Time for the BoJ to hike rates?

What to look out for today

Companies reporting on Monday, 20th October: WR Berkley, Steel Dynamics

Key data to move markets today

EU: German Producer Price Index (PPI) and speeches by ECB Executive Board member Isabel Schnabel and Deutsche Bundesbank President Joachim Nagel

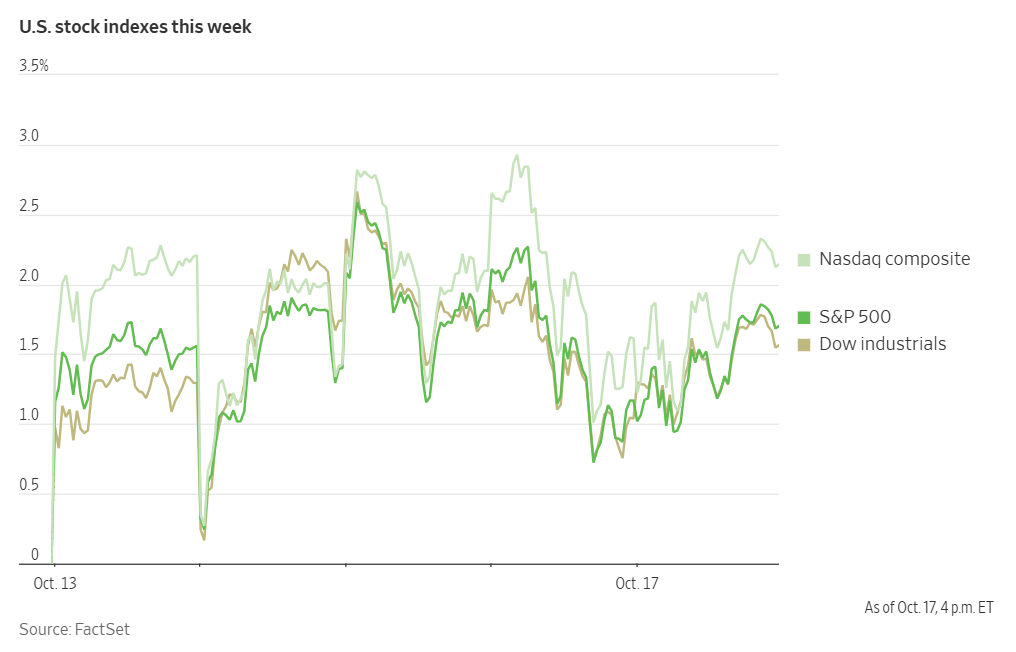

US Stock Indices

Dow Jones Industrial Average +0.52%

Nasdaq 100 +0.65%

S&P 500 +0.53%, with 9 of the 11 sectors of the S&P 500 up

All three major indices finished last week higher, with the S&P 500 +0.14% and the Nasdaq Composite and the Dow Jones Industrial Average both +0.27%.

However, on Friday, the Cboe Volatility Index reached an intraday high of 28.99, its most elevated level since late April. The sharp decline in regional bank stocks has heightened concerns that the underlying economy may be more fragile than generally perceived. Renewed trade tensions with China could potentially precipitate a recession. Simultaneously, skepticism is emerging over the aggressive bets on AI that previously fuelled the market’s rally from its April lows to new records.

Nevertheless, recent earnings reports from banks have been robust, with many analysts suggesting that the issues in loan portfolios appear to be limited.

Some investors remain concerned that the markets are increasingly vulnerable to disruption. The prolonged rally has increased valuations, rendering leading stocks historically expensive. There is also apprehension that the surge in volatility could reveal underlying issues that were previously obscured by the extended period of market stability.

In corporate news, Morgan Stanley conducted an $8 billion investment-grade bond offering on Friday. It marked the third transaction of its kind by a leading Wall Street institution last week subsequent to the announcement of third-quarter results.

CME Group intends to introduce financial contracts linked to sports events and economic indicators by year-end, according to sources familiar with the matter.

Man Group reported a record increase in assets over the three months ending September, driven by heightened client allocations to long-only products and improved performance metrics.

BYD, the leading global manufacturer of EVs, is initiating a recall of more than 115,000 units in its primary domestic market due to technical faults, raising questions regarding quality assurance amid the company's ongoing efforts to manage costs.

S&P 500 Best performing sector

Consumer Staples +1.23 %, with Kenvue +8.36 %, Estee Lauder Companies +4.11%, and Dollar Tree +2.56 %

S&P 500 Worst performing sector

Utilities -0.38%, with Vistra -4.30%, Constellation Energy -2.53%, and AES -1.62%

Mega Caps

Alphabet +0.76%, Amazon -0.67%, Apple +1.96%, Meta Platforms +0.68%, Microsoft +0.39%, Nvidia +0.78%, and Tesla +2.46%

Information Technology

Best performer: Workday +2.92%

Worst performer: Oracle -6.93%

Materials and Mining

Best performer: Ecolab +2.27%

Worst performer: Newmont -7.63%

European Stock Indices

CAC 40 -0.18%

DAX -1.82%

FTSE 100 -0.86%

Corporate Earnings Reports

Posted on Friday, 17th October

American Express quarterly revenue +10.8% to $18.426 bn vs. $18.048 bn estimate.

EPS at $4.14 vs. $4.00 estimate.

Stephen J. Squeri, Chairman and CEO, said, “We delivered a very strong quarter, with revenues growing 11 percent year-over-year to a record $18.4 billion, and EPS rising 19 percent to $4.14. Card Member spend growth accelerated to 8 percent on an FX-adjusted basis, and our credit metrics remained best-in-class. The successful launch of our updated U.S. Consumer and Business Platinum Cards reinforces our leadership in the premium space. The initial customer demand and engagement exceeded our expectations, with new U.S. Platinum account acquisitions doubling compared to pre-refresh levels. Given our strong performance year to date, we are raising our full-year guidance to revenue growth of 9 to 10 percent and EPS of $15.20 to $15.50. Looking ahead, we are confident in our growth prospects as we continue to execute our proven product refresh strategy and enhance our powerful Membership Model to deliver value for our Card Members, merchant partners, and shareholders.” — see report.

Schlumberger quarterly revenue -2.5% to $8.928 bn vs. $8.918 bn estimate.

EPS at $0.69 vs. $0.66 estimate.

Olivier Le Peuch, CEO, said, “The third quarter played out in line with our expectations as our revenue increased sequentially supported by two months’ additional ChampionX revenue, further growth in Digital and the resilient performance of our Core business. SLB improved revenue despite the backdrop of a fully supplied oil market, an uncertain geopolitical environment and subdued commodity prices. In this context, international markets — while facing challenges in some regions — are demonstrating resilience, with several countries across the Middle East and Asia continuing to show robust growth. Looking ahead, we expect OPEC+ production releases to support investment across many countries where SLB is well established.” — see report.

Volvo quarterly revenue +4.7% to $11.721 bn vs $11.804 bn estimate.

EPS at $0.39 vs $0.44 estimate.

Martin Lundstedt, President and CEO, said, “In Q3 2025, the Volvo Group's net sales increased in Europe, while more difficult market conditions in North America and South America impacted sales negatively. In total, the Group's net sales amounted to SEK 110.7 billion (117.0), which was an increase of 1% when adjusted for currency movements. Sales of vehicles were 1% lower than in Q3 2024 when adjusted for currency. The underlying development in the service business remained good, with service sales growing by 4% adjusted for currency. On a rolling 12-month basis service revenues amounted to SEK 126 billion. Despite the lower vehicle volumes, we maintained our earnings resilience and generated an adjusted operating income of SEK 11.7 billion (14.1) with an adjusted operating margin of 10.6% (12.0).”— see report.

Commodities

Gold spot -2.07% to $4,248.73 an ounce

Silver spot -4.31% to $51.85 an ounce

West Texas Intermediate +0.26% to $57.64 a barrel

Brent crude +0.43% to $61.37 a barrel

Gold prices declined by more than two percent on Friday due to a stronger dollar. Spot gold fell -2.07% to $4,248.73 per ounce, following an all-time high of $4,378.69 earlier in the session. The metal surpassed the $4,300 mark for the first time on Thursday and recorded a weekly gain of +5.76%.

The dollar index rose +0.21%, making dollar-denominated gold more expensive for international buyers.

Gold has surged +61.93% year-to-date, driven by heightened geopolitical tensions, increased central bank purchases, a shift away from the dollar, and robust inflows into gold ETFs. Expectations of lower US interest rates have further supported the non-yielding asset.

Despite record-high prices, physical gold demand in Asia remained strong, with Indian premiums reaching a decade high ahead of upcoming festivals.

Oil prices posted modest gains on Friday, but were down for the week as the International Energy Agency’s (IEA) forecast a growing supply surplus and a meeting between US President Donald Trump and Russian President Vladimir Putin to discuss Ukraine was announced.

Brent crude futures were up 26 cents, or +0.43%, to settle at $61.37 per barrel. US WTI futures closed at $57.64 per barrel, up 15 cents, or +0.26%. Over the course of the week, WTI was -1.03%, while Brent was -1.29%.

The weekly decline in oil prices also stemmed from escalating trade tensions between the US and China, which have fuelled concerns about a potential economic slowdown and diminished energy demand. Further pressuring crude prices was the IEA’s outlook, predicting a significant supply surplus in 2026. Additionally, the US Energy Information Administration reported on Thursday that US crude inventories rose by 3.5 million barrels last week, reaching 423.8 million barrels. This larger-than-anticipated inventory build was primarily attributed to reduced refinery utilisation, as refineries undergo seasonal maintenance during autumn turnarounds. The data also indicated an increase in US crude production, which climbed to 13.636 million barrels per day (bpd), marking a new record high.

Baker Hughes report. According to the latest report released Friday by Baker Hughes, US energy companies increased the number of oil and natural gas rigs for the first time in three weeks. The total count of active oil and gas rigs—considered a leading indicator of future production—rose by one to reach 548 for the week ending 17th October.

Despite this modest uptick, Baker Hughes noted that the total number of rigs remains 37 lower than the same period last year, a decline of 6%. The report detailed that the number of oil rigs remained unchanged at 418, while gas rigs increased by one to 121, marking the highest level since August.

In regional developments, the Gulf of Mexico saw its rig count fall by two to eight, the lowest figure recorded since September 2021. Texas, the US’ largest oil and gas producing state, experienced a decrease of one rig, bringing its total to 237—also the lowest since September 2021. Conversely, Wyoming’s rig count dropped by one to 12, the lowest since August 2024, while Colorado saw an increase of one, raising its total to 15, the highest since April 2024.

Note: As of 5 pm EDT 17 October 2025

Currencies

EUR -0.31% to $1.1651

GBP -0.06% to $1.3424

Bitcoin -0.67% to $107,385.12

Ethereum -0.16% to $3,879.35

The US dollar posted a weekly decline against both the Swiss franc and the yen on Friday, reflecting heightened concerns over trade tensions and unease surrounding certain regional American banks. In addition, the ongoing US federal government shutdown has halted the publication of essential macroeconomic data, increasing uncertainty for investors attempting to assess the economic climate.

The dollar fell -0.08% against the Swiss franc, settling at CHF 0.7925—its weakest position since mid-September—and had its largest weekly loss since June. The euro declined -0.31% to $1.1651 on Friday, yet registered its strongest weekly gain against the dollar in nine weeks at +0.28%. The dollar index slipped -0.32% over the week, though it rose +0.21% on Friday to reach 98.54.

The British pound fell -0.06% on Friday to $1.3424, but experienced a +0.28% gain over the week.

Japan’s lower house scheduling committee has agreed to hold a parliamentary vote on 21st October to select the nation’s next prime minister. The yen has faced downward pressure since fiscal moderate Sanae Takaichi was chosen to head the ruling Liberal Democratic Party earlier this month. The vote to formally appoint her as prime minister was postponed due to disagreements within the coalition.

The US dollar was +0.16% to ¥150.62 on Friday, but recorded a -0.35% weekly loss. BoJ Governor Ueda stated in Washington on Thursday that the central bank remains prepared to raise its key policy rate should the probability of its growth and inflation forecasts materialising increase.

Fixed Income

US 10-year Treasury +3.3 basis points to 4.014%

German 10-year bund +0.9 basis points to 2.584%

UK 10-year gilt +3.5 basis points to 4.537%

US Treasury yields rose Friday as concerns about escalating trade tensions with China and credit risks among regional banks subsided. Despite this uptick, the yield on the 10-year Treasury note declined for the third consecutive week.

On Friday, the yield on the 10-year Treasury note was +3.3 bps to 4.014%, after reaching a six-and-a-half-month low of 3.936% earlier in the session. Over the course of last week, it was down by -2.2 bps. The yield on the 30-year Treasury bond was +2.5 bps to 4.615%, but registered a slight decline of -0.6 bps for the week. The two-year Treasury yield—which often reflects interest rate expectations— rose +4.8 bps to 3.474% after earlier dropping to 3.376%, its lowest level since 26th August, 2022. Nevertheless, it was down -3.8 bps for the week, marking a third consecutive weekly drop.

The yield spread between the two-year and 10-year Treasury notes was +54.0 bps, up from the prior week’s +52.4 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 99.0% probability of a 25 bps rate cut at October’s FOMC meeting, higher than the prior week’s 98.3%. Traders are currently expecting 51.6 bps of cuts by year-end, higher than the 47.9 bps anticipated the prior week.

Across the Atlantic, eurozone bond yields advanced across regions on Friday, but posted weekly declines. The German 10-year Bund yield increased +0.9 bps, to 2.584%, but was -6.2 bps for the week. The yield on Germany’s two-year Schatz, which is more sensitive to expectations for ECB policy, remained flat on Friday at 1.913%, contributing to a weekly drop of -4.7 bps. At the long end, the German 30-year yield was +1.5 bps on Friday and closed the week -4.7 bps lower at 3.178%.

France’s 10-year yields rose +2.0 bps on Friday to 3.362%, while the spread between 10-year French OATs and German Bunds contracted to 77.8 bps from 82.8 bps the previous week.

The German-Italian 10-year yield spread narrowed by 3.5 bps to 77.4 bps, compared with 80.9 bps the week before. Italy’s 10-year yield was +2.7 bps on Friday, but -9.7 bps lower for the week at 3.358%.

S&P downgrades France’s credit rating amid political turmoil. On Friday, S&P Global unexpectedly downgraded France’s credit rating by one notch from 'AA-/A-1+' to 'A+/A-1'. It said political instability threatens the government’s ability to restore fiscal health in the eurozone’s second-largest economy. Prime Minister Sebastien Lecornu pledged to suspend the contentious 2023 pension reform and faced two parliamentary votes of no-confidence last week.

Credit rating agencies seldom issue downgrades outside their regular update cycles. In its statement, S&P Global noted, ‘We anticipate that policy uncertainty will weigh on the French economy by dampening investment activity and private consumption, thereby restraining economic growth.’ Although Prime Minister Lecornu survived both no-confidence votes on Thursday, his newly formed government was compelled to abandon President Emmanuel Macron’s flagship pension reform in exchange for support from Socialist lawmakers.

This reprieve is likely to be short-lived, as Lecornu’s proposed 2026 budget, unveiled earlier in the week, is expected to encounter significant challenges in France’s divided parliament. Responding to the downgrade, Finance Minister Roland Lescure emphasised that it is now ‘the collective responsibility of the government and parliament’ to approve a budget before the year ends, thereby ensuring that the fiscal deficit moves toward the EU’s ceiling of 3% of GDP by 2029.

S&P indicated that timely passage of the budget would provide much-needed clarity regarding France’s approach to managing its growing debt, which the agency projects will reach 121% of GDP by 2028, up from 112% at the end of 2024. However, S&P cautioned, ‘Uncertainty surrounding public finances remains elevated in the lead-up to the 2027 presidential elections.’ The agency revised France’s outlook from ‘negative’ to ‘stable,’ stating that the stable outlook reflects a balance between rising government debt and the lack of broad political consensus on fiscal consolidation, offset by the country’s underlying credit strengths.

Note: As of 5 pm EDT 17 October 2025

Global Macro Updates

BoJ's Takata argues for policy shift amid price stability. In a speech on Monday, BoJ Board Member Hajime Takata, one of two dissenters at the September Monetary Policy Meeting, asserted that the economic impact of US tariffs on Japan has been limited. To support this view, he referenced the positive findings of the latest BoJ Tankan survey.

Drawing on a broader array of data, Mr. Takata observed no significant signs of distress across four main areas of assessment: adverse impacts on business fixed investment, a notable slowdown in exports, a downturn in corporate profits that could threaten wage growth, and an appreciation of the yen. He rationalised this resilience with a historical analysis, noting that Japan has effectively diversified its global economic exposure over the decades. While acknowledging that automakers are the most vulnerable sector, he highlighted that the proportion of Japan's auto output exported to the US has fallen from a peak of around 20% in 1988 to approximately 6% in 2024. Moreover, the near-tenfold growth in total corporate profits since the late 1990s provides a stronger buffer against external shocks.

However, a subtle, but notable difference in semantics emerged, as Mr. Takata repeatedly stated the price stability target has ‘almost’ been achieved. This contrasts with the phrasing in the September policy statement, which quoted him as saying the target had ‘more or less’ been achieved. Still, given that headline inflation has exceeded 2% for three and a half years, he argued it is vital to reconcile this reality from a policy standpoint. With tariff uncertainties diminishing, he concluded that ‘now is the prime opportunity to raise the policy interest rate.’

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。