Will Corporate America continue to beat Q3 estimates?

Corporate Earnings Calendar

23rd October - 29th October 2025

Thursday: Blackstone, CenterPoint Energy, Digital Realty Trust, Dow, Ford Motor, Freeport-McMoran, Hasbro, Honeywell, Intel, Newmont, Kenvue, Southwest Airlines, T-Mobile US, Unilever, Valero Energy

Friday: Baker Hughes, Booz Allen Hamilton, Eni SpA, General Dynamics, HCA Healthcare, Procter & Gamble, Sanofi

Monday: Cadence Design Systems, F5, Keurig Dr Pepper, Nucor, Revvity, Welltower

Tuesday: Adobe, American Tower, BNP Paribas, Booking Holdings, Cemex, Electronic Arts, Mondelez International, PayPal Holdings, Regeneron Pharmaceuticals, Royal Caribbean, Seagate, Sherwin-Williams, Southern Copper, Teradyne, UnitedHealth Group, UPS, Visa

Wednesday: Adidas, Alphabet, American Electric Power, Boeing, Caterpillar, Centene, Chipotle Mexican Grill, CVS Health, eBay, Etsy, Fiverr International, Kraft-Heinz, Mercedes-Benz Group, Meta Platforms, MGM Resorts International, Microsoft, Phillips 66, ServiceNow, Starbucks, Teladoc Health, Verizon

Global market indices

US Stock Indices Price Performance

Nasdaq 100 +0.81% MTD and +18.40% YTD

Dow Jones Industrial Average +1.14% MTD and +10.30% YTD

NYSE -0.23% MTD and +12.66% YTD

S&P 500 +0.16% MTD and +13.90% YTD

The S&P 500 is +0.42% over the past seven days, with 5 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.52% over this past week and +8.33% YTD.

The S&P 500 Health Care sector is the leading sector so far this month, +4.74% MTD and +5.99% YTD, while Financials is the weakest sector at -2.79% MTD and +8.38% YTD.

Over this past week, Health Care outperformed within the S&P 500 at +2.44%, followed by Energy and Real Estate at +1.76% and +1.49%, respectively. Conversely, Utilities underperformed at -2.68%, followed by Financials and Materials at -1.49% and -0.69%, respectively.

The equal-weight version of the S&P 500 was -0.51% on Wednesday, outperforming its cap-weighted counterpart by 0.02 percentage points.

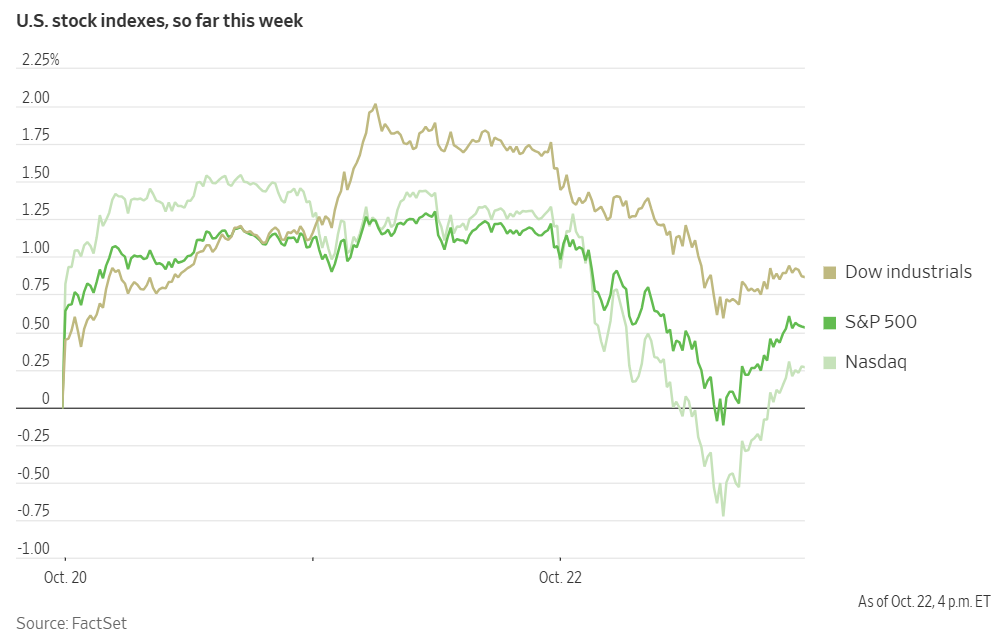

Technology stocks declined on Wednesday following reports of potential US export restrictions on software-related products to China.

The Nasdaq Composite retreated by -0.93%, the S&P 500 decreased by -0.53%, and the Dow Jones Industrial Average fell by -0.71%. Losses extended beyond the tech sector, with seven of the eleven S&P 500 sectors falling on the day.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +9.2%. This number jumps to +10.1% when excluding the Energy sector. Of the 78 companies in the S&P 500 that have reported earnings to date for Q3 2025, 87.2% have reported earnings above analyst estimates, with 84.6% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be +6.3% in Q2, increasing to +7.0% when excluding the Energy sector.

The Real Estate, Materials, Consumer Staples and Consumer Discretionary sectors, at 100.0%, are the sectors with most companies reporting above estimates, while Consumer Discretionary with a surprise factor of 13.0%, is the sector that’s beaten earnings expectations by the highest surprise factor. Within Consumer Discretionary, 40.0% of companies have reported below estimates, while Information Technology is the sector with the lowest surprise factor at 3.1%. The S&P 500 surprise factor is 7.2%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.9x.

In corporate news, Alphabet’s Google successfully executed an algorithm on its Willow quantum-computing chip, which can be replicated on comparable platforms and surpasses classical supercomputers. This milestone, according to Google, paves the way for practical quantum technology applications within the next five years.

Reddit initiated legal action against Perplexity AI and three other companies over alleged unauthorised data scraping from its discussion site. This underscores the rising value and demand for original data in the expanding artificial intelligence sector.

In its latest initiative to attract customers from rival Uber Technologies, Lyft has launched a pilot programme offering select customers cash back on future rides.

Uber Technologies and Nebius Group announced commitments of up to $375 million to support the development of Avride, the autonomous vehicle subsidiary of Dutch cloud infrastructure firm Nebius Group.

Prediction market platform Kalshi is receiving investment offers from venture capitalists that would value the company at over $10 billion, following its recent $300 million funding round at a $5 billion valuation.

Barclays has undertaken a comprehensive review of its loan portfolio after the British lender was impacted by the abrupt collapse of Tricolor Holdings.

Hermès International continues to be the luxury industry’s leading performer. It reported another quarterly increase in sales, although its flagship leather unit, known for the Birkin and Kelly bags, delivered results slightly below expectations.

Mega caps: The Magnificent Seven had a positive performance over the past week. Over the last seven days, Apple +3.65%, Meta Platforms +2.21%, Microsoft +1.38%, Amazon +1.10%, Tesla +0.88%, Alphabet +0.26%, and Nvidia +0.25%.

Tesla Q3 earnings. Tesla’s Q3 was characterised by record-setting revenue alongside a decline in net income, which fell by 37%. Despite an increase in vehicle sales, the company's net income was $1.4 billion, down from $2.2 billion a year earlier. This dip in profitability was primarily attributed to increased R&D costs, particularly in areas like AI, and a significant 44% reduction in carbon credit revenue, which totalled $417 million.

Total revenue for Q3 reached a record $28 billion, marking a 12% increase y/o/y. This growth was driven by a record volume of vehicle sales, partially fuelled by American consumers capitalising on the $7,500 federal EV tax credit before its expiration on 30th September. Furthermore, the company's Energy Generation and Storage business revenue surged by 44% following a record deployment of battery capacity.

The quarter’s financial results demonstrated strength across segments: Automotive Revenue came in at $21.21 billion, surpassing consensus of $19.60 billion. Energy Generation and Storage Revenue was $3.42 billion, against a consensus of $3.20 billion, and Services and Other Revenue reached $3.48 billion, exceeding the $3.16 billion consensus.

The company reported an Adjusted EBITDA margin of 15.0%, ahead of the 14.5% consensus. Tesla achieved a record FCF of $3.99 billion, significantly outpacing the FactSet consensus of $922.8 million, while CapEx was $2.25 billion, below the $2.84 billion consensus.

CEO Elon Musk placed strong emphasis on the company's advancements in Full Self-Driving (FSD) software and autonomous vehicles during the earnings call. Key targets announced included the planned removal of safety drivers from robotaxis operating in Austin by the end of the year. Additionally, the new Cybercab, an autonomously driven two-seater vehicle devoid of a steering wheel or pedals, is slated for production in Q2 2026.

The company's core strategic themes for Q3 revolved around accelerating real-world AI through FSD, the Robotaxi programme, the humanoid robot Optimus, and expanding production capacity.

Regarding the Robotaxi initiative, the company aims to have operations in 8 – 10 metro areas by year-end, contingent upon regulatory approvals. Nevada, Florida, and Arizona are specifically mentioned as targets. However, one of the risks discussed during the call was regulatory and safety challenges. These could result in delays or setbacks due to issues with obtaining approvals, safety incidents, or how autonomous technology is viewed by the public.

A relevant upcoming event is the shareholder vote at the company's annual meeting on 6th November on a new executive pay package for Musk. This could be valued at up to $1 trillion over a decade. The board of directors maintains that this substantial package is necessary to ensure Musk's continued commitment as the company's focus broadens beyond its EV core. Musk, who currently holds approximately 15% of the company's voting power, previously indicated a preference to pursue his AI projects externally should he not achieve a 25% voting stake in Tesla.

Energy stocks had a mostly positive performance this week, with the Energy sector itself +1.76%. WTI and Brent prices are +1.77% and +1.75%, respectively, over the past week. Over the last seven days, Halliburton +17.51%, Baker Hughes +6.36%, ExxonMobil +2.78%, Shell +2.58%, Marathon Petroleum +2.56%, Chevron +2.27%, Phillips 66 +1.41%, and BP +1.32%, while ConocoPhillips -0.38%, Occidental Petroleum -0.36%, APA -1.51%, and Energy Fuels -9.44%.

Materials and Mining stocks had a mostly negative performance this week, with the Materials sector -0.69%. Over the past seven days, Celanese Corporation +0.62%, and CF Industries +0.57%, while Nucor -0.08%, Mosaic -0.47%, Freeport-McMoRan -2.23%, Yara International -2.39%, Albemarle -7.02%, Newmont Corporation -7.02%, and Sibanye Stillwater -11.35%.

European Stock Indices Price Performance

Stoxx 600 +2.53% MTD and +12.74% YTD

DAX +1.13% MTD and +21.31% YTD

CAC 40 +3.94% MTD and +11.19% YTD

IBEX 35 +1.98% MTD and +36.11% YTD

FTSE MIB -0.18% MTD and +24.75% YTD

FTSE 100 +1.76% MTD and +16.42% YTD

This week, the pan-European Stoxx Europe 600 index is +0.80%. It was -0.18% on Wednesday, closing at 572.29.

So far this month in the STOXX Europe 600, Food & Beverages is the leading sector, +8.11% MTD and +2.17% YTD, while Autos & Parts is the weakest at -4.78% MTD and -10.17% YTD.

This week, Food & Beverages outperformed within the STOXX Europe 600, at +5.21%, followed by Autos & Parts and Chemicals at +3.13% and +2.26%, respectively. Conversely, Insurance underperformed at -0.59%, followed by Basic Resources and Financial Services at -1.13% and -0.98%, respectively.

Germany's DAX index was -0.74% on Wednesday, closing at 24,151.13. It was -0.13% over the past seven days. France's CAC 40 index was -0.63% on Wednesday, closing at 8,206.87. It was +1.61% over the past week.

The UK's FTSE 100 index was +0.96% over the past seven days to 9,515.00. It was +0.93% on Wednesday.

In Wednesday's trading session, Energy stocks outperformed, supported by firmer crude prices. Aker BP shares saw its shares climb after the company announced a return to profit in Q3, posting $285 million in net income compared to a loss in Q2. The company also maintained its $2.52 annual dividend.

Basic Resources also advanced as gold prices rebounded from the prior day's slump, lifting gold miners like Fresnillo and Endeavour Mining. SSAB shares traded higher, supported by solid US steel prices, after reporting Q3 operating profit of SEK 1.87 billion, higher than the SEK 1.25 billion reported last year.

The Travel & Leisure sector outperformed the broader market. Norwegian Air Shuttle rose following strong Q3 earnings. Finnair was higher as it indicated that its fleet normalisation was nearing completion. International Airlines Group was supported by a rating upgrade to Buy from Goldman Sachs.

Banks also advanced, with the focus on Barclays after it announced solid Q3 results, a £500 million share buyback, and an upgraded return-on-tangible-equity (RoTE) target. UniCredit contributed to the sector's strength by posting solid profit growth in Q3.

Conversely, the Luxury segment underperformed within Personal & Household Goods as concerns over slowing demand recovery in China weighed on earnings for L'Oréal, Hermès International, and Adidas.

Chemicals also traded lower after Akzo Nobel reported Q3 earnings with significant provision affecting profits. Media shares fell as ITV shares fell following a stake sale by Liberty Global, and TeamViewer revised its 2025 revenue outlook to the lower end of its guidance.

The Food & Beverages sector also underperformed. Heineken warned of lower profit growth as beer sales fell by 4.3% amid inflationary pressures and weak demand. However, Reckitt Benckiser provided a counterpoint, reporting a Q3 beat on revenue at £3.61 billion, reaffirming its full-year guidance, and announcing the second tranche of its £1 billion share buyback programme.

As of 21st October, according to LSEG I/B/E/S data for the STOXX 600, Q3 2025 earnings are expected to increase +0.2% from Q3 2024. Excluding the Energy sector, earnings are expected to increase +0.3%. Q3 2025 revenue is expected to increase +0.2% from Q3 2024. Excluding the Energy sector, revenues are expected to increase +0.5%. 22 companies in the STOXX 600 have reported earnings for Q3 2025. 50.0% of these 22 companies reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. 25 STOXX 600 companies have reported revenue to date for Q3 2025. Of these, 52.0% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

The STOXX 600 expects to see shareweighted earnings of €123.3 bn in Q3 2025, compared to share-weighted earnings of €123.1 bn (based on the year-ago earnings of the current constituents) in Q3 2024.

Four of the ten sectors in the index expect improved earnings compared to Q3 2024. The Real Estate sector has the highest earnings growth rate at 4.9% for the quarter, while Utilities has the highest anticipated contraction of -6.1% compared to Q3 2024.

The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.8x, above the 10-year average of 14.2x.

During the week of 27th October, 84 companies are expected to report quarterly earnings.

Analysts anticipate positive Q3 earnings growth in nine of the sixteen countries comprising the STOXX 600 index. Poland, with an estimated growth rate of 61.1%, and Ireland, at 27.2%, are projected to have the highest earnings growth, whereas Denmark and the Netherlands are expected to experience the most significant declines, estimated at -21.4% and -9.3%, respectively.

Other Global Stock Indices Price Performance

MSCI World Index +0.61% MTD and +17.76% YTD

Hang Seng -4.08% MTD and +28.41% YTD

The MSCI World Index is +0.54% over the past 7 days, while the Hang Seng Index is -0.58% over the past 7 days.

Currencies

EUR -1.05% MTD and +12.16% YTD to $1.1612

GBP -0.68% MTD and +6.74% YTD to $1.3352

The British pound declined on Wednesday following lower-than-expected inflation figures for September, while the US dollar edged slightly lower against the Japanese yen.

Sterling was the weakest major currency for the day, as inflation remained unchanged at 3.8% y/o/y, falling short of both the market’s and BoE's projections. Although a rate cut next month remains unlikely, the odds of a rate cut before Christmas rose to roughly 75% from around 46% earlier in the session. The pound fell by as much as 0.50% against the dollar early in the session. By afternoon trading, it had retreated -0.12% to end the day at $1.3352. Over the week, sterling dropped -0.29% and is down -0.68% month-to-date.

The dollar index fell after three straight days of gains, down -0.08% to 98.88. However, the index was +0.22% over the week and is +1.11% MTD.

The euro strengthened by +0.08% against the dollar on Wednesday to $1.1612, but was -0.27% over the past week. It is -1.05% month-to-date.

The US dollar was +0.01% against the Japanese yen at ¥151.89 on Wednesday. The yen reached a one-week low against the dollar on Tuesday, as Japan’s new Prime Minister Sanae Takaichi prepared an economic stimulus package aimed at assisting households with rising inflation. It is likely to surpass last year’s ¥13.9 trillion.

Over the past seven days, the yen has depreciated by -0.56%, contributing to a -2.74% drop this month—its largest monthly decline against the dollar since July. This shift may be attributed to expectations of expansionary fiscal policy and concerns about the BoJ’s monetary stance under Takaichi’s regime as she is a known supporter of Abenomics.

On Tuesday, Prime Minister Takaichi remarked that decisions regarding monetary policy are the responsibility of the BoJ. Additionally, Finance Minister Satsuki Katayama emphasised on Wednesday the necessity of coordination between the government and the BoJ to ensure effective economic and monetary policies.

The BoJ is set to announce its latest policy decision on 30th October, with futures markets suggesting an approximately 20% chance of a quarter-point rate hike to 0.75%. Year-to-date, the US dollar has depreciated -3.15% against the Japanese yen.

Note: As of 5:00 pm EDT 22 October 2025

Cryptocurrencies

Bitcoin -6.12% MTD and +14.29% YTD to $107,204.33

Ethereum -9.84% MTD and +12.04% YTD to $3,745.93

Bitcoin is -3.68% and Ethereum -5.69% over the past 7 days. On Wednesday, Bitcoin was -3.36% to $107,204.33 and Ethereum was -5.18% to $3,745.93.

Bitcoin and Ethereum were hit this week by gold’s momentum trade unwind. Both tokens have been struggling to recover following on from President Trump’s imposition of 100% tariffs on Chinese goods a couple of weeks ago, but had gained back some ground over the past few days as China’s President Xi and President Trump agreed to meet for further discussions. The crypto market capitalisation has continued to fall this week, hitting 3.76 trillion today, according to data from CoinGecko. Much will depend on wider macro conditions, particularly the September consumer price index report coming out Friday, which may give an indication of the future path of US monetary policy.

Crypto ETFs continue to be affected by the US government shutdown with approval of several pending altcoin ETF applications that were expected to launch in October being delayed. According to Eric Balchunas, a senior ETF analyst at Bloomberg, there are 155 cryptocurrency-based ETP filings tracking 35 different digital assets awaiting regulatory approval. As noted by The Block, issuers have put forth proposals for 2x and 3x leveraged ETFs as well as other products with staking components. These proposals came after the US Securities and Exchange Commission (SEC) approved listing standards proposed by three exchanges, asking the agency to change a rule governing the trading and listing of commodity-based trust shares, which sets out requirements to have certain shares listed on their exchanges.

These new ETFs are likely to be attractive to crypto “whales”, particularly Bitcoin whales as a swap from Bitcoin into ETF shares may not trigger a tax bill. According to Bitget, BlackRock is said to have handled over $3 billion of these conversions.

Note: As of 5:00 pm EDT 22 October 2025

Fixed Income

US 10-year yield -17.8 bps MTD and -60.2 bps YTD to 3.951%

German 10-year yield -14.8 bps MTD and +19.9 bps YTD to 2.568%

UK 10-year yield -28.5 bps MTD and -15.3 bps YTD to 4.415%

US Treasury yields declined for a third consecutive session in volatile trading on Wednesday, as the market remained range-bound and investor sentiment subdued amid an ongoing federal government shutdown, which extended into its 22nd day without any resolution.

The decline in yields was further pronounced in early afternoon trading, particularly at the longer end of the yield curve, following a well-received $13 billion auction of 20-year bonds.

Market participants turned their attention to Friday’s release of the CPI for September, seeking insights into future inflation trends. However, expectations are that the report will not influence the Fed’s inclination to lower interest rates by a quarter percentage point at the conclusion of its upcoming two-day policy meeting.

In afternoon trading, the yield on the 10-year Treasury note fell by -2.3 bps to 3.951%, while yields on 30-year bonds declined by -1.2 bps to 4.536%. On the short end of the curve, yields for US two-year Treasury notes—sensitive to interest rate expectations—edged lower by -0.6 bps to 3.455%.

The 20-year bond auction contributed to the downward pressure on yields, clearing at 4.506%, which was below the anticipated bid deadline rate of 4.52%. This outcome indicated robust investor demand, as participants were willing to purchase the bonds without requiring a premium. The auction’s bid-to-cover ratio stood at 2.73x, consistent with the 2.74x recorded last month and surpassing the 2.60x average. Subsequently, yields on 20-year bonds decreased by -1.3 bps to 4.507%.

The spread between the two- and 10-year Treasury notes was a positive 49.6 bps, a contraction of 2.7 bps from the 52.3 bps recorded last week.

Over the past seven days, the yield on the 10-year Treasury note was -5.9 bps. The yield on the 30-year Treasury bond was -9.2 bps. On the shorter end, the two-year Treasury yield was -5.5 bps.

Traders are pricing in 49.2 bps of cuts by year-end, higher than last week’s 48.5 bps, according to CME Group's FedWatch Tool. Fed funds futures traders are now pricing in a 96.7% probability of a 25 bps rate cut at October’s FOMC meeting, down from 97.3% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was -7.3 bps to 4.415%. The UK 10-year yield was -13.6 bps over the past seven days. The 30-year gilt was -3.3 bps to 5.235% on Wednesday and is -11.4 bps over the past seven days.

Eurozone government bond yields advanced on Wednesday, with German 10-year Bund yields rising by +0.9 bps to 2.568%, and two-year Schatz yields increasing by +0.4 bps to 1.917%. On the longer end, the 30-year German yield climbed +1.0 bps to 3.147%.

French government bonds also experienced modest losses, with yields up +0.5 bps to 3.351%, remaining largely steady over the past week. This stability follows the recent compromise reached between Prime Minister Sebastien Lecornu's new administration and leftist lawmakers regarding the national budget, which helped prevent further political upheaval.

Looking forward, Moody’s is set to review France’s credit rating on Friday. This follows last week's unexpected downgrade by S&P Global, which cited concerns that ongoing political instability is hampering the government’s ability to restore fiscal discipline. There was a similar downgrade by Fitch last month.

The ECB is set to meet next week and is widely anticipated to maintain its current monetary policy stance.

The yield spread between German Bunds and 10-year UK gilts narrowed to its tightest level since March, reaching 184.7 bps on Wednesday. This contraction, amounting to 12.9 bps over the past week, was primarily driven by a marked decline in British government bond yields after data revealed that inflation in the UK slowed more than expected last month.

The 10-year French yield was slightly higher, +0.5 bps, to 3.351% on Wednesday. The yield spread between French and German 10-year government bonds was 2.4 bps higher from the previous week's 75.9.bps, settling at 78.3 bps.

Over the past seven days, the German 10-year yield was -0.7 bps. Germany's two-year bond yield was -0.9 bps, and, on the longer end, Germany's 30-year yield was -0.3 bps.

The spread between US 10-year Treasuries and German Bunds is now 140.6 bps, a contraction of 5.2 bps from last week’s 145.8 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 75.4 bps, a 1.6 bps contraction from 77.0 bps last week. The Italian 10-year yield was -2.3 bps over the last week, after trading +0.4 bps higher on Wednesday to 3.322%.

Commodities

Gold spot +6.09% MTD and +56.09% YTD to $4,095.39 per ounce

Silver spot +3.96% MTD and +66.94% YTD to $48.52 per ounce

West Texas Intermediate crude -4.31% MTD and -16.58% YTD to $59.79 a barrel

Brent crude -5.28% MTD and -16.14% YTD to $63.52 a barrel

On Wednesday, gold prices declined to their lowest level in nearly two weeks, extending losses after experiencing the steepest single-day drop in five years during the prior session. Spot gold fell -0.64% to $4,095.39 per ounce, retreating from an earlier high of $4,161.17 reached earlier in the day.

On Tuesday prices fell by -5.36%, following a record high of $4,381.21 in the session before. From a technical perspective, gold remains supported by its 21-day moving average at $4,005.

Gold prices are -2.70% over the last seven days and are +6.09% so far this month. Year-to-date, gold prices have risen +56.09% due to a combination of factors such as escalating geopolitical tensions, anticipation of monetary easing, increased central bank purchases, efforts toward de-dollarisation, and robust ETF inflows.

Oil prices continued to rise following Wednesday’s settlement after the US President implemented Ukraine-related sanctions against Russia for the first time during his second term, specifically targeting major oil firms Lukoil and Rosneft.

The US Treasury Department indicated its readiness to take additional measures and urged Moscow to immediately agree to a ceasefire to end hostilities in Ukraine.

Brent crude futures advanced $1.91, or +3.10%, to $63.52 post-settlement. US West Texas Intermediate crude futures increased $2.22, or +3.86%, to $59.79. This week, WTI and Brent prices are +1.77% and +1.75%, respectively.

Oil prices were further supported by rising US energy demand, as highlighted in the latest EIA report.

Additionally, investors remained attentive to the developments in US - China trade negotiations, with officials from both nations scheduled to meet in Malaysia this week. US President Trump expressed optimism on Monday about securing a fair trade agreement with China. He further confirmed on Wednesday that an extensive meeting with President Xi Jinping is scheduled during his trip to South Korea.

EIA report. The Energy Information Administration (EIA) reported on Wednesday that inventories of US crude oil, gasoline, and distillates declined last week, reflecting stronger refining activity and increased demand.

Specifically, crude oil inventories decreased by 961,000 barrels to a total of 422.8 million barrels for the week ending 17th October. At the Cushing, Oklahoma delivery hub, crude stocks dropped by 770,000 barrels.

Refinery crude throughput increased by 600,000 barrels per day (bpd), while utilisation rates climbed by 2.9 percentage points to reach 88.6% of total capacity. Notably, utilisation rates on the US East Coast rose to 93.7%, marking the highest level since January 2023, according to the EIA.

Gasoline inventories fell by 2.1 million barrels to 216.7 million barrels, and distillate stockpiles—which include diesel and heating oil—declined by 1.5 million barrels to 115.6 million barrels.

Total product supplied, which serves as a proxy for overall demand, increased by 288,000 bpd to 20.01 million bpd. However, average total product demand over the past four weeks stood at 20.47 million bpd, representing a slight decrease of 0.1% compared to the same period last year.

Additionally, the EIA noted that net US crude imports rose by 656,000 bpd last week to 1.7 million bpd, while exports fell by 263,000 bpd to 4.2 million bpd.

Note: As of 5:00 pm EDT 22 October 2025

Key data to move markets

EUROPE

Thursday: Eurozone consumer Confidence and a speech by ECB Chief Economist Philip Lane

Friday: Eurozone, German and French HCOB Composite, Manufacturing and Services PMIs and speeches by ECB Executive Board Member Piero Cipollone and German Bundesbank President Joachim Nagel

Monday: German IFO Current Assessment, Expectations and Business Climate Index

Tuesday: ECB Bank Lending Survey and German GfK Consumer Confidence Survey

Wednesday: Spanish GDP

UK

Thursday: GfK Consumer Confidence

Friday: Retail Sales, Retail Sales ex-Fuel and S&P Global Composite, Manufacturing, and Services PMIs

USA

Thursday: Continuing and Initial Jobless Claims, Existing and New Home Sales, and speeches by Fed Vice Chair for Supervision Michelle Bowman and Fed Governor Michael Barr

Friday: CPI, Core CPI, S&P Global Composite, Manufacturing and Services PMIs, Michigan Consumer Expectations and Sentiment Indices, UoM 1-year and 5-year Consumer Inflation Expectations

Monday: Durable Goods Orders, Nondefence Capital Goods Orders excluding Aircraft, and Dallas Fed Manufacturing Business Index

Tuesday: Housing Price Index, Consumer Confidence, and Richmond Fed Manufacturing Index

Wednesday: Fed Interest Rate Decision, Fed Monetary Policy Statement, and FOMC Press Conference

CHINA

Tuesday: Chung Yeung Festival

JAPAN

Thursday: National CPI, and National Core CPI

Wednesday: BoJ Interest Rate Decision, BoJ Monetary Policy Statement, and BoJ Outlook Report

Global Macro Updates

Upcoming catalysts may disrupt subdued volatility. The market's current data vacuum is set to ease slightly with the rescheduled release of the September CPI on Friday. However, the week of 27th October promises significant activity, headlined by the FOMC decision on Wednesday, where the Fed is widely expected to cut rates by another 25 bps.

Earnings season will be in full swing next week. The majority of the Magnificent Seven constituents’ earnings are due. Microsoft, Google, and Meta are scheduled to report on 29th October after the close, followed by Apple and Amazon on 30th October after the close. Q3 earnings for the Magnificent Seven are expected to show an approximate 14% increase, which is roughly half the pace seen in Q2 and below their average 30% growth rate over the past year.

The APEC summit runs from 31st October through 1st November, featuring an anticipated meeting between Presidents Trump and Xi. While this meeting isn't expected to yield a meaningful trade deal, the market appears hopeful for some de-escalation, particularly concerning rare earths and technology restrictions.

On the trade front, 30th October marks the end of the 90-day tariff extension granted to Mexico by President Trump. With ongoing talks, there's speculation that another extension might be forthcoming.

Additionally, on 5th November, the US Supreme Court will begin oral arguments on IEEPA tariffs. Significant market debate surrounds the implications of this hearing, given the prolonged uncertainty and the shifting focus toward sectoral tariffs. The week of 3rd November will also feature the release of the October ISM Manufacturing and Services reports on 3rd and 5th November, respectively, providing further clarity on the state of the economy.

UK inflation lower than expected. UK inflation data for September delivered a welcome surprise to the downside, potentially fuelling speculation for a year-end rate cut by the BoE. The headline CPI held steady at 3.8% y/o/y, coming in below the 4.0% consensus forecast. Even more surprisingly, Core CPI eased to 3.5%, beating the 3.7% forecast and falling from the previous month's 3.6%.

Services prices, however, remained firm at 4.7%. A key positive was the deceleration in food price inflation, dropping to 4.5% in September from 5.1% previously. The Office for National Statistics (ONS) reported that the biggest upward pressure came from transport, but this was offset by softer prices in food and non-alcoholic beverages, and recreation and culture.

This softer inflation reading is significant because the BoE has previously flagged high household sensitivity to food prices, which can strongly influence inflation expectations. When combined with media reports of potential government measures in the November budget aimed at curbing household services prices, this data keeps the possibility of a BoE rate cut alive before the end of the year.

However, the IMF has advised the BoE to remain cautious about cutting rates before inflation is fully controlled. The BoE had previously signalled that September should mark the peak of the inflation cycle before a gradual easing begins, driven by favourable base effects and expected softness in services prices.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。