Steady as she goes across the Atlantic?

What to look out for today

Companies reporting on Friday, 6th February: Biogen, Centene, and Philip Morris International

Key data to move markets today

EU: German Industrial Production and Trade Balance, and speeches by ECB Executive Board member Piero Cipollone and Bank of Austria Governor Martin Koche

USA: Michigan Consumer Expectations and Sentiment Indices, UoM 1 and 5-year Inflation Expectations, and a speech by Fed Governor Phillip Jefferson

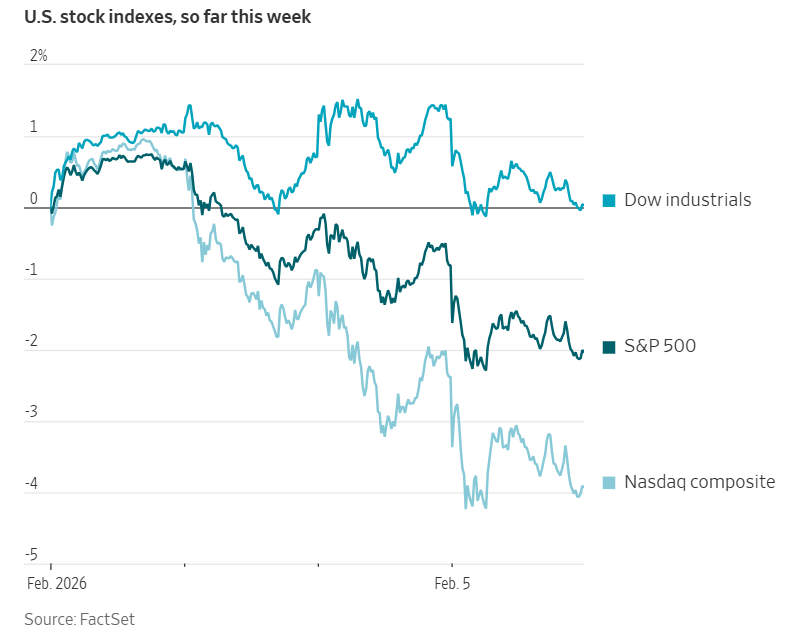

US Stock Indices

Dow Jones Industrial Average -1.18%

Nasdaq 100 -1.34%

S&P 500 -1.21%, with 9 of the 11 sectors of the S&P 500 down

The Dow Jones Industrial Average declined by nearly 600 points, representing a decrease of -1.20%. The S&P 500 also registered a -1.21% loss, moving into negative territory for 2026.

In corporate news, Saudi Arabia’s flagship airline has initiated preliminary discussions with both Boeing and Airbus, exploring what could become its largest aircraft order to date. This move underscores the kingdom’s substantial investment in transforming itself into a premier destination for travel and tourism.

Hims & Hers Health has introduced a more affordable generic alternative to Novo Nordisk’s Wegovy pill. This development comes amid a challenging week for the Danish pharmaceutical giant, which has cautioned investors that its sales could drop by as much as 13% this year.

Bank of America, with ambitions to double its consumer profit, is overhauling its credit card strategy as part of an effort to achieve one of its boldest financial goals set last year.

Rio Tinto has decided to withdraw from acquisition talks with Glencore after the companies failed to agree on a valuation, effectively ending negotiations for a potential mega-merger that would have created the world’s leading mining firm.

Barrick Mining is planning to spin off its premier North American gold assets through an initial public offering later this year, marking a strategic shift for the Canadian metals producer.

BP is seeking a partner to boost output and share costs at one of the Middle East’s oldest oil fields, according to sources familiar with the matter.

Shell reported a decline in Q4 profits, falling short of expectations as weaker crude prices and underperformance in its chemicals division weighed on earnings.

S&P 500 Best performing sector

Consumer Staples +0.25%, with Hershey +9.03%, Mondelez International +1.53%, and Coca-Cola Company +1.50%

S&P 500 Worst performing sector

Materials -2.75%, with FMC -19.54%, Albemarle -7.22%, and Newmont -7.12%

Mega Caps

Alphabet -0.50%, Amazon -4.22%, Apple -0.05%, Meta Platforms +0.20%, Microsoft -4.92%, Nvidia -1.27%, and Tesla -2.14%

Information Technology

Best performer: Skyworks +3.25%

Worst performer: CrowdStrike Holdings -9.20%

Materials and Mining

Best performer: Ball +2.13%

Worst performer: FMC -19.54%

Corporate Earnings Reports

Posted on Thursday, 5th February from Pulse, a real-time AI- driven news tool. Available exclusively on the EXANTE Web Platform

ConocoPhillips reported Q4 2025 adjusted EPS of $1.02, missing Wall Street consensus of $1.06; adjusted net income of $1.3 billion versus $1.35 billion expected. Cash flow from operations reached $4.32 billion, beating $4.25 billion forecast. Production was 2,320 mboed. The company declared a Q1 ordinary dividend of 84c/share. For 2026, capex is guided at about $12 billion, in line with $12.01 billion estimates. Q1 production is forecasted at 2.30 million to 2.34 million boe/d, below 2.36 million expected. - see report.

Shell reported fourth-quarter profits missing expectations, with an 11% year-over-year decline to the lowest level since early 2021, primarily due to weaker oil prices. The company plans to return an additional $3.5 billion to investors and increase its dividend, while maintaining its share buyback programme. - see report.

For Peloton Interactive, the summary is too mellow and fails to capture the extent of the disappointment following a weak holiday quarter after a splashy product overhaul: Peloton reported second quarter earnings before market open on 5th February, 2026, missing Wall Street consensus on revenue and earnings per share. - see report.

European Stock Indices

CAC 40 -0.29%

DAX -0.46%

FTSE 100 -0.90%

Commodities

Gold spot -3.79% to $4,775.22 an ounce

Silver spot -19.66% to $70.83 an ounce

West Texas Intermediate -2.09% to $63.12 a barrel

Brent crude -1.96% to $67.39 a barrel

Gold fell on Thursday, while silver slid nearly 20%, as a stronger dollar and a broad market risk-off sentiment prompted investors to liquidate precious metal holdings.

Spot gold lost -3.79% to $4,775.22 per ounce. Spot silver was down -19.66% at $70.86 an ounce.

Oil prices settled down on Thursday in choppy trading, after the US and Iran agreed to hold talks in Oman on Friday, easing concerns about Iranian crude supplies.

Brent crude futures down $1.35, or -1.96%, at $67.39 per barrel. US WTI crude settled down $1.35, or -2.09%, at $63.12.

The discussions come as the US builds up forces in the Middle East, and regional players seek to avoid a military confrontation that many fear could escalate into a wider war.

About a fifth of the world's total oil consumption passes through the Strait of Hormuz between Oman and Iran. Other OPEC members, Saudi Arabia, the United Arab Emirates, Kuwait and Iraq, export most of their crude via the strait, as does Iran.

On the supply side, discounts on Russian oil exports to China widened to new records this week as sellers cut prices to attract demand from the world's top crude importer and offset the likely loss of Indian sales, traders said.

Note: As of 4 pm EST 5 February 2026

Currencies

EUR -0.26% to $1.1775

GBP -0.93% to $1.3525

Bitcoin -13.09% to $63,119.85

Ethereum -13.13% to $1,846.77

The US dollar hit a two-week high on Thursday as fresh volatility gripped stocks and the pound tumbled after the BoE voted by a razor-thin margin to leave UK rates unchanged.

The greenback found firmer footing this week as investors turned more risk-averse and financial markets assessed results so far in the US corporate earnings season, now halfway complete. The dollar largely stayed range-bound after a run of softer US labour data, including jobless claims rising more than expected and unexpectedly low job openings in December.

The dollar index was up +0.31% at 97.94, rising for a second day. It rose to its highest since 23rd January earlier in the session.

Sterling was down -0.93% against the dollar at $1.3525 and off -0.62% versus the euro, after the BoE left borrowing costs unchanged in a 5 - 4 split among the nine policymakers that make up its rate-setting committee.

The ECB also delivered no change in interest rates at its policy meeting on Thursday. The euro was down -0.26% at $1.1775.

The yen declined -0.11% against the US dollar to ¥157.03. General elections will take place on Sunday.

Fixed Income

US 10-year Treasury -9.6 basis points to 4.184%

German 10-year bund -1.6 basis points to 2.848%

UK 10-year gilt +0.6 basis points to 4.563%

US Treasury yields fell on Thursday and two-year yields hit a four-week low as two economic releases pointed to a weaker than expected jobs market ahead of next week's highly anticipated payrolls report for January.

The number of Americans filing new applications for unemployment benefits increased more than expected last week amid winter storms, while job openings fell to a more than five-year low in December.

The 2-year note, which moves in line with Fed interest rate expectations, fell -9.2 bps to 3.461%. The yield on US 10-year notes declined by -9.6 bps to 4.206%. Both maturities registered their biggest one day drop in yields since October.

The yield curve between two-year and 10-year notes steepened to 72.3 bps, its steepest level since April.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 58.5 bps of cuts in 2026, higher than the 52.9 bps priced in the previous week. Fed funds futures traders are now pricing in a 8.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 16.7% a week ago.

On Thursday, eurozone markets maintained a confident stance, anticipating that the ECB would likely keep interest rates unchanged for the remainder of the year. In this environment, the strength of the euro is expected to remain a key focus.

Following the ECB's decision to hold its benchmark rate steady at 2.0%, ECB President Christine Lagarde downplayed the significance of recent movements in the US dollar regarding future monetary policy decisions. She emphasised that the ECB's inflation outlook has remained largely consistent.

Market participants continue to assign approximately a 20% probability to an ECB rate cut by September, unchanged from forecasts before the monetary decision, and around a 10% chance of a rate hike by April 2027.

German two-year yields, sensitive to interest rate expectations, briefly declined, falling -2.8 bps to 2.074%. The yield on Germany's 10-year government bond decreased by -1.6 bps to 2.848%, and the 30-year yield dropped -2.4 bps to 3.504%.

Lagarde reiterated that while the ECB does not target the exchange rate, it closely monitors currency developments. She noted that the recent weakening of the dollar against the euro should be considered within the context of the past year rather than just the past few weeks.

Nevertheless, the threshold for any further rate cut remains high.

Italy’s 10-year BTP yield also edged lower, declining by -0.2 bps to 3.474%, maintaining its spread over German Bunds at 62.6 bps.

Similarly, France’s 10-year OAT yield slipped by -0.3 bps to 3.447%.

Note: As of 5 pm EST 5 February 2026

Global Macro Updates

ECB maintains policy unchanged for fifth consecutive meeting. The ECB opted to keep its key policy rates steady, in line with expectations. The accompanying policy statement reflected caution, noting the persistent uncertainty stemming from global trade dynamics and ongoing geopolitical tensions.

The ECB reaffirmed its medium-term inflation target of 2%, with updated assessments indicating that inflation is expected to stabilise at this level. The statement also emphasised the resilience of the euro area economy despite challenging conditions, highlighting continued low unemployment and strong private sector balance sheets.

Previous interest rate cuts were cited as a supportive factor for growth. The ECB reiterated its commitment to a data-dependent, meeting-by-meeting policy approach, with decisions guided by comprehensive analysis of inflation trends and related economic and financial risks. As stated by President Lagarde in the December meeting, FX developments are closely monitored as a component of the inflation outlook. Recently, the euro surpassed $1.20 for the first time since June 2021. Additionally, the ECB’s wage tracker continues to trend lower, which is expected to mitigate upward pressure on services prices, although recent PMI data indicate signs of emerging price pressures. Other factors influencing the outlook include volatility in commodity markets.

BoE holds rates amid tighter vote split. The BoE left its key Bank Rate unchanged at 3.75%, with a narrower-than-anticipated vote split of 5 - 4, compared to market expectations for a 7 - 2 decision. For the third consecutive meeting, Governor Bailey exercised the casting vote. MPC members Breeden, Dhingra, Ramsden, and Taylor voted in favour of a 25 bps rate cut.

Governor Bailey expressed increased confidence in the trajectory of wage disinflation but acknowledged uncertainty over the timing and extent to which the forecasted decline in inflation would affect wage settlements. He indicated that, based on current evidence, further rate reductions are likely, while emphasising that decisions on additional easing will become more finely balanced. The magnitude and timing of future adjustments will depend on the evolution of inflation data.

In its statement, the MPC noted that its central projection is predicated on a market-implied interest rate curve, which is expected to decline slightly in 2026 before trending upward. Surveyed market participants anticipate rates falling to 3.25% and remaining at that level for an extended period. The BoE now expects inflation to reach its 2% target a year earlier, by Q2 2026. Updated forecasts reflect a lower medium-term inflation outlook, with projections of 1.7% for 2027 (previously 2.2%), 1.8% for 2028 (vs. 2.1%), and 2.0% for 2029. Additionally, GDP growth forecasts have been revised downward: 0.8% for 2026 (previously 1.1%), 1.2% for 2027 (vs. 1.5%), and 1.9% for 2028 (compared to 1.8%).

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。