Can France reach a deal without snap elections?

Key data to move markets today

EU: A speech by Bundesbank President Joachim Nagel.

UK: A speech by BoE’s Deputy Governor for Financial Stability Sarah Breeden.

USA: Nonfarm Payrolls Benchmark Revision.

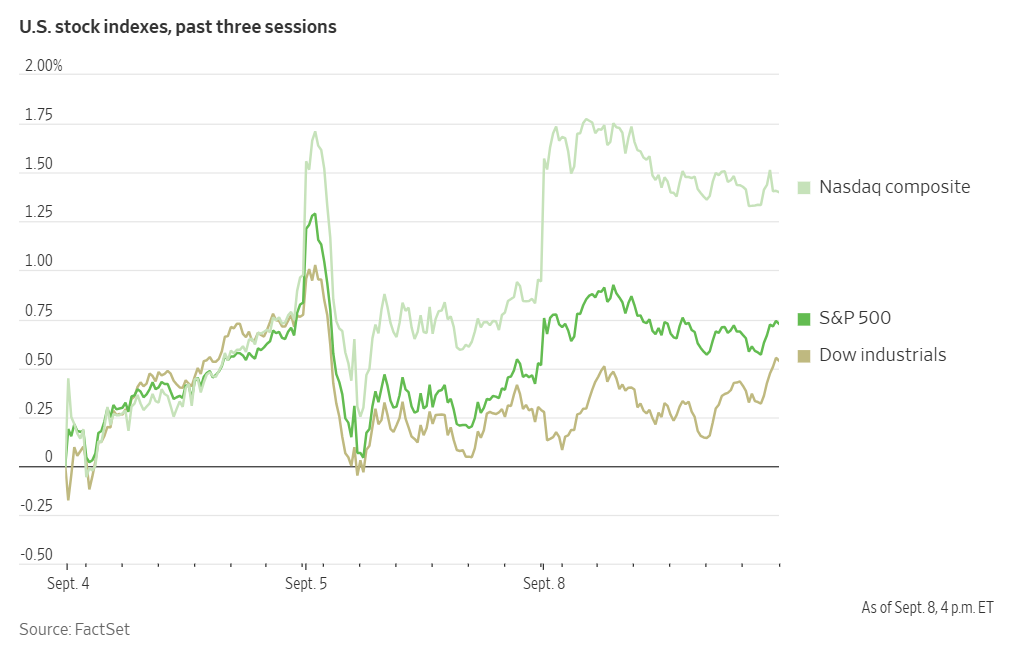

US Stock Indices

Dow Jones Industrial Average +0.25%.

Nasdaq 100 +0.46%.

S&P 500 +0.21%, with 5 of the 11 sectors of the S&P 500 up.

US stock indices advanced on Monday, with the Nasdaq Composite closing at a new record high. The tech-heavy Nasdaq gained +0.45% to end the session at 21,798.70, marking its 21st record close of the year. The S&P 500 rose +0.21%, while the Dow Jones Industrial Average added 114 points, or +0.25%.

Monday's gains come as the market enters what is a historically challenging month for equities. While the S&P 500 has averaged a 1% decline in September since 1971, historical data suggests this year could defy the seasonal trend. According to Bloomberg Intelligence, in years when the Fed was cutting interest rates and the economy was not in a recession, the index has posted an average gain of 1.2% for the month.

Looking ahead, investors are focussed on Thursday's Consumer Price Index (CPI) report. According to Bloomberg news, options market data, compiled by investment bank Piper Sandler, indicates that traders are anticipating a relatively modest market reaction, pricing in a potential move of approximately 0.7% in either direction for the S&P 500. This is notably smaller than the average realised move of 1% on CPI report days over the past year.

In corporate news, SpaceX has agreed to acquire wireless spectrum from telecommunications firm EchoStar for approximately $17 billion. The deal provides Elon Musk's satellite internet company, Starlink, with valuable spectrum while allowing EchoStar to resolve a pending regulatory probe and reduce its debt.

Amazon acquired a stake in Colombian delivery firm Rappi. The strategic partnership aims to combine Amazon’s retail and technology infrastructure with one of Latin America’s most prominent last-mile delivery networks.

Dell Technologies announced that CFO Yvonne McGill is resigning. David Kennedy, a senior vice president at the company, will replace her on an interim basis.

Robinhood Markets is set to join the S&P 500 index, marking a significant milestone for the retail trading platform that gained prominence during the pandemic. S&P Dow Jones Indices confirmed on Friday that the company will be included in the benchmark's next quarterly rebalance.

Finally, looking ahead, analysts are cautioning that Apple’s largest product event of the year may not serve as the next major catalyst for its recently revived stock, suggesting investors might temper their expectations.

S&P 500 Best performing sector

Information Technology +0.67%, with Broadcom +3.21%, IBM +3.04%, and ServiceNow +2.79%.

S&P 500 Worst performing sector

Utilities -1.07%, with PG&E -3.51%, American Water Works -2.49%, and Edison International -2.11%.

Mega Caps

Alphabet -0.34%, Amazon +1.51%, Apple -0.76%, Meta Platforms -0.02%, Microsoft +0.65%, Nvidia +0.77%, and Tesla -1.27%.

Information Technology

Best performer: Broadcom +3.21%.

Worst performer: Epam Systems -2.96%.

Materials and Mining

Best performer: PPG +1.41%.

Worst performer: International Paper -2.63%.

European Stock Indices

CAC 40 +0.78%.

DAX +0.89%.

FTSE 100 +0.14%.

Commodities

Gold spot +1.41% to $3,636.92 an ounce.

Silver spot +0.83% to $41.32 an ounce.

West Texas Intermediate +0.76% to $62.44 a barrel.

Brent crude +0.91% to $66.21 a barrel.

Gold prices surged to a record high on Monday, surpassing the $3,600 per ounce threshold for the first time, as weak US labour market data strengthened expectations for a Fed interest rate cut next week.

Spot gold advanced +1.41% to end the trading session at $3,636.92 per ounce, after reaching an intraday peak of $3,646.29. Gold’s rally has been supported by a weakening dollar, disappointing macroeconomic data, a slowing US labour market, rising geopolitical risk in the UK, France, and Japan, President Trump’s attacks on the Federal Reserve, challenging its independence, and continued purchases by emerging markets central banks.

Year-to-date, bullion has gained +38.64%, building on a +27.24% increase in 2024. Highlighting the robust demand, data released on Sunday showed that China's PBoC continued its gold purchasing for the tenth consecutive month in August.

Oil prices settled higher on Monday, recouping some of last week's losses, as the market responded to a modest production increase from OPEC+ and the prospect of additional sanctions on Russian crude.

Brent crude futures settled up 60 cents, or +0.91%, at $66.21 a barrel. WTI crude gained 47 cents, or +0.76%, to close at $62.44 a barrel. Both benchmarks had traded more than $1 higher earlier in the session. The gains represent a partial recovery from last week, when prices fell more than three percentage points after a weak US jobs report raised concerns about the outlook for energy demand.

On Sunday, OPEC+ agreed to increase oil production by 137,000 barrels per day (bpd) starting in October. Analysts suggest the net impact may be limited, as the decision could partly absorb barrels from members who have already been producing above their quotas.

In a related move, OPEC on Monday issued a compensation schedule for six members to make up for prior overproduction, requiring monthly cuts ranging from 190,000 bpd to 829,000 bpd through June of next year. A day after the OPEC+ agreement, top exporter Saudi Arabia cut its official selling price for Arab Light crude for its Asian customers.

Escalating geopolitical tensions added to price pressures. The US President stated Sunday that he is prepared to implement a second phase of sanctions against Russia over the war in Ukraine. New sanctions targeting buyers of Russian oil could significantly disrupt global crude flows. This development follows what Ukrainian officials described as Russia's largest air attack of the war over the weekend, which struck central Kyiv.

Note: As of 5 pm EDT 8 September 2025

Currencies

EUR +0.38% to $1.1761.

GBP +0.27% to $1.3543.

Bitcoin +1.51% to $112,335.99.

Ethereum +0.51% to $4,320.73.

The US dollar extended its decline on Monday, pressured by the lingering impact of Friday’s poor domestic jobs report that has solidified expectations for a Fed rate cut at next week’s meeting. The dollar index edged down -0.30% to 97.44.

The Japanese yen continued to weaken following the weekend resignation of Prime Minister Shigeru Ishiba, a move that introduces a period of significant policy uncertainty for the world's fourth-largest economy. The dollar initially rose 0.80% against the yen on this news. However, as the market's focus returned to US monetary policy, the greenback pared most of its gains, ending the session +0.09% at ¥147.51. Investors are now focussed on Ishiba’s potential successor, who may advocate for looser fiscal and monetary policies, a possibility that contributed to a surge in Japanese stocks.

The euro was +0.38% to $1.1761. It showed little reaction to political turmoil in France, where parliament voted to oust Prime Minister François Bayrou's government over its fiscal consolidation plans, plunging the eurozone's second-largest economy into a deeper political crisis.

Similarly, the British pound continued its advance against the dollar, with sterling +0.27% to $1.3543.

Fixed Income

US 10-year Treasury -3.4 basis points to 4.043%.

German 10-year bund -2.4 basis points to 2.646%.

UK 10-year gilt -4.5 basis points to 4.609%.

US Treasury yields fell on Monday, with the 10-year yield touching a five-month low, as investors continued to react to Friday's weak employment report, which solidified expectations for at least a quarter point reduction by the Fed next week. Investors have also lowered their economic growth outlook.

The yield on the benchmark 10-year Treasury note fell -3.4 bps to 4.043%, its lowest level since early April. The 30-year bond yield was -6.6 bps to 4.696%, its lowest point since 1st May. The 2-year Treasury yield, which is highly sensitive to interest rate expectations, fell -2.1 bps to 3.498%.

The yield curve measuring the spread between 2- and 10-year notes flattened slightly to 54.5 bps.

Looking ahead, traders are awaiting key inflation data for further confirmation of monetary policy direction and the potential sizing of any cuts. The Producer Price Index (PPI) is due out Wednesday and the Consumer Price Index (CPI) on Thursday. Investor demand for government debt will also be tested this week through a series of auctions for 3-year notes, 10-year notes, and 30-year bonds.

Fed funds futures traders are now pricing in a 100.0% probability of a rate cut in September, up from 86.4% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 71.5 bps of cuts by year-end, higher than the 56.4 bps expected last week.

Across the Atlantic, euro area benchmark government bond yields declined on Monday, with Germany's 10-year Bund yield falling to a one-month low as investors monitored political developments in France.

Germany’s 10-year bond yield fell -2.4 bps to 2.646%, its lowest level since 8th August.

Despite the political uncertainty, the market reaction remained contained. The yield spread between German Bunds and 10-year French government bonds (OATs)—a key indicator of the risk premium on French debt—tightened to 76.3 bps after widening to 82 bps last week. This suggests that investors have largely priced in the government's fall and expect a resolution that avoids a disruptive snap election, likely through the appointment of a new prime minister by President Emmanuel Macron.

Looking ahead, market participants are also turning their attention to the ECB's policy meeting later this week. While no immediate rate cuts are anticipated, despite the unexpected cut in German exports in July due to US tariffs, investors expect a cautious message on the future path of monetary policy. Currently, markets are pricing in an 80% probability of a 25 bps rate cut by the summer of next year.

In other maturities, Germany’s 2-year yield, which is sensitive to ECB rate expectations, was down -0.3 bps at 1.937%. Yields on 30-year German bonds fell -3.1 bps to 3.270%, retreating from a multi-year high reached last week. Similarly, France’s 30-year bond yield declined -2.3 bps to 4.333%.

Note: As of 5 pm EDT 8 September 2025

Global Macro Updates

French PM Bayrou's government falls after a confidence vote. The government of French Prime Minister François Bayrou has fallen after losing a confidence motion in the national assembly regarding its proposed deficit-cutting measures. The motion was defeated by a vote of 364 to 194, an outcome that was widely anticipated after opposition parties signalled they would not support the government.

This development marks the third change of government in France in just over a year, highlighting a period of significant political instability. The decision now rests with President Emmanuel Macron, who must either appoint a new leader to form a government or dissolve parliament and call for new elections.

The political landscape remains highly fractured, complicating efforts to build a stable coalition. In the week preceding the vote, President Macron had directed centrist party leaders to negotiate with the Socialists, but right-wing parties have rejected the possibility of a Socialist-led government. Meanwhile, both Marine Le Pen's National Rally on the far-right and the leftist France Unbowed have called for snap elections.

According to sources, President Macron's preference is to avoid another election. One potential strategy under consideration is the appointment of a caretaker government, which could pass a budget by decree. This would provide the president with more time to find a viable candidate for prime minister and negotiate a more durable political solution.

Japan LDP preparing leadership vote for 4th October. Japan's ruling Liberal Democratic Party (LDP) may reach a consensus today on the timeline and format for its upcoming presidential election. Party executives reportedly favour a comprehensive "full spec" method, which allocates an equal number of votes to Diet members and regional party chapters. The proposed election date is 4th October. This would leave a political vacuum for nearly a month.

An election committee is scheduled to finalise these specifics today. The full-format election is estimated to take only a week longer than a simplified alternative that would reduce the number of regional votes and give more weight to Diet members, a method seen as advantageous to nationally recognised candidates.

As the process takes shape, potential candidates have begun gauging support, each requiring a minimum of 20 endorsements from Diet members. So far, the field consists of prominent figures, including Agriculture Minister Koizumi, former economic security minister Takaichi, Chief Cabinet Secretary Hayashi, Finance Minister Kato, and former Secretary-General Motegi.

This leadership transition is already impacting economic policy. Before announcing his resignation, Prime Minister Ishiba called for a new stimulus package to cushion the effects of inflation and tariffs. However, the legislative process for this package is now suspended until a new prime minister is appointed. Moving forward, the measures will require a supplementary budget for fiscal year 2025, which will need the support of opposition parties to pass.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供给您仅供信息参考之用,不应被视为认购或销售此处提及任何投资或相关服务的优惠招揽或游说。金融工具交易存在重大亏损风险,未必适合所有投资者。过往表现并非未来业绩的可靠指标。