What will the data reveal to the Fed?

Global market indices

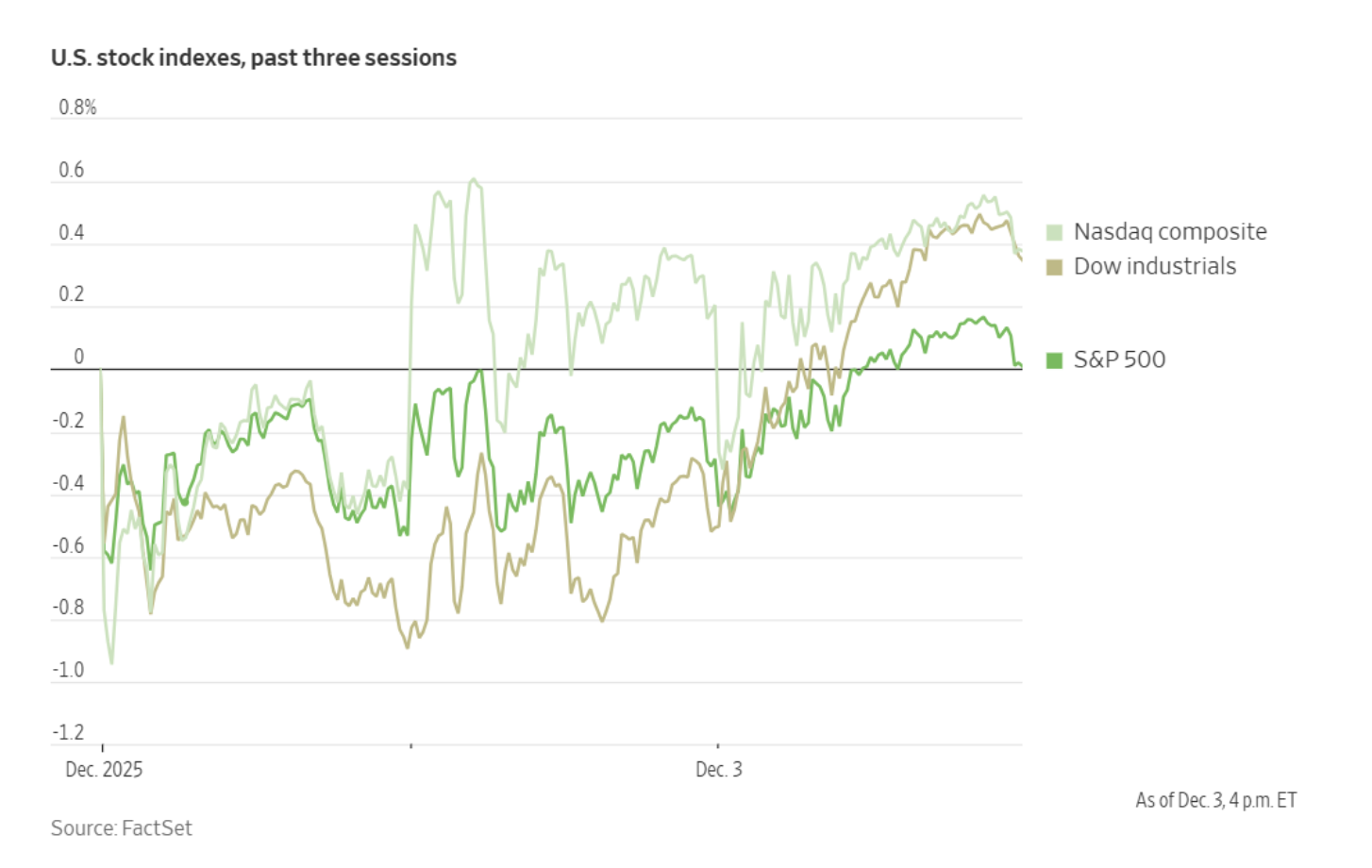

US Stock Indices Price Performance

Nasdaq 100 +0.67% MTD and +21.87% YTD

Dow Jones Industrial Average -0.51% MTD and +11.59% YTD

NYSE -0.09% MTD and +14.18% YTD

S&P 500 +0.01% MTD and +16.46% YTD

The S&P 500 is +0.54% over the past seven days, with 5 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.47% over this past week and +9.03% YTD.

The S&P 500 Energy sector is the leading sector so far this month, +1.45% MTD and +6.37% YTD, while Utilities is the weakest sector at -3.37% MTD and +15.01% YTD.

Over the past seven days, Energy outperformed within the S&P 500 at +2.79%, followed by Consumer Discretionary and Financials at +1.74% and +1.06%, respectively. Conversely, Utilities underperformed at -2.67%, followed by Health Care and Real Estate at -2.10% and -1.00%, respectively.

The equal-weight version of the S&P 500 was +0.73% on Wednesday, outperforming its cap-weighted counterpart by 0.43 percentage points.

Equities moved higher on Wednesday, with the Dow Jones Industrial Average posting a gain of 408 points, or +0.86%. The Russell 2000, which tracks small-cap companies, led major US indexes with a +1.91% increase. In contrast, the Nasdaq Composite rose +0.17%, and technology stocks within the S&P 500 experienced a modest decline. The S&P 500 concluded the session near 6,850, +0.30%, marking its seventh advance in eight trading days.

Over the past seven days, the S&P 500 is +0.54%, the Dow Jones +0.96%, and the Nasdaq Composite +1.03%.

In corporate news, shares of Bristol-Myers Squibb rallied following the announcement of a delay in the release of clinical-trial results for a potential Alzheimer’s disease therapy. Analysts interpreted the postponement positively, noting investor relief as fears of a failed study before the month’s end were not realised.

Chevron announced plans to allocate a greater portion of its capital budget to offshore drilling projects in the coming year, responding to the maturing state of US shale oil and gas fields. The company indicated that capital expenditures for 2026 could reach up to $19 billion, revising earlier guidance that projected annual budgets as high as $21 billion.

Intel revealed it will retain its networking division as an internal unit, foregoing previous intentions to spin off or sell a stake, citing a higher likelihood of success within the current structure.

Marvell Technology reassured investors regarding its custom chip-design business, reporting repeat orders and sustained growth fuelled by expanding demand for AI computing solutions.

Dario Amodei, CEO of Anthropic PBC, cautioned that certain artificial intelligence firms may be incurring excessive risk by committing vast sums — potentially hundreds of billions of dollars or more — toward the development and support of AI systems.

Delta Air Lines forecasts approximately $5 billion in profit for 2025, despite the US government shutdown, which reduced revenue by $200 million and necessitated flight reductions.

Constellation Energy is negotiating a settlement with the US Justice Department to facilitate the completion of its $16.4 billion acquisition of privately held Calpine. The transaction would establish the nation’s largest power generation fleet.

Uber Technologies is introducing autonomous ride services with Avride in Dallas, expanding its previously announced partnership.

Capricor Therapeutics reported that its experimental medication demonstrated efficacy in a pivotal trial for patients suffering from a fatal muscle disorder. The company expressed optimism that these positive results could prompt regulators to reconsider a prior rejection.

Mega caps: The Magnificent Seven had a mixed performance over the past week. Over the last seven days, Tesla +4.73%, Apple +2.38%, Amazon +1.41%, and Meta Platforms +0.95%, while Alphabet -0.10%, Nvidia -0.37%, and Microsoft -1.60%.

Energy stocks had a positive performance this week, with the Energy sector itself +2.79%. WTI and Brent prices are +0.80% and -0.38%, respectively, over the past week. Over the last seven days, APA +9.24%, Halliburton +6.24%, ConocoPhillips +5.42%, Energy Fuels +4.26%, Phillips 66 +3.62%, ExxonMobil +2.64%, BP +2.50%, Occidental Petroleum +2.49%, Baker Hughes +1.94%, Chevron +1.39%, and Shell +1.17%, while Marathon Petroleum -1.20%.

Materials and Mining stocks had a mixed performance this week, with the Materials sector -0.15%. Over the past seven days, Freeport-McMoRan +5.65%, Celanese Corporation +3.36%, Yara International +3.57%, Nucor +3.51%, Sibanye Stillwater +2.81%, and CF Industries +1.12%, while Mosaic -0.21%, Albemarle -0.33%, and Newmont Corporation -0.96%.

European Stock Indices Price Performance

Stoxx 600 -0.04% MTD and +13.51% YTD

DAX -0.60% MTD and +19.01% YTD

CAC 40 -0.43% MTD and +9.57% YTD

IBEX 35 +1.3 % MTD and +43.04% YTD

FTSE MIB +0.05% MTD and +26.90% YTD

FTSE 100 -0.29% MTD and +18.59% YTD

This week, the pan-European Stoxx Europe 600 index is +0.35%. It was +0.10% Wednesday, closing at 576.22.

So far this month in the STOXX Europe 600, Retail is the leading sector, +4.08% MTD and +7.26% YTD, while Insurance is the weakest at -1.73% MTD and +18.09% YTD.

Over the past seven days, Retail outperformed within the STOXX Europe 600, at +4.60%, followed by Basic Resources and Autos & Parts at +3.22% and +2.75%, respectively. Conversely, Travel & Leisure underperformed at -1.67%, followed by Insurance and Telecoms at -1.38% and -0.98%, respectively.

Germany's DAX index was -0.07% Wednesday, closing at 23,693.71. It was -0.14% over the past seven days. France's CAC 40 index was +0.16% Wednesday, closing at 8,087.42. It was -0.14% over the past week.

The UK's FTSE 100 index was -0.10% over the past seven days to 9,692.07. It was +0.01% on Wednesday.

In Wednesday's trading session, the Retail sector emerged as the primary outperformer, benefiting from broad-based momentum and a substantial earnings beat from Inditex, following robust November and third-quarter sales. This positive performance buoyed the apparel and specialty retail segments. The only notable headwind came from Qatar’s partial divestment of its stake in Sainsbury, which exerted some pressure but did not undermine sector leadership.

Basic Resources also advanced, supported by improving macroeconomic sentiment and favourable developments in the semiconductor sector. The Autos & Parts sector was further boosted by UBS’s upgrade of Stellantis, citing a recovery in North America and beneficial regulatory trends.

In the Industrial Goods & Services sector, Aerospace & Defence companies contributed to gains, with Airbus rebounding despite lower delivery targets for 2025. Among underperformers, Insurance faced pressure due to concerns over potential rate cuts, while luxury stocks declined following a guidance revision from Hugo Boss, which weighed on the broader Personal & Household Goods sector. Travel & Leisure stocks were subdued amid ongoing geopolitical uncertainty relating to the Russia-Ukraine conflict and limited support from lower energy prices.

Other Global Stock Indices Price Performance

MSCI World Index +0.09% MTD and +18.73% YTD

Hang Seng -0.38% MTD and +28.42% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are +0.69% and -0.65%, respectively.

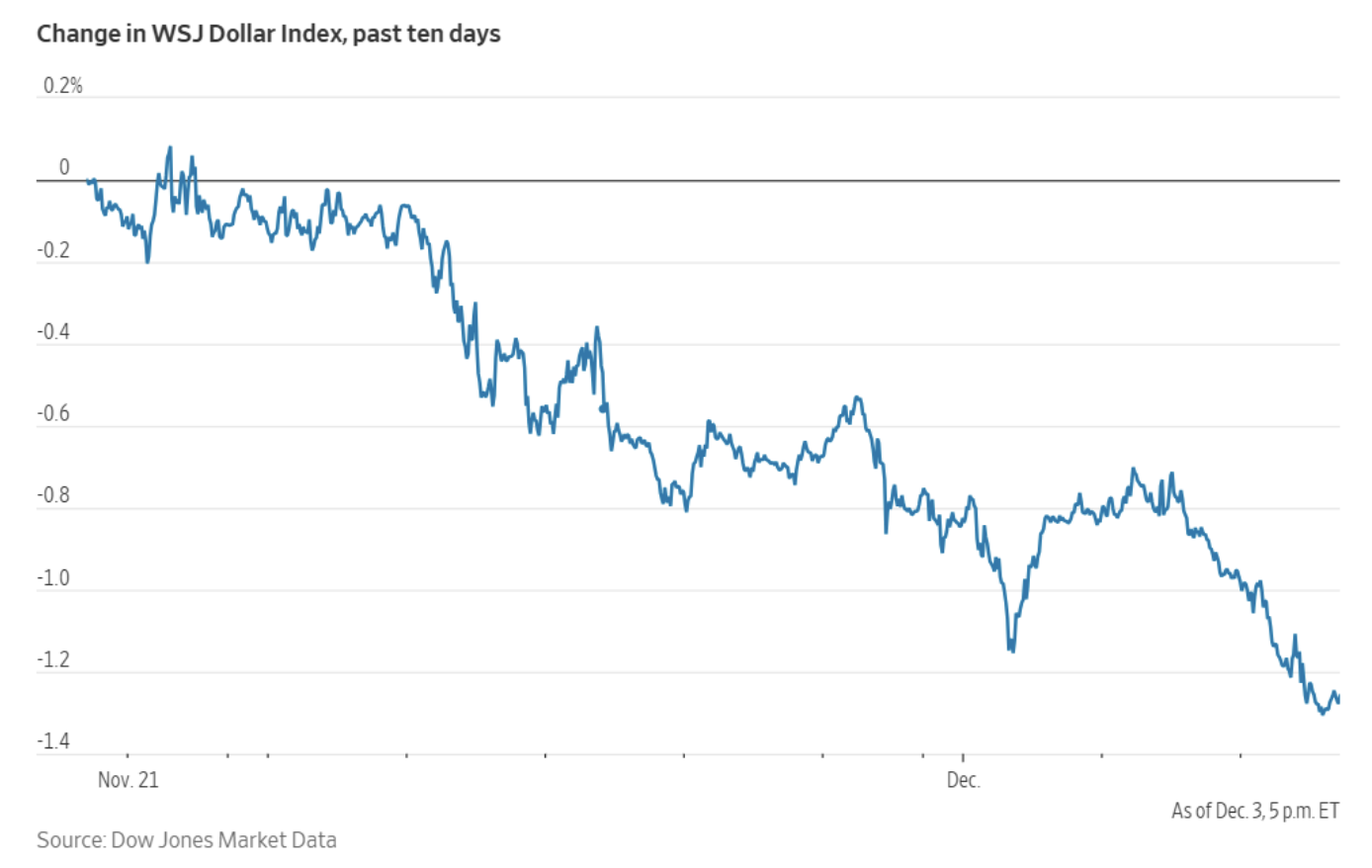

Currencies

EUR +0.62% MTD and +12.71% YTD to $1.1670

GBP +0.89% MTD and +6.68% YTD to $1.3351

The euro advanced to its highest level against the dollar in nearly seven weeks on Wednesday, rising +0.41% to $1.1670 and reaching an intraday peak of $1.1677 — the strongest since 17th October. The euro had touched a four-year high of $1.1918 on 17th September. Over the course of the week, the euro has gained +0.66%.

The dollar index declined -0.45% to 98.87, briefly dipping to 98.82, the lowest since 29th October. Throughout the week, the index fell -0.71%. The greenback’s losses accelerated after the ADP employment report revealed an unexpected decrease in US private-sector payrolls for November. The dollar index is -0.62% MTD and -8.88% YTD.

Market speculation regarding White House economic adviser Kevin Hassett potentially succeeding Jerome Powell as Fed Chair after Powell’s term ends in May has contributed to the dollar’s recent softness, with expectations that Hassett would advocate for further interest rate cuts. The Wall Street Journal reported on Tuesday that the Trump administration cancelled interviews with other finalists for the Fed Chair position, suggesting a decision has already been made.

Sterling appreciated against the euro after two consecutive days of losses, as investors weighed contrasting monetary policy outlooks between the eurozone and the UK. The euro’s firmness earlier in the week was attributed to market expectations that the ECB would maintain current rates through 2027, while the BoE is expected to lower rates next year.

Traders are currently pricing in only about a 30% probability of an ECB rate cut in 2026 and project the deposit rate to decrease from 2% to 1.95% by December 2026. The BoE is expected to implement approximately 60 bps of rate reductions by the end of 2026.

On Wednesday, the euro declined -0.20% against the pound, settling at 87.80 pence. It reached 87.46 pence last Thursday, the lowest since 28th October. The British pound climbed to a five-week high against the dollar, +1.04%, to $1.3351, on Wednesday, marking an increase of +0.84% this week.

The Japanese yen also strengthened, gaining +0.39% against the dollar to ¥155.24. The yen’s rise followed remarks on Monday from BoJ Governor Kazuo Ueda, who indicated the central bank would weigh the merits of raising interest rates at its upcoming policy meeting—signaling a possible rate hike later this month. Over the past seven days, the yen has risen by +0.79%, contributing to a +0.60% so far this month. Year-to-date, the US dollar is -1.11% against the Japanese yen.

Note: As of 5:00 pm EST 3 December 2025

Fixed Income

US 10-year yield +4.9 bps MTD and -50.9 bps YTD to 4.067%

German 10-year yield +5.8 bps MTD and +38.1 bps YTD to 2.750%

UK 10-year yield +0.4 bps MTD and -11.7 bps YTD to 4.451%

US Treasury yields declined on Wednesday following the release of data indicating an unexpected drop in private-sector payrolls for November, intensifying concerns about labour market weakness and reinforcing expectations that the Fed will implement a rate cut next week.

In afternoon trading, the yield on the 10-year Treasury note decreased by -2.8 bps to 4.067%, while the 30-year yield edged lower by -1.5 bps to 4.733%. On the short end of the curve, the two-year yield—sensitive to anticipated Fed policy changes—fell by -2.0 bps to 3.498%.

According to the latest data, US private employment contracted by 32,000 jobs last month, following a revised gain of 47,000 positions in October. This figure fell short of economists’ expectations of an increase of 10,000 jobs after a previously reported rebound of 42,000 in October.

Over the past seven days, the yield on the 10-year Treasury note was +7.0 bps. The yield on the 30-year Treasury bond was +8.9 bps. On the shorter end, the two-year Treasury yield was +1.3 bps.

The spread between two- and ten-year yields widened by 5.5 bps over the past week, reaching 56.9 bps from 51.4 a week ago.

Traders are pricing in 22.3 bps of cuts by year-end, higher than last week’s 20.9 bps, according to CME Group's FedWatch Tool. Fed funds futures traders are now pricing in a 89.0% probability of a 25 bps rate cut at December’s FOMC meeting, up from 83.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was -2.2 bps to 4.451%. Over the past seven days, it is +2.4 bps.

On Wednesday, Germany’s 10-year government bond remained stable, trading just below the previous session’s two-and-a-half-month high.

Yields were driven higher on Tuesday by eurozone inflation data that exceeded expectations, diminishing the likelihood of another ECB rate cut during the current cycle. According to preliminary figures from the European Union’s statistics agency, inflation in the eurozone accelerated to an annual rate of 2.2% in November, with services inflation registering strong advances.

ECB policymakers have underscored that, with inflation essentially aligning with the central bank’s 2% target, a forceful reaction to minor deviations from that level is unwarranted.

The 10-year German yield was relatively stable on Wednesday, declining by -0.4 bps to 2.750%, after reaching 2.768% on Tuesday—the highest level since late September. Germany’s two-year yield, more responsive to shifts in the ECB policy rate outlook, was nearly unchanged—down -0.1 bps at 2.059%. At the longer end of the curve, the German 30-year yield edged up by +0.1 bps to 3.387% on Wednesday.

France’s 10-year yield declined by -0.4 bps to 3.493%, while Italy’s 10-year yield dropped by -3.0 bps to 3.443%, resulting in a spread of 69.3 bps over the German 10-year yield.

Over the past seven days, the German 10-year yield was +7.6 bps. Germany's two-year bond yield was +4.0 bps, and, on the longer end, Germany's 30-year yield was +8.0 bps.

The yield spread between German Bunds and 10-year UK gilts reached 170.1 bps on Wednesday and was 5.2 bps narrower over the past week.

The spread between US 10-year Treasuries and German Bunds is now 131.7 bps, 0.8 bps lower from last week’s 132.5 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 69.3 bps, a 2.9 bps decline from 72.2 bps last week. The Italian 10-year yield was +4.7 bps over the last week.

Commodities

Gold spot -0.31% MTD and +60.24% YTD to $4,202.94 per ounce

Silver spot +8.48% MTD and +102.34% YTD to $58.48 per ounce

West Texas Intermediate crude +0.92% MTD and -17.74% YTD to $59.02 a barrel

Brent crude +0.75% MTD and -15.93% YTD to $62.79 a barrel

Gold prices remained stable on Wednesday, with spot gold largely unchanged at $4,202.94 per ounce after reaching an intraday high of $4,241.29.

It was +0.98% over the last seven days. It is -0.31% MTD. Year-to-date, spot gold is +60.18% due to a combination of factors such as escalating geopolitical tensions, expectations of monetary easing, increased central bank purchases, efforts toward de-dollarisation, and robust ETF inflows.

Silver edged +0.08% higher on Wednesday to $59.02, having previously set a record high of $58.98 earlier in the session. Silver has appreciated +102.53% year-to-date, driven by its designation as a critical mineral in the US and an ongoing structural supply deficit.

Oil prices finished higher on Wednesday, supported by the continued failure of the US and Russia to reach an agreement that might resolve the war in Ukraine and lift sanctions on Moscow’s oil sector. However, the extent of these gains remained limited due to lingering concerns about oversupply in the market.

Brent crude settled at $62.79 per barrel, up 40 cents or +0.64%, while US West Texas Intermediate advanced 37 cents, or +0.63%, to close at $59.02. Both benchmarks had declined by more than one percent in the previous trading session.

This week, WTI and Brent prices are +0.80% and -0.38%, respectively.

According to the Russian government, negotiations between Russian President Vladimir Putin and senior envoys from US President Donald Trump’s administration lasted five hours but failed to produce a compromise. Market participants are closely monitoring the outcome of these talks, as any potential deal could result in the lifting of sanctions on Russian firms—including major oil producers such as Rosneft and Lukoil—and potentially release currently restricted oil supplies.

Ukrainian strikes on Russian oil export facilities along the Black Sea coast in the last two weeks have further underscored the geopolitical risks associated with the ongoing war. Last week, Ukraine targeted two sanctioned tankers transporting Russian oil in the Black Sea.

President Putin announced that Russia plans to take action against tankers from countries assisting Ukraine, intensifying geopolitical risks and contributing to market uncertainty.

EIA report. According to the EIA, US crude oil and fuel inventories increased last week, coinciding with a rise in refining activity. Crude oil inventories expanded by 574,000 barrels, reaching a total of 427.5 million barrels for the week ending 28th November. Conversely, crude stocks at the Cushing, Oklahoma, delivery hub declined by 457,000 barrels. Refinery crude runs advanced by 433,000 barrels per day (bpd), while refinery utilisation rates climbed by 1.8 percentage points to 94.1%.

In addition, US gasoline inventories rose by 4.52 million barrels to 214.42 million barrels. Distillate stockpiles — which encompass diesel and heating oil — increased by 2.1 million barrels, totalling 114.3 million barrels.

Total product supplied, serving as a proxy for demand, decreased by 51,000 bpd to 20.189 million bpd. Net US crude imports also fell, dropping by 470,000 bpd to 2.37 million bpd.

Note: As of 5:00 pm EST 3 December 2025

Key data to move markets

EUROPE

Thursday: Eurozone Retail Sales and speeches by ECB Executive Board Member Piero Cipollone, ECB Chief Economist Philip Lane, and ECB Vice President Luis de Guindos

Friday: Eurozone GDP, Eurozone Employment Change, German Factory Orders, and a speech by ECB Chief Economist Philip Lane

Monday: German Industrial Production and Eurozone Sentix Investor Confidence

Tuesday: German Trade Balance

UK

Monday: BRC Like-For-Like Retail Sales

USA

Thursday: Initial and Continuing Jobless Claims, Challenger Job Cuts, and a speech by Fed Vice Chair Michelle Bowman

Friday: Personal Consumption Expenditures (PCE), Core PCE, Personal Income, Personal Spending, Factory Orders, Michigan Consumer Sentiment and Expectations Indices, UoM 1- and 5-year Consumer Inflation Expectations

Tuesday: ADP Employment Change 4-week average, Nonfarm Productivity, Unit Labor Costs, and JOLTS Job Openings

Wednesday: Fed Interest Rate Decision, Fed Monetary Policy Statement, FOMC Economic Projections, Interest Rate Projections, FOMC Press Conference, Employment Cost Index, and Monthly Budget Statement

JAPAN

Sunday: GDP and Current Account

CHINA

Sunday: Exports, Imports, and Trade Balance

Tuesday: Consumer Price Index and Producer Price Index

Global Macro Updates

ADP payroll report signals ongoing labour market challenges. The November ADP private payroll report fell well short of expectations, declining by 32,000 m/o/m compared to the consensus forecast of a 10,000 gain and October's revised increase of 47,000 (previously +42,000). ADP has posted negative results in four of the past six months, with November representing the weakest reading since March 2023.

Year-over-year pay growth for employees who remained in their jobs rose by 4.4%, a slight decrease from October's 4.5%. Meanwhile, pay for job changers increased by 6.3%, down from 6.7% in the prior month.

Job losses were recorded in professional and business services (-26,000), information (-20,000), manufacturing (-18,000), construction (-9,000), financial activities (-9,000), and other sectors (-4,000). In contrast, gains were observed in education and health services (+33,000), leisure and hospitality (+13,000), natural resources and mining (+8,000), and trade, transportation, and utilities (+1,000).

The declines were largely concentrated in the Northeast and Southern United States, with small businesses accounting for nearly all of the job reductions. It has been reported that bankruptcies among small businesses reached another record high in 2025, reflecting ongoing challenges with debt.

This report follows Monday's decline in the ISM Manufacturing employment component after three consecutive months of improvement. Initial jobless claims and Challenger job cut data for November are scheduled for release on Thursday morning.

Prior to their final policy meeting of the year, Fed officials will receive an outdated update on their preferred measure of inflation. The September income and spending report, which has been delayed due to the government shutdown, is scheduled for release on Friday. This report will provide data on the personal consumption expenditures (PCE) price index and the core measure that excludes volatile food and energy prices.

Economists anticipate that the core index will post a third consecutive 0.2% m/o/m increase. Such a result would keep the annual figure just below 3%, indicating that inflationary pressures are proving to be persistent.

Eurozone composite PMI reaches 30-month high. The eurozone's final composite PMI for November came in at 52.8, surpassing both the flash estimate of 52.4 and the previous reading of 52.5. This figure marks a 30-month high and remains above the long-term average of 52.4. This represents the sixth consecutive monthly increase, signalling a robust pace of expansion within the region. The acceleration in overall output may be primarily attributable to stronger momentum in the services sector, even as factory production slowed to a nine-month low. The widespread nature of the growth is particularly encouraging.

On a country-by-country basis, the most pronounced growth was observed in Italy and Spain. France recorded its first expansion in 15 months. However, economic activity in Germany moderated following a peak at a 29-month high in October. Eurozone companies expressed heightened optimism regarding the outlook for the coming year, with increased confidence evident across both manufacturing and services sectors, although overall growth expectations remain below the historical trend.

Price dynamics also shifted in November. Input prices climbed to an eight-month high, driven by a renewed rise in manufacturing purchasing costs and a more pronounced increase within the services sector. Nevertheless, prices charged to customers saw only a slight change, as output charge inflation eased to a six-month low.

While every effort has been made to verify the accuracy of this information, LHCM Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora