Will it be a meeting of minds or politics?

Key data to move markets today

EU: Speeches by EU Executive Board member Isabel Schnabel and ECB President Christine Lagarde

USA: NY Empire State Manufacturing

CHINA: Industrial Production and Retail Sales

US Stock Indices

Dow Jones Industrial Average -0.59%

Nasdaq 100 +0.42%

S&P 500 -0.05%, with 7 of the 11 sectors of the S&P 500 down

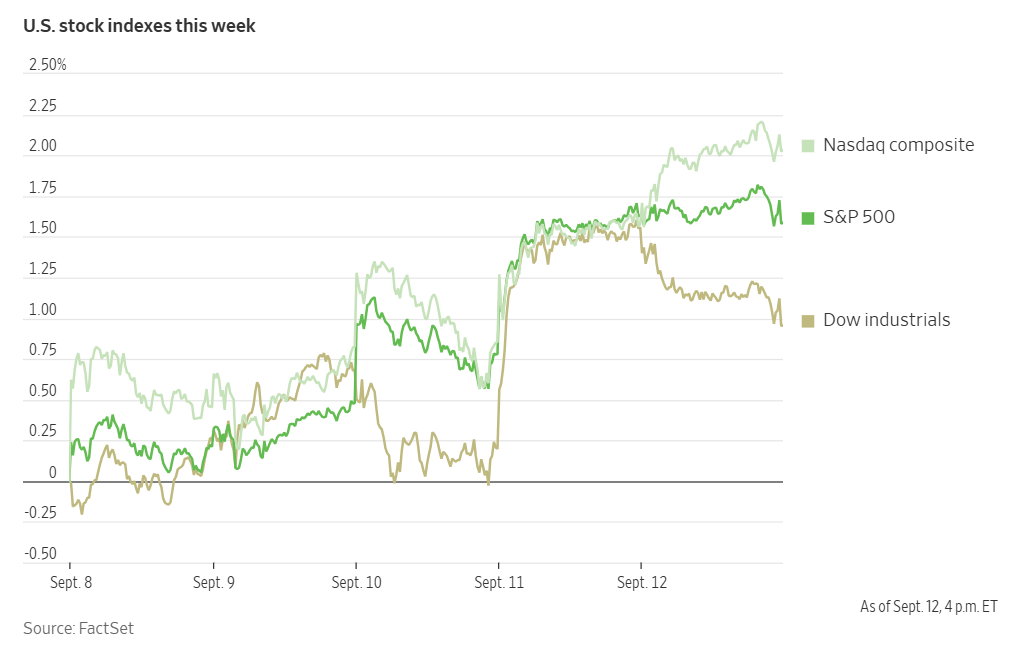

In a record-setting week, the Nasdaq Composite rose +0.44% on Friday, closing at 22,141.10 - its 25th record of the year - and gaining +1.57% over the last five sessions. While the S&P 500 slipped by a fractional -0.05% on Friday, it still ended the week +1.37% higher. The Dow Jones Industrial Average retreated -0.59% to 45,834.22, dropping 274 points after a historic rally above 46,000 on Thursday. Still, the Dow ended the week +0.70%.

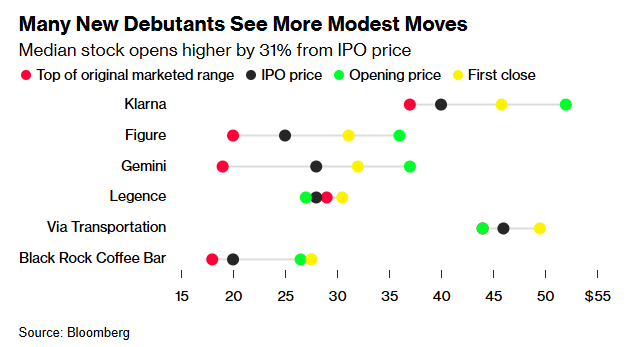

The IPO market also kicked into high gear last week, with six deals raising over $4 billion. This was the busiest period since 2021. Though five of the six initial public offerings worth at least $290 million priced above their expected ranges, their post-debut performances were mostly uninspiring.

Last week’s notable debut’s included Klarna Group, which fluctuated after its launch on Wednesday. Figure Technology Solutions ended its second day of trading higher. In a flurry of four listings on Friday, Gemini Space Station soared as investors flocked to the crypto exchange before it trimmed its gains. Additionally, Blackstone-backed Legence and Via Transportation both rose more modestly after opening below their IPO prices.

This week's IPOs include Stubhub Holdings and Netskope. IPOs this week could raise up to $2.53 billion. According to Bloomberg data, this would be the first time since December 2021 that the US IPO market has seen back-to-back weeks of such volume (excluding SPACs, REITs, and closed-end funds).

In corporate news, Apple has delayed launching its new iPhone Air in mainland China, citing delays in regulatory approval.

Microsoft has successfully avoided a significant EU antitrust fine. The EU has accepted Microsoft's proposal to resolve a probe into the alleged illegal bundling of its Teams video-conferencing application with other software.

The US FTC is reportedly investigating whether Amazon and Alphabet's Google misled advertisers regarding ad placements on their websites.

OpenAI has announced it is moving closer to becoming a traditional for-profit company. This follows a challenging period of negotiations with its largest shareholder, Microsoft, and the establishment of terms that would allocate at least $100 billion in equity to its nonprofit arm.

WisdomTree has launched its first tokenised fund offering investors exposure to private credit.

One of Banco de Sabadell's largest shareholders has publicly stated that they will refuse BBVA's current $18 billion takeover bid. This stance places increased pressure on BBVA to offer a more compelling price.

S&P 500 Best performing sector

Consumer Discretionary +0.57%, with Tesla +7.36%, Tractor Supply +0.98%, and Deckers Outdoor +0.53%

S&P 500 Worst performing sector

Health Care -1.13%, with Moderna -7.40%, Charles River Laboratories International -4.29%, and Molina Healthcare -4.01%

Mega Caps

Alphabet +0.25%, Amazon -0.78%, Apple +1.76%, Meta Platforms +0.62%, Microsoft +1.77%, Nvidia +0.37%, and Tesla +7.36%

Information Technology

Best performer: Micron Technology +4.42%

Worst performer: Arista Networks -8.92%

Materials and Mining

Best performer: Corteva +1.78%

Worst performer: Smurfit WestRock -3.00%

European Stock Indices

CAC 40 +0.02%

DAX -0.02%

FTSE 100 -0.15%

Commodities

Gold spot +0.24% to $3,642.63 an ounce

Silver spot +1.57% to $42.17 an ounce

West Texas Intermediate +1.18% to $62.60 a barrel

Brent crude +0.92% to $66.88 a barrel

Gold prices increased on Friday, remaining near the record highs established earlier in the week. A weakening US labour market has reinforced expectations that the Fed will implement its first interest rate cut of the year this week. Additionally, the PBoC initiated a public consultation on Friday to simplify its regulations for importing and exporting gold by streamlining the licensing process.

Spot gold was +0.24% to $3,642.63 per troy ounce, approaching Tuesday's record high of $3,673.95. It was +1.57% last week, marking its fourth consecutive weekly increase. Gold has appreciated by +38.48% this year.

Brent crude futures closed at $66.88 a barrel, up 61 cents, or +0.92%. WTI crude ended the day at $62.60, a gain of 73 cents, or +1.18%. Last week, the Brent and WTI were +1.94% and +1.02%, respectively.

Initially, crude prices responded to a drone strike on Russia's northwestern port of Primorsk, which a Ukrainian SBU security service official stated had suspended oil loading operations overnight. Later in the day, however, gains diminished as traders focused on a revised US jobs report and higher inflation figures released earlier in the week.

Additionally, markets are monitoring potential sanctions or tariffs from the Trump administration aimed at reducing Russian crude oil consumption by India and China.

In a related development, the International Energy Agency (IEA) reported on Thursday that global oil supply is expected to increase more rapidly than previously forecast this year due to planned output hikes by OPEC+.

Further impacting the supply side, India's largest private port operator, Adani Group, has prohibited tankers sanctioned by Western nations from entering its ports. This could potentially restrict Russian oil supplies, as India is the primary purchaser of seaborne Russian oil, much of which is transported on vessels under sanctions from the EU, the US, and Britain.

Note: As of 5 pm EDT 12 September 2025

Currencies

EUR 0.0% to $1.1733

GBP -0.12% to $1.3556

Bitcoin +1.24% to $115,951.37

Ethereum +5.03% to $4,652.37

The US dollar weakened on Friday ahead of this week's FOMC meeting, which is expected to result in further monetary easing after an approximate nine-month pause. The dollar index was down -0.09% to 97.59. It fell -0.22% last week, its second consecutive weekly fall.

The greenback was slightly pressured by data showing that US consumer sentiment had fallen for the second straight month in September. The University of Michigan's consumer sentiment index dropped to 55.4, its lowest point since May, from a final August reading of 58.2. This was below economists' forecast of 58.0. In addition, on Thursday, data revealed the largest weekly increase in four years for initial jobless claims, overshadowing August’s CPI report. While August prices rose at the fastest pace in seven months, the increases were still modest and generally aligned with expectations.

The euro was unchanged against the dollar at $1.1733 on Friday, but was +0.14% for the week. The ECB kept its key rate at 2.0% for the second consecutive meeting. ECB President Christine Lagarde stated that the eurozone remains in a ‘good place’ and that economic risks have become more balanced.

The British pound traded -0.12% lower at $1.3556 on Friday after data indicated that the British economy stagnated in July. The UK's GDP showed zero growth for July, consistent with forecasts. It was down from the 0.4% expansion in the prior month. For the three months leading up to July, GDP grew by 0.2%, down from 0.3% in June and 0.6% in May. Despite this, the pound advanced +0.37% last week.

The dollar was +0.34% against the Japanese yen on Friday, closing at ¥147.66. This contributed to a +0.19% weekly gain. It was the third straight week of gains for the US dollar against the yen. The dollar had firmed earlier Friday following a joint US-Japanese statement that affirmed exchange rates should be ‘market determined’ and that excessive volatility and disorderly movements were undesirable.

Fixed Income

US 10-year Treasury +4.0 basis points to 4.070%

German 10-year bund +5.6 basis points to 2.716%

UK 10-year gilt +6.6 basis points to 4.676%

US Treasury yields increased on Friday in a quiet trading session. The yield on the 10-year note briefly ticked lower after the mid-morning release of the University of Michigan's preliminary September sentiment index. However, the yield remained above Thursday's five-month low of 3.994%. It was +4.0 bps to 4.070%, but -0.7 bps for the week.

The 30-year bond yield rose +2.3 bps to 4.683%, though it was -7.9 bps for the week.

The two-year US Treasury yield was +1.0 bps on Friday to 3.562%, contributing to a +4.3 bps increase for the week.

The spread between the yields on the two- and 10-year Treasury notes, a key measure of the yield curve, ended the week at 50.8 bps, a 5.0 bps contraction from the previous week.

The FOMC is due to meet Tuesday and Wednesday amid clear signs of a weakening labour market and moderate inflation. Expectations are that the Fed will restart its rate cutting cycle. Fed funds futures traders are now pricing in a 93.4% probability of a 25 bps rate cut in September, up from 89.0% last week, however, the probability of a 50 bps rate cut at the same meeting is now priced in at 6.6%, down from 11.0% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 70.8 bps of cuts by year-end, higher than the 69.7 bps expected last week.

Across the Atlantic, European government bond yields finished last week higher on the short end, as investors reduced their expectations for interest rate cuts by the ECB. Market attention also focused on Fitch's review of France's sovereign credit rating.

The yield on Germany's 10-year bond was +5.6 bps to 2.716% and +4.6 bps for the week. The interest rate-sensitive 2-year yield was +4.5 bps to 2.037%, its highest level since April. It was +9.7 bps for the week.

Following the ECB's policy meeting last Thursday, money markets are now pricing in less than a 40% chance of a 25 bps rate cut by June 2026, a decrease from nearly 50% before the meeting.

Yields on other regional bonds, such as those of France and Italy, generally tracked Germany's performance. France's 10-year yield was +6.3 bps to 3.512% on Friday, while Italy's advanced by +6.6 bps to 3.526%. Over the course of the week, Italy's 10-year BTP yield rose by +2.3 bps, and the French 10-year OAT yield increased by +7.6 bps.

The differing outlooks for the Fed and the ECB have narrowed the spread between 10-year German and US yields to its tightest point since July 2023, settling at 135.4 bps last week- a contraction of 5.3 bps from the previous week. The spread between French and German 10-year bond yields widened by 3.0 bps from the prior week's 76.6 bps, reaching 79.6 bps.

Although a credit rating downgrade by Fitch signifies a negative development for France, the market has largely priced this in.

Note: As of 5 pm EDT 12 September 2025

Global Macro Updates

Fitch downgrades France credit rating. On Friday, Fitch Ratings downgraded France's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'A+' from 'AA-', assigning a Stable Outlook. The decision was primarily driven by France's deteriorating public finances and a challenging political environment that hinders fiscal consolidation.

The central issue highlighted by Fitch is France's high and continuously rising general government debt. The agency projects the debt-to-GDP ratio will climb from 113.2% in 2024 to 121% by 2027, with no clear path to stabilisation. This level is double the median for 'A' rated sovereigns and the third highest among all 'A' and 'AA' rated countries.

Compounding the debt problem is significant political fragmentation. Fitch notes that political instability, including a government defeat in a confidence vote and three different administrations since the mid-2024 snap elections, severely weakens the state's ability to implement substantial fiscal reforms. This political deadlock makes it highly improbable that France will achieve its target of reducing the fiscal deficit to 3% of GDP by 2029. The agency anticipates that the run-up to the 2027 presidential election will further limit any appetite for meaningful consolidation. This is consistent with France's historically weak record on fiscal discipline, having run a headline deficit above 3% of GDP in all but three of the past 20 years and failing to achieve a primary fiscal surplus since 2001.

Fitch projects the fiscal deficit will remain high at 5.5% of GDP in 2025 and stay above 5.0% through 2027. This forecast assumes only modest annual consolidation measures, which will be partly offset by rising interest costs and defence spending. Structural fiscal rigidities, such as the EU's highest tax-to-GDP ratio (45.6%) and extensive social spending, at 32% of GDP, leave little room for manoeuvre through tax hikes or spending cuts, which have historically faced strong political and social opposition.

Despite these significant fiscal headwinds, France's 'A+' rating is supported by strong underlying credit fundamentals. The country possesses a large, diversified, and high-income economy with robust institutional quality, strong governance indicators, and the benefits of eurozone membership. Its banking sector is sound, and it enjoys excellent access to financing from a diverse investor base. Fitch forecasts modest real GDP growth, rising from 0.6% in 2025 to 1.2% in 2027, driven by domestic demand supported by high household savings and strong corporate balance sheets.

Looking forward, a negative rating action could be triggered by a sustained increase in the government debt ratio or materially lower economic growth. Conversely, an upgrade would require confidence that the debt-to-GDP ratio is on a firm downward trajectory, likely resulting from successful fiscal consolidation and stronger economic performance.

US consumer sentiment for September weaker than anticipated. US consumer sentiment weakened unexpectedly in early September, with the preliminary reading falling to 55.4, well below the consensus forecast of 59.3 and August's final figure of 58.2.

The decline was driven by a marked increase in pessimism about the future. While the Current Economic Conditions index saw only a modest dip to 61.2 from 61.7, the Index of Consumer Expectations dropped to 51.8 from 55.9 in August. The report highlighted that this erosion in economic outlook was particularly pronounced among lower and middle-income consumers, a trend that aligns with recent commentary from retailers who have noted some softening in spending within those demographics.

Regarding inflation, consumers' expectations were largely stable for the near term, with the one-year outlook holding at 4.8%. However, the five-year inflation expectation rose to 3.9% from August's final reading of 3.5%.

The survey revealed several key areas of concern weighing on consumers. Trade policy remains a highly salient issue, with approximately 60% of respondents mentioning tariffs in their interviews without being prompted. Consumers also cited rising risks to business conditions, the labour market, and inflation as primary sources of anxiety.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artículo se presenta a modo informativo únicamente y no debe ser considerado una oferta ni solicitud de oferta para comprar ni vender inversión alguna ni los servicios relaciones a los que se pueda haber hecho referencia aquí. Operar con instrumentos financieros implica un riesgo significativo de pérdida y puede no ser adecuado para todos los inversores. Los resultados pasados no garantizan rendimientos futuros.

Regístrese para recibir perspectivas de los mercados

Regístrese

para recibir perspectivas

de los mercados

Suscríbase ahora