Is alpha shifting from bytes to bricks?

Corporate Earnings Calendar

Thursday: Amazon, Bristol Myers, Cardinal Health, ConocoPhillips, Fastenal, Fortinet, Hershey, KKR, Molina Healthcare, Monolithic Power Systems, News Corp, and Ralph Lauren

Friday: Biogen, Centene, and Philip Morris International

Monday: Apollo Global Management, Loews, ON semiconductor, and Principal Financial Group

Tuesday: American International Group, Duke Energy, DuPont de Nemours, Ford Motor, Gilead Sciences, Hasbro, Marriott International, Robinhood Markets, S&P Global, and The Coca-Cola Co

Wednesday: Albemarle, Cisco Systems, CVS Health, Equinix, Hilton Worldwide, Humana, Kraft Heinz, Martin Marietta Materials, McDonald’s, MGM Resorts International, Motorola Solutions, Smurfit WestRock, and T-Mobile US

Global market indices

US Stock Indices Price Performance

Nasdaq 100 -2.59% MTD and +2.99% YTD

Dow Jones Industrial Average +1.13% MTD and +4.42% YTD

NYSE +1.13% MTD and +4.42% YTD

S&P 500 -0.81% MTD and +0.54% YTD

The S&P 500 is -1.37% over the past seven days, with 7 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.98% over this past week and +4.48% YTD.

The S&P 500 Consumer Staples is the leading sector so far this month, +4.40% YTD, while Information Technology is the weakest sector at -3.58% YTD.

Over the past seven days, Consumer Staples outperformed within the S&P 500 at 5.78%, followed by Energy and Industrials at +5.66% and +3.16%, respectively. Conversely, Information Technology underperformed at -6.64%, followed by Consumer Discretionary and Utilities at -2.09% and -0.59%, respectively.

The equal-weight version of the S&P 500 was +0.88% on Wednesday, performing its cap-weighted counterpart by 1.19 percentage points.

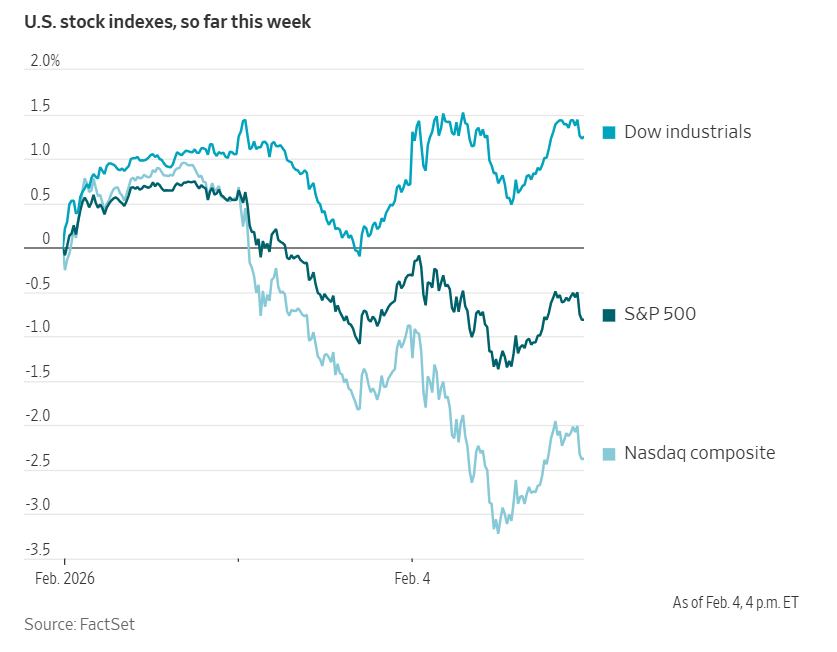

On Wednesday the S&P 500 was -0.51% to 6,882.72, while the Dow Jones Industrial Average +0.53%, or 260.31 points. The Nasdaq Composite Index was -1.51%.

Over the past seven days, the S&P 500 is -1.37%, the Dow Jones +0.99%, and the Nasdaq Composite -3.99%.

Technology stocks experienced heavier losses on Wednesday, with declines spreading beyond software companies to include semiconductor manufacturers and firms involved in artificial intelligence infrastructure. The Nasdaq Composite suffered back-to-back declines exceeding one percent for the first time since Liberation Day.

These movements unsettled investors, who were already anxious following the recent sell-off in software shares—a slide that gathered pace after the AI start-up Anthropic unveiled a new range of tools capable of performing industry-specific tasks such as reviewing legal contracts. Traders now fear that AI may have a wider impact than previously anticipated, and, at the same time, also concerned that companies caught up in the AI arms race might not deliver commensurate returns.

Wednesday’s declines were more widespread than the software-led rout that shook markets on Tuesday. Chip maker Advanced Micro Devices tumbled -17.31% after posting disappointing Q4 earnings, marking its worst trading day since 2017. Palantir Technologies shares sank -11.62%, while data storage firm SanDisk dropped -15.95%.

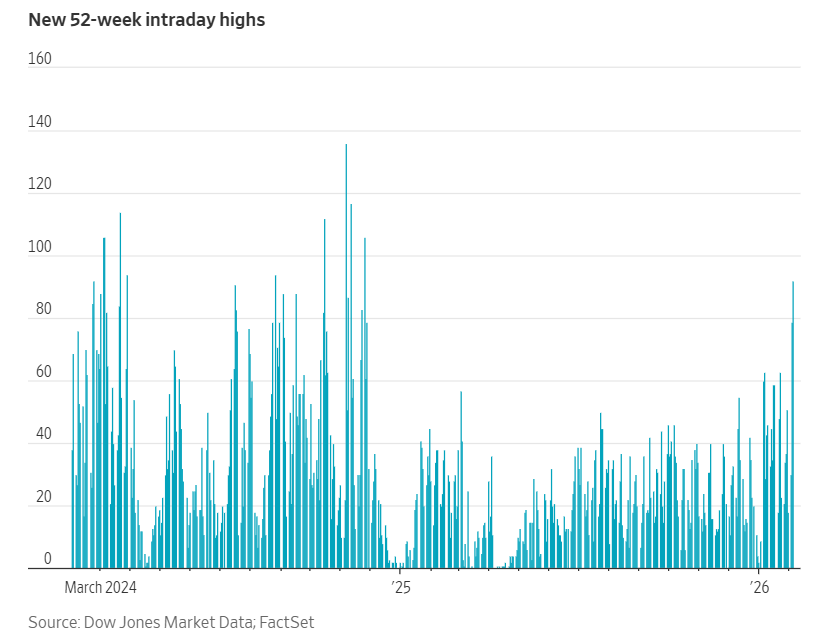

Despite the drag from technology shares, the Dow Jones Industrial Average gained +0.53% on Wednesday. The S&P 500 fell -0.51% to 6,882.72, yet according to Dow Jones Market Data, 92 S&P 500 constituents hit one-year highs, marking the highest number in a session since November 2024, even as the sell-off in technology weighed on the broader market.

Much of this positive momentum has come from Industrials, with 27 achieving the milestone, including Caterpillar, RTX, and GE Vernova. Financials saw 15 companies post new highs, while the Energy contributed 10 to the tally.

Among the companies with the largest market capitalisations hitting fresh highs were Walmart, Exxon Mobil, and Johnson & Johnson.

In corporate news, Texas Instruments has agreed to acquire US chip firm Silicon Laboratories for $7.5 billion, thereby strengthening its position in established markets such as home appliances, power, industry, and medical devices.

Target’s new chief executive, Michael Fiddelke, acknowledged at his inaugural town hall that the retailer has lost trust with both shoppers and staff, and pledged to restore those relationships.

SAS AB is currently in discussions with Boeing and Airbus regarding a significant purchase of widebody aircraft, as the Scandinavian airline bets on rising demand for long-haul travel from its Copenhagen hub, according to its chief executive.

D.E. Shaw & Co. has criticised the board of CoStar Group in a letter, increasing pressure on the real estate analytics provider, which is also contending with activist investor Dan Loeb.

Clear Street, a Wall Street broker built on cloud computing technology, is seeking to raise up to $1.05 billion through an IPO.

Mega caps: The Magnificent Seven had a mostly negative performance over the past week. Over the last seven days, Apple +7.82%, and Meta Platforms +0.04%, while Alphabet -0.88%, Amazon -4.12%, Tesla -5.90%, Nvidia -9.05%, and Microsoft -14.00%.

Energy stocks had a positive performance this week, with the Energy sector itself +5.66%. WTI and Brent prices are +0.70% and +0.07%, respectively, over the past week. Over the last seven days, Marathon Petroleum +13.90%, Phillips 66 +8.88%, ExxonMobil +7.28%, Chevron +6.65%, ConocoPhillips +6.12%, APA +5.27%, Shell +4.92%, BP +4.76%, Baker Hughes +4.49%, Occidental Petroleum +4.15%, and Halliburton +2.94%, while Energy Fuels -21.89%.

Materials and Mining stocks had a mixed performance this week, with the Materials sector +2.80%. Over the past seven days, Celanese Corporation +14.38%, Nucor +9.68%, Mosaic +2.42%, Yara International +2.14%, and CF Industries +1.64%, while Freeport-McMoRan -2.78%, Albemarle -8.50%, Newmont Corporation -11.44%, and Sibanye Stillwater -13.84%.

European Stock Indices Price Performance

Stoxx 600 +1.17% MTD and +4.38% YTD

DAX +0.26% MTD and +0.46% YTD

CAC 40 +1.67% MTD and +1.38% YTD

IBEX 35 +1.24% MTD and +4.59% YTD

FTSE MIB +1.96% MTD and +3.28% YTD

FTSE 100 +1.75% MTD and +4.74% YTD

This week, the pan-European Stoxx Europe 600 index is +1.58%. It was +0.03% Wednesday, closing at 618.12.

So far this month in the STOXX Europe 600, Telecom is the leading sector, +6.05% MTD and +10.51% YTD, while Technology is the weakest at -5.83% MTD and -0.85% YTD.

Over the past seven days, Food & Beverages outperformed within the STOXX Europe 600, at +7.45%, followed by Telecom and Chemicals at +7.03% and +5.02%, respectively. Conversely, Technology underperformed at -8.37%, followed by Financial Services and Industrial Goods at -2.44% and +0.42%, respectively.

Germany's DAX index was -0.72% Wednesday, closing at 24,603.04. It was -0.89% over the past seven days. France's CAC 40 index was +1.01% Wednesday, closing at 8,262.16. It was +2.42% over the past week.

The UK's FTSE 100 index was +2.44% over the past seven days to 10,402.34. It was +0.85% on Wednesday.

In Wednesday's trading session, Technology and Media extended the previous day's selloff, driven by a new wave of concerns over the disruptive impact of AI following Anthropic's launch of Claude Cowork plug-ins. Among individual stocks, TomTom fell after missing revenue expectations and issuing guidance for flat or lower performance in 2026, reflecting competitive pressures in the automotive tech market. Conversely, Infineon provided a more optimistic outlook, forecasting increased sales and announcing a €2.7 billion investment in data centre infrastructure to capitalise on rising demand for AI applications. Additionally, ams-OSRAM advanced following the sale of its sensor unit to Infineon for €570 million.

Health Care underperformed, weighed down by disappointing earnings reports. Novo Nordisk declined after projecting reductions in both sales and EBIT for 2026, attributing the weaker outlook to pricing pressure in the US and increased competition in the obesity treatment market. Novartis also declined in response to weak Q4 sales and guidance that suggested low single-digit declines in core operating profit for 2026, pressured by generics competition. Although GSK delivered a strong headline Q4 beat, it was overshadowed by its guidance for sales through to 2031, which fell short of expectations.

Banks and Financial Services faced challenges despite reporting better-than-expected earnings. UBS shares declined notwithstanding a 56% surge in profits, strong performance in wealth management, and the announcement of new share buybacks. Santander also underperformed following its $12.2 billion acquisition of Webster Financial, with analysts citing integration risks and ambitious RotE targets. Credit Agricole came under pressure as restructuring costs in Italy and higher provisions overshadowed the company’s asset gathering strengths.

Autos & Parts benefitted from M&A discussions, including talks between Ford and Geely regarding technology sharing, and Tesla’s 9% increase in shipments to China. Telecom benefitted from sector rotation, as investors moved away from technology shares in the wake of AI disruption fears. Defensive positioning supported Retail and Food & Beverage, with Carlsberg advancing despite cautioning about challenging consumer conditions in 2026; the company cited cost control and synergies with Britvic as offsetting weaker demand. Nestlé was buoyed by media reports suggesting a strategic shift under its new CEO.

European software and data companies’ shares fall due to Anthropic’s AI disruption fears. Considerable attention was drawn to Wednesday’s pronounced selloff within the European software, data, and advertising sectors, following Tuesday’s announcement of Anthropic’s Claude legal plug-in which crystallised fears over AI disruption. Companies most exposed to professional information, analytics, and advertising revenue streams came under significant selling pressure. SAP approached its lowest share price in two years, affected both by the news surrounding Anthropic’s AI capabilities and an earlier subdued outlook for its cloud segment on 29th January.

Market participants are increasingly scrutinising the long-term viability of such firms, irrespective of ongoing AI product innovations. RELX and Wolters Kluwer also declined, as their legal analytics operations are perceived to be directly challenged by Claude’s capacity to automate legal research and workflows. The London Stock Exchange Group extended previous session losses, with investors questioning the sustainability of premium data and terminal pricing in the wake of its strategic shift involving Refinitiv.

Advertising agencies, including Publicis Groupe and WPP, declined due to concerns that generative AI may structurally compress margins and lower barriers to entry in creative and media services. Analysts noted that the broad European selloff in exposed companies reflects a broader de-rating of long-term growth assets, as investors are reluctant to underwrite future AI monetization amid uncertainty over competitive dynamics and client adoption of in-house solutions. Markets are aggressively re-pricing disruption risks.

Other Global Stock Indices Price Performance

MSCI World Index -0.50% MTD and +1.69% YTD

Hang Seng -3.22% MTD and +3.42% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -1.05% and -4.73%, respectively.

Currencies

EUR -0.35% MTD and +0.52% YTD to $1.1806

GBP -0.26% MTD and +1.33% YTD to $1.3652

On Wednesday, the US dollar strengthened against the Japanese yen, positioning the yen for a fourth consecutive session of losses. This movement comes ahead of elections anticipated to reinforce Prime Minister Sanae Takaichi’s commitment to increased fiscal and defence spending.

The greenback also advanced against most other major currencies, including the euro and the pound sterling. The dollar index rose by +0.26% on the day, reaching 97.64. Over the week the index increased by +1.50%. However, the dollar index is +0.51% MTD and -0.65% YTD.

The US dollar was up by +0.72% at ¥156.85 per dollar, having reached its weakest level since 23rd January, when the yen experienced a sharp appreciation from ¥159.23 amid speculation regarding potential rate checks by the New York Fed.

Since 30th January, the yen has depreciated by -1.35%. Over the course of the past seven days, it has declined by -2.25% against the US dollar.

Earlier this week, Prime Minister Takaichi contributed to downward pressure on the yen following a campaign speech highlighting the advantages of a weaker currency. Although she subsequently moderated her remarks, concerns persist that inconsistent messaging from the prime minister could complicate efforts to stabilise the already fragile yen.

The dollar has advanced against both the euro and the yen last week after the US President announced the selection of former Fed Governor Kevin Warsh to lead the FOMC once Fed Chair Powell’s term concludes in May, alleviating concerns over an excessively dovish Fed stance.

The euro declined by -0.10% to $1.1806 ahead of the ECB’s policy decision, with market participants attentive to any commentary regarding the influence of the single currency’s valuation on policy direction.

Last week, the euro reached a four-and-a-half-year high at $1.2084 as officials expressed increasing concern over its rapid appreciation, warning that further strengthening could dampen inflation, particularly as price growth is already projected to fall short of the ECB’s 2% target.

The euro-dollar pair has been driven predominantly by sentiment towards the US dollar, with interest rate differentials playing a more secondary role. Over the past seven days, the euro was -1.22%.

Sterling climbed to a fresh five month high against the euro on Wednesday, although investors remained cautious ahead of the BoE’s policy announcement. The euro fell to its lowest level since 27th August against the pound, trading at 86.15 pence, and was down -0.09% on Wednesday at 86.21 pence.

The British pound was -0.33% lower against the US dollar at $1.3652. This marked a decline of -1.11% over the last seven days. Market pricing reflected expectations of 35 bps of BoE rate cuts by year-end, implying one 25 bps reduction and a 40% probability of an additional cut.

Political risks also linger in the UK, particularly regarding Prime Minister Starmer’s leadership, with the Gorton and Denton by-election scheduled for 26th February and the local elections in May drawing further attention.

Note: As of 5:00 pm EST 4 February 2026

Cryptocurrencies

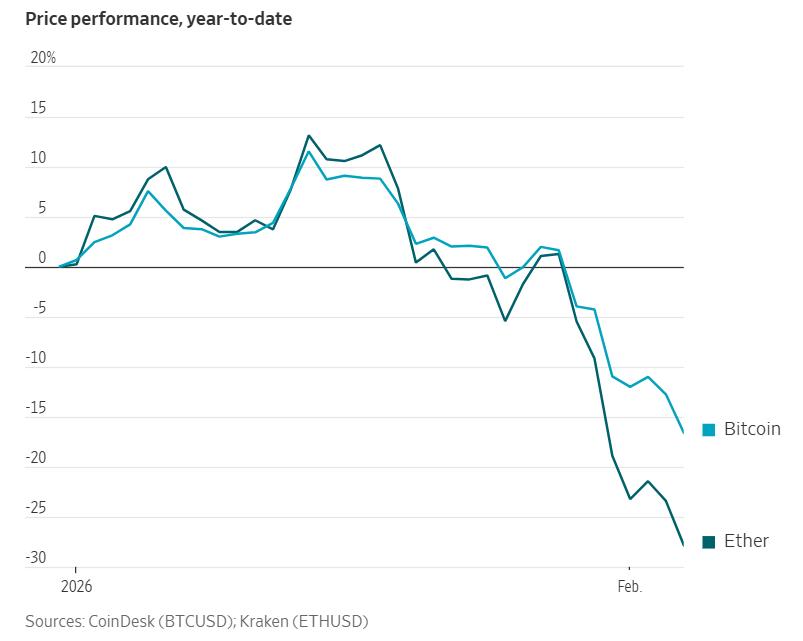

Bitcoin -13.77% MTD and -17.18% YTD to $72,627.00

Ethereum -21.40% MTD and -28.63% YTD to $2,125.92

Bitcoin is -18.68% over the last seven days and Ethereum is -29.51%. On Wednesday, Bitcoin was -4.64% to $72,627.00 and Ethereum was -6.84% to $2,125.92.

On Wednesday, Bitcoin fell below the $73,000 threshold, extending a downward trajectory that has seen the world’s largest cryptocurrency decline by 17.18% since the start of the year.

At its lowest point, Bitcoin reached $72,102, wiping out all the gains accumulated since the election of crypto-friendly President Trump in November 2024. The cryptocurrency was recently quoted at $72,627.00, representing a fall of more than 42% from its early-October peak, which exceeded $126,000.

Ether, the second-largest digital asset, reached a nine-month low of $2,077 before partially recovering. By Wednesday afternoon, it was trading at $2,125.92, marking a decline of 57.09% from its all-time high of $4,955 recorded last summer.

The pronounced declines in leading cryptocurrencies have adversely affected crypto treasury stocks, particularly those firms that issued shares and borrowed capital to accumulate digital assets. Shares of Strategy, the Bitcoin-accumulation company led by Michael Saylor, dropped 3.1% on Wednesday. BitMine Immersion Technologies, an Ether-treasury enterprise overseen by Wall Street strategist Tom Lee, fell by 9.2%.

Throughout much of the past year, firms like Strategy and BitMine raised billions through new share and debt issuances, using the proceeds to amass Bitcoin, Ether and other cryptocurrencies. This approach transformed these so-called crypto-treasury stocks into leveraged stand-ins for the underlying tokens, drawing in a surge of retail and institutional investors eager to amplify their exposure to the digital asset rally.

Now, the market finds itself on edge, bracing for a potential inflection point. Many investors have begun to question the long-term viability of crypto-treasury companies, concerned that a continued drop in cryptocurrency prices might eventually force some firms to offload holdings. Such a scenario could spark a broad sell-off, with repercussions reverberating through the token markets for years to come.

Strategy, widely seen as the pioneer of the crypto-treasury model, began signalling unease late last year. Michael Saylor—long an advocate of holding bitcoin indefinitely—unsettled markets when he suggested the company might consider selling some of its Bitcoin holdings or derivatives if its mNAV (enterprise value divided by the value of its crypto assets) were to fall below one.

When a crypto-treasury firm’s mNAV is above one, its shares trade at a premium to the value of its crypto holdings, indicating investor confidence in the company’s strategy of raising capital to buy more Bitcoin. Conversely, if mNAV drops below one, the company’s shares are valued at a discount, raising the possibility that it may need to sell tokens to support the share price.

Saylor’s shift in tone came as Strategy announced it had raised $1.44 billion through a share sale, bolstering its ability to cover future dividend and debt interest payments. The company now holds more than $2 billion in cash reserves.

Presently, Strategy’s mNAV stands at 1.1—down from over two a year ago. The company has continued purchasing Bitcoin in recent weeks, acquiring 855 coins for roughly $75.3 million at an average price of $87,974 each in the seven days ending Sunday. Strategy recorded a $17.44 billion unrealised loss in Q4 and is due to release its full financial results today.

Note: As of 5:00 pm EST 4 February 2026

Fixed Income

US 10-year yield +4.2 bps MTD and +10.8 bps YTD to 4.280%

German 10-year yield +1.7 bps MTD and +0.4 bps YTD to 2.864%

UK 10-year yield +2.7 bps MTD and +7.9 bps YTD to 4.557%

Short-dated US Treasury yields declined on Wednesday, while yields on long-term Treasuries edged higher, resulting in a steeper yield curve as market participants awaited the release of delayed US economic data.

The US government’s highly anticipated employment report for January, originally scheduled for release on Friday, has been postponed to next Wednesday due to a four-day partial government shutdown that concluded on Tuesday.

In the interim, the ADP National Employment Report published on Wednesday indicated that US private sector payrolls increased less than anticipated in January, with notable job losses recorded in both professional and business services, as well as the manufacturing sector.

The yield on the two-year Treasury note—sensitive to expectations for Fed funds rates policy—declined by -2.5 bps to 3.553%. The yield on the 10-year note rose by +1.3 bps to 4.280%. On the long end of the maturity spectrum, the 30-year yield rose by +2.2 bps to 4.919%.

Over the course of the week, the yield curve between two- and ten-year notes steepened by 7.8 bps, reaching 72.7 bps.

Data released on Wednesday showed that the US services sector remained stable in January, although businesses experienced rising input costs, implying that services inflation could accelerate following a period of moderation in recent months.

Additionally, the US Treasury Department announced on Wednesday that it does not anticipate increasing the size of its note and bond auctions for several more quarters, in line with market expectations, as it detailed a $125 billion refunding to cover the period from February to April 2026.

Over the past seven days, the yield on the 10-year Treasury note was +5.3 bps. The yield on the 30-year Treasury bond was +6.9 bps. On the shorter end, the two-year Treasury yield was -2.5 bps.

According to CME Group's FedWatch Tool, traders are pricing in 49.4 bps of cuts in 2026, higher than the 46.3 bps priced in last week. Fed funds futures traders are now pricing in a 9.9% probability of a 25 bps rate cut at March’s FOMC meeting, down from 12.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was +3.0 bps to 4.557%. Over the past seven days, it was +0.4 bps.

On Wednesday, eurozone government bond yields edged lower following the release of bloc-wide inflation figures, which indicated a further easing of price pressures in January, although this is not expected to prevent the ECB from keeping interest rates unchanged in today’s decision.

Consumer price growth within the eurozone declined to 1.7% in January, marking its lowest point since September 2024 and aligning with economists’ expectations. Core inflation—which excludes volatile categories such as energy, food, alcohol, and tobacco—unexpectedly fell to 2.2%, the lowest level recorded since October 2021.

The yield on Germany’s 10-year Bund fell by -3.0 bps to 2.864%. Long-dated bonds were marginally firmer, with the 30-year yield standing +1.0 bps higher at 3.528%, a touch below Tuesday’s peak of 3.559%, the highest level since 2011.

Germany’s two-year yield, sensitive to expectations surrounding ECB policy, was slightly higher by +0.3 bps, ending the session at 2.102%.

The ECB is set to announce its latest monetary policy decision today and is widely expected to keep the deposit rate unchanged at 2% for the fifth consecutive meeting. President Christine Lagarde is anticipated to reaffirm that monetary policy is currently in a ‘good place’.

Ten-year government bond yields in both Italy and France also declined, by -1.9 bps to 3.476% and -1.7 bps to 3.450% respectively, resulting in the yield spreads between these countries and Germany remaining at historically narrow levels.

Over the past seven days, the German 10-year yield was +2.5 bps. Germany's two-year bond yield was +2.1 bps, and, on the longer end, Germany's 30-year yield was +3.8 bps.

The yield spread between German Bunds and 10-year UK gilts reached 169.3 bps on Wednesday, a contraction of 2.1 bps over the past seven days.

The spread between US 10-year Treasuries and German Bunds is now 141.6 bps, 2.5 bps higher from last week’s 139.1 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 61.2 bps, 0.6 bps lower than last week’s spread of 61.8 bps. The Italian 10-year yield was +1.5 bps over the last week.

Over the course of the week, France’s 10-year yield has risen by +2.5 bps. The spread between French OAT 10-year yields and German Bund 10-year yields stood at 58.6 bps, equal to last week’s spread.

Commodities

Gold spot +2.03% MTD and +15.05% YTD to $4,963.21 per ounce

Silver spot +4.20% MTD and +23.73% YTD to $88.17 per ounce

West Texas Intermediate crude -1.93% MTD and +12.30% YTD to $64.47 a barrel

Brent crude -2.77% MTD and +12.86% YTD to $68.74 a barrel

Gold prices edged higher on Wednesday, extending the rebound from the previous session.

Spot gold increased by +0.18% to $4,963.21 per ounce, having risen as much as 3.10% earlier in the session. Prices rose +6.33% rise on Tuesday.

The precious metal had experienced a sharp decline of more than 13% across Friday and Monday, marking its steepest two-day sell-off in decades, after reaching a record high of $5,594.82 on 29th January. Over the last seven days, gold prices have declined by -8.32%.

Spot silver advanced +3.62% to $88.17 per ounce on Wednesday. The metal had previously fallen to a one-month low of $71.33 on Monday, following a record high of $121.64 last Thursday, and is up +23.73% year-to-date.

Oil prices advanced on Wednesday, following media reports indicating that scheduled negotiations between the US and Iran on Friday may be at risk of collapsing.

Brent crude futures settled up by $0.75, or +1.10%, at $68.74 per barrel, while US WTI crude increased by $0.57, or +0.89%, closing at $64.47 per barrel.

According to Axios, the US declined Iran's request to alter the venue for the forthcoming discussions, citing sources within the US administration.

Throughout the week, both crude benchmarks have fluctuated in response to developments concerning efforts to ease tensions between Washington and Tehran, as well as increasing apprehension over possible disruptions to oil shipments through the Strait of Hormuz.

The Strait of Hormuz remains a vital export route for OPEC members including Saudi Arabia, Iran, the United Arab Emirates, Kuwait, and Iraq, who predominantly dispatch their crude oil to Asian markets via this corridor.

India's imports of Russian oil declined in January, extending the downward trend that began in December. This shift was attributed to refiners seeking alternative sources in response to Western sanctions and the ongoing US–India trade negotiations, according to recent data.

EIA report. According to the Energy Information Administration (EIA) on Wednesday, US crude oil and distillate inventories declined during the week ending 30th January, while gasoline stocks increased. This occurred as a severe winter storm impacted extensive regions across the country.

Crude oil inventories fell by 3.5 million barrels to 420.3 million barrels, as oil output dropped to its lowest level since November 2024, according to the EIA.

The reduction in US oil production was primarily attributed to widespread freeze-offs experienced during the past week. Production outages peaked near 2 million barrels per day (bpd) due to the winter storm, which began on 23rd January and affected approximately 30 states.

Additionally, crude stocks at the Cushing, Oklahoma, delivery hub decreased by 743,000 barrels over the same period.

Refinery crude runs declined by 180,000 bpd, and refinery utilisation rates dropped by 0.4 percentage points to 90.5% last week. US gasoline inventories rose by 685,000 barrels to 257.9 million barrels last week, marking the highest level since June 2020, according to EIA data.

Distillate stockpiles—which include diesel and heating oil—declined by 5.6 million barrels to 127.4 million barrels during the week. This represented the largest weekly fall in distillate inventories since February 2021. Net US crude imports increased by 1.1 million bpd.

Note: As of 5:00 pm EST 4 February 2026

Key data to move markets

EUROPE

Thursday: ECB Rate on Deposit Facility, ECB Main Refinancing Operations Rate, ECB Monetary Policy Statement and Press Conference, Eurozone Retail Sales, and German Factory Orders

Friday: German Industrial Production and Trade Balance, and speeches by ECB Executive Board member Piero Cipollone and Bank of Austria Governor Martin Koche

Monday: Sentix Investor Confidence

UK

Thursday: BoE’s Interest Rate Decision, Minutes, Monetary Policy Report and Policy Summary, MPC Vote Count, and a speech by BoE Governor Andrew Bailey

Sunday: A speech by BoE Governor Andrew Bailey

USA

Thursday: Challenger Job Cuts, Initial and Continuing Jobless Claims, JOLTS Job Openings, and a speech by Atlanta Fed President Raphael Bostic

Friday: Michigan Consumer Expectations and Sentiment Indices, UoM 1 and 5-year Inflation Expectations, and a speech by Fed Governor Phillip Jefferson

Monday: A speech by Atlanta Fed President Raphael Bostic

Tuesday: ADP Employment Change 4-week Average, Employment Cost Index, Retail Sales, and a speech by Cleveland Fed President Beth Hammack

Wednesday: CPI, and Core CPI

JAPAN

Saturday: Japanese General Elections

Sunday: Labor Cash Earnings, and Current Account

CHINA

Tuesday: CPI and PPI

Global Macro Updates

Signs of investors diversifying their portfolios into Europe are becoming clear. Bloomberg conducted an interview with Euroclear chief executive Valerie Urbain, who noted a pronounced trend of investors reallocating assets into Europe as a means of diversifying away from the US, particularly in light of policies introduced under President Trump. Urbain highlighted that clients from China, the Middle East, and the Asia-Pacific region have been directing investments into Europe throughout 2025. At the close of 2025, Euroclear reported assets under custody exceeding €43 trillion—a 7% increase compared to the previous year.

Reuters further corroborated this trend, citing prime brokerage data that demonstrates hedge funds are reducing their exposure to North America, while concurrently increasing their allocations to Europe and Asia. BNP highlighted Europe as the most sought-after region for hedge fund allocation last year, with an additional 30% exposure attributed to the continent. While some analysts interpret these developments as part of a broader diversification strategy, rather than a wholesale retreat from the US, consensus holds that Europe offers a compelling hedge due to its diverse sectoral composition—including defence, industry, and reduced concentration risk.

Over the course of the week, miners, telecommunications, food and beverage, and chemicals sectors have outperformed. Banks’ leadership continues to be an ongoing thematic strategy, with the sector at its highest valuation since 2008. Analysts remain bullish about Europe’s prospects for the year, citing the region’s valuation discount relative to the US and supportive macroeconomic fundamentals.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。