- EXANTE LinkedIn Poll Results

- Markets in October

- Global market indices

- Currencies

- Cryptocurrencies

- Fixed Income

- Commodity sector news

- Global Macro Updates

- Key events in October

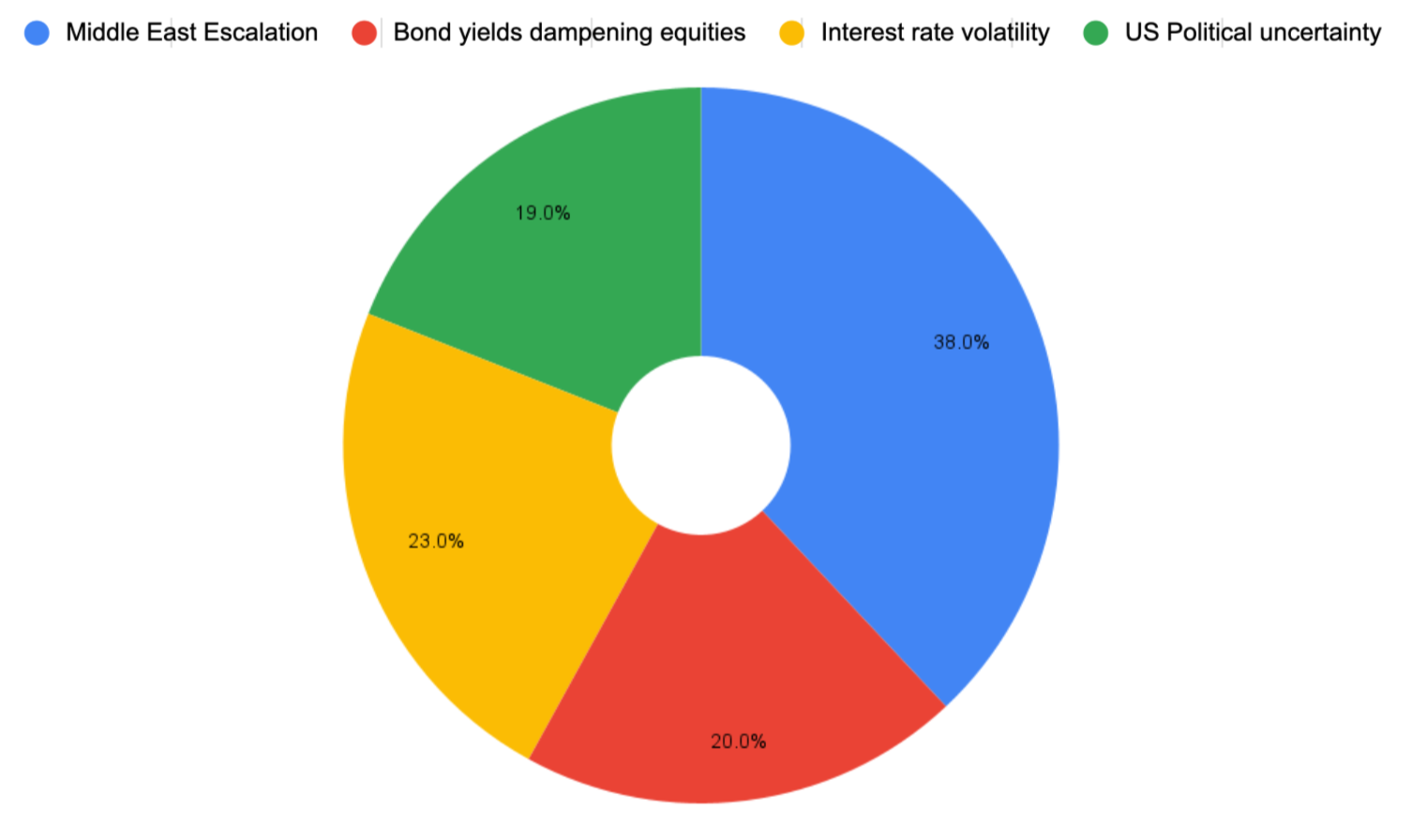

Last week we asked on LinkedIn, “What do you consider to be the biggest risk to global markets?”

38% of respondents said Middle East Escalation. Given the impact on bond prices, oil prices and on the USD (as well as other safe haven currencies such as the CHF) events in the Middle East have had, it may well turn out to be one of, if not the, biggest risk to global markets this quarter.

Markets in October

October has been a volatile month for markets as investors focus on the widening geopolitical risk landscape: the war between Hamas and Israel and the still present threat of its possible internationalisation, the ongoing war in Ukraine, and growing trade frictions between the US and China following US export limitations on graphite used in electric vehicle production (EVs) and AI microchip exports. Markets have also been anxious about Q3 corporate earnings results and forecasts for Q4 with the performance of the mega cap 7, Alphabet, Amazon, Apple, Nvidia, Microsoft, Tesla, and Meta Platforms, firmly under the spotlight. There are worries these stock valuations remain overly elevated and that bond income may become more attractive on a relative risk basis.

The market also contended with a rising possibility of $100 a barrel crude oil. The combination of oil prices rising and rates continuing to surge is not good for stock markets nor the economy. One of the catalysts dragging stocks lower this month is soaring US Treasury yields. The advance estimate by the Commerce Department’s Bureau of Economic Analysis of GDP at 4.9% last quarter, the fastest since the fourth quarter of 2021, was the latest sign of the country’s economic resilience despite high interest rates and solidifying the “higher for longer” scenario. However, with rising yields, the dollar strengthening, and equity market volatility increasing in October, the renewed tightening of financial conditions has done some of the work for the Fed, thereby reducing the need for further policy actions. Despite the fall in personal savings, particularly among low income consumers, the US consumer appears, for the moment at least, to remain resilient with retail sales surprising to the upside. However, the resumption of student loan repayments in October could dent spending into Q4. Continuing labour market tightness and rising business activity levels, with the S&P Global Flash Composite PMI reaching a 3-month high at 51.0 in October, the services PMI also at a three-month high, rising to 50.9, and the Manufacturing PMI climbing as well to 51.1, are giving hope that the US economy may have grown at its fastest pace of any quarter in nearly two years during Q3, again defying recession warnings and raising the possibility of a soft landing.

However, fears for the eurozone economy grew in October. Although headline inflation fell in September in the eurozone to 4.3%, down from 5.2% in August, there are concerns that rising energy prices, due to the conflicts in the Middle East and in Ukraine, could be a headwind for inflation. Business activity appears to be slowing with the eurozone's HCOB flash Composite PMI falling to 46.5 in October from September's 47.2 and its lowest since November 2020.

Global Market Indices

US:

S&P 500 -0.94% MTD and +10.63% YTD

Nasdaq 100 -2.26% MTD and +31.47% YTD

Dow Jones Industrial Average -1.09% MTD and -0.02% YTD

NYSE Composite -3.14% MTD and -1.78% YTD

According to LSEG I/B/E/S data, the 23Q3 Y/Y blended earnings growth estimate is 2.6%. If the energy sector is excluded, the growth rate for the index is 7.4%. Of the 146 companies in the S&P 500 that have reported earnings to date for 23Q3, 80.1% reported above analyst expectations. This compares to a long-term average of 66%. The 23Q3 Y/Y blended revenue growth estimate is 1.2%. If the energy sector is excluded, the growth rate for the index is 3.6%.

Europe:

Stoxx 600 -3.32% MTD and +2.44% YTD

DAX -3.21% MTD and +6.96% YTD

CAC 40 -3.08% MTD and +6.82% YTD

FTSE 100 -2.55% MTD and -0.50% YTD

IBEX 35 -4.70% MTD and +9.18% YTD

FTSE MIB -2.88% MTD and +15.70% YTD

Global:

MSCI World Index -1.97% MTD and +6.36% YTD

Hang Seng -4.07% MTD and -13.63% YTD

Mega cap stocks had a relatively poor October with Alphabet, Amazon, Apple, Nvidia, Tesla,and Meta Platforms all down on the month, while Microsoft was up.

Microsoft had reported an unexpected 29% revenue growth in its Azure cloud computing platform in Q3 which lifted its overall revenues and forecasts, while Alphabet was hit by disappointing cloud services revenue and Meta Platforms declined after being sued by forty-one states and Washington D.C. for addictive features on its social media apps.

Energy stocks had a volatile October despite oil futures being on a largely steady marchupwards for much of the month with Phillips 66, Marathon Petroleum, Occidental Petroleum Corporation, BP, ExxonMobil, Chevron, Baker Hughes Company, Energy Fuels, Apa Corp (US), and Halliburton all down on the month. Shell is up on the month as it announced plans to cut 200 low-carbon jobs and review another 130 next year, in an effort to reduce headcount and to grow profits.

Materials and Mining stocks had a poor October on USD strengthening and strong price declines. Mining stocks Freeport-McMoRan, Nucor Corporation, and Sibanye Stillwater all went down. Newmont Mining was slightly up. Materials stocks Albemarle Corporation, Mosaic, Celanese Corporation, CF Industries Holdings, and Yara International are all down in October.

Commodities

Oil prices were buoyed in October by worries about the conflict in the Middle East spreading, but gains have been capped by higher US crude inventories and the risk of recession in Europe. An increase in Chinese demand following the decision for greater fiscal expansion through the issue of 1 trillion yuan ($137 billion) in sovereign bonds may boost oil into Q4 but the prospect that ‘higher for longer’ interest rates could slow economic and demand growth will likely weigh on markets. As noted by the International Energy Agency, global output growth will be driven by non-OPEC countries and will increase by 1.5 mb/d and 1.7 mb/d in 2023 and 2024, respectively, to new record highs. Overall OPEC+ output is set to decline in 2023, although Iran may rank as the world’s second largest source of growth after the United States.

Gold prices climbed in October, reaching a five-month peak, as investors sought out this safe haven asset as concerns around the widening of the conflict in the Middle East grew, despite a stronger US dollar and surging bond yields. The geopolitical concerns are not going away in the short term, which will continue supporting gold although gold’s gains may be limited.

Currencies

The dollar rose in October due to rising Treasury yields and a decreased appetite for riskier currencies as investors sought out the global safe haven currency. It was an extremely tough month for Sterling. The GBP is -0.68% MTD and +0.14% YTD against the USD as rising US yields have driven up the value of the USD. The EUR +0.02% MTD, but still -1.21% YTD against the USD. With inflation falling in the Eurozone, the ECB is now expected to have reached its peak rate in its hiking cycle, ending a 15-month streak of hikes by maintaining rates at 4% during today’s meeting.

Cryptocurrencies

Bitcoin +28.85% MTD and +109.17% YTD

Ethereum +7.15% MTD and +49.14% YTD

Bitcoin surged ahead the latter part of October, reaching its highest point in nearly 18 months — and more than double the price seen at the start of 2023. This was largely due to rising expectations that the SEC will approve ETF applications from BlackRock and other large institutional investors and drive capital into cryptocurrencies. It also appears to have benefited from geopolitical strains as these growing risks have highlighted the international role of cryptocurrencies. According to Barrons.com, Bitcoin’s correlation to the S&P 500 and Nasdaq stock indexes has faded while its link to gold prices has increased. Therefore, as investors continue to flock to safe haven gold in a period of rising geopolitical uncertainty, they will also include cryptocurrencies, otherwise known as “digital gold.”

Fixed Income

US Treasuries 10 year yield to 4.94%.

German 10 year yield to 2.89%.

UK 10 year yield to 4.61%.

US Treasury yields rose to a 16-year peak in October, boosted by concerns over the number and size of bond auctions required, the rising level of overall debt, the risk of further fiscal slippage, and the sell-off in bonds which was reinforced by stronger than expected labour market, retail sales and business activity data which indicated that inflation was unlikely to fall far over the quarter.

In Europe, the ECB has maintained interest rates at their highest level during its meeting today. However, there are growing concerns around widening bond spreads in the Eurozone economy. As noted by Allianz Chief Economist Ludovic Subran, part of the problem on the budgetary side is that there’s currently no regional agreement on how to operate the European Union’s fiscal regime limiting deficits to 3%, when the suspension on those rules ends.

The UK was also hit in October by the global bond sell-off, resulting in a rise in UK gilt yields. The Bank of England is widely expected to hold rates steady at its meeting in November.

Note: As of 5:00 pm EDT 25 October 2023

Global macroupdates

Will Congress finally act? The US House of Representatives elected Republican Mike Johnson as its 56th speaker on Wednesday, 25 October, after a turbulent three weeks following the unprecedented removal of Kevin McCarthy. This was the fourth attempt to agree on a Speaker. The new speaker will be under pressure to deal with another possible government shutdown as the 17 November funding deadline approaches. A shutdown was very narrowly avoided in October. One of the issues remaining to be addressed is the White House’s request for an additional $100 billion national security supplement to support Israel and Ukraine amid their respective conflicts and that features $61.4bn in funding for Ukraine and $14.3bn for Israel. Additional aid to Ukraine was one of the stumbling blocks of previous funding negotiations. As noted by The Hill, many Republicans appear to be moving an assistance package for Israel separately from military aid for Ukraine. It is not clear if the new speaker will be able to unite the house in passing new funding measures as Republicans want spending cuts and increased funding for border security, but the Democratic majority in the Senate is not likely to agree to these demands.

A growing worry for Europe? The ECB, as expected, kept rates on hold today. The ECB said that inflation is still expected to stay too high for too long, and domestic price pressures remain strong. At the same time, inflation dropped markedly in September, including due to strong base effects, and most measures of underlying inflation have continued to ease. On Wednesday ECB President Christine Lagarde had said in an interview with Greek state television ERT that officials must be “very attentive” in monitoring risks — including a potential upswing in oil prices due to the conflict in the Middle East. Adding to weak European economic data in recent weeks European Central Bank data showed bank lending across the eurozone came to a near standstill in September. There is also a growing divergence in yield spreads between countries in the Eurozone. The decision to hold rates will shift the focus on just how long rates will stay at their current highs and if rising energy costs could could act as an inflationary headwind just as growth is faltering, especially in its largest economy, Germany. The combination of still high rates and rising inflation could result in a damaging period of stagflation.

Key events in November

31 October - 1 November 2023 US Federal Reserve Monetary Policy meeting. The Fed will remain data dependent and likely to focus on this Friday’s personal consumption expenditures price index. Although the housing market is also under pressure with mortgage rates reaching a 23-year high in October, the Fed is likely to maintain its higher for longer mantra as GDP continues to climb and may let rising yields continue to do much of its tightening.

2 November 2023 Bank of England Monetary Policy Summary, minutes and Monetary Policy Report. Markets will be looking to see how confident the Bank is about the direction of growth in the UK. Inflation remains persistent with September’s headline and core staying at 6.7% and 5.9%, respectively. With the labour market loosening and business activity in the services sector falling to 49.2 in October, the lowest reading since January and below the 50 threshold that separates growth from contraction, markets are betting that the BoE will hold rates once again due to the uncertainty about how much of the impact of its 14 rate hikes to date has yet to be felt. Although BoE Governor Andrew Bailey said the latest inflation figures were not far off the central bank's expectations and a slowdown in core inflation was "quite encouraging,” price growth in the services sector, which largely reflects high wage pressures, remains above target.

13-14 November 2023 Asia-Pacific Economic Cooperation (APEC) 2023 Summit, San Francisco, California, USA. The summit will discuss supply chain resilience, digital trade, connectivity, opportunities for small and medium-sized enterprises, climate change and environmental sustainability as key themes for the summit.

26 November 2023 Organization of the Petroleum Exporting Countries (OPEC) ministerial meeting. The OPEC+ full ministerial meeting will take place to discuss oil production output, including quotas.

30 Nov-12 December 2023 Conference of the Parties to the UN Framework Convention on Climate Change (COP28). COP28 will take place in Dubai, UAE. As a result of disappointing progress at COP27, members will be under pressure to make significant progress in securing commitments to reducing carbon emissions.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Dit artikel wordt u alleen ter informatie verstrekt en mag niet worden beschouwd als een aanbod of uitnodiging tot het kopen of verkopen van beleggingen of gerelateerde diensten waarnaar hier mogelijk wordt verwezen. Handelen in financiële instrumenten omvat een aanzienlijk verliesrisico en is mogelijk niet geschikt voor alle beleggers. In het verleden behaalde resultaten bieden geen betrouwbare indicatie voor toekomstige resultaten.