Is Germany finally picking up speed?

What to look out for today

Companies reporting on Tuesday, 28th October: Adobe, American Tower, BNP Paribas, Booking Holdings, Cemex, Electronic Arts, Mondelez International, PayPal Holdings, Regeneron Pharmaceuticals, Royal Caribbean, Seagate, Sherwin-Williams, Southern Copper, Teradyne, UnitedHealth Group, UPS, Visa

Key data to move markets today

EU: ECB Bank Lending Survey and German GfK Consumer Confidence Survey

USA: Housing Price Index, Consumer Confidence, and Richmond Fed Manufacturing Index

CHINA: Banks closed for Chung Yeung Festival

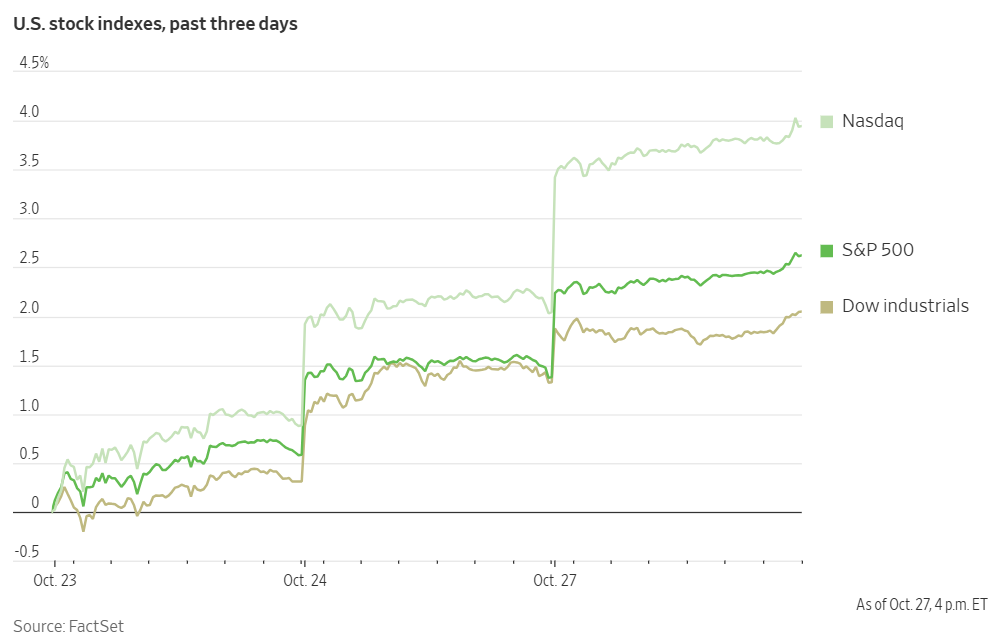

US Stock Indices

Dow Jones Industrial Average +0.71%

Nasdaq 100 +1.83%

S&P 500 +1.23%, with 9 of the 11 sectors of the S&P 500 up

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all posted new all-time highs after both the US and China highlighted progress in trade discussions ahead of a leaders' summit later this week. The S&P 500 surpassed 6,875, marking its strongest three-day rally since May.

This week is particularly significant for the stock market, with over one-third of S&P 500 companies scheduled to release their quarterly earnings, including Apple, Meta Platforms, and Alphabet. Additionally, the Fed is set to announce its latest decision on interest rates on Wednesday afternoon, with widespread expectations of another rate cut among investors.

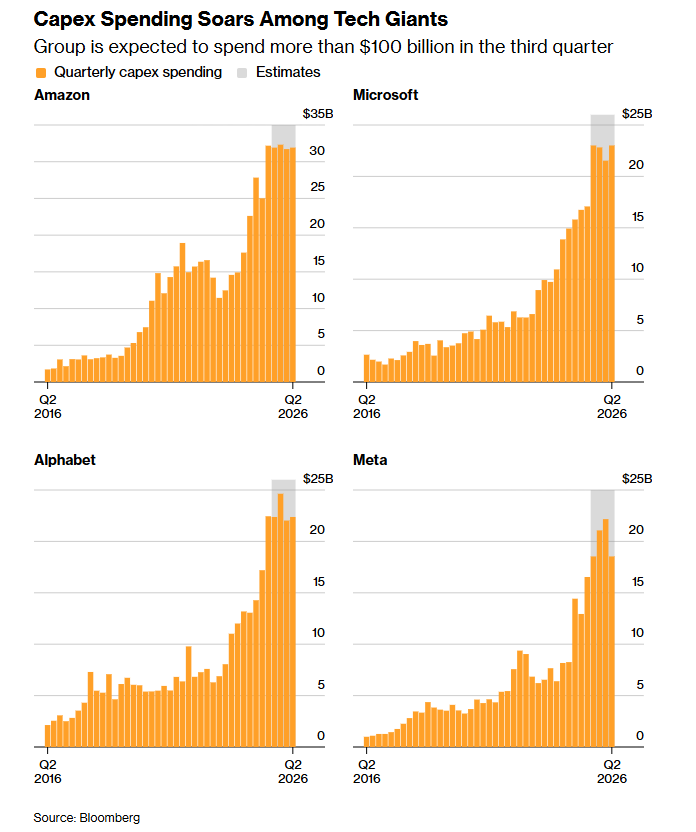

In the technology sector, Microsoft, Alphabet, Amazon, and Meta Platforms are projected to collectively invest approximately $360 billion in CapEx during their current fiscal years, much of which is directed toward AI initiatives. Analyst estimates compiled by Bloomberg suggest this figure may rise to nearly $420 billion next year.

In corporate news, Qualcomm shares surged following the company’s introduction of new chips and computers designed for the booming AI data centre market.

Amazon is preparing to implement workforce reductions across key departments, including logistics, payments, video games, and its cloud computing division. According to sources cited by Reuters, these layoffs could affect up to 30,000 positions, with terminations expected as early as Tuesday.

Wall Street sentiment toward Microsoft remains optimistic, with global asset management and investment advisory firm Guggenheim upgrading the company to a ‘buy’ rating ahead of its quarterly earnings release.

Berkshire Hathaway received a rare ‘sell’ rating from analysts, reflecting caution regarding its earnings outlook, concerns about Warren Buffett’s eventual departure, and broader macroeconomic uncertainties.

IBM announced the launch of a digital assets platform, enabling financial institutions, governments, and corporations to introduce blockchain-based services amid growing interest in cryptocurrency applications.

Huntington Bancshares has agreed to acquire Cadence Bank for $7.4 billion. It is its second major transaction this year aimed at expanding its presence in southern and southeastern states. This deal is part of a broader wave of mergers among US regional banks.

American Water Works has entered into an all-stock agreement to purchase Essential Utilities in a transaction valued at approximately $12 billion. This will be the largest water utility acquisition by total value in the US this century.

S&P 500 Best performing sector

Information Technology +2.02%, with Qualcomm +11.09%, Super Micro Computer +6.79%, and ON Semiconductor +3.88%

S&P 500 Worst performing sector

Consumer Staples -0.27%, with Philip Morris International -2.80%, Archer-Daniels-Midland -2.19%, and Estee Lauder Companies -1.66%

Mega Caps

Alphabet +3.62%, Amazon +1.23%, Apple +2.28%, Meta Platforms +1.69%, Microsoft +1.51%, Nvidia +2.81%, and Tesla +4.31%

Information Technology

Best performer: Qualcomm +11.09%

Worst performer: Roper Technologies -3.15%

Materials and Mining

Best performer: Nucor +3.94%

Worst performer: Albemarle -8.91%

European Stock Indices

CAC 40 +0.16%

DAX +0.28%

FTSE 100 +0.09%

Corporate Earnings Reports

Posted on Monday, 27th October

Cadence Design Systems quarterly revenue +10.1% to $1.339 bn vs. $1.323 bn estimate.

EPS at $1.93 vs. $1.79 estimate.

Anirudh Devgan, President and CEO, said, “Cadence delivered excellent results for the third quarter of 2025. With a record backlog and ongoing broad-based strength of our business, we are raising our full year revenue outlook to ~14% growth year-over-year. With deepening strategic relationships across the AI ecosystem, Cadence is uniquely positioned to be the trusted partner to deliver AI-centric transformational solutions.” — see report.

Keurig Dr Pepper quarterly revenue +10.7% to $4.306 bn vs. $4.153 bn estimate.

EPS at $0.54 vs. $0.54 estimate.

Tim Cofer, CEO, said, “We are pleased with our third quarter results, which demonstrated robust growth in U.S. Refreshment Beverages and encouraging sequential progress in U.S. Coffee. Strong innovation and in-market execution drove market share gains across key categories, with sales momentum, along with disciplined actions to offset inflationary pressures, contributing to solid earnings and free cash flow growth. We are focused on sustaining our base business strength while also thoughtfully preparing for the transformation ahead as we first acquire and integrate JDE Peet’s and subsequently separate into two, advantaged pure-play companies.” — see report.

Nucor quarterly revenue +14.5% to $8.521 bn vs. $8.171 bn estimate.

EPS at $2.63 vs. $2.16 estimate.

Leon Topalian, Chair, President and CEO, said, “We continue to execute on Nucor's strategy of growing our core steelmaking capabilities, while expanding into downstream, steel-adjacent businesses. During the third quarter, we began ramping up production at two recently completed bar mill projects, advanced our sheet steel production and coating projects, and commenced pole production at our Alabama Towers & Structures facility. Throughout a period of capital investment, Nucor continues to have the strongest balance sheet of any major steel producer in North America and has returned nearly $1 billion to shareholders year-to-date, representing more than 70% of net earnings through the third quarter.” — see report.

Commodities

Gold spot -3.19% to $3,980.55 an ounce

Silver spot -3.50% to $46.89 an ounce

West Texas Intermediate +0.02% to $61.45 a barrel

Brent crude -0.15% to $65.75 a barrel

Gold prices fell below $4,000 per ounce on Monday, as indications of easing trade tensions between the US and China reduced the metal’s traditional safe-haven appeal.

Spot gold fell -3.19% to $3,980.55 per ounce, with prices touching a session low of $3,970.81, the lowest level recorded since 10th October.

Oil prices remained relatively stable Monday as OPEC once again signalled its intention to increase production.

Brent crude futures declined by approximately 10 cents, or -0.15%, to settle at $65.75 per barrel. US WTI futures ended up 1 cent, or +0.02% to $61.45. Both benchmarks had fallen nearly one percent during early trading.

Reuters reported that eight OPEC+ member nations are inclined to support a modest output increase for December during their meeting on Sunday, with Saudi Arabia seeking to regain market share. Persistent concerns about subdued demand have weighed on prices. However, renewed US sanctions on Russia, combined with stronger-than-anticipated demand in the US, have provided some support to the market.

Throughout this year, OPEC and its allies have shifted strategy by reversing previous production cuts to recapture market share. This has contributed to capping oil price gains. Iraq, the group’s largest overproducer, is currently negotiating its output quota within its available capacity of 5.5 million barrels per day, according to Oil Minister Hayan Abdel-Ghani. He also noted that Sunday’s fire at Iraq’s Zubair oilfield did not affect the country’s export volumes.

Note: As of 5 pm EDT 27 October 2025

Currencies

EUR +0.17% to $1.1645

GBP +0.19% to $1.3334

Bitcoin +2.90% to $114,325.82

Ethereum +4.42% to $4,118.33

The overall currency market remained subdued as market participants await several significant central bank decisions later this week. The dollar index fell -0.14% to 98.80. The euro was +0.17% to $1.1645. The British pound also appreciated, rising +0.19% to $1.3334.

Anticipation is building around this week’s central bank meetings, with the Fed and the BoC expected to announce rate cuts on Wednesday. The ECB and the BoJ are likely to keep their rates unchanged when they meet Thursday.

Additionally, traders are closely watching the meeting between US President Trump and Japan’s new Prime Minister, Sanae Takaichi for signs of changes in the trading relationship. The Japanese yen has softened in recent weeks amid speculation that Prime Minister Takaichi may pursue more expansionary fiscal policies. On Monday, the US dollar remained steady against the yen, trading at ¥152.85.

Fixed Income

US 10-year Treasury -4.4 basis points to 3.979%

German 10-year bund -0.9 basis points to 2.619%

UK 10-year gilt -3.0 basis points to 4.405%

US Treasury yields declined on Monday. The yield on the 10-year Treasury note was -4.4 bps to 3.979%. Yields on the long end of the curve also fell, with the 30-year Treasury yield dropping -5.7 bps to 4.547%.

Yields initially rose because of two major Treasury auctions: $69 billion in 2-year notes and $70 billion in 5-year notes. At deadline, the 2-year notes were priced slightly lower than the market expected, indicating investors wanted a small premium. Direct bidders—those buying for their own portfolios—took 34.8% of the 2-year notes, which analysts say is the most since October 2012 and the second-largest share ever recorded.

The latest auction of 5-year notes yielded better results, with a pricing rate of 3.625%, which is lower than the recent six-auction average of 3.894%. The bid-to-cover ratio was 2.38x, just above the average of 2.36x.

Following the auctions, yields on the US 2-year Treasury note, which often reflect shifts in interest rate expectations, edged down by -0.2 bps to 3.499%. The yield spread between 2-year and 10-year Treasury notes narrowed to 48.0 bps from 52.2 bps late Friday, the lowest spread since September.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 97.3% probability of a 25 bps rate cut at this week’s FOMC meeting, lower than last week’s 99.4%. Traders are currently expecting 48.8 bps of cuts by year-end, lower than the 50.1 bps anticipated the prior week.

Eurozone bond yields remained near their highest levels in two weeks on Monday, supported by a series of positive economic data from the region.

The German 10-year Bund yield reached its 14th October peak before easing slightly to close -0.9 bps to 2.619%. Market consensus is that the ECB will maintain its current interest rates at this Thursday’s meeting. Traders are largely expecting no further adjustments over the coming year, although ECB officials have cautioned about emerging financial market risks.

The German two-year yield edged up +0.9 bps to a two-week high of 1.976%. This uptick followed business activity surveys indicating stronger-than-expected momentum across the eurozone, with Germany’s private sector experiencing its most substantial rise in activity in more than two years.

French 10-year yields fell by -1.7 bps to 3.421%, following Moody’s decision on Friday to affirm France’s credit rating but revise its outlook from ‘stable’ to ‘negative.’

This week, Germany, Belgium, and Italy are set to auction new government debt. Commerzbank estimates that total supply will reach approximately €25 billion, a significant increase from last week’s approximately €6 billion. This could exert upward pressure on yields.

Italian 10-year yields decreased -2.1 bps to 3.370%, while the yield spread between Italy’s 10-year BTP and the 10-year German Bund narrowed by 1.2 bps, settling at 75.1 bps.

Note: As of 5 pm EDT 27 October 2025

Global Macro Updates

Ifo survey signals a brighter economic outlook for Germany. The German Ifo Business Climate Survey for October reported a figure of 88.4, which surpassed both the consensus forecast of 87.8 and the prior month's reading of 87.7.

This improvement in the headline index was primarily driven by a significantly better Expectations Index, which rose to 91.6 and outperformed the 89.1 consensus. In contrast, the Current Conditions Index remained soft, declining slightly to 85.3 from the previous 85.7 and falling just short of the 85.5$ forecast.

The Ifo Institute noted that companies remain hopeful about an economic upturn next year. These survey results are consistent with recent favourable shifts in German PMI data.

The Manufacturing index rose as the decline in new orders stopped. The Services sector posted a significant increase, with strength highlighted in tourism and IT services. Trade sentiment also improved marginally, while the Construction sector recorded a slight decline.

Following both the PMI and Ifo updates, there is a growing consensus that the necessary conditions are in place for a recovery in GDP growth during Q4. The German government has also raised its 2025 GDP forecast to 0.2% and its 2026 forecast to 1.3%.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。