Is policy divergence accelerating?

Key data to move markets today

EU: German Industrial Production and Eurozone Sentix Investor Confidence

UK: BRC Like-For-Like Retail Sales, and speeches by BoE’s MPC External Member Alan Taylor and Deputy Governor Clare Lombardelli

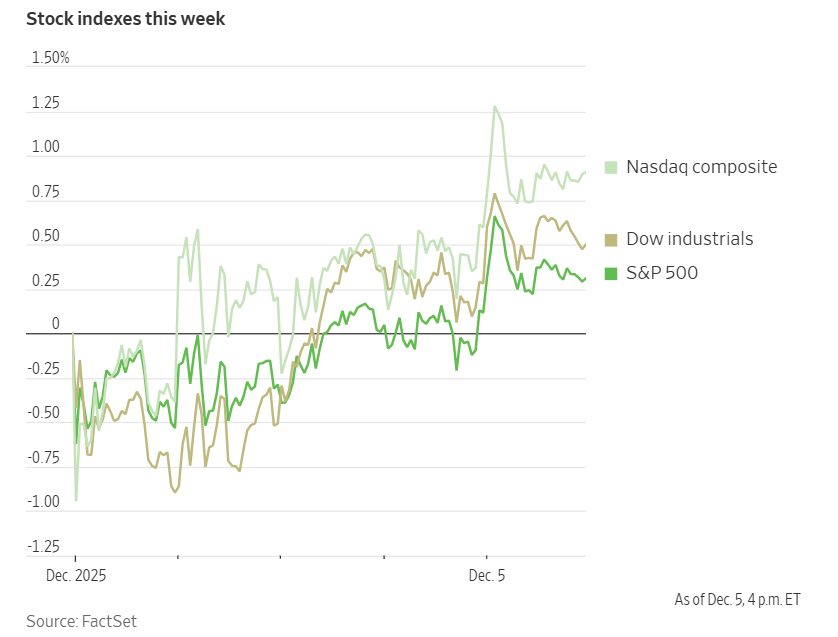

US Stock Indices

Dow Jones Industrial Average +0.22%

Nasdaq 100 +0.43%

S&P 500 +0.19%, with 4 of the 11 sectors of the S&P 500 up

Stocks concluded the week near record highs, buoyed by investor optimism that the Fed will announce an interest rate cut this week. On Friday, the S&P 500 advanced by +0.19%, while the Nasdaq Composite gained +0.31%. The Dow Jones Industrial Average increased by 104 points, or 0.22%. On a weekly basis, the S&P 500 achieved a +0.31% gain, the Nasdaq Composite rose +0.91%, and the Dow Jones Industrial Average climbed +1.41%. Additionally, the Russell 2000 index, which tracks small-cap companies, recorded a weekly increase of +0.84%.

In corporate news, SpaceX is reportedly preparing to sell insider shares in a transaction that would value the company at a level surpassing OpenAI’s landmark $500 billion valuation, according to sources cited by The Wall Street Journal.

SoftBank Group is engaged in discussions to acquire DigitalBridge Group, a private equity firm focused on investments in digital infrastructure such as data centers, aiming to capitalize on the accelerating demand driven by AI advancements.

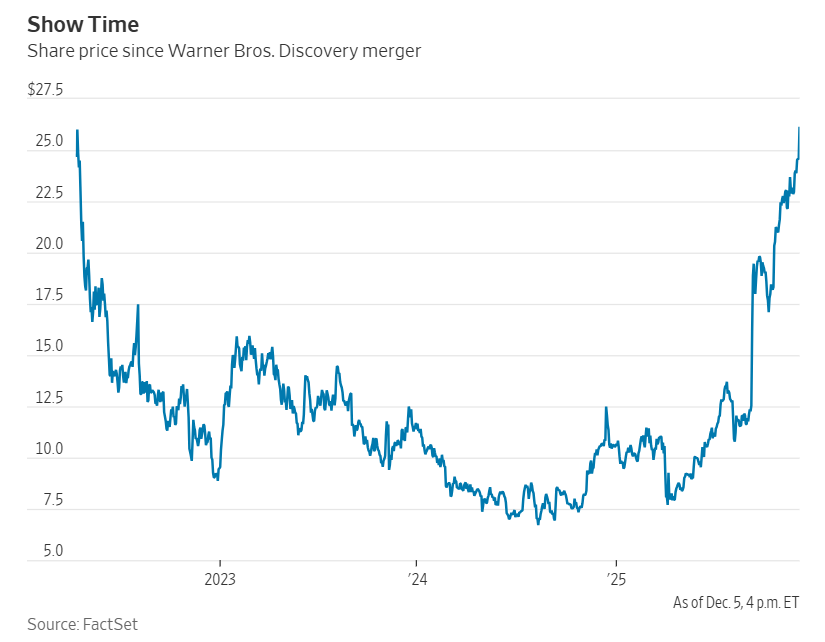

Netflix has reached an agreement to acquire Warner Bros. for $72 billion, following Warner Bros Discovery's planned separation of its studios and HBO Max streaming business from its cable networks. The transaction is poised to significantly reshape the industry landscape. The offer values Warner Discovery at $27.75 per share and assigns the company an enterprise value of approximately $82.7 billion. Rival firm Paramount Skydance had previously submitted an all-cash bid of $30 per share for Warner Discovery, intending to acquire all of its assets, including the cable networks, according to individuals familiar with the matter.

This transaction represents Netflix’s largest acquisition to date and stands among the most significant deals announced this year, reflecting a resurgence in mergers and acquisitions activity during the current administration. Both Warner Discovery and Netflix anticipate that the deal will close within 12 to 18 months. Industry analysts have noted that Netflix’s acquisition of Warner Discovery’s streaming and studio assets introduces key questions regarding potential changes to Netflix’s business strategy, particularly in relation to its approach to film releases.

S&P 500 Best performing sector

Communication Services +0.95%, with Warner Bros Discovery +6.28%, Omnicom Group +4.66%, and Charter Communications +2.56%

S&P 500 Worst performing sector

Utilities -0.98%, with Vistra -5.05%, NRG Energy -3.76%, and Constellation Energy -2.39%

Mega Caps

Alphabet +1.16%, Amazon +0.18%, Apple -0.68%, Meta Platforms +1.80%, Microsoft +0.48%, Nvidia -0.53%, and Tesla +0.11%

Information Technology

Best performer: Adobe +5.33%

Worst performer: Akamai Technologies -3.59%

Materials and Mining

Best performer: Albemarle +5.08%

Worst performer: CF Industries -2.93%

European Stock Indices

CAC 40 -0.09%

DAX +0.61%

FTSE 100 -0.45%

Commodities

Gold spot -0.25% to $4,196.53 an ounce

Silver spot +2.06% to $58.28 an ounce

West Texas Intermediate +0.77% to $60.14 a barrel

Brent crude +0.73% to $63.78 a barrel

Gold prices declined on Friday, with spot gold falling -0.25% to $4,196.53 per ounce and posting a -0.46% loss for the week.

In contrast, silver experienced a significant rally, climbing +2.06% to $58.28 an ounce and advancing +8.10% over the week, after reaching a record high of $59.32 earlier in the session.

Oil prices advanced to their highest levels in two weeks on Friday, with both Brent and US WTI crude settling higher amid ongoing geopolitical uncertainties that may constrain supplies from Russia and Venezuela.

Brent crude futures rose by 46 cents, or +0.73%, closing at $63.78 per barrel, while WTI increased by 46 cents, or +0.77%, to settle at $60.14 per barrel. These settlements marked the strongest finishes for both benchmarks since 18th November. Over the week, Brent gained +2.34% and WTI climbed +2.84%, representing the second consecutive week of gains for both contracts.

Market participants closely monitored developments in Russia and Venezuela to assess future supply prospects from these heavily sanctioned OPEC+ producers. The lack of progress in US - Russia negotiations regarding the conflict in Ukraine added upward pressure to oil prices throughout the week.

Furthermore, the G7 and the EU were reportedly in discussions to replace the price cap on Russian oil exports with a comprehensive ban on maritime services, aiming to curb Russia's oil revenues that support its war efforts in Ukraine, according to sources cited by Reuters.

During his visit to New Delhi—the first since Russia’s 2022 invasion of Ukraine—President Vladimir Putin offered India uninterrupted fuel supplies. However, Indian officials responded cautiously, as the two countries agreed to bolster trade and defense cooperation. Meanwhile, state-run Indian refiners, including Indian Oil and Bharat Petroleum, have reportedly placed orders for January deliveries of Russian oil from non-sanctioned suppliers, attracted by widening price discounts, according to trade sources referenced by Reuters.

Additionally, a Ukrainian drone strike ignited a fire at Russia’s Azov Sea port of Temryuk, which handles liquefied petroleum gas (LPG), oil products, petrochemicals, and various bulk commodities. The market was also attentive to the potential for US military action in Venezuela, which could jeopardize the nation’s crude oil output—currently around 1.1 million barrels per day, with the majority destined for China.

Note: As of 4 pm EST 5 December 2025

Currencies

EUR -0.02% to $1.1642

GBP -0.03% to $1.3319

Bitcoin -3.25% to $89,176.80

Ethereum -3.32% to $3,019.72

The US dollar eased on Friday, remaining confined within its recent trading range against major counterparts as market participants awaited the upcoming FOMC meeting, where policymakers are widely anticipated to announce an interest rate cut.

The dollar index slipped -0.08% to 98.99, staying close to Thursday’s five-week low of 98.765 and posting a -0.50% decline for the week.

The euro edged -0.02% lower to $1.1642, holding near Thursday’s three-week high of $1.1681. Similarly, the British pound was down -0.03% at $1.3319, just below the previous session’s six-week peak of $1.3385.

The Japanese yen, which has garnered support in recent sessions amid speculation that the BoJ may raise rates this month, advanced +0.15% to ¥155.34 on Friday. Over the week, the yen strengthened by +0.54% against the US dollar.

The week ahead features a series of central bank policy decisions, with the Reserve Bank of Australia meeting on Tuesday, the BoC convening on Wednesday, and the Swiss National Bank announcing its decision on Thursday, in addition to the Fed’s statement on Wednesday.

The following week will see further monetary policy announcements from the BoJ, ECB, BoE, and Sweden’s Riksbank.

Fixed Income

US 10-year Treasury +3.9 basis points to 4.141%

German 10-year bund +2.5 basis points to 2.801%

UK 10-year gilt +4.0 basis points to 4.481%

On Friday, US Treasury securities declined, driving yields to multi-week highs as market participants anticipated a Fed rate cut in the upcoming week, yet remained cautious about the potential for a less aggressive easing cycle than previously expected. This sentiment was marked by investor hesitancy to increase bond holdings amid continued uncertainty regarding the trajectory and pace of the policy path.

Economic data released on Friday did little to alter prevailing expectations for the Fed’s monetary policy path. Inflation, as measured by the Personal Consumption Expenditures (PCE) Price Index, aligned with consensus forecasts, while US consumer sentiment registered an improvement for December.

During afternoon trading, the yield on the 10-year Treasury note increased by +3.9 bps to 4.141%, reaching a two-week high earlier in the session. For the week, the 10-year yield advanced by +12.3 bps, marking its largest weekly gain since early April.

Yields on 30-year US government bonds climbed to a three-month high, ending the day up +3.8 bps at 4.793%. Over the course of the week, 30-year yields gained +12.6 bps, representing the most substantial weekly increase in eight months.

On the short end of the curve, two-year Treasury yields—which are closely tied to interest rate expectations—also reached a two-week high, rising by +3.8 bps to 3.569%. The weekly increase totaled +6.7 bps, the sharpest advance since late October.

The yield curve experienced minimal movement on Friday, with the spread between the two-year and 10-year Treasury yields at 57.2 bps, up from 51.6 bps the previous week.

The FOMC is expected to conclude its two-day meeting this week by reducing the benchmark overnight rate by 25 bps, setting the target range at 3.50% to 3.75%. This would mark the third consecutive meeting in which the central bank has eased policy.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 88.4% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 86.4% and the 66.9% probability assigned a month ago. Traders are currently expecting 22.1 bps of cuts by year-end.

Eurozone sovereign bond yields increased on Friday, concluding a week marked by one of the most significant sell-offs in ultra-long debt over the past three months, as investor concerns regarding government finances persisted.

Long-term yields surged more notably than their shorter-term counterparts, with 30-year German bonds rising +11.1 bps over the week to 3.432%, the highest level since mid-August. In contrast, two-year Schatz yields climbed +6.3 bps last week to 2.100%.

The yield on the 10-year Bund also advanced, reaching a three-month high of 2.801% after gaining +2.5 bps on the day and +10.9 bps over the week—its largest weekly increase since July.

On Friday, investors also considered political developments in France and Germany. German Chancellor Friedrich Merz narrowly avoided a government crisis by securing an absolute majority for a pensions bill in parliament. However, the uncertainty surrounding the bill’s passage underscored Merz’s limited authority over his fractious coalition, highlighting the increasing political sensitivity of pension reforms across Europe as populations age. This demographic trend continues to exert pressure on government borrowing and accentuates concerns about long-term debt.

In France, lawmakers in the lower house approved a social security financing bill after Prime Minister Sebastien Lecornu made key concessions. French government bonds slightly outperformed their German counterparts on Friday, with the 10-year OAT yield rising +0.8 bps to 3.533%, following an underperformance on Thursday. Over the week, French yields increased by +11.7 bps.

Italian 10-year yields rose +1.7 bps to 3.494%, contributing to a +8.7 bps weekly rise and narrowing the spread over Bunds to 69.3 bps, approaching a 16-year low.

Note: As of 5 pm EST 5 December 2025

Global Macro Updates

Consumer sentiment rises, inflation outlook eases in December. The preliminary December report on US consumer sentiment, as measured by the Michigan Consumer Sentiment Index, indicated a mixed outlook. The headline index rose to 53.3, surpassing both the consensus estimate of 52.0 and November’s final reading of 51.0. However, the Current Conditions Index edged lower to 50.7 from 51.1 month-over-month, while the Index of Consumer Expectations improved significantly to 55.0 from 51.0.

Inflation expectations moderated. The one-year ahead inflation expectation declined to 4.1% from 4.5% in the previous month, marking the lowest level since January. Long-term inflation expectations also ticked down to 3.2% from 3.4%. The report highlighted a marginal improvement in labor market expectations, although overall consumer sentiment regarding employment conditions and inflation remains cautious.

In other economic data, the delayed release of September’s Personal Consumption Expenditures (PCE) showed a 0.3% m/o/m increase, slightly above the consensus forecast of 0.2% and matching August’s 0.3% gain. The core PCE index rose 0.2% m/o/m, in line with both expectations and the previous month’s figure. On an annualized basis, core PCE registered 2.8%, consistent with projections and a slight decrease from August’s 2.9%.

Additionally, personal spending in September grew by 0.3% m/o/m, in line with expectations but down from a revised 0.5% in August (previously reported as +0.6%). Personal income increased by 0.4% m/o/m, also matching both consensus and the prior month’s result.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora