Will big tech's AI binge frighten investors?

What to look out for today

Companies reporting on Wednesday, 12th November: ABN AMRO, Bayer, Cisco Systems, Copart, TransDigm Group

Key data to move markets today

EU: German CPI and Harmonised Index of Consumer Prices and speeches by ECB Executive Board member Isabel Schnabel and ECB Vice President Luis de Guindos

US: Speeches by New York Fed President John Williams, Philadelphia Fed President Anna Paulson, Fed Governor Christopher Waller, Atlanta Fed President Raphael Bostic, Fed Governor Stephen Miran, and Boston Fed President Susan Collins

US Stock Indices

Dow Jones Industrial Average +1.18%

Nasdaq 100 -0.31%

S&P 500 +0.21%, with 10 of the 11 sectors of the S&P 500 up

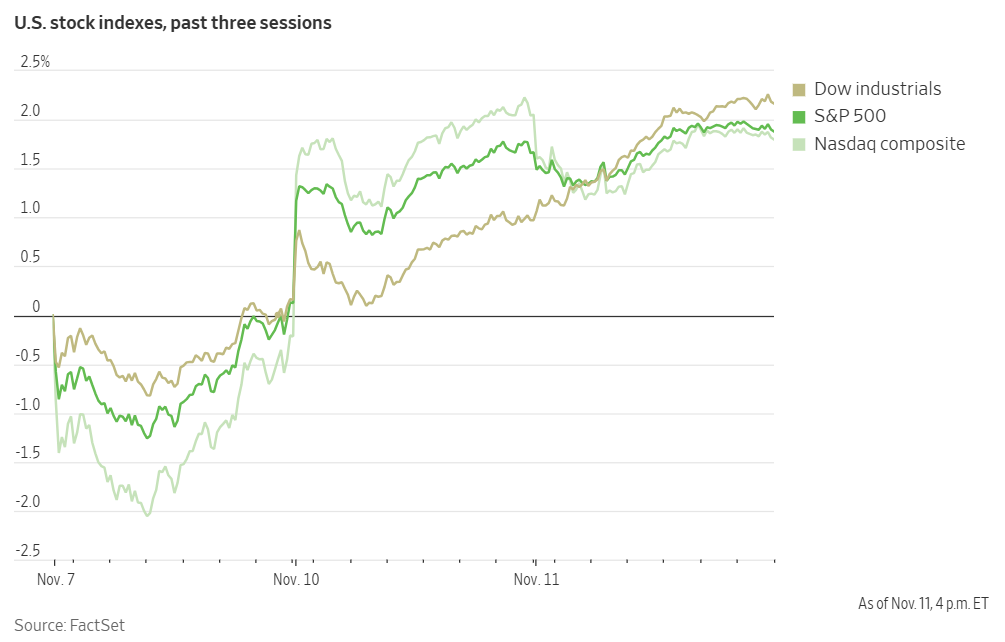

Stocks advanced on Tuesday as investors weighed indications of labour market softness alongside expectations for an imminent resolution to the government shutdown.

The Dow Jones Industrial Average was +1.18% and reached a new record high, while the S&P 500 edged higher by +0.21% with approximately 345 of its constituents posting gains. However, declines in the technology sector exerted downward pressure on the Nasdaq Composite.

In corporate news, SoftBank divested its entire holding in Nvidia for $5.83 billion. The proceeds are earmarked to support investments in AI, despite ongoing investor concerns regarding the scale of capital allocation to a rapidly evolving technology.

Microsoft announced plans to invest $10 billion in an AI data centre along the Portuguese coast, marking one of its largest European investments this year.

Alphabet’s Google revealed the introduction of new AI features for its Pixel devices, such as message summaries and prioritised notifications. It also committed €5.5 billion toward expanding computing resources and operations in Germany over the next four years.

Parker-Hannifin reached an agreement to acquire Filtration Group from Madison Industries for $9.25 billion, further enhancing its industrial filtration portfolio.

S&P 500 Best performing sector

Health Care +2.33%, with Viatris +10.13%, Moderna +6.66%, and DexCom +6.00%

S&P 500 Worst performing sector

Information Technology -0.72%, with Enphase Energy -6.09%, Micron Technology -4.81%, and Lam Research -4.32%

Mega Caps

Alphabet +0.39%, Amazon +0.28%, Apple +2.16%, Meta Platforms -0.74%, Microsoft +0.53%, Nvidia -2.96%, and Tesla -1.26%

Information Technology

Best performer: Akamai Technologies +4.01%

Worst performer: Enphase Energy -6.09%

Materials and Mining

Best performer: International Flavors & Fragrances +4.03%

Worst performer: FMC -1.28%

European Stock Indices

CAC 40 +1.25%

DAX +0.53%

FTSE 100 +1.15%

Corporate Earnings Reports

Posted on Tuesday, 11th November

Occidental Petroleum quarterly revenue -7.7% to $6.424 bn vs $6.753 bn estimate

EPS at $0.64 vs $0.51 estimate

Vicki Hollub, President and CEO, said, “Occidental’s third quarter results are a testament to the exceptional operational execution of our teams and the strength of our upstream portfolio. We achieved notable outperformance across our oil and gas assets as well as within our midstream and marketing operations. The sale of OxyChem is an important milestone in the strategic transformation of our company and will enable us to further strengthen our balance sheet, accelerate shareholder returns and unlock high-return opportunities across our core oil and gas business.” — see report.

Commodities

Gold spot +0.25% to $4,125.87 an ounce

Silver spot +1.36% to $51.19 an ounce

West Texas Intermediate +1.53% to $60.88 a barrel

Brent crude +1.88% to $65.15 a barrel

Gold prices reached their highest level in nearly three weeks on Tuesday. Spot gold rose +0.25% to $4,125.87 per ounce after earlier touching its 23rd October peak.

Oil prices advanced on Tuesday, driven by the latest US sanctions on Russian oil. However, concerns about oversupply tempered overall gains. Brent crude futures closed up $1.20, or +1.88%, at $65.15 per barrel. US WTI crude settled 92 cents higher, or +1.53%, at $60.88 per barrel.

Investors are continuing to evaluate the effects on both crude oil and refined fuel markets of these US sanctions on Russia. Middle Eastern producers — including Saudi Arabia, Iraq, and Kuwait — are set to increase crude oil deliveries to India in December as Indian refiners look for alternatives to Russian barrels, according to sources from four Indian refiners cited by Reuters.

Note: As of 5 pm EST 11 November 2025

Currencies

EUR +0.21% to $1.1580

GBP -0.17% to $1.3150

Bitcoin -2.80% to $102,650.01

Ethereum -3.46% to $3,418.69

The US dollar weakened on Tuesday, as concerns over the deteriorating US labour market intensified following a report indicating that private employers reduced jobs in the previous month.

Since mid-September, the dollar had experienced a rebound, supported by expectations of fewer interest rate cuts due to a more favourable outlook for US economic growth. Additionally, many Fed officials have expressed caution regarding further reductions in rates, citing persistent concerns about inflation.

Trading activity was muted on Tuesday, with the US bond market closed in observance of the Veterans Day holiday.

The dollar index fell -0.16% to 99.46. The euro gained +0.29% to reach $1.1580.

The British pound fell by -0.17% to $1.3150, following data that revealed a noticeable cooling in the UK labour market during Q3, as the unemployment rate climbed and wage growth slowed.

The Japanese yen edged higher against the dollar, with the dollar falling -0.01% to ¥154.15.

Fixed Income

US Treasury market was closed in observance of the Veterans' Day holiday

German 10-year bund -0.6 basis points to 2.663%

UK 10-year gilt +0.0 basis points to 4.391%

Eurozone bond yields eased slightly on Tuesday, though they remained near one-month highs as market participants assessed subdued German investor sentiment data along with numerous comments from policymakers.

Germany’s 10-year government bond yield declined -0.6 bps to 2.663%, holding close to Monday’s 2.699% — the highest level since early October. On the shorter end of the curve, the two-year Schatz yield rose +1.3 bps to 2.009%, while the 30-year Bund yield slipped -0.8 bps to 3.254%.

Yields on other major European government bonds largely mirrored the German benchmark. Italy’s 10-year yield was down -0.8 bps at 3.405% after reaching a near one-month high the previous day and France’s 10-year yield fell -1.8 bps to 3.423%.

Note: As of 5 pm EST 11 November 2025

Global Macro Updates

ADP's weekly payroll offers new insights into labour market data. ADP reported that payrolls declined by an average of 11,250 jobs per week over the four weeks ending on 25th October. This figure contrasts with ADP’s October report, which indicated a gain of 42,000 private-sector jobs, suggesting a deceleration in hiring activity toward the end of the month. These developments coincide with an uptick in corporate layoff announcements. The 6th November Challenger report had recorded 153,000 layoffs in October.

Analysts have expressed mixed views on interpreting alternative labour market data during the government shutdown. Some suggest that labour market deterioration has increased, citing signs of rising layoffs during a period typically characterised by low hiring. Others contend that labour demand has slowed more markedly than labour supply, noting that the recent wave of layoff announcements undermines the ‘low fire’ aspect commonly associated with current labour market conditions, thereby introducing significant risk to the broader economic outlook. Despite these considerations, it is still uncertain how the anticipated influx of data following the government reopening will be interpreted.

AI sentiment slows amid different updates. CoreWeave reported stronger-than-expected Q3 revenues but revised its FY 2025 revenue guidance downward due to supply chain disruptions affecting a third-party data centre developer. These challenges resulted in delays in fulfilling customer contracts. In addition, the company reduced its CapEx guidance for Q4 by approximately 50%, with the remaining expenditure anticipated to shift into Q1. JPMorgan subsequently downgraded CoreWeave's shares to neutral, citing that these revenue shifts have made forecasting future results more challenging. These developments occur alongside other cautious updates within the AI space. Analysts have noted investors selling off the debt of major US technology firms — including Alphabet, Meta Platforms, Microsoft, and Oracle — amid concerns over increased AI spending. Bond spreads for those companies have widened since September.

SoftBank has divested its entire $5.83 billion stake in Nvidia, with plans to reinvest the proceeds into other companies, including OpenAI. Reports also indicate that Anthropic is on track to achieve profitability much sooner and with less cash burn than OpenAI, owing to its focus on revenue-generating corporate clients and greater reliance on Amazon and Google chips, in contrast to OpenAI's preference for Nvidia hardware. Additionally, Meta's shares declined following a Financial Times report that its chief AI scientist, Yann LeCun, is set to depart the company to establish his own start-up.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora