What will the data show?

What to look out for today

Companies reporting on Tuesday, 18th November: Baidu, Medtronic, Home Depot

Key data to move markets today

EU: A speech by ECB Executive Board member Frank Elderson

UK: Speeches by BoE Chief Economist Huw Pill and External Member Swati Dhingra

US: ADP Employment Change 4-week Average, Industrial Production, Factory Orders and speeches by Fed Governor Michael Barr and Richmond Fed President Thomas Barkin

JAPAN: Adjusted Merchandise Trade Balance, Exports, Imports and Merchandise Trade Balance Total

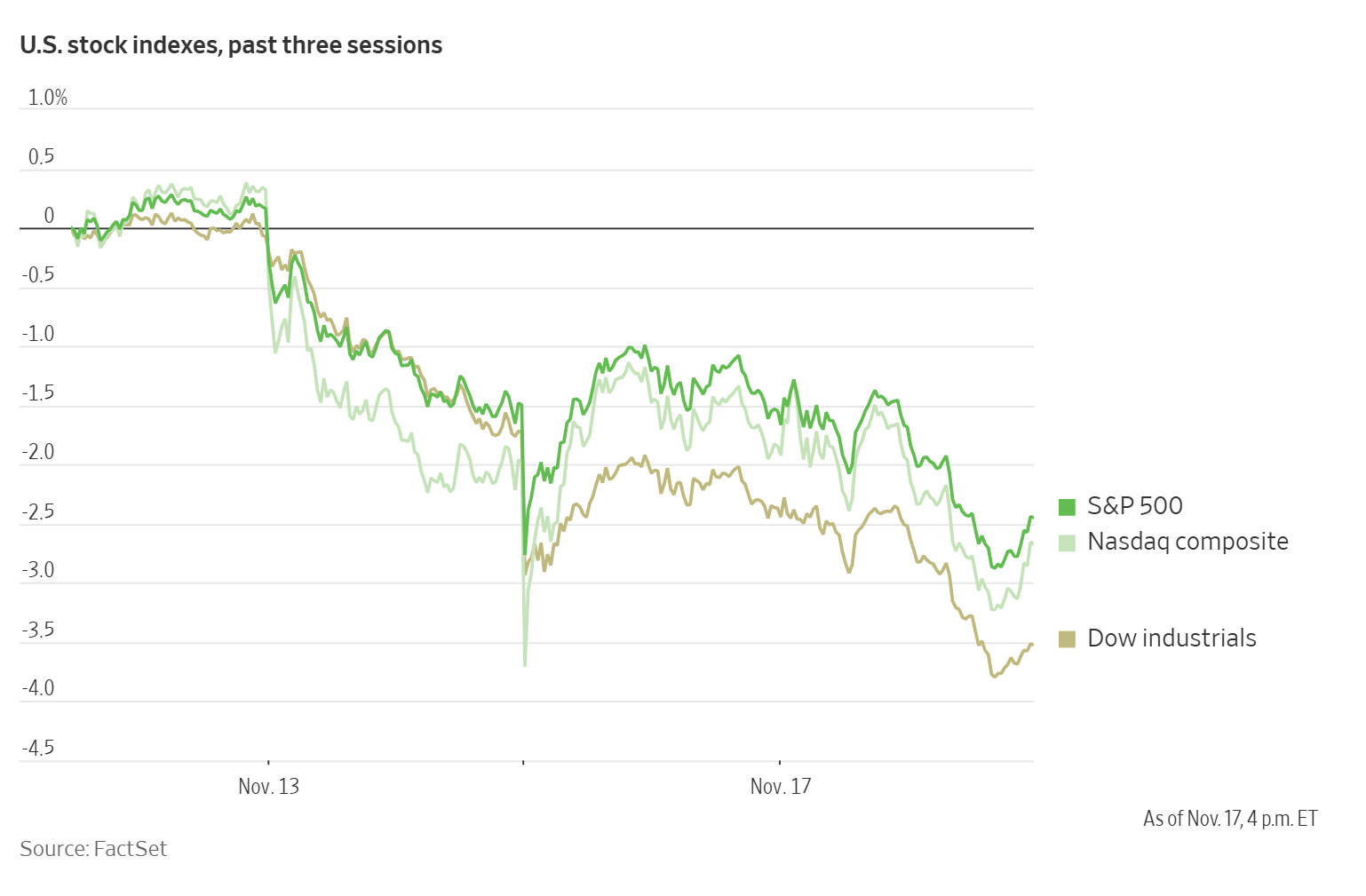

US Stock Indices

Dow Jones Industrial Average -1.18%

Nasdaq 100 -0.83%

S&P 500 -0.92%, with 9 of the 11 sectors of the S&P 500 down.

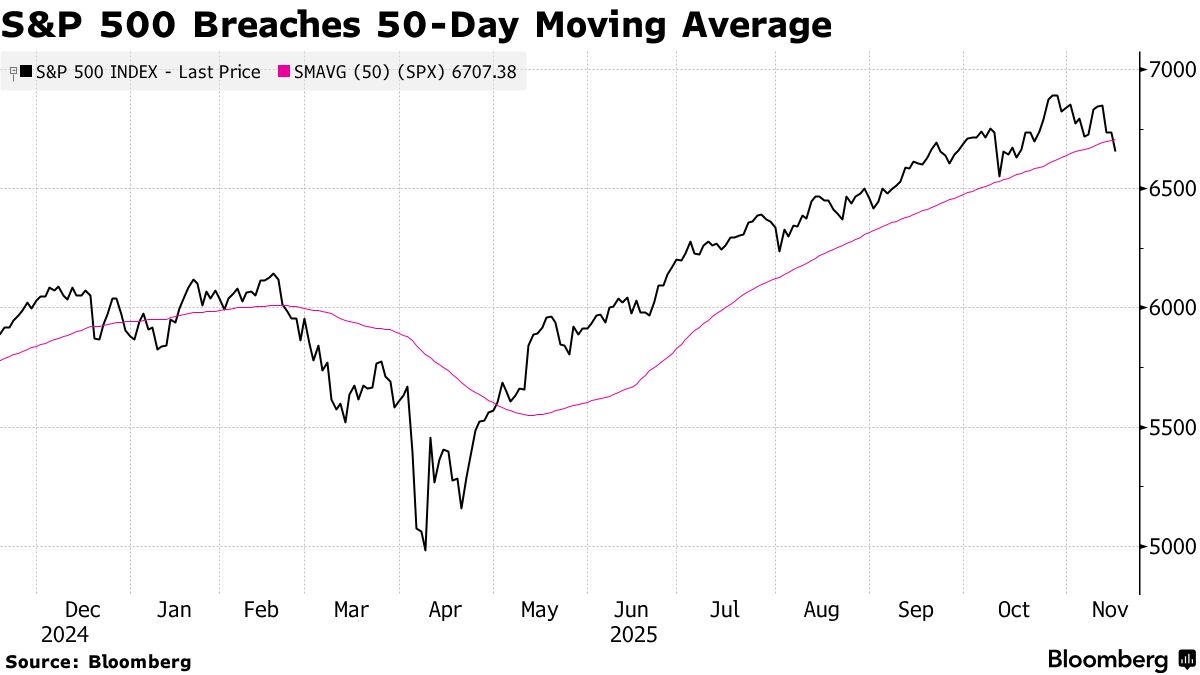

More than 400 shares in the S&P 500 fell on Monday as investors await quarterly results from Nvidia on Wednesday and key retailers including Target and Walmart on Wednesday and Thursday, respectively. The S&P 500 and the Nasdaq closed below their 50 day moving averages for the first time since 30th April. The S&P 500 closed down 61.70 points or -0.92% to 6,672.41 as a sell-off in tech companies and banking stocks continued. The Nasdaq Composite lost 192.51 points or -0.84% to 22,708.07. Nvidia, Meta Platforms, and Amazon were all down as were Advanced Micro Devices, Super Micro Computer, Dell Technologies, Oracle and CoreWeave. The Dow Jones Industrial Average fell 557.24 points, or -1.18%, to 47,147.48; it was below its 50-day moving average for the first time since 10th October.

In corporate news, Amazon is set to raise $15 billion from its first US dollar bond offering since 2022.

Ford Motor has struck a deal with Amazon to sell certified used cars through its e-commerce website, becoming the second major automaker to sell to customers through the online retailer.

Berkshire Hathaway acquired 17.9 million shares of Google parent Alphabet in Q3, while further reducing its holdings in Bank of America and Apple.

Johnson & Johnson agreed to buy the cancer treatment biotech Halda Therapeutics for $3.05 billion cash as part of a strategy to cope with eroding sales for its major psoriasis drug.

S&P 500 Best performing sector

Communications +1.13%, with Alphabet +3.11%, T-Mobile -0.11%, and Verizon -0.12%

S&P 500 Worst performing sector

Financials -1.93%, with KKR & Co. -4.77%, Invesco -4.59%, and American Express -4.46%

Mega Caps

Alphabet +3.11%, Amazon -0.78%, Apple -1.82%, Meta Platforms -1.22%, Microsoft -0.53%, Nvidia -1.88%, and Tesla +1.13%

Information Technology

Best performer: Western Digital +2.93%

Worst performer: Dell Technologies -8.43%

Materials and Mining

Best performer: Albemarle +2.22%

Worst performer: Mosaic -5.87%

European Stock Indices

CAC 40 -0.63%

DAX -1.20%

FTSE 100 -0.24%

Corporate Earnings Reports

Posted on Monday, 17th November

XPeng quarterly revenue +11.5% to RMB 10.1 bn vs RMB 20.63 estimate

EPS at RMB 1.91 vs RMB 1.34 estimate

Xiaopeng He, chairman and CEO, said, "In the third quarter of 2025, Xpeng delivered another set of record results. Vehicle deliveries, revenue, gross margin and cash on hand all reached new highs. We are in the early stages of rapid expansion in terms of sales volume and market share, with Robotaxi and humanoid robots advancing rapidly toward mass production. I firmly believe Xpeng will evolve into a global embodied AI company. Centered around physical AI applications, we are developing a comprehensive portfolio of technologies and products, alongside a thriving business ecosystem, thereby creating greater value for customers and shareholders worldwide." — see report.

Commodities

Gold spot -1.21% to $4,045.50 an ounce

Silver spot -1.25% to $50.05 an ounce

West Texas Intermediate -0.3% to $59.91 a barrel

Brent crude -0.3% to $64.20 a barrel

Gold prices fell on Monday with Spot gold -1.21% to $4,045.50 an ounce as the dollar index rose +0.24% to 99.54, making dollar-priced bullion expensive for holders of other currencies. Monday’s drop followed comments from Fed Vice Chair Philip Jefferson, who said the Fed needs to "proceed slowly" with any further interest rate cuts. Gold tends to rise when interest rates are falling.

Oil prices fell on Monday despite loadings resuming at Russia's Novorossiysk export hub after a two-day suspension after the Black Sea port had been hit by a Ukrainian drone attack. Oil prices remain largely rangebound as these ongoing geopolitical issues counterbalance bearish concerns about global oversupply.

Brent crude settled 19 cents, or 0.3%, lower at $64.20 a barrel. US WTI crude was 18 cents, or -0.3%, to $59.9 a barrel.

Note: As of 5 pm EST 17 November 2025

Currencies

EUR -0.24% to $1.1594

GBP -0.02% to $1.3160

Bitcoin -2.70% to $91,743.00

Ethereum -2.85% to $3,003.29

The US dollar strengthened against the euro and the Japanese yen on Monday as traders focussed on the September nonfarm payroll data due on Thursday following the end of the government shutdown last week. The dollar index was +0.24% to 99.54.

The euro was -0.24% to $.1594. On Monday Dutch central bank president Olaf Sleijpen said that inflation risks in the euro area are balanced despite some suggestions that next round of ECB economic projections, due in December, could show price growth undershooting the bank's 2% target in 2026 on a statistical base effect. This theoretically could get entrenched if firms adjust their wage and price-setting behaviour.

The British pound edged down -0.02% against the US dollar on Monday to $1.3160 as speculation around the 26th November budget continued. The pound may also come under pressure this week from monthly inflation data. In a 5-4 vote earlier this month, the Bank of England (BoE) kept rates on hold with Governor Andrew Bailey stating that the Bank needed to "see more evidence" inflation was slowing before rates could be reduced.

The Japanese yen remained near 9-month lows on Monday. The dollar was +0.40% to ¥ 155.20. Data earlier in the day showed the Japanese economy shrank at an annualised 1.8% in the three months through September. This was attributed to a drop in exports as a result of US tariffs.

Fixed Income

US 10-year Treasury -0.70 basis points to 4.140%

German 10-year bund +0.30 basis points to 2.711%

UK 10-year gilt -4.5 basis points to 4.531%

US Treasury yields declined slightly on Monday in anticipation of a slew of data delayed during the federal government shutdown which is expected to provide clues on the health of the US economy, with the September nonfarm payrolls report due onThursday.

The yield on the US 10-year Treasury note was -0.7 bps to 4.140% on Monday. The two-year US Treasury yield, which generally reflects expectations for Fed policy, was unchanged at 3.610%. The yield on the 30-year Treasury bond was -1.4 bps to 4.734%.

The spread between the yields on two-year and 10-year Treasury notes stood at a positive 53 bps, 0.5 bps lower than the previous week’s 53.5 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 42.9% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 62.4% probability. Markets are now pricing in less than a 40% chance of a 25-basis-point rate cut in December, down from more than 60% earlier in November.

Germany’s 10-year government bond yield edged up slightly by +0.3 bps to 2.711% on Monday after the Dutch central bank president, Olaf Sleijpen, told reporters that the risks for the eurozone inflation outlook are balanced and the current level of interest rates is appropriate.

The 2-year German yield, considered more responsive to expectations surrounding ECB policy, was +0.6 bps to 2.035%. The 30-year yield was +0.5 bps to 3.309%.

Italy’s 10-year government bond yield was -1.7 bps to 4.446%, with the spread over 10-year German Bunds standing at 173.5 bps.

In the UK, gilts steadied following Friday’s sell-off driven by investor concerns over Chancellor Rachel Reeves’ decision to not to raise income tax in next week’s Budget.

The 10-year yield fell -4.5 basis points to 4.531%, but still remained close to its highest levels in a month.

Note: As of 5 pm EST 17 November 2025

Global Macro Updates

An increasingly divergent Fed? On Monday Fed Vice Chair Philip Jefferson said the Fed needs to move slowly in terms of further rate cuts given trade-offs between potentially sticky inflation and a weakening labour market. However, Fed Governor Christopher Waller came out in support of further rate cuts, saying that the data available during the Government shutdown indicated a weakening labour market with no evidence of building wage pressures and that restrictive monetary policy was weighing on the economy. At a speech in London, he said, "I am not worried about inflation accelerating or inflation expectations rising significantly. My focus is on the labour market, and after months of weakening, it is unlikely that the September jobs report later this week or any other data in the next few weeks would change my view that another cut is in order when the Fed meets in December.” He also refuted the Fed being “in a fog” and stressed the availability of private and some public sector data to provide a picture of the economy.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora