Is inflation set to beat expectations?

What to look out for today

Companies reporting on Tuesday, 25th November: HP, Zscaler

Key data to move markets today

EU: German GDP, and speeches by Bank of Spain Governor José Luis Escrivá, De Nederlandsche Bank President Olaf Sleijpen, and ECB Executive Board Member Piero Cipollone

USA: ADP Employment Change 4-week average, PPI, Core PPI, Retail Sales, Housing Price Index, Consumer Confidence, Pending Home Sales, and Richmond Fed Manufacturing Index

US Stock Indices

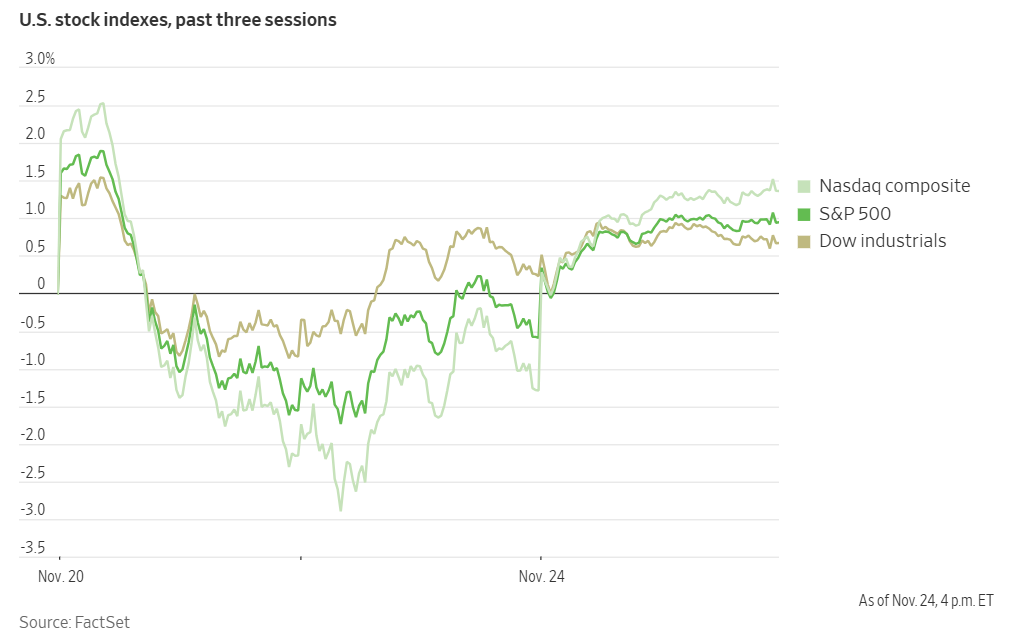

Dow Jones Industrial Average +0.44%

Nasdaq 100 +2.62%

S&P 500 +1.55%, with 9 of the 11 sectors of the S&P 500 up

Leading technology stocks, particularly in the semiconductor sector, advanced on Monday, building on the positive momentum observed at the end of last week and indicating that concerns over a potential artificial intelligence-driven market bubble are subsiding. Semiconductor companies Broadcom, AMD and Micron Technology were among the big winners, while Tesla and Alphabet both added more than six percent.

These movements supported the Nasdaq Composite Index’s performance, which achieved its largest single-day increase since May with a +2.69% gain. The S&P 500 Index posted a rise of +1.55%.

In corporate news, Alibaba announced that its Qwen artificial intelligence application exceeded 10 million downloads within the first week following its relaunch.

Shares of Novo Nordisk declined sharply after its drug, semaglutide, failed to slow the progression of Alzheimer’s disease in clinical trials involving more than 3,800 participants. Although the drug demonstrated improvements in Alzheimer’s biomarkers, it did not impact disease progression. This setback comes on the heels of Novo Nordisk losing market share to Eli Lilly and withdrawing from a competitive bid for Metsera.

Performance Food Group and US Foods Holdings have mutually agreed to terminate merger discussions, opting instead to pursue independent strategic paths. Had the merger proceeded, it would have resulted in a food distribution entity with a combined market capitalisation of approximately $31.2 billion. In light of this decision, US Foods has announced plans to accelerate a $250 million stock repurchase and has authorised a new $1 billion buyback programme.

S&P 500 Best performing sector

Communication Services +3.49%, with Alphabet +6.28%, Meta Platforms +3.16%, and Netflix +2.55%

S&P 500 Worst performing sector

Consumer Staples -1.32%, with Target -3.52%, Campbell’s Company -3.32%, and General Mills -2.86%

Mega Caps

Alphabet +6.28%, Amazon +2.53%, Apple +1.63%, Meta Platforms +3.16%, Microsoft +0.40%, Nvidia +2.05%, and Tesla +6.82%

Information Technology

Best performer: Broadcom +11.10%

Worst performer: Tyler Technologies -4.17%

Materials and Mining

Best performer: Newmont +3.64%

Worst performer: Mosaic -2.36%

European Stock Indices

CAC 40 -0.29%

DAX +0.64%

FTSE 100 -0.05%

Corporate Earnings Reports

Posted on Monday, 24th November

Zoom Communications quarterly revenue +4.4% to $1.230 bn vs $1.214 bn estimate

EPS at $1.52 vs $1.49 estimate

Eric S. Yuan, Founder and CEO, said, “Zoom is continuing to build on our vision of an AI‑first platform that helps people connect and collaborate more seamlessly. This quarter we announced AI Companion 3.0, and we’re thrilled to see AI Companion adoption grow meaningfully. We’re also seeing strong momentum with Custom AI Companion and our AI‑first Customer Experience suite, which helped make this one of our best CX quarters, with broad AI adoption across major deals. Our disciplined approach is fueling top-line growth, stellar profitability, and lower dilution helping us turn AI innovation into real, lasting value for customers and shareholders.” — see report.

Commodities

Gold spot +1.70% to $4,134.47 an ounce

Silver spot +2.68% to $51.34 an ounce

West Texas Intermediate +1.36% to $58.77 a barrel

Brent crude +1.39% to $63.35 a barrel

Gold prices advanced by over one percent on Monday, with spot gold increasing +1.70% to reach $4,134.47 per ounce.

Market participants are closely monitoring significant economic reports that have been postponed due to the recent government shutdown. These include US retail sales, jobless claims, and producer price data, all of which are expected to be released later this week.

Oil prices advanced over one percent on Monday, driven by increasing skepticism regarding the prospects of a peace agreement between Russia and Ukraine that could facilitate higher oil exports from Moscow.

Brent crude futures gained 87 cents, or +1.39%, settling at $63.35 per barrel, while WTI crude rose 79 cents, or +1.36%, to close at $58.77 per barrel. Both benchmarks had ended Friday’s session at their lowest levels since 21st October.

The US and Ukraine have been working to bridge differences in a proposed peace plan aimed at ending the Russia-Ukraine conflict, following a US initiative that Kyiv and its European partners perceived as heavily favouring the Kremlin's interests.

Earlier declines in oil prices were primarily attributed to reported progress in negotiations between Ukraine and Russia. Although US sanctions on Russian oil companies Rosneft and Lukoil—enacted on Friday—would typically be expected to support prices, market attention remains concentrated on the ongoing peace talks.

Russian state oil and gas revenues are projected to decrease by as much as 35% y/o/y in November, reaching 520 billion roubles, largely due to lower oil prices and a stronger rouble.

Note: As of 5 pm EST 24 November 2025

Currencies

EUR +0.08% to $1.1520

GBP +0.05% to $1.3101

Bitcoin +4.71% to $88,797.00

Ethereum +7.04% to $2,960.82

The US dollar declined on Monday, though it strengthened against the Japanese yen as market participants closely watched for indications of potential intervention by Tokyo to curb the yen's depreciation. Trading volumes were subdued, reflecting both a public holiday in Japan and reduced activity in the US ahead of the Thanksgiving holiday on Thursday.

During afternoon trading, the euro appreciated by +0.08% against the dollar, reaching $1.1520, which brought the dollar index down -0.03% to 100.15.

The greenback’s modest losses deepened following remarks from Fed Governor Christopher Waller, who stated that current data suggests the US labour market remains sufficiently weak to justify another quarter-point rate cut at the FOMC policy meeting scheduled for 9th – 10th December. His comments echoed those of New York Fed President John Williams, who indicated last Friday that the Fed can reduce interest rates ‘in the near term’ without compromising its inflation objectives.

The British pound edged +0.05% higher to $1.3101 against the dollar in advance of Wednesday’s UK budget announcement.

The yen depreciated against the dollar, with the US currency rising +0.33% to ¥156.90, approaching its ten-month high of ¥157.90 set last week. The ongoing weakness in Japan’s currency is largely attributed to the nation’s accommodative fiscal policies and persistently low interest rates, leading traders to speculate about possible intervention by Japanese authorities to stabilise the yen.

The yen recovered some ground last Friday, rebounding from ten-month lows after Finance Minister Satsuki Katayama heightened warnings regarding potential intervention to arrest the currency’s decline. Market participants anticipate the risk of intervention between ¥158 and ¥162 per dollar, with the reduced activity during Thursday’s Thanksgiving holiday presenting a potential window for official action.

Fixed Income

US 10-year Treasury -3.6 basis points to 4.032%

German 10-year bund -1.2 basis points to 2.695%

UK 10-year gilt -0.7 basis points to 4.544%

US Treasury yields declined on Monday as market participants assessed remarks from Fed governors that bolstered expectations for a potential interest rate reduction next month. This shift occurred despite persistent uncertainty regarding the Fed's trajectory for policy easing.

The yield on the 10-year Treasury note fell by -3.6 bps to 4.032%, while the two-year yield decreased by -1.5 bps to 3.503%. At the long end of the curve, the 30-year yield slipped -4.8 bps to 4.666%.

On the supply side, the Treasury Department conducted a $69 billion auction of two-year notes on Monday, marking the first in a series of three auctions this week, with five- and seven-year notes scheduled for sale on Tuesday and Wednesday, respectively.

The two-year notes were issued at a high yield of 3.489%, closely matching prevailing market rates at the bidding deadline. The bid-to-cover ratio stood at 2.68x, surpassing the 12-month average of 2.62x.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 80.9% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 42.4%. Traders are currently expecting 20.2 bps of cuts by year-end, higher than the 10.6 bps anticipated the prior week.

German government bond yields experienced a slight decline on Monday, remaining near their narrowest spread against US Treasury yields in the past month.

The 10-year Bund yield, which had recently approached a six-week high, eased by -1.2 bps to 2.695%, reducing its discount to Treasuries to 133.7 bps—the smallest differential over the last month. In contrast, the 2-year Schatz yield rose by +0.8 bps to 2.021%. At the longer end of the curve, the 30-year German government bond yield fell by -1.8 bps to 3.341%.

Regarding euro zone monetary policy, ECB officials Madis Muller and Martin Kocher stated during a panel discussion on Friday that the central bank anticipates inflation will remain close to its 2% target in the near term, though they emphasised the importance of continued vigilance.

Italy’s 10-year government bond yield declined by -1.4 bps to 3.450%. The spread over German Bunds—a key measure of the additional return investors require to hold Italian debt as opposed to the more secure German bonds—stood at 75.5 bps following Moody’s upgrade of Italy’s credit rating on Friday, its first such improvement in 23 years. Earlier in November, this spread reached a 15-year low of 70.7 bps.

Note: As of 5 pm EST 24 November 2025

Global Macro Updates

Dovish Fedspeak highlights labour weakness, favours near-term easing. Fed Governor Christopher Waller stated in an interview with Fox Business on Monday that he is advocating for a rate cut in December, citing concerns regarding the health of the labour market. He further noted that, beginning in January, the Fed is likely to adopt a meeting-by-meeting approach to policy decisions, given ongoing labour market weakness and the heightened uncertainty stemming from upcoming economic data releases, which could complicate the decision-making process for January.

In an interview with The Wall Street Journal, San Francisco Fed President Mary Daly also expressed support for a December rate cut, emphasising the labour market’s vulnerability. Daly remarked that the risk of a sudden downturn in employment outweighs the possibility of a resurgence in inflation. She asserted that the Fed can return inflation to its 2% target without increasing unemployment, and that failure to achieve this balance would constitute a policy shortcoming.

The remarks from Waller and Daly represent the latest dovish signals from Fed officials regarding a potential December rate cut, following similar comments made by New York Fed President John Williams last Friday.

Dallas Fed Index deepens decline, and market turns to retail sales, PPI, and consumer confidence. On Monday, the November Dallas Fed manufacturing index registered at -10.4, falling short of both the consensus estimate of -2.0 and October’s figure of -5.0. While the report noted encouraging signs such as improved new orders and shipments, it also highlighted a deterioration in overall business sentiment. The employment component remained largely unchanged, though there was a modest increase in hours worked.

Looking ahead, market participants are focused on several significant reports scheduled for today. These include delayed releases for September retail sales and the Producer Price Index (PPI). Expectations are for headline retail sales to rise by 0.4% m/o/m, although some analyst forecasts anticipate a slightly weaker outcome following notable increases in July and August. The consensus for core PPI stands at 0.3% m/o/m, compared to a 0.1% gain in August.

Consumer confidence data for November will also be released today, with forecasts anticipating a decline to 92.9 from the previous reading of 94.6. Analysts are expected to focus on the labour-market differential, particularly in light of recent employment uncertainties. Consumer confidence reached a cycle low in September before showing a modest improvement in October.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora