Will the rally expand beyond AI?

% to $3,958.96 after hitting a record high of $3,969.91

% to 98.11

Key data to move markets today

EU: German Factory Orders, and speeches by Bundesbank President Joachim Nagel, and ECB President Christine Lagarde

US: Speeches by Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Stephen Miran, and Minneapolis Fed President Neel Kashkari

JAPAN: A speech by BoJ Governor Kazuo Ueda

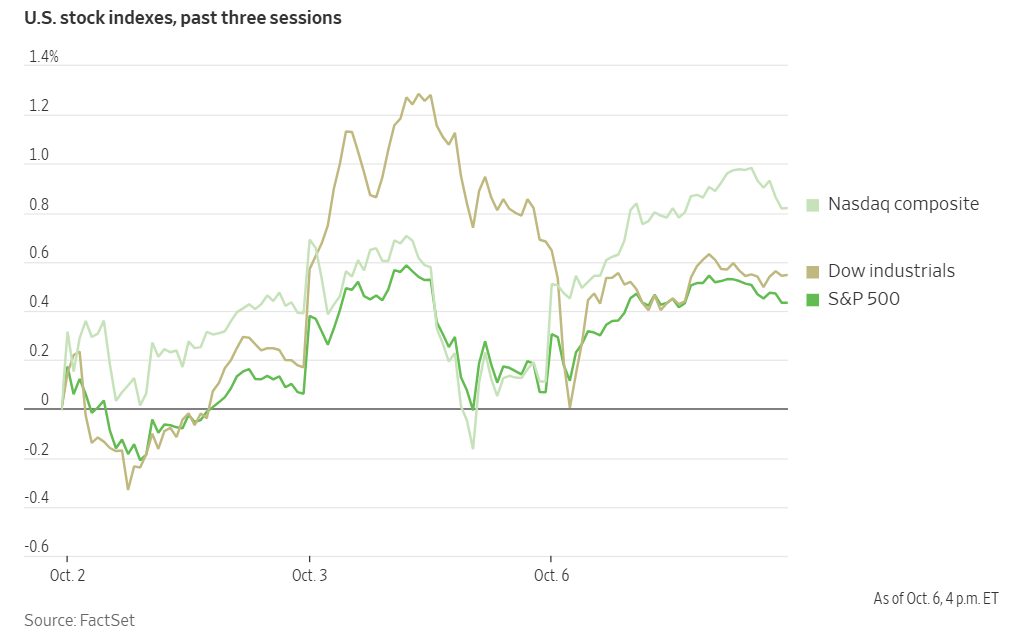

US Stock Indices

Dow Jones Industrial Average -0.14%

Nasdaq 100 +0.78%

S&P 500 +0.36%, with 4 of the 11 sectors of the S&P 500 up

US equity markets saw divergent performance on Monday, with technology shares leading the advance. The S&P 500 continued its record-setting run, climbing +0.36% to secure its 32nd all-time high of the year and its seventh consecutive day of gains. The Nasdaq Composite also reached a new peak, rising +0.71% for its 31st record close in 2025. In contrast, the Dow Jones Industrial Average retreated slightly, declining -0.14%, or 63.31 points. The sustained rally comes as Wednesday marks six months since the S&P 500 reached its lowest point of the year.

In corporate news, OpenAI and Advanced Micro Devices (AMD) announced a multi-billion dollar partnership to build AI data centres. The agreement includes a commitment from OpenAI to purchase 6 gigawatts of AMD's MI450 chips. As part of the deal, OpenAI will receive warrants to acquire up to 160 million AMD shares—equivalent to approximately 10% of the company—at a nominal price of one cent per share, contingent upon meeting deployment milestones. The transaction is AMD's most significant success to date in challenging Nvidia’s dominance in the AI semiconductor market, with the first gigawatt of capacity scheduled to be online by the second half of next year. News of the partnership sent AMD's stock soaring, adding over $63 billion to its market capitalisation in its largest single-day gain on record.

The US Supreme Court declined to hear an appeal from Live Nation Entertainment in a consumer antitrust lawsuit. The decision represents a significant setback to the ticketing giant's strategy of channeling such cases into private arbitration.

Paramount Skydance acquired the online news site The Free Press and appointed its founder, Bari Weiss, as the new editor-in-chief of CBS News. The move is anticipated to stir controversy within the news organisation and the broader media landscape.

Hon Hai Precision Industry, a key server production partner for Nvidia, reported an 11% increase in quarterly sales. The strong results signal robust demand for the chips and servers crucial for AI development. In response to geopolitical shifts, including US - China trade tensions, Hon Hai is expanding its AI server production capacity in the US with facilities in Wisconsin and Texas.

S&P 500 Best performing sector

Consumer Discretionary +1.05%, with Tesla +5.45%, DoorDash +3.88%, and Las Vegas Sands +2.55%

S&P 500 Worst performing sector

Real Estate -0.99%, with Alexandria Real Estate Equities -4.55%, CoStar Group -4.30%, and Simon Property Group -3.27%

Mega Caps

Alphabet +2.05%, Amazon +0.63%, Apple -0.52%, Meta Platforms +0.72%, Microsoft +2.17%, Nvidia -1.11%, and Tesla +5.45%

Information Technology

Best performer: Advanced Micro Devices +23.71%

Worst performer: Applovin -14.03%

Materials and Mining

Best performer: Albemarle +4.32%

Worst performer: Smurfit WestRock -3.98%

European Stock Indices

CAC 40 -1.36%

DAX -0.00%

FTSE 100 -0.13%

Commodities

Gold spot +1.88% to $3,958.96 an ounce

Silver spot +1.16% to $48.53 an ounce

West Texas Intermediate +1.71% to $61.73 a barrel

Brent crude +1.80% to $65.54 a barrel

Gold reached a record high, soaring above $3,900 per ounce on Monday, driven by mounting expectations of a Fed rate cut this month and heightened economic and political uncertainty in the US, France, and Japan.

Spot gold climbed +1.88% to $3,958.96 per ounce, after peaking at $3,969.91 earlier in the session.

The ongoing US government shutdown, political developments in France, and rising yields in Japan amid inflationary pressures have all contributed to the strength of gold's rally.

Oil prices advanced by over 1.5 percentage points on Monday, driven by OPEC+'s announcement of a more moderate production increase for November than many market participants had anticipated. This development helped alleviate some concerns regarding additional supply, although a subdued outlook for demand is expected to constrain further gains in the near term.

Brent crude futures closed $1.16 higher, rising +1.80% to settle at $65.54 per barrel. Meanwhile, US WTI crude finished at $61.73 per barrel, up $1.04 or +1.71%.

OPEC+ revealed on Sunday that it would raise production by 137,000 barrels per day (bpd) starting in November, in line with October’s increase, as apprehension persists over a potential supply surplus. This measured production adjustment coincides with increasing Venezuelan exports, the resumption of Kurdish oil shipments through Turkey, and the availability of unsold Middle Eastern barrels scheduled for November loading. OPEC+ has raised its oil output targets by over 2.7 million bpd this year, representing an increase equivalent to ~2.50% of global demand.

Saudi Arabia, the world's foremost oil exporter, has maintained the official selling price of its flagship Arab Light crude to Asia unchanged, following OPEC+'s recent decision to implement a modest increase in oil production. The kingdom has set the official price for November at $2.20 per barrel above the Oman/Dubai benchmark, consistent with the level established for October.

Meanwhile, the official selling prices for other grades have seen adjustments: Arab Medium and Arab Heavy prices declined by 30 cents, now standing at $1.45 and $0.10 per barrel respectively, while the price for Arab Extra Light remains steady at $2.50 per barrel.

Note: As of 5 pm EDT 6 October 2025

Currencies

EUR -0.27% to $1.1709

GBP +0.01% to $1.3479

Bitcoin +2.47% to $125,449.03

Ethereum +3.65% to $4,691.46

The Japanese yen weakened against the US dollar on Monday, driven by concerns about fiscal and political stability. This came after Japan's ruling Liberal Democratic Party elected a new leader, Sanae Takaichi, who is known for supporting former premier Shinzo Abe's ‘Abenomics’ strategy, which focuses on aggressive government spending and easy monetary policy. Her appointment prompted traders to lower expectations that the BoJ would raise interest rates this month.

As a result, the dollar surged to reach ¥150.47, marking the highest level since 1st August. It was last seen trading +1.91% higher at ¥150.27, the most significant daily gain since 12th May. Despite maintaining a cautiously optimistic outlook for the economy, the BoJ warned of persistent uncertainty regarding the impact of US tariffs on corporate profits, indicating a preference to wait for additional data before considering a rate hike.

The euro also lost ground against the dollar and the British pound following the resignation of France's new Prime Minister, Sébastien Lecornu, and his government. This event occurred just hours after the cabinet lineup was announced, making it the shortest-lived administration in modern French history.

The euro fell -0.27% to $1.1709, having earlier touched $1.1649, the lowest level since 25th September. Against the pound, the euro dropped to its lowest point since 18th September.

The dollar index rose +0.41% to 98.11 amid the ongoing US government shutdown, which has prevented Congress from passing a bill to continue funding federal operations. As a consequence, the absence of critical US economic data, including last Friday's delayed monthly jobs report for September, has led to lower market volatility.

Fixed Income

US 10-year Treasury +3.1 basis points to 4.152%

German 10-year bund +2.1 basis points to 2.723%

UK 10-year gilt +4.6 basis points to 4.741%

US Treasury yields closed higher across the maturity spectrum on Monday, as the ongoing government shutdown—now in its sixth full day—continued to deprive investors of critical economic data, resulting in a largely directionless market.

This week, Fedspeak is expected to attract heightened attention, given the diminished visibility of the economic backdrop ahead of the FOMC upcoming meeting on 28th – 29th October.

The yield on the US 10-year Treasury note increased by +3.1 bps to 4.152%, while the yield on the 30-year bond advanced by +4.0 bps to 4.751%. The 2-year Treasury note, sensitive to changes in interest rate expectations, rose by +2.3 bps to 3.597%.

The yield spread between the 2-year and 10-year Treasury notes widened modestly by 0.8 bps to reach 55.5 bps.

Market participants are also anticipating a broader assessment of demand for US debt later in the week, with upcoming auctions for 3-year, 10-year, and 30-year notes and bonds. Additionally, the University of Michigan is scheduled to release updated consumer sentiment data on Friday.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 94.1% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 89.8%. Traders are currently anticipating 70.8 bps of cuts by year-end, higher than the 66.1 bps expected last week.

Across the Atlantic, French government bond yields climbed on Monday following the unexpected resignation of Prime Minister Sébastien Lecornu, intensifying the political uncertainty in Europe's second-largest economy. This development caused the yield premium on French OATs over safe-haven German Bunds to reach its highest point since January. Market participants are now closely monitoring whether France will proceed with a snap election, in which the Rassemblement National is anticipated to play a significant role in forming the next government.

Germany’s 10-year Bund yield increased by +2.1 bps to 2.723%. In contrast, the 2-year German yield—which is more responsive to potential changes in ECB policy rates—fell by -2.0 bps to 2.009%, after briefly touching 1.987%, its lowest level since 12th September. The yield on Germany’s 30-year bonds rose by +3.2 bps to 3.298%.

French 30-year bond yields climbed as much as 10.8 bps to 4.441%, marking their highest level since 4th September, before retreating to 4.399%, +6.9 bps above Friday’s close. The yield on French 10-year bonds increased by +6.0 bps to 3.574%. As a result, the yield spread between German Bunds and 10-year French government bonds—a key indicator of the risk premium required by investors to hold French debt—stood at 85.1 bps, having earlier reached 87.9 bps, its highest since 13th January.

Italy’s 10-year yield also rose, gaining +2.8 bps to reach 3.546%.

In reaction to the evolving situation, traders marginally raised their expectations for future ECB rate cuts, now assigning roughly a 40% probability of a 25 bps cut by July, up from 35% prior to Lecornu’s resignation. The ECB’s key rate is projected to stand at 1.90% by February 2027, compared with the current level of 2.00%.

Note: As of 5 pm EDT 6 October 2025

Global Macro Updates

Lecornu's resignation triggers political uncertainty and roils French assets. French Prime Minister Lecornu tendered his resignation on Monday morning, merely a day after President Macron appointed a new cabinet that drew widespread criticism. Weakened by a revolt from within the Republican party led by Interior Minister Retailleau and under attack from across the political spectrum, Mr. Lecornu's government unraveled with remarkable speed. The appointment of Mr. Le Maire to the Ministry of the Armed Forces served as a particular catalyst for cross-party opposition.

Critics denounced the administration's lack of renewal despite promises of change, noting that 12 of the 18 ministers had served in the government of the former premier, Bayrou, before his overthrow in September. Following the resignation, Rassemblement National leader Jordan Bardella called for the dissolution of the National Assembly and new legislative elections, while La France Insoumise leader Mathilde Panot called for President Macron's resignation.

Financial markets reacted sharply to the political instability. Yields on French government bonds surged, pushing the premium over German debt to 85.1 bps, its highest level since January. The euro weakened, and French stocks lagged behind their European peers.

The crisis deepens France's political paralysis at a critical juncture. Mr. Lecornu had previously pledged not to invoke constitutional powers to force through the 2026 budget, surrendering key leverage. Yet, Socialist opponents immediately escalated pressure, demanding a suspension of pension reforms under the threat of dissolution. With France's budget deficit already the widest in the eurozone and credit rating downgrades looming, investors fear that the mounting debt burden risks suffocating economic growth.

Fund managers urge BoE to halt Gilt sales. A growing chorus of prominent fund managers is calling on the BoE to halt its sales of UK government bonds (Gilts), arguing the policy is placing unnecessary strain on the country's debt market.

According to a Reuters report that surveyed ten major investors prior to the BoE's 18th September announcement, the central bank's subsequent pledge to slow its balance sheet reduction was insufficient. These investors advocate for a complete cessation of active Gilt sales. Some participants warned of a negative feedback loop, where increased bond sales drive up government borrowing costs, which in turn weakens the UK's fiscal position and amplifies the need for corrective fiscal measures.

However, this perspective is not universally held. Strategists at AXA Investment Managers, for instance, believe that fears of a Gilt market ‘doom loop’ are overblown. They argue that this view overlooks similar dynamics in other developed markets, such as the US and Japan, which are also navigating a period of higher long-term borrowing costs.

The BoE itself has downplayed recent volatility at the long end of the yield curve, attributing it primarily to a supply-demand imbalance rather than systemic risk. Furthermore, the central bank maintains that its QE programme still represents a net cashflow benefit to UK taxpayers, estimated at £34 billion.

Reflecting a more optimistic outlook, AXA noted that it sees a favourable risk-reward profile in UK debt, particularly in shorter-maturity bonds where investor demand has remained robust.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora