Corporate Earnings News

Global market indices

Currencies

Cryptocurrencies

Fixed Income

Commodity sector news

Key data to move markets this week

Global macroupdates

Corporate Earnings News

Corporate earning calendar 9 November - 16 November 2023

Thursday: AstraZeneca, Fiverr International, Illumina, The Trade Desk, Unity Software

Friday: Allianz

Monday: Sun Life Financial, Tyson Foods, Vodacom Group

Tuesday: Home Depot, Vodafone Group, Imperial Brands

Wednesday: XPeng, Cisco Systems, Palo Alto Networks, Target, Alcon AG

Thursday: Alibaba Group Holdings, Applied Materials, Walmart, Ross Stores, Lenovo Group

US Stock Indices

Nasdaq 100 +6.27% MTD and +39.98% YTD

Dow Jones Industrial Average +3.33% MTD and +3.03% YTD

NYSE +2.90% MTD and +1.11% YTD

S&P 500 +4.11% MTD and +13.71% YTD

The S&P 500 had risen for its eighth straight day by Wednesday while Wall Street’s “fear gauge” — the VIX — saw its longest slide since October 2015. The S&P 500 has rebounded about 6.5% over the past month as benchmark 10-year Treasury yields have fallen about 0.5%. The question is whether financial conditions could become too loose for the Fed’s comfort if yields keep falling and labour markets remain tight, increasing the likelihood of the Fed keeping rates higher for much longer than traders are currently anticipating in order to prevent a resurgence in inflation.

Mega caps: A great week for the “magnificent seven” mega caps as falling US yields and expectations of global rates having peaked encouraged investors. Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla are all up this week.

Energy stocks had a bad week this week as demand concerns rose as the Eurozone and Chinese economies appear to be slowing and the war-risk premium appears to have waned, contributing to a sell-off in oil. It has also been suggested that hedge funds are also exiting long positions taken up following the outbreak of the war in Gaza. Occidental Petroleum, Apa Corp (US), ConocoPhillips, Shell, Chevron, Halliburton, ExxonMobil, Baker Hughes, Marathon Petroleum, Phillips 66, and Energy Fuels are all down this week.

Materials and Mining stocks were mixed this week as industrial metals traded lower with the focus on weak China data and a strengthening USD later in the week. Yara International, Sibanye Stillwater, and Nucor Corporation are up, while Freeport-McMoRan, Newmont Mining, Albemarle Corporation, CF Industries Holdings, and Mosaic are all down.

European Stock Indices

Stoxx 600 +2.40% MTD and +4.51% YTD

DAX +2.83% MTD and +9.38% YTD

CAC 40 +2.16% MTD and +8.66% YTD

IBEX 35 +2.96% MTD and +12.82% YTD

FTSE MIB +2.49% MTD and +19.94% YTD

FTSE 100 +1.09% MTD and -0.67% YTD

Other Global Stock Indices

MSCI World Index +4.36% MTD and +9.75% YTD

Hang Seng +2.66% MTD and -11.19% YTD

Currencies

The US dollar fell over the past week on rising confidence that the Fed has ended its rate hiking cycle before steadying on Wednesday. The US economy, although still very resilient, is expected to start to slow in Q4 thereby increasing the likelihood of the Fed either maintaining the current rate or potentially looking to cut rates before the end of Q2 2024. Both scenarios make the USD less attractive. The GBP is +1.09% MTD and +1.55% YTD against the USD. It hit a seven-week high against the US dollar this past week. The EUR is +1.23% MTD and +0.04% YTD against the USD, but was hit this week by retail sales in September falling 0.3% month-on-month and the European Commission admitting that the Eurozone economy is weakening, with a 0.1% contraction in GDP in the third quarter of the year. European Commission Vice President Valdis Dombrovskis said during Wednesday’s Eurogroup meeting that “it’s clear that currently we are in a period of economic weakness” while former ECB President Mario Draghi said, according to the Financial Times, the Eurozone was nearly certain to experience a recession by the end of 2023.

Cryptocurrencies

Bitcoin +2.81% MTD and +114.87% YTD

Ethereum +4.13% MTD and +57.75% YTD

As noted by Forkast.news, today kicks off the first day of an eight-day period for the US Securities and Exchange Commission (SEC) to “theoretically approve” pending spot Bitcoin exchange-traded fund (ETF) applications. Bitcoin in particular has surged over the past month on expectations that the SEC is likely to approve a Bitcoin ETF, with reports emerging of the SEC beginning talks with fund manager Grayscale on Wednesday.

Fixed Income

US 10-year yield to 4.49%.

German 10-year yield to 2.62.%.

UK 10-year yield to 4.24%.

US benchmark 10-year yields dropped by about half a percentage point over the past week while the biggest declines were seen in longer maturities. The US Treasury has been auctioning bonds over the past week with the next auction of $24 billion in 30-year bonds on Thursday. However, yields on shorter dated maturities are rising with the yield curve further inverting from Tuesday. An inverted yield curve is a typical precursor to recession.

Commodities

Gold futures to $1,957.80 an ounce.

Silver futures to $22.52 per ounce.

West Texas Intermediate crude to $75.33 a barrel.

Brent crude to $79.54 a barrel.

Oil prices fell over 2% on Wednesday to their lowest in more than three months on concerns over waning demand in the US and China as traders' concerns seemed to ease around the risks of the war in Gaza drawing in neighbouring countries. Both benchmarks hit their lowest since mid-July. The rise in US crude oil stocks also weighed on prices this week as the American Petroleum Institute suggested crude oil stocks rose by almost 12 million barrels last week. The US Energy Information Administration (EIA) has delayed release of weekly oil inventory data until 15 November to complete a systems upgrade.

Gold prices retreated for a third straight session on Wednesday as investors looked for fresh cues on the Fed’s interest rate outlook. Gold has fallen this week as this risk premium from rising geopolitical tensions from the Israel-Hamas war appear to be controlled.

Note: As of 5 pm EST 8 November 2023

Key data to move markets this week

EUROPE

Thursday: Ecofin Meeting, ECB Economic Bulletin and speeches by ECB President Christine Lagarde and German Bundesbank President Joachim Nagel.

Friday: Speeches by ECB President Christine Lagarde and Bundesbank President Joachim Nagel.

Monday: European Commission Economic Growth Forecasts.

Tuesday: Spanish Harmonised Index of Consumer Prices,Eurozone Employment Change, Eurozone GDP, Eurozone ZEW Economic Sentiment, German ZEW Current Situation and Economic Sentiment.

Wednesday: French CPI, Spanish CPI and Eurozone Industrial Production.

UK

Thursday: A speech by BoE Chief Economist Huw Pill.

Friday: GDP, Industrial Production and Manufacturing Production.

Monday: A speech by BoE MPC member Catherine Mann.

Tuesday: Average earnings, Claimant Count Change, Claimant Count Rate, Employment Change and ILO Unemployment Rate.

Wednesday: CPI, Core CPI, PPI Output, PPI, and BoE Monetary Policy Report Hearings.

Thursday: A speech by BoE Deputy Governor for Markets and Banking David Ramsden.

US

Thursday: Initial Jobless Claims, Speeches by Fed Chair Jerome Powell, Atlanta Fed President Raphael Bostic and Richmond Fed President Tom Barkin.

Friday: Speeches by Dallas Fed President Lorie Logan and Atlanta Fed President Raphael Bostic, University of Michigan Consumer Sentiment, UoM 5-year Inflation Expectations.

Tuesday: CPI and Core CPI.

Wednesday: NY State Empire Manufacturing Index, PPI, Core PPI, and Retail Sales.

Thursday: Initial jobless claims, Philadelphia Fed Manufacturing Survey, and Industrial Production.

CHINA

Thursday: CPI and PPI.

Wednesday: Industrial Production and Retail Sales.

Global Macro Updates

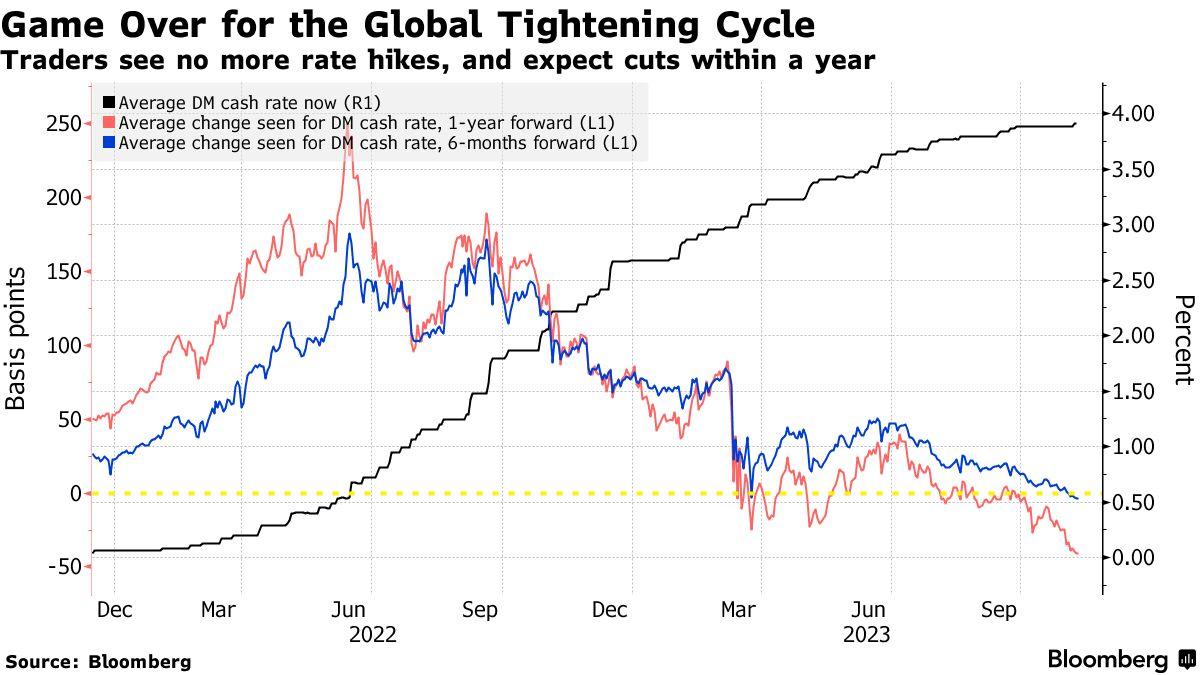

Fed doves are still crowing over hawks. Philadelphia Fed President Patrick Harker said on Wednesday the Fed’s decision to hold rates steady was the right choice. He said staying at the current policy settings “will allow us to make more measured and educated policy rate decisions going forward — decisions, which I must add, could go either way, depending upon what the data tell us.” He did, however, admit that a rate cut is not likely to happen in the short term. He said, “I ascribe to the position that rates are going to have to remain higher for longer” to help the Fed accomplish its mission of lowering inflation. While he expects growth to slow, he does not see the economy tipping into recession. More hawkish tones were heard from his peers earlier this week as they attempted to stamp out speculation about potential rate cuts with Minneapolis Fed President Neel Kashkari saying the Fed may have to put in more work if it wants inflation to return to the 2% goal, Fed Board of Governors member Michelle Bowman saying the economy could need a higher interest rate to slowdown, and Dallas Fed President Lorie Logan also saying inflation remains too high and tight financial conditions would be needed to bring inflationdown to target.

And it is not just the risk of inflation that has Fed officials worried. As noted by Fed Governor Lisa Cook, a rise in geopolitical tensions across the world could aggravate already subdued growth in Europe and China and the spillover may alter the path of the US economy. She said at a panel discussion hosted by the Central Bank of Ireland that, “what happens to the rest of the world affects the US and right now economic growth is pretty subdued among our major trading partners. We are not only watching subdued growth, we're watching the geopolitical tensions that we're all talking about, and that could change the outlook both in the United States and the global economy." Cook added that geopolitical tensions may in particular destabilise commodity markets and access to credit in the current higher interest rate environment.

ECB insists still too soon to discuss rate cuts. It is premature to discuss European Central Bank rate cuts as there are still some risks to the inflation outlook, particularly for underlying prices, ECB Vice President Luis de Guindos said in a newspaper interview. Energy price increases, the weakening of the euro and rising unit labour costs are all potential threats for consumer price inflation, which is already down to 2.9% but will need until 2025 to fall back to 2%, Luis de Guindos was quoted by Slovenia's Finance on Thursday. "It is essential to focus on core inflation, for which there are several risks," de Guindos said. "Any discussion about lowering interest rates is clearly premature." According to Bloomberg news, the ECB is seen as the most likely to start the cutting cycle, with traders pricing in a 68% chance it lowers rates at its April meeting.

BoE disagreement on “too soon” hits bond yields. Bank of England Governor Andrew Bailey on Wednesday at a conference hosted by the Central Bank of Ireland said that it was “really too early to be talking about cutting rates. We are very clear, we are not talking about that.” The UK still has the highest level of inflation of the G7 economies, coming in at 6.7% in September. The BoE kept interest rates unchanged at a 15-year high of 5.25% last week and stressed that monetary policy would need to remain restrictive for an extended period. Despite the upside risks the BoE had highlighted last week, such as a widening of events in the Middle East pushing up energy costs, BoE Chief Economist Huw Pill said on Monday that financial market expectations of a rate cut in August 2024 “doesn’t seem totally unreasonable, at least to me.” Pill said the BoE could be in a position to “consider or reassess” its stance on rates in the middle of next year depending on how the economic prospects evolved. His comments led to a sharp fall in short-dated government bond yields on Tuesday.

China’s deflationary problem. Earlier today it became clearer that the Chinese economy is still struggling with weak domestic demand and a sluggish manufacturing sector. Consumer prices fell 0.2% last month compared to a year earlier after being near zero in the previous two months and the producer price index, which measures the costs of goods exiting factories, was down 2.6%, according to data from the National Bureau of Statistics. The Chinese government has tried to support the economy with the People’s Bank of China (PBoC) cutting interest rates and the amount of cash banks must keep in reserve. The government has issued $137 billion and allowed local governments to frontload part of their 2024 bond quotas, in order to support the economy. The country has also introduced various measures to support the property market. Although these efforts have lifted demand for raw materials, with crude oil imports surging 14% in the year through October, manufacturing contracted in October. Although the IMF updated its growth forecast for China from 5% to 5.4% this year, it appears that the credit-fueled growth model may now be petering out.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Dit artikel wordt u alleen ter informatie verstrekt en mag niet worden beschouwd als een aanbod of uitnodiging tot het kopen of verkopen van beleggingen of gerelateerde diensten waarnaar hier mogelijk wordt verwezen. Handelen in financiële instrumenten omvat een aanzienlijk verliesrisico en is mogelijk niet geschikt voor alle beleggers. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige resultaten.