Key data to move markets today

EU: German Industrial Production and Eurozone Sentix Investor Confidence.

UK: BRC Like-for-Like Retail Sales.

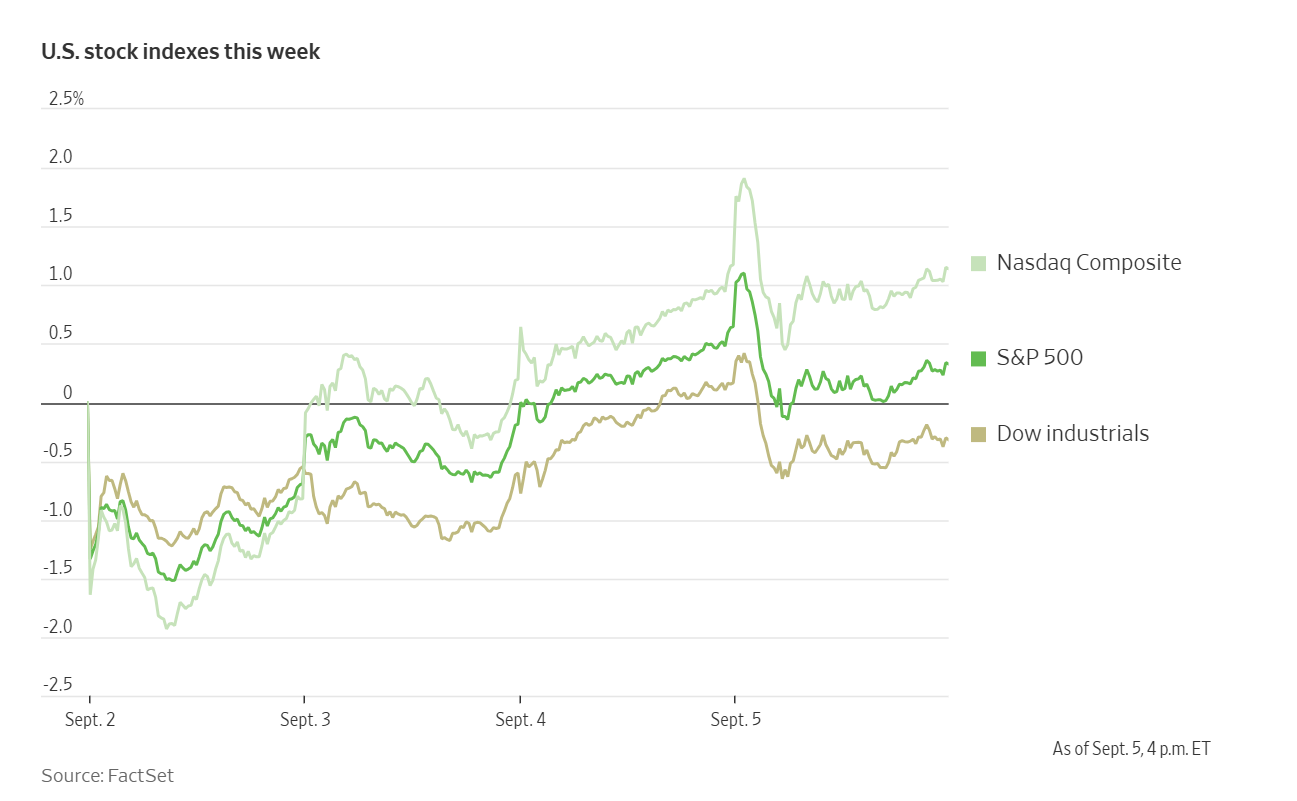

US Stock Indices

Dow Jones Industrial Average -0.48%.

Nasdaq 100 +0.08%.

S&P 500 -0.32%, with 6 of the 11 sectors of the S&P 500 down.

US stocks briefly hit record highs on Friday before reversing course to trade lower after a weaker than expected nonfarm payrolls report solidified the case for a Federal Reserve rate cut later this month. The S&P 500 hit a record high of 6,532.65 points in early trade before pulling back to end the day -0.32% or down 20.58 points to 6,481.50. The Dow Jones Industrial Average also hit a record high in the first few minutes of the trading day before ending the day down -0.48% or 220.43 points to 45,400.86, while the Nasdaq Composite barely moved, ending the day -0.03% or down 7.31 points to 21,700.39.

In corporate news, Tesla proposed a new compensation agreement for Chief Executive Officer Elon Musk. This new package would grant him additional shares of Tesla stock if the company is able to grow to about $8.5 trillion. It is currently valued at around $1.1 trillion. According to CNN, the new pay package could grant Musk 423.7 million additional Tesla shares. Those shares would be worth almost $1 trillion if he meets this target.

Nvidia’s major server production partner Hon Hai Precision Industry Co. reported solid monthly sales growth, signalling demand for AI infrastructure remains intact in the US.

Eli Lilly & Co. and Novo Nordisk saw their share prices fall after US regulators established a “green list” of foreign manufacturers who produce raw materials that compounding pharmacies use to make copies of their blockbuster GLP-1 drugs.

S&P 500 Best performing sector

Real Estate +0.98%, with Extra Space Storage +2.39%, Weyerhaeuser +2.35%, and Alexandria Real Estate Equities +2.18%.

S&P 500 Worst performing sector

Energy -2.06%, with Texas Pacific Land -4.28%, EOG Resources -3.02%, and ConocoPhillips -2.94%.

Mega Caps

Alphabet +1.16%, Amazon -1,42%, Apple -0.04%, Meta Platforms +0.51%, Microsoft -2.55%, Nvidia -2.70%, and Tesla +3.64%.

Information Technology

Best performer: Broadcom +9.41%.

Worst performer: Advanced Micro Devices -6.58%.

Materials and Mining

Best performer: Steel Dynamics +2.88%.

Worst performer: Linde -0.61%.

European Stock Indices

CAC 40 -0.31%.

DAX -0.73%.

FTSE 100 -0.09%.

Commodities

Gold spot +1.3% to $3,593.04 an ounce.

Silver spot +0.8% to $40.98.

West Texas Intermediate -2.54% to $61.87 a barrel.

Brent crude -2.22% to $65.50 a barrel.

Spot gold hit another record high on Friday as a poor jobs report raised expectations for more gold supportive Federal Reserve rate cuts. It was +1.2% to $3,589.01 per troy ounce after hitting a record high of $3,599.89 earlier in the day. Gold has been up in seven of the past eight sessions. US gold futures for December delivery settled 1.3% higher at $3,653.30.

YTD spot gold is up about +37.43% and has built on 2024’s +27% gain due to dollar weakness, continued central bank buying, wider geopolitical and global growth uncertainty, and a softening monetary policy environment.

China and India, normally top gold consumers, saw the physical demand for gold drop last week due to record high prices. However, China’s central bank continued to buy gold for the 10th straight month. China’s gold reserves stood at 74.02 million fine troy ounces at the end of August, up from 73.96 million at the end of July. China’s gold reserves were valued at $253.84 billion at the end of August, up from $243.99 billion previously, according to data released by the central bank on Sunday.

Oil prices declined for a third consecutive session on Friday in reaction to weaker than expected nonfarm payrolls report which dimmed the outlook for energy demand. There were also growing concerns that supplies would swell even further after this weekend’s OPEC+ meeting. At this online meeting of 8 OPEC+ members, OPEC+ agreed to further raise oil production from October by 137,000 barrels per day. This is significantly lower than the monthly increases of around 55,000 bpd for September and August. As noted by Reuters, this deal means that OPEC+ has begun to unwind a second tranche of cuts of about 1.65 million bpd by 8 members more than a year ahead of schedule. The group has already fully unwound the first tranche of 2.5 million bpd since April, equivalent to about 2.4% of global demand.

Brent crude futures settled at $65.50 a barrel, down $1.49, or -2.22%. WTI settled at $61.87, down $1.61, or -2.54%. The European Union's energy commissioner said the bloc would welcome President Donald Trump's plan to stop buying Russian oil.

Note: As of 4 pm EDT 5 September 2025

Currencies

EUR +0.59% to $1.1720

GBP +0.56% to $1.3510

Bitcoin +1.1% to $111,570.39

Ethereum +0.6% to $4,330.83

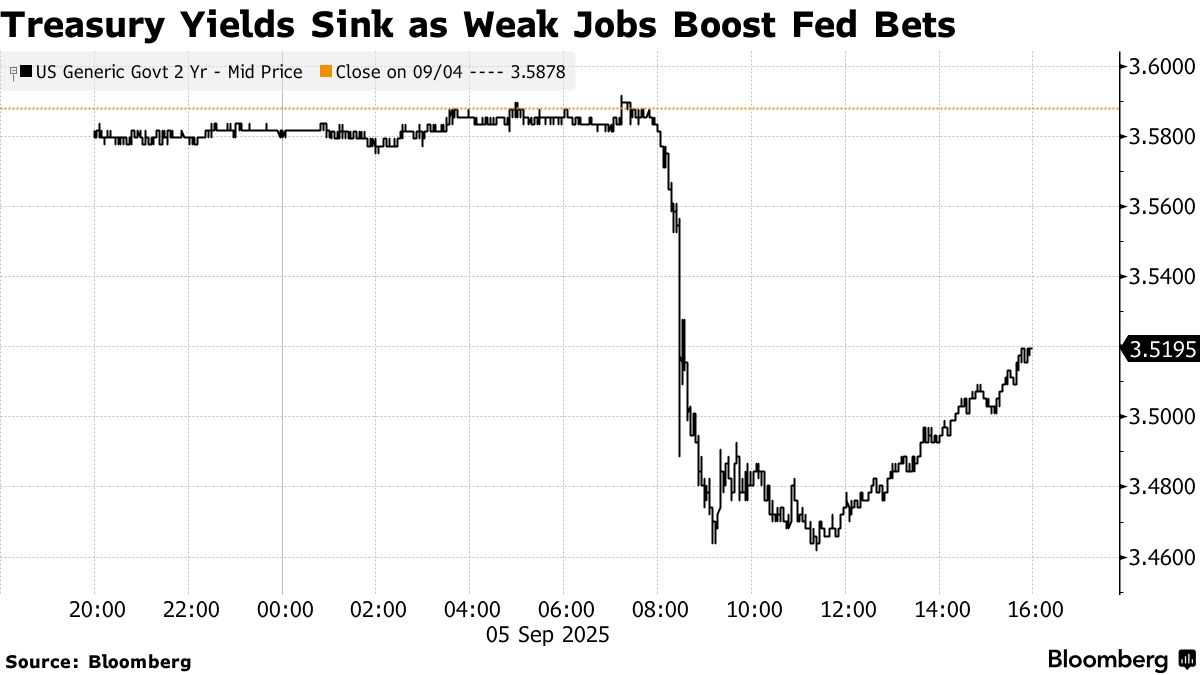

The US dollar fell sharply against all major currencies on Friday as a weaker than expected nonfarm payrolls report, affirming a quickly weakening labour market. This caused a significant drop in Treasury yields as expectations of a Fed cut later this month rose, with some market participants suggesting the Fed may consider a 50 bps cut. The US dollar index was -0.64% to 97.72 on Friday and down about -0.23% for the week.

A softer dollar helped to support the euro, which rose +0.59% to $1.1720.

The British pound also rose against the dollar, +0.56% to $1.3510. This followed the resignation of the British Deputy Prime Minister Angela Rayner after she admitted to underpaying property tax on a new home. The dollar also fell against the safe-haven Swiss Franc, dropping -0.91% to 0.79830 and its fourth consecutive week of losses against the currency.

The dollar fell -0.73% against the Japanese yen to ¥147.40. Earlier on Friday the US signed a deal to impose lower auto tariffs on Japan.

Fixed Income

US 10-year Treasury -8.1 basis points to 4.088%.

German 10-year bund -5.2 basis points to 2.670%.

UK 10-year gilt -7.1 basis points to 4.654%.

Yields fell on Friday after the nonfarm payroll showed only 22,000 new jobs were added in August, far below expectations of 75,000.

Bonds rallied on Friday following the release of the weaker than expected nonfarm payrolls report. The 10-year was -8.1 bps to 4.088%. The two-year yield was -8.1 bps to 3.511%. At the longer end, the US 30-year bond yield was -9.5 bps to 4.762%.

Fed funds futures traders are now pricing in a 90% probability of a 25 bps rate cut this month, up from 86.4% last week, according to CME Group's FedWatch Tool. Market participants are also now pricing in a 10% chance of a 50 bps cut at the September meeting. Traders are currently anticipating about 66 bps of cuts by year-end.

Across the Atlantic, the 10-year UK gilt yield was -5.2 bps to 2.670%. At the longer end of the curve, the 30-year was -7 bps to 5.51% after borrowing costs hit their highest since 1998 earlier last week. The rate sensitive 2-year gilt was -5 bps to 3.917%.

France's 30-year yield at 4.38%, down from a peak of 4.52% on Wednesday, but markets are expecting France’s current Prime Minister, François Bayrou, to lose a confidence vote over his deficit-cutting efforts today. If Bayrou is forced from his post, French President Macron will have to look for his fifth prime minister in two years. This would be the highest level of churn since the Fifth Republic was created in 1958.

The German 10-year bond yield was -5.2 bps to 2.670%. At the longer end, the 30-year German bund yield was -4 bps to 3.30% while the 2-year, more sensitive to ECB rate expectations, was -4 bps to 1.93%. German industrial orders unexpectedly fell for the third month in a row. They fell 2.9% in July due to a drop in large orders. This confirms the weakness of the German industry, which continues to struggle with limited external and internal demand, and high financing and energy costs. This continuing weakness in Europe’s largest economy may put additional pressure on the ECB.

Italy’s 10-year yield was -8 bps to 3.503%.

Note: As of 5 pm EDT 5 September 2025

Global Macro Updates

A disappointing nonfarm payrolls ratchets up likelihood of Fed cuts. The Labor Department’s Bureau of Labor Statistics said on Friday that nonfarm payrolls report showed the US added just 22,000 jobs in August, undershooting forecasts, after rising by a revised 79,000 in July. June’s figure was revised down to a job loss of 13,000. This is the first time the US economy has shed positions since the coronavirus pandemic in 2020. As widely expected, the unemployment rate rose to 4.3% from July’s 4.2%.

The weak jobs report will put further pressure on the Fed to cut interest rates with some market participants calling for a 50 bps cut so that the Fed doesn’t get ‘behind the curve’. However, Fed policymakers are still sending conflicting signals about rate cuts. Chicago Fed President Austan Goolsbee said he’s still undecided on a September rate decision, but noted job growth is definitely below breakeven. In an interview published Thursday, Cleveland Fed President Beth Hammack reiterated that she sees no case for a September rate cut, arguing inflation is still too high and trending in the wrong direction. Other Fed policymakers, such as Fed governor Christopher Waller has said he could back a jumbo rate cut at the next policy vote should August jobs data signal a “substantial weakening” of the labour market. Waller is reported to be among three finalists to replace Jerome Powell in the role of Fed Chair along with White House economic adviser Kevin Hassett and former Fed Governor Kevin Warsh.ч>

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Dit artikel wordt u alleen ter informatie verstrekt en mag niet worden beschouwd als een aanbod of uitnodiging tot het kopen of verkopen van beleggingen of gerelateerde diensten waarnaar hier mogelijk wordt verwezen. Handelen in financiële instrumenten omvat een aanzienlijk verliesrisico en is mogelijk niet geschikt voor alle beleggers. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige resultaten.