Steady as she goes

What to look out for today

Companies reporting on Friday, 31st October: Abbvie, Aon, CBOE Global Markets, Charter Communications, Chevron, Church & Dwight, Colgate-Palmolive, Dominion Energy, Exxon Mobil, Federal Realty Investment Trust, T. Rowe Price Group, W.W. Grainger

Key data to move markets today

EU: A speech by Austrian Central Bank Governor Martin Kocher, German Retail Sales, Eurozone Harmonised Index of Consumer Prices, Core Harmonised Index of Consumer Prices, Italian CPI, and French CPI

USA: Personal Consumption Expenditures (PCE) Index, and Core PCE index, Personal Income, Personal Spending, Employment Cost Index, ISM Chicago PMI, and speeches by Atlanta Fed Governor Raphael Bostic, and Cleveland Fed President Beth Hammack

US Stock Indices

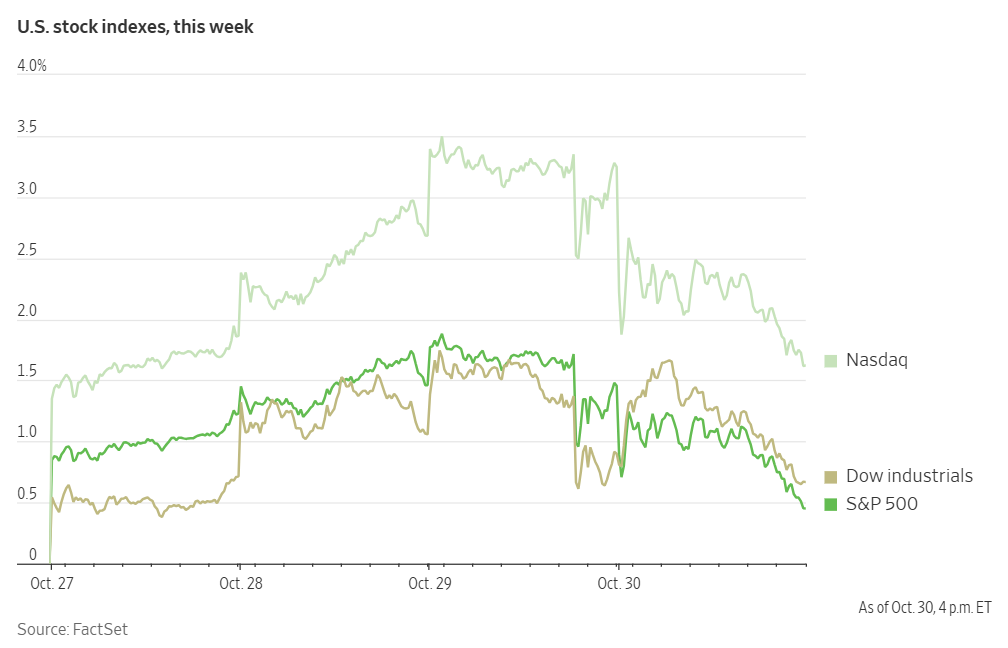

Dow Jones Industrial Average -0.23%

Nasdaq 100 -1.47%

S&P 500 -0.99%, with 3 of the 7 sectors of the S&P 500 down

Technology stocks fell on Thursday as Meta Platforms and Microsoft posted post-earnings losses. However, shares of Amazon and Apple rose in after-hours trading, driven by the companies' latest earnings reports. Major technology firms continue to invest heavily in AI, relying on expansive data centres equipped with high-performance servers. As the substantial costs associated with these initiatives become more apparent, investors’ tolerance is being tested.

The Nasdaq Composite ended the day -1.57%, the S&P 500 fell -0.99% and the Dow Jones Industrial Average declined -0.23%.

In corporate news, Gilead Sciences reported Q3 product sales that fell short of analyst expectations. While its core HIV drugs demonstrated steady growth, this was not enough to compensate for the drop in Covid-related and cell therapy treatments sales.

Shareholders of Core Scientific rejected a takeover offer from CoreWeave, following recommendations from proxy advisers who said the bid undervalued the data centre company. This decision concludes a protracted and contentious negotiation period.

Hershey reported disappointing Halloween sales figures in the US, but increased its annual forecast on recent price hikes.

American International Group announced agreements to acquire stakes in specialty insurer Convex Group and alternative asset manager Onex. The combined transactions total over $2.7 billion.

Steel producer Cleveland-Cliffs revealed that South Korean steelmaker Posco Holdings will serve as its new strategic partner.

S&P 500 Best performing sector

Real Estate +0.65%, with Ventas +6.56%, Equinix +4.44%, and Invitation Homes +3.42%

S&P 500 Worst performing sector

Consumer Discretionary -2.56%, with Chipotle Mexican Grill -18.18%, eBay -15.88%, and Tesla -4.63%

Mega Caps

Alphabet +2.45%, Amazon -3.23%, Apple +0.63%, Meta Platforms -11.33%, Microsoft -2.92%, Nvidia -2.00%, and Tesla -4.63%

Amazon Q3 earnings. Once considered to be trailing in the field of AI, Amazon addressed these concerns on Thursday by reporting stronger-than-anticipated growth in AI-related revenue. It also unveiled ambitious plans to expand its data centre capacity.

For Q3, the company reported a 13% y/o/y increase in sales, reaching $180 billion, surpassing the FactSet consensus of $177.91 billion. Revenue generated by Amazon Web Services (AWS) was $33.01 billion, surpassing the $32.42 billion consensus forecast. Online Stores revenue stood at $67.41 billion versus the $66.94 billion forecast.

The operating margin, excluding one-time charges, was approximately 12.0%, exceeding FactSet’s estimate of 11.1% and up from 11.0% in the same period last year. Net profit rose sharply by 39% y/o/y to $21.2 billion. AWS, which contributes significantly to Amazon’s profitability, experienced a 20% y/o/y growth in revenue for Q3, its fastest pace since 2022.

Amazon continues to broaden its same-day grocery delivery services. It has opened new warehouses in rural regions across the US, aiming to further increase its market share.

The company noted that earnings for the quarter were affected by one-time charges stemming from a legal settlement and workforce restructuring. In September, Amazon agreed to a $2.5 billion settlement in a lawsuit brought by the Federal Trade Commission regarding its Prime subscription practices. Additionally, this week, Amazon announced the elimination of 14,000 white-collar positions. This is projected to result in $1.8 billion in associated costs.

CapEx reached nearly $90 billion in the first nine months of the year, with the company projecting full-year spending to total $125 billion. Amazon’s guidance for Q4 revenue is between $206.0 and $213.0 billion, compared to FactSet’s forecast of $208.41 billion.

CEO Andy Jassy remarked that demand for cloud computing and AI services is exceeding Amazon’s current capacity, with customers acquiring these offerings as quickly as they become available. On Wednesday, Amazon announced that Project Rainier, one of its most significant AI data centre investments, is now fully operational. Jassy added that Amazon has doubled its data centre capacity since 2022 and expects to double again by late 2027.

During its earnings call, Amazon provided near-term guidance. It includes: plans to increase AWS capacity by at least one gigawatt in the fourth quarter of 2025, expand same-day perishable grocery delivery to 2,300 US cities by year-end 2025, maintain cash capital expenditures around $125 billion for full-year 2025, deploy over one million Trainium2 chips by the end of 2025, and preview Trainium3 chips in late 2025 with broader availability expected in early 2026.

The Q&A session highlighted several key themes: the ongoing substantial expansion of AWS capacity, with a goal to double total capacity by 2027; strong demand for Trainium2 chips with full subscription, and anticipation for Trainium3; Project Rainier’s demonstration of large-scale Trainium clusters, with similar infrastructure planned for future Trainium3 customers; the grocery segment surpassing $100 billion in gross sales; and continued experimentation with physical store formats. The most momentum is being seen in the integrated online-perishable delivery model.

The primary risk highlighted was sustaining capacity expansion. As cloud and AI services rapidly scale their infrastructure, there is a possibility of encountering bottlenecks due to limitations in power or chip supply.

Apple Q3 earnings. Apple reported record sales for the quarter and expressed optimism for a robust Q4, as customer demand for the new iPhone 17 continues to surge.

CFO Kevan Parekh said the company expects total revenue growth of 10% to 12% in the upcoming holiday quarter vs Wall Street analysts’ expectations of 6%. This is primarily attributed to an expected ‘double-digit’ rise in iPhone sales compared to the prior year period.

During Q3, iPhone sales reached $49 billion, coming in slightly below expectations. Mr. Parekh noted that Apple encountered supply constraints on several models due to exceptionally strong demand, as confirmed by CEO Tim Cook during the company’s earnings call.

Apple’s total revenue for Q3 was $102.5 billion, an 8% y/o/y increase and marginally exceeding the FactSet estimate of $102.23 billion. Product revenue totalled $73.72 billion vs the consensus of $74.33 billion. Services revenue was $28.75 billion vs the $28.23 billion forecast. Revenue from China declined by 3.6% y/o/y to $14.49 billion, the only geographic segment with a decrease.

The company’s operating margin reached 31.6% vs the consensus estimate of 31.1%.

Earlier on Thursday, Apple received favourable news as the US President announced a reduction of the 20% fentanyl-related tariffs on China, as part of a preliminary trade agreement. This particular tariff is the only one currently applicable to Apple’s US imports, following earlier exemptions granted in exchange for increased domestic investment commitments by the company.

Apple reported $1.1 billion in tariff-related costs for Q3. It anticipates these costs will rise to $1.4 billion in Q4.

During the earnings call, the company’s near-term guidance emphasised the strength of the unparalleled iPhone 17 lineup, with the Pro and Air models driving global demand and resonating strongly with consumers. Services revenue reached all-time highs across categories and geographies, with no significant impact from antitrust or tax matters.

Key themes discussed during the Q&A session included: accelerating AI integration across devices and services to foster innovation and user engagement; strengthening the product portfolio by launching the most advanced iPhone, Mac, iPad, and wearables to capitalise on upgrade cycles; and navigating global supply chains to manage ongoing supply constraints and tariff challenges while ensuring strong product availability worldwide.

The primary risk identified by the company is maintaining a sustained balance between supply and demand. Continued supply constraints on key products may restrict revenue potential during periods of heightened demand.

Information Technology

Best performer: Keysight Technologies +2.87%

Worst performer: Oracle -6.69%

Materials and Mining

Best performer: Newmont +3.31%

Worst performer: International Paper -12.66%

European Stock Indices

CAC 40 -0.53%

DAX -0.02%

FTSE 100 +0.04%

Corporate Earnings Reports

Posted on Thursday, 30th October

Eli Lilly quarterly revenue +53.9% to $17.601 bn vs $16.053 bn estimate.

EPS at $7.02 vs $5.69 estimate.

David A. Ricks, Chair and CEO, said, “Lilly delivered another strong quarter, with 54% revenue growth year-over-year driven by continued demand for our incretin portfolio. We advanced orforglipron through four additional Phase 3 trials, enabling global obesity submissions by year-end, and we achieved U.S. FDA approval of Inluriyo (imlunestrant)—marking key progress across our pipeline. We continue to increase manufacturing capacity, announcing new facilities in Virginia and Texas and an expansion of our site in Puerto Rico.” — see report.

Estee Lauder Companies quarterly revenue +3.6% to $3.481 bn vs $3.382 bn estimate.

EPS at $0.32 vs $0.18 estimate.

Stéphane de La Faverie, President and CEO, said, “Having closed fiscal 2025 as expected, we remain wholly focused on continuing to execute our strategic vision of Beauty Reimagined with excellence. Despite continued volatility in the external environment, we embarked on fiscal 2026 with signs of momentum and confidence in our outlook to deliver organic sales growth this year after three years of declines and to begin rebuilding operating profitability in pursuit of a solid double-digit adjusted operating margin over the next few years.” — see report.

Fox quarterly revenue +4.9% to $3.738 bn vs $3.567 bn estimate.

EPS at $1.51 vs $1.11 estimate.

Lachlan Murdoch, Executive Chair and CEO, said, “Coming off a record Fiscal 2025, our strong operating momentum has carried through the first quarter of Fiscal 2026. We are delivering for audiences with continued engagement growth across the portfolio which underpins the robust advertising demand we are seeing across sports, news, entertainment and Tubi. The quality of our assets and their consistent capacity to deliver financially gives me great confidence in the positive outlook for FOX. This morning’s announcement to leverage the strength of our balance sheet with a $1.5 billion accelerated share repurchase transaction clearly underscores this confidence along with our commitment to creating value for our shareholders.” — see report.

Commodities

Gold spot +2.39% to $4,023.22 an ounce

Silver spot +2.85% to $48.91 an ounce

West Texas Intermediate -0.12% to $60.29 a barrel

Brent crude -0.11% to $64.73 a barrel

Spot gold rose +2.39% to $4,023.22 per ounce on Thursday, supported by the FOMC decision to cut interest rates and ongoing uncertainty surrounding the progress of trade negotiations between China and the US.

Oil prices edged lower on Thursday. Brent crude futures increased modestly by 7 cents, or -0.11%, to close at $64.73 per barrel. US WTI crude slipped by 7 cents, or -0.12%, to $60.29 per barrel.

Shell and TotalEnergies reported quarterly profit declines of 10% and 2%, respectively. They attributed this to weaker oil prices. Despite the overall decline, Shell surpassed market expectations, aided by stronger trading performance in its large gas division.

Both major crude benchmarks are poised to record losses of over 3% for October, marking the third straight month of declines amid ongoing concerns about an oversupply in the market.

In the US, crude oil production reached a new weekly record of approximately 13.6 million barrels per day (bpd) last week.

Market participants are now focused on the upcoming OPEC+ meeting scheduled for 2nd November, where the alliance is expected to announce an additional supply increase of 137,000 bpd for December. Through a series of monthly output hikes, eight OPEC+ members have raised production targets by a cumulative total of more than 2.7 million bpd, representing about 2.5% of global supply.

Saudi Arabia, the world’s largest oil exporter, reported a widening budget deficit of 88.5 billion riyals in Q3 — a 160% increase from Q2 — driven by higher government spending and falling revenues, according to the finance ministry.

Note: As of 5 pm EDT 30 October 2025

Currencies

EUR -0.30% to $1.1569

GBP -0.28% to $1.3152

Bitcoin -3.31% to $107,897.85

Ethereum -4.32% to $3,775.38

The Japanese yen declined sharply against the US dollar on Thursday after the BoJ adopted a less hawkish stance than had been expected. The US dollar remained supported by Fed Chair Jerome Powell comments on Wednesday when he stated that a rate cut in December was not assured.

While the BoJ maintained its current interest rate levels, Governor Kazuo Ueda provided the clearest indication yet that a rate hike could be considered as early as December, contingent upon wage growth prospects in the coming year. However, during the post-meeting press conference, Ueda offered limited specifics on the timing of any future rate changes. This increased downward pressure on the yen.

The dollar index was +0.39% on Thursday to 99.52, reaching as high as 99.72 — the highest level recorded since 1st August. The dollar was +0.90% to ¥154.08, its strongest position since 13th February.

The euro remained lower after the ECB kept its key interest rate steady at 2.0% for the third consecutive meeting on Thursday and refrained from providing any guidance on future policy actions. It ended the day -0.30% to $1.1569, after hitting a low of $1.1546, the weakest since 14th October.

The British pound also weakened, falling -0.28% to $1.3152, its lowest point since 14th April. Recent declines in sterling have been driven by growing expectations that the BoE may reduce interest rates in the near future due better than expected inflation data. However, there is great fiscal uncertainty, with the budget not expected until 26 November. This means that the BoE may want to wait to evaluate the budget’s potential impact on growth and inflation. Market pricing currently suggests roughly a one-in-three chance of a 25 bps rate cut next week.

The pound traded at 88.1 pence per euro, just below Wednesday's 88.16 pence per euro, marking its softest level since May 2023.

Fixed Income

US 10-year Treasury +2.3 basis point to 4.099%

German 10-year bund +2.3 basis point to 2.648%

UK 10-year gilt +3.8 basis point to 4.432%

US Treasury yields continued to rise on Thursday as investors perceived diminished prospects for an additional Fed interest rate cut in December. This movement was further amplified by Meta Platforms’ substantial corporate bond issuance, which prompted increased selling of Treasuries for hedging purposes.

Although Meta’s investment in AI did not meet stock market expectations, the company achieved notable success with its bond offering. It included maturities spanning 5, 30, and 40 years. According to IFR News, the yield spreads over Treasuries ranged from 50 bps on the 5-year bonds to 110 bps on the 40-year bonds.

The yield on the US 10-year Treasury note rose +2.3 bps to 4.099%. The yield on the two-year Treasury note, often sensitive to changes in interest rate expectations, increased +1.2 bps to 3.616%. The 30-year Treasury yield advanced +3.4 bps. The spread between the two-year and 10-year Treasury note yields widened to a positive 48.3 bps, compared to 47.2 bps Wednesday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 74.7% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 91.1%. Traders are currently expecting 18.7 bps of cuts by year-end, lower than the 22.8 bps anticipated last week.

Eurozone government bond yields rose Thursday following the release of data indicating the region’s economy grew at a faster pace than anticipated in Q3. This stronger-than-expected 0.2% expansion was driven by robust consumer spending that offset weaker exports and ongoing difficulties in Germany’s large industrial sector. This reinforced market expectations that the ECB would maintain its current interest rate policy.

The ECB opted to keep interest rates unchanged for the third consecutive meeting on Thursday, benefiting from a period of subdued inflation and stable growth despite continued volatility stemming from evolving international trade dynamics.

Germany’s 10-year bond yield climbed to its highest level since 10th October, rising +2.3 bps to 2.648%. Italy’s 10-year yield also moved higher, increasing +1.4 bps to 3.372%. This resulted in a yield spread of 72.4 bps between Italy’s 10-year BTP and the 10-year German Bund.

Germany’s two-year bond yield, particularly sensitive to expectations regarding ECB policy, reached a three-week high, advancing +1.8 bps to 1.993%.

Note: As of 5 pm EDT 30 October 2025

Global Macro Updates

BoJ Governor Ueda signals patience on next BoJ rate move. As widely anticipated, the BoJ held its policy rate steady at 0.50%. Tariff impacts continue to be cited as a key source of uncertainty. The BoJ reaffirmed its core guidance, saying policy accommodation will be adjusted if the economic outlook remains consistent with expectations. The decision passed with a vote of 7 - 2, as BoJ board members Hajime Takata and Naoki Tamura dissented, once again advocating for a 25 bps rate increase; their rationale remained unchanged from the previous meeting.

The October Outlook Report showed that economic forecasts were largely unchanged. The BoJ maintains its view that underlying inflation will eventually overcome the current sluggish phase, expecting that a pickup in growth momentum will intensify labour shortages. The price stability target is still projected to be achieved in the latter half of the projection period, beginning in late 2026. Overall, risks to the outlook are seen as broadly balanced, although some downside risk to fiscal year 2026 GDP growth persists. A footnote in the forecast table noted that estimates have yet to account for the potential abolition of the provisional gasoline tax rate currently being debated in parliament, a change that could reduce core CPI by approximately 0.2 percentage points for a year.

Governor Ueda’s press conference did not provide any indication of the timing for the next rate hike, stating that more data is needed before any further action is taken. He continued to downplay concerns that the BoJ is lagging behind global monetary policy shifts. He suggested that tariff impacts on the US economy might be less severe than previously anticipated, though acknowledged that a government shutdown introduces additional uncertainty. Governor Ueda refrained from commenting on communications with Prime Minister Takaichi or recent remarks by US Treasury Secretary Bessent regarding Japan’s policy direction.

ECB remains cautious, sets high bar for further easing. The ECB held its key policy rates steady for the third consecutive meeting, maintaining the deposit rate at 2.0%. In its accompanying statement, the ECB noted that inflation remains near its 2% target, with its overall assessment of price pressures largely unchanged. The ECB acknowledged that the euro area economy continues to expand despite a challenging global backdrop, citing a strong labour market, healthy private sector balance sheets, and the ongoing effects of previous rate adjustments as factors supporting resilience.

While the ECB recognised ongoing uncertainty, it refrained from making any forward commitments regarding the future path of interest rates, emphasising instead a data-dependent, meeting-by-meeting approach. President Lagarde is unlikely to provide further guidance on upcoming policy decisions. Some analysts consider the December meeting to be ‘live,’ yet the threshold for any further easing remains high and would require a significant shift in the economic outlook. The December gathering will also mark the release of the ECB’s first set of projections extending to 2028. ECB officials have indicated their willingness to review minor deviations from the inflation target.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora