Is Q4 the bottom of the barrel for oil?

% to 97.86

Key data to move markets today

JAPAN: LDP Presidential Election

EU: Spanish, Italian, French, German and Eurozone’s HCOB Services PMIs, Services PMIs, and Composite PMIs, Italy’s Public Deficit, Eurozone’s PPI and speeches by DNB President Olaf Sleijpen, ECB Executive Board member Isabel Schnabel, and ECB President Christine Lagarde

UK: Speech by BoE Governor Andrew Bailey

USA: Nonfarm Payrolls, Average Hourly Earnings, Labor Force Participation Rate, U6 Underemployment Rate, Unemployment Rate, ISM Services PMI, Employment Index, New Orders Index, and Prices Paid, and a speech by New York Fed President John Williams

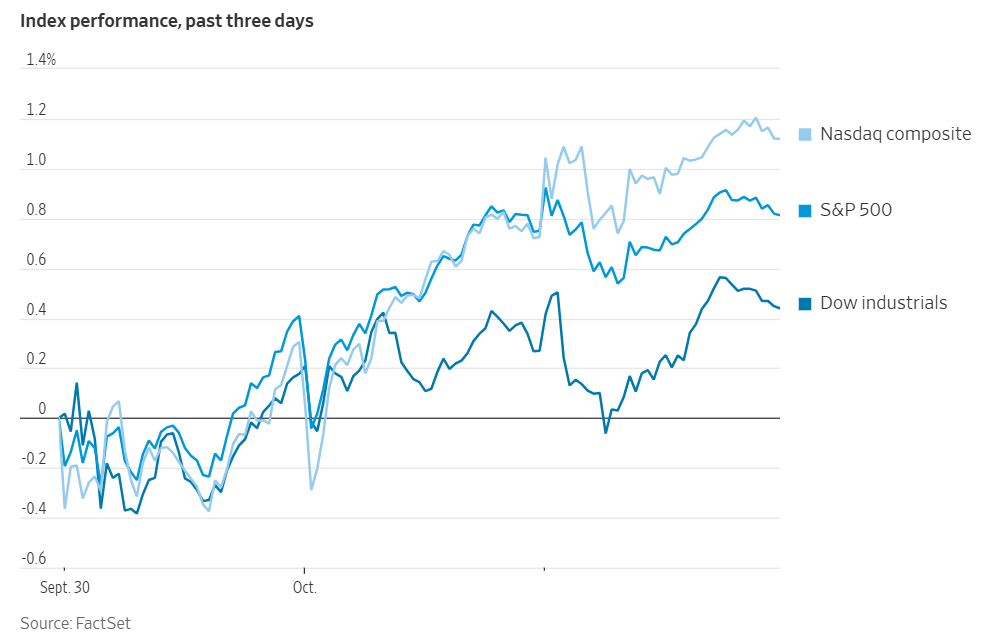

US Stock Indices

Dow Jones Industrial Average +0.17%

Nasdaq 100 +0.37%

S&P 500 +0.06%, with 4 of the 11 sectors of the S&P 500 up

The Nasdaq Composite rose +0.37% and the S&P 500 index added +0.06%, both closing at all-time highs for the 30th time this year. The Dow Jones Industrial Average closed at a new record for the 10th time in 2025, rising by +0.17% or 78.62 points.

Prediction markets indicate that participants widely expect the government shutdown to persist at least through the end of next week. As the shutdown entered its second day on Thursday, both Republican and Democratic lawmakers remained at an impasse over spending negotiations.

On the Kalshi platform, contracts that yield a return if the shutdown continues for more than ten days are currently trading at 68 cents, reflecting an implied probability of 68% that the closure will extend beyond 10th October. Similarly, on the competing platform Polymarket, contract pricing suggests a 35% likelihood that the shutdown will conclude between 10th and 14th October, while there is a 39% probability it will continue through 15th October.

In corporate news, Berkshire Hathaway has confirmed its intention to acquire Occidental Petroleum's petrochemical division in a transaction valued at $9.7 billion, marking Berkshire’s largest acquisition since 2022.

Shares of Fermi—a recently established data-centre and energy firm—fell by 12% following an impressive 55% surge on Wednesday, its first day of trading. Fermi’s robust market debut, despite Thursday's decline, highlights the current enthusiasm for AI-related stocks.

Starbucks announced late Wednesday an increase in its quarterly dividend to $0.62 per share, up from $0.61.

Fair Isaac revealed it will begin licencing its credit scores used for evaluating the creditworthiness of mortgage applicants, enabling resellers to bypass traditional credit bureaus.

S&P 500 Best performing sector

Materials +1.05%, with CF Industries +3.95%, Eastman Chemical +3.89%, and Albemarle +3.72%

S&P 500 Worst performing sector

Energy -1.02%, with Occidental Petroleum -7.31%, APA -4.71%, and Coterra Energy -3.38%

Mega Caps

Alphabet +0.36%, Amazon +0.81%, Apple +0.66%, Meta Platforms +1.35%, Microsoft -0.76%, Nvidia +0.88%, and Tesla -5.11%

Information Technology

Best performer: Fair Isaac +17.98%

Worst performer: Synopsys -3.61%

Materials and Mining

Best performer: CF Industries +3.95%

Worst performer: Smurfit WestRock -1.83%

European Stock Indices

CAC 40 +1.13%

DAX +1.28%

FTSE 100 -0.20%

Commodities

Gold spot -0.24% to $3,856.01 an ounce

Silver spot -0.75% to $46.97 an ounce

West Texas Intermediate -1.89% to $60.63 a barrel

Brent crude -1.68% to $64.30 a barrel

Gold prices fell on Thursday, retreating from a record high hit earlier in the session, after Dallas Fed President Lorie Logan urged caution on further interest rate cuts.

Spot gold was down -0.24% at $3,856.018 per ounce. Spot prices had hit a record high of $3,896.49 earlier in the session.

Logan said the Fed appropriately took out some insurance against any sharp deterioration in the labour market with its interest-rate cut last month, but needs to be ‘cautious’ with any further rate cuts.

The US government shutdown extended to a second day on Thursday, potentially delaying key economic data releases, including the closely watched non-farm payrolls (NFP) report due Friday. The weekly jobless claims report, a key gauge of labor market health that was due on Thursday, was also not released.

Oil prices declined more than 1.5 percentage points on Thursday, marking their lowest level in four months and extending a run of declines into a fourth session. This continued weakness has been primarily driven by concerns over excess supply in advance of the OPEC+ meeting scheduled for the weekend.

Brent crude futures decreased by $1.10, or -1.68%, to close at $64.30 per barrel, the lowest since 2nd June. Similarly, US WTI crude fell $1.17, or -1.89%, settling at $60.63 per barrel, the lowest since 30th May.

During the upcoming meeting, OPEC+ may consider raising oil production by as much as 500,000 barrels per day in November, which would be three times the increase seen in October. This potential move is reportedly motivated by Saudi Arabia's efforts to regain market share.

Expectations for higher OPEC+ output, coupled with slower global refinery runs due to scheduled maintenance and a seasonal decrease in demand, are anticipated to accelerate the accumulation of oil inventories. Supporting this outlook, the Energy Information Administration reported on Wednesday that US stocks of crude oil, gasoline, and distillates increased last week amid reduced refining activity and weakened demand.

On the geopolitical front, finance ministers from the Group of Seven nations announced on Wednesday their intention to intensify pressure on Russia by targeting entities that continue to increase purchases of Russian oil. In addition, the United States will provide Ukraine with intelligence to facilitate long-range missile strikes against Russian energy infrastructure, as confirmed by a report from The Wall Street Journal. This support is designed to help Ukraine target refineries, pipelines, and other critical assets, thereby limiting the Kremlin’s revenue generated from oil.

Despite these bearish factors, stockpiling activity from China, the world's top crude oil importer, helped to moderate the decline in oil prices, according to traders. Additionally, the Colonial Pipeline—the largest fuel conduit in the US—resumed operations on Thursday following a brief outage caused by unplanned system maintenance, as reported by a company spokesperson.

Note: As of 5 pm EDT 2 October 2025

Currencies

EUR -0.09% to $1.1717

GBP -0.26% to $1.3437

Bitcoin +2.24% to $120,236.91

Ethereum +3.56% to $4,473.32

The US dollar strengthened against both the euro and the yen on Thursday, rebounding versus the Japanese currency after four consecutive sessions of losses. This shift occurred as market participants assessed the implications of the ongoing US government shutdown.

According to a report released by the Chicago Fed, which integrates private and available public data, the estimated jobless rate for September remained at 4.3%, unchanged from August. This stability suggests that the anticipated sharp increase in unemployment has not yet materialised.

However, the report’s underlying details, alongside additional data, indicate continued softness in the labour market. The dollar declined on Wednesday following the ADP National Employment Report, which revealed a drop of 32,000 private payrolls in September. Nevertheless, the currency recovered those losses on Thursday.

On the day, the dollar index rose by +0.12% to 97.86. The euro depreciated by -0.09% to $1.1717, while the British pound weakened by -0.26% to $1.3437. Market participants are increasingly focused on evaluating the potential effects of the upcoming UK November budget on both the economy and the pound.

Against the Japanese yen, the dollar advanced by +0.24% to reach ¥147.40. Attention now turns to this weekend’s election for the leadership of Japan’s ruling party.

Fixed Income

US 10-year Treasury -1.6 basis points to 4.086%

German 10-year bund -1.4 basis points to 2.704%

UK 10-year gilt +1.9 basis points to 4.714%

On Thursday, long-dated US Treasury yields predominantly moved lower, reflecting subdued trading activity and limited economic data as a result of the ongoing US government shutdown. The closure, marking the fifteenth such event since 1981, entered its second day with no clear indication of a forthcoming resolution between Republicans and Democrats to restore government operations.

Early Thursday, a report from the outplacement firm Challenger, Gray & Christmas indicated that US employers reduced fewer positions in September; however, hiring intentions remained at their lowest point since 2009. This data followed Wednesday’s disappointing ADP National Employment Report.

By the end of the trading day, the yield on the 10-year Treasury note stood at 4.086%, down -1.6 bps. The two-year Treasury yield edged slightly higher, +0.8 bps, closing at 3.545%. Consequently, the spread between two- and 10-year yields narrowed to 54.1 bps. At the longer end of the curve, the 30-year yield declined by -1.9 bps, settling at 4.690%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 97.8% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 85.5%. Traders are currently anticipating 72.1 bps of cuts by year-end, higher than the 64.3 bps expected last week.

Across the Atlantic, eurozone government bond yields declined modestly on Thursday, mirroring the upward momentum observed in the US Treasuries. The yield on Germany’s 10-year Bund slipped by -1.4 bps for the day, settling at 2.704%, after reaching an intraday low of 2.693%. Having traded within a narrow band in recent months, Bund yields are poised for a second consecutive weekly decline, marking the first such occurrence since mid-June.

Yields on Germany’s two-year Schatz, particularly sensitive to short-term expectations of ECB monetary policy, remained unchanged at 2.021%. At the longer end of the maturity spectrum, 30-year German Bund yields dropped -2.3 bps to 3.276%.

On the supply side, France experienced robust demand for both its 10-year and longer-maturity bonds auctioned on Thursday. The 2035 and 2036 Obligations Assimilables du Trésor (OATs) achieved bid-to-cover ratios of 2.533x and 2.947x, respectively. In contrast, Germany’s 10-year Bund auction on Wednesday attracted relatively weak interest, with a bid-to-cover ratio of just 1.2x, matching the lowest levels recorded this year.

French 10-year government bond yields traded -0.6 bps lower on Thursday, closing at 3.533%. These yields are now among the highest in the eurozone, now higher than Italy’s, where 10-year yields decreased by -0.8 bps to 3.521%.

The spread between Italy’s and Germany’s 10-year government bond yields widened by 2.6 bps during Thursday’s session, reaching 81.7 bps. Italy, which has earned investor favour in recent years due to its fiscal prudence, is reportedly ahead of schedule in reducing its budget deficit to 3% of GDP, according to Industry Minister Adolfo Urso’s statement on Thursday.

Note: As of 5 pm EDT 2 October 2025

Global Macro Updates

Second day of government shutdown: no deal in sight. With no resolution in sight, the government shutdown has entered its second day. While reports indicate that lawmakers from both parties are exploring potential compromises, any agreement is expected to require endorsement from President Trump and may necessitate concessions from both sides. Senate Majority Leader Thune and Vice President Vance have expressed openness to extending expiring healthcare subsidies requested by Democrats; however, they have stated that negotiations will not proceed while the government remains closed. The next Senate vote is scheduled for 1:30 PM ET today.

Three Democrats broke ranks during Tuesday’s vote to pass a stop-gap funding bill, but the GOP still requires support from four additional senators to reopen the government without making healthcare concessions. Furthermore, the Trump administration has intensified pressure to resolve the shutdown, threatening to halt $18 billion in infrastructure spending and terminate thousands of federal workers—a move some have characterised as unprecedented and punitive, particularly as it appears to target political opponents. Several Republicans have voiced opposition to these measures, cautioning that such strategies could backfire and damage the party’s political standing.

Despite these developments, the market impact remains limited. According to a Bloomberg article, some economists estimate that each week of a shutdown could reduce GDP by 0.1 percentage points; however, this effect could easily double should the White House proceed with mass firings, as diminished corporate confidence and reduced capital investments may further exacerbate economic losses.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora