Will sanctions bite global oil supply?

What to look out for today

Companies reporting on Friday, 24th October: Baker Hughes, Booz Allen Hamilton, Eni SpA, General Dynamics, HCA Healthcare, Procter & Gamble, Sanofi

Key data to move markets today

UK: Retail Sales, Retail Sales ex-Fuel and S&P Global Composite, Manufacturing, and Services PMIs

EU: Eurozone, German and French HCOB Composite, Manufacturing and Services PMIs and speeches by ECB Executive Board Member Piero Cipollone and German Bundesbank President Joachim Nagel

USA: CPI, Core CPI, S&P Global Composite, Manufacturing and Services PMIs, Michigan Consumer Expectations and Sentiment Indices, UoM 1-year and 5-year Consumer Inflation Expectations

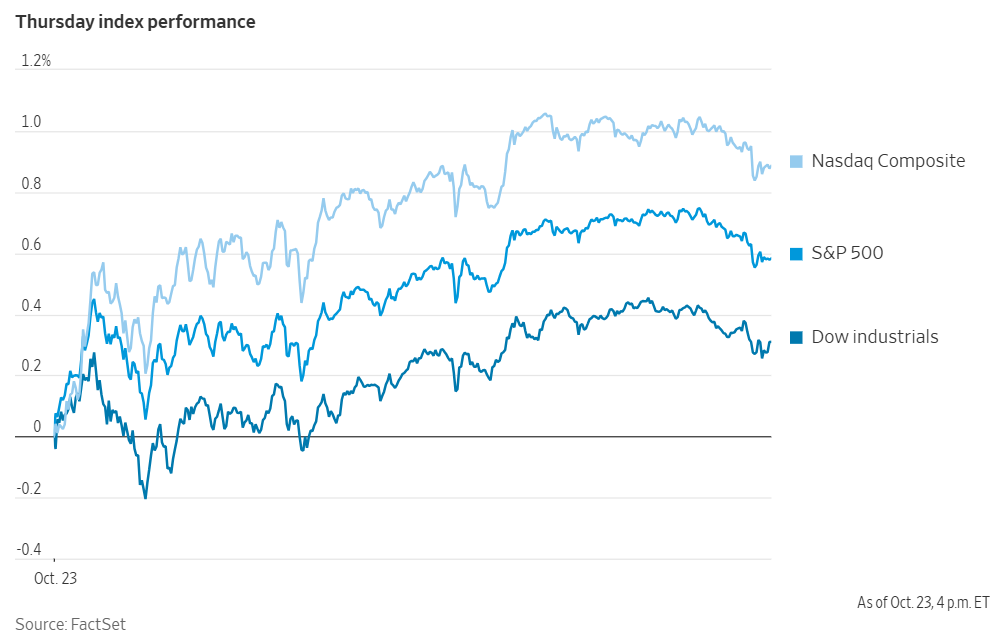

US Stock Indices

Dow Jones Industrial Average +0.31%

Nasdaq 100 +0.88%

S&P 500 +0.58%, with 7 of the 11 sectors of the S&P 500 up

On Thursday, major US equity indices ended the day higher. The Nasdaq Composite advanced by +0.89%, the Dow advanced by +0.31%, and the S&P 500 by +0.58%.

In corporate news, Microsoft has directed its Xbox gaming division to achieve profit margins significantly exceeding the industry average. This increases pressure on its video-game creators during an already challenging period for the sector.

Palantir Technologies has entered into a new partnership with Lumen Technologies to provide AI software, supporting the telecom company's efforts to expand its AI services while enabling Palantir to broaden its customer base.

Southwest Airlines, during its Q3 earnings call, reported that the ongoing US government shutdown is beginning to impact domestic air travel, posing a risk to the record sales anticipated during the critical holiday season.

Rivian Automotive announced plans to reduce its workforce by more than 600 positions, representing approximately 4.5% of its employees, as it navigates a volatile US EV market.

Moderna disclosed that its vaccine aimed at preventing cytomegalovirus—a leading cause of birth defects—did not meet its primary endpoint in a late-stage trial, marking a setback for the company as it seeks to recover from the pandemic.

Blackstone has accumulated $508 billion in credit assets as the private capital leader shifts its focus toward investing in higher-grade debt.

S&P 500 Best performing sector

Energy +1.29%, with APA +7.56%, Valero Energy +6.96%, and Marathon Petroleum +3.94%

S&P 500 Worst performing sector

Consumer Staples -0.41%, with General Mills -2.54%, Molson Coors Beverage Company -2.08%, and JM Smucker -2.06%

Mega Caps

Alphabet +0.48%, Amazon +1.44%, Apple +0.44%, Meta Platforms +0.08%, Microsoft +0.00%, Nvidia +1.04%, and Tesla +2.28%

Information Technology

Best performer: Monolithic Power Systems +6.93%

Worst performer: Super Micro Computer -8.72%

Materials and Mining

Best performer: Dow +12.95%

Worst performer: Sherwin-Williams -0.62%

European Stock Indices

CAC 40 +0.23%

DAX +0.23%

FTSE 100 +0.67%

Corporate Earnings Reports

Posted on Thursday, 23rd October

Ford Motor quarterly revenue +9.4% to $50.534 bn vs. $47.048 bn estimate.

EPS at $0.45 vs. $0.23 estimate.

Jim Farley, President and CEO, said, “Ford posted another strong quarter, delivering more than $50 billion in revenue powered by our incredible products and services, the durability of Ford Pro and our disciplined focus on cost and quality. We are heading into 2026 as a stronger and more agile company. We will continue to focus on execution and on quickly making the right strategic calls on propulsion, partnerships and technology that will create tremendous value for our customers.” — see report.

Freeport-McMoran quarterly revenue +2.7% to $6.972 bn vs. $6.713 bn estimate.

EPS at $0.50 vs. $0.42 estimate.

Kathleen Quirk, President and CEO, said, “Our strong third-quarter 2025 results were overshadowed by the tragic incident at our Grasberg operation in September. The entire FCX organization is grieving for our coworkers lost in this accident and we remain steadfast in our commitment to prioritize the safety of our workforce above all else. As a leading global supplier of copper and other metals with large-scale production, significant reserves and resources and an attractive pipeline for future growth, we are focused on the important role we play to provide copper, gold and molybdenum reliably and responsibly to a world with growing demand for metals.” — see report.

Valero Energy quarterly revenue -2.2% to $32.168 bn vs. $29.965 bn estimate.

EPS at $3.66 vs. $3.05 estimate.

Lane Riggs, Chairman, CEO and President, said, “We are pleased to report strong financial results for the third quarter, highlighting our long-standing track record of operational and commercial excellence. Our refinery throughput utilization was 97 percent, with the Gulf Coast and North Atlantic regions setting new all-time highs for throughput – following last quarter’s record performance in the Gulf Coast. Our strong financial results and record operating achievements this quarter are a testament to our commitment to commercial and operational excellence. This, coupled with the strength of our balance sheet, should continue to support strong shareholder returns.” — see report.

Commodities

Gold spot +0.71% to $4,124.41 an ounce

Silver spot +0.82% to $48.92 an ounce

West Texas Intermediate +3.11% to $61.65 a barrel

Brent crude +3.11% to $65.91 a barrel

Gold prices advanced on Thursday, following two consecutive sessions of declines, as renewed geopolitical tensions increased demand for safe-haven assets.

Spot gold climbed +0.71% to $4,124.41 per ounce after having dropped to its lowest level in nearly two weeks during the previous session.

While prices reached a record high of $4,381.21 on Monday, they subsequently experienced their sharpest single-day decline in five years on Tuesday.

Oil prices reached their highest level in two weeks following the US’ imposition of sanctions on major Russian suppliers Rosneft and Lukoil in response to Moscow’s ongoing conflict in Ukraine.

Brent crude futures rose $2.39, or +3.76%, to close at $65.91 per barrel. US WTI crude was up $1.86, or +3.11%, to settle at $61.65 per barrel. Both benchmarks recorded their largest daily percentage gains since mid-June and achieved their highest closing prices since 8th October.

In addition to the surge in crude oil prices, US diesel futures jumped nearly 7%, driving the diesel crack spread—the measure of refining profit margins—to its highest level since February 2024.

The newly imposed US sanctions require refineries in China and India, the largest buyers of Russian oil, to seek alternative sources to avoid exclusion from the Western banking system. According to multiple trade sources cited by Reuters, Chinese state-owned oil companies have suspended purchases of seaborne Russian oil from the sanctioned entities, further supporting the upward trend in prices.

Kuwait’s oil minister said OPEC is willing to offset any market shortfall by reversing output cuts if necessary. Russian President Vladimir Putin acknowledged that replacing Russian oil in the global market would take time.

Last week, the UK also sanctioned Rosneft and Lukoil and the EU approved its 19th sanctions package against Russia. This includes a ban on imports of Russian liquefied natural gas. The EU further added two Chinese refiners, with a combined processing capacity of 600,000 barrels per day, and Chinaoil Hong Kong, a trading subsidiary of PetroChina, to its sanctions list, according to its Official Journal released on Thursday.

Indian refiners, which have become the largest purchasers of discounted Russian seaborne crude since the onset of the Ukraine war, are now expected to significantly reduce imports from Russia to comply with new US sanctions. Reliance Industries, India’s leading private importer of Russian crude, is planning to scale back or completely halt such purchases, as confirmed by two sources familiar with the matter.

Note: As of 5 pm EDT 23 October 2025

Currencies

EUR +0.03% to $1.1615

GBP -0.22% to $1.3322

Bitcoin +2.22% to $109,583.93

Ethereum +2.22% to $3,829.05

The US dollar strengthened modestly against the yen on Thursday, while the British pound declined by -0.22% to $1.3322. Sterling extended its losses from Wednesday, which followed weaker-than-expected consumer inflation data that prompted markets to raise the probability of an additional BoE rate cut this year.

The US dollar index edged up +0.04% to 98.925, and the euro gained +0.03% to trade at $1.1615.

The US dollar climbed +0.43% to ¥152.55. The yen came under renewed pressure due to domestic developments, approaching last week’s seven-month low of ¥153.29 — a level reached earlier this week after Sanae Takaichi, broadly regarded as favouring accommodative fiscal and monetary policies, was selected to lead Japan’s ruling party. With Takaichi now serving as prime minister, investors are closely monitoring forthcoming details regarding a potential stimulus package.

Fixed Income

US 10-year Treasury +5.4 basis points to 4.005%

German 10-year bund +2.0 basis points to 2.588%

UK 10-year gilt +2.0 basis points to 4.435%

On Thursday, yields on US Treasuries rose. The US Bureau of Labor Statistics announced last week that, despite the government shutdown now in its 23rd day, it would proceed with publishing the Consumer Price Index (CPI) report. This decision aims to support the Social Security Administration's calculation of the 2026 annual cost-of-living adjustment for millions of retirees and other benefits recipients.

In afternoon trading, the yield on the 10-year Treasury note climbed +5.4 bps to 4.005%, while the 30-year yield advanced +3.9 bps to 4.575%. The yield on the two-year note, which is generally more sensitive to shifts in the Fed funds rate expectations, rose +4.6 bps to 3.501%.

Additionally, the US Treasury conducted an auction for $26 billion in new five-year Treasury Inflation-Protected Securities (TIPS) on Thursday. The auction encountered subdued demand, clearing at a high yield of 1.182%; this exceeded expectations at the bidding deadline. This outcome indicated that investors required a premium to absorb the supply of the new note.

Indirect bidders were allotted 62.1% of the issue, lower than the 74.6% from the prior auction and the 64.2% seen in April. Dealers were required to purchase 13.5% of the offering—double the previous 6.6% and above the 9.1% average—reflecting weak demand that necessitated greater involvement from primary dealers. Analysts attributed the tepid interest in the TIPS note in part to the auction's size, as the $26 billion offering represents the largest TIPS auction on record.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 99.4% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 96.3%. Traders are currently expecting 48.1 bps of cuts by year-end, lower than the 53.0 bps anticipated the prior week.

Across the Atlantic, eurozone government bond yields rose modestly on Thursday. Following four consecutive sessions of declines last week—driven by heightened demand for safe-haven assets—Germany’s 10-year bond yield advanced +2.0 bps to 2.588%. The yield on Germany’s two-year bond, typically more responsive to expectations surrounding ECB policy, rose +2.1 bps to 1.938%. The yield on the 30-year bond gained +2.2 bps.

Market participants largely disregarded data indicating an improvement in eurozone consumer sentiment, which registered at -14.2 in October compared to -14.9 in the previous month. This reading surpassed economists' forecast for a decline to -15.0.

In Italy, the yield on the 10-year government bond increased +2.1 bps to 3.343%. Consequently, the spread between Italian and German 10-year bonds narrowed to 75.5 bps—the smallest differential observed since approximately April 2010.

Note: As of 5 pm EDT 23 October 2025

Global Macro Updates

September CPI preview. The September CPI report is scheduled for release today, at 8:30 AM Eastern Time.

This particular release holds significant weight as it is the only one guaranteed during the current shutdown, a necessity due to the critical data it provides for determining the Social Security Administration's Cost of Living Adjustment (COLA), as reported by Bloomberg news.

Consensus forecasts for Core CPI project figures of 0.3% m/o/m and 3.1% y/o/y, both remaining unchanged from the August print. To contextualise, the August m/o/m figure of 0.346% was the highest recorded since January and marked the third consecutive monthly acceleration. The annualised rate was the highest since February, signifying the fourth straight month of increase.

Economist previews suggest the shelter component may not offer a significant disinflationary effect. For instance, JPMorgan forecasts both Owners' Equivalent Rent (OER) and rent will register a firm 0.3 m/o/m. In the services sector, airline fares are anticipated to show hotter growth, though lodging away from home is expected to cool down after a robust August print of 2.3% m/o/m. Conversely, BofA economists anticipate the core goods reading to be 0.1% m/o/m, a cooler figure than the three-month average, largely driven by an expected decline in used vehicles. However, excluding used automobiles, the forecast stands at 0.2% m/o/m, with analysts arguing that tariff-linked categories are likely to remain an upward pressure on inflation over the next several quarters.

Finally, Citi's analysis concludes that Core CPI remaining approximately one percentage point above the Fed’s target is unlikely to alter the trajectory for rate cuts, given the overarching expectation that inflation is still heading toward the 2% target.

EU imposes 19th sanctions package and gas market outlook expected to be volatile. EU member states have formally approved their 19th sanctions package against Russia. This includes a ban on importing Russian liquefied natural gas (LNG) from January 2027, as reported by Bloomberg news.

These new measures are designed to target the evasion of existing restrictions, specifically placing sanctions on 45 entities involved in circumvention. These include 12 companies in China and Hong Kong. Furthermore, the EU has added 117 oil tankers belonging to Russia's so-called ‘shadow fleet’ to its blacklist and has tightened restrictions on major energy producers Rosneft and Lukoil.

Danish Foreign Minister Lars Løkke Rasmussen commended the agreement, which successfully overcame weeks of resistance from member states, particularly Austria, Hungary, and Slovakia. As noted by the Financial Times, this move aligns with recent sanctions implemented by the US administration targeting Russian oil giants, collectively amplifying Western economic pressure on President Putin amidst ongoing Ukraine peace negotiations.

Despite this long-term ban, the immediate energy outlook remains volatile. BofA recently issued a warning concerning Europe’s current gas storage levels. These are 13% below the previous year and currently below target. The bank cautioned that this deficit could cause TTF natural gas prices to surge to €60/MWh during potential cold snaps this winter, effectively doubling current price levels.

However, the longer-term market forecast suggests a different dynamic. Massive global LNG capacity additions anticipated for 2026 and 2027 are expected to trigger a significant supply glut, which could potentially drive TTF prices back below €25/MWh by late 2026. Analysts noted that such a price collapse could significantly benefit European data centre expansion. Weak gas prices and excess power generation capacity would make the region increasingly attractive for large-scale AI infrastructure investment, offering a competitive alternative to constrained markets in the US.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora