Key data to move markets today

China: CPI and PPI

USA: PPI

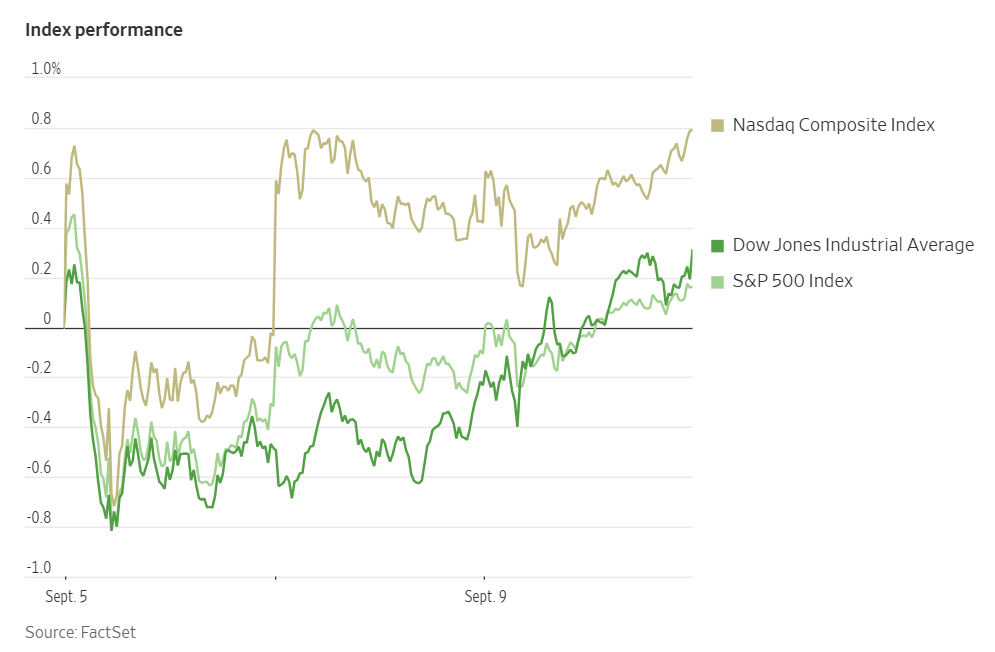

US Stock Indices

Dow Jones Industrial Average +0.43%.

Nasdaq 100 +0.33%.

S&P 500 +0.27%, with 8 of the 11 sectors of the S&P 500 up.

Major US stock indexes ended trading at new record highs on Tuesday, as investor optimism for potential interest rate cuts outweighed growing concerns about a slowing jobs market.

For the first time this year, all three major benchmarks—the S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average—achieved new all-time highs in the same session. This marked the first simultaneous record close since December 2024. The S&P 500 index rose by +0.27% to 6,512.61, while the tech-heavy Nasdaq composite advanced +0.37% to 21,879.49. The Dow Jones Industrial Average also gained, adding +0.43%, or 196 points, to 45,711.34.

In corporate news, Apple slipped -1.48% after the tech giant unveiled the iPhone 17 lineup at its annual September event.

The American depositary shares of Anglo American surged 11% after the company said it would merge with Teck Resources to create a $53 billion copper giant. News of the merger lifted global mining stocks.

Nvidia, whose chips and systems are at the heart of the AI computing boom, said it plans to offer a new product designed to handle demanding tasks like video generation and software creation.

In the latest sign of steadying factory operations, Boeing delivered 57 commercial aircraft in August, its best performance for the month since 2018.

United Airlines Holdings said corporate travel has bounced back from a dip earlier in the year, with signs that the trend will continue through the rest of 2025.

UnitedHealth Group said it expects most of its Medicare Advantage members to be in highly rated plans that earn bonus payments next year. This is a boon for its health insurance business.

Goldman Sachs Group won a $40 billion mandate from Shell to oversee pension assets for the energy company, in one of the biggest outsourced deals of its kind.

Nebius Group shares soared on Tuesday after signing an artificial intelligence infrastructure deal worth as much as $19.4 billion with Microsoft.

S&P 500 Best performing sector

Communication Services +1.64%, with Alphabet +2.47%, AT&T +1.80%, and Meta Platforms +1.78%.

S&P 500 Worst performing sector

Materials -1.57%, with Albemarle -11.49%, Freeport-McMoRan -5.94%, and Sherwin-Williams -3.69%.

Mega Caps

Alphabet +2.47%, Amazon +1.02%, Apple -1.48%, Meta Platforms +1.78%, Microsoft +0.04%, Nvidia +1.46%, and Tesla +0.16%.

Information Technology

Best performer: Super Micro Computer +7.19%.

Worst performer: PTC -4.09%.

Materials and Mining

Best performer: Dow +0.67%.

Worst performer: Albemarle -11.49%.

European Stock Indices

CAC 40 +0.19%.

DAX -0.37%.

FTSE 100 +0.23%.

As of 9th September, according to LSEG I/B/E/S data, for the STOXX 600, Q2 2025 earnings are expected to increase 4.3% from Q2 2024. Excluding the Energy sector, earnings are expected to increase 8.1%. Q2 2025 revenue is expected to decrease 1.6% from Q2 2024. Excluding the Energy sector, revenues are expected to increase 0.6%. Of the 283 companies in the STOXX 600 that have reported earnings by 9th September for Q2 2025, 50.5% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 353 companies in the STOXX 600 that have reported revenue for Q2 2025, 48.4% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

Financials is the sector with most companies reporting above estimates at 70%. Financials, with a surprise factor of 12.2%, is the sector that beat earnings expectations by the highest surprise factor. In the Basic Materials sector, 73% of companies have reported below estimates. Its earnings surprise factor was the lowest at -13.1%. The STOXX 600 surprise factor is 5.5%, which is below the long-term (since 2012) average surprise factor of 5.8%. The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.4x, above the 10-year average of 14.2x.

During the week of 15th September, 1 company is scheduled to report Q2 earnings.

Commodities

Gold spot -0.31% to $3,625.59 an ounce.

Silver spot -1.00% to $40.91 an ounce.

West Texas Intermediate +0.86% to $62.98 a barrel.

Brent crude +0.48% to $66.53 a barrel.

Gold prices continued their record-setting ascent on Tuesday, propelled by expectations of a US interest rate cut in September, although it later pared its gains.

After reaching an all-time high of $3,673.95 earlier in the session, spot gold ended trading at $3,625.59 per ounce, a decline of -0.31%.

Although the dollar index rose slightly, it remained near a seven-week low against other major currencies.

Bullion's recent rally, which saw it surpass the $3,600 per ounce mark on Monday, is part of a broader trend that has produced multiple record highs this year. The metal's strong performance has been underpinned by a combination of factors, including a softer dollar, robust buying from central banks, higher expectations of dovish monetary policy, attacks by the US President on the Fed, and heightened geopolitical uncertainties.

Oil prices settled higher on Tuesday following news of an Israeli military operation targeting Hamas leadership in Doha, Qatar, which signalled an expansion of conflict in the Middle East.

Brent crude futures ended 32 cents, or +0.48%, higher at $66.53 a barrel. WTI crude futures climbed 54 cents, or +0.86%, to close at $62.98 a barrel.

Both benchmarks had initially spiked by nearly two percentage points on the news, but later pared the majority of those gains. The retreat from session highs occurred as the attack did not cause any immediate supply disruptions. Furthermore, diplomatic assurances aimed at de-escalation and a muted reaction from other Gulf Cooperation Council (GCC) members helped ease market concerns about a wider regional flare-up.

Even before the attack, oil benchmarks were trading in positive territory, supported by a smaller-than-anticipated production increase from OPEC+, expectations of continued strategic stockpiling by China, and ongoing concerns about potential new sanctions on Russia.

Gains were limited, however, by a forecast from the US Energy Information Administration (EIA). The agency projected that rising global inventories would likely place significant pressure on crude prices in the coming months.

Note: As of 5 pm EDT 9 September 2025

Currencies

EUR -0.43% to $1.1711.

GBP -0.13% to $1.3526.

Bitcoin -0.91% to $111,308.73.

Ethereum -0.45% to $4,301.13.

The US dollar recovered from earlier losses to gain against most major currencies on Tuesday, except for the Japanese yen, as investors consolidated positions ahead of key US inflation data releases this week.

Market focus is on the upcoming Producer Price Index (PPI) report due today, which will be followed by the Consumer Price Index (CPI) reading on Thursday. These data points will be scrutinised to assess the impact of tariffs on prices within the US economy.

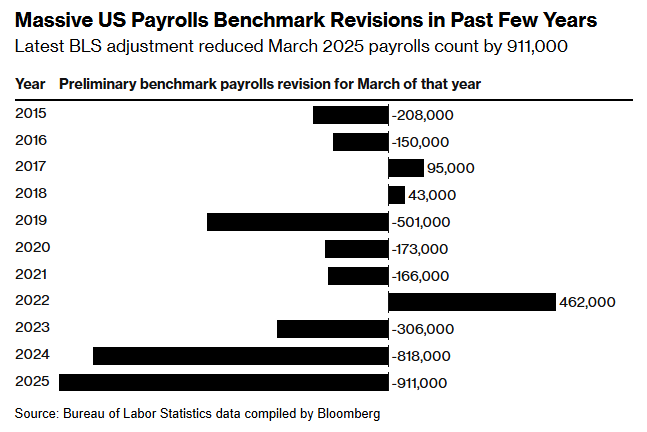

The dollar experienced a brief period of weakness after a report revealed significant downward revisions to previous government jobs data, indicating the creation of nearly one million fewer jobs between April 2024 and March 2025 than initially estimated. However, the market impact of this revision was short-lived as investor attention reverted to the upcoming inflation figures.

In afternoon trading, the dollar index rose +0.31% to 97.75 after touching a seven-week low earlier in the session. The euro declined -0.43% against the US dollar to $1.1711. The dollar also strengthened against the Swiss franc, rising +0.60% to 0.7976 after recovering from a six-week trough. The British pound edged down -0.13% to $1.3526, while the Japanese yen advanced +0.11% to ¥147.35 against the US dollar.

Fixed Income

US 10-year Treasury +4.7 basis points to 4.090%.

German 10-year bund +1.4 basis points to 2.660%.

UK 10-year gilt +1.6 basis points to 4.625%.

US Treasury yields rose on Tuesday as a recent rally in long-term bonds paused, even as a significant downward revision in historical employment data reinforced the view of a weakening labour market and strengthened the case for Fed rate cuts.

Data from the Bureau of Labor Statistics showed that payrolls were revised down by a record 911,000 jobs for the 12 months through March 2025. This adjustment, which implies a reduction of 76,000 jobs per month over that period, suggests that job growth was already stalling prior to the implementation of recent import tariffs.

This revision, coupled with last week's weak nonfarm payrolls report showing only a 22,000 job gain in August, has solidified expectations that the FOMC will cut interest rates at its upcoming meeting on 16th - 17th September. The debate among investors has now shifted to the aggressiveness of future policy actions, as the Fed balances its mandates of promoting employment and controlling inflation.

In Tuesday's trading, the yield on the 10-year Treasury note rose +4.7 bps to 4.090%, recovering from a session low reached immediately after the jobs data was released. The 2-year Treasury yield, which is highly sensitive to Fed policy expectations, climbed +7.9 bps to 3.577%, while the 30-year bond yield increased by +4.1 bps to 4.737%. The spread between the 2- and 10-year yields was 51.3 bps.

Regarding market supply, a $58 billion auction of 3-year notes on Tuesday was met with strong demand. Market attention is shifting to longer-term debt, specifically Wednesday's 10-year note auction and Thursday's more significant 30-year bond sale, to assess investor demand.

Fed funds futures traders are now pricing in a 93.7% probability of a 25 bps rate cut in September, up from 92.7% last week, however, the probability of a 50 bps rate cut at the same meeting is now priced in at 6.3%, up from 0.0% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 66.6 bps of cuts by year-end, higher than the 55.5 bps expected last week.

Across the Atlantic, the reaction in euro area sovereign bond markets was muted on Tuesday following the widely expected collapse of the French government.

In response to the political turmoil, which followed the previous government's loss of a confidence vote, French President Emmanuel Macron appointed Defence Minister Sébastien Lecornu as his new prime minister. Analysts noted that markets had already priced in this outcome.

However, investor concerns persist regarding the ability of a new minority government to establish a credible path toward reducing public debt, a factor that could prompt demands for a higher risk premium on French sovereign bonds in the future.

The yield spread between 10-year French and German government bonds—a key measure of the risk premium on French debt—was at 75.0 bps, having earlier peaked at 83.0 bps. Analysts noted that data for the benchmark French bond shifted Tuesday from the May 2035 OAT to the November 2035 OAT, which may have influenced the reported spread.

Germany’s 10-year bond yield rose +1.4 bps to 2.660%, following a high of 2.800% last week. On the short end of the curve, the 2-year yield increased by +1.5 bps to 1.952%, while the 30-year yield advanced by +1.0 bps to 3.280%. The yield spread between Italian and French bonds was 7.6 bps. In line with safer German Bunds, Italian 10-year yields, which carry the euro area’s highest debt load, remained steady, rising +1.6 bps to 3.486%.

Note: As of 5 pm EDT 9 September 2025

Global Macro Updates

The periphery threat: France's deteriorating fiscal health and market volatility. France has emerged as a growing concern in European debt markets, with investors increasingly viewing the country as part of the eurozone's periphery, according to the Financial Times. This shift in sentiment is largely attributed to the political turmoil that has derailed Prime Minister François Bayrou's deficit-reduction plan, leading to a sharp rise in French borrowing costs. The 10-year French government bond yield, now at 3.410%, has surpassed Greece's yield of 3.331% and is approaching Italy's 3.486%, a level historically associated with higher-risk borrowers. The spread over German Bunds has widened to 75 bps, with some investors cautioning that this elevated risk premium could become a new baseline.

Furthermore, France's debt-to-GDP ratio has steadily climbed from 101% in 2017 to 113% in 2024, with projections indicating a further increase to 118% by 2026. This deteriorating fiscal outlook has prompted a downgrade from Moody's last December, while both S&P and Fitch have maintained negative outlooks on the country's credit rating. Given the expectation of prolonged political gridlock until the 2027 elections and a lack of political will for fiscal consolidation, the risk premium on French debt is anticipated to persist, leaving markets susceptible to continued volatility.

Preliminary BLS annual payrolls benchmark revised down by 911K. The Bureau of Labor Statistics' annual revision to nonfarm payrolls for the period spanning April 2024 to March 2025 resulted in a significant downward adjustment of 911,000 jobs, exceeding the consensus forecast for an 800,000 revision. This outcome was not entirely unforeseen. Several sell-side analysts, including Deutsche Bank, Bank of America, and Goldman Sachs, had anticipated a substantial downward revision in their previews.

The majority of the revision was concentrated in specific sectors, with the most notable reductions occurring in trade, transportation, and utilities (-226,000 jobs), leisure and hospitality (-176,000 jobs), professional and business services (-158,000 jobs), and manufacturing (-95,000 jobs). Analysts suggest that a revision of this magnitude, approaching 1 million jobs, is likely to encourage the Federal Reserve to adopt a more dovish stance, given the mounting evidence of a weakening labour market.

This revised data follows the recent revelation that job growth nearly stalled in August and that the economy experienced its first job losses since the pandemic in June. According to a Bank of America analysis, the substantial downward revision indicates that the labour market was already in a near-stalled state during Q1 of 2025, prior to recent trade-related uncertainties.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Este artigo é-lhe fornecido apenas para fins informativos e não deve ser considerado como uma oferta ou solicitação de uma proposta para compra ou venda de quaisquer investimentos ou serviços relacionados que possam ser aqui referenciados. A negociação de instrumentos financeiros envolve um risco significativo de perda e pode não ser adequada para todos os investidores. O desempenho passado não é um indicador fiável do desempenho futuro.