Will Venezuelan oil turn the tide?

What to look out for today

Companies reporting on Friday, 16th January: State Street, M&T Bank, PNC Financial

Key data to move markets today

EU: German Harmonised Index of Consumer Prices and Italian CPI

USA: Industrial Production and a speech by Fed Vice Chair Michelle Bowman

US Stock Indices

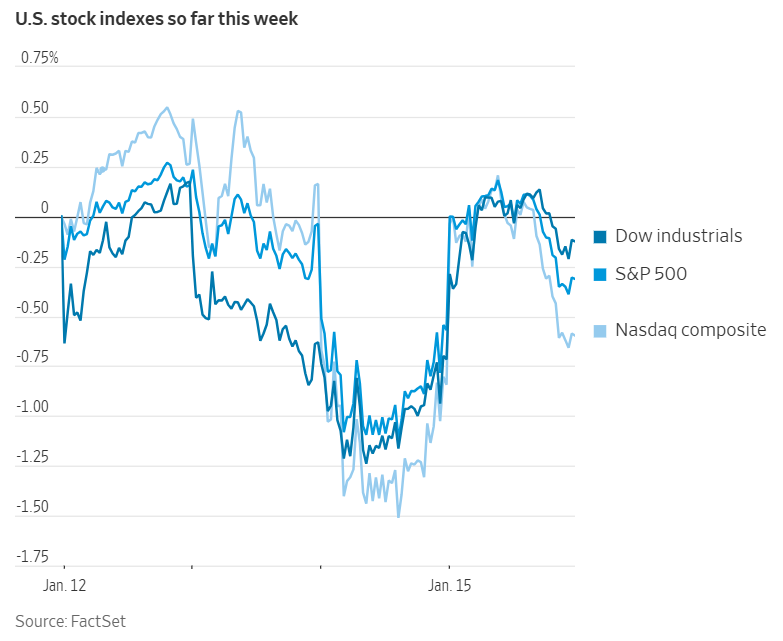

Dow Jones Industrial Average +0.60%

Nasdaq 100 +0.32%

S&P 500 +0.26%, with 4 of the 11 sectors of the S&P 500 up

Investors welcomed upbeat earnings reports from two of Wall Street’s leading banks and a key supplier to the AI sector. The Dow Jones Industrial Average led major indices, recovering Wednesday’s losses.

Semiconductor stocks including Applied Materials, AMD, and ASML advanced following a record-setting quarter by contract chipmaker TSMC. Goldman Sachs and Morgan Stanley both exceeded earnings forecasts, with the former achieving record annual revenue.

The Nasdaq Composite finished the day up +0.25% after giving back most of its earlier gains; at its peak on Thursday, the index had risen more than one percent. This rebound followed the Nasdaq’s worst session in a month on Wednesday. After also retreating from intraday highs, the S&P 500 closed +0.26% higher, while the Dow Jones Industrial Average advanced +0.60%.

Year to date, the Russell 2000 has had the strongest start, with the index up +7.76% compared to a modest +1.24% gain for the Nasdaq. After a +0.86% increase on Thursday, the Russell 2000 has outperformed the S&P 500 for ten consecutive sessions. According to Dow Jones Market Data, this is its longest streak against the broader benchmark since 2008.

In corporate news, a judge declined to expedite Paramount Skydance’s lawsuit, which alleges that directors of Warner Bros. Discovery misled investors regarding a buyout offer exceeding $82.7 billion from Netflix.

Boston Scientific announced an agreement to acquire medical device manufacturer Penumbra in a transaction valued at over $14 billion, aiming to expand its presence in treatments for blood clots and strokes.

Talen Energy agreed to purchase three natural gas power plants from Energy Capital Partners for $3.5 billion. Power producers are seeking to acquire generation assets amid surging electricity demand driven by AI.

Spotify announced an 8% increase in the price of its premium subscription service as part of its efforts to achieve sustained profitability.

S&P 500 Best performing sector

Utilities +1.04%, with Vistra +6.63%, NRG Energy +5.79%, and Constellation Energy +3.28%

S&P 500 Worst performing sector

Energy -0.91%, with Devon Energy -4.22%, ONEOK -3.30%, and Occidental Petroleum -2.59%

Mega Caps

Alphabet -0.94%, Amazon +0.62%, Apple -0.69%, Meta Platforms +0.86%, Microsoft -0.59%, Nvidia +2.13%, and Tesla -0.13%

Information Technology

Best performer: KLA +7.70%

Worst performer: IBM -3.59%

Materials and Mining

Best performer: Steel Dynamics +2.52%

Worst performer: LyondellBasell Industries -2.15%

Corporate Earnings Reports

Posted on Thursday, 15th January

Goldman Sachs quarterly revenue -3.0% to $13.454 bn vs $14.520 bn estimate

EPS at $14.01 vs $11.80 estimate

David Solomon, Chairman, DJ and CEO, said, “Since our first Investor Day where we laid out our comprehensive strategy, the firm has grown its revenues by 60%, improved returns by 500 basis points and delivered total shareholder returns of more than 340%. We continue to see high levels of client engagement across our franchise and expect momentum to accelerate in 2026, activating a flywheel of activity across our entire firm. While there are meaningful opportunities to deploy capital across our franchise and to return capital to shareholders, our unwavering focus remains on maintaining a disciplined risk management framework and robust standards.” — see report.

Morgan Stanley quarterly revenue +10.3% to $17.890 bn vs $17.741 bn estimate

EPS at $2.68 vs $2.43 estimate

Ted Pick, Chairman and CEO, said, “Morgan Stanley delivered outstanding performance in 2025. The Firm produced full-year revenues of $70.6 billion, EPS of $10.21 and a ROTCE of 21.6%. Our performance reflects multi-year investments which have contributed to growth and momentum across the Integrated Firm. Total client assets in Wealth and Investment Management grew to $9.3 trillion, supported by over $350 billion in net new assets. Our Institutional Securities business served as a trusted advisor to clients as investment banking activity accelerated and global markets remained strong. The four pillars of the Integrated Firm – Strategy, Culture, Financial Strength and Growth – support our ability to drive long-term value for shareholders." — see report.

TSMC quarterly revenue +25.5% to $33.111 bn vs $32.627 bn estimate

EPS at $0.62 vs $0.57 estimate

Wendell Huang, Senior VP and Chief Financial Officer, said, “Our business in the fourth quarter was supported by strong demand for our leading-edge process technologies. Moving into first quarter 2026, we expect our business to be supported by continued strong demand for our leading-edge process technologies." — see report.

European Stock Indices

CAC 40 -0.21%

DAX +0.26%

FTSE 100 +0.54%

Commodities

Gold spot -0.27% to $4,615.12 an ounce

Silver spot -0.83% to $92.37 an ounce

West Texas Intermediate -2.90% to $59.28 a barrel

Brent crude -2.65% to $63.82 a barrel

Gold prices declined on Thursday as the demand for safe-haven assets eased.

Spot gold fell -0.27%, reaching $4,615.12 per ounce, following a record high of $4,642.72 registered on Wednesday.

However, the Governor of Poland's central bank, Adam Glapinski, announced that the institution held 550 tons of gold at the end of 2025 and intends to increase its reserves to 700 tons.

In addition, spot silver decreased -0.83% to $92.37 per ounce after hitting an all-time high of $93.57 earlier in the day.

Oil prices declined by more than two percent on Thursday, bringing an end to a five-day streak of consecutive gains.

Brent crude futures settled at $63.82 per barrel, a drop of $1.74 or -2.65%. US WTI crude fell by $1.77, or -2.90%, to close at $59.28 per barrel.

Both benchmarks had climbed to multi-month highs earlier this week. On Wednesday, Brent had reached $66.82 per barrel, its highest level since September.

Global traders and refineries position for Venezuelan crude comeback. Several European partners of Venezuela’s state-owned oil company, PDVSA, including Spain’s Repsol, Italy’s Eni, and France’s Maurel & Prom, have submitted applications to the US government seeking licences or authorisations to export oil from the OPEC member nation, according to industry sources cited by Reuters.

The terms requested are reportedly similar to those previously granted by Washington. The terms permitted these companies to receive and export Venezuelan crude for their refineries and other clients while also supplying fuel to Venezuela as part of a debt-recovery arrangement.

These companies have been unable to export Venezuelan oil since Q2 2025, following the suspension of licences by the US administration. Repsol recently participated in a meeting at the White House, where the US President urged a group of oil companies to invest in Venezuela.

Following the capture of dictator Nicolas Maduro, the US has indicated its intention to ease the sanctions imposed on Venezuela since 2019.

PDVSA’s European partners are engaged in multiple projects within Venezuela and may require individual authorisations for each initiative. Some requests were submitted several months ago, while others have been re-submitted in recent days, according to sources.

The petitions from European energy firms follow two authorisations granted to traders Vitol and Trafigura last week, which allowed the first $500 million in oil sales. This was confirmed by a government official on Wednesday.

Shipping data indicate that at least two tankers have departed Venezuela in recent weeks, carrying oil exports to Caribbean terminals. Curacao’s port authority reported on Wednesday that one vessel arrived at the government-operated Bullen Bay terminal, where several trading companies lease storage tanks, according to local media reports.

Earlier this month, Caracas and Washington reached an agreement for the supply of 50 million barrels of crude oil, marking the initial phase of an ambitious $100 billion plan to revitalise Venezuela’s struggling oil sector.

Industry sources also noted that other companies, including US-based Valero Energy, India’s Reliance, and traders Mercuria and Glencore, are engaged in discussions with Washington regarding licences to conduct business with Venezuela. Marathon Petroleum confirmed to Reuters that it too is participating in talks for a licence.

Permian Powerhouse? Devon and Coterra approach merger. Devon Energy and Coterra Energy are reportedly engaged in discussions regarding a potential merger, which, if realised, would establish one of the largest independent shale producers in the US, according to an exclusive report by Reuters.

This prospective union would represent one of the most significant transactions among American energy companies in recent years. The timing coincides with downward pressure on US crude prices, stemming from a temporary global oil surplus and the anticipated entry of additional supply from Venezuela.

Although energy sector mergers and acquisitions slowed in 2025 compared to previous record levels, the rationale for further consolidation among US oil and natural gas producers remains compelling. Key advantages include achieving economies of scale — crucial for managing costs in a depressed price environment — and securing new resource bases as many shale formations reach maturity and premium development acreage becomes increasingly scarce.

Both Devon and Coterra maintain operations across several shale regions, including the Delaware portion of the Permian Basin in Texas and New Mexico and the Anadarko Basin in Oklahoma.

Devon Energy also holds assets in the Eagle Ford play of South Texas and the Williston Basin in North Dakota. Coterra, formed in 2021 through the merger of Cimarex Energy and Marcellus-focused Cabot Oil & Gas, has established a significant presence in Appalachia.

Coterra is currently under pressure from Kimmeridge Energy Management, an investment firm that, on 4th November, publicly called for changes in the company’s governance and strategic direction. Kimmeridge, recognised as one of the most prominent activist investors in the oil and gas sector, also holds a stake in Devon, according to regulatory disclosures.

Note: As of 4 pm EST 15 January 2026

Currencies

EUR -0.32% to $1.1606

GBP -0.48% to $1.3378

Bitcoin -2.01% to $95,549.24

Ethereum -2.02% to $3,297.84

The dollar advanced to a six-week high on Thursday, with the dollar index climbing +0.30% to 99.37 and reaching an intraday peak of 99.49, its highest level since 2nd December. The euro fell -0.32% to $1.1606, touching a low of $1.1592, also marking its weakest point since 2nd December.

Despite stronger-than-expected economic data from the UK showing robust growth in November, sterling continued to decline against the dollar on Thursday. The UK GDP recorded its fastest expansion since June, bolstered by the resumption of full production at Jaguar Land Rover following a cyberattack that had previously disrupted operations for the automaker and its suppliers.

The pound was down -0.48% at $1.3378, a sharper decline compared to its earlier 0.10% drop before the data release. The euro appreciated by +0.15% against the pound to 86.54 pence.

The Japanese yen weakened amid concerns that Prime Minister Sanae Takaichi may implement more expansionary fiscal policies. According to the party's secretary general, Takaichi intends to dissolve parliament next week and call for a snap parliamentary election, seeking public support for her proposed spending initiatives. The Japanese yen declined by -0.13% against the greenback at ¥158.64.

Fixed Income

US 10-year Treasury +3.9 basis points to 4.178%

German 10-year bund +0.2 basis points to 2.821%

UK 10-year gilt +4.8 basis points to 4.392%

On Thursday, yields on US Treasury rose following the release of economic data that exceeded expectations, thereby tempering anticipations of imminent interest rate cuts by the Fed.

The yield on the 10-year US Treasury note was +3.9 bps to 4.178%, while the yield on the 30-year bond ended the session +1.3 bps higher at 4.800%. At the shorter end, the two-year Treasury yield rose +5.3 bps to 3.522%.

The spread between the yields on two- and 10-year Treasury notes stood at 60.3 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 47.6 bps of cuts in 2026, lower than the 57.0 bps priced in the previous week. Fed funds futures traders are now pricing in a 5.5% probability of a 25 bps rate cut at January’s FOMC meeting, up from 4.4% a week ago.

Eurozone government bond yields remained stable during afternoon trading on Thursday, following a decline to their lowest levels in over a month observed the previous day.

Germany’s 10-year yield edged +0.2 bps higher to 2.821%, while the two-year yield increased +2.5 bps to 2.103%.

European yields have been moving downward this year from recent highs as multiple countries have successfully completed bond issuances — alleviating a concern that weighed on markets late last year. Germany’s 10-year yield rose to as high as 2.91% in late December, marking a nine-month peak.

On Thursday, Spain issued a total of 5.86 billion euros in debt, drawing robust investor demand, while Germany had attracted healthy interest with its auction on Wednesday.

French government bond auctions have also been met with solid demand, even as France remains a focal point for eurozone bond investors amid ongoing efforts to approve the 2026 budget. According to Bank of France Governor François Villeroy de Galhau, France risks entering a ‘danger zone’ if its deficit exceeds 5% in 2026.

Nevertheless, in secondary markets on Thursday, French bond performance closely tracked that of the German benchmark, with the 10-year yield declining -0.3 basis points to 3.481%. Italy’s 10-year yield also registered a modest decrease of -1.5 basis points, settling at 3.442%.

Earlier in the day, Martins Kazaks, Governor of Latvijas Banka, remarked that interest rates remain appropriately set and recent eurozone inflation data has been encouraging.

Note: As of 5 pm EST 15 January 2026

Global Macro Updates

Fedspeak defends Fed Chair Powell's record against a backdrop of independence concerns. Minneapolis Fed President Neel Kashkari expressed skepticism about a rate cut in January and cautioned that inflation may persist at elevated levels. In contrast, Fed Governor Stephen Miran – unsurprisingly – advocated for a more aggressive approach to easing monetary policy.

On Thursday, in an interview with CNBC, Chicago Fed President Austan Goolsbee reiterated his expectation for rate cuts within the year, though he emphasised the need for supporting data to confirm this outlook. He also warned that the loss of central bank independence could result in a resurgence of inflation.

Fed Governor Michael Barr in an interview with Yahoo Finance characterised the Department of Justice’s investigation into Fed Chair Powell as a threat to the Fed’s independence and stated that interest rates are currently appropriately calibrated.

Kansas City Fed President Jeff Schmid cautioned against complacency regarding inflation, stressing the considerable risks associated with undermining the Fed’s credibility. Philadelphia Fed President Anna Paulson commented to The Wall Street Journal that current rates are somewhat restrictive, but the central bank can afford to be patient and monitor incoming data.

San Francisco Fed President Mary Daly advocated for a cautious and deliberate approach to policy adjustments, noting that while economic data appear encouraging, uncertainties and risks remain with respect to the Fed’s dual mandate of price stability and maximum employment.

Germany exits stagnation with 0.2% growth and Q4 beat. Germany's economy expanded by 0.2% in 2025, marking the end of a two-year recession. This growth aligned with market consensus and surpassed the IFO Institute's forecast of 0.1%. Q4 growth also reached 0.2%, outperforming expectations, while Q1 results were revised upward by 0.1 percentage points to 0.4%, according to DeStatis.

The primary drivers of this recovery were household and government consumption, which increased by 1.4% and 1.5%, respectively, effectively offsetting declines in exports (-0.3%) and investment (-0.5%). Despite these positive developments, the manufacturing sector contracted by 1.3% and construction declined by 3.6%. In contrast, services experienced an increase of 1.2% to 1.4%. The annual growth rate of 0.2% does not indicate a significant shift in the overall economic trend, as growth has remained subdued since the peak in 2021. Additionally, unemployment rose to 6.3% in January, the highest level since 2013.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora