How far will the Sanae shock go?

What to look out for today

Companies reporting on Wednesday, 21st January: Truist, Charles Schwab, Halliburton, Johnson & Johnson, Travelers Companies, and Prologis

Key data to move markets today

EU: Speeches by ECB President Christine Lagarde, Bank of Spain Governor José Luis Escrivá, Bank of France Governor François Villeroy de Galhau, and Bundersbank President Joachim Nagel

UK: CPI, Core CPI, PPI Core Output, PPI Output and Input, and Retail Price Index

USA: Pending Home Sales and a speech from US President Donald Trump at the World Economic Forum

JAPAN: Merchandise Trade Balance, Imports and Exports

US Stock Indices

Dow Jones Industrial Average -1.76%

Nasdaq 100 -2.12%

S&P 500 -2.06%, with 10 of the 11 sectors of the S&P 500 down

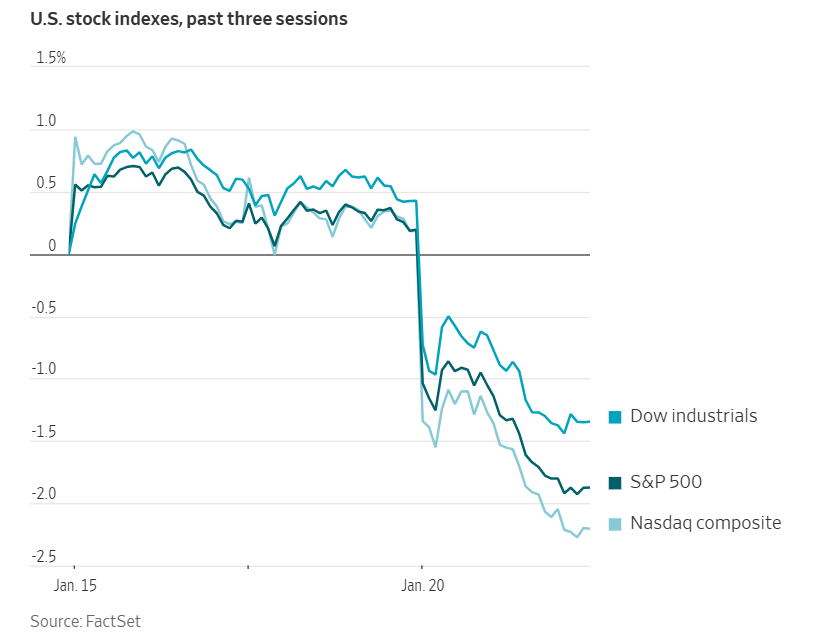

On Tuesday, equity markets had their sharpest decline since October, as President Trump's demand for the US to take control of Greenland renewed concerns about a global trade war.

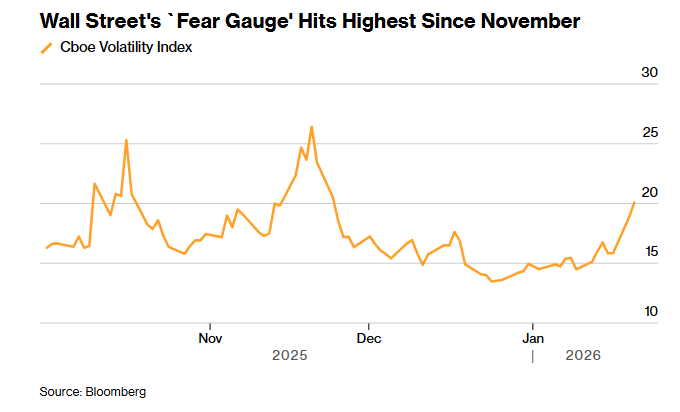

All three major US stock indices registered their most pronounced declines since 10th October. The Nasdaq Composite fell -2.39%, while the S&P 500 dropped -2.06%. The Russell 2000 also declined -1.21%, but it outperformed the US equity benchmark for the twelfth consecutive session. The VIX index surged to its highest level since November.

In corporate news, Boeing shares have recovered their earlier losses following a near-disastrous midair incident involving one of its aircraft in January 2024. This recovery reflects growing investor confidence in the company’s turnaround efforts under CEO Kelly Ortberg.

Wells Fargo announced plans to relocate the headquarters of its wealth-management division to West Palm Beach, thereby becoming the first major bank to establish this operation at the epicentre of South Florida’s burgeoning wealth sector.

Goldman Sachs and the Qatar Investment Authority have agreed to deepen their strategic partnership, potentially resulting in the sovereign wealth fund committing up to $25 billion to the Wall Street firm’s asset management operations.

The US Federal Trade Commission (FTC) filed an appeal with the US appeals court for the District of Columbia against a ruling that Meta does not hold an illegal monopoly. Last November, judge James Boasberg had said that the FTC had failed to sufficiently prove that Meta maintained monopoly power by adopting a “buy or bury” strategy.

Vitol has completed the loading of its inaugural oil shipment from Venezuelan shore-based storage facilities. This is expected to alleviate logistical bottlenecks and facilitate increased crude production in Venezuela.

GSK has reached an agreement to acquire Rapt Therapeutics, a US-based biotechnology firm specialising in treatments for inflammatory and immunologic diseases, in a transaction valued at $2.2 billion.

S&P 500 Best performing sector

Consumer Staples +0.12%, with Constellation Brands +4.47%, Monster Beverage +4.22%, and Brown-Forman +2.99%

S&P 500 Worst performing sector

Information Technology -2.94%, with NetApp -9.37%, Dell Technologies -7.45%, and Oracle -5.85%

Mega Caps

Alphabet -2.48%, Amazon -3.40%, Apple -3.45%, Meta Platforms -2.60%, Microsoft -1.16%, Nvidia -4.32%, and Tesla -4.18%

Information Technology

Best performer: Intel +3.41%

Worst performer: NetApp -9.37%

Materials and Mining

Best performer: Albemarle +5.83%

Worst performer: Celanese -5.77%

Corporate Earnings Reports

Posted on Tuesday, 20th January

Netflix quarterly revenue +17.6% to $12.051 bn vs $11.970 bn estimate

EPS at $0.56 vs $0.55 estimate

Greg Peters, Co-CEO, during the earnings call said, “And to be super clear on this point, we have often in our Netflix history debated building that theatrical business. But we were busy investing in other areas, and it never made our priority cut. But now with Warner Brothers, they are a mature, well-run, theatrical business with amazing films, and we're super excited about that addition. And then you get to the streaming side of things. You've got HBO. It is an amazing brand. It says prestige TV better than almost anything. Customers know it. They love it. They know what it means. We have programming from HBO. You know what an HBO show means? It's also very complementary to our existing service and business.” — see report.

3M quarterly revenue +3.3% to $6.000 bn vs $6.004 bn estimate

EPS at $1.83 vs $1.80 estimate

William Brown, Chairman and CEO, said, “2025 was an important year for 3M as we built a strong foundation that is reshaping our operating model and driving sustainable value creation. I want to thank the team for their dedication to eXcellence, which helped us finish 2025 with growth above macro, strong margin expansion, double-digit earnings growth, and solid cash conversion. Our accelerated pace of innovation and commercial execution positions us to outperform the macro environment again in 2026. Our continued operating rigor supports further margin expansion and earnings growth, putting us on a clear path to meet or exceed the 2027 financial commitments we outlined at our Investor Day last year." — see report.

Fastenal quarterly revenue +11.1% to $2.027 bn vs $2.038 bn estimate

EPS at $0.26 vs $0.26 estimate

Jeffery Michael Watts, President and Chief Sales Officer, during the earnings call, said, “Fastenal delivered a strong fourth quarter, capping an impressive 2025 recovery. We achieved double-digit growth in Q4 with daily sales up just over 11% and we continue to gain market share despite a sluggish industrial economy. This marks our second consecutive quarter of double-digit growth, but our success is not just about favourable comparisons, it's driven by continued progress on our strategic objectives, and they start with increasing our sales effectiveness. We're winning with key accounts and new contracts. Our focused sales strategy is yielding share gains. We're signing more national and global contracts and we're deepening relationships with existing large customers. In 2025, our total contract customer count, it grew by 241 or just over 7%, reflecting solid new customer signings and expansions. And these partnerships with big customers are the core driver of our growth." — see report.

European Stock Indices

CAC 40 -0.61%

DAX -1.03%

FTSE 100 -0.67%

Commodities

Gold spot +1.99% to $4,762.80 an ounce

Silver spot -0.11% to $94.58 an ounce

West Texas Intermediate +0.00% to $59.52 a barrel

Brent crude -0.44% to $63.90 a barrel

Gold surged to a new all-time high on Tuesday, surpassing the $4,700 per ounce threshold, as intensifying geopolitical tensions heightened demand for safe-haven assets. Silver also advanced, crossing the $95 mark for the first time on record.

Spot gold settled +1.99% to $4,762.80 per ounce following an earlier session peak of $4,765.93.

Oil prices remained stable on Tuesday, despite the temporary suspension of production at some Kazakhstan's oil fields and expectations of robust global economic growth that could bolster fuel demand.

Brent crude futures closed 28 cents, or -0.44%, lower at $63.90 per barrel. The US WTI crude contract for February delivery, which expires on Tuesday, was unchanged at $59.52.

Kazakh oil producer Tengizchevroil, operated by Chevron, announced on Monday that it had temporarily ceased operations at the Tengiz and Korolev oil fields due to an issue affecting the power distribution systems.

According to sources cited by Reuters on Tuesday, production at Tengiz may remain suspended for an additional seven to ten days, potentially reducing crude exports via the Caspian Pipeline Consortium.

Further support for the oil market stemmed from stronger-than-anticipated Q4 Chinese GDP data released on Monday. Official figures indicated that China's economy expanded by 5% last year, with refinery throughput in 2025 rising 4.1% y/o/y and crude oil output increasing by 1.5%.

Note: As of 4 pm EST 20 January 2026

Currencies

EUR +0.68% to $1.1723

GBP +0.10% to $1.3438

Bitcoin -3.77% to $89,417.16

Ethereum -6.86% to $2,990.93

On Tuesday, the US dollar experienced its most significant daily decline in over a month, following White House warnings directed at Europe regarding the future of Greenland. These developments precipitated a widespread selloff in US equities and bonds, boosting both the euro and the British pound.

The dollar index dropped by as much as 0.70%, marking its largest single-day decrease since mid-December. It closed -0.49% lower at 98.55 as market participants grew increasingly cautious about their exposure to US assets.

The euro was +0.68% to $1.1723, while the British pound advanced +0.10% to $1.3438. Sterling received a modest additional boost earlier in the session from UK labour market data, which revealed that although unemployment remained at a five-year high, there was a stabilisation in vacancy figures.

The Japanese yen, which had depreciated overnight amid intensified selling in the Japanese government bond market, regained strength as European trading commenced. This left the dollar marginally higher by +0.01% at ¥158.15.

Japanese Prime Minister Sanae Takaichi's decision to call snap elections for 8th February, along with her commitment to introduce a series of fiscal easing measures, has unsettled investors concerned about the country's precarious public finances.

Fixed Income

US 10-year Treasury +7.3 basis points to 4.300%

German 10-year bund +0.3 basis points to 2.842%

UK 10-year gilt +2.4 basis points to 4.421%

US Treasury securities declined on Tuesday, with the selloff most pronounced at the long end of the yield curve, as investors responded to volatility in Japanese government bonds and renewed threats from the US President regarding a potential trade war with the EU over its proposed acquisition of Greenland.

Japanese government bonds (JGBs) also experienced significant selling on Tuesday, with the effects spilling over into the US and European markets, following Prime Minister Sanae Takaichi's announcement of a snap election, which unsettled confidence in Japan's fiscal outlook.

A lackluster auction of Japan's 20-year bonds further intensified the selloff in Japanese government bonds.

The yield on the US 10-year Treasury note reached its highest level since late August at 4.313%, rising +7.3 bps to 4.300%.

Yields on the 30-year climbed +8.6 bps to end the session at 4.924%, after briefly touching 4.948% — its highest since early September. It was the largest daily increase since mid-July.

At the short end of the curve, the two-year Treasury yield eased -1.3 bps to 3.605%.

Consequently, the yield curve steepened on Tuesday, with the spread between two-year and ten-year yields widening to as much as 70.9 bps — the largest gap in approximately two weeks.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 46.0 bps of cuts in 2026, lower than the 53.4 bps priced in the previous week. Fed funds futures traders are now pricing in a 5.0% probability of a 25 bps rate cut at January’s FOMC meeting, up from 2.2% a week ago.

On Tuesday, eurozone yield curves experienced a notable steepening, driven by a selloff in longer-dated bonds, while shorter-term maturities registered modest gains.

Germany’s 10-year government bond yield rose +1.9 bps to end the session at 2.861%, having earlier reached 2.894%, its highest level in two weeks.

The yield on the 30-year German bond was +2.9 bps to 3.454%, whereas the two-year yield declined -3.0 bps to 2.092%.

German government bonds also demonstrated slight outperformance relative to other European markets on Tuesday, which may reflect a degree of safe-haven demand.

Italy’s 10-year yield advanced +3.6 bps to 3.502%, while France’s equivalent rose +2.2 bps to 3.526%. French bonds had outperformed the previous day after Prime Minister Sebastien Lecornu announced his intention to invoke special constitutional powers to secure passage of the 2026 budget, having garnered sufficient political support to withstand the anticipated no-confidence motion.

Note: As of 5 pm EST 20 January 2026

Global Macro Updates

From the 'Takaichi trade' to the 'Sanae shock'. Significant repercussions followed Tuesday’s sharp decline in superlong Japanese government bonds (JGBs). The exceptionally rare surge of more than 20 bps in yields for both the 30-year and 40-year maturities surpassed previous records. According to Nikkei, the primary trigger was Prime Minister Takaichi’s press conference on Monday evening, during which she officially announced the dissolution of the lower house and unveiled a plan to eliminate the consumption tax on food for two years, without providing specifics on funding sources. This announcement heightened concerns regarding fiscal discipline, inviting comparisons to the UK’s ‘Truss shock’ in 2022.

The JGB market response reflected skepticism about whether the proposed tax cut would indeed be temporary as promised. This episode is now being referred to as the ‘Sanae shock.’ The heightened volatility in superlong bonds revealed a structural shift within the market, highlighting the growing influence of foreign investors amid declining participation from domestic institutional investors. This points to a significant contraction in investment time horizons and may contribute to greater future volatility.

Data from the Japan Securities Dealers Association (JSDA) indicated that foreign investors accounted for more than half of all superlong bond purchases last year. Total net purchases of Japanese bonds reached JPY13.3 trillion last year, a record high on a comparable basis dating back to 2005. There has been a substantial gap in demand resulting from reductions in BoJ purchases. Life insurance companies, which had traditionally been predominant in the superlong sector, have shown a reduced appetite for these bonds due the need to comply with revised asset-liability management (ALM) matching regulations.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora