In the streaming wars, is IP the only anchor?

Key data to move markets today

EU: German Trade Balance and a speech by Bundesbank President Joachim Nagel

USA: ADP Employment Change 4-week average, Nonfarm Productivity, Unit Labor Costs, and JOLTS Job Openings

JAPAN: A speech by BoJ Governor Kazuo Ueda

CHINA: Consumer Price Index and Producer Price Index

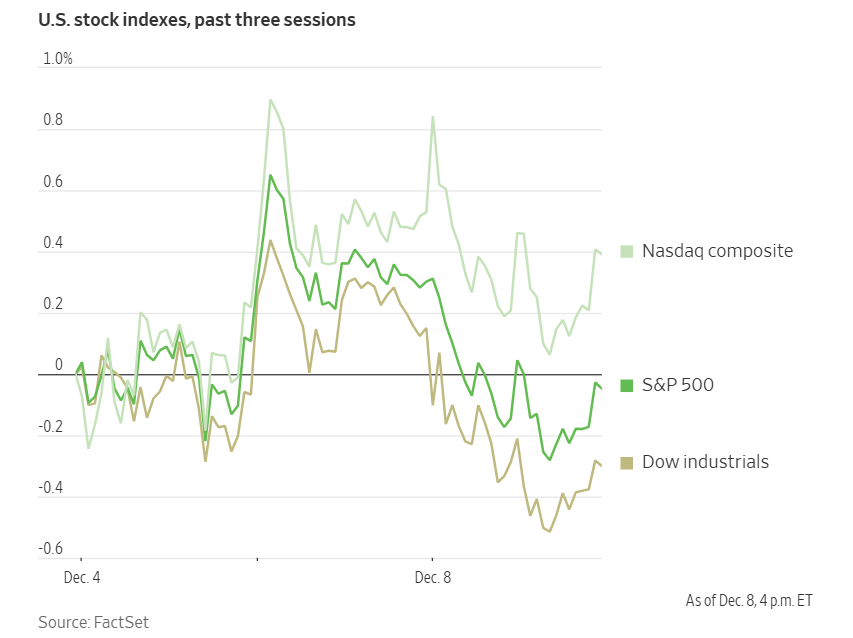

US Stock Indices

Dow Jones Industrial Average -0.45%

Nasdaq 100 -0.25%

S&P 500 -0.35%, with 10 of the 11 sectors of the S&P 500 down

Equity markets moved modestly lower on Monday. The S&P 500 declined by -0.35% after nearing an all-time high following two consecutive weeks of gains. The Dow Jones Industrial Average also fell, ending the session down -0.45%. The Nasdaq Composite displayed relative resilience, slipping only -0.14%.

Investor sentiment was dampened by ongoing uncertainty regarding the pace of monetary policy easing anticipated in 2026, compounded by concerns over the sustainability of the recent rally driven by AI.

In corporate news, IBM announced its acquisition of Confluent for approximately $9.3 billion, representing one of the company’s largest deals to date and signaling a significant commitment to enterprise software supporting artificial intelligence capabilities.

Shares of CRH and Carvana advanced after S&P Dow Jones Indices revealed both companies would be added to the S&P 500 Index prior to the opening of trading on 22nd December.

Unilever’s spinoff, The Magnum Ice Cream, debuted at a valuation below some analyst expectations, as the world’s largest ice cream company pursues renewed growth as an independent entity.

Paramount crashed the WBD party. What’s the playbook? On Monday, Paramount Skydance launched a $77.9 billion hostile takeover bid for Warner Bros. Discovery, intensifying its competition with Netflix for control of the entertainment company by appealing directly to Warner’s shareholders.

Just days prior, on Friday, Netflix had reached an agreement to acquire Warner Bros. for $72 billion, contingent upon Warner’s split of its studios and HBO Max streaming business from its cable networks. The announcement reverberated throughout Hollywood and Wall Street, underscoring the magnitude of the proposed transaction.

In such tender offers, shareholders are given a deadline — often subject to extension — to participate. Warner’s shareholders have until 8th January to decide whether to accept Paramount’s all-cash bid of $30 per share, unless this deadline is extended.

Warner Bros. Discovery has indicated it is currently reviewing Paramount’s proposal, while continuing to recommend that shareholders support the deal with Netflix, which will be subject to a future shareholder vote. The Netflix transaction, valued at $27.75 per share, includes a minor allocation of Netflix shares as part of the consideration. However, Warner believes the true value is closer to $31–$32 per share, factoring in the continued ownership of Warner’s cable networks by its shareholders following the corporate split. Paramount also retains the option to increase its offer before the tender period expires.

The company has a period of 10 business days — ending Monday, 22nd December — to consult with its advisers and determine whether Paramount’s bid constitutes a superior proposal compared to Netflix’s offer. Should Paramount’s bid be deemed superior, Warner would likely initiate negotiations with Paramount, granting Netflix four business days to issue a counteroffer.

If Paramount’s proposal is ultimately judged superior, Netflix will be afforded the opportunity to match or surpass the bid. Alternatively, Netflix could seek to enhance its terms with Warner during this period.

Should Warner elect to terminate its agreement with Netflix, it would be obligated to pay the streaming company a breakup fee of $2.8 billion. Conversely, if the transaction fails due to regulatory or other complications, Netflix would owe Warner $5.8 billion — a breakup fee among the largest ever, reflecting Netflix’s confidence in the deal’s completion.

If finalised, Paramount’s bid for Warner would represent the largest successful hostile tender offer in a competitive process. The current record is held by Royal Bank of Scotland’s acquisition of National Westminster Bank in 2000, which was valued at over $36 billion.

S&P 500 Best performing sector

Information Technology +0.93%, with Micron Technology +4.09%, ON Semiconductor +3.00%, and Broadcom +2.78%

S&P 500 Worst performing sector

Communication Services -1.77%, with Netflix -3.44%, T-Mobile US -2.48%, and Comcast -2.42%

Mega Caps

Alphabet -2.31%, Amazon -1.15%, Apple -0.32%, Meta Platforms -0.98%, Microsoft +1.63%, Nvidia +1.72%, and Tesla -3.39%

Information Technology

Best performer: Micron Technology +4.09%

Worst performer: Fortinet -3.90%

Materials and Mining

Best performer: Albemarle +1.61%

Worst performer: Air Products and Chemicals -9.45%

European Stock Indices

CAC 40 -0.08%

DAX +0.07%

FTSE 100 -0.14%

Commodities

Gold spot -0.17% to $4,189.59 an ounce

Silver spot -0.26% to $58.13 an ounce

West Texas Intermediate -2.11% to $58.87 a barrel

Brent crude -2.02% to $62.49 a barrel

Gold prices edged slightly lower on Monday, with spot gold declining -0.17% to $4,189.59 per ounce.

Silver also retreated, falling -0.26% to $58.13 per ounce after reaching a record high of $59.32 on Friday.

Oil prices declined by more than one percent on Monday following Iraq’s restoration of output at one of its major oilfields, which represents 0.5% of global supply. This development occurred as market participants continued to assess ongoing negotiations aimed at ending the war in Ukraine.

Brent crude futures fell $1.29, or -2.02%, to $62.49 per barrel, while US WTI crude dropped $1.27, or -2.11%, to $58.87 per barrel.

Iraq resumed production at Lukoil’s West Qurna 2 oilfield — a facility ranked among the world’s largest — after an export pipeline leak had significantly curtailed output, according to two Iraqi energy officials cited by Reuters on Monday. Earlier, prices had slightly pared their losses when reports emerged that Iraq had halted output at the field, which has a capacity of roughly 460,000 barrels per day (bpd). Both crude contracts had concluded Friday’s session at their highest levels since 18th November.

Negotiations regarding peace in Ukraine remain sluggish, with disagreements persisting over security guarantees for Kyiv and the status of Russian-occupied territories, despite continued pressure from US President Donald Trump for a resolution. On Monday, Ukrainian President Volodymyr Zelenskiy convened with European leaders in London.

Any geopolitical risk premium is being considered in light of indications of a mounting global surplus, as increased supply from both OPEC+ and non-OPEC producers continues to outpace tepid demand growth.

Chinese independent refiners have increased their purchases of sanctioned Iranian oil from onshore storage tanks, taking advantage of newly issued import quotas, according to trade sources and analysts as reported by Reuters.

Note: As of 4 pm EST 8 December 2025

Currencies

EUR -0.05% to $1.1636

GBP -0.02% to $1.3317

Bitcoin +2.44% to $91,350.84

Ethereum +4.25% to $3,148.11

The US dollar advanced against major currencies on Monday amid volatile trading conditions, as market participants prepared for a week dominated by central bank meetings, with particular focus on the upcoming Fed decision.

In addition to the FOMC's announcement scheduled for Wednesday, the central banks of Australia, Brazil, Canada, and Switzerland are set to convene for their respective rate-setting meetings, although no changes to monetary policy are anticipated from these institutions.

The dollar index increased by +0.11% to 99.10. The euro declined -0.05% to $1.1636, having previously found support from elevated eurozone bond yields, with German 30-year yields reaching their highest level since 2011 earlier in the session. Sterling edged lower by -0.02% to $1.3317 against the dollar.

The Japanese yen weakened broadly after a significant magnitude 7.6 earthquake struck Japan's northeast region late on Monday, leading to tsunami warnings and evacuation orders. Depending on the severity of the earthquake's impact, there is speculation that the BoJ may postpone a highly anticipated rate hike originally expected next week.

The dollar rose +0.37% against the yen to ¥155.92. The next BoJ monetary policy meeting is scheduled for 18th – 19th December, with the policy decision and statement expected on the second day.

The Reserve Bank of Australia is meeting today, following a series of robust data releases on inflation, economic growth, and household spending. Futures markets currently imply that the next policy move will be a rate hike, potentially as early as May.

The BoC is widely expected to maintain its current rates at Wednesday’s meeting, with markets fully pricing in a rate hike by December 2026.

Fixed Income

US 10-year Treasury +2.6 basis points to 4.167%

German 10-year bund +6.1 basis points to 2.862%

UK 10-year gilt +4.7 basis points to 4.528%

US 10-year Treasury yields advanced on Monday as investors positioned themselves ahead of the Fed’s upcoming policy announcement.

The yield on the US 10-year Treasury note climbed +2.6 bps to 4.167%, after reaching 4.192%, the highest level since 26th September, and a third consecutive session of gains. The yield on the 30-year Treasury bond increased +1.1 bps to 4.804%, having earlier touched 4.835%, its highest since 5th September.

At the short end of the curve, the two-year US Treasury yield — which typically tracks Fed interest rate expectations — rose +1.2 bps to 3.581%, after briefly reaching 3.610%, marking its highest point since 20th November.

Market analysts anticipate the Fed to deliver a hawkish cut, with the language in the statement, updated median forecasts, and Fed Chair Jerome Powell’s press conference all likely to indicate a more stringent threshold for additional rate reductions. The FOMC has not recorded three or more dissents at a meeting since 2019, an event that has occurred only nine times since 1990.

The US Treasury yield curve, measuring the spread between two- and 10-year Treasury notes, stood at a 58.6 bps.

Monday’s auction of $58 billion in three-year notes was deemed solid by analysts, with a bid-to-cover ratio of 2.64x. Additional supply is expected later in the week, as the Treasury will auction $39 billion in 10-year notes today and $22 billion in 30-year bonds on Thursday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 87.3% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 86.4% and the 66.9% probability assigned a month ago. Traders are currently expecting 21.8 bps of cuts by year-end.

Eurozone borrowing costs surged on Monday as investors reconsidered their expectations for ECB rate cuts, following robust economic data and remarks by ECB policymaker Isabel Schnabel, who indicated that the next policy move could be an interest rate increase, albeit not in the near term.

Germany’s 30-year government bond yield reached its highest level since the summer of 2011, as long-term debt markets faced global pressures stemming from concerns over rising fiscal expenditures and an increase in bond issuance.

The yield on Germany's 10-year government bond climbed +6.1 bps to 2.862%, marking its highest point since March. Germany's 30-year yield increased by +4.0 bps to 3.472%, following a weekly rise of +11.1 bps last week, representing the largest weekly jump since August.

The two-year yield, which is particularly sensitive to shifts in interest rate expectations, rose by +7.5 bps to 2.175%.

Market participants have now eliminated the prospect of an ECB rate cut in 2026, with traders assigning zero probability to such a move by July, compared to approximately 15% late last week.

In France, the 10-year yield advanced by +5.0 bps to 3.583%, with the spread between French and German 10-year yields at 72.1 bps. Italy’s 10-year yield also moved higher, up +7.3 bps to 3.567%, leaving the spread to German Bunds at 70.5 bps.

Note: As of 5 pm EST 8 December 2025

Global Macro Updates

German industrial production beat expectations. German industrial production posted an increase of 1.8% m/o/m in October, outperforming the projected 0.3% rise and following a revised 1.1% gain in September, previously reported as 1.3%. This positive result was primarily driven by strong activity in the construction, machinery, and electronics sectors, although output within the automotive industry declined. The data comes on the heels of Friday's report showing a 1.5% uptick in factory orders, propelled by an 87% surge in transport orders. This marks the first instance since early 2024 where industrial production has expanded for two consecutive months.

Market observers suggest that these encouraging figures are consistent with expectations for an improvement in Germany’s overall economic performance in Q4. The Bundesbank also anticipates output growth during this period, supported by increased government expenditure and recent rate cuts by the ECB. Nevertheless, forward-looking indicators such as the Purchasing Managers’ Index remain subdued, and BDI President Leibinger cautioned last week that the economy is facing a ‘dramatic low point.’ Business sentiment across Germany continues to be cautiously optimistic, with ongoing disappointment regarding the pace of government reforms and the scale of investment initiatives.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora