Will there be a US - China trade deal or more delays?

What to look out for today

Companies reporting on Tuesday, 21st October: GE Aerospace, General Motors, The Coca-Cola Company, RTX, Halliburton, 3M, Equifax, Philip Morris International, Lockheed Martin, Netflix, Northrop Grumman, Capital One Financial, Chubb, L’Oréal, Texas Instruments, Intuitive Surgical

Key data to move markets today

EU: Speeches by ECB Chief Economist Philip Lane, ECB President Christine Lagarde, ECB Governor Martin Kocher, and Bank of Spain Governor José Luis Escrivá

USA: A speech by Federal Reserve Bank Governor Christopher Waller

JAPAN: Adjusted Merchandise Trade Balance, Exports, Imports, Merchandise Trade Balance

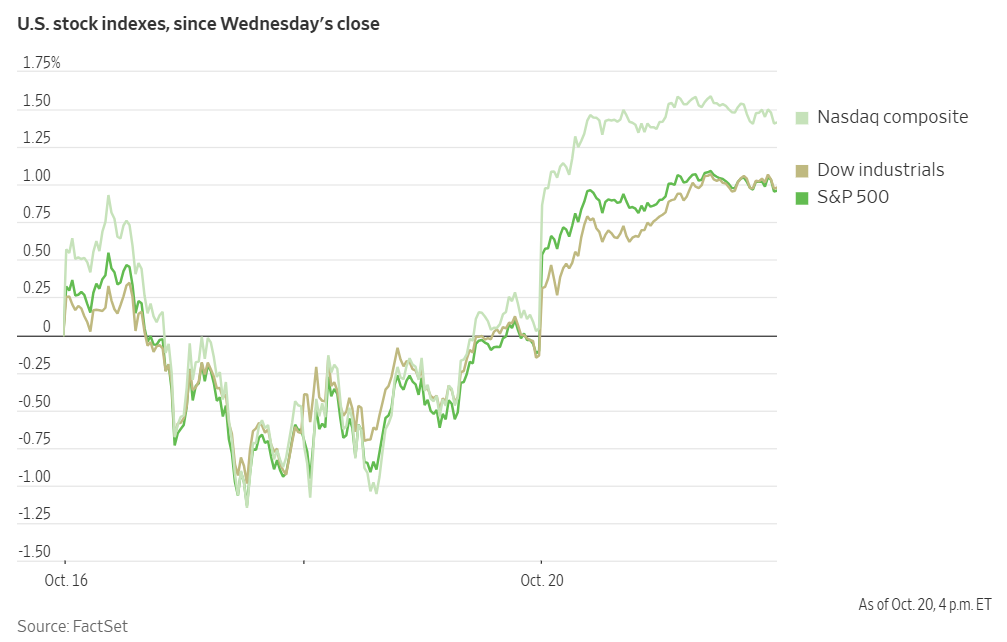

US Stock Indices

Dow Jones Industrial Average +1.12%

Nasdaq 100 +1.30%

S&P 500 +1.07%, with 9 of the 11 sectors of the S&P 500 up

Equities advanced at the outset of a pivotal week for corporate earnings, with major benchmarks rebounding toward levels previously reached in October. The Dow Jones Industrial Average was up approximately 516 points, or +1.12%, while the S&P 500 also posted a +1.07% gain. The Nasdaq Composite rose +1.37%. All three indices now stand within 0.3% of their respective all-time highs.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +9.3%. This number jumps to 10.1% when excluding the Energy sector. Of the 58 companies in the S&P 500 that have reported earnings to date for Q3 2025, 86.2% have reported earnings above analyst estimates, with 81.0% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 6.2% in Q2, increasing to 6.8% when excluding the Energy sector.

The Consumer Staples and Energy sectors, at 100.0%, are the sectors with most companies reporting above estimates, while Financials with a surprise factor of 2.6%, is the sector that’s beaten earnings expectations by the highest surprise factor. Within Health Care, 50.0% of companies have reported below estimates, while Information Technology is the sector with the lowest surprise factor at -5.0%. The S&P 500 surprise factor is 1.5%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.5x.

In corporate news, Apple’s latest iPhone series has experienced a stronger-than-expected launch, with the entry-level model seeing particularly robust demand.

Alphabet’s Google announced plans to allow Pixel smartphone enthusiasts to preview the upcoming device before its official release.

Kenvue has actively urged US regulators to dismiss a petition discouraging Tylenol use during pregnancy. It presented a comprehensive defence of its flagship product after prior government assertions linked its use to autism risk.

BNP Paribas suffered a sharp decline following a court decision implicating the company in human rights violations in Sudan. This fuelled speculation that the firm may ultimately be required to pay substantial settlements in related cases.

Kering reached an agreement to divest its beauty division to L’Oréal in a transaction valued at €4 billion, as newly appointed CEO Luca de Meo seeks to revitalise the trajectory of the French luxury group.

Shares of TKMS, a prominent submarine manufacturer, soared during their debut on the Frankfurt exchange after the company was spun off from Thyssenkrupp AG.

Stellantis reiterated its commitment to Italian manufacturing by pledging to hire an additional 400 workers to enhance production at the Mirafiori facility in Turin.

EQT AB is reportedly in discussions with potential acquisition candidates, including Coller Capital, as the private equity firm aims to strengthen its presence in the secondaries market, according to individuals familiar with the matter.

S&P 500 Best performing sector

Communication Services +1.52 %, with Trade Desk +5.03 %, Netflix +3.27%, and Meta Platforms +2.13%

S&P 500 Worst performing sector

Consumer Staples -0.10%, with Kenvue -2.16%, Molson Coors Beverage -1.54%, and Altria Group -1.00%

Mega Caps

Alphabet +1.27%, Amazon +1.61%, Apple +3.94%, Meta Platforms +2.13%, Microsoft +0.63%, Nvidia -0.32%, and Tesla +1.85%

Amazon cloud outage: DynamoDB glitch sends ripple effects across AWS network. Amazon Web Services (AWS) reported that a widespread internet outage, which disrupted millions of users and numerous businesses, has mostly been resolved over 13 hours after it began.

The outage, which started at approximately 3 am EDT on Monday, originated from a technical update to AWS’s DynamoDB database service. This update mistakenly included incorrect Domain Name Service (DNS) information. It caused the database to go offline in Amazon’s vital Northern Virginia data centres, heavily relied upon by many East Coast companies.

The failure of DynamoDB triggered additional problems across the AWS network, eventually impacting 113 services. By 10:30 am EDT, only 32 of these services had been restored. Although the DNS issue was fixed shortly after 5 am EDT, related complications persisted well into the day. One of the main problems was that an internal system responsible for balancing computing loads across AWS was also affected, resulting in further outages.

AWS is a backbone for millions of websites and mobile apps, providing essential cloud-computing services like servers and storage to major companies worldwide. DynamoDB, in particular, serves over a million customers in sectors such as retail, finance, media, and entertainment. Notable users include Disney+, Zoom, Airbnb, Lyft, Dropbox, and Nike.

Information Technology

Best performer: Super Micro Computer +5.48%

Worst performer: Applovin -5.57%

Materials and Mining

Best performer: Newmont +4.54%

Worst performer: LyondellBasell Industries -1.23%

European Stock Indices

CAC 40 +0.39%

DAX +1.80%

FTSE 100 +0.52%

Corporate Earnings Reports

Posted on Monday, 20th October

WR Berkley quarterly revenue +10.8% to $3.768 bn vs. $3.693 bn estimate.

EPS at $1.10 vs. $1.09 estimate.

The Company’s management stated, “The Company delivered strong third quarter results highlighted by a 24.3% return on beginning of year shareholders’ equity, reflecting continued strength in both underwriting and investment income.

Book value per share increased 5.8%, before dividends and share repurchases. Our decentralized structure and focus on specialty niche markets continue to differentiate us, enabling growth while maintaining rate adequacy and underwriting discipline. This approach resulted in another strong quarterly combined ratio of 90.9%. Fixed-maturity investment income increased 9.8% over the corresponding period of 2024. The Company’s new money rate continues to exceed the book yield of our fixed-maturity securities. The strength of our operating cash flow continues to grow our investable assets and will continue to make a positive contribution to investment income. Our disciplined underwriting, anchored in our focus on long-term risk-adjusted return, continues to drive superior performance across market cycles. We believe the Company remains well-positioned to create exceptional value for our shareholders throughout the remainder of 2025 and beyond.” — see report.

Steel Dynamics quarterly revenue +11.2% to $4.828 bn vs. $4.877 bn estimate.

EPS at $2.74 vs. $2.66 estimate.

Mark D. Millett, Chairman and CEO, said, “Our teams performed exceptionally well in the third quarter, achieving strong financial performance and hitting several operating milestones, while continuing to prioritize the safety and well-being of one another. Consolidated third quarter 2025 operating income improved 33 percent and adjusted EBITDA increased 24 percent sequentially. Our three-year after-tax return-on-invested capital of 15 percent is a testament to our ongoing high-return capital allocation strategy. We are growing, returning significant capital to shareholders, while also maintaining strong returns as compared to best-in-class domestic manufacturers.” — see report.

Commodities

Gold spot +2.51% to $4,355.25 an ounce

Silver spot +1.20% to $52.47 an ounce

West Texas Intermediate -0.29% to $57.47 a barrel

Brent crude -0.77% to $60.90 a barrel

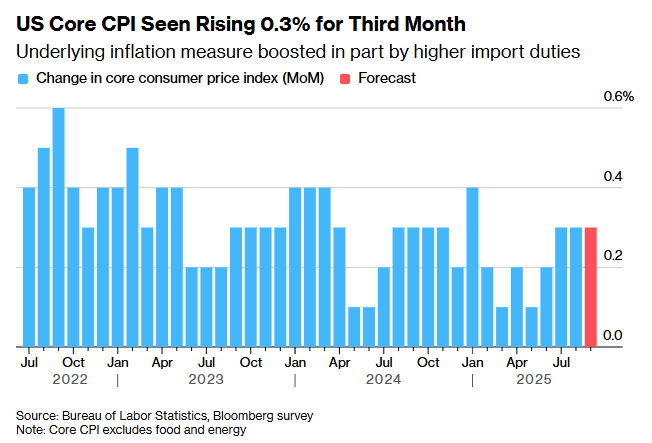

Gold prices advanced by more than 2.5 percent on Monday, supported by growing expectations of lower US interest rates and continued demand for safe-haven assets. Investors are closely monitoring the upcoming US - China trade negotiations and the release of US inflation data scheduled for later this week.

Spot gold was +2.51% to $4,355.25 per ounce, following a record high of $4,378.69 reached on Friday.

The US government shutdown entered its twentieth day on Monday, after senators were unable to resolve the deadlock for the tenth time last week. As a result, key economic data releases have been postponed, leaving both investors and policymakers with limited information ahead of the FOMC meeting next week. The delayed US consumer price index data is now expected to be released on Friday.

On Monday, oil prices settled at their lowest since early May on the possibility of a global oversupply. Heightened US - China trade tensions have intensified concerns about a slowing economy and diminished energy demand.

Brent crude futures closed down 47 cents, or -0.77%, at $60.90 per barrel. US WTI futures declined by 17 cents, or -0.29%, to $57.47.

Market sentiment among oil traders has notably shifted from worries about undersupply to apprehensions regarding oversupply. This shift is reflected in the futures contract structure of Brent crude, which now exhibits a contango pattern—where contracts for near-term delivery are priced lower than those for later delivery. Such a structure incentivises traders to store oil, anticipating higher prices when future supplies are expected to decrease.

The Brent contango, which first re-emerged last Thursday following a brief appearance in May, is currently trading at its widest spread since December 2023. Similarly, US crude futures entered contango last Friday for the first time since January 2024.

Throughout much of the year, both futures contracts exhibited a persistent state of backwardation, in which prompt prices traded at a premium to deferred deliveries. This structure signalled tighter near-term supply conditions and robust demand.

Note: As of 5 pm EDT 20 October 2025

Currencies

EUR -0.06% to $1.1644

GBP -0.15% to $1.3404

Bitcoin +3.01% to $110,616.56

Ethereum +2.58% to $3,979.28

The US dollar remained relatively stable against the yen on Monday as market participants turned their attention to political developments in Japan and the euro area, while concerns over US credit risk lingered.

The euro edged marginally lower against the dollar as political tensions in France subsided. Markets have yet to fully discount the risk to the euro; the French government's decision to freeze pension reform provides only a temporary reprieve to longer term fiscal issues.

The euro declined -0.06% to $1.1644. The US dollar index advanced +0.06% to 98.60, after having touched 98.025 on Friday—its lowest level since 6th October.

Sterling ended a three-day rally against the dollar and weakened versus the euro on Monday, as ongoing concerns about the British economy weighed on sentiment. Economists anticipate that Wednesday's UK services inflation data will fall short of BoE's projections.

Sterling slipped -0.15% to $1.3404, retreating from Friday's high of $1.3471, the strongest level in nearly two weeks. Against the euro, the British currency declined -0.10% to 86.85 pence, from 86.75 pence last week.

The dollar was marginally lower against the yen on Monday, declining -0.01% to ¥150.61. The BoJ is scheduled to decide on monetary policy on 30th October, with market-implied probabilities of a quarter-point rate increase currently standing at 23%. However, with Sanae Takaichi poised to become Japan's first female prime minister following a decisive parliamentary vote which saw her supported by a new coalition with the right-wing Japan Innovation Party, investors are concerned about possible fiscal expansion, which could exert downward pressure on the yen.

Fixed Income

US 10-year Treasury -3.1 basis points to 3.983%

German 10-year bund -0.4 basis points to 2.580%

UK 10-year gilt -2.3 basis points to 4.514%

On Monday, US Treasuries were moderately bid, resulting in slightly lower yields and a period of relatively subdued trading activity. This was largely attributed to an improvement in risk sentiment, as concerns over the China trade outlook eased.

Despite this, investors maintained a cautious stance given that the federal government remained closed for the twentieth consecutive day, with no meaningful compromise anticipated from either the Republican or Democratic parties.

The yield on the 10-year Treasury note was -3.1 bps to 3.983%, while the 30-year bond yield fell -4.9 bps to 4.566%. At the shorter end, the two-year Treasury yield was -0.8 bps at 3.466%.

US Treasury Secretary Scott Bessent announced last Friday his intention to meet this week with Chinese Vice Premier He Lifeng in Malaysia. The purpose of this meeting is to prevent a further escalation of US tariffs on Chinese goods, a situation that President Donald Trump has described as unsustainable. The US President also confirmed he plans to meet Chinese President Xi Jinping in South Korea in two weeks.

The yield spread between US two-year and 10-year Treasuries narrowed to 51.7 bps, down from 54.0 bps recorded late Friday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 99.4% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 98.3%. Traders are currently expecting 50.1 bps of cuts by year-end, higher than the 48.9 bps anticipated the prior week.

Across the Atlantic, eurozone yields were relatively stable on Monday, demonstrating limited response to France’s unexpected credit downgrade last Friday. Germany's 10-year Bund yield declined -0.4 bps to 2.580%, after reaching 2.523% on Friday, its lowest level since 25th June.

In the money markets, expectations point to no adjustment in the ECB’s base rate at the upcoming meeting on 30th October, with projections indicating approximately one 25 bps rate cut by the end of July 2026.

Germany’s two-year Bund yield, which is particularly sensitive to changes in ECB policy outlook, ended +0.5 bps to 1.918%.

The yield spread between German Bunds and 10-year French government bonds widened 1.3 bps to 79.1 bps. This spread reached 87.96 basis points earlier in the month, marking the highest level since 13th January amid concerns regarding France’s fiscal trajectory. However, the spread later narrowed to below 75 bps following Prime Minister Sebastien Lecornu’s successful navigation of two no-confidence votes in parliament on Thursday.

Italy’s 10-year yield edged +0.2 bps higher to 3.360%. The spread between Italy’s 1- year BTP and the 10-year Bund stood at 78.0 bps.

Note: As of 5 pm EDT 20 October 2025

Global Macro Updates

Trump balances trade deal hopes with new tariff threats. On Monday, President Trump expressed optimism regarding upcoming trade negotiations in South Korea with Chinese President Xi Jinping. He stated his belief that the US and China will ultimately forge a ‘fair, great trade deal.’ The President also noted that he has been invited to China and plans to visit in early 2026.

Despite this positive outlook, President Trump reiterated a significant threat, warning that if a deal is not reached by the 1st November deadline, the US could impose an additional 100-percentage-point tariff on Chinese imports. This would bring the total rate to 155%. He also mentioned other potential actions, such as restricting shipments of commercial airline parts to China.

According to Bloomberg news, when asked if he would consider a deal that involved withdrawing US support for Taiwan in exchange for trade concessions, the President deferred from commenting directly. He did confirm his expectation that Taiwan would be on the agenda in his talks with President Xi.

These remarks followed a positive weekend video call between Treasury Secretary Bessent and China's Vice Premier He Lifeng, who made plans to meet face-to-face this week. Furthermore, the administration's comments follow reports that the White House has been softening its tariff policy, increasingly offering exemptions and carve-outs for products with little or no domestic production. This move may also be positioning for a potential Supreme Court challenge to the tariffs.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。