Key data to move markets today

Japan: Industrial Production.

EU: German, French and Italian Harmonised Index of Consumer Prices, and Consumer Price Indexes (CPIs), and a speech by Bundesbank President Joachim Nagel.

UK: GDP, Industrial Production, Manufacturing Production, and Consumer Inflation Expectations.

USA: Michigan Consumer Expectations Index and Consumer Sentiment Index, UoM 1-year and 5-year Consumer Inflation Expectations.

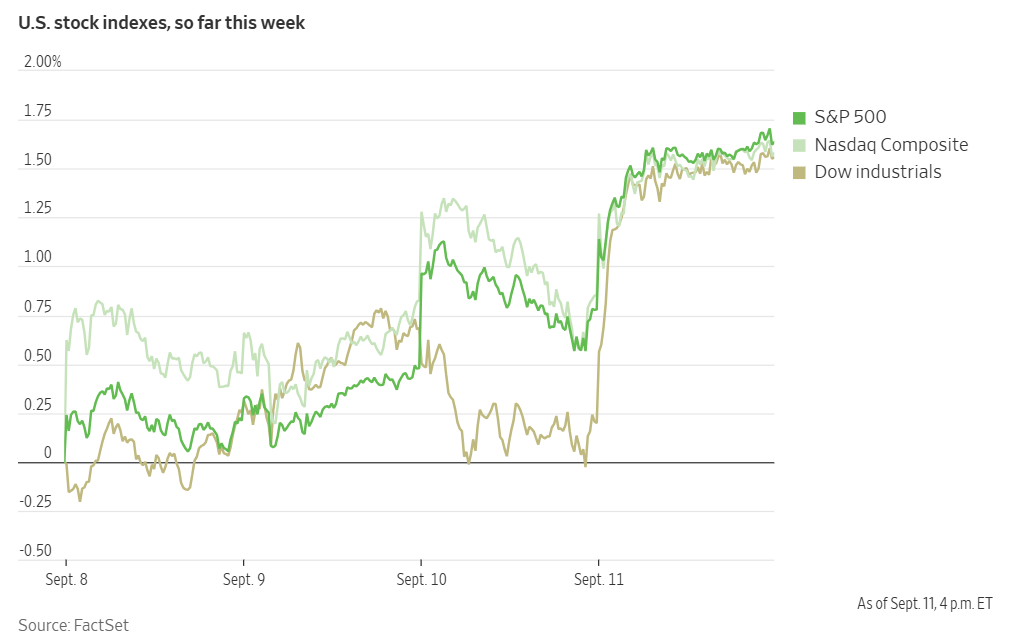

US Stock Indices

Dow Jones Industrial Average +1.36%.

Nasdaq 100 +0.60%.

S&P 500 +0.85%, with 10 of the 11 sectors of the S&P 500 up.

On Thursday, US stocks reached record highs as the final inflation report before the FOMC meeting next week solidified expectations for a likely interest rate cut. The S&P 500 was led higher by gains in the Materials, Health Care, and Consumer Discretionary sectors, ending the session up +0.85% to 6,587.47. The Nasdaq Composite increased by +0.72% to 22,043.07, and the Dow Jones Industrial Average rose by 617 points, or +1.36%, to close above the 46,000 mark for the first time at 46,108.00.

In corporate news, The Wall Street Journal reported that Paramount Skydance, with support from the Ellison family, is preparing a majority cash bid to acquire Warner Bros. Discovery. The bid would encompass the entire company, including its cable networks and movie studio, potentially preempting a bidding war. Following this news, Warner shares surged by +28.95%, and Paramount Skydance shares rose by +15.55%.

AbbVie reached an agreement that will delay generic competition for its blockbuster drug Rinvoq by more than a decade, causing its shares to jump +4.1% to a new all-time high.

Adobe also raised its full-year outlook after reporting strong sales and profits in Q3.

Luxury furniture company RH lowered its full-year sales forecast, citing delays to its seasonal catalog caused by new US tariffs.

Kroger raised its full-year sales forecast, driven by stable consumer food spending despite shoppers' continued focus on finding bargains.

Boeing announced that it is falling behind schedule in its efforts to secure regulatory certification for its 777X aircraft next year, raising the risk of another delay for a programme that is already six years behind its original timeline.

S&P 500 Best performing sector

Materials +2.14%, with Dow +4.99%, Eastman Chemical +4.43%, and Sherwin-Williams +3.14%.

S&P 500 Worst performing sector

Energy -0.04%, with APA -1.33%, Halliburton -1.28%, and Diamondback Energy -0.87%.

Mega Caps

Alphabet +0.51%, Amazon -0.16%, Apple +1.43%, Meta Platforms -0.14%, Microsoft +0.13%, Nvidia -0.08%, and Tesla +6.04%.

Information Technology

Best performer: Synopsys +12.98%.

Worst performer: Oracle -6.23%.

Materials and Mining

Best performer: Dow +4.99%.

Worst performer: CF Industries Holdings -0.89%.

European Stock Indices

CAC 40 +0.80%.

DAX +0.30%.

FTSE 100 +0.78%.

Commodities

Gold spot -0.18% to $3,633.74 an ounce.

Silver spot +0.91% to $41.52 an ounce.

West Texas Intermediate -2.95% to $61.87 a barrel.

Brent crude -1.92% to $66.27 a barrel.

On Thursday, gold prices pared losses, maintaining their position near all-time highs. This resilience was attributed to weak US jobs data, which offset concerns from slightly hotter-than-expected inflation figures.

Spot gold decreased by -0.18%, settling at $3,633.74 per ounce, after reaching a record high of $3,673.95 on Tuesday.

Year-to-date, gold has appreciated by +39.11%. The precious metal is often considered as a valuable hedge against inflation and economic and geopolitical instability.

On Thursday, oil prices ended the trading session lower as concerns regarding potential softening of US demand and an overall market surplus outweighed geopolitical threats to production in the Middle East and Ukraine.

Brent crude futures fell $1.30, or -1.92%, to settle at $66.27 per barrel, while US West Texas Intermediate crude decreased by $1.88, or -2.95%, to $61.87.

The International Energy Agency (IEA), in its monthly report, projected a more rapid rise in global oil supply this year than previously anticipated, primarily due to planned production increases by OPEC+. This follows the recent OPEC+ agreement to raise production starting in October.

Saudi Arabia's crude oil exports to China are projected to increase, with state-controlled energy firm Aramco scheduled to ship approximately 1.65 million barrels per day (bpd) in October, up from the 1.43 million bpd allocated in September.

In Russia, the world's second-largest crude producer after the US, revenue from crude and oil product sales declined in August to one of its lowest levels since the beginning of the conflict in Ukraine, according to the IEA.

In related developments, US Energy Secretary Chris Wright and European Commissioner for Energy and Housing Dan Jorgensen held discussions in Brussels regarding efforts to restrict Russian energy trade. Commissioner Jorgensen stated that while the EU's deadlines were ambitious, there was a need to accelerate the process.

Additionally, in India, the Adani Group, the nation's largest private port operator, has banned entry at its ports for tankers sanctioned by Western countries. This action could impact Russian oil supplies for two Indian refiners.

Note: As of 5 pm EDT 11 September 2025

Currencies

EUR +0.31% to $1.1733.

GBP +0.33% to $1.3572.

Bitcoin +0.69% to $114,526.00.

Ethereum +2.03% to $4,429.38.

On Thursday, the US dollar weakened against other major currencies, including the euro and the yen, as modestly higher August inflation data and lower-than-expected initial jobless claims reinforced expectations that the Fed resume monetary easing at next week’s FOMC meeting.

In afternoon trading, the dollar fell -0.15% against the yen to ¥147.16, while the euro climbed +0.31% to $1.1733. Consequently, the dollar index declined by -0.19% to 97.64.

The British pound advanced +0.33% against the dollar, rising to $1.3572.

The euro found support from diminished expectations of further borrowing cost reductions after the ECB held interest rates steady at 2.0%, as anticipated, and maintained a positive outlook on growth and inflation. In a subsequent press conference, ECB President Christine Lagarde commented that the eurozone continues to be in a ‘good place’ and that inflation is meeting the central bank's objective.

Heightened attention on the US labour market follows two recent weak employment reports. The non-farm payrolls data for August revealed the creation of only 22,000 jobs, far below the 75,000 forecast, while a separate report showed a downward revision of 911,000 jobs for the year ending in March.

The euro stabilised after a two-day decline amid geopolitical tensions on the EU's eastern border. On Wednesday, Poland announced it had shot down suspected Russian drones in its airspace with support from NATO allies, marking the first instance of a member of the military alliance firing shots during Russia's war in Ukraine.

Stephen Miran's nomination to the Fed's Board of Governors advanced after a vote by the Senate Banking Committee, prompting minimal market reaction. The development is viewed as part of an effort by the US President to exert more direct influence over monetary policy, although it is uncertain if the confirmation process will be completed in time for Miran to participate in next week's FOMC meeting.

Fixed Income

US 10-year Treasury -2.3 basis points to 4.030%.

German 10-year bund +0.3 basis points to 2.660%.

UK 10-year gilt -2.3 basis points to 4.610%.

On Thursday, the yield on the 10-year Treasury note fell to a five-month low following reports on consumer prices and jobless claims. These reports reinforced market expectations that economic conditions are favourable for the Fed to implement its first interest rate reduction in nine months at its upcoming meeting.

The 10-year yield briefly dipped below 4%, reaching its lowest point since the April tariff crisis triggered by Liberation Day. This occurred after the US Bureau of Labor Statistics announced that its August Consumer Price Index (CPI) rose by 0.4% m/o/m, slightly exceeding the 0.3% increase that was expected. Annually, the CPI rose 2.9%, in line with expectations and a modest increase from the 2.7% rise in July.

Despite the slightly higher-than-expected inflation figure, the market remained confident that inflation would not be severe enough to deter the Fed from easing monetary policy, especially after a reported decline in producer prices on Wednesday.

The yield on the 10-year US Treasury note touched 3.994% and concluded the day -2.3 bps lower at 4.030%.

The two-year US Treasury yield, which is often correlated to Fed interest rate expectations, decreased by -0.2 bps to 3.552%. The spread between the two- and 10-year Treasury notes flattened to 47.8 bps from 50.3 bps the previous day.

On the long end of the maturity spectrum, the yield on the 30-year bond was -3.8 bps lower at 4.660%, supported by a respectable, though not spectacular, bond auction that underscored a week of consistent demand for long-term Treasuries.

Fed funds futures traders are now pricing in a 92.5% probability of a 25 bps rate cut in September, down from 96.4% last week, however, the probability of a 50 bps rate cut at the same meeting is now priced in at 7.5%, up from 0.0% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 71.3 bps of cuts by year-end, higher than the 59.4 bps expected last week.

Across the Atlantic, European government bond yields experienced a slight decline after the ECB maintained its key interest rate at 2.0%.

The ECB had previously reduced its key rate to 2.0% over the year leading up to June. However, it has since held the rate steady, asserting that the 20-country eurozone economy is in a ‘good place,’ even if further easing cannot be entirely dismissed.

Germany's 10-year bond yield was up +0.3 bps at 2.660%, slightly higher than its level before the ECB's decision and the release of new data.

The yield spread between 10-year French and German government bonds, a key indicator of the risk premium on French debt, widened to 78.9 bps, an increase of 4.9 bps from Wednesday. The French 10-year yield rose by +5.2 bps to 3.449%.

On the short end of the curve, the 2-year Schatz yield increased by +2.9 bps to 1.992%.Conversely, the 30-year yield fell by -2.0 bps to 3.256%.

The yield spread between Italian and French bonds was 1.1 bps. Italian 10-year yields, which are tied to the euro area's largest debt load, declined by -1.1 bps to 3.460%.

Note: As of 5 pm EDT 11 September 2025

Global Macro Updates

ECB leaves policy steady for second consecutive meeting. The ECB's Thursday decision to keep its key deposit rate at 2.0% for the second consecutive meeting was widely anticipated. This decision aligns with President Christine Lagarde's previous statements that the current policy stance is appropriate and that the bank is comfortable with a ‘wait-and-see’ approach.

The latest macroeconomic forecasts provided little new insight into the future policy direction. The ECB's assessment of the inflation outlook remains largely consistent. The bank slightly revised its inflation projections upward for 2025 and 2026 by 0.1% to 2.1% and 1.7%, respectively, but it reduced the 2027 forecast from 2.0% to 1.9%. The outlook for core inflation remained unchanged for the next two years at 2.4% and 1.9%, but it was marginally softened for 2027 to 1.8% from the previous 1.9%.

In terms of economic growth, the ECB revised its 2025 GDP forecast upward to 1.2% from the prior 0.9%, while the 2026 forecast was slightly reduced to 1.0% from 1.1%. The growth outlook for 2027 remained unchanged at 1.3%. The ECB's longstanding guidance for a data-dependent, meeting-by-meeting approach was maintained.

Most officials appear content with the current policy settings, though recent reports suggest that the possibility of further easing remains if the economy shows signs of weakening. The potential for French political risk poses a possible challenge for the euro area, although market reaction has so far been contained. President Lagarde has confirmed that the ECB is closely monitoring bond market developments in this context.

August CPI report. The Consumer Price Index (CPI) report for August revealed that core CPI increased by 0.3% m/o/m, aligning with both consensus expectations and the previous month's increase. The annualised core inflation rate was 3.1%, which was also in line with forecasts.

In contrast, the headline CPI rose by 0.4% m/o/m, exceeding the consensus expectation of a 0.3% increase and the 0.2% rise observed in July. The annualised headline inflation rate was 2.9%, matching consensus but representing an increase from July's 2.7%. The primary factor contributing to this increase was a 0.4% rise in the shelter component, although both rent and owners' equivalent rent (OER) remained within their recent ranges.

Additionally, core services firmed further, largely driven by a significant surge in airfares. Core goods continued to show modest impacts from recent tariffs. Similar to the recent Producer Price Index (PPI) report, the effects of these tariffs on specific categories were mixed and less pronounced than anticipated. For example, apparel saw a 0.5% increase, while new and used vehicles rose by 0.3% and 1%, respectively. In contrast, household furnishings and furniture saw smaller increases, while appliances rebounded with a 0.4% rise.

Analysts noted that these inflation figures have some positive implications for the Personal Consumption Expenditures (PCE) index. However, they also highlighted that the Fed's focus has largely shifted to the labour market in light of recent signs of softening, as evidenced by yesterday's jump in initial jobless claims.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Questo articolo viene fornito all'utente soltanto a scopo informativo e non deve essere considerato come un'offerta o una sollecitazione di un'offerta di acquisto o di vendita di investimenti o servizi correlati che possono essere qui menzionati.