Will tech pass today’s AI earnings test?

What to look out for today

Companies reporting on Wednesday, 29th October: Alphabet, Microsoft, Meta Platforms, ADP, American Electric Power, Boeing, Caterpillar, Centene, Chipotle Mexican Grill, CVS Health, eBay, Etsy, Fiverr International, Kraft-Heinz, Mercedes-Benz Group, MGM Resorts International, Phillips 66, ServiceNow, Starbucks, Teladoc Health, Verizon, Adidas

Key data to move markets today

EU: Spanish GDP

USA: Pending Home Sales, Fed Interest Rate Decision, Fed Monetary Policy Statement, and FOMC Press Conference

JAPAN: BoJ Interest Rate Decision, BoJ Monetary Policy Statement, and BoJ Outlook Report

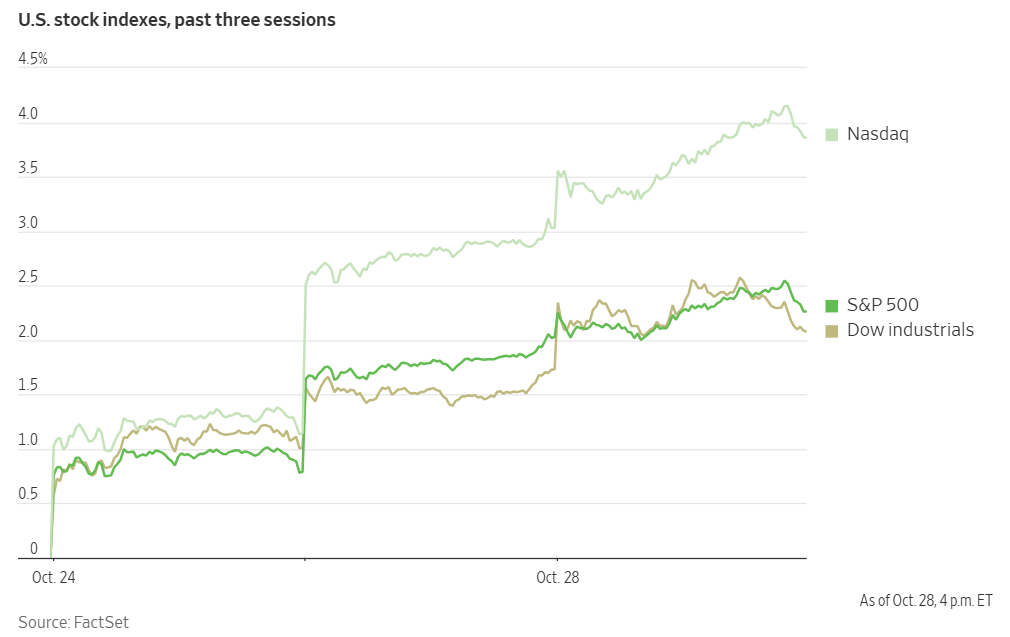

US Stock Indices

Dow Jones Industrial Average +0.34%

Nasdaq 100 +0.74%

S&P 500 +0.23%, with 3 of the 11 sectors of the S&P 500 up

The S&P 500 and Dow Jones Industrial Average both reached new record highs on Tuesday. The Dow advanced 161.78 points, or +0.34%, to close at 47,706.37, while the S&P 500 was +0.23%. The Nasdaq Composite rose +0.80% to 23,827.49.

In corporate news, Cameco and Brookfield Asset Management, together with their Westinghouse Electric subsidiary, have entered into a partnership with the US government to build at least $80 billion in nuclear reactors.

Nvidia announced plans to invest $1 billion in equity in Nokia Oyj, signalling strong confidence in the Finnish company’s strategic shift from mobile networking equipment toward AI.

Skyworks Solutions agreed to acquire Qorvo through a cash and stock transaction. This merger brings together two major Apple suppliers as the technology giant continues its transition to in-house component production.

PayPal Holdings raised its full-year earnings forecast and revealed a new collaboration with OpenAI to integrate its digital wallet functionality with ChatGPT.

The State of Texas has filed suit against Johnson & Johnson and Kenvue, alleging that the companies concealed potential risks of autism and other developmental disorders in children born to mothers who used Tylenol during pregnancy.

Medline has submitted a public filing for a US initial public offering, positioning itself for what could become one of the largest private equity-backed listings in history.

S&P 500 Best performing sector

Information Technology +1.64%, with Skyworks Solutions +5.83%, Intel +5.03%, and Nvidia +4.98%

S&P 500 Worst performing sector

Real Estate -2.22%, with Alexandria Real Estate Equities -19.17%, Healthpeak Properties -5.40%, and American Tower -3.69%

Mega Caps

Alphabet -1.50%, Amazon +1.00%, Apple +0.07%, Meta Platforms +0.08%, Microsoft +1.98%, Nvidia +4.98%, and Tesla +1.80%

Microsoft’s new OpenAI deal drives its valuation past $4 trillion. On Tuesday, Microsoft’s market capitalisation surpassed the $4 trillion mark following the announcement of a new agreement with OpenAI. While Microsoft previously reached this valuation on an intraday basis three months ago, the stock had not closed at a level sufficient to maintain it until now.

Apple also briefly exceeded a $4 trillion valuation earlier in the day, and Nvidia has consistently remained above that threshold since July. Microsoft’s share price advanced +1.98% on Tuesday, resulting in a closing market capitalisation of approximately $4.05 trillion.

The recently announced agreement with OpenAI is part of the company’s transition to a more conventional corporate structure. Under this new arrangement, Microsoft will hold a 27% stake in the public benefit corporation, a slight decrease from its previous 32.5% ownership in OpenAI’s former structure.

Furthermore, Microsoft will relinquish its right of first refusal to supply computing services to OpenAI. However, the agreement introduces a $250 billion purchase commitment for OpenAI to utilise Microsoft’s Azure cloud services.

OpenAI has demonstrated its intention to diversify its computing partnerships, having recently entered into significant agreements with other major cloud providers such as Oracle, Google, and CoreWeave. Nevertheless, the new deal with OpenAI addresses a key uncertainty that has surrounded Microsoft in recent months, particularly in light of reports regarding tensions between the two companies.

Information Technology

Best performer: Skyworks Solutions +5.83%

Worst performer: Zebra Technologies -11.68%

Materials and Mining

Best performer: Sherwin-Williams +5.47%

Worst performer: Celanese -5.96%

European Stock Indices

CAC 40 -0.27%

DAX -0.12%

FTSE 100 +0.44%

Corporate Earnings Reports

Posted on Tuesday, 28th October

UPS quarterly revenue -3.6% to $21.400 bn vs. $20.842 bn estimate.

EPS at $1.74 vs. $1.29 estimate.

Carol Tomé, CEO, said, “I want to extend my gratitude to all UPSers for their dedication and steadfast commitment to serving our customers. We are executing the most significant strategic shift in our company’s history, and the changes we are implementing are designed to deliver long-term value for all stakeholders. With the holiday shipping season nearly upon us, we are positioned to run the most efficient peak in our history while providing industry-leading service to our customers for the eighth consecutive year.” — see report.

Visa quarterly revenue +11.5% to $10.724 bn vs. $10.677 bn estimate.

EPS at $2.98 vs. $2.98 estimate.

Ryan McInerney, CEO, said, “In our fourth quarter, continued healthy consumer spending drove net revenue up 12% to $10.7 billion. For the full year, Visa delivered strong performance, with net revenue of $40 billion, up 11%, and broad-based growth across key metrics, underscoring the durability of our diverse business model. We continued to invest in our Visa as a Service stack to serve as a hyperscaler across the payments ecosystem. As technologies like AI-driven commerce, real-time money movement, tokenization and stablecoins converge to reshape commerce, our focus on innovation and product development positions Visa to lead this transformation.” — see report.

Regeneron Pharmaceuticals quarterly revenue +0.9% to $3.754 bn vs. $3.592 bn estimate.

EPS at $11.83 vs. $9.65 estimate.

Leonard S. Schleifer, Board co-Chair, President and CEO, said, “Regeneron had a solid financial quarter and made progress across our late-stage portfolio by securing new FDA approvals for Libtayo, Evkeeza, and Lynozyfic, receiving positive CHMP opinions for Libtayo and Dupixent, and sharing promising data across our oncology, obesity, allergy, and rare disease portfolios. We were proud to receive one of the FDA’s first Commissioner's National Priority Vouchers for DB-OTO for a rare form of congenital hearing loss. We also donated our Ebola treatment, Inmazeb, to countries most at risk of outbreaks, reflecting our commitment to ensuring patients in need are able to access our novel medicines.” — see report.

Commodities

Gold spot -0.73% to $3,951.56 an ounce

Silver spot +0.32% to $47.04 an ounce

West Texas Intermediate -2.07% to $60.18 a barrel

Brent crude -1.96% to $64.46 a barrel

Gold declined to a three-week low on Tuesday as optimism surrounding progress in US – China trade negotiations diminished its appeal as a safe-haven asset.

Spot gold fell -0.73% to $3,951.56 per ounce, marking its lowest level since 6th October.

Traditionally regarded as a hedge against uncertainty and a non-yielding investment, gold is +50.60% YTD, supported by persistent geopolitical and trade tensions, and anticipated lower US interest rates.

Oil prices extended their losses for a third consecutive session on Tuesday. Brent crude futures settled $1.29 lower, or -1.96%, at $64.46 per barrel. US WTI crude futures fell $1.27, or -2.07%, to $60.18 per barrel.

Last week, both Brent and WTI registered their most significant weekly gains since June, following the US President’s decision to impose Ukraine-related sanctions on Russia for the first time in his second term. He specifically targeted major oil companies Lukoil and Rosneft. However, the US government has provided written assurances that the German operations of Rosneft will be exempt from these sanctions, as the assets are no longer under Russian control, according to Germany’s economy minister.

Fatih Birol, Executive Director of the International Energy Agency, said Tuesday that the impact of these sanctions on oil-exporting nations would be limited due to surplus production capacity. In response to the sanctions, Lukoil, Russia’s second-largest oil producer, announced on Monday its intention to divest its international assets. This represents the most significant action to date by a Russian company in reaction to Western sanctions since the onset of Russia’s full-scale war in Ukraine. Lukoil, headquartered in Moscow, is responsible for approximately 2% of global oil output.

Furthermore, Indian refiners have halted new purchases of Russian oil pending further guidance from the government and suppliers, according to sources cited by Reuters on Tuesday.

On Tuesday, the CEO of Saudi Arabian state oil company Aramco noted that crude oil demand was robust even before the sanctions were imposed on Rosneft and Lukoil, and emphasised that demand from China remains healthy.

Note: As of 5 pm EDT 28 October 2025

Currencies

EUR +0.06% to $1.1652

GBP -0.46% to $1.3272

Bitcoin -1.14% to $113,023.54

Ethereum -3.25% to $3,984.42

The dollar fluctuated following several US economic data releases Tuesday. The dollar initially advanced after the ADP National Employment Report’s first weekly preliminary estimate showed that US private payrolls increased by an average of 14,250 jobs in the four weeks ending 11th October. However, it later weakened following a report from the Conference Board indicating that US consumer confidence declined in October as households expressed concerns about job availability over the next six months and persistently high prices driven by tariffs on imported goods.

At the close of trading, the dollar index was -0.06% to 98.74. The euro was +0.06% to $1.1652. The euro also reached its highest level against the British pound since May 2023, while the pound fell to its lowest level against the dollar since 1st August, declining -0.46% to $1.3272.

The Japanese yen strengthened Tuesday, recovering from seven consecutive sessions of depreciation against the US dollar. This rebound followed reassuring remarks from a Japanese government minister and US Treasury Secretary Scott Bessent regarding the potential for more expansionary fiscal and monetary policies in Japan.

Japan’s newly appointed Economic Revitalisation Minister, Minoru Kiuchi, emphasised that the nation can enhance its long-term growth prospects by stimulating demand and maintaining a tight labour market, while also remaining vigilant about fiscal discipline. Kiuchi noted that the government is closely monitoring the effects of currency fluctuations on the Japanese economy.

Further support for the yen came as Secretary Bessent underscored the importance of ‘sound monetary policy formulation’ during discussions with Japan’s Satsuki Katayama. These comments were interpreted as a subtle critique of the BoJ’s gradual approach to raising interest rates.

The BoJ is widely expected to keep interest rates unchanged when it ends its two-day meeting on Thursday, though market participants will be attentive to any indications regarding the timing of future rate hikes. By the end of Tuesday’s session, the yen was up +0.50% against the US dollar, trading at ¥152.08 per dollar.

The ECB is also anticipated to maintain its current policy stance when it meets on Thursday, while the Fed is expected to implement a rate cut today.

Fixed Income

US 10-year Treasury +0.1 basis point to 3.980%

German 10-year bund +0.8 basis point to 2.627%

UK 10-year gilt +0.9 basis point to 4.405%

On Tuesday, US Treasury yields remained relatively stable, with the market largely consolidating previous movements as investors awaited the Fed’s interest rate decision today.

The yield on the 10-year Treasury note edged up by +0.1 bps to 3.980%. The two-year Treasury yield, which is closely tied to monetary policy expectations, slipped -0.1 bps to 3.498%. The yield on the 30-year Treasury bond held steady at 4.547%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 99.5% probability of a 25 bps rate cut at today’s FOMC meeting, higher than last week’s 98.3%. Traders are currently expecting 48.1 bps of cuts by year-end, lower than the 48.7 bps anticipated last week.

Eurozone government bond yields remained stable, as investors adopted a cautious stance ahead of upcoming central bank policy decisions. Borrowing costs had previously surged on Friday, following robust eurozone PMI figures.

The yield on Germany’s 10-year Bund was nearly unchanged in late European trading, rising +0.8 bps to 2.627%, after having slipped -0.9 bps the previous day.

According to the ECB’s Consumer Expectations Survey, consumers across the eurozone have reduced their inflation expectations for the coming year. Germany’s two-year bond yields—particularly sensitive to shifts in ECB monetary policy—rose +0.5 bps to 1.981%.

The spread between the yields on the safe-haven 10-year German Bund and the 10-year French government bond held steady at 80.4 bps. Earlier in October, this spread had widened to 87.96 bps amid heightened investor apprehension regarding France’s fiscal outlook.

Italy’s 10-year bond yield increased +1.0 bps, resulting in a spread of 75.3 bps between Italy’s 10-year BTP and the 10-year German Bund.

Note: As of 5 pm EDT 28 October 2025

Global Macro Updates

FOMC Preview. The statement from the October FOMC meeting is scheduled for release at 2:00 PM EDT, with the market widely anticipating another 25 bps rate cut. Previews indicate that Fed Governor Stephen Miran may once again dissent, advocating for a larger 50 bps reduction; BofA has also highlighted the likelihood of at least one dissent favouring a hold. While analysts are somewhat divided on potential changes to the statement, the consensus is that the language regarding ‘additional adjustments’ will be maintained, though it is unlikely to include explicit guidance for December. The statement may provide an improved assessment of economic strength while acknowledging the current lack of comprehensive data due to the government shutdown.

Several reports have discussed the possibility of announcing an end to quantitative tightening (QT), following Fed Chair Jerome Powell’s remarks on 14th October that the target for ‘ample’ reserves could be reached ‘in the coming months.’ Both JP Morgan and BofA anticipate an immediate conclusion to QT, whereas Morgan Stanley and Deutsche Bank expect the process to wrap up in January or February. In the post-meeting press conference, Fed Chair Jerome Powell is expected to proceed with caution, preserving flexibility for further policy easing without committing to a specific course of action. He may once more reference September’s Summary of Economic Projections, which indicated a median expectation among policymakers for three rate cuts by the end of the year.

Consumer confidence slightly declines in October; Richmond Fed Index beats. In October, consumer confidence registered at 94.6, slightly above the consensus estimate of 94.2 but below the September reading of 95.6. The Present Situations Index recorded an increase, rising from 127.5 in September to 129.3 in October. Conversely, the Expectations Index declined from 74.4 to 71.5 during the same period. Assessment of the labour market showed improvement, with 27.8% of respondents indicating that jobs were ‘plentiful,’ up from 26.9% previously, while 18.4% considered jobs ‘hard to get,’ a marginal rise from 18.2%. Notably, 27.8% of consumers anticipated fewer job opportunities in October, compared to 25.7% in September.

The Richmond Fed Index for October stood at -4.0, outperforming both the consensus forecast of -9.5 and the prior month’s reading of -17.0. All three component indexes posted gains: the shipments index advanced to 4 from −20, new orders improved to -6 from -15, and employment increased to −10 from −15.

Additionally, the August Case-Shiller Home Price Index rose by 0.2% m/o/m, defying expectations of a 0.1% decline and reversing the previous month’s 0.1% decrease.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。