil prices.

EIA report. According to the EIA on Thursday, US crude oil inventories increased last week, while gasoline and distillate stocks experienced declines amid stronger demand.

Crude inventories rose by 6.4 million barrels, reaching a total of 427.6 million barrels for the week ending 7th November. Stock levels at the Cushing, Oklahoma, delivery hub decreased by 346,000 barrels during the same period.

The EIA also reported that net US crude imports grew by 849,000 barrels per day (bpd), whereas crude exports dropped by 1.55 million bpd to 2.82 million bpd. Refinery crude throughput increased by 717,000 bpd, with refinery utilisation rates climbing by 3.4 percentage points to 89.4% for the week.

Gasoline inventories declined by 945,000 barrels, bringing total stocks to 205.1 million barrels—the lowest level observed since November 2014, according to the EIA. Distillate inventories, which include diesel and heating oil, fell by 637,000 barrels to 110.9 million barrels.

Furthermore, total product supplied, a key indicator of demand, rose by 414,000 bpd last week to 20.77 million bpd, as reported by the EIA.

Note: As of 5 pm EST 13 November 2025

Currencies

EUR +0.34% to $1.1631

GBP +0.45% to $1.3189

Bitcoin -3.02% to $98,803.33

Ethereum -7.08% to $3,180.09

The US dollar declined on Thursday, following the conclusion of the US government's longest shutdown on record. The shutdown significantly disrupted air travel, reduced food assistance for low-income individuals, and resulted in over one million federal employees going without pay for more than a month.

The dollar index slipped by -0.32% to 99.16. Meanwhile, the euro appreciated +0.34% to $1.1631, marking its highest level since 29th October. Notably, the euro has now surpassed the downtrend channel against the US dollar that began on 17th September.

Despite data indicating minimal economic growth in Britain during Q3, the pound also advanced, rising +0.34% to $1.3189. Against the Japanese yen, the dollar weakened by -0.16% to ¥154.55.

On Wednesday, the US dollar had reached a nine-month high versus the yen after Japanese Prime Minister Sanae Takaichi reaffirmed her government’s preference for maintaining low interest rates and called for close cooperation with the BoJ. On Thursday, the yen fell to its lowest level against the euro since 1999, the year the EU introduced the single currency.

The continued weakness of the yen may prompt the BoJ to consider a rate hike next month; however, traders currently estimate only a 24% probability of a quarter-point increase to the key rate in December.

Fixed Income

US 10-year Treasury +5.1 basis points to 4.126%

German 10-year bund +4.5 basis points to 2.692%

UK 10-year gilt +3.8 basis points to 4.441%

On Thursday, US Treasuries declined across the yield curve as investors moderated their expectations for an imminent Fed interest rate cut in December. This shift occurred amid persistent uncertainty regarding inflation and pronounced disagreements among FOMC members concerning the economic and monetary policy outlook.

The reopening of the US government after a historic 43-day shutdown has alleviated some market apprehension by removing a major source of disruption. Nevertheless, the bond market’s attention remains fixed on broader fiscal and monetary challenges that lie ahead.

During afternoon trading, the yield on the 10-year Treasury note increased by +5.1 bps to 4.126%, while yields on 30-year US bonds rose +4.1 bps to 4.709%. On the short end, the two-year Treasury yield—which is particularly sensitive to interest rate expectations—climbed +2.7 bps to 3.603%.

Additionally, the US Treasury conducted a $25 billion auction of 30-year bonds on Thursday, which was met with subdued demand. The bonds were priced at 4.694%, exceeding market expectations at the time of bidding, reflecting that investors required a premium to purchase them. The bid-to-cover ratio registered at 2.29x, lower than the 2.38x observed at last month’s $22 billion auction, but slightly higher than the 2.27x recorded for a similar auction in August.

Data revealed that primary dealers absorbed 14.5% of the auction’s supply—nearly double the previous figure of 8.7% and just above the 13.1% average—indicating that these dealers had to intervene to bolster demand. Generally, primary dealers are reluctant to hold substantial volumes of Treasuries, as this practice expands their balance sheets, elevates leverage requirements, and compels them to allocate additional capital.

The yield spread between two-year and 10-year US Treasuries widened to 52.3 bps, up from 49.9 bps late Wednesday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 50.7% probability of a 25 bps rate cut at December FOMC meeting, significantly lower than the prior week’s 69.6%. Traders are currently expecting 12.7 bps of cuts by year-end, lower than the 17.4 bps anticipated the prior week.

On Thursday, Bund yields advanced following three consecutive sessions of modest declines, as Germany’s latest economic growth data cast doubt on the extent of any uplift attributable to government fiscal stimulus measures.

The yield on Germany’s 10-year government bond climbed by +4.5 bps to reach 2.692%. Meanwhile, two-year yields—which are particularly responsive to expectations for the ECB’s policy stance—rose +3.3 bps to 2.041%. At the long end of the maturity spectrum, the 30-year yield increased by +5.3 bps, settling at 3.282%.

Italy’s 10-year government bond yield also advanced +4.5 bps, reaching 3.422%. The yield spread over benchmark German Bunds narrowed to 73.0 bps, its tightest level since 2010.

Within the euro area, market participants continued to price in roughly a 40% probability of a 25 bps interest rate cut by the ECB by September. Additionally, they anticipate the deposit rate to stand at 1.97% by March 2027, compared to the current rate of 2.00%.

Note: As of 5 pm EST 13 November 2025

Global Macro Updates

Excluding Ireland, eurozone industrial output surprises to the upside. Eurozone industrial production increased by just 0.2% in September, falling short of the 0.7% growth forecast. This underperformance was largely attributed to volatility in Ireland, rather than an indication of widespread fundamental weakness across the bloc.

Germany recorded a robust 1.9% m/o/m rise, while Italy experienced a 2.8% m/o/m increase. France and Spain also reported above-average growth rates. In contrast, Irish industrial output declined by 9.4% m/o/m, which distorted the overall figures. Analysts highlighted that large multinational corporations headquartered in Ireland for tax purposes often contribute to such pronounced swings, leading some economists to exclude Ireland from aggregate calculations.

On an annual basis, industrial output grew by 1.2%, missing the anticipated 2.1% increase. Production levels have remained steady since April, when the effects of US tariff-related frontloading subsided. Despite concerns, the anticipated major decline in output linked to tariffs has not materialised, and production remains above the 2024 average. Nevertheless, analysts advise caution, even as manufacturer sentiment improves. Rising production expectations and less negative order books reflect a more positive outlook, yet challenges persist due to global competition, a strong euro, and ongoing ramifications of US tariffs. Furthermore, significant public investment plans have not yet accelerated activity meaningfully.

UK economic growth flatlines in Q3, impacted by concerns over taxes and a cyberattack. Britain’s economic growth nearly stagnated in Q3, expanding by only 0.1% compared to 0.3% in Q2. This performance not only missed the 0.2% growth forecast by economists and the BoE, but also reflected a softer economy than anticipated. While moderation was expected following a robust start to the year, the latest data points to slightly weaker underlying conditions. The main drags on growth were net acquisitions and business investment, both of which are recognised for their volatility.

September proved particularly challenging, with GDP contracting by 0.1% as manufacturing output declined by 1.7%. A cyberattack affecting Jaguar Land Rover led to a 27% collapse in UK car production, reducing monthly GDP by 0.17%. These disappointing figures add to the pressure on Chancellor Reeves ahead of her budget presentation scheduled for 26th November. Analysts project that quarterly GDP growth will likely remain limited to a range of 0.1% to 0.2% through the end of the year, as budget-related uncertainties continue to postpone significant investment and hiring decisions until 2026.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。