Will Q3 earnings sustain the rally?

% last week to $6,664.36

% last week to $3,683.73

Key data to move markets today

EU: Eurozone Consumer Confidence and speeches by ECB Chief Economist Philip Lane and German Bundesbank President Joachim Nagel

UK: Speeches by BoE Chief Economist Huw Pill and Governor Andrew Bailey

USA: Speeches by New York Fed President John Williams, St Louis Fed President Alberto Musalem, Richmond Fed President Thomas Barkin, Cleveland Fed President Beth Hammack and Fed Governor Stephen Miran

CHINA: PBoC Interest Rate Decision

US Stock Indices

Dow Jones Industrial Average +0.37%

Nasdaq 100 +0.70%

S&P 500 +0.49%, with 7 of the 11 sectors of the S&P 500 up

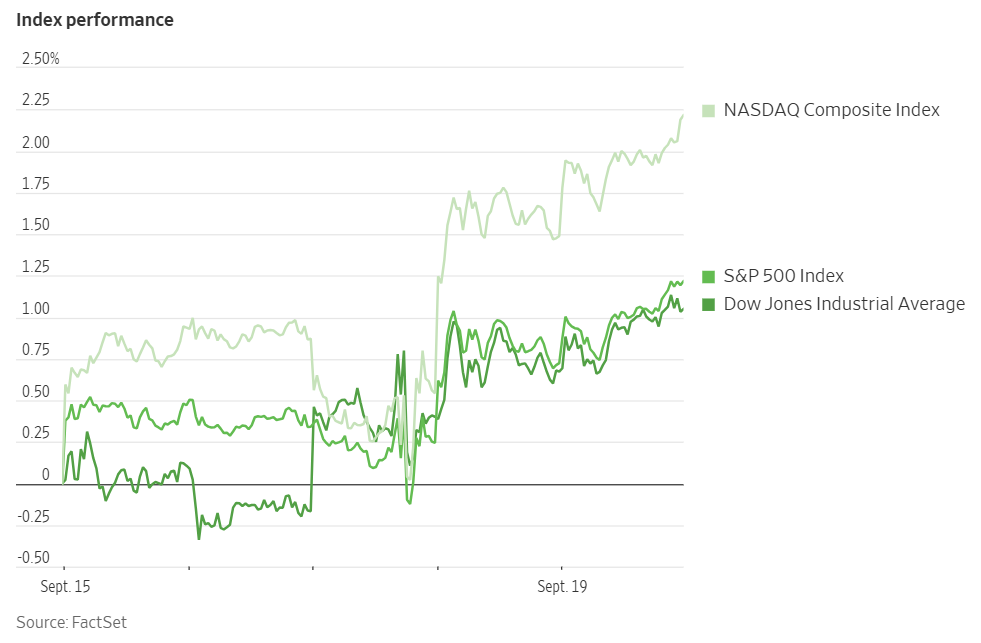

US equities advanced on Friday following all four major US indices recording simultaneous all-time highs on Thursday, a feat not seen since November 2021. Market activity was exceptionally high, with trading volume swelling due to a $5 trillion triple-witching options expiration.

Major indices recorded positive gains last week, with the Nasdaq Composite +2.22%, the Russell 2000 +1.81%, the S&P 500 +1.22%, and the Dow Jones Industrial Average +1.05%.

The rally is occurring just ahead of the beginning of Q3 earnings season. Expectations for corporate profit growth have been improving, with a rising number of S&P 500 companies issuing Q3 guidance that exceeds analyst forecasts—the highest share in a year. Furthermore, the percentage of firms providing negative profit outlooks has declined to a four-quarter low.

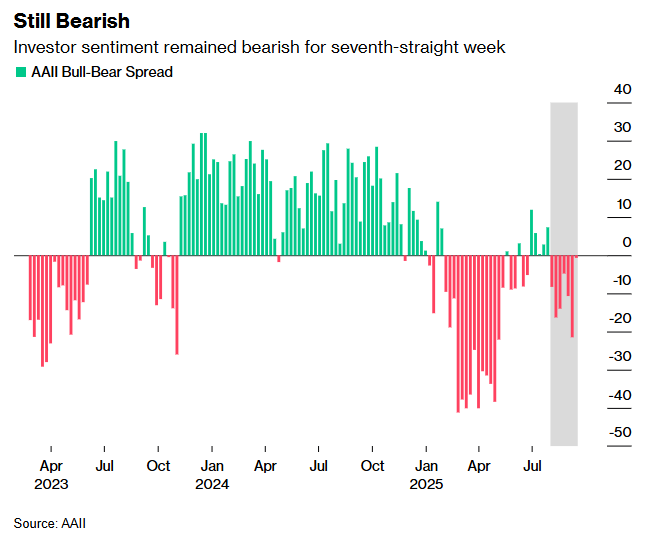

Despite the market's record-breaking performance, sentiment among individual investors remains cautious. The American Association of Individual Investors survey indicated that bears outnumbered bulls for the seventh consecutive week.

In corporate news, Meta Platforms is taking steps to enter the wholesale power-trading market to more effectively manage the significant energy requirements of its data centres.

Alphabet’s Google is set to follow an EU deadline to propose changes to its ad tech business following a nearly €3 billion fine. The proposal is not expected to include the full structural breakup that regulators have sought.

Oracle is reportedly in negotiations with Meta Platforms for a cloud computing deal, valued at approximately $20 billion, that would solidify its position as a key infrastructure provider.

Boeing and Lockheed Martin are nearing a significant agreement with Turkey for substantial aircraft orders. An announcement, possible as early as next week, could include up to 250 commercial aircraft from Boeing and additional F-16 fighter jets from Lockheed Martin. The deal may also feature a resolution to the long-standing dispute over the F-35 programme.

S&P 500 Best performing sector

Information Technology +1.19%, with Applovin +4.52%, Oracle +4.06%, and Fortinet +3.98%

S&P 500 Worst performing sector

Energy -1.28%, with Texas Pacific Land -4.18%, Coterra Energy -3.36%, and Targa Resources -3.34%

Mega Caps

Alphabet +1.15%, Amazon +0.11%, Apple +3.20%, Meta Platforms -0.24%, Microsoft +1.86%, Nvidia +0.24%, and Tesla +2.21%

Information Technology

Best performer: Applovin +4.52%

Worst performer: Cognizant Technology Solutions -4.73%

Materials and Mining

Best performer: Newmont +4.34%

Worst performer: Dow -2.57%

European Stock Indices

CAC 40 -0.01%

DAX -0.15%

FTSE 100 -0.12%

Commodities

Gold spot +1.09% to $3,683.73 an ounce

Silver spot +3.06% to $43.08 an ounce

West Texas Intermediate -1.41% to $62.72 a barrel

Brent crude -1.27% to $66.64 a barrel

Gold prices advanced on Friday, marking the fifth consecutive week of gains. Spot gold ended the session at $3,683.73 per ounce, a +1.09% increase for the day and a +1.13% rise for the week.

Market sentiment has been influenced by the Fed's policy announcement last Wednesday. Although the Fed enacted a 25 bps interest rate cut, the decision came with cautionary remarks on inflation, casting doubt on the trajectory of future rate reductions.

In the physical gold markets, premiums in India surged to a 10-month peak as record-high prices failed to deter buyers ahead of the festival season. Conversely, in China local discounts deepened to a five-year high.

Oil prices declined on Friday due to prevailing market concerns over ample supply and weakening demand. Brent crude futures settled down 86 cents or -1.27% to refr@exante.eu$66.64 a barrel. US WTI futures were down 90 cents or -1.41% to $62.72.

On a weekly basis, the benchmarks diverged; Brent registered a slight decline of -0.36%, whereas WTI posted a modest increase of +0.19%. The bearish sentiment has been reinforced by major energy agencies, including the US Energy Information Administration. They have highlighted weakening demand fundamentals, limiting expectations for any significant near-term upside in prices.

Note: As of 5 pm EDT 19 September 2025

Currencies

EUR -0.36% to $1.1744

GBP -0.63% to $1.3466

Bitcoin -1.54% to $115,552.26

Ethereum -2.64% to $4,474.19

The US dollar broadly strengthened on Friday as investors reassessed the monetary policy outlook following the Fed's interest rate cut.

The US Dollar Index rose +0.29% to 97.65, securing a +0.10% gain for the week. The euro declined -0.36% to $1.1744 on Friday, but was +0.09% for the week.

Sterling faced significant downward after official data revealed that public borrowing had significantly exceeded forecasts, complicating the nation's fiscal outlook. Public sector borrowing from April to August reached £83.8 billion, £11.4 billion higher than projected by the Office for Budget Responsibility. This overshadowed positive retail sales figures and pressured the currency. Sterling eased -0.63% to $1.3466, contributing to its largest two-day decline since April. For the week, the British pound was -0.66%.

The Japanese yen experienced a volatile session following BoJ's decision to hold interest rates steady. There was an unexpected dissent from two board members. This unsettled investors and shifted focus to the timing of the next potential rate hike. Board member Hajime Takata argued that the price stability target had largely been met, while Board member Kazuya Tamura cited upside risks to inflation.

The yen settled nearly unchanged at ¥147.94 per dollar, but recorded a -0.19% loss for the week. Investors also remain cautious about whether the upcoming leadership election in Japan's ruling party on 4th October will affect future monetary policy.

Fixed Income

US 10-year Treasury +2.3 basis points to 4.131%

German 10-year bund +2.6 basis points to 2.751%

UK 10-year gilt +3.7 basis points to 4.717%

Longer-dated US Treasury yields advanced on Friday, with the 10-year note securing its third consecutive daily gain and its first weekly advance in five weeks. This upward move marks a reversal from the trend observed in the weeks preceding the FOMC policy meeting when yields had steadily declined, pushing the 10-year yield to a seven-month low last week.

The turnaround came after the Fed implemented a widely anticipated 25 bps rate cut Wednesday. The ascent in yields gained further momentum from stronger-than-expected economic data, including weekly jobless claims and a regional manufacturing report released on Thursday.

On Friday, the yield on the 10-year Treasury note was +2.3 bps to 4.131%, bringing its gain for the week to +6.1 bps. On the longer end, the 30-year bond yield was +2.0 bps to 4.746%, closing the week +6.3 bps higher. The two-year yield, highly sensitive to Fed monetary policy expectations, edged up +1.0 bps to 3.584%, and ended the week +2.2 bps higher. Consequently, the spread between the two- and 10-year yields widened to 54.7 bps, 3.9 bps higher than last week’s 50.8 bps.

Minneapolis Fed President Neel Kashkari said Friday that labour market risks justified last week’s rate cut and could warrant further reductions at the central bank's next two meetings.

Fed funds futures traders are pricing in a 91.9% probability of a 25 bps rate cut at October’s FOMC meeting, up from 79.0% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 69.9 bps of cuts by year-end, lower than the 70.8 bps expected last week.

Across the Atlantic, long-dated eurozone government bond yields climbed on Friday, concluding a volatile week marked by news of Germany's expanded debt issuance plans.

Germany announced it would increase its fourth-quarter bond issuance by €15 billion to fund higher spending on infrastructure and defence. While an increase was anticipated, the slight bias towards longer-dated tenors drew market attention, pushing issuance levels toward a record high this year.

This development amplified a broader market trend of curve steepening. Investor concerns about government finances have exerted more upward pressure on long-term yields than on shorter-term debt, which remains anchored by expectations of interest rate cuts.

Germany's 30-year bond yield was +3.2 bps on Friday to 3.338%, finishing the week +4.4 bps higher. The 10-year Bund yield also rose, ending the week +3.5 bps. On the short end, the German 2-year yield, sensitive to ECB monetary policy expectations, was +1.0 bps on Friday, but ended the week -0.3 bps lower to 2.034%.

French 10-year yields ended the week +5.2 bps higher, while the spread over their German counterparts widened to 81.3 bps. Notably, following a credit rating downgrade by Fitch, French yields traded above their Italian counterparts for the first time last week.

Italy’s 10-year yield was +2.7 bps on Friday, and +1.6 bps higher over the last week. The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 79.1 bps, a 1.9 bps contraction from 81.0 bps the prior week.

In the UK, gilt yields followed a similar trajectory. Driven by higher-than-expected public borrowing figures and the BoE's policy statement on Thursday, the UK's 30-year bond yield was +5.5 bps on Friday, ending the week +5.6 bps higher. The UK 10-year gilt was +3.7 bps on Friday, and +4.1 bps for the week.

Note: As of 5 pm EDT 19 September 2025

Global Macro Updates

UK public deficit exceeds projections. The UK's public finances showed considerable strain in August, as government borrowing significantly exceeded expectations. Borrowing for the month was recorded at £18 billion, well above the £12.5 billion projected by the fiscal watchdog, the Office for Budget Responsibility (OBR), and marking the highest August figure in five years.

For the current fiscal year-to-date, borrowing has reached £83.8 billion, an increase of £16.2 billion compared to the same five-month period in 2024 and the second-highest level for this period since records began in 1993.

This deterioration in public finances compounds the challenge facing Chancellor Rachel Reeves ahead of the November budget. The prevailing sentiment surrounding UK fiscal policy is pessimistic due to higher borrowing costs, economic underperformance, and recent government policy reversals on spending cuts.

Economists anticipate the upcoming fiscal statement will likely feature a combination of tax increases, structural reforms, and efficiency savings. The government needs to address a fiscal gap estimated to be as large as £50 billion if it wishes to preserve its modest fiscal headroom of approximately £10 billion.

The fiscal outlook is further complicated by reports that the OBR has informed the Chancellor of its intention to downgrade the UK's productivity forecasts, which would likely worsen the fiscal projections.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。