% to $3,747.77

Key data to move markets today

EU: Spanish GDP and speeches by ECB Executive Board member Piero Cipollone and Bank of Spain Governor José Luis Escrivá

UK: BoE Quarterly Bulletin

USA: PCE Price Index, Core PCE Price Index, Personal Income, Personal Spending, Michigan Consumer Expectations, Sentiment Index, UoM 1-year and 5-year Consumer Inflation Expectations, and speeches by Richmond Fed President Thomas Barkin and Fed Governor Michelle Bowman

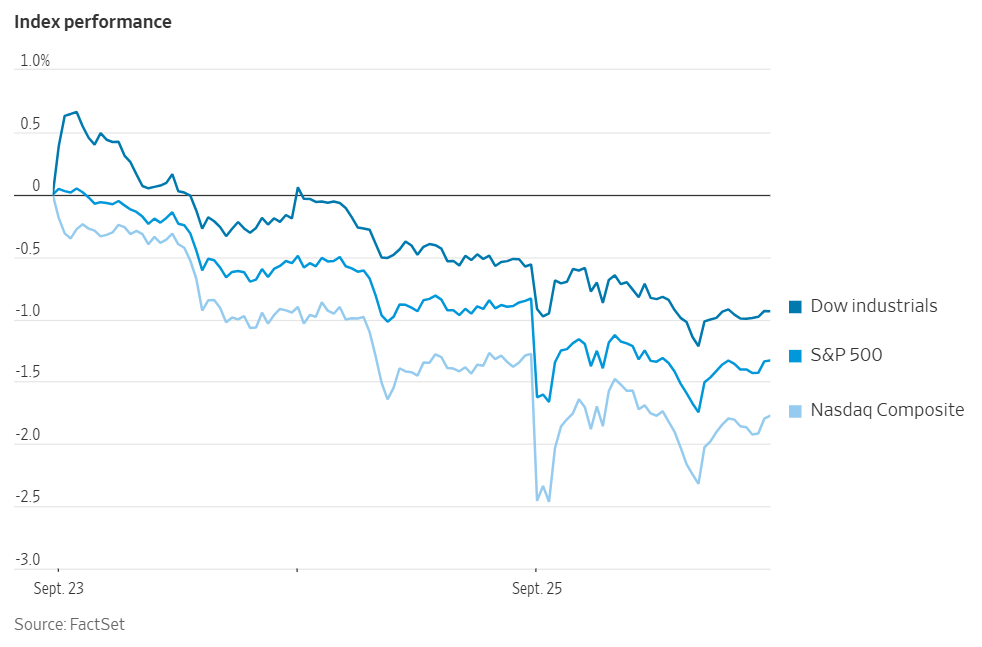

US Stock Indices

Dow Jones Industrial Average -0.38%

Nasdaq 100 -0.43%

S&P 500 -0.50%, with 9 of the 11 sectors of the S&P 500 down

Major US stock indexes fell for the third straight session Thursday. The S&P 500 and the Nasdaq Composite both recorded a -0.50% loss, while the Dow Jones Industrial Average fell by -0.38%, corresponding to a drop of 174 points.

Market attention is now focussed on today's release of the Personal Consumption Expenditures (PCE) Price Index, which serves as the Fed’s preferred gauge of inflation. Economists anticipate the y/o/y reading will be approximately 2.9%, a level that remains above the central bank’s target inflation rate.

In corporate news, Amazon has consented to a settlement with the US Federal Trade Commission (FTC), which includes paying $2.5 billion in penalties and customer refunds. The agreement also mandates significant changes to the process by which customers can cancel their Prime subscription.

Microsoft has partially disabled the use of some of its software by the Israeli military. This action follows an internal investigation prompted by public reports suggesting the company’s products were utilised in the surveillance of civilians.

Apple has petitioned EU antitrust regulators to scrap new regulations designed to protect digital consumers. The company argues that these rules expose users to significant privacy risks and threaten to undermine technological innovation.

Starbucks announced a substantial restructuring effort valued at $1 billion, which involves closing stores and eliminating 900 jobs. This initiative is part of an accelerated turnaround plan being implemented under CEO Brian Niccol.

Live Nation Entertainment's Ticketmaster agreed to implement specific changes to its ticketing operations. This follows concerns raised by the UK's antitrust watchdog that the company risked misleading customers during the sale of Oasis concert tickets last year.

Finally, the Qatar Investment Authority (QIA) is partnering with Blue Owl Capital to finance and invest in data centres. This collaboration marks the sovereign wealth fund’s latest strategic investment in the rapidly expanding AI sector.

S&P 500 Best performing sector

Energy +0.87%, with Valero Energy +2.10%, Phillips 66 +1.82%, and Marathon Petroleum +1.73%

S&P 500 Worst performing sector

Health Care -1.67%, with Moderna -4.91%, Baxter International -3.77%, and Regeneron Pharmaceuticals -3.72%

Mega Caps

Alphabet -0.51%, Amazon -0.94%, Apple +1.81%, Meta Platforms -1.54%, Microsoft -0.61%, Nvidia +0.41%, and Tesla -4.38%

Information Technology

Best performer: Intel +8.87%

Worst performer: Jabil -6.69%

Materials and Mining

Best performer: Albemarle +3.98%

Worst performer: Freeport-McMoRan -6.19%

European Stock Indices

CAC 40 -0.41%

DAX -0.56%

FTSE 100 -0.39%

Commodities

Gold spot +0.32% to $3,747.77 an ounce

Silver spot +2.79% to $45.14 an ounce

West Texas Intermediate +0.63% to $65.22 a barrel

Brent crude +0.65% to $69.58 a barrel

Gold prices experienced a modest paring of gains on Thursday, following an earlier surge in the trading session. Spot gold ended the day +0.32% to $3,747.77 per ounce, having peaked at a 0.60% rise earlier in the session. It had reached a record high of $3,790.82 on Tuesday.

Oil prices stabilised on Thursday, following a rise in the preceding session that pushed them to a seven-week high. This earlier momentum was due to Russia's decision to implement a partial restriction on fuel exports until the year's end. However, further gains were restrained by the release of new US economic data, which subsequently moderated expectations for additional monetary easing by the Fed.

Brent crude futures ended the day up $0.45, or +0.65%, to settle at $69.58 a barrel. US WTI futures advanced $0.41, or +0.63%, to $65.22.

The market received additional support after Russian Deputy Prime Minister Alexander Novak announced on Thursday the nation's intention to introduce a partial ban on diesel exports and extend the existing ban on gasoline exports until the close of the year. This action follows a series of drone attacks by Ukraine targeting Russian refineries.

Conversely, downward pressure on prices stemmed from an expected increase in oil from Iraq and Kurdistan. The Kurdistan Regional Government (KRG) declared on Thursday that oil exports would resume within 48 hours, following a tripartite agreement involving Iraq's oil ministry, the KRG ministry of natural resources, and the producing companies.

Note: As of 5 pm EDT 25 September 2025

Currencies

EUR -0.66% to $1.1660

GBP -0.81% to $1.3336

Bitcoin -3.62% to $109,514.99

Ethereum -6.35% to $3,907.35

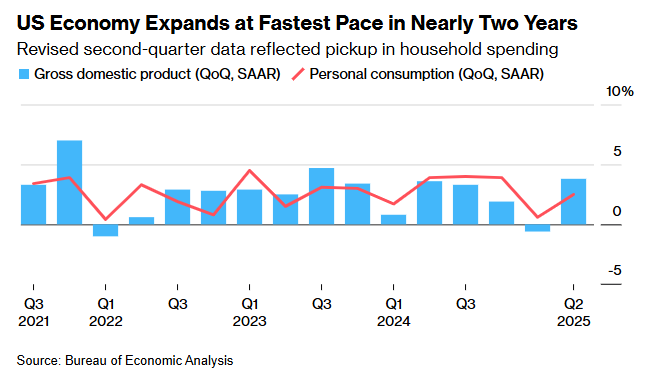

The US dollar rose on Thursday after the Commerce Department reported an upward revision to the US GDP, which expanded at a 3.8% y/o/y in Q2, exceeding the initial estimate of 3.3%. This growth was perceived to reduce the likelihood of Fed rate cuts.

The dollar index was +0.61% to 98.45, achieving a two-week high.

The euro was -0.66% against the dollar to $1.1660, marking a more than two-week low. The British pound declined -0.81% to $1.3336.

The dollar also extended its gains against the Swiss franc following the positive US GDP report. Further pressure on the franc came from the SNB, which maintained its key interest rates at zero, as anticipated.

The SNB also issued a warning that US tariffs had clouded the Swiss economic outlook heading into 2026. The greenback ultimately hit a two-week high against the Swiss franc, ending +0.60% to CHF 0.800.

The dollar strengthened +0.60% against the Japanese yen to ¥149.75, reaching its highest level since 1st August.

Fixed Income

US 10-year Treasury +1.9 basis points to 4.169%

German 10-year bund +2.2 basis points to 2.775%

UK 10-year gilt +8.3 basis points to 4.759%

US Treasury yields maintained their earlier gains on Thursday, following the release of stronger-than-expected Q2 GDP data. This rise in GDP may bolster support for the Fed to pause at its October meeting.

The yield on the 10-year Treasury note was +1.9 bps, settling at 4.168%. On Monday it reached its highest level since 5th September. The two-year yield, highly sensitive to short-term interest rate expectations, saw a more significant rise, +4.3 bps to 3.655%.

Conversely, the 30-year bond yield was -0.1 bps, at 4.754%.

On the supply side, the Treasury Department auctioned $44 billion in seven-year notes on Thursday afternoon, which yielded a bid-to-cover ratio of 2.48x. Following the auction, the seven-year notes experienced a sell-off, causing their yields to rise by +4.5 bps to 3.946%. This issuance followed two- and five-year note auctions earlier in the week, both of which were met with average demand from primary dealers.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 89.8% probability of a 25 bps rate cut at October’s FOMC meeting, up from 74.3% last week. Traders are currently anticipating 68.7 bps of cuts by year-end, matching the 68.7 bps expected last week.

Across the Atlantic, euro area government bond yields registered a modest increase on Thursday, tracking the rise of US Treasuries in the wake of robust US economic data.

The yield on Germany’s 10-year bond was +2.2 bps, settling at 2.775% following a recovery from an intraday dip. Germany’s 2-year yield, which is more closely aligned with ECB policy expectations, advanced +1.3 bps to 2.040%, marking its highest level since April.

Current money market pricing reflects less than a 35% probability of a 25 bps ECB rate cut by June 2026.

Italy’s 10-year yield rose +4.5 bps to 3.614%. This movement caused the yield spread over German Bunds to widen by 2.3 bps from Wednesday's close, reaching 83.9 bps.

French OAT yields also increased, by +3.1 bps, closing at 3.609%. The risk premium for French debt - measured by the spread between German Bunds and 10-year French government bonds - widened slightly to 83.4 bps.

Note: As of 5 pm EDT 25 September 2025

Global Macro Updates

Stronger-than-expected Q2 GDP and jobless claims. US economic data released on Thursday indicated surprising strength across several key metrics, surpassing market expectations.

Initial jobless claims for the preceding week registered 218,000, falling below the consensus forecast of 235,000 and the prior week's revised figure of 232,000 (originally 231,000). Continuing claims were also better than expected, totaling 1,926,000 compared to the consensus of 1,938,000 and the previous week's revised 1,928,000 (originally 1,920,000).

Preliminary durable goods orders for August demonstrated a substantial recovery, increasing by 2.9% m/o/m. This figure dramatically outperformed the consensus expectation for a 0.5% decline and reversed the 2.7% decline recorded in July. This headline growth, which follows two consecutive months of contraction, was primarily driven by a surge in transportation equipment orders.

Excluding the volatile transportation component, durable orders still increased by 0.4% m/o/m, beating the expected 0.2% decline. Furthermore, core orders (non-defence capital goods excluding aircraft) rose by 0.6% m/o/m, exceeding the consensus forecast for a 0.3% decline.

The final reading for Q2 GDP was revised upward, registering an annualised growth rate of 3.8% q/o/q, notably higher than both the consensus and the preliminary reading of +3.3%. The annualised Q2 GDP growth rate remained unrevised and in line with expectations at 2.1%. The upward revision to GDP was chiefly attributable to a significant increase in consumer spending, which was revised up from an earlier estimate of 1.6% to 2.5%.

The GDP Chain Price Index for the quarter also exceeded expectations, coming in at 2.1% q/o/q, slightly higher than the prior reading and consensus of 2.0%.

Finally, the Core PCE Price Index q/o/q was finalised at 2.6%, marginally above the previous reading and consensus of 2.5%.

ECB bulletin highlights policy transmission strength. The latest ECB Bulletin from the Governing Council’s meeting on 11th September reaffirmed a data-dependent, meeting-by-meeting approach to monetary policy. The assessment of inflation remains broadly consistent with that of June, with the current rate near the 2.0% target.

The ECB staff projections forecast that headline inflation will average 2.1% in 2025, decline to 1.7% in 2026, and return to 1.9% in 2027. Core inflation is anticipated to moderate as underlying wage pressures begin to recede.

Growth forecasts for 2025 were revised to 1.2% from 0.9% in June. Conversely, the 2026 growth outlook was marginally weakened to 1.0%, primarily attributed to the appreciation of the euro and softer foreign demand. Notably, trade tariffs induced significant volatility in H1 2025, particularly affecting Irish trade flows due to frontloading effects.

The labour market remains a source of economic resilience, with the unemployment rate steady at 6.2%. Wage growth moderated, slowing to 3.9% in Q2.

Financial conditions reflect a continued easing of borrowing costs, with the average rate on new firm loans declining to 3.5%. Bank lending data confirms an upward trend, with household loans growing by 2.5% y/o/y in August and corporate loans accelerating to 3.0%. The robust transmission of monetary policy, despite global uncertainties, suggests that recent concerns regarding investment may be overstated.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artigo é-lhe fornecido apenas para fins informativos e não deve ser considerado como uma oferta ou solicitação de uma proposta para compra ou venda de quaisquer investimentos ou serviços relacionados que possam ser aqui referenciados. A negociação de instrumentos financeiros envolve um risco significativo de perda e pode não ser adequada para todos os investidores. O desempenho passado não é um indicador fiável do desempenho futuro.