No hay un camino sin riesgos por delante

Índices bursátiles mundiales

Evolución de los índices bursátiles estadounidenses

El Nasdaq 100 +3,45% en lo que va de mes y +15,28% en lo que va de año

El Dow Jones Industrial Average +1,04% en lo que va de mes y +8,17% en lo que va de año

El NYSE +1,36% en lo que va de mes y +12,27% en lo que va de año

El S&P 500 +2,17% en lo que va de mes y +12,22% en lo que va de año

El S&P 500 ha subido un +1,05% durante los últimos siete días, con 5 de los 11 sectores al alza en el mes. La versión igualmente ponderada del S&P 500 ha crecido un +0,38% durante la última semana y un +7,10% en lo que va de año.

El sector de servicios de comunicación del S&P 500 es el sector líder en lo que va de mes, con un aumento del +8,64% en lo que va de mes y del +27,34% en lo que va de año, mientras que el sector de materiales es el más débil, con una caída del -1,34% en lo que va de mes y un alza del +8,80% en lo que llevamos de año.

Durante la semana, el sector de consumo discrecional es el que mejor se ha comportado dentro del S&P 500, con un crecimiento del +3,93%, seguido por los servicios de comunicación y las finanzas, que han avanzado un +2,95% y un +1,72%, respectivamente. Por el contrario, el sector de servicios públicos es el que peor rendimiento ha tenido, con una caída del -0,34%, seguido por el sector sanitario y el industrial, que han retrocedido un -0,17% y un -0,16%, respectivamente.

La versión de igual ponderación del S&P 500 subió un +0,10% el miércoles, superando a su homólogo ponderado por capitalización en 0,20 puntos porcentuales.

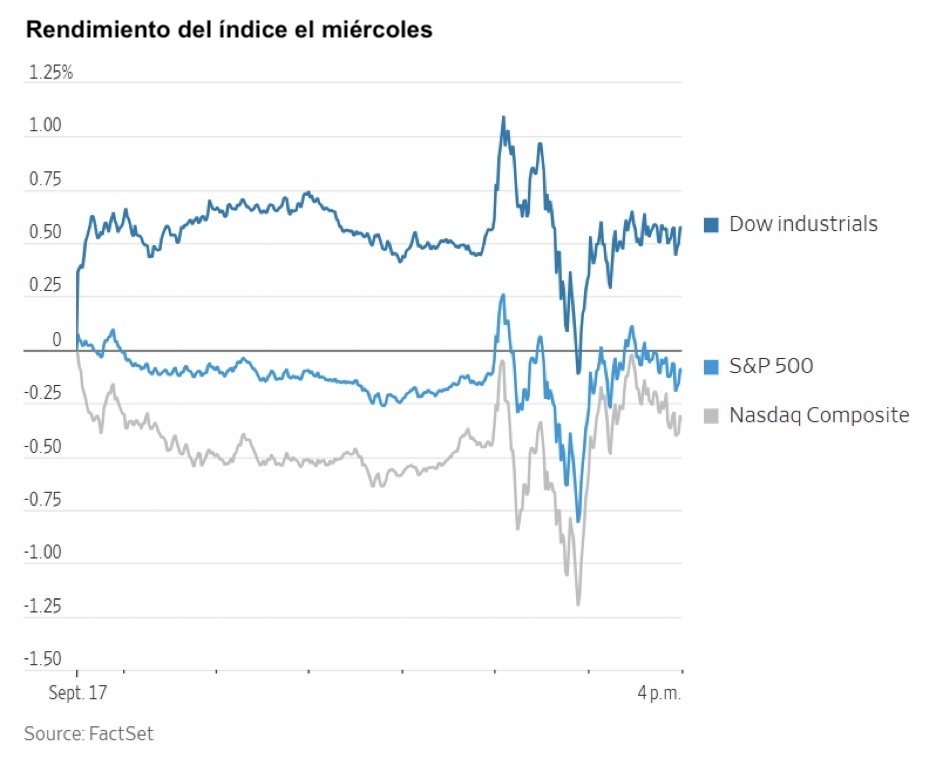

En una medida ampliamente esperada, la Reserva Federal aplicó el miércoles una bajada de tipos de interés de 25 puntos básicos, lo que provocó una respuesta moderada por parte de los inversores. En un principio, las acciones repuntaron tras la decisión del FOMC sobre los tipos de interés y la publicación de sus previsiones económicas, pero estas ganancias se esfumaron rápidamente, incluso antes de que comenzara la rueda de prensa posterior a la reunión del presidente de la Fed, Jerome Powell. Las acciones y los bonos ya habían repuntado en los días previos a la reunión, en lo que algunos inversores denominaron una operación de "vender la noticia".

Al final de la sesión bursátil, el Dow Jones Industrial Average subió un +0,57%, cerrando solo un 0,2% por debajo de su máximo histórico. Por el contrario, el S&P 500 perdió un -0,10% y el Nasdaq Composite bajó un -0,33%.

En cuanto a noticias corporativas, las acciones de Uber Technologies cayeron un -4,99% tras el anuncio de una asociación entre Lyft y Waymo, de Alphabet, para lanzar servicios de transporte autónomo, que comenzarán el año que viene.

Apple registró una caída del -6% en las ventas de sus teléfonos inteligentes en China durante las semanas previas al lanzamiento del iPhone 17. Esta caída fue más significativa que la típica caída observada antes del lanzamiento de un nuevo producto estrella.

Reddit está manteniendo conversaciones preliminares para alcanzar otro acuerdo de intercambio de contenidos con Google, de Alphabet. El objetivo es obtener más valor de futuros acuerdos, ya que los datos de Reddit han cobrado cada vez más importancia para los resultados de búsqueda y el entrenamiento de modelos de IA generativa.

La píldora experimental para la diabetes de Eli Lilly mostró resultados prometedores en su primera comparación directa con un rival aprobado de Novo Nordisk. Los pacientes que tomaron el medicamento de Eli Lilly experimentaron una mayor pérdida de peso y un mejor control del azúcar en sangre.

Las acciones de WaterBridge Infrastructure subieron un +14,15% en su debut bursátil. La empresa de infraestructuras hidráulicas recaudó 634 millones de dólares en una oferta pública inicial que se situó en el límite superior de su rango de comercialización.

Abu Dhabi National Oil ha retirado su oferta de 19.000 millones de dólares por la productora australiana de gas natural Santos. La empresa ha afirmado que una "combinación de factores" le ha llevado a tomar la decisión de no presentar una oferta definitiva.

Empresas de gran capitalización: Las Siete Magníficas han tenido un rendimiento mayoritariamente positivo durante la semana. En los últimos siete días, Tesla +22,45%, Apple +5,38%, Alphabet +4,33%, Meta Platforms +3,16%, Microsoft +1,93% y Amazon +0,56%, mientras que Nvidia -3,97%.

Las acciones de las empresas del sector energético han tenido un rendimiento mixto esta semana, mientras que el propio sector energético ha subido un +1,08%. Los precios del WTI y del Brent han aumentado un +0,55% y un +0,49%, respectivamente, esta semana. Durante estos siete días, Energy Fuels +10,69%, APA +3,71%, ExxonMobil +2,48%, Occidental Petroleum +1,90%, Marathon Petroleum +1,65%, Chevron +1,46% y Phillips 66 +1,31%, mientras que ConocoPhillips -0,53%, Baker Hughes -0,94%, BP -1,11%, Halliburton -1,55% y Shell -1,88%.

Las acciones de los sectores de materiales y minería han registrado un rendimiento mayoritariamente positivo esta semana en el que el sector de materiales ha avanzado un +0,15%. Durante los últimos siete días, Albemarle +9,33%, Mosaic +2,24%, Celanese Corporation +2,01%, Nucor +0,65%, Freeport-McMoRan +0,47%, Sibanye Stillwater +0,37% y Newmont Corporation +0,33%, mientras que Yara International -0,30% y CF Industries -3,12%.

Evolución de los índices bursátiles europeos

El Stoxx 600 +0,09% en lo que va de mes y +8,47% en lo que va de año

El DAX -2,27% en lo que va de mes y +17,33% en lo que va de año

El CAC 40 +1,08% en lo que va de mes y +5,50% en lo que va de año

El IBEX 35 +1,28% en lo que va de mes y +30,46% en lo que va de año

El FTSE MIB +0,73% en lo que va de mes y +24,33% en lo que va de año

El FTSE 100 +0,09% en lo que va de mes y +12,51% en lo que va de año

Esta semana, el índice paneuropeo Stoxx Europe 600 ha bajado un -0,30%, mientras que el miércoles cerró con una caída del -0,03%, en 550,63 puntos.

En lo que va de mes, el sector minorista es el que mejor se ha comportado en el STOXX Europe 600, con un aumento del +4,11% en lo que va de mes y una caída del -0,64% en lo que va de año, mientras que el sector de alimentación y bebidas es el más débil, con una disminución del -4,17% en lo que va de mes y del -4,89% en lo que va de año.

Esta semana, el sector tecnológico ha sido el que mejor se ha comportado dentro del STOXX Europe 600, con un alza del +1,95%, seguido por el minorista y el de recursos básicos, que han crecido un +1,84% y un +0,55%, respectivamente. Por el contrario, el sector de alimentación y bebidas es el que peor rendimiento ha tenido, con una caída del -2,05%, seguido por el del petróleo y el gas y el de la salud, que han retrocedido un -1,71% y un -1,61%, respectivamente.

El índice DAX de Alemania subió un +0,13% el miércoles, cerrando en 23.359,18 puntos. Durante los últimos siete días, este ha bajado un -1,16%. El índice CAC 40 de Francia cayó un 0,40% el miércoles, cerrando en 7.786,98. Durante la última semana, ha avanzado un +0,33%.

El índice FTSE 100 del Reino Unido cerró con una caída del -0,32% durante los últimos siete días, hasta situarse en los 9.195,66 puntos. El miércoles cerró con una disminución del -0,88%.

En la sesión bursátil del miércoles, el sector tecnológico fue el que mejor se comportó, impulsado por las operaciones por valor de aproximadamente 30.000 millones de libras esterlinas realizadas por las principales inversiones tecnológicas estadounidenses en el Reino Unido durante la visita de Estado del presidente Trump. Dentro del sector, las acciones de SAP subieron después de que Jefferies destacara los sólidos pedidos en la nube y el potencial de flujo de caja de la empresa.

El sector minorista también tuvo un buen rendimiento. Moonpig Group avanzó después de reafirmar sus previsiones para el ejercicio fiscal 2026, mientras que Inditex fue elevada a la calificación de "comprar" por UBS, citando sus sólidas perspectivas de crecimiento. Del mismo modo, Marks and Spencer Group ganó terreno gracias a la mejora de la confianza en sus beneficios. PZ Cussons superó las expectativas en cuanto a su beneficio por acción ajustado para todo el año, y Fnac Darty avanzó en medio de los rumores sobre una posible adquisición de Engie Home Services.

En el sector sanitario, el impulso positivo se vio respaldado por las mejoras de las calificaciones de los analistas. Novo Nordisk fue elevada a "comprar" por Berenberg, que señaló el potencial alcista impulsado por el nuevo liderazgo. El sector también se vio impulsado por las noticias sobre la expansión de los medicamentos contra la obesidad dirigidos a afecciones como la apnea del sueño y el dolor de rodilla. GSK anunció una inversión de 30.000 millones de dólares en Estados Unidos. Por el contrario, las acciones de AstraZeneca bajaron tras los resultados dispares de los ensayos clínicos.

En cambio, varios sectores se enfrentaron a dificultades. Los recursos básicos bajaron debido a la prolongación de la caída de los precios del cobre. Los precios del mineral de hierro también bajaron debido a la preocupación por el aumento de los envíos y la demanda. El sector de automóviles y piezas retrocedió, ya que Volkswagen se ha visto presionado por los posibles costes arancelarios de 1.000 millones de euros en Estados Unidos que afectan a su marca Audi. El sector químico también tuvo un rendimiento inferior, y Morgan Stanley rebajó las calificaciones de Solvay y Wacker Chemie.

Evolución de otros índices bursátiles mundiales

El MSCI World Index +2,61% en lo que va de mes y +16,05% en lo que va de año

El Hang Seng +7,05% en lo que va de mes y +33,83% en lo que va de año

El índice MSCI World ha subido un +1,20% durante los últimos siete días, mientras que el índice Hang Seng ha avanzado un +2,42% en el mismo periodo.

Divisas

El EUR +1,13% en lo que va de mes y +14,12% en lo que va de año hasta situarse en 1,1816 $

La GBP +0,89% en lo que va de mes y +8,91% en lo que va de año hasta situarse en 1,3623 $

Tras la decisión de la Fed de recortar los tipos de interés en un cuarto de punto porcentual, el dólar estadounidense experimentó una sesión bursátil volátil. El dólar cayó inicialmente a su mínimo de cuatro años frente al euro, antes de revertir sus pérdidas y cotizar al alza al cierre de la jornada.

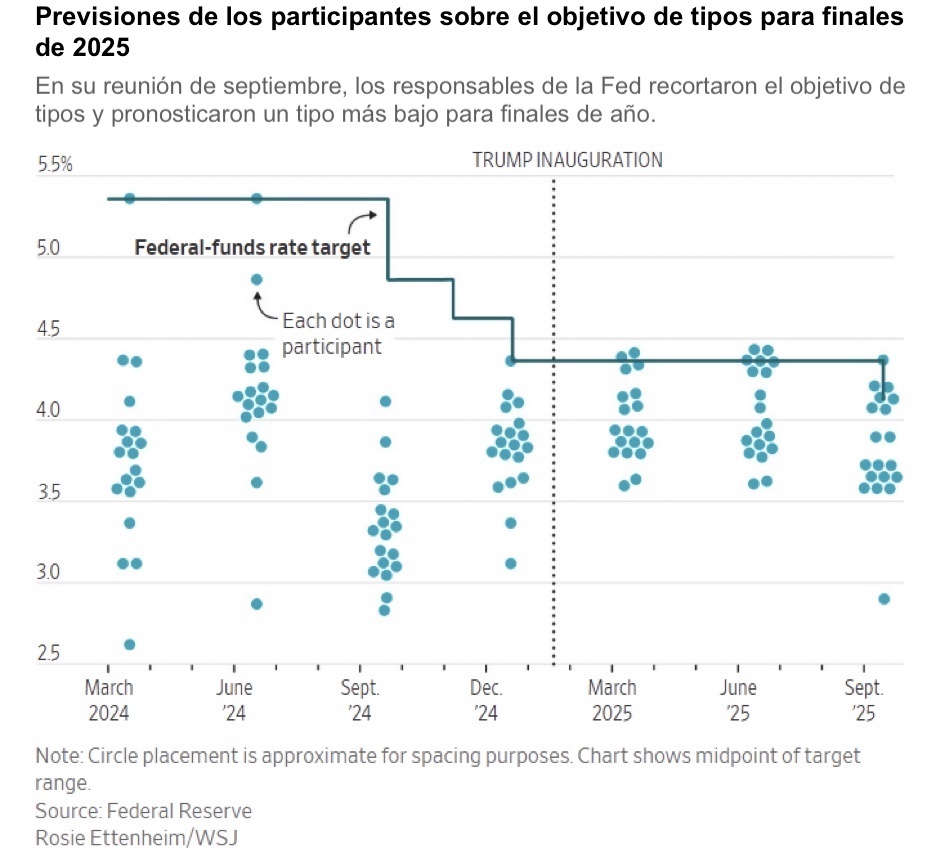

Esta bajada de tipos, la primera del FOMC desde diciembre de 2024, redujo el tipo oficial a un rango del 4,00% al 4,25%. Esta decisión, junto con las previsiones de que se produzcan dos recortes más de un cuarto de punto porcentual este año, sugiere que los responsables de la Reserva Federal están cada vez menos preocupados por que las políticas comerciales del Gobierno provoquen una inflación sostenida.

El dólar encontró apoyo después de que el presidente de la Fed, Jerome Powell, describiera las perspectivas de los tipos como una "situación que se evaluará reunión a reunión", calificando la reciente medida como un "recorte de gestión del riesgo" e indicando que no hay necesidad inmediata de cambios rápidos en los tipos.

El euro subió inicialmente hasta 1,1918 dólares, su nivel más alto desde junio de 2021, antes de caer hasta cotizar a 1,1816 dólares, lo que supone un descenso del -0,36% en el día. A pesar de ello, el euro subió un +1,02% durante la semana.

El índice del dólar cerró la jornada con un alza del +0,34%, hasta situarse en 97,01, aunque ha bajado un -0,83% durante la última semana. En lo que va de mes, ha bajado un -0,86% y, en lo que va de año, un -10,57%.

A primera hora del día, los datos mostraron una caída en la construcción de viviendas unifamiliares y en los permisos de construcción en Estados Unidos en agosto, influida por el excedente de viviendas nuevas sin vender y el debilitamiento del mercado laboral, a pesar de la caída simultánea de los tipos hipotecarios.

La libra esterlina bajó un -0,15% frente al dólar, hasta situarse en 1,3623 dólares, aunque se mantuvo cerca de su máximo de dos meses y medio. La libra esterlina ha subido un +0,70% durante la última semana.

Se espera que el Banco de Inglaterra mantenga su tipo de interés en el 4,0% durante su reunión de hoy. Esta expectativa se ve respaldada por las cifras oficiales que muestran una tasa de inflación anual del 3,8% en agosto, lo que refuerza la opinión de que es poco probable que se produzcan nuevas bajadas de tipos a corto plazo.

Frente al yen japonés, el dólar subió un +0,35% hasta situarse en 146,94 yenes. En las últimas cinco sesiones bursátiles, el dólar ha caído un -0,30% frente al yen, lo que ha contribuido a un descenso del -0,05% en lo que va de mes.

Se prevé que el Banco de Japón (BoJ) mantenga sus tipos actuales en su reunión de política monetaria del viernes. La atención en Japón sigue centrada en la próxima votación del 4 de octubre para elegir al nuevo líder del Partido Liberal Democrático, que sustituirá al primer ministro saliente, Shigeru Ishiba.

Nota: los datos corresponden al 17 de septiembre de 2025 a las 17.00 EDT

Criptomonedas

El bitcoin +7,01% en lo que va de mes y +24,07% en lo que va de año hasta situarse en 116.071,50 $

El ethereum +3,78% en lo que va de mes y +36,72% en lo que va de año hasta situarse en 4.531,11 $

El bitcoin ha subido un +2,05% y el ethereum un +4,37% en los últimos siete días. El miércoles, el bitcoin bajó un -0,60% hasta los 116.071,50 $, mientras que el ethereum subió un +0,80% hasta los 4.531,11 $. Los fondos cotizados en bolsa (ETFs) de bitcoin al contado de EE. UU. han registrado una racha de siete días de entradas por un total de casi 2.900 millones de dólares. Además, la esperada bajada de tipos del miércoles puede llevar a los inversores a buscar mayores rendimientos a través de activos alternativos, como las criptomonedas. El recorte de tipos podría inyectar más liquidez en los mercados y provocar un aumento del volumen de negociación de las criptomonedas.

Otra señal positiva para las criptomonedas es la noticia de que la Comisión de Bolsa y Valores de EE. UU. (SEC) votó el miércoles a favor de aprobar cambios en la normativa que permitirán a las bolsas adoptar normas de cotización genéricas para determinados productos cotizados en bolsa (ETPs) que poseen físicamente materias primas como activos digitales. Como resultado, estos productos de activos digitales podrán cotizar y negociarse en bolsa sin estar sujetos a la revisión de la Comisión.

Nota: los datos corresponden al 17 de septiembre de 2025 a las 17.00 EDT

Renta fija

La rentabilidad de los bonos estadounidenses a 10 años ha bajado -14,8 pb en su acumulado mensual y -49,1 pb en su acumulado anual hasta el 4,085%

La rentabilidad de los bonos alemanes a 10 años ha caído -5,3 pb en su acumulado mensual y subido +30,5 pb en su acumulado anual hasta el 2,674%

La rentabilidad de los bonos británicos a 10 años ha disminuido -9,5 pb en su acumulado mensual y crecido +6,1 pb en su acumulado anual hasta el 4,629%

Tras la decisión de la Reserva Federal de recortar los tipos de interés en 25 pb, los rendimientos de los bonos del Tesoro estadounidense subieron en toda la curva en una sesión bursátil volátil. La medida del FOMC parece dar prioridad a los riesgos a la baja para el empleo, lo que sugiere que los responsables están dando más importancia al mercado laboral que al aumento de la inflación señalado en sus proyecciones económicas. Esta medida indica un cambio hacia una política monetaria ligeramente más acomodaticia.

Tras el anuncio del FOMC, los rendimientos de los bonos del Tesoro bajaron y se mantuvieron a la baja durante la sesión, antes de invertir su curso cuando Powell tomó la palabra, con lo que el rendimiento de los bonos del Tesoro a 10 años acabó subiendo +5,0 pb, hasta situarse en el 4,085%.

Al cierre de la sesión, el rendimiento de los bonos a 30 años aumentó +3,7 pb hasta el 4,653%. El rendimiento de los bonos del Tesoro a dos años, que es muy sensible a las expectativas sobre la política de la Fed, subió +6,0 pb hasta el 3,572%. El diferencial entre los bonos del Tesoro a dos y a 10 años se amplió hasta los 51,3 pb positivos, lo que supone una expansión de 1,0 pb con respecto a los 50,3 pb registrados la semana pasada.

Durante los últimos siete días, el rendimiento de los bonos del Tesoro a 10 años ha aumentado +3,2 pb, mientras que el rendimiento de los bonos del Tesoro a 30 años ha caído -0,8 pb. En el extremo más corto, el rendimiento de los bonos del Tesoro a dos años ha crecido +2,2 pb.

Antes de la declaración de la Fed, las expectativas del mercado, reflejadas en la herramienta FedWatch de CME, mostraban una probabilidad del 96,1% de que se produzca una bajada de tipos de 25 pb, con un 3,9% de posibilidades de una reducción mayor, de 50 pb.

Tras la decisión del FOMC y la rueda de prensa del miércoles, los operadores están descontando recortes de 70,2 pb para finales de año, por encima de los 68,1 pb de la semana pasada, según la herramienta FedWatch de CME Group. Los operadores de futuros sobre fondos federales están descontando ahora una probabilidad del 87,7% de un recorte de tipos de 25 pb en la reunión del FOMC de octubre, frente al 73,9% de la semana pasada.

Al otro lado del Atlántico, en el Reino Unido, el miércoles el bono a 10 años bajó -1,5 pb hasta el 4,629%. El rendimiento a 10 años del Reino Unido ha caído -0,4 pb durante los últimos siete días. El bono a 30 años bajó -2,3 pb hasta el 5,432% el miércoles y -5,2 pb durante los últimos siete días.

Al otro lado del Canal de la Mancha, los rendimientos de los bonos gubernamentales de la eurozona bajaron en toda la curva y en toda la región el miércoles, ya que los mercados anticipaban una bajada de tipos por parte de la Fed a lo largo del día.

El rendimiento del bono alemán a 10 años bajó -2,1 pb, hasta el 2,674%. Este descenso se produce en un momento en que los mercados monetarios siguen descontando que el BCE no bajará los tipos durante el resto del año.

Los bonos a más largo plazo registraron un descenso más significativo, ya que el rendimiento de los bonos alemanes a 30 años cayó -4,6 pb hasta el 3,230%, alcanzando su nivel más bajo desde el 14 de agosto. Este movimiento coincidió con una exitosa subasta de bonos alemanes a 30 años, que registró una mejora en la relación entre la oferta y la demanda, lo que indica una fuerte demanda de los inversores por la deuda a largo plazo tras un período de presión reciente.

En el extremo corto de la curva alemana, el Schatz a 2 años bajó -0,4 pb hasta situarse en el 2,008%.

Los rendimientos franceses bajaron en menor medida el miércoles, ya que el rendimiento francés a 10 años bajó -1,2 pb, hasta el 3,490%. El diferencial de rendimiento entre los bonos del Estado francés y alemán a 10 años, un indicador clave de la prima de riesgo de la deuda francesa, subió +7,6 pb desde los 74,0 pb de la semana anterior, situándose en 81,6 pb.

Durante los últimos siete días, el rendimiento alemán a 10 años ha aumentado +1,7 pb. El rendimiento de los bonos alemanes a dos años ha subido +4,5 pb y, en el extremo más largo del espectro, el rendimiento alemán a 30 años ha caído -4,6 pb.

El diferencial entre los bonos del Tesoro estadounidense a 10 años y los bonos alemanes es ahora de 141,1 pb, 1,5 pb más que los 139,6 pb de la semana pasada.

El diferencial entre los rendimientos de los BTPs italianos a 10 años y los rendimientos de los bonos alemanes a 10 años se situó en 79,6 pb, lo que supone una contracción de 1,8 pb desde los 81,4 pb de la semana pasada. El rendimiento italiano a 10 años ha caído -0,1 pb con respecto a la semana pasada, después de caer -1,9 pb el miércoles, hasta situarse en el 3,470%.

Materias primas

El oro al contado +6,18% en lo que va de mes y +39,56% en lo que va de año hasta alcanzar 3.659,67 $ por onza

La plata al contado +5,00% en lo que va de mes y +44,40% en lo que va de año hasta alcanzar 41,66 $ por onza

El crudo West Texas Intermediate +0,14% en lo que va de mes y -10,62% en lo que va de año hasta alcanzar 64,10 $ por barril

El crudo Brent -0,32% en lo que va de mes y -9,02% en lo que va de año hasta alcanzar 67,90 $ por barril

Los precios del oro bajaron el miércoles, retrocediendo desde el máximo histórico alcanzado a primera hora de la sesión.

El oro al contado cayó un -0,81% hasta cotizar a 3.659,67 dólares por onza, tras alcanzar un máximo histórico de 3.707,40 dólares. A pesar de este retroceso, los precios siguen acumulando una subida del +0,53% durante los últimos siete días y han ganado un +6,18% en lo que va de mes.

El buen comportamiento del oro este año se ha visto respaldado por varios factores clave, entre los que se incluyen las compras sostenidas de los bancos centrales, la diversificación frente al dólar estadounidense, la continua demanda de refugios seguros impulsada por las tensiones geopolíticas y comerciales, y la debilidad generalizada del propio dólar.

Los precios del petróleo bajaron el miércoles tras conocerse los datos que revelaban un aumento de las reservas de diésel en Estados Unidos, lo que suscitó preocupaciones sobre la demanda futura.

Los futuros del crudo Brent cerraron con una caída de 61 centavos, un descenso del -0,89%, hasta los 67,90 dólares el barril. Los futuros del crudo WTI estadounidense, por su parte, cayeron 45 centavos, o un -0,70%, hasta situarse en 64,10 dólares.

Esta semana, los precios del WTI y del Brent han subido un +0,49% y un +0,53%, respectivamente.

En cuanto a la oferta, varios acontecimientos acapararon la atención. Kazajistán reanudó el suministro de petróleo a través del oleoducto Bakú-Tiflis-Ceyhan el 13 de septiembre, según la empresa estatal de energía Kazmunaygaz. El suministro se había suspendido el mes pasado debido a problemas de contaminación.

En Nigeria, el presidente Bola Tinubu levantó el estado de emergencia en Rivers después de 6 meses, un estado clave para las exportaciones de crudo del país.

Además, los riesgos del suministro de petróleo ruso fueron motivo de preocupación tras la intensificación de los ataques de Ucrania contra la infraestructura energética del país. El monopolio ruso de oleoductos, Transneft, advirtió el martes a los productores que podrían verse obligados a reducir la producción tras los recientes ataques con drones contra puertos y refinerías de exportación críticos.

Informe de la EIA. Según los datos publicados ayer por la Administración de Información Energética (EIA), las reservas de crudo de Estados Unidos disminuyeron la semana pasada. Este descenso se debió a un mínimo histórico en las importaciones netas, ya que las exportaciones alcanzaron su nivel más alto en casi dos años.

En la semana que finalizó el 12 de septiembre, las reservas de crudo cayeron en 9,3 millones de barriles, hasta un total de 415,4 millones de barriles. Esta caída se vio respaldada por un aumento significativo de las exportaciones de crudo de EE. UU., que aumentaron en 2,53 millones de barriles diarios (bpd) hasta alcanzar los 5,28 millones de bpd, su nivel más alto desde diciembre de 2023. Al mismo tiempo, las importaciones netas de crudo de EE. UU. cayeron en 3,11 millones de bpd, alcanzando el nivel más bajo registrado desde 2021.

Las reservas de crudo en el importante centro de distribución de Cushing, Oklahoma, también disminuyeron en 296.000 barriles.

Además del crudo, las reservas de gasolina también disminuyeron en 2,3 millones de barriles, hasta alcanzar los 217,6 millones de barriles. Sin embargo, las reservas de destilados, que incluyen el diésel y el gasóleo de calefacción, aumentaron en 4 millones de barriles, hasta alcanzar los 124,7 millones de barriles.

El suministro total de productos, un indicador clave de la demanda, aumentó hasta los 20,64 millones de barriles diarios, frente a los 19,78 millones de barriles diarios de la semana anterior. A pesar de ello, el procesamiento de crudo en las refinerías disminuyó en 394.000 barriles diarios y las tasas de utilización cayeron 1,6 puntos porcentuales, hasta el 93,3%.

Nota: los datos corresponden al 17 de septiembre de 2025 a las 17.00 EDT

Datos clave que determinarán el movimiento de los mercados

EUROPA

Jueves: informe mensual del Bundesbank y discursos de la presidenta del BCE, Christine Lagarde, y del vicepresidente, Luis de Guindos, la miembro del Comité Ejecutivo, Isabel Schnabel, el gobernador del Banco de España, José Luis Escrivá, y el presidente del Deutsche Bundesbank, Joachim Nagel

Viernes: IPP alemán, reunión del EcoFin de la UE, reunión del Eurogrupo y discurso del presidente del banco central neerlandés (DNB), Olaf Sleijpen

Sábado: reunión del EcoFin

Lunes: confianza de los consumidores de la zona euro

Martes: PMI compuesto, de servicios y manufacturero del HCOB de Francia, Alemania y la zona euro

Miércoles: encuestas del clima empresarial, la valoración actual y las expectativas del IFO alemán

REINO UNIDO

Jueves: decisión sobre los tipos de interés del Banco de Inglaterra, actas y resumen de la política monetaria, y confianza del consumidor de GfK

Lunes: discursos del economista jefe del Banco de Inglaterra, Huw Pill, y del gobernador Andrew Bailey

Martes: PMI compuesto, de servicios y manufacturero de S&P Global, y discurso del economista jefe del Banco de Inglaterra, Huw Pill

Miércoles: discurso de la miembro externa del Banco de Inglaterra Megan Greene

EE. UU.

Jueves: solicitudes iniciales y continuas de subsidio por desempleo y encuesta manufacturera de la Fed de Filadelfia

Viernes: discurso de la presidenta de la Fed de San Francisco, Mary Daly

Lunes: discursos del presidente de la Fed de Nueva York, John Williams, del presidente de la Fed de St. Louis, Alberto Musalem, y de la presidenta de la Fed de Cleveland, Beth Hammack

Martes: PMI compuesto, de servicios y manufacturero de S&P Global y variación de las ventas de viviendas existentes

Miércoles: variación de las ventas de viviendas nuevas y discurso de la presidenta de la Fed de San Francisco, Mary Daly

CHINA

Lunes: decisión sobre los tipos de interés del Banco Popular de China

JAPÓN

Jueves: índice nacional de precios al consumidor

Viernes: decisión sobre los tipos de interés del Banco de Japón y declaración sobre política monetaria

Miércoles: actas de la reunión sobre política monetaria del Banco de Japón

Actualizaciones macroeconómicas mundiales

La Fed recorta los tipos ante el debilitamiento del mercado laboral y da señales de que habrá más recortes. El miércoles, el FOMC votó por 11 votos a 1 a favor de recortar el rango objetivo para los tipos de interés de los fondos federales al 4%-4,25%. El presidente de la Fed, Jerome Powell, afirmó que la Reserva Federal se encuentra ahora en una "situación de reunión por reunión", pero las previsiones apuntan a dos recortes más este año de 25 puntos básicos cada uno, otros 25 puntos básicos en 2026 y un recorte final de 25 puntos básicos en 2027.

En la rueda de prensa, Powell afirmó que "la demanda de mano de obra se ha debilitado y el ritmo reciente de creación de empleo parece estar por debajo de la tasa de equilibrio necesaria para mantener constante la tasa de desempleo". Sin embargo, los problemas del mercado laboral se atribuyeron más a cuestiones relacionadas con la oferta de mano de obra. Powell también sugirió que la inflación relacionada con los aranceles podría ser algo más que un hecho puntual.

Una estrecha mayoría de los miembros de la junta de la Reserva Federal previó al menos dos recortes adicionales de los tipos de interés este año, lo que implica medidas consecutivas en las reuniones restantes de octubre y diciembre. Estas previsiones sugieren un cambio más amplio de enfoque hacia las debilidades emergentes en el mercado laboral, un entorno que se ha vuelto más complejo debido a los importantes cambios políticos que han reducido la previsibilidad económica.

El presidente de la Fed, Jerome Powell, que había hecho referencia al "riesgo a la baja" en seis ocasiones durante una rueda de prensa celebrada en julio, confirmó este cambio de perspectiva al afirmar que "ese riesgo a la baja es ahora una realidad".

Las previsiones también subrayan la posibilidad de que se tomen decisiones más controvertidas en el futuro. Siete de los diecinueve participantes en la reunión no prevén más recortes de tipos este año, mientras que otros dos esperan solo uno más. Además, las previsiones indican que la mayoría de los responsables no prevén numerosos recortes adicionales el año que viene, basándose en sus perspectivas actuales de una actividad económica sólida, aunque en desaceleración.

"No hay un camino sin riesgos", señaló Powell, destacando el reto de gestionar los riesgos tanto de una mayor inflación como de un empleo más débil. "No es muy obvio qué hay que hacer", añadió.

Aunque los mercados pueden ver con buenos ojos la tendencia a la flexibilización, el mensaje de la Fed sigue siendo matizado y no llega a suponer un giro completo de la política. Aunque el gráfico de puntos ahora implica dos recortes más en 2025, Powell restó importancia a su significado, calificando las perspectivas como "más equilibradas" en lugar de inclinadas decisivamente hacia los riesgos del mercado laboral.

Este cambio se reflejó en múltiples modificaciones de la declaración del FOMC sobre el mercado laboral. El comité señaló que "el crecimiento del empleo se ha ralentizado y la tasa de desempleo ha aumentado ligeramente". También eliminó el lenguaje que describía el mercado laboral como "sólido" y añadió que "han aumentado los riesgos a la baja para el empleo".

Por el momento, el anuncio de la Fed envía una señal de su disposición a tolerar una inflación moderadamente elevada a corto plazo, ya que se alarga el plazo para alcanzar su objetivo del 2%.

En el Resumen de las Proyecciones Económicas adjunto, la previsión del PIB real para 2025 se revisó al alza en 0,2 puntos porcentuales, hasta el 1,6%. La previsión de la tasa de desempleo media para 2025 se mantuvo sin cambios en el 4,5%, y la proyección de la inflación subyacente del PCE para 2025 también se mantuvo estable en el 3,1%.

En resumen, parece que el doble mandato de la Fed la está empujando en direcciones opuestas, ya que las presiones inflacionistas siguen siendo motivo de preocupación a medida que se debilitan las cifras de empleo.

Aunque se han hecho todos los esfuerzos posibles para verificar la exactitud de esta información, EXT Ltd. (en adelante, "EXANTE") no se hace responsable de la confianza que cualquier persona pueda depositar en esta publicación o en cualquier información, opinión o conclusión contenida en ella. Las conclusiones y opiniones expresadas en esta publicación no reflejan necesariamente la opinión de EXANTE. Cualquier acción realizada sobre la base de la información contenida en esta publicación es estrictamente bajo su propio riesgo. EXANTE no se hará responsable de ninguna pérdida o daño relacionado con esta publicación.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora