Will the job market surprise to the downside?

What to look out for today

Companies reporting on Monday, 10th November: Barrick Mining, Paramount Skydance, Tyson Foods

Key data to move markets today

EU: A speech by ECB Vice President Luis de Guindos and Eurozone Sentix Investor Confidence

UK: BRC Like-For-Like Retail Sales and a speech by BoE Deputy Governor Clare Lombardelli

JAPAN: Current Account

US Stock Indices

Dow Jones Industrial Average +0.16%

Nasdaq 100 -0.28%

S&P 500 +0.13%, with 9 of the 11 sectors of the S&P 500 up

On Friday, US equities rebounded sharply from session lows amid growing optimism that lawmakers are nearing an agreement to end the longest government shutdown in American history. Nearly 400 S&P 500 constituents advanced. On Sunday evening, the US Senate voted 60-40 on a procedural measure to advance a bill to end the government shutdown. According to Bloomberg news, under the agreement, Congress would pass full-year funding for the departments of Agriculture, Veterans Affairs and Congress itself, while funding other agencies through 30 January. The bill would provide pay for furloughed government workers, resume withheld federal payments to states and localities and recall agency employees who were laid off during the shutdown. However, the bill can still fail if any Senator objects. This bill was, as noted by The Hill, blocked by Senate Democrats on 14 previous occasions.

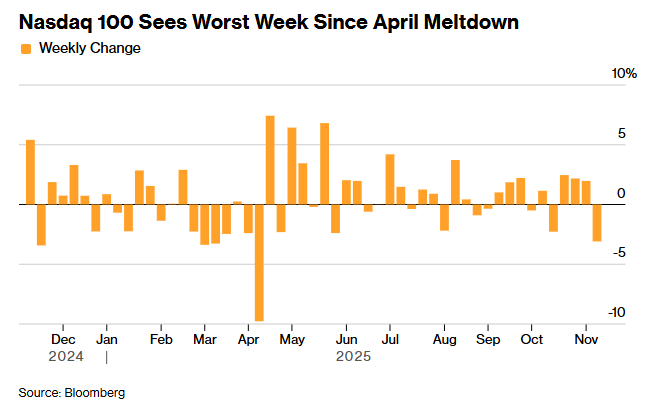

The S&P 500 closed +0.13% after testing its 50-day moving average earlier in the session. While the Nasdaq 100 trimmed most of its Friday decline, it nonetheless recorded its worst weekly performance since April. Over the last week, the S&P 500 fell -1.80%, the Nasdaq Composite declined -3.48%, and the Dow Jones Industrial Average lost -0.74%.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +16.8%. This number jumps to 17.8% when excluding the Energy sector. Of the 446 companies in the S&P 500 that have reported earnings to date for Q3 2025, 82.5% have reported earnings above analyst estimates, with 78.1% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 8.1% in Q3, increasing to 8.7% when excluding the Energy sector.

The Health Care sector, at 93.0%, is the sector with most companies reporting above estimates. Industrials and Communication Services, both with a surprise factor of 15.6%, are the sectors that have beaten earnings expectations by the highest surprise factors. Within Communication Services, 38.9% of companies have reported below estimates and Real Estate is the sector with the lowest surprise factor at 4.0%. The S&P 500 surprise factor is 10.3%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.7x.

In corporate news, according to Bloomberg news, a consortium of approximately 20 banks is extending a project finance loan of roughly $18 billion to support the construction of a data centre campus affiliated with Oracle.

International Airlines Group, parent company of British Airways, reported some softness on its key North Atlantic route during Q3, which negatively affected earnings and led to the most significant stock decline since April. US officials cautioned that flight cancellations may need to double if the government shutdown persists and staffing shortages among air-traffic controllers worsen, heightening the risk of travel disruptions as the country approaches one of its busiest travel periods.

Banca Monte dei Paschi di Siena reported Q3 earnings that exceeded expectations, providing a boost to CEO Luigi Lovaglio following the acquisition of rival Mediobanca.

S&P 500 Best performing sector

Energy +1.56 %, with Devon Energy +3.92%, EQT +3.00%, and Williams Companies +2.83%

S&P 500 Worst performing sector

Communication Services -0.84%, with Take-Two Interactive Software -8.08%, Alphabet -1.98%, and Electronic Arts +0.11 %

Mega Caps

Alphabet -1.98%, Amazon +0.56 %, Apple -0.48%, Meta Platforms +0.45 %, Microsoft -0.06%, Nvidia +0.04 %, and Tesla -3.68%

Information Technology

Best performer: Akamai Technologies +14.71%

Worst performer: Microchip Technology -5.17%

Materials and Mining

Best performer: Celanese +14.37%

Worst performer: International Flavors & Fragrances -1.35%

European Stock Indices

CAC 40 -0.18%

DAX -0.69%

FTSE 100 -0.55%

Corporate Earnings Reports

Posted on Friday, 7th November

Constellation Energy quarterly revenue +0.3% to $6.570 bn vs $6.202 bn estimate

EPS at $3.04 vs $3.11 estimate

Joe Dominguez, President and CEO, said, “We achieved one of the highest operating quarters for our nuclear fleet and advanced major milestones like our historic settlement with Maryland for continued operations of the Conowingo dam. Momentum continues to build around reliable, clean nuclear energy as a cornerstone of America's energy strategy. With growing recognition of nuclear's role in powering the data economy and supporting reliability and affordability for consumers, Constellation is positioned to help our regions and nation grow, while continuing to deliver benefits for our customers, communities, and owners.” — see report.

Duke Energy quarterly revenue +4.8% to $8.542 bn vs $8.567 bn estimate

EPS at $1.81 vs $1.76 estimate

Harry Sideris, President and CEO, said, “We remain on track to deliver strong results in 2025, while advancing an energy modernization strategy that creates value for our customers, stakeholders and investors. With our economic development pipeline continuing to progress and concrete investment plans in place, we are reaffirming our long-term EPS growth rate and have confidence we will earn in the top half of the range beginning in 2028.” — see report.

KKR & Co quarterly revenue +22.5% to $2.400 bn vs $2.010 bn estimate

EPS at $1.41 vs $1.30 estimate

Joseph Y. Bae and Scott C. Nuttall, Co-CEOs, said, “KKR’s strong performance continued in Q3 with latest twelve month management fees, Fee Related Earnings and Adjusted Net Income all at record levels. New capital raised reached $43 billion – the highest quarterly figure for KKR in over four years – reflecting the trust we’ve built with our investors and continued momentum across our businesses. With a record $126 billion of dry powder, we remain incredibly well positioned to help our clients navigate the current environment.” — see report.

Commodities

Gold spot +0.55% to $3,998.72 an ounce

Silver spot +0.60% to $48.31 an ounce

West Texas Intermediate +0.54% to $59.84 a barrel

Brent crude +0.33% to $63.69 a barrel

Gold prices advanced on Friday as the US dollar weakened as the ongoing government shutdown contributed to increased safe-haven demand. Spot gold rose +0.55% to $3,998.72 per ounce. Despite the daily gain, gold prices posted a modest weekly decline of -0.08%.

The US dollar index fell -0.16% on Friday, making gold, which is priced in dollars, more affordable for holders of other currencies.

Crude oil experienced a midday decline on Friday attributed to widespread flight cancellations caused by a shortage of US air traffic controllers. The US government shutdown has resulted in many controllers going unpaid, prompting the Federal Aviation Administration to instruct airlines to cut thousands of flights. However, oil rebounded by the end of trading on optimism that Hungary may be permitted to continue using Russian crude supplies, following a meeting between US President Donald Trump and Hungarian Prime Minister Viktor Orban at the White House. Hungary's continued use of Russian energy since the onset of the 2022 conflict in Ukraine has drawn criticism from several European Union and NATO allies. Brent crude futures advanced $0.21, or +0.33% to $63.69 per barrel. US WTI crude was up $0.32, or +0.54%, to $59.84 per barrel.

Both benchmarks still posted weekly losses, with WTI and Brent falling -1.71% and -2.12%, respectively, amid rising output from major global producers.

Concerns regarding oversupply were further heightened this past week as US crude inventories unexpectedly increased by 5.2 million barrels. According to the Energy Information Administration, this rise was attributed to higher imports and reduced refinery activity, even as gasoline and distillate stocks declined. This news followed the OPEC+ announcement of a modest increase in production for December.

Continuing European and US sanctions on Russia and Iran are disrupting supply routes to leading importers, notably China and India, thus providing some support for global prices. In October, China's crude oil imports rose by 2.3% from September and were 8.2% higher y/o/y, reaching 48.36 million tons, due to elevated refinery utilisation rates.

On Thursday Swiss commodities trader Gunvor announced the withdrawal of its proposal to purchase the foreign assets of Russian energy company Lukoil, following opposition from the US Treasury. The Treasury characterised Lukoil as a Russian proxy and signalled its objection to the transaction. Gunvor's decision to abandon the deal indicates that the US is maintaining its maximum pressure strategy against Russia, with the potential for stricter enforcement of sanctions on companies such as Rosneft and Lukoil.

Baker Hughes report. According to a report from energy technology company Baker Hughes released Friday, US energy firms increased the number of oil and natural gas rigs for the third time in four weeks. The combined oil and gas rig count, which serves as an early indicator of future production levels, rose by two to a total of 548 for the week ending 7th November.

Despite this recent uptick, Baker Hughes noted that the overall rig count remains at 37 rigs, or 6%, below the level recorded during the same period last year. The number of oil rigs remained unchanged at 414, while gas rigs increased by three to 128 — their highest point since August 2023. Conversely, miscellaneous rigs decreased by one, bringing the total to six.

Regionally, Texas — the nation's leading oil and gas producing state — saw its rig count decline by one to 234, marking the lowest level since September 2021. In contrast, Louisiana experienced a gain of two rigs to 43, the highest number since September 2024.

Note: As of 5 pm EST 7 November 2025

Currencies

EUR +0.16% to $1.1565

GBP +0.16% to $1.3157

Bitcoin +2.71% to $103,827.55

Ethereum +4.23% to $3,467.07

The US dollar weakened against major currencies on Friday as investors weighed the Fed's hawkish stance against ongoing concerns about the US economy.

The euro was +0.16% to $1.1565 and posted a +0.31% gain for the week after two consecutive weeks of losses. Euro support is being driven by expectations that the ECB is at or near the end of its rate cutting cycle. Further rate cuts are anticipated in both the US and the UK in 2026.

The British pound was +0.16% on Friday, bringing Sterling’s weekly performance into positive territory at +0.05%.

The dollar had rallied following remarks by Fed Chair Jerome Powell, who highlighted the risks associated with additional easing measures. However, the dollar fell Thursday in response to weaker labour market data. With the release of the monthly non-farm payrolls report delayed due to the government shutdown, traders instead relied on private sector data, which indicated job losses in October, particularly in the government and retail sectors.

The dollar index fell -0.16% to 99.56, representing a weekly drop of -0.16%, ending a two-week period of consecutive gains.

The dollar was +0.22% against the yen to ¥153.40 on Friday. It was, however, -0.39% for the week.

Fixed Income

US 10-year Treasury +0.8 basis points to 4.101%

German 10-year bund +1.8 basis points to 2.672%

UK 10-year gilt +3.2 basis points to 4.470%

US Treasury yields edged higher on Friday following new survey results indicating a decline in consumer sentiment due to the ongoing US government shutdown. Investors also continued to weigh concerns over increased debt issuance against signs of economic slowdown.

The University of Michigan’s preliminary consumer sentiment index for November dropped to 50.3, marking its lowest reading since June 2022. Additionally, year-ahead inflation expectations rose slightly to 4.7% from 4.6% in the previous month. Additionally, the New York Fed’s survey of consumer expectations revealed that Americans foresee moderating inflation pressures in the near term, with persistent uncertainty remaining regarding the future of the job market.

The 10-year Treasury note was +0.8 bps to 4.101%. The two-year yield fell -0.4 bps to 3.568%, having earlier touched a one-week low of 3.547%. The 30-year yield increased +2.3 bps, closing at 4.698%. The yield curve continued to steepen, with the spread between two- and 10-year notes widening to 53.3 bps — the most pronounced level since mid-October — compared to 49.7 bps the previous week.

Over the course of the week, the two-year yield declined -1.4 bps, the 10-year yield rose +2.2 bps, and the 30-year yield advanced +5.1 bps.

The Treasury Department is scheduled to auction a total of $125 billion in notes and bonds this week, spanning 3, 10, and 30-year maturities.

Investor focus has also shifted back to the US fiscal outlook, prompted by the potential consequences of a pending Supreme Court ruling regarding the President’s broad tariffs. Should these tariffs be overturned, there could be an expansion of government budget deficits, potentially resulting in increased Treasury debt supply entering the market.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 66.5% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 63.0%. Traders are currently expecting 16.6 bps of cuts by year-end, higher than the 15.8 bps anticipated the prior week.

Borrowing costs in the euro area increased on Friday, with German bond yields reaching roughly one-month highs as market participants express confidence that the ECB has likely ended its rate cutting cycle.

The 10-year and 30-year German bond yields were +1.8 bps to 2.672% and +2.5 bps and 3.267%, respectively. This was their highest level since 10th October. The two-year Schatz also advanced +1.0 bps to 2.005%.

Across the German yield curve, rates finished the week higher. The two-year Schatz gained +3.3 bps, the 10-year yield rose +3.8 bps, and the 30-year yield increased +5.5 bps. Money markets currently assign roughly a 40% probability to an ECB rate cut by July of next year.

A speech on Thursday by ECB Executive Board member Isabel Schnabel may have added further upward pressure on long-term bond yields. Schnabel, who oversees the ECB’s market operations, indicated that the central bank remains far from resuming debt purchases to inject liquidity into the banking system. She emphasised the need to further reduce the bond holdings accumulated over a decade of accommodative policy.

On Friday 10-year French government bond yields edged +1.5 bps higher to 3.464%, while the spread over its German counterpart stood at 79.2 bps after widening by 4.2 bps the previous week. In contrast, the Italian 10-year yield declined -43.0 bps on Friday to 3.438%, ending a volatile week during which the yield surged by +47.9 bps overnight on Tuesday before dropping -46.0 bps earlier on Friday. The spread between Italian 10-year BTPs and German Bunds ended the week at 76.6 bps, up 3.7 bps compared to the previous week.

Note: As of 5 pm EST 7 November 2025

Global Macro Updates

UoM consumer sentiment hits lowest point since June 2022. The preliminary University of Michigan Consumer Sentiment Index for November registered at 50.3, falling short of the consensus estimate of 54.2 and the previous reading of 53.6. This was its lowest level since June 2022. Inflation expectations presented a mixed picture: year-ahead expectations edged up to 4.7% from 4.6%, while long-term expectations declined to 3.6% from 3.9%. The Current Economic Conditions Index dropped sharply to 52.3 from 58.6, reaching a record low, while the Index of Consumer Expectations decreased to 49.0 from 50.3. The report attributed the decline in sentiment primarily to a 17% reduction in assessments of current personal finances and an 11% decline in expectations for business conditions in the coming year. Concerns about a potential extended government shutdown also weighed on sentiment. Notably, the report highlighted that consumers with greater stock market exposure experienced an improvement in sentiment, reflecting optimism about strong market performance. Overall, the data reinforces the narrative of a continuing K-shaped divergence in outlook between lower and higher income consumers.

New York Fed survey: Inflation expectations down, household outlook slips. The New York Fed’s October Survey of Consumer Expectations revealed that the median year-ahead inflation expectation declined to 3.2%, down from 3.4% the previous month. Inflation expectations for the three- and five-year horizons remained unchanged at 3.0%. Both median inflation uncertainty and home-price inflation expectations held steady, with the latter remaining at 3.0% for the fifth consecutive month. Regarding the labour market, the survey indicated that median expectations for year-ahead earnings growth increased to 2.6% from 2.4%. The proportion of respondents anticipating a higher US unemployment rate in a year rose for the third consecutive month.

The average perceived probability of losing one’s job within the next 12 months fell to 14.0% from 14.9%. Expectations for the ability to find a new job fell to 46.8% from 47.4% in September. Additionally, the median expectation for year-ahead household spending growth edged down by 0.1 percentage points to 4.8%. While perceptions of credit access improved, the perceived likelihood of missing a minimum debt payment increased slightly. Overall, a greater share of households reported a worse financial situation y/o/y compared to September.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora