A margin call on transatlantic trust at Munich?

What to look out for today

Companies reporting on Friday, 13th February: Moderna

Key data to move markets today

EU: GDP, Employment Change, Spanish Harmonised Index of Consumer Prices, and speech by ECB Executive Board Vice President Luis de Guindos

UK: A speech by BoE Chief Economist Huw Pill

USA: CPI and Core CPI

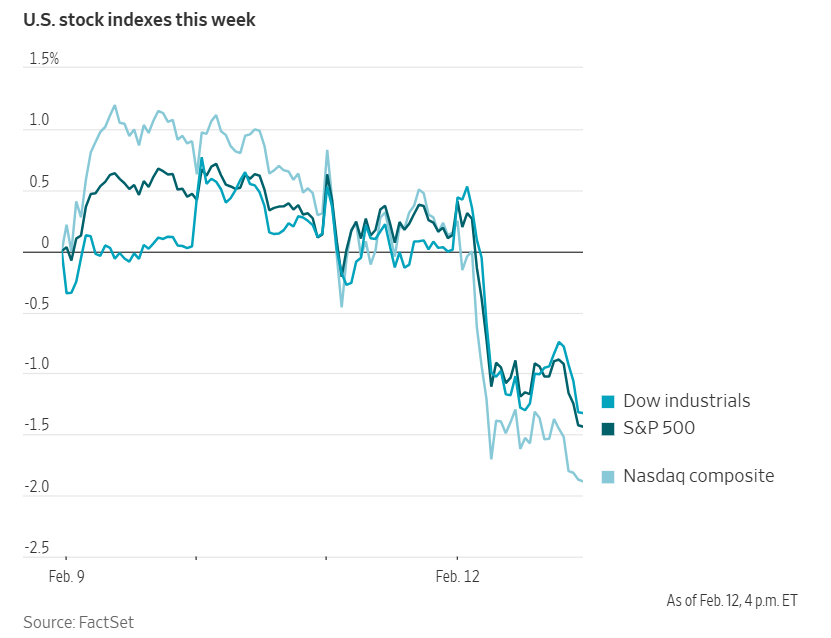

US Stock Indices

Dow Jones Industrial Average -1.34%

Nasdaq 100 -2.04%

S&P 500 -1.57%, with 8 of the 11 sectors of the S&P 500 down

On Thursday, US indices declined amid renewed concerns regarding the long-term implications of AI for the technology, financial, and logistics sectors. The Nasdaq Composite led the downturn with a -2.03% loss, the S&P 500 fell -1.57%, and the Dow Jones Industrial Average retreated -1.34%, or 670 points.

Apprehensions regarding AI have affected various sectors in recent sessions. On Monday, insurance brokers experienced losses following announcements that OpenAI was introducing an application for homeowner insurance quotations. On Tuesday, wealth managers and brokerage firms saw share prices fall in response to news of an AI-powered tool for tax planning strategies.

Last week, reports regarding an AI assistant capable of performing legal and research tasks reverberated throughout the software sector, prompting a sell-off that negatively impacted companies such as Salesforce, PayPal, and Thomson Reuters.

In corporate news, Nvidia is expected to lease a data centre currently under construction. It is anticipated to be financed from a $3.8 billion high-yield bond issuance, contributing to the surge in borrowing for AI infrastructure.

Anthropic has secured $30 billion in investment from backers at a valuation of $380 billion, inclusive of the capital raised, strengthening its competitive position in the AI sector as it closes the gap with OpenAI.

OpenAI is set to unveil its inaugural AI model operating on processors provided by the semiconductor start-up Cerebras Systems as part of its efforts to diversify its chip supplier base beyond Nvidia.

Constellation Brands, owner of the Modelo beer brand in the US, has announced that its board has appointed Nicholas Fink as the company’s next CEO.

Clear Street Group has significantly reduced the target value of its IPO by nearly two thirds, following resistance from potential investors.

L’Oréal’s sales underperformed expectations during Q4 2025, with the luxury division reporting disappointing results.

Nuveen has agreed to acquire Schroders in a £9.9 billion transaction. This makes it one of the largest active asset management firms globally, with assets totalling nearly $2.5 trillion.

S&P 500 Best performing sector

Utilities +1.50%, with Exelon +6.97%, American Water Works +3.78%, and American Electric Power +3.42%

S&P 500 Worst performing sector

Information Technology -2.65%, with Tyler Technologies -15.39%, Cisco Systems -12.32%, and Dell Technologies -9.13%

Mega Caps

Alphabet -0.60%, Amazon -2.25%, Apple -5.00%, Meta Platforms -2.82%, Microsoft -0.63%, Nvidia -1.61%, and Tesla -2.69%

Information Technology

Best performer: Akamai Technologies +10.35%

Worst performer: Tyler Technologies -15.39%

Materials and Mining

Best performer: International Flavors & Fragrance +5.89%

Worst performer: FMC -9.47%

Corporate Earnings Reports

Posted on Thursday, 12th February

Airbnb quarterly revenue +12.0% to $2.778 bn vs $2.778 bn estimate

EPS at $0.56 vs $0.56 estimate

Its shareholder letter stated, “Airbnb closed out 2025 with strong momentum, delivering double-digit growth across our key top-line metrics during the fourth quarter. Despite a tough year-over-year comparison, our business accelerated in Q4 compared to Q3. Revenue grew 12%, exceeding the high end of our guidance range, while Gross Booking Value grew 16% year-over-year—our highest-growth quarter in more than two years. Nights and Seats Booked rose 10%, marking our strongest growth quarter of the year. Our overall business performance was driven by the strength in demand across all regions and ADR.” — see report.

Applied Materials quarterly revenue -2.2% to $7.012 bn vs $6.870 bn estimate

EPS at $2.38 vs $2.21 estimate

Gary Dickerson, President and CEO, said, “Applied Materials delivered strong results in our fiscal first quarter, fueled by the acceleration of industry investments in AI computing. The need for higher performance and more energy-efficient chips is driving high growth rates for leading-edge logic, high-bandwidth memory and advanced packaging. These are areas where Applied is the process equipment leader, and we expect to grow our semiconductor equipment business over 20 percent this calendar year.” — see report.

Vertex Pharmaceuticals quarterly revenue +9.6% to $3.190 bn vs $3.184 bn estimate

EPS at $5.03 vs $5.11 estimate

Reshma Kewalramani, President and CEO, said, “2025 marked a year of strong revenue growth, commercial diversification, and pipeline advancement. Our focus in 2026 remains on executing across the CF franchise, bringing CASGEVY to more patients around the globe and continuing to launch JOURNAVX, as we also prepare for the anticipated near‑term commercialization of povetacicept in IgAN. With expanding leadership in CF, exciting commercial momentum, and multiple mid- and late-stage programs advancing, Vertex is well positioned to deliver long‑term value for patients and shareholders.” — see report.

European Stock Indices

CAC 40 +0.33%

DAX -0.01%

FTSE 100 -0.67%

Commodities

Gold spot -3.18% to $4,921.30 an ounce

Silver spot -10.83% to $75.16 an ounce

West Texas Intermediate -3.07% to $62.91 a barrel

Brent crude -2.97% to $67.59 a barrel

On Thursday, gold prices declined, reaching their lowest point in nearly a week, as concerns about AI’s impact on some companies and sectors’ future earnings, triggered a drop across risk assets. Spot gold was down -3.18% to $4,921.30 per ounce, having touched its lowest level since 6th February earlier in the session.

Silver also declined, plunging -10.83% to $75.16 per ounce, following an increase of +4.35% on Wednesday.

Oil prices dropped on Thursday due to falling demand, retreating fears of renewed Middle East conflict and expected increases in supply.

Brent crude oil futures settled at $67.59 a barrel down $2.07, or -2.97%. US WTI crude finished at $62.91 a barrel, down $1.99, or -3.07%.

On Thursday the International Energy Agency said global oil demand will rise more slowly than previously expected this year. It projected a sizable surplus despite outages that cut supply in January.

On the supply side, Russia's seaborne oil products exports in January rose 0.7% from December to 9.12 million metric tons on high fuel output and a seasonal drop in domestic demand.

Saudi Midad eyes Lukoil assets amid sanctions. Saudi-backed Midad Energy has entered into a term sheet to acquire the sanctioned assets of Russia’s Lukoil, positioning itself in a high-stakes competition alongside other bidders such as Carlyle Group. The proposed transaction remains subject to approval by US regulators, sources told Reuters.

This move reflects the ongoing efforts by Lukoil to divest international holdings constrained by Western sanctions and highlights the increasing interest from Middle Eastern investors in acquiring discounted oil and refining assets globally. However, these transactions face rigorous regulatory oversight and are subject to significant geopolitical risk.

The agreement, finalised in late January, encompasses all targeted assets, according to sources. Midad has committed to placing its all-cash offer in escrow while both parties pursue the necessary regulatory clearances, including authorisation from the US Treasury.

US authorities have granted temporary general licence extensions for sanctioned Russian energy assets, allowing limited maintenance, wind-down activities, and tightly regulated divestiture exploration. These measures aim to prevent sudden market disruptions while maintaining regulatory oversight.

Any final transfer of Lukoil’s sanctioned assets will nonetheless require explicit approval from US authorities, with no assurance that Washington will authorise the sale.

Midad had previously emerged as one of the foremost contenders for Lukoil’s international portfolio. This portfolio, which includes oilfields, refineries, and thousands of fuel stations worldwide, attracted substantial interest from global investors, including a rival bid from Carlyle.

US sanctions have stalled Lukoil’s efforts to sell its foreign assets, forcing Russian energy companies and buyers to depend on escrow and conditional payments until they receive US government approval.

Note: As of 4 pm EST 12 February 2026

Currencies

EUR -0.01% to $1.1869

GBP -0.02% to $1.3622

Bitcoin -2.92% to $65,796.45

Ethereum -2.38% to $1,922.70

On Thursday, the US dollar was little changed against major peers. The dollar index was marginally lower by -0.01% at 96.90.

The euro depreciated slightly by -0.01% against the dollar, closing at $1.1869, while the US dollar fell -0.29% against the Swiss franc, reaching 0.7695. The British pound fell -0.02% against the US dollar.

The Japanese yen continued to be supported by optimism following Prime Minister Sanae Takaichi's Liberal Democratic Party's decisive victory in last Sunday's election, which strengthened her mandate to pursue increased investment and reduced taxation to stimulate the Japanese economy.

The yen appreciated +0.34% against the dollar, reaching ¥152.72, marking four consecutive sessions of gains.

Fixed Income

US 10-year Treasury -7.3 basis points to 4.104%

German 10-year -1.6 basis points to 2.782%

UK 10-year gilt -2.6 basis points to 4.455%

US Treasury yields declined on Thursday. Yields briefly retraced some of their losses after the US Department of Labor reported that initial claims for state unemployment benefits fell by 5,000 to a seasonally adjusted 227,000. Although this was above the estimated 222,000, it signalled stability within the labour market.

The yield on the US 10-year Treasury note dropped -7.3 bps to 4.104%, marking its most substantial single-day decline since 10th October.

Yields continued to decline following a robust auction of $25 billion in 30-year bonds, with a bid-to-cover ratio of 2.66x, higher than the average of 2.36x.

The yield on the 30-year US Treasury bond fell -7.0 bps to 4.739%, after reaching 4.728%, its lowest level since 3rd December.

The yield curve spread between two-year and 10-year Treasury notes, stood at 64.2 bps after dipping to 63.2 bps earlier in the session, the lowest since 27th January.

The two-year US Treasury yield, closely aligned with expectations for the Fed funds rate, declined -6.7 bps to 3.462%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 57.9 bps of cuts in 2026, higher than the 55.2 bps priced in the previous week. Fed funds futures traders are now pricing in a 7.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 18.4% a week ago.

Market participants will focus on the CPI release today.

In the eurozone, the yield on Germany’s 10-year bund fell -1.6 bps, after briefly dropping to 2.783%, its lowest mark since 14th January.

The yield on the two-year bond declined -0.8 bps to 2.066%. At the longer end of the curve, the 30-year yield was also lower, down -1.2 bps at 3.446%.

The Italian 10-year government bond yield fell -1.5 bps, after earlier touching 3.386% - a level not seen since late November - before settling at 3.391%.

The yield spread between the Italian and German 10-year bonds stood at 60.9 bps, having narrowed to as low as 53.5 bps in mid-January, the tightest spread since August 2008.

Money markets are currently pricing in a 23% probability of an ECB rate cut by December.

Note: As of 5 pm EST 12 February 2026

Global Macro Updates

Munich Security Conference. The Munich Security Report 2026, titled Under Destruction, delivers a stark diagnosis of a world order in accelerating disarray. At its core, the report argues that the US — the very architect of the post-World War Two international system — has become one of the principal forces dismantling it. It attributes this to the second Trump administration deploying tariffs at levels not seen since the 1930s, weaponising trade policy as a coercive instrument, and conditioning security commitments on commercial alignment. For defence and infrastructure industries, the implications are profound. European NATO members have boosted defence budgets by roughly 41% since 2021, yet procurement remains heavily tilted toward US suppliers, accounting for 51% of European equipment spending between 2022 and 2024, up from 28% between 2019 and 2021. This is entrenching dependency rather than fostering indigenous European defence capacity. Germany alone plans to invest €650 billion in defence through 2030, and has exempted military spending from its constitutional debt brake. As highlighted in Can the Defence sector be the new offensive line of your investment strategy? from our Alpha Vibes series, challenges persist. Rising defence budgets are, however, fuelling industrial nationalism and fragmentation across the continent, inflating costs and eroding joint procurement targets that EU members have missed since 2007, thus forfeiting critical economies of scale. Furthermore, US - China trade frictions are disrupting supply chains in critical minerals that directly affect Europe's automotive and defence sectors.

On the geopolitical front, the report identifies Russia's full-scale war in Ukraine, now in its fifth year, as the most significant direct threat to NATO and European security. Russia has devoted nearly 8% of GDP to defence and escalating a hybrid warfare campaign that includes sabotage, cyberattacks, arson, and unauthorised drone incursions across European airspace. Intelligence agencies estimate Russia could reconstitute forces capable of a regional conflict in the Baltic Sea area within two years of a potential ceasefire. Simultaneously, Washington's posture has shifted from guarantor to conditional partner: US military aid to Ukraine has dropped sharply since January 2025, with Europe left to shoulder the bulk of the burden. A leaked 28-point US-backed peace plan leaned heavily toward Russian interests, blindsiding European capitals. In the Indo-Pacific, China's defence budget now exceeds one-third of US defence spending, its nuclear warhead stockpile is projected to reach 1,500 by 2035, and its increasingly coercive behaviour toward Taiwan and neighbours has prompted Japan, South Korea, Taiwan, and the Philippines to announce significant defence spending increases. The report's overarching warning is that a world shaped by ‘wrecking-ball politics’ risks collapsing into transactional deal-making where the strong prey on the weak, with the rules-based international order ‘battered but not broken’.

This weekend's Munich Security Conference, 13th – 15th February, will test transatlantic relations and Europe's ability to act on its own. Secretary of State Marco Rubio, leading the US delegation including over 50 members of Congress, is expected to deliver a traditional foreign policy speech expressing support for the alliance while underscoring Washington's strategic pivot toward the Western Hemisphere and Asia — a marked contrast to Vice President Vance's abrasive address last year. Eurasia Group has identified ‘Europe under siege’ and ‘Russia's second front’ among its top risks for 2026, warning that the continent's political centre is collapsing just as it must fill the security vacuum left by America's retreat. It notes that the most dangerous front may shift from Ukraine's trenches to a broader hybrid war between Russia and NATO. Politico frames the conference's underlying question as to whether Europeans can credibly ‘stand on their own two feet’, noting that German Chancellor Merz and French President Macron will each use their Friday addresses to articulate a vision of European strategic autonomy anchored in higher defence spending, technological independence, and reduced reliance on American military hardware and intelligence. Although there is a clear drive to boost European competitiveness, taking action proves much harder than simply expressing ambition, an issue that will continue to challenge policymakers beyond this weekend.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora