What will the Fed’s projections be?

Key data to move markets today

EU: A speech by ECB President Christine Lagarde

UK: A speech by BoE Governor Andrew Bailey

USA: Fed Interest Rate Decision, Fed Monetary Policy Statement, FOMC Economic Projections, Interest Rate Projections, FOMC Press Conference, Employment Cost Index, and Monthly Budget Statement

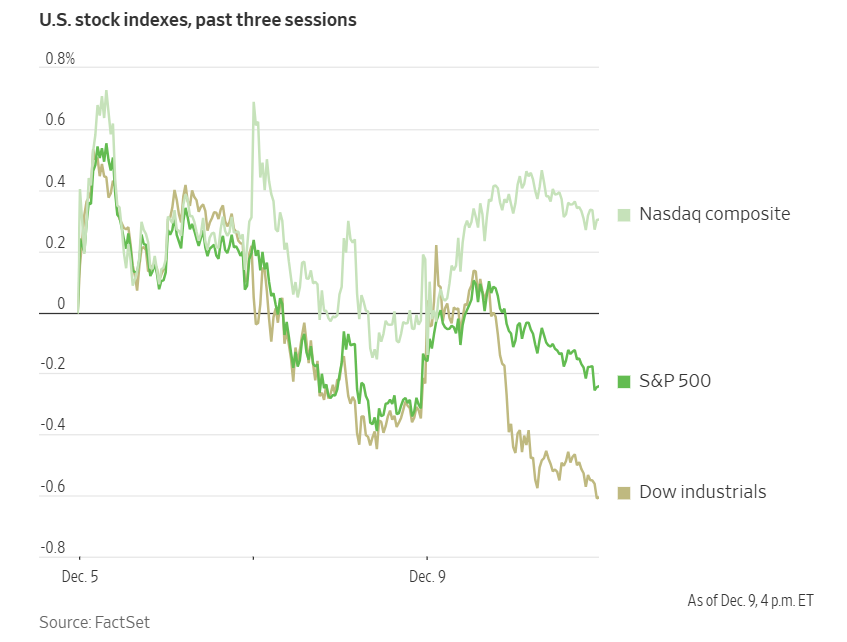

US Stock Indices

Dow Jones Industrial Average -0.38%

Nasdaq 100 +0.16%

S&P 500 -0.09%, with 5 of the 11 sectors of the S&P 500 down

A decline in JPMorgan Chase shares contributed to a downturn in the Dow Jones Industrial Average Tuesday. JPMorgan’s stock fell -4.66% — its steepest one-day loss since April — after the nation’s largest bank informed investors that its expenses for the coming year are projected to reach $105 billion, exceeding analysts’ estimates of approximately $101 billion. The Dow closed down 179 points, or -0.38%.

The S&P 500 slipped -0.09%, though it remains near record highs, while the Nasdaq Composite managed a modest gain of +0.13%. The Russell 2000 index, which tracks smaller companies, advanced +0.21%, approaching a new record level at 2,526.24.

In corporate news, AutoZone reported Q3 EPS that fell short of expectations, despite same-store sales aligning with forecasts.

Campbell’s outperformed projections for its quarterly results, although both profit and revenue declined.

Ares Management is set to be included in the S&P 500, replacing Kellanova. Its shares surged +7.27% in response.

CVS Health raised its annual outlook and anticipates profit growth next year.

PepsiCo reached an agreement with activist investor Elliott Investment Management to implement cost reductions and lower food prices across its operations.

British American Tobacco said its 2026 financial results are expected to fall at the lower end of its guidance range.

Accenture announced a three-year partnership with Anthropic to provide artificial intelligence services to business clients. Anthropic now leads OpenAI among corporate users.

S&P 500 Best performing sector

Energy +0.69%, with Targa Resources +2.56%, Exxon Mobil +1.96%, and Halliburton +1.78%

S&P 500 Worst performing sector

Health Care -0.98%, with Solventum -3.01%, Biogen -2.55%, and IQVIA -2.46%

Mega Caps

Alphabet +1.05%, Amazon +0.45%, Apple -0.26%, Meta Platforms -1.48%, Microsoft +0.20%, Nvidia -0.33%, and Tesla +1.27%

Information Technology

Best performer: F5 +3.94%

Worst performer: VeriSign -3.34%

Materials and Mining

Best performer: Newmont +5.72%

Worst performer: International Paper -2.41%

European Stock Indices

CAC 40 -0.69%

DAX +0.49%

FTSE 100 -0.03%

Commodities

Gold spot +0.41% to $4,206.68 an ounce

Silver spot +4.34% to $60.65 an ounce

West Texas Intermediate -0.88% to $58.35 a barrel

Brent crude -0.67% to $62.07 a barrel

Gold advanced on Tuesday, while silver surged to $60 per ounce on ongoing supply constraints.

Spot gold increased +0.41% to $4,206.68 per ounce. Spot silver hit a record high, climbing +4.34% to $60.65 per ounce.

Market participants expect robust industrial demand for silver in the coming years. According to a research report from the industry association Silver Institute, sectors such as solar energy, electric vehicles and related infrastructure, and data centres and artificial intelligence, are projected to drive industrial demand higher through 2030.

BIS warns of retail-driven gold bubble risk. The BIS has cautioned that retail investors are significantly contributing to gold's ascent toward ‘bubble’ territory, thereby increasing the risk of a sudden and disorderly market correction. In its latest quarterly review released on Monday, the BIS identified several signs of a bubble in the gold market, such as heightened enthusiasm among retail investors, rapidly rising valuations, and intensifying media coverage.

This warning is particularly notable given the BIS’s unique role as the ‘bank for central banks,’ which involves both facilitating and safeguarding central bank gold transactions. According to the BIS, ‘the past few quarters represent the only time in at least the last fifty years in which gold and equities have simultaneously reached such elevated levels. Historically, once a bubble enters its explosive phase, it is typically followed by a sharp and abrupt correction.’

According to the BIS, over the past three months, retail investors have made up the majority of inflows into gold and US equity funds, whereas institutional investors have generally reduced their exposure to US equities and maintained steady gold holdings.

The BIS further emphasised that the increasing dominance of retail investors in these markets could pose risks to future market stability, as their tendency for herd-like behaviour may exacerbate price volatility, particularly if rapid sell-offs occur. Additionally, inflows into gold ETFs — which include investments from both retail and institutional participants — are, according to the World Gold Council, on pace for a record-setting year.

Central bank gold purchases have also remained robust, averaging approximately 1,000 tonnes annually since 2022. However, the sharp price rally has compelled some central banks to sell portions of their gold reserves to remain within their allocation limits.

Oil prices declined on Tuesday, following a more than two percent decline in the previous session. Investors are closely monitoring ongoing peace negotiations between Russia and Ukraine and weighing concerns around abundant supply.

Brent crude futures settled 42 cents lower, or -0.67%, to $62.07 per barrel. US WTI crude decreased by 52 cents, or -0.88%, to $58.35 per barrel.

Ukraine is expected to present a revised peace proposal to the United States after discussions in London involving President Volodymyr Zelenskiy and the leaders of France, Germany, and Britain. Achieving peace between Ukraine and Russia could trigger the lifting of international sanctions on Russian companies and the release of previously restricted oil supplies. On Tuesday, approximately half of Kyiv's residents experienced power outages following renewed Russian attacks on Ukraine's energy infrastructure.

The next International Energy Agency report, scheduled for release on 11th December, is expected to provide further insight into the global oil supply outlook.

Note: As of 4 pm EST 9 December 2025

Currencies

EUR -0.10% to $1.1624

GBP -0.15% to $1.3297

Bitcoin +1.46% to $92,687.58

Ethereum +4.86% to $3,300.96

The US dollar advanced on Tuesday due to rising currency volatility. The US dollar extended its gains after US labour market data revealed a modest increase in job openings for October, even as overall hiring remained subdued. The US dollar index was +0.13% to 99.23, underscoring the dollar's broad-based strength.

The dollar climbed to a two-week high against the Japanese yen, +0.62% to ¥156.88. It was also up against the euro, which declined -0.10% to $1.1624.

The British pound was -0.15% to $1.3297 as traders placed about an 86% probability that the BoE will cut interest rates by 25 bps to 3.75% at its next policy meeting scheduled for 19th December. Market participants are expected to closely watch for the latest UK GDP figures for October, set to be released on Friday.

Fixed Income

US 10-year Treasury +2.0 basis points to 4.187%

German 10-year bund -0.5 basis points to 2.857%

UK 10-year gilt -2.4 basis points to 4.504%

On Tuesday, US Treasury yields advanced across the curve, reversing earlier declines in response to a labour market report and ahead of today’s much anticipated FOMC policy announcement.

Yields had initially moved lower during the session, but rebounded after the Labor Department reported that job openings increased to 7.67 million as of the end of October, surpassing the estimated 7.11 million.

The yield on the US 10-year Treasury note climbed +2.0 bps to 4.187% after reaching a session low of 4.141%. This marked its first four-session streak of gains in five weeks. The 30-year bond yield rose +0.5 bps to 4.809%, recovering from a session low of 4.775%. The two-year US Treasury yield — which is typically sensitive to expectations regarding Fed policy — rose +3.6 bps to 3.617%.

The yield curve, as measured by the spread between the two- and 10-year Treasury notes, stood at 57.0 bps.

Analysts characterised the $39 billion auction of 10-year notes as robust, noting a bid-to-cover ratio of 2.55x. Additional supply is expected on Thursday, with a $22 billion auction of 30-year bonds scheduled.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 88.6% probability of a 25 bps rate cut at today’s December FOMC meeting, higher than the prior week’s 88.0% and the 66.9% probability assigned a month ago. Traders are currently expecting 22.2 bps of cuts by year-end.

Eurozone government bond yields fell modestly on Tuesday. Germany’s 10-year yield slipped -0.5 bps to 2.857% after briefly reaching 2.879% — its highest level since mid-March. Monday saw the largest single-day increase in 10-year German yields since mid-August.

Long-term German government bonds also faced upward pressure, with the 30-year yield rising to its highest levels in more than 14 years before easing slightly to end the day -0.9 bps lower at 3.463%. On the shorter end of the curve, the 2-year Schatz yield closed -1.6 bps lower at 2.159%.

Italy’s 10-year yield fell -0.2 bps to 3.565%. As a result, the yield spread between Italian bonds and German Bunds widened 0.3 bps to 70.8 bps.

France’s 10-year OATSs outperformed eurozone peers, with the French 10-year yield declining -0.8 bps to 3.575%, leaving the spread between French and German yields at 71.8 bps.

French assembly passes social security bill, eases budget crisis. The French National Assembly has successfully passed the social security bill for the upcoming year, mitigating the risk of a government crisis and increasing the likelihood that lawmakers will approve a new budget before the year's end. During the legislation's second reading in the lower house, 247 members voted in favour while 234 opposed, a result that includes a provision to suspend President Emmanuel Macron’s pension reform as a concession to the Socialist Party.

The adoption of this bill enhances prospects for garnering support for the main budget when parliamentary debates commence on 15th December. The government had cautioned that failure to pass the social security legislation would have resulted in an additional €10 billion being added to next year’s welfare deficit.

This outcome also serves to temporarily quell opposition demands for Prime Minister Sebastien Lecornu’s resignation. Lecornu’s approach of granting concessions to opposition parties, particularly the Socialists — a pivotal swing group within the fragmented National Assembly — proved effective in overcoming political gridlock. Both of Lecornu’s predecessors, Michel Barnier and Francois Bayrou, were removed from office due to disputes over budgetary matters.

Note: As of 5 pm EST 9 December 2025

Global Macro Updates

Preview: Fed December meeting.The FOMC is scheduled to release its December meeting statement and updated Summary of Economic Projections (SEP) at 2:00 pm Eastern Time on Wednesday. Another 25 bps rate cut is widely expected following dovish comments made by New York Fed President John Williams on 21st November. Despite these expectations, analyst previews suggest the possibility of multiple dissents within the Committee.

Most analysts anticipate a hawkish cut, wherein the FOMC proceeds with a rate reduction while signalling a higher threshold for further easing. Several previews indicate that the statement could restore language about ‘carefully considering the extent and timing of additional adjustments,’ which had been omitted in September. Additionally, the statement may remove the reference to the unemployment rate having ‘remained low,’ acknowledging the recent increase in joblessness.

As for the SEP, only modest adjustments to the economic outlook are expected. Projections may reflect an upward revision to GDP and a slight decrease in core PCE inflation. The unemployment rate could also be revised higher, with Bank of America suggesting this adjustment might provide the Fed with cover to cut rates even as growth expectations remain elevated. Regarding the dot plot, most analysts foresee no change in the median forecast, which continues to indicate one 25 bps rate cut each in 2026 and 2027.

October JOLTS report beats expectations; both hiring and quit rates fall. The October Job Openings and Labor Turnover Survey (JOLTS) reported job openings at 7.67 million, surpassing the consensus estimate of 7.11 million and slightly above the previous reading of 7.65 million. This headline figure marks the highest level since May, with the job openings rate remaining steady at 4.6%.

The hiring rate dropped from 3.4% to 3.2%, while the separations rate also declined to 3.2% from 3.3%. The quit rate fell to 1.8%, from 2.0%, reaching its lowest point since May 2020. In September, quits within the federal government reached a series high of 46,000, attributed to buyout incentives offered to federal employees earlier in the year by the Trump administration.

The layoff and discharge rate held steady at 1.2%, with most layoffs observed in the accommodation and food services sector and state and local government. Analysts suggest that October’s hiring and separations data will provide further clarity for next week’s payroll report, with some anticipating a slowdown in private-sector hiring due to weaker seasonal demand and elevated continuing claims.

Additionally, the ADP preliminary private employment estimate indicated an average addition of 4,750 jobs per week over the four weeks ending 22nd November, ending a streak of three consecutive negative readings.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora